Equinix to Buy Some Verizon Data Centers for $3.6 Billion -- Update

December 06 2016 - 12:14PM

Dow Jones News

By Drew FitzGerald and Austen Hufford

Equinix Inc. agreed to pay Verizon Communications Inc. $3.6

billion for a portfolio of 24 data center sites in a transaction

that will expand its operations deeper into more U.S. cities and

Latin America.

The all-cash deal, announced Tuesday, will boost Equinix's data

center count to 175 data centers around the globe, giving it

properties in 15 metro markets including Bogotá, Colombia as well

as Houston and Culpeper, Va. The transaction is expected to close

in the middle of next year.

Verizon joins several telecom companies that have cast off

underperforming physical assets to focus on services they consider

the core of their business. CenturyLink Inc. last month struck a

$2.3 billion deal to sell its data center business to a

private-equity consortium led by BC Partners.

Verizon has also has sold off parts of its landline operation to

Frontier Communications Corp. and cell tower assets to American

Tower Corp. in recent years while spending cash on Web companies

like AOL and Yahoo Inc.

Verizon Chief Executive Lowell McAdam said at an investor

conference Tuesday that Verizon didn't have very much scale in data

centers so it was better to sell them and put that money to better

use. The carrier wants to "trim the branches of the tree so the

tree can be stronger," Mr. McAdam said.

Many carriers have struggled to earn sales in buildings they

control because their rivals are wary of paying a competitor.

CenturyLink last year acknowledged revenue in its data center

business was declining.

But for Equinix, the acquisition of the slow-growing assets will

help build its footprint and expand its customer base. "All of the

assets to us are very strategic," President Karl Strohmeyer

said.

Equinix said the new data centers serve about 900 customers,

many of which are new to the company. The Redwood City,

Calif.-company runs a portfolio of data centers around the world

where Web companies and data carriers, including Verizon, hook up

to each others' networks. The landlord is a tax-advantaged

real-estate investment trust.

The deal is Equinix's biggest acquisition since its 2015

purchase of U.K. peer Telecity PLC, also worth about $3.6 billion

when the deal was struck.

Equinix executives said it has the capacity to pay for the

purchase on its own but will likely raise debt and equity.

Shares of Equinix rose 2.3% to $339.85 Tuesday morning, while

Verizon shares climbed about 1.5% to $50.48.

--Ryan Knutson contributed to this article.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 06, 2016 11:59 ET (16:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

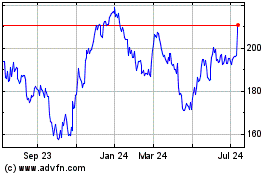

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

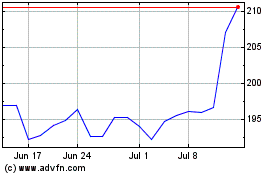

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024