UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT

REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 27, 2015

AMERICAN TOWER CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-14195 |

|

65-0723837 |

| (State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

116 Huntington Avenue

Boston, Massachusetts 02116

(Address of Principal Executive Offices) (Zip Code)

(617) 375-7500

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01 Completion of Acquisition or Disposition of

Assets.

As previously reported on its Current Report on Form 8-K filed with the Securities and Exchange Commission

(the “SEC”) on March 30, 2015 (the “Closing 8-K”), American Tower Corporation (the “Company”), through certain of its wholly owned subsidiaries, completed its acquisition of the exclusive right to lease, acquire or

otherwise operate and manage 11,448 wireless communications sites from certain subsidiaries of Verizon Communications Inc. (“Verizon”) for approximately $5.053 billion in cash (the “Verizon Transaction”) on March 27, 2015.

For a description of the Verizon Transaction and the related agreements, see Item 1.01 of the Company’s Current

Report on Form 8-K filed with the SEC on February 5, 2015, as supplemented by the Closing 8-K.

This Current Report on Form 8-K/A

amends the Closing 8-K and is being filed to provide the financial statements and pro forma financial information relating to the Verizon Transaction set forth below under Item 9.01. In entering into the Verizon Transaction, the Company

evaluated, among other things, sources of revenue (including, but not limited to, the lease to Verizon, described more fully in the Closing 8-K) and expenses (including, but not limited to, expenses associated with leases, property taxes, repairs

and maintenance and utilities, as well as other operating expenses and selling, general and administrative expenses). After reasonable inquiry, management is not aware of any other material factors affecting these sites that would cause the reported

financial information not to be indicative of their future operating results, other than as disclosed in the pro forma financial information.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of real estate operations acquired

| |

1. |

The audited statement of revenues and certain expenses of Tower Sites (a component of Verizon) for the year ended December 31, 2014 is

attached as Exhibit 99.1 hereto and is incorporated herein by reference. |

(b) Pro forma financial information

The following unaudited pro forma condensed combined financial information of the Company, giving effect to the Verizon Transaction, is

attached as Exhibit 99.2 hereto and is incorporated herein by reference:

| |

1. |

The unaudited pro forma condensed combined balance sheet and the notes thereto as of December 31, 2014; and |

| |

2. |

The unaudited pro forma condensed combined statement of operations and notes thereto for the year ended December 31, 2014.

|

(d) Exhibits

Exhibit

No. Description

| 23.1 |

Consent of Ernst & Young LLP, Independent Auditors. |

| 99.1 |

Audited statement of revenues and certain expenses of Tower Sites (a component of Verizon) for the year ended December 31, 2014. |

| 99.2 |

The unaudited pro forma condensed combined financial information of the Company. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN TOWER CORPORATION |

|

|

|

|

|

|

|

| Date: June 11, 2015 |

|

|

|

By: |

|

/s/ THOMAS A.

BARTLETT |

|

|

|

|

|

|

|

|

Thomas A. Bartlett |

|

|

|

|

|

|

Executive Vice President and Chief Financial

Officer |

|

|

EXHIBIT INDEX

Exhibit No. Description

| 23.1 |

Consent of Ernst & Young LLP, Independent Auditors. |

| 99.1 |

Audited statement of revenues and certain expenses of Tower Sites (a component of Verizon) for the year ended December 31, 2014. |

| 99.2 |

The unaudited pro forma condensed combined financial information of the Company. |

Exhibit 23.1

Consent of Independent Auditors

We consent to the incorporation by

reference in the following Registration Statements of American Tower Corporation

| |

1. |

Registration Statement (Form S-3 No. 333-188812), |

| |

2. |

Registration Statement (Form S-8 No. 333-41226), |

| |

3. |

Registration Statement (Form S-8 No. 333-41224), |

| |

4. |

Registration Statement (Form S-8 No. 333-76324), |

| |

5. |

Registration Statement (Form S-8 No. 333-51959), |

| |

6. |

Registration Statement (Form S-8 No. 333-145609), and |

| |

7. |

Registration Statement (Form S-8 No. 333-145610) |

of our report dated April 16, 2015, with respect to the

Statement of Revenues and Certain Expenses of Tower Sites (a component of Verizon Communications Inc.) for the year ended December 31, 2014, included in this Current Report on Form 8-K.

|

| /s/ Ernst & Young LLP |

|

| Ernst & Young LLP |

|

| New York, New York |

|

| June 11, 2015 |

Exhibit 99.1

Tower Sites

(A component of Verizon Communications Inc.)

Statement of Revenues and Certain Expenses

For the Year Ended

December 31, 2014

Tower Sites

(A component of Verizon Communications Inc.)

For the Year Ended December 31, 2014

|

|

|

|

|

| Index |

|

|

|

| |

|

Page(s) |

|

| Report of Independent Auditors |

|

|

1 |

|

| Statement of Revenues and Certain Expenses |

|

|

2 |

|

| Notes to Statement of Revenues and Certain Expenses |

|

|

3-6 |

|

Report of Independent Auditors

The Board of Directors of Verizon Communications Inc.:

We have audited the accompanying Statement of Revenues and Certain Expenses (the Statement) of Tower Sites (a component of Verizon

Communications Inc.), comprising the operations of certain wireless communications towers of Verizon Communications Inc., for the year ended December 31, 2014, and the related notes to the Statement.

Management is responsible for the preparation and fair presentation of the Statement in conformity with U.S. generally accepted accounting

principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of the Statement that is free of material misstatement, whether due to fraud or error.

Our responsibility is to express an opinion on the Statement based on our audit. We conducted our audit in accordance with auditing standards

generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the Statement is free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the Statement. The procedures selected

depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the Statement, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the

entity’s preparation and fair presentation of the Statement in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal

control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall

presentation of the Statement. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

In our opinion, the Statement referred to above presents fairly, in all material respects, the revenues and certain expenses described in Note

1, of Tower Sites (a component of Verizon Communications Inc.) for the year ended December 31, 2014, in conformity with U.S. generally accepted accounting principles.

As described in Note 1, the Statement of Revenues and Certain Expenses has been prepared for the purpose of complying with Rule 3-14 of

Regulation S-X of the Securities and Exchange Commission, and is not intended to be a complete presentation of Tower Sites’ revenue and expenses. Our opinion is not modified with respect to this matter.

|

| /s/ Ernst & Young LLP |

|

| Ernst & Young LLP |

| New York, New York |

|

| April 16, 2015 |

Tower Sites

(A component of Verizon Communications Inc.)

Statement of Revenues and Certain Expenses

(Dollars in Thousands)

For the Year

Ended December 31, 2014

|

|

|

|

|

| Revenues |

|

|

|

|

| Lease revenue |

|

$ |

96,364 |

|

|

|

| Certain operating expenses |

|

|

|

|

| Lease expense |

|

|

127,167 |

|

| Selling, general and administrative |

|

|

13,470 |

|

| Property taxes |

|

|

21,614 |

|

|

|

|

|

|

| Total certain operating expenses |

|

|

162,251 |

|

|

|

|

|

|

|

|

| Certain expenses in excess of revenues |

|

$ |

(65,887) |

|

|

|

|

|

|

The accompanying notes are an integral part of this Statement of Revenues and Certain Expenses.

2

Tower Sites

(A component of Verizon Communications Inc.)

Notes to the Statement of Revenues and Certain Expenses

For the Year Ended December 31, 2014

| 1. |

Summary of Significant Accounting Policies |

Operations and Basis of Presentation

The accompanying Statement of Revenues and Certain Expenses (the Statement) includes the operations of certain wireless communications

towers owned by subsidiaries of Verizon Communications Inc. (together with its subsidiaries, Verizon or the Company). These towers represent those to be leased, managed or acquired by American Tower Corporation (together with its subsidiaries,

American Tower) as described in the next paragraph. These communications towers are located on real property primarily leased from a variety of third-party individuals and commercial landlords. For the purposes of this Statement, Verizon’s

investment in these towers, and the associated operations, including leasing activities with landlords, maintenance of the communications towers, and the marketing and leasing of available tower capacity on the communications towers to other

wireless service providers, are referred to collectively as “Tower Sites.” Tower Sites is not a legal entity.

On

February 5, 2015, a definitive agreement (the Agreement) was reached by Verizon and American Tower under which American Tower will have exclusive rights to lease, manage, or purchase, and operate 11,448 sites that make up the Tower Sites tower

portfolio, the financial results for which are included in this Statement. Under the terms of the Agreement, American Tower will also take over the existing collocation agreements with third-party tenants who lease space on the towers. Verizon has

committed to sublease space on the towers from American Tower for a minimum of 10 years. The Agreement and this Statement exclude certain other Verizon-owned wireless sites and related assets that are not subject to the Agreement.

The accompanying Statement has been prepared for the purpose of complying with requirements under Regulation S-X Article 3 Rule

210.3-14, Special instructions for real estate operations to be acquired, of the Securities and Exchange Commission and therefore does not include a balance sheet or statement of cash flows. The Statement, which encompasses the towers to be

leased, managed or acquired by American Tower, is not representative of the actual operations of Tower Sites for the period presented nor indicative of future operations of Tower Sites as no revenue from Verizon’s occupation of tower space has

been included, as discussed below in Revenue Recognition. Additionally, certain expenses primarily consisting of corporate overhead, interest expense, depreciation and amortization, and income taxes have been excluded.

The accompanying Tower Sites’ Statement has been prepared using accounting principles generally accepted in the United States

applicable to the information presented herein.

Revenue Recognition

Lease revenues include revenues from site collocation rendered to non-affiliate customers for those sites that have collocation

agreements. No revenue has been recognized for Verizon’s occupation of tower space. Collocation agreements with non-affiliated customers are subject to frequent amendments that change minimum lease payments over the term of the contract.

Escalation clauses and other incentives present in the lease agreements with Tower Sites customers are therefore recognized in the period that they are effective. In agreements, where we provide collocations services in exchange for fiber capacity,

revenue is recognized based on contractual amounts receivable in the absence of fiber exchange.

3

Tower Sites

(A component of Verizon Communications Inc.)

Notes to the Statement of Revenues and Certain Expenses continued

For the Year Ended December 31, 2014

Lease Expense

Tower Sites recognizes lease expense, primarily on sites with ground leases, on a straight-line basis over the initial lease term and

renewal periods that are considered reasonably assured at the inception of the lease. Rent escalations, excluding variable lease rentals such as those tied to the Consumer Price Index (CPI), present in the lease agreements between Tower Sites and

its ground lessors are included in the computation of straight-line rent. Expense incurred in advance of required payments is accrued as a liability.

Certain ground leases contain provisions which require Tower Sites to pay the landlord a certain percentage or fixed amount of revenues

earned from collocation tenants of Verizon. Ground lease expenses related to such tower share provisions amounted to approximately 2.2% of total lease expense for the year ended December 31, 2014.

Use of Estimates

The

preparation of the Statement requires management to make estimates and assumptions that affect the reported amounts of revenues and expenses for the year ended December 31, 2014, and the disclosure of contingencies that exist as of the

Statement date. Significant estimates include reasonably assured renewal terms for operating leases. Verizon based these estimates on historical experience, where applicable, and other assumptions that management believes are reasonable under the

circumstances. Due to the inherent uncertainty involved in making estimates, actual results may differ from such estimates if management’s assumptions prove invalid or conditions change.

Concentrations of Risk

Tower Sites had five customers that generated an aggregate of approximately 85% of revenues for the year ended December 31, 2014,

including three customers that each generated more than 10% of the revenues. The percentage of revenues by customer is summarized in the table below for the year ended December 31, 2014:

|

|

|

|

|

| Customer A |

|

|

42 |

% |

| Customer B |

|

|

23 |

% |

| Customer C |

|

|

13 |

% |

| 2. |

Related-Party Transactions and Allocations |

Verizon occupied space on substantially all of the towers operated by Tower Sites during the year ended December 31, 2014. Revenue

associated with Verizon’s occupation of tower space has not been included in this statement.

Tower Sites is dependent upon

Verizon to fund its operations and anticipates that this funding requirement will continue until the transaction with American Tower is completed.

Verizon does not file separate property tax returns for the Tower Sites property and equipment. For purposes of this Statement, property

taxes were determined by applying the property tax rate per Tower Site as stated in the Agreement.

Tower Sites has not been

operated as a separate legal entity. As a result, direct costs of the towers have been reflected in this Statement to the extent they were directly attributable or allocable as outlined below.

4

Tower Sites

(A component of Verizon Communications Inc.)

Notes to the Statement of Revenues and Certain Expenses continued

For the Year Ended December 31, 2014

Selling, general and administrative expenses are directly attributable to

Verizon’s overall tower business, but not to the specific portfolio of towers included in the transaction. These costs have been allocated to Tower Sites using a variety of reasonable allocations, including a pro-rata basis, based on the

quantity of towers and leases included in the Tower Sites, and headcount or level of effort of employees in departments providing services to the tower portfolio (e.g., accounting, compliance).

| 3. |

Operating Lease Revenues |

At December 31, 2014, the expected future rental revenue receipts for Tower Sites with leased space from non-affiliate tenants based on contracted rates for the total term of the arrangement without regard to any early termination options available to either party, are as follows:

|

|

|

|

|

| |

|

Years Ending

December 31 |

|

| |

|

(Dollars in

Thousands) |

|

| 2015 |

|

$ |

98,086 |

|

| 2016 |

|

|

100,098 |

|

| 2017 |

|

|

102,165 |

|

| 2018 |

|

|

104,141 |

|

| 2019 |

|

|

106,120 |

|

| Thereafter |

|

|

1,466,219 |

|

|

|

|

|

|

|

|

$ |

1,976,829 |

|

|

|

|

|

|

| 4. |

Operating Lease Commitments |

Lease commitments consist primarily of contractual lease rentals for ground leases. Tower Sites recognizes rent expense, including the

effect of fixed increases in rent, on a straight-line basis over the term estimated at inception or acquisition of the lease. Future minimum lease payments over the remaining estimated lease terms are as follows:

|

|

|

|

|

| |

|

Years Ending

December 31 |

|

| |

|

(Dollars in

Thousands) |

|

| 2015 |

|

$ |

123,679 |

|

| 2016 |

|

|

103,870 |

|

| 2017 |

|

|

80,188 |

|

| 2018 |

|

|

51,570 |

|

| 2019 |

|

|

21,766 |

|

| Thereafter |

|

|

54,662 |

|

|

|

|

|

|

|

|

$ |

435,735 |

|

|

|

|

|

|

5

Tower Sites

(A component of Verizon Communications Inc.)

Notes to the Statement of Revenues and Certain Expenses continued

For the Year Ended December 31, 2014

| 5. |

Commitments and Contingencies |

The Company is subject to various legal proceedings and claims that arise out of the ordinary course of business. Management believes

that the ultimate settlement of these actions will not have a material adverse effect on Tower Sites’ revenues or certain operating expenses.

The Company evaluated subsequent events through April 16, 2015, the date the financial statements were available to be issued.

6

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The accompanying unaudited pro forma condensed combined financial statements present the pro forma combined financial position and results of

operations of the combined company based upon the historical financial statements of American Tower Corporation (“American Tower” or the “Company”) and Tower Sites (a component of Verizon Communications Inc.

(“Verizon”)), after giving effect to (i) American Tower’s exclusive right to lease, acquire or otherwise operate and manage 11,448 wireless communications sites (the “Sites”) from certain subsidiaries of Verizon for

approximately $5.053 billion in cash (the “Verizon Transaction”) and (ii) the related financings described herein (together with the Verizon Transaction, the “Transactions”). American Tower leased or subleased 11,285

communications sites pursuant to a master prepaid lease (“MPL”) and acquired 163 additional communications sites (“Sale Sites”). The adjustments set forth herein and described in the accompanying footnotes are intended to reflect

the impact of the Transactions on American Tower.

The accompanying unaudited pro forma condensed combined financial statements are based

upon the historical financial statements of American Tower and Tower Sites and have been developed from the (i) audited consolidated financial statements of American Tower contained in its Annual Report on Form 10-K for the fiscal year ended

December 31, 2014 (“Form 10-K”), which was filed with the Securities and Exchange Commission (the “SEC”) on February 24, 2015, and (ii) audited Statement of Revenues and Certain Expenses of Tower Sites for the year

ended December 31, 2014. Tower Sites is not a legal entity and references to “Tower Sites” refer to the collective operations of the Sites. The unaudited pro forma condensed combined financial statements are prepared as if the

Transactions had been consummated on December 31, 2014 for purposes of preparing the unaudited pro forma condensed combined balance sheet, and on January 1, 2014, for purposes of preparing the unaudited pro forma condensed combined

statement of operations for the year ended December 31, 2014.

The information reflects American Tower’s preliminary estimates

of the allocation of the consideration transferred for the Verizon Transaction based upon available information and certain assumptions that the Company believes are reasonable. The primary areas of the allocation that are not yet finalized relate

to fair values of property and equipment and intangible assets. However, as indicated in the notes to the unaudited pro forma condensed combined financial statements, American Tower made preliminary estimates of the fair values necessary to prepare

the unaudited pro forma condensed combined financial statements. The preliminary allocation is based on the assumption that substantially all of the Sites in the Verizon Transaction are accounted for as prepaid capital leases, with the Sale Sites

being accounted for as a business combination. Any excess consideration over the acquired net assets, as adjusted to reflect estimated fair values, has been recorded as goodwill for those sites accounted for as a business combination. Actual results

may differ from these unaudited pro forma condensed combined financial statements once American Tower has completed valuations necessary to finalize the allocation of consideration over the fair value of the assets acquired and liabilities assumed.

Both Tower Sites and American Tower’s consolidated financial statements were prepared in accordance with accounting principles

generally accepted in the United States of America (GAAP). The unaudited pro forma condensed combined financial information does not purport to represent what American Tower’s results of operations or financial position would actually have been

had the Transactions occurred on the dates described above or to project its results of operations or financial position for any future date or period. The information does not reflect cost savings or operating synergies that may result from the

Transactions or the costs to achieve any such potential cost savings or operating synergies.

The following unaudited pro forma condensed

combined financial statements and accompanying notes should be read together with (1) American Tower’s audited consolidated financial statements and accompanying notes, at and for the fiscal year ended December 31, 2014, and

Management’s Discussion and Analysis of Financial Condition and Results of Operations included in American Tower’s Form 10-K, (2) American Tower’s Current Report on Form 8-K, which was filed with the SEC on March 30, 2015

and (3) the audited Statements of Revenues and Certain Expenses of Tower Sites (a component of Verizon) and accompanying notes, which is included as Exhibit 99.1 to this filing. The historical consolidated financial statements have been

adjusted in the unaudited pro forma financial information to give effect to pro forma events that are (1) directly attributable to the Transactions, (2) factually supportable and (3) with respect to the consolidated statement of

operations, expected to have a continuing impact on the combined results of the Company.

American Tower Corporation and Subsidiaries

Unaudited Pro Forma Condensed Combined Balance Sheet

At December 31, 2014

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

American Tower |

|

|

Adjustments for the

Transactions |

|

|

|

|

Pro Forma |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

313,492 |

|

|

$ |

(165,018) |

|

|

(a) |

|

$ |

148,474 |

|

| Restricted cash |

|

|

160,206 |

|

|

|

— |

|

|

|

|

|

160,206 |

|

| Short-term investments |

|

|

6,302 |

|

|

|

— |

|

|

|

|

|

6,302 |

|

| Accounts receivable, net |

|

|

198,714 |

|

|

|

— |

|

|

|

|

|

198,714 |

|

| Prepaid and other current assets |

|

|

254,622 |

|

|

|

13,112 |

|

|

(b) |

|

|

267,734 |

|

| Deferred income taxes |

|

|

14,632 |

|

|

|

— |

|

|

|

|

|

14,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

947,968 |

|

|

|

(151,906) |

|

|

|

|

|

796,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT, net |

|

|

7,626,817 |

|

|

|

2,056,142 |

|

|

(b) |

|

|

9,682,959 |

|

| GOODWILL |

|

|

4,017,082 |

|

|

|

8,356 |

|

|

(b) |

|

|

4,025,438 |

|

| OTHER INTANGIBLE ASSETS, net |

|

|

6,889,331 |

|

|

|

2,989,003 |

|

|

(b) |

|

|

9,878,334 |

|

| DEFERRED INCOME TAXES |

|

|

253,186 |

|

|

|

— |

|

|

|

|

|

253,186 |

|

| DEFERRED RENT ASSET |

|

|

1,030,707 |

|

|

|

— |

|

|

|

|

|

1,030,707 |

|

| NOTES RECEIVABLE AND OTHER NON-CURRENT ASSETS |

|

|

566,454 |

|

|

|

209,492 |

|

|

(b) |

|

|

775,946 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

$ |

21,331,545 |

|

|

$ |

5,111,087 |

|

|

|

|

$ |

26,442,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

90,366 |

|

|

$ |

— |

|

|

|

|

$ |

90,366 |

|

| Accrued expenses |

|

|

417,754 |

|

|

|

10,747 |

|

|

(b) |

|

|

428,501 |

|

| Distributions payable |

|

|

159,864 |

|

|

|

— |

|

|

|

|

|

159,864 |

|

| Accrued interest |

|

|

130,265 |

|

|

|

— |

|

|

|

|

|

130,265 |

|

| Current portion of long-term obligations |

|

|

897,624 |

|

|

|

— |

|

|

|

|

|

897,624 |

|

| Unearned revenue |

|

|

233,819 |

|

|

|

— |

|

|

|

|

|

233,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,929,692 |

|

|

|

10,747 |

|

|

|

|

|

1,940,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LONG-TERM OBLIGATIONS |

|

|

13,711,084 |

|

|

|

1,120,000 |

|

|

(c) |

|

|

14,831,084 |

|

| ASSET RETIREMENT OBLIGATIONS |

|

|

609,035 |

|

|

|

202,141 |

|

|

(b) |

|

|

811,176 |

|

| OTHER NON-CURRENT LIABILITIES |

|

|

1,028,382 |

|

|

|

— |

|

|

|

|

|

1,028,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

17,278,193 |

|

|

|

1,332,888 |

|

|

|

|

|

18,611,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5.25%, Series A |

|

|

60 |

|

|

|

— |

|

|

|

|

|

60 |

|

| 5.50%, Series B |

|

|

— |

|

|

|

14 |

|

|

(d) |

|

|

14 |

|

| Common stock |

|

|

3,995 |

|

|

|

259 |

|

|

(d) |

|

|

4,254 |

|

| Additional paid-in capital |

|

|

5,788,786 |

|

|

|

3,778,126 |

|

|

(d) |

|

|

9,566,912 |

|

| Distributions in excess of earnings |

|

|

(837,320) |

|

|

|

(200) |

|

|

(b) |

|

|

(837,520) |

|

| Accumulated other comprehensive loss |

|

|

(794,221) |

|

|

|

— |

|

|

|

|

|

(794,221) |

|

| Treasury stock |

|

|

(207,740) |

|

|

|

— |

|

|

|

|

|

(207,740) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total American Tower Corporation equity |

|

|

3,953,560 |

|

|

|

3,778,199 |

|

|

|

|

|

7,731,759 |

|

| Noncontrolling interest |

|

|

99,792 |

|

|

|

— |

|

|

|

|

|

99,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

4,053,352 |

|

|

|

3,778,199 |

|

|

|

|

|

7,831,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

$ |

21,331,545 |

|

|

$ |

5,111,087 |

|

|

|

|

$ |

26,442,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Unaudited Pro Forma Condensed Combined Balance Sheet

American Tower Corporation and Subsidiaries

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2014

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

American Tower |

|

|

Adjustments for

the Transactions |

|

|

|

|

Pro Forma |

|

| REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental and management |

|

$ |

4,006,854 |

|

|

$ |

382,836 |

|

|

(e) |

|

$ |

4,389,690 |

|

| Network development services |

|

|

93,194 |

|

|

|

— |

|

|

|

|

|

93,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating revenues |

|

|

4,100,048 |

|

|

|

382,836 |

|

|

|

|

|

4,482,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of operations (exclusive of items shown separately below): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental and management |

|

|

1,056,177 |

|

|

|

198,527 |

|

|

(e) |

|

|

1,254,704 |

|

| Network development services |

|

|

38,088 |

|

|

|

— |

|

|

|

|

|

38,088 |

|

| Depreciation, amortization and accretion |

|

|

1,003,802 |

|

|

|

262,582 |

|

|

(f) |

|

|

1,266,384 |

|

| Selling, general, administrative and development expense |

|

|

446,542 |

|

|

|

1,026 |

|

|

(e) |

|

|

447,568 |

|

| Other operating expenses |

|

|

68,517 |

|

|

|

— |

|

|

|

|

|

68,517 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

2,613,126 |

|

|

|

462,135 |

|

|

|

|

|

3,075,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

1,486,922 |

|

|

|

(79,299) |

|

|

|

|

|

1,407,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income, TV Azteca, net of interest expense |

|

|

10,547 |

|

|

|

— |

|

|

|

|

|

10,547 |

|

| Interest income |

|

|

14,002 |

|

|

|

— |

|

|

|

|

|

14,002 |

|

| Interest expense |

|

|

(580,234) |

|

|

|

(30,725) |

|

|

(g) |

|

|

(610,959) |

|

| Loss on retirement of long-term obligations |

|

|

(3,473) |

|

|

|

— |

|

|

|

|

|

(3,473) |

|

| Other expense |

|

|

(62,060) |

|

|

|

— |

|

|

|

|

|

(62,060) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(621,218) |

|

|

|

(30,725) |

|

|

|

|

|

(651,943) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES AND INCOME ON EQUITY METHOD INVESTMENTS |

|

|

865,704 |

|

|

|

(110,024) |

|

|

|

|

|

755,680 |

|

| Income tax provision |

|

|

(62,505) |

|

|

|

— |

|

|

|

|

|

(62,505) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

|

803,199 |

|

|

|

(110,024) |

|

|

|

|

|

693,175 |

|

| Net loss attributable to noncontrolling interest |

|

|

21,711 |

|

|

|

— |

|

|

|

|

|

21,711 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO AMERICAN TOWER CORPORATION STOCKHOLDERS |

|

|

824,910 |

|

|

|

(110,024) |

|

|

|

|

|

714,886 |

|

| Dividends on preferred stock |

|

|

(23,888) |

|

|

|

(75,625) |

|

|

(h) |

|

|

(99,513) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO AMERICAN TOWER CORPORATION COMMON STOCKHOLDERS |

|

$ |

801,022 |

|

|

$ |

(185,649) |

|

|

|

|

$ |

615,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME PER COMMON SHARE AMOUNTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income attributable to American Tower Corporation common stockholders |

|

$ |

2.02 |

|

|

|

|

|

|

|

|

$ |

1.46 |

|

| Diluted net income attributable to American Tower Corporation common stockholders |

|

$ |

2.00 |

|

|

|

|

|

|

|

|

$ |

1.44 |

|

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC |

|

|

395,958 |

|

|

|

25,850 |

|

|

(i) |

|

|

421,808 |

|

| DILUTED |

|

|

400,086 |

|

|

|

25,850 |

|

|

(i) |

|

|

425,936 |

|

See Notes to Unaudited Pro Forma Condensed Combined Statement of Operations

Notes to Unaudited Pro Forma Condensed Combined Balance Sheet

The following adjustments for the Transactions are reflected in the unaudited pro forma condensed combined balance sheet.

| (a) |

The following summarizes the total consideration transferred and funding sources for the Verizon Transaction (in thousands): |

|

|

|

|

|

| Cash on hand |

|

$ |

154,957 |

|

| Common Stock Offering, net of fees and expenses (see Note

(d)) |

|

|

2,440,390 |

|

| Series B Preferred Stock offering, net of fees and expenses (see Note

(d)) |

|

|

1,338,009 |

|

| 2013 Credit Facility net borrowings (see Note (c)) |

|

|

285,000 |

|

| 2014 Credit Facility net borrowings (see Note (c)) |

|

|

835,000 |

|

|

|

|

|

|

| Total consideration transferred |

|

$ |

5,053,356

|

|

|

|

|

|

|

In addition, approximately $10.1 million of transaction costs were incurred directly related to the Verizon

Transaction and are reflected on the unaudited pro forma condensed combined balance sheet.

| (b) |

The following summarizes the consideration transferred as if the Verizon Transaction occurred on December 31, 2014 (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

MPL (1) |

|

|

Sale Sites |

|

|

Adjustments for

the Transactions |

|

| Current assets |

|

$ |

13,112 |

|

|

$ |

— |

|

|

$ |

13,112 |

|

| Non-current assets |

|

|

208,492 |

|

|

|

1,000 |

|

|

|

209,492 |

|

| Property and equipment (2) |

|

|

2,031,657 |

|

|

|

24,485 |

|

|

|

2,056,142 |

|

| Intangible assets (2): |

|

|

|

|

|

|

|

|

|

|

|

|

| Customer-related intangible assets |

|

|

1,742,824 |

|

|

|

37,603 |

|

|

|

1,780,427 |

|

| Network location intangible assets |

|

|

1,179,409 |

|

|

|

29,167 |

|

|

|

1,208,576 |

|

| Goodwill |

|

|

— |

|

|

|

8,356 |

|

|

|

8,356 |

|

| Current liabilities |

|

|

(10,747) |

|

|

|

— |

|

|

|

(10,747) |

|

| Other non-current liabilities |

|

|

(200,530) |

|

|

|

(1,611) |

|

|

|

(202,141) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value of consideration transferred |

|

$ |

4,964,217 |

|

|

$ |

99,000 |

|

|

$ |

5,063,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) |

Approximately $9.9 million of transaction costs have been capitalized as part of the MPL assets’ fair value. |

| |

(2) |

Estimated useful life of 20 years. |

In addition, distributions in excess of earnings was

reduced by $0.2 million for estimated transaction costs incurred by American Tower directly related to the Transactions. Estimated transaction costs have been excluded from the unaudited pro forma condensed combined statement of operations as they

reflect non-recurring charges.

| (c) |

Debt Financings. The Company borrowed approximately $285.0 million under its multi-currency senior unsecured revolving credit facility entered into in June 2013, as amended (the “2013 Credit

Facility”), and approximately $835.0 million under its senior unsecured revolving credit facility entered into in January 2012, as amended and restated in September 2014 (the “2014 Credit Facility”), to initially fund the Verizon

Transaction. |

The 2013 Credit Facility and the 2014 Credit Facility currently bear interest at a per annum rate equal to

1.250% over the London Interbank Offered Rate (LIBOR) and have a commitment fee on the undrawn portion of 0.150%. The current interest rate per annum on each facility is approximately 1.43%. A hypothetical unfavorable fluctuation in market interest

rates on borrowings used to fund the Verizon Transaction under the 2013 Credit Facility and the 2014 Credit Facility of 0.125% over a 12 month period would increase the Company’s interest expense by approximately $0.4 million and $1.0 million,

respectively.

Subsequent to the close of the Verizon Transaction, the Company issued senior unsecured notes due 2020 and 2025, each in

aggregate principal amounts of $750.0 million, bearing interest of 2.800% and 4.000%, respectively. The weighted-average interest rate of the notes was approximately 3.4%. The Company used the net proceeds to repay existing indebtedness under

the 2013 Credit Facility. As this issuance represents the long-term financing related to the Transactions, the Company has included these rates in its calculation of recurring interest expense in the pro forma condensed consolidated statement of

operation.

| (d) |

Equity Financing. In March 2015, American Tower completed a registered public offering of 25,850,000 shares of its common stock, par value $0.01 per share (the “Common Stock Offering”), including

the underwriters’ exercise of their over-allotment option. The aggregate net proceeds of the Common Stock Offering were approximately $2.44 billion after deducting commissions and related expenses. In addition, the Company completed a

registered public offering of 13,750,000 depository shares, each representing a 1/10th interest in a share of its 5.50% Mandatory Convertible Preferred Stock, Series B (the “Series B Preferred Stock”), liquidation preference $1,000.00 per

share, par value $0.01 per share, including the underwriters’ exercise of their over-allotment option. The aggregate net proceeds of the Series B Preferred Stock offering were approximately $1.34 billion after deducting commissions and related

expenses. The Company used the net proceeds from these offerings to fund a portion of the Verizon Transaction. |

Unless

converted or redeemed earlier, each share of the Series B Preferred Stock will convert automatically on February 15, 2018, into between 8.5911 and 10.3093 shares of common stock, depending on the applicable market value of the common stock and

subject to anti-dilution adjustments. Subject to certain restrictions, at any time prior to February 15, 2018, holders of the Series B Preferred Stock may elect to convert all or a portion of their shares into common stock at the minimum

conversion rate then in effect.

Notes to Unaudited Pro Forma Condensed Combined Statement of Operations

The unaudited pro forma condensed combined statement of operations does not include any non-recurring charges. The following adjustments for the Transactions

are reflected in the unaudited pro forma condensed combined statement of operations.

| (e) |

The following includes the revenues and certain expenses of Tower Sites for the year ended December 31, 2014, as adjusted for the items footnoted below (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Tower Sites (1) |

|

|

Adjustments |

|

|

|

|

Adjustments for the

Transactions |

|

| Revenues |

|

$ |

96,364 |

|

|

$ |

286,472 |

|

|

(2) |

|

$ |

382,836 |

|

|

|

|

|

|

| Certain operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease expense |

|

|

127,167 |

|

|

|

34,790 |

|

|

(3) |

|

|

161,957 |

|

| Property taxes |

|

|

21,614 |

|

|

|

— |

|

|

|

|

|

21,614 |

|

| Other operating expenses |

|

|

— |

|

|

|

14,956 |

|

|

(4) |

|

|

14,956 |

|

| Selling, general and administrative

(5) |

|

|

13,470 |

|

|

|

(12,444) |

|

|

(6) |

|

|

1,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total certain operating expenses |

|

|

162,251 |

|

|

|

37,302 |

|

|

|

|

|

199,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certain tower cash flows |

|

$ |

(65,887) |

|

|

$ |

249,170 |

|

|

|

|

$ |

183,283 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) |

Amounts were derived from the audited Statement of Revenues and Certain Expenses of Tower Sites for the year ended December 31, 2014. |

| |

(2) |

Represents the combination of (i) the annual rent of $261.0 million American Tower expects to recognize from Verizon under Verizon’s contracted lease of space on the Sites at an initial monthly rate of $1,900

per Site and (ii) an increase in straight-line revenues from the Verizon lease and other third-party leases of approximately $25.5 million. |

| |

(3) |

Represents (i) an adjustment of $25.2 million related to straight-line expense for ground leases with contractual fixed escalations relating to the Sites and (ii) an adjustment of $9.6 million for amortization

of leasehold interests. |

| |

(4) |

Represents direct tower operating expenses such as repairs and maintenance, utilities and other operating expenses. |

| |

(5) |

Amounts may not be indicative of the combined Company’s selling, general and administrative expenses. |

| |

(6) |

Certain selling, general and administrative expenses represent costs directly related to the Sites and have been reclassified to other operating expenses to conform to the Company’s presentation. |

| (f) |

The following summarizes the depreciation, amortization and accretion expense based on the estimated property and equipment, network location and customer-related intangible assets of the Sites. A useful life of

20 years was used for purposes of computing pro forma depreciation and amortization expense. |

|

|

|

|

|

| (in thousands) |

|

For the year ended December 31, 2014 |

|

| Intangible asset amortization |

|

$ |

149,450 |

|

| Property and equipment depreciation |

|

|

102,257 |

|

| Asset retirement obligation accretion |

|

|

10,875 |

|

|

|

|

|

|

| Total |

|

$ |

262,582 |

|

|

|

|

|

|

| (g) |

Reflects the increased annual interest expense from the aggregate borrowings of $1,120.0 million using an average rate of 2.74%, which represents the average interest rate of borrowings under the 2013 Credit

Facility, 2014 Credit Facility and the issuance of the senior unsecured notes due 2020 and 2025. See Note (c). |

| (h) |

Reflects expected dividends on the Series B Preferred Stock discussed in Note (d). |

| (i) |

The following is a summary of the pro forma adjustment to the weighted-average common shares outstanding and net income attributable to American Tower Corporation common stockholders (in thousands, except per

share data): |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

American

Tower |

|

|

Adjustments for

the Transactions |

|

|

Pro Forma |

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted-average common shares

outstanding |

|

|

395,958 |

|

|

|

25,850 |

|

|

|

421,808 |

|

| Dilutive securities |

|

|

4,128 |

|

|

|

— |

|

|

|

4,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted-average common shares outstanding |

|

|

400,086 |

|

|

|

25,850 |

|

|

|

425,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income attributable to American Tower

Corporation common stockholders |

|

$ |

2.02 |

|

|

|

|

|

|

$ |

1.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income attributable to American Tower Corporation common stockholders |

|

$ |

2.00 |

|

|

|

|

|

|

$ |

1.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The weighted-average common shares outstanding are inclusive of the impact of the issuance of 25,850,000

shares in the Common Stock Offering. The conversion of the Series B Preferred Stock is not included in the computation of diluted earnings per share because the effect would be anti-dilutive. See Note (d).

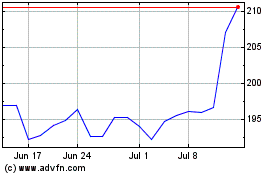

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

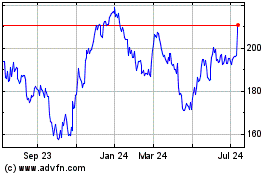

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024