Deal Sets Up Face-Off For Plane Makers

April 05 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 4/5/16)

By Jon Ostrower

Airline mergers have been a mixed blessing for Boeing Co.'s

fortunes in the U.S., but the planned combination of Alaska Air

Group Inc. and Virgin America Inc. could help it regain some lost

ground.

A senior Alaska Air executive said Monday it will decide in the

next two years whether to keep a mix of Boeing and Airbus Group SE

jets, or drop the European plane maker.

Virgin America has an all-Airbus fleet of 63 planes, while

Seattle-based Alaska is a longtime Boeing customer and operates 152

of the aircraft maker's 737 jetliners, in addition to 67 regional

jets and turbopropsfrom other manufacturers. Airlines typically

prefer to minimize the types of aircraft they fly to reduce

maintenance and pilot-training costs. Plane makers, in the past,

have used events such as mergers, periods of rapid expansion or

renewal to try to flip carriers from one manufacturer to the

other.

"We are big believers in single fleet [airlines], so much so

that we bought another single fleet [airline]," said Alaska Air

Chief Financial Officer Brandon Pedersen.

He added on an investor call that a decision on whether to keep

the Airbus jets long term is "probably a couple years away," but it

has flexibility to shift the enlarged airline back to being an

almostall-Boeing operation for its largest jets.

Most of Virgin America's jets are leased from companies such as

GE Capital Aviation Services, and 31 of the planes could be

returned by 2021, according to an investor presentation. Virgin

also has ordered 40 of the new Airbus A320neo jets, which have more

fuel-efficient engines. Mr. Pedersen said there were "favorable

cancellation provisions" for these planes, suggesting Alaska could

drop the deals with few financial penalties.

Alaska has 37 Boeing 737 Max jets on order, which are expected

to be added in 2018.

The mixed fleet created by an Alaska-Virgin America combination

had been touted by analysts as one drawback of its bid in the face

of strong interest from JetBlue Airways Corp., which mainly flies

Airbus jets, a viewpoint acknowledged by Alaska executives.

Airbushas expanded its presence among U.S. carriers by targeting

low-cost operators. "We will look forward todemonstrating the value

and customer-friendliness of Airbus single-aisle aircraft to

Alaska," said a spokesman for Airbus.

Boeing declined to comment.

(END) Dow Jones Newswires

April 05, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

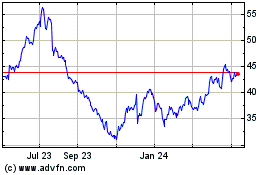

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

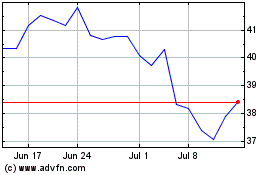

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024