Delta Air Lines to Leave Airline Trade Group

October 27 2015 - 6:20PM

Dow Jones News

Delta Air Lines Inc. said Tuesday it intends to pull out of

Airlines for America, the leading U.S. carrier trade association,

in April. The move, which will save Delta $5 million in annual

dues, will free up the carrier to find "a more efficient way of

communicating in Washington" on issues important to Delta, its

customers and employees, the company said in a statement.

Airlines for America said the move wasn't unexpected because

Delta "has not been aligned with other… members on a few key

industry positions, including the need to modernize and improve the

nation's air-traffic control system," said association CEO Nick

Calio.

Delta's departure will reduce the trade group's airline

membership to nine big airlines, including three cargo carriers.

Left among the passenger airlines will be American Airlines Group

Inc., United Continental Holdings Inc., Southwest Airlines Co.,

Alaska Air Group Inc., JetBlue Airlines Corp. and Hawaiian Holdings

Inc.'s Hawaiian Airlines. The loss of Delta, the third-largest

passenger carrier by traffic, could weaken the group's lobbying

efforts.

Doug Parker, CEO of American and the current chairman of the

trade association's board of directors, said the group has been and

will continue to be more effective as an industry advocate "with a

unified voice in Washington," Mr. Parker said in a statement. Other

issues the association is working on are fighting higher taxes on

airlines and unnecessary regulations, while pushing for updated

infrastructure and modernizing the nation's air-navigation

system.

Delta Chief Executive Richard Anderson, who served as chairman

of the trade association for the first two years of Mr. Calio's

tenure, recently stopped attending meetings of the group's board,

although other Delta employees still serve on number of trade group

councils and committees.

Mr. Anderson, chief of the Atlanta-based airline since 2007,

isn't shy about taking a contrarian view. Delta is the only leading

U.S. airline to pick a fight with the U.S. Export-Import Bank for

offering loan guarantees on Boeing Co. aircraft to well-heeled

foreign carriers. The export bank, whose mandate wasn't extended

earlier this year, currently is fighting for its life in the budget

battle playing out in Congress.

Mr. Anderson also lead the charge, later joined by American and

United, against three large Persian Gulf airlines. The three U.S.

carriers want the U.S. government to curtail the Gulf trio's access

to the U.S. on the grounds they are highly subsidized by their

government owners, assertions the Gulf carriers deny. The U.S.

position has led to conflict within the trade association, with

JetBlue, Alaska and the cargo carriers decrying what they fear is

protectionism on the part of the largest three members. The other

U.S. carriers also fear retaliation by the Gulf airlines, with whom

some of them have close ties.

And the Delta CEO has said numerous times this year that he

doesn't believe a privatization or corporatization of the nation's

air-traffic control system is a good idea. Many other U.S. airlines

think the government should take air-navigation activities out of

the Federal Aviation Administration and put it into a federal

corporation, a public-private partnership or a nonprofit company.

More than two dozen foreign countries have made that move.

U.S. advocates believe the FAA's big air-traffic-control

modernization program would roll out faster and surer under

privatized authority. Mr. Anderson has said he thinks the FAA is

doing a good job, and he recently assumed the leadership role of an

influential committee that advises the FAA on that modernization

effort.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 18:05 ET (22:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

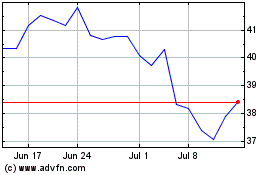

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

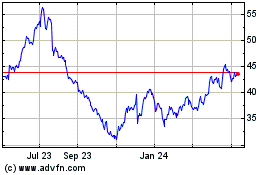

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024