CONSOLIDATED HIGHLIGHTSThird Quarter 2016

- Total revenue increased 22.4% to $1,515

million

- Property revenue increased 23.5% to

$1,498 million

- Net income increased 169.8% to $264

million

- Adjusted EBITDA increased 17.5% to $915

million

- Consolidated AFFO increased 14.9% to

$641 million

American Tower Corporation (NYSE:AMT) today reported financial

results for the quarter ended September 30, 2016.

Jim Taiclet, American Tower’s Chief Executive Officer stated,

“In response to rapid growth in mobile data usage, our tenants

continue to utilize a combination of incremental spectrum assets,

advancing technology and our diverse portfolio of real estate to

expand their mobile networks and deliver top quality service to

their subscribers. Our global asset base of nearly 144,000 towers

and over 700 small cell systems is uniquely positioned to benefit

from these continuing investments, and as a result, we were able to

extend our long track record of generating double digit growth in

property revenue, Adjusted EBITDA and Consolidated AFFO per Share

in the third quarter.”

CONSOLIDATED OPERATING RESULTS OVERVIEWAmerican Tower

generated the following operating results for the quarter ended

September 30, 2016 (unless otherwise indicated, all

comparative information is presented against the quarter ended

September 30, 2015).

($ in millions, except per share amounts)

Q3 2016 Growth Rate Total revenue $

1,515 22.4 % Total property revenue $ 1,498 23.5 % Total Tenant

Billings Growth $ 216 21.1 % Organic Tenant Billings Growth $ 78

7.7 % Property Gross Margin $ 1,016 18.1 % Property Gross Margin %

67.8 % Net income attributable to AMT common stockholders(1) $ 238

211.9 % Net income attributable to AMT common stockholders per

diluted share(1) $ 0.55 205.6 % Adjusted EBITDA $ 915 17.5 %

Adjusted EBITDA Margin % 60.4 % NAREIT Funds From Operations

(FFO) attributable to AMT common stockholders $ 578 56.0 %

Consolidated AFFO $ 641 14.9 % Consolidated AFFO per Share $ 1.49

13.7 % AFFO attributable to AMT common stockholders $ 612 10.8 %

AFFO attributable to AMT common stockholders per Share $ 1.42 10.1

% Cash provided by operating activities $ 667 31.5 % Less:

total cash capital expenditures(2) $ 161

(22.3)

%

Free Cash Flow $ 506 68.6 %

_______________

(1) Growth rate includes the impact of unrealized foreign

currency losses of approximately $78 million in the prior-year

period and a one-time cash tax charge of approximately $93 million

as part of a tax election recorded in the prior-year period,

pursuant to which GTP REIT no longer operates as a separate REIT

for federal and state income tax purposes. (2) Cash capital

expenditures for Q3 2016 include $5.0 million of payments on

capital leases of property and equipment, which are presented in

the condensed consolidated statements of cash flows included herein

under Repayments of notes payable, credit facilities, senior notes,

term loan and capital leases.

Please refer to “Non-GAAP and Defined Financial Measures” below

for definitions and other information regarding the Company’s use

of non-GAAP measures. For financial information and reconciliations

to GAAP measures, please refer to the “Unaudited Selected

Consolidated Financial Information” and “Unaudited Reconciliations

to GAAP Measures and the Calculation of Defined Financial Measures”

below.

CAPITAL ALLOCATION OVERVIEW

Distributions – During the third quarter of 2016, the

Company declared the following regular cash distributions to its

common stockholders:

Common Stock Distributions Q3

2016(1) Distribution per share $ 0.55 Aggregate amount

(in millions) $ 234 Year-over-year per share growth 19.6 %

_______________

(1) The dividend declared was paid in the fourth quarter of 2016

to stockholders of record as of the close of business on September

30, 2016.

In addition, the Company declared approximately $27 million in

preferred stock dividends during the third quarter of 2016.

Capital Expenditures – During the third quarter of 2016,

total capital expenditures were $161 million, of which

approximately $30 million was for non-discretionary capital

improvements and corporate capital expenditures. For additional

capital expenditure details, please refer to the supplemental

disclosure package available on the Company’s website.

Acquisitions and Other Transactions – During the third

quarter of 2016, the Company spent $93.4 million to acquire 351

communications sites primarily in the Company’s international

markets.

Subsequent to the end of the third quarter of 2016, the Company

announced that it had entered into a definitive agreement with

Dutch pension fund manager PGGM to form a joint venture.

LEVERAGE AND FINANCING OVERVIEW

Leverage – For the quarter ended September 30, 2016,

the Company’s Net Leverage Ratio was approximately 5.0x net debt

(total debt less cash and cash equivalents) to third quarter 2016

annualized Adjusted EBITDA.

Calculation of Net Leverage Ratio ($ in

millions)

As of September 30, 2016 Total debt $ 18,679 Less:

Cash and cash equivalents 530 Net Debt 18,149 Divided By: Third

quarter annualized Adjusted EBITDA(1) 3,660 Net Leverage Ratio 5.0x

_______________

(1) Q3 2016 Adjusted EBITDA multiplied by four.

Liquidity – As of September 30, 2016, the Company

had approximately $3.3 billion of total liquidity, consisting of

over $0.5 billion in cash and cash equivalents plus the ability to

borrow an aggregate of approximately $2.8 billion under its

revolving credit facilities, net of any outstanding letters of

credit.

On September 30, 2016, the Company completed an offering of

2.250% senior unsecured notes due 2022 and 3.125% senior unsecured

notes due 2027, in principal amounts of $600.0 million and $400.0

million, respectively. The proceeds from this offering were used to

repay existing indebtedness under the Company’s term loan entered

into in October 2013, as amended.

FULL YEAR 2016 OUTLOOK

The following estimates are based on a number of assumptions

that management believes to be reasonable and reflect the Company’s

expectations as of October 27, 2016. Actual results may differ

materially from these estimates as a result of various factors, and

the Company refers you to the cautionary language regarding

“forward-looking” statements included in this press release when

considering this information.

The Company is raising the midpoint of its full year 2016

outlook for property revenue, net income, Adjusted EBITDA and

Consolidated AFFO by $50 million, $15 million, $25 million and $30

million, respectively. This includes the impact of foreign currency

exchange rate fluctuations on property revenue, Adjusted EBITDA and

Consolidated AFFO, as outlined below.

The Company’s revised outlook is based on the following average

foreign currency exchange rates to 1.00 U.S. Dollar for the

fourth quarter of 2016: (a) 3.40 Brazilian Reais; (b) 680

Chilean Pesos; (c) 3,050 Colombian Pesos; (d) 0.91 Euros;

(e) 4.10 Ghanaian Cedi; (f) 68.30 Indian Rupees;

(g) 18.60 Mexican Pesos; (h) 330 Nigerian Naira; (i) 3.45

Peruvian Soles; (j) 15.00 South African Rand; and

(k) 3,400 Ugandan Shillings.

Based on these assumptions, the Company’s current outlook

reflects favorable impacts of foreign currency fluctuations of

approximately $23 million for total property revenue, $15 million

for Adjusted EBITDA and $8 million for Consolidated AFFO, as

compared to the Company’s previously issued full year outlook.

Additional information pertaining to the impact of foreign currency

fluctuations on the Company’s outlook has been provided in the

supplemental disclosure package available on its website. The

impact of foreign currency fluctuations on net income is not

provided, as the impact on all components of the net income measure

cannot be calculated without unreasonable effort.

2016 Outlook ($ in millions)

Full

Year 2016 Midpoint

Growth

Total property revenue(1) $ 5,685 to $ 5,735

22.0% Net income 995 to 1,025 50.3% Adjusted EBITDA 3,530 to 3,560

15.6% Consolidated AFFO 2,455 to 2,485 14.9%

_______________

(1) Includes U.S. Property revenue of $3,360 to $3,380 and

International Property revenue of $2,325 to $2,355, reflecting

midpoint growth rates of 6.7% and 53.7%, respectively.

2016 Outlook for Total Property

revenue, at the midpoint, includes the

International Total

following

components(1): ($ in millions,totals may not add

due to rounding.)

U.S. Property

Property(2)

Property International pass-through revenue $ N/A $ 737 $

737 Straight-line revenue 78 51 129

_______________

(1) For additional discussion regarding these components,

please refer to “Revenue Components” below. (2) International

property revenue reflects the Company’s Latin America, EMEA and

Asia segments.

Total Property

Adjusted Consolidated

2016 Outlook growth, at the midpoint,

includes the following components(1):

Revenue

EBITDA

AFFO

Outlook midpoint growth

22.0% 15.6% 14.9% Estimated impact of fluctuations in foreign

currency exchange rates (2.8)% (2.6)% (2.7)% Estimated impact of

straight-line revenue and expense recognition (1.3)% (1.8)% —%

Estimated impact of international pass-through revenue 5.2% —% —%

_______________

(1) Growth components for net income are not provided, as the

impact of each of the line items on the measure cannot be

calculated without unreasonable effort.

2016 Outlook growth, at the midpoint,

includes the following components(1):

International

(Totals may not add due to rounding.)

U.S. Property

Property(2)

Total Property

Organic Tenant Billings 5.8% 13.3% 7.8% New Site Tenant Billings

3.2% 45.6% 14.5% Total Tenant Billings Growth 8.9% 58.9% 22.3%

_______________

(1) For additional discussion regarding the component growth

rates, please refer to “Revenue Components” below. (2)

International property revenue reflects the Company’s Latin

America, EMEA and Asia segments.

Outlook for Capital

Expenditures:

($ in millions)

(Totals may not add due to rounding.)

Full Year 2016 Discretionary capital projects(1) $ 170 to $

200 Ground lease purchases 140 to 160 Start-up capital projects 95

to 115 Redevelopment 155 to 175 Capital improvement 110 to 120

Corporate 15 — 15 Total $ 685 to $ 785

_______________

(1) Includes the construction of approximately 1,750 to 2,250

communications sites globally, reflecting reduced expectations for

new site construction in India for the balance of the year.

Reconciliation of Outlook for Net Income to Adjusted

EBITDA: ($ in millions) (Totals may not add due

to rounding.)

Full Year 2016 Net income $ 995

to $ 1,025 Interest expense 730 to 720 Depreciation,

amortization and accretion 1,520 to 1,550 Income tax provision 133

to 122 Stock-based compensation expense 90 — 90

Other, including other operating expenses,

interest income, gain (loss) on retirement of long-term

obligations and other income (expense)

62 to 53 Adjusted EBITDA $ 3,530 to $ 3,560

Reconciliation of Outlook for Net Income to Consolidated

AFFO: ($ in millions) (Totals may not add due to

rounding.)

Full Year 2016 Net income $ 995 to

$ 1,025 Straight-line revenue (129 ) — (129 ) Straight-line expense

67 — 67 Depreciation, amortization and accretion 1,520 to 1,550

Stock-based compensation expense 90 — 90 Deferred portion of income

tax 38 to 25

Other, including other operating expenses,

amortization of deferred financing costs, capitalized

interest, debt discounts and premiums,

gain (loss) on retirement of long-term obligations, other

income (expense), long-term deferred

interest charges and dividends on preferred stock

(1 )

to

(8 ) Capital improvement capital expenditures (110 ) to (120 )

Corporate capital expenditures (15 ) — (15 ) Consolidated AFFO $

2,455 to $ 2,485

Conference Call InformationAmerican Tower will host a

conference call today at 8:30 a.m. ET to discuss its financial

results for the quarter ended September 30, 2016 and its

outlook for 2016. Supplemental materials for the call will be

available on the Company’s website, www.americantower.com. The conference call dial-in

numbers are as follows:

U.S./Canada dial-in: (800)

260-0712International dial-in: (651) 291-1170Passcode: 403366

When available, a replay of the call can be accessed until 11:59

p.m. ET on November 10, 2016. The replay dial-in numbers are as

follows:

U.S./Canada dial-in: (800)

475-6701International dial-in: (320) 365-3844Passcode: 403366

American Tower will also sponsor a live simulcast and replay of

the call on its website, www.americantower.com.

About American TowerAmerican Tower, one of the largest

global REITs, is a leading independent owner, operator and

developer of multitenant communications real estate with a

portfolio of over 144,000 communications sites. For more

information about American Tower, please visit the “Earnings

Materials” and “Company & Industry Resources” sections of our

investor relations website at www.americantower.com.

Non-GAAP and Defined Financial MeasuresIn addition to the

results prepared in accordance with generally accepted accounting

principles in the United States (GAAP) provided throughout this

press release, the Company has presented the following non-GAAP and

defined financial measures: Gross Margin, Operating Profit,

Operating Profit Margin, Adjusted EBITDA, Adjusted EBITDA Margin,

NAREIT Funds From Operations (FFO) attributable to American Tower

Corporation common stockholders, Consolidated Adjusted Funds From

Operations (AFFO), AFFO attributable to American Tower Corporation

common stockholders, Consolidated AFFO per Share, AFFO attributable

to American Tower Corporation common stockholders per Share, Free

Cash Flow, Net Debt and Net Leverage Ratio. In addition, the

Company presents: Tenant Billings, Tenant Billings Growth, Organic

Tenant Billings Growth and New Site Tenant Billings Growth.

These measures are not intended to replace financial performance

measures determined in accordance with GAAP. Rather, they are

presented as additional information because management believes

they are useful indicators of the current financial performance of

the Company's core businesses and are commonly used across its

industry peer group. As outlined in detail below, the Company

believes that these measures can assist in comparing company

performance on a consistent basis irrespective of depreciation and

amortization or capital structure, while also providing valuable

incremental insight into the underlying operating trends of its

business.

Depreciation and amortization can vary significantly among

companies depending on accounting methods, particularly where

acquisitions or non-operating factors, including historical cost

basis, are involved. Notwithstanding the foregoing, the Company's

Non-GAAP and Defined Financial measures may not be comparable to

similarly titled measures used by other companies.

Revenue Components

In addition to reporting total revenue, the Company believes

that providing transparency around the components of its revenue

provides investors with insight into the indicators of the

underlying demand for, and operating performance of, its real

estate portfolio. Accordingly, the Company has provided disclosure

of the following revenue components: (i) Tenant Billings, (ii) New

Site Tenant Billings; (iii) Organic Tenant Billings; (iv)

International pass-through revenue; (v) Straight-line revenue; (vi)

Pre-paid amortization revenue; and (vii) Other revenue.

Tenant Billings: The majority of the Company’s revenue is

generated from non-cancellable, long-term tenant leases. Revenue

from Tenant Billings reflects several key aspects of the Company’s

real estate business: (i) “colocations/amendments” reflects new

tenant leases for space on existing towers and amendments to

existing leases to add additional tenant equipment; (ii)

“escalations” reflects contractual increases in billing rates,

which are typically tied to fixed percentages or a variable

percentage based on a consumer price index; (iii) “cancellations”

reflects the impact of tenant lease terminations or non-renewals

or, in limited circumstances, when the lease rates on existing

leases are reduced; and (iv) “new sites” reflects the impact of new

property construction and acquisitions.

New Site Tenant Billings: Day-one Tenant Billings

associated with sites that have been built or acquired since the

beginning of the prior-year period. Incremental

colocations/amendments, escalations or cancellations that occur on

these sites after the date of their initial addition to our

portfolio is not included in New Site Tenant Billings. The Company

believes providing New Site Tenant Billings enhances an investor’s

ability to analyze our existing real estate portfolio growth as

well as our development program growth, as the Company’s

construction and acquisition activities can drive variability in

growth rates from period to period.

Organic Tenant Billings: Tenant Billings on sites that

the Company has owned since the beginning of the prior-year period,

as well as Tenant Billings activity on new sites that occurred

after the date of their initial addition to the Company’s

portfolio.

International pass-through revenue: A portion of the

Company’s pass-through revenue is based on power and fuel expense

reimbursements and therefore subject to fluctuations in fuel

prices. As a result, revenue growth rates may fluctuate depending

on the market price for fuel in any given period, which is not

representative of the Company’s real estate business and its

economic exposure to power and fuel costs. Furthermore, this

expense reimbursement mitigates the economic impact associated with

fluctuations in operating expenses, such as power and fuel costs

and land rents in certain of the Company’s markets. As a result,

the Company believes that it is appropriate to provide insight into

the impact of pass-through revenue on certain revenue growth

rates.

Straight-line revenue: Under GAAP, the Company recognizes

revenue on a straight-line basis over the term of the contract for

certain of its tenant leases. Due to the Company’s significant base

of non-cancellable, long-term tenant leases, this can result in

significant fluctuations in growth rates upon tenant lease signings

and renewals (typically increases), when amounts billed or received

upfront upon these events are initially deferred. These signings

and renewals are only a portion of the Company’s underlying

business growth and can distort the underlying performance of our

Tenant Billings Growth. As a result, the Company believes that it

is appropriate to provide insight into the impact of straight-line

revenue on certain growth rates in revenue and select other

measures.

Pre-paid amortization revenue: The Company recovers a

portion of the costs it incurs for the redevelopment and

development of its properties from its tenants. These upfront

payments are then amortized over the initial term of the

corresponding tenant lease. Given this amortization is not

necessarily directly representative of underlying leasing activity

on our real estate portfolio, (i.e.: does not have a renewal option

or escalation as our tenant leases do) the Company believes that it

is appropriate to provide insight into the impact of pre-paid

amortization revenue on certain revenue growth rates to provide

transparency into the underlying performance of our real estate

business.

Foreign currency exchange impact: The majority of the

Company’s international revenue and operating expenses are

denominated in each respective country’s local currency. As a

result, foreign currency fluctuations may distort the underlying

performance of our real estate business from period to period,

depending on the movement of foreign currency exchange rates versus

the U.S. Dollar. The Company believes it is appropriate to quantify

the impact of foreign currency exchange fluctuations to its

reported growth to provide transparency into the underlying

performance of its real estate business.

Other revenue: Typically an immaterial portion of the

Company’s total revenue, Other revenue represents revenue not

captured by the above listed terms and can include items such as

tenant settlements.

Non-GAAP and Defined Financial Measure

Definitions

Tenant Billings Growth: The increase or decrease

resulting from a comparison of Tenant Billings for a current period

with Tenant Billings for the corresponding prior-year period, in

each case adjusted for foreign currency exchange fluctuations. The

Company believes this measure provides valuable insight into the

growth in recurring Tenant Billings and underlying demand for its

real estate portfolio.

Organic Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to Organic Tenant Billings. The

Company believes that organic growth is a useful measure of its

ability to add tenancy and incremental revenue to its assets for

the reported period, which enables investors and analysts to gain

additional insight into the relative attractiveness, and therefore

the value, of the Company’s property assets.

New Site Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to New Site Tenant Billings. The

Company believes this measure provides valuable insight into the

growth attributable to Tenant Billings from recently acquired or

constructed properties.

Gross Margin: Revenues less operating expenses, excluding

stock-based compensation expense recorded in costs of operations,

depreciation, amortization and accretion, selling, general,

administrative and development expense and other operating

expenses. The Company believes this measure provides valuable

insight into the site-level profitability of its assets.

Operating Profit: Gross Margin less selling, general,

administrative and development expense, excluding stock-based

compensation expense and corporate expenses. The Company believes

this measure provides valuable insight into the site-level

profitability of its assets while also taking into account the

overhead expenses required to manage each of its operating

segments.

For segment reporting purposes, the Latin America property

segment Operating Profit and Gross Margin also include interest

income, TV Azteca, net. Operating Profit and Gross Margin are

before interest income, interest expense, gain (loss) on retirement

of long-term obligations, other income (expense), net income (loss)

attributable to noncontrolling interest and income tax benefit

(provision).

Operating Profit Margin: The percentage that results from

dividing Operating Profit by revenue.

Adjusted EBITDA: Net income before income (loss) from

equity method investments, income tax benefit (provision), other

income (expense), gain (loss) on retirement of long-term

obligations, interest expense, interest income, other operating

income (expense), depreciation, amortization and accretion and

stock-based compensation expense. The Company believes this measure

provides valuable insight into the profitability of its operations

while at the same time taking into account the central overhead

expenses required to manage its global operations. In addition, it

is a widely used performance measure across our telecommunications

real estate sector.

Adjusted EBITDA Margin: The percentage that results from

dividing Adjusted EBITDA by total revenue.

NAREIT Funds From Operations (FFO), as defined by the

National Association of Real Estate Investment Trusts (NAREIT),

attributable to American Tower Corporation common stockholders:

Net income before gains or losses from the sale or disposal of real

estate, real estate related impairment charges, real estate related

depreciation, amortization and accretion and dividends on preferred

stock, and including adjustments for (i) unconsolidated affiliates

and (ii) noncontrolling interests. The Company believes this

measure provides valuable insight into the operating performance of

its property assets by excluding the charges described above,

particularly depreciation expenses, given the high initial,

up-front capital intensity of the Company’s operating model. In

addition, it is a widely used performance measure across our

telecommunications real estate sector.

Consolidated Adjusted Funds From Operations (AFFO):

NAREIT FFO attributable to American Tower Corporation common

stockholders before (i) straight-line revenue and expense, (ii)

stock-based compensation expense, (iii) the deferred portion of its

tax provision, (iv) non-real estate related depreciation,

amortization and accretion, (v) amortization of deferred financing

costs, capitalized interest, debt discounts and premiums and

long-term deferred interest charges, (vi) other income (expense),

(vii) gain (loss) on retirement of long-term obligations, (viii)

other operating income (expense), and adjustments for (ix)

unconsolidated affiliates and (x) noncontrolling interests, less

cash payments related to capital improvements and cash payments

related to corporate capital expenditures. The Company believes

this measure provides valuable insight into the operating

performance of its property assets by further adjusting the NAREIT

FFO attributable to American Tower Corporation common stockholders

metric to exclude the factors outlined above, which if unadjusted,

may cause material fluctuations in NAREIT FFO attributable to

American Tower Corporation common stockholders growth from period

to period that would not be representative of the underlying

performance of our property assets in those periods. In addition,

it is a widely used performance measure across our

telecommunications real estate sector.

Adjusted Funds From Operations (AFFO) attributable to

American Tower Corporation common stockholders: Consolidated

AFFO, excluding the impact of noncontrolling interests on both

NAREIT FFO attributable to American Tower Corporation common

stockholders as well as the other line items included in the

calculation of Consolidated AFFO. The Company believes that

providing this additional metric enhances transparency, given a

significantly larger minority interest component of its business as

a result of the Company’s Viom transaction, which closed in the

second quarter of 2016.

Consolidated AFFO per Share: Consolidated AFFO divided by

the diluted weighted average common shares outstanding.

AFFO attributable to American Tower Corporation common

stockholders per Share: AFFO attributable to American Tower

Corporation common stockholders divided by the diluted weighted

average common shares outstanding.

Free Cash Flow: Cash provided by operating activities

less total cash capital expenditures, including payments on capital

leases of property and equipment. The Company believes that Free

Cash Flow is useful to investors as the basis for comparing our

performance and coverage ratios with other companies in its

industry.

Net Debt: Total long-term debt less cash and cash

equivalents.

Net Leverage Ratio: Net Debt divided by the quarter’s

annualized Adjusted EBITDA (the quarter’s Adjusted EBITDA

multiplied by four). The Company believes that including this

calculation is important for investors and analysts given it is a

critical component underlying its credit agency ratings.

Cautionary Language Regarding Forward-Looking

StatementsThis press release contains “forward-looking

statements” concerning our goals, beliefs, expectations,

strategies, objectives, plans, future operating results and

underlying assumptions, and other statements that are not

necessarily based on historical facts. Examples of these statements

include, but are not limited to, statements regarding our full year

2016 outlook, foreign currency exchange rates and our expectation

regarding the leasing demand for communications real estate. Actual

results may differ materially from those indicated in our

forward-looking statements as a result of various important

factors, including: (1) decrease in demand for our communications

sites would materially and adversely affect our operating results,

and we cannot control that demand; (2) if our tenants share site

infrastructure to a significant degree or consolidate or merge, our

growth, revenue and ability to generate positive cash flows could

be materially and adversely affected; (3) increasing competition

for tenants in the tower industry may materially and adversely

affect our pricing; (4) competition for assets could adversely

affect our ability to achieve our return on investment criteria;

(5) our business is subject to government and tax regulations and

changes in current or future laws or regulations could restrict our

ability to operate our business as we currently do; (6) our

leverage and debt service obligations may materially and adversely

affect us, including our ability to raise additional financing to

fund capital expenditures, future growth and expansion initiatives

and to satisfy our distribution requirements; (7) our expansion

initiatives involve a number of risks and uncertainties, including

those related to integration of acquired or leased assets, that

could adversely affect our operating results, disrupt our

operations or expose us to additional risk; (8) our foreign

operations are subject to economic, political and other risks that

could materially and adversely affect our revenues or financial

position, including risks associated with fluctuations in foreign

currency exchange rates; (9) new technologies or changes in a

tenant’s business model could make our tower leasing business less

desirable and result in decreasing revenues; (10) a substantial

portion of our revenue is derived from a small number of tenants,

and we are sensitive to changes in the creditworthiness and

financial strength of our tenants; (11) if we fail to remain

qualified for taxation as a REIT, we will be subject to tax at

corporate income tax rates, which may substantially reduce funds

otherwise available, and even if we qualify for taxation as a REIT,

we may face tax liabilities that impact earnings and available cash

flow; (12) complying with REIT requirements may limit our

flexibility or cause us to forego otherwise attractive

opportunities; (13) if we are unable to protect our rights to the

land under our towers, it could adversely affect our business and

operating results; (14) if we are unable or choose not to exercise

our rights to purchase towers that are subject to lease and

sublease agreements at the end of the applicable period, our cash

flows derived from such towers will be eliminated; (15) restrictive

covenants in the agreements related to our securitization

transactions, our credit facilities and our debt securities and the

terms of our preferred stock could materially and adversely affect

our business by limiting flexibility, and we may be prohibited from

paying dividends on our common stock, which may jeopardize our

qualification for taxation as a REIT; (16) our costs could increase

and our revenues could decrease due to perceived health risks from

radio emissions, especially if these perceived risks are

substantiated; (17) we could have liability under environmental and

occupational safety and health laws; and (18) our towers, data

centers or computer systems may be affected by natural disasters

and other unforeseen events for which our insurance may not provide

adequate coverage. For additional information regarding factors

that may cause actual results to differ materially from those

indicated in our forward-looking statements, we refer you to the

information contained in Item 1A of our Form 10-K for the year

ended December 31, 2015, under the caption “Risk Factors”. We

undertake no obligation to update the information contained in this

press release to reflect subsequently occurring events or

circumstances.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(In thousands)

September 30, 2016 December 31, 2015

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 530,358 $

320,686 Restricted cash 150,655 142,193 Accounts receivable, net

273,907 227,354 Prepaid and other current assets 415,836

306,235 Total current assets 1,370,756 996,468

PROPERTY AND EQUIPMENT, net 10,452,038 9,866,424 GOODWILL 4,997,224

4,091,805 OTHER INTANGIBLE ASSETS, net 11,557,964 9,837,876

DEFERRED TAX ASSET 197,914 212,041 DEFERRED RENT ASSET 1,265,700

1,166,755 NOTES RECEIVABLE AND OTHER NON-CURRENT ASSETS 813,931

732,903 TOTAL $ 30,655,527 $ 26,904,272

LIABILITIES CURRENT LIABILITIES: Accounts payable $ 105,551

$ 96,714 Accrued expenses 571,989 516,413 Distributions payable

236,608 210,027 Accrued interest 108,077 115,672 Current portion of

long-term obligations 242,992 50,202 Unearned revenue 254,336

211,001 Total current liabilities 1,519,553

1,200,029 LONG-TERM OBLIGATIONS 18,436,144 17,068,807 ASSET

RETIREMENT OBLIGATIONS 965,087 856,936 DEFERRED TAX LIABILITY

792,139 106,333 OTHER NON-CURRENT LIABILITIES 1,068,121

959,349 Total liabilities 22,781,044 20,191,454

COMMITMENTS AND CONTINGENCIES REDEEMABLE

NONCONTROLLING INTERESTS 1,100,202 —

EQUITY: Preferred

stock, Series A 60 60 Preferred stock, Series B 14 14 Common stock

4,284 4,267 Additional paid-in capital 9,817,815 9,690,609

Distributions in excess of earnings (1,030,663 ) (998,535 )

Accumulated other comprehensive loss (1,876,374 ) (1,836,996 )

Treasury stock (207,740 ) (207,740 ) Total American Tower

Corporation equity 6,707,396 6,651,679 Noncontrolling interests

66,885 61,139 Total equity 6,774,281 6,712,818

TOTAL $ 30,655,527 $ 26,904,272

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share data)

Three months ended Nine months ended

September 30, September 30, 2016

2015 2016 2015 REVENUES: Property $

1,497,936 $ 1,212,849 $ 4,191,779 $ 3,429,264 Services 16,909

25,061 54,340 62,211 Total operating

revenues 1,514,845 1,237,910 4,246,119

3,491,475 OPERATING EXPENSES: Costs of operations (exclusive

of items shown separately below):

Property (including stock-based

compensation expense of $426, $396,

$1,325 and $1,218, respectively)

485,525 356,082 1,280,386 929,624

Services (including stock-based

compensation expense of $172, $99, $578

and $336, respectively)

5,712 9,307 22,007 22,863 Depreciation, amortization and accretion

397,999 341,096 1,137,398 932,972

Selling, general, administrative and

development expense (including stock-based

compensation expense of $19,628, $17,850,

$68,309 and $70,697,

respectively) 131,537 114,832 405,086 354,460 Other operating

expenses 14,998 15,668 37,509 40,891

Total operating expenses 1,035,771 836,985 2,882,386

2,280,810 OPERATING INCOME 479,074 400,925

1,363,733 1,210,665 OTHER INCOME (EXPENSE):

Interest income, TV Azteca, net of

interest expense of $279, $40, $846 and $780,

respectively

2,742 2,993 8,206 8,251 Interest income 6,376 4,503 16,378 11,871

Interest expense (190,160 ) (149,787 ) (531,076 ) (446,228 ) Gain

(loss) on retirement of long-term obligations — — 830 (78,793 )

Other expense (including unrealized

foreign currency losses of $8,321, $77,864,

$3,544 and $107,871, respectively)

(12,260 ) (66,659 ) (25,894 ) (123,291 ) Total other expense

(193,302 ) (208,950 ) (531,556 ) (628,190 ) INCOME FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES 285,772 191,975 832,177 582,475

Income tax provision(1)

(22,037 ) (94,235 ) (94,671 ) (132,063 ) NET INCOME 263,735 97,740

737,506 450,412 Net loss (income) attributable to noncontrolling

interests 774 5,259 (10,288 ) 1,960

NET INCOME ATTRIBUTABLE TO AMERICAN TOWER

CORPORATION

STOCKHOLDERS

264,509 102,999 727,218 452,372 Dividends on preferred stock

(26,781 ) (26,781 ) (80,344 ) (63,382 ) NET INCOME ATTRIBUTABLE TO

AMERICAN TOWER CORPORATION COMMON STOCKHOLDERS $ 237,728 $

76,218 $ 646,874 $ 388,990 NET INCOME PER

COMMON SHARE AMOUNTS:

Basic net income attributable to American

Tower Corporation common

stockholders

$ 0.56 $ 0.18 $ 1.52 $ 0.93

Diluted net income attributable to

American Tower Corporation common

stockholders

$ 0.55 $ 0.18 $ 1.51 $ 0.92 WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING: BASIC 425,517 423,375

424,831 417,280 DILUTED 429,925 427,227

429,019 421,352

_______________

(1) 2015 amounts include the impact of a one-time cash tax

charge of approximately $93 million as part of the tax election

related to the GTP REIT.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

Nine Months Ended September 30, 2016

2015 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $

737,506 $ 450,412 Adjustments to reconcile net income to cash

provided by operating activities: Depreciation, amortization and

accretion 1,137,398 932,972 Stock-based compensation expense 70,212

72,251 (Gain) loss on early retirement of long-term obligations

(830 ) 78,793 Other non-cash items reflected in statements of

operations 120,170 143,412 Decrease in restricted cash 4,126 19,971

Increase in net deferred rent balances (51,762 ) (69,019 ) Increase

in assets (8,863 ) (106,535 ) (Decrease) increase in liabilities

(29,526 ) 21,358 Cash provided by operating activities

1,978,431 1,543,615 CASH FLOWS FROM INVESTING

ACTIVITIES: Payments for purchase of property and equipment and

construction activities (475,174 ) (518,018 ) Payments for

acquisitions, net of cash acquired (1,309,915 ) (1,616,205 )

Payment for Verizon transaction (4,748 ) (5,058,895 ) Proceeds from

sales of short-term investments and other non-current assets 4,459

1,002,214 Payments for short-term investments — (1,011,320 )

Deposits, restricted cash, investments and other (824 ) (2,053 )

Cash used for investing activities (1,786,202 ) (7,204,277 ) CASH

FLOWS FROM FINANCING ACTIVITIES: (Repayments of) proceeds from of

short-term borrowings, net (7,337 ) 8,282 Borrowings under credit

facilities 1,529,477 5,727,831 Proceeds from issuance of senior

notes, net 3,236,383 1,492,298 Proceeds from term loan — 500,000

Proceeds from other borrowings 70,806 — Proceeds from issuance of

securities in securitization transaction — 875,000 Repayments of

notes payable, credit facilities, senior notes, term loan and

capital leases(1) (4,116,645 ) (6,092,710 ) (Distributions to)

contributions from noncontrolling interest holders, net (700 )

4,449 Proceeds from stock options and ESPP 76,601 29,324

Distributions paid on preferred stock (80,344 ) (57,866 )

Distributions paid on common stock (651,966 ) (516,012 ) Proceeds

from the issuance of common stock, net — 2,440,327 Proceeds from

the issuance of preferred stock, net — 1,337,946 Payment for early

retirement of long-term obligations (125 ) (86,107 ) Deferred

financing costs and other financing activities (29,423 ) (30,314 )

Cash provided by financing activities 26,727 5,632,448

Net effect of changes in foreign currency exchange rates on

cash and cash equivalents (9,284 ) 2,126 NET INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS 209,672 (26,088 ) CASH AND

CASH EQUIVALENTS, BEGINNING OF PERIOD 320,686 313,492

CASH AND CASH EQUIVALENTS, END OF PERIOD $ 530,358 $ 287,404

CASH PAID FOR INCOME TAXES, NET $ 71,868 $ 130,231

CASH PAID FOR INTEREST $ 516,382 $ 472,079

_______________

(1) Nine months ended September 30, 2016 includes $13.8 million

of payments on capital leases of property and equipment.

UNAUDITED CONSOLIDATED RESULTS FROM OPERATIONS, BY

SEGMENT

($ in millions. Totals may not add due to

rounding.)

Three Months Ended September 30, 2016 Property

Services Total U.S.

LatinAmerica

Asia EMEA

TotalInternational

TotalProperty

Segment revenues $ 837 $ 260 $ 270 $ 131 $ 661 $ 1,498 $ 17 $ 1,515

Segment operating expenses(1)

189 88 154 54

296

485 6 491 Interest income, TV Azteca, net — 3 —

— 3 3 — 3 Segment Gross

Margin $ 648 $ 175 $ 116 $ 77 $ 367

$ 1,016 $ 11 $ 1,027

Segment SG&A(1)

36 15 15 13 43 79 3

82 Segment Operating Profit $ 613 $ 159

$ 101 $ 64 $ 324 $ 937 $ 9 $ 945

Segment Operating Profit Margin 73 % 61 % 37 % 49 % 49 % 63

% 51 % 62 % Revenue Growth 3.6 % 19.0 % 338.4 % 4.9 % 63.2 %

23.5 % (32.5 )% 22.4 % Total Tenant Billings Growth 5.8 % 20.3 %

355.9 % 14.5 % 62.1 % 21.1 % Organic Tenant Billings Growth 5.7 %

13.9 % 11.2 % 12.0 % 13.0 % 7.7 %

Revenue Components(2)

Prior-Year Tenant Billings $ 744 $ 152 $ 36 $ 91 $ 279 $ 1,023

Colocations/Amendments 33 10 5 5 20 53 Escalations 21 12 2 5 19 40

Cancellations (13 ) (1 ) (3 ) (1 ) (5 ) (18 ) Other 2 1

(0 ) 1 1 3 Organic Tenant Billings $

786 $ 173 $ 40 $ 102 $ 315 $

1,101 New Site Tenant Billings 1 10 125

2 137 138 Total Tenant Billings $ 787 $

182 $ 165 $ 104 $ 451 $ 1,239

Foreign Currency Exchange Impact(3)

— (1 ) (5 ) (7 ) (14 ) (14 ) Total Tenant Billings (Current

Period) $ 787 $ 181 $ 160 $ 97 $ 437

$ 1,225 Straight-Line Revenue 20 9 6 1 15 36

Prepaid Amortization Revenue 23 0 — 0 0 24 Other Revenue 6 2 (4 )

(1 ) (2 ) 4 International Pass-Through Revenue — 69 112 42 223 223

Foreign Currency Exchange Impact(4)

— (1 ) (4 ) (8 ) (13 ) (13 ) Total Property Revenue (Current

Period) $ 837 $ 260 $ 270 $ 131 $ 661

$ 1,498

_______________

(1) Excludes stock-based compensation expense. (2) All

components of revenue, except those labeled current period, have

been translated at prior period foreign exchange rates. (3)

Reflects foreign currency exchange impact on all components of

Total Tenant Billings. (4) Reflects foreign currency exchange

impact on components of revenue, other than Total Tenant Billings.

UNAUDITED CONSOLIDATED RESULTS FROM OPERATIONS, BY

SEGMENT (CONTINUED)

($ in millions. Totals may not add due to

rounding.)

Three Months Ended September 30,

2015

Property Services Total

U.S.

Latin America

Asia EMEA

TotalInternational

TotalProperty

Segment revenues $ 808 $ 219 $ 62 $ 125 $ 405 $ 1,213 $ 25 $ 1,238

Segment operating expenses(1)

187 78 33 57 168 356 9 365 Interest income, TV Azteca, net —

3 — — 3 3 — 3

Segment Gross Margin $ 621 $ 144 $ 29 $ 67

$ 240 $ 860 $ 16 $ 876

Segment SG&A(1)

31 14 6 13 33 65 4

68 Segment Operating Profit $ 589 $ 129 $ 23

$ 54 $ 206 $ 796 $ 12 $ 808

Segment Operating Profit Margin 73 % 59 % 38 % 43 % 51 % 66

% 48 % 65 % Revenue Growth 21.8 % 2.0 % 6.3 % 65.6 % 16.5 %

20.0 % (7.4 )% 19.2 % Total Tenant Billings Growth 21.9 % 38.6 %

22.7 % 84.9 % 46.9 % 29.0 % Organic Tenant Billings Growth 6.3 %

12.1 % 12.1 % 13.8 % 12.5 % 8.1 %

Revenue Components(2)

Prior-Year Tenant Billings $ 611 $ 155 $ 32 $ 54 $ 241 $ 852

Colocations/Amendments 34 11 4 4 19 54 Escalations 19 9 1 4 13 32

Cancellations (14 ) (2 ) (1 ) (0 ) (3 ) (18 ) Other (0 ) 1 0

0 1 1 Organic Tenant Billings $ 649

$ 174 $ 36 $ 62 $ 271 $ 920

New Site Tenant Billings 95 41 3 39

83 178 Total Tenant Billings $ 744 $

215 $ 39 $ 101 $ 354 $ 1,098

Foreign Currency Exchange Impact(3)

— (63 ) (3 ) (10 ) (76 ) (76 ) Total Tenant Billings

(Current Period) $ 744 $ 152 $ 36 $ 91

$ 279 $ 1,023 Straight-Line Revenue 32 6 0 2 8

41 Prepaid Amortization Revenue 21 0 — 0 1 21 Other Revenue 11 3 (0

) 3 6 16 International Pass-Through Revenue — 83 27 32 142 142

Foreign Currency Exchange Impact(4)

— (25 ) (2 ) (3 ) (30 ) (30 ) Total Property Revenue

(Current Period) $ 808 $ 219 $ 62 $ 125

$ 405 $ 1,213

_______________

(1) Excludes stock-based compensation expense. (2) All

components of revenue, except those labeled current period, have

been translated at prior period foreign exchange rates. (3)

Reflects foreign currency exchange impact on all components of

Total Tenant Billings. (4) Reflects foreign currency exchange

impact on components of revenue, other than Total Tenant Billings.

UNAUDITED SELECTED CONSOLIDATED FINANCIAL INFORMATION

($ in thousands. Totals may not add due to rounding.)

The following table reflects the estimated impact of foreign

currency exchange rate fluctuations, pass-through revenue and

straight-line revenue and expense recognition on total property

revenue, Adjusted EBITDA and Consolidated AFFO growth rates.

Components of Growth(1)(2):

Property Adjusted

Consolidated Three months ended September 30, 2016

Revenue EBITDA AFFO Growth 23.5 % 17.5 % 14.9

% Estimated impact of fluctuations in foreign currency exchange

rates (1.2

)%

(0.5 )% (0.1 )% Estimated impact of straight-line revenue and

expense recognition (1.1 )% (1.2 )% — % Estimated impact of

international pass-through revenue 6.3 % — % — %

_______________

(1) See “Non-GAAP and Defined Financial Measures” above. (2)

Growth components for net income are not provided, as the impact of

each of the line items on the measure cannot be calculated without

unreasonable effort.

The reconciliation of net income to Adjusted EBITDA and the

calculation of Adjusted EBITDA Margin are as follows:

Three months ended September 30, 2016

2015 Net income $ 263,735 $ 97,740 Income tax

provision 22,037 94,235 Other expense 12,260 66,659 Interest

expense 190,160 149,787 Interest income (6,376 ) (4,503 ) Other

operating expenses 14,998 15,668 Depreciation, amortization and

accretion 397,999 341,096 Stock-based compensation expense 20,226

18,345 Adjusted EBITDA $ 915,039 $ 779,027

Total revenue 1,514,845 1,237,910 Adjusted

EBITDA Margin 60 % 63 %

UNAUDITED RECONCILIATIONS TO GAAP MEASURES AND THE

CALCULATION OF DEFINED FINANCIAL MEASURES

($ in thousands, except per share data. Totals may not add due

to rounding.)

The reconciliation of net income to NAREIT FFO attributable

to American Tower Corporation common stockholders and the

calculation of Consolidated AFFO, Consolidated AFFO per Share, AFFO

attributable to American Tower Corporation common stockholders and

AFFO attributable to American Tower Corporation common stockholders

per Share are presented below:

Three months ended September 30, 2016

2015 Net income $ 263,735 $ 97,740 Real estate

related depreciation, amortization and accretion 355,721 297,263

Losses from sale or disposal of real estate and real estate related

impairment charges 12,150 1,200 Dividends on preferred stock

(26,781 ) (26,781 ) Adjustments for unconsolidated affiliates and

noncontrolling interests (27,224 ) 804 NAREIT FFO

attributable to AMT common stockholders $ 577,601 $ 370,226

Straight-line revenue (34,645 ) (38,798 ) Straight-line

expense 17,814 16,433 Stock-based compensation expense 20,226

18,345 Deferred portion of income tax 582 (6,085 )

GTP REIT One-time charge(1)

— 93,044 Non-real estate related depreciation, amortization and

accretion 42,278 43,833

Amortization of deferred financing costs,

capitalized interest and debt discounts and

premiums and long-term deferred interest

charges

5,578 7,292

Other expense(2)

12,260 66,659 Other operating expense(3) 2,848 14,468 Capital

improvement capital expenditures (27,975 ) (22,202 ) Corporate

capital expenditures (2,508 ) (4,343 ) Adjustments for

unconsolidated affiliates and noncontrolling interests 27,224

(804 ) Consolidated AFFO $ 641,283 $ 558,068

Adjustments for unconsolidated affiliates and noncontrolling

interests (29,315 ) (5,834 ) AFFO attributable to AMT common

stockholders $ 611,968 $ 552,234 Divided by weighted

average diluted shares outstanding 429,925 427,227

Consolidated AFFO per Share $ 1.49 $ 1.31 AFFO

attributable to AMT common stockholders per Share $ 1.42 $

1.29

_______________

(1) In the third quarter of 2015, the Company filed a tax

election, pursuant to which GTP no longer operates as a separate

REIT for federal and state income tax purposes. In connection with

this election, the Company incurred a one-time cash tax charge

during the third quarter of 2015. As this charge is non-recurring,

the Company does not believe it is an indication of operating

performance and believes it is more meaningful to present its AFFO

metrics excluding its impact. Accordingly, the Company presents

Consolidated AFFO and AFFO attributable to American Tower

Corporation common stockholders for the three months ended

September 30, 2015 excluding this charge. (2) Primarily includes

realized and unrealized (gains) losses on foreign currency exchange

rate fluctuations. (3) Primarily includes integration and

acquisition-related costs.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027005585/en/

American Tower CorporationLeah Stearns, 617-375-7500Senior Vice

President, Treasurer and Investor Relations

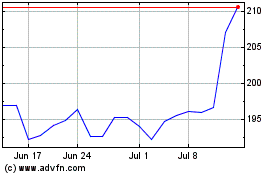

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

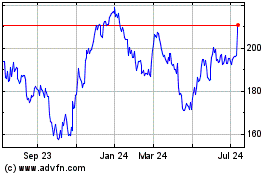

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024