More Economists See Fed Waiting Until June to Raise Rates

March 10 2016 - 11:10AM

Dow Jones News

Most economists surveyed by The Wall Street Journal expect the

Federal Reserve to leave short-term interest rates unchanged at its

next two policy meetings, and next raise them in June.

About 76% of business and academic economists polled in recent

days said the Fed would next raise its benchmark federal-funds rate

at its June 14-15 policy meeting, up from 60% in the February

survey.

Just 3% of forecasters predicted Fed officials would lift rates

at the March 15-16 meeting, down from 9% in the last survey. Asked

to gauge the probability of a March rate increase, on average

economists said 12%.

"A more stable global and financial environment will allow [the]

Fed to raise rates again" said BBVA Group Chief U.S. Economist

Nathaniel Karp, who predicted the Fed would move in June.

Some 6% expected the Fed to hold rates steady next week and then

lift them at its April 26-27 meeting. An additional 15% said rates

would remain unchanged until after June, including 6% who said the

Fed would wait until its September meeting to make its next

move.

One economist said officials would keep rates steady through

2017, while another predicted the next move would be to lower

short-term rates.

J.P. Morgan Senior Economist Robert Mellman was among those

predicting the Fed's next rate increase in June, but said, "It is a

very close call."

On average, forecasters estimated the probability of a rate

increase then at just 56%. And financial markets appear to share

their uncertainty, with federal-funds futures earlier this week

suggesting a 44% chance of a June rate increase, according to CME

Group Inc.

Chad Moutray, chief economist for the National Association of

Manufacturers, said Fed officials "will be looking for

broader-based rebounds in economic data after the lull seen in the

early weeks of 2016," but guessed the Fed would next move rates up

in June.

The Fed in January held its benchmark federal-funds rate in a

range of 0.25%-0.50%, after raising it in December from near zero,

where it was pinned for seven years.

Forecasters on average saw the benchmark rate reaching 0.92 by

the end of 2016, in line with last month's survey. That suggests

private economists still expect the Fed to make roughly two

quarter-percentage-point rate moves this year.

"Even these slow expectations are likely too optimistic," said

Russell Price, senior economist at Ameriprise Financial Inc., who

predicted the federal-funds rate would reach 0.88 by the end of the

year and 2.13 by the end of 2017.

Fed policy makers in December penciled in four

quarter-percentage-point rate increases in 2016. They release new

forecasts after their meeting next week and could adjust them to

predict a more gradual rise in rates in the coming years. Most

private forecasters predicted three 2016 quarter-point rate

increases when they were surveyed in December.

Financial market volatility earlier this year raised concerns

about risks to the U.S. economic outlook and damped expectations

for Fed rate increases this year. Despite recent signs of steady

job gains and solid household spending, slowing global growth and

mixed inflation data have some Fed officials wary of raising rates

prematurely and knocking the U.S. expansion off course.

"From a risk-management perspective, this argues for patience as

the outlook becomes clearer," Fed governor Lael Brainard said in a

speech Monday.

The Journal surveyed 64 economists Friday through Tuesday,

though not every respondent answered every question.

Write to Kate Davidson at kate.davidson@wsj.com

(END) Dow Jones Newswires

March 10, 2016 10:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

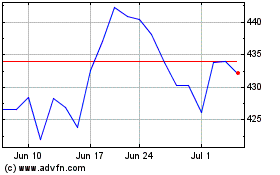

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024