Former Law Partner, Adviser Arrested For Insider Trading

August 10 2016 - 2:20PM

Dow Jones News

A former partner at law firm Hunton & Williams LLP and an

investment adviser were arrested Wednesday and accused of

participating in an insider-trading scheme ahead of a Pfizer Inc.

acquisition.

Prosecutors say Robert Schulman, an intellectual property lawyer

at Hunton & Williams, tipped off his investment adviser Tibor

Klein in 2010 about a pending merger between Pfizer and King

Pharmaceuticals Inc. Mr. Klein, 43, was president of the investment

advisory firm Klein Financial Services.

Mr. Schulman, Mr. Klein and their co-conspirators allegedly

traded in King securities ahead of the deal and reaped more than

$400,000 in profits, according to a federal indictment unsealed

Wednesday.

Both men were charged by the Brooklyn U.S. attorney's office

with securities fraud and securities fraud conspiracy charges. Each

faces a maximum sentence of 20 years in prison.

Mr. Klein was sued by the Securities and Exchange Commission in

Miami federal court three years ago, where he was accused of the

same alleged scheme. The other defendant in the SEC case, Michael

Shechtman, a former Ameriprise Financial Inc. employee, pleaded

guilty in 2014 to one count of conspiracy to commit securities

fraud.

Mr. Schulman, 58, appeared in the SEC's allegations, but he

wasn't sued at the time. The SEC case was put on hold in 2014 in

order for the criminal investigation by Brooklyn federal

prosecutors to proceed, according to court filings.

Lawyers for Mr. Schulman and Mr. Klein either didn't respond to

requests for comment or couldn't be identified.

According to the government, Mr. Schulman found out about the

pending Pfizer deal because he was representing King in separate

litigation at the time.

In August 2010, Mr. Schulman and Mr. Klein met at Mr. Schulman's

home in McLean, Va., to discuss Mr. Schulman's investment

portfolio, the indictment said. During a meal that weekend, after

several glasses of wine, Mr. Schulman blurted out to Mr. Klein, "It

would be nice to be King for a day," according to the SEC.

Prosecutors say Mr. Schulman revealed the pending merger between

King and Pfizer at that dinner.

A few days later, Mr. Klein allegedly bought hundreds of King

shares for himself and thousands more for his clients, including

Mr. Schulman, for a total of $585,216.

Mr. Klein also worked with an unnamed co-conspirator who bought

hundreds of call options for King, according to the government. The

co-conspirator matches the description of Mr. Shechtman in the SEC

complaint. Prosecutors say the co-conspirator made over $109,000 in

profits and gave $28,000 to Mr. Klein.

Pfizer publicly announced its acquisition of King in October

2010. Mr. Klein then sold all the King shares he and his clients

owned and reaped more than $319,000 in profits, according to the

indictment. He allegedly made a personal profit of over $8,800,

while Mr. Schulman made $15,500.

Christopher M. Matthews contributed to this article.

Write to Nicole Hong at nicole.hong@wsj.com

(END) Dow Jones Newswires

August 10, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

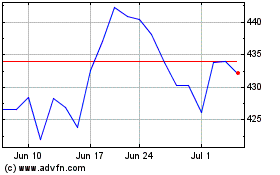

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024