UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

July 2, 2015

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

| | |

1-8957 | | 91-1292054 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

19300 International Boulevard, Seattle, Washington | | 98188 |

(Address of Principal Executive Offices) | | (Zip Code) |

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01. Regulation FD Disclosure

Pursuant to 17 CFR Part 243 (“Regulation FD”), the Company is submitting information relating to its financial and operational outlook in an Investor Update as attached in Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information under this item and Exhibit 99.2 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

ITEM 8.01. Other Events

On July 2, 2015, Alaska Air Group, Inc. issued a press release announcing its June 2015 operational results. The press release is furnished herewith as Exhibit 99.1.

ITEM 9.01 Financial Statements and Other Exhibits

Exhibit 99.1 June 2015 Traffic Press Release dated July 2, 2015

Exhibit 99.2 Investor Update dated July 10, 2015

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: July 10, 2015

/s/ Brandon S. Pedersen

Brandon S. Pedersen

Executive Vice President/Finance and Chief Financial Officer

Exhibit 99.1

|

| | |

Media contact: | | Investor contact: |

Bobbie Egan | | Lavanya Sareen |

Corporate Communications | | Managing Director, Investor Relations |

(206) 392-5134 | | (206) 392-5656 |

July 2, 2015

Alaska Air Group Reports June 2015 Operational Results

SEATTLE - Alaska Air Group Inc. (NYSE: ALK) today reported June and year-to-date operational results for its subsidiaries, Alaska Airlines and Horizon Air, and on a combined basis. Detailed information is provided below.

AIR GROUP

On a combined basis, Air Group reported a 6.9 percent increase in traffic on a 7.2 percent increase in capacity compared to June 2014. This resulted in a 0.2 point decrease in load factor to 86.7 percent. These statistics include flights operated by Alaska and those under capacity purchase agreements, including Horizon, SkyWest and PenAir.

The following table shows the operational results for June and year-to-date 2015, compared to the prior-year periods:

|

| | | | | | | | | | | |

| June | | Year-to-Date |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Revenue passengers (in thousands) | 2,805 | | 2,609 | | 7.5% | | 15,340 | | 14,002 | | 9.6% |

Revenue passenger miles RPM (in millions) | 2,921 | | 2,733 | | 6.9% | | 16,173 | | 14,832 | | 9.0% |

Available seat miles ASM (in millions) | 3,371 | | 3,144 | | 7.2% | | 19,206 | | 17,341 | | 10.8% |

Passenger load factor | 86.7% | | 86.9% | | (0.2) pts | | 84.2% | | 85.5% | | (1.3) pts |

-more-

-2-

ALASKA AIRLINES - MAINLINE

Alaska reported a 6.9 percent increase in traffic on a 7.4 percent increase in capacity compared to June 2014. This resulted in a 0.4 point decrease in load factor to 87.0 percent. Alaska also reported 87.5 percent of its flights arrived on time in June, compared to the 86.0 percent reported in June 2014.

The following table shows Alaska's operational results for June and year-to-date 2015, compared to the prior-year periods:

|

| | | | | | | | | | | |

| June | | Year-to-Date |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Revenue passengers (in thousands) | 2,020 | | 1,887 | | 7.0% | | 11,022 | | 10,044 | | 9.7% |

RPMs (in millions) | 2,647 | | 2,475 | | 6.9% | | 14,657 | | 13,431 | | 9.1% |

ASMs (in millions) | 3,041 | | 2,831 | | 7.4% | | 17,330 | | 15,590 | | 11.2% |

Passenger load factor | 87.0% | | 87.4% | | (0.4) pts | | 84.6% | | 86.2% | | (1.6) pts |

On-time arrivals as reported to U.S. DOT | 87.5% | | 86.0% | | 1.5 pts | | 86.7% | | 87.8% | | (1.1) pts |

HORIZON AIR

Horizon reported a 6.7 percent increase in June traffic on a 5.5 percent increase in capacity compared to June 2014. This resulted in a 0.9 point increase in load factor to 82.0 percent. Horizon also reported 86.6 percent of its flights arrived on time in June, compared to the 92.9 percent reported in June 2014.

The following table shows Horizon's operational results for June and year-to-date 2015, compared to the prior-year periods:

|

| | | | | | | | | | | |

| June | | Year-to-Date |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Revenue passengers (in thousands) | 698 | | 649 | | 7.6% | | 3,848 | | 3,570 | | 7.8% |

RPMs (in millions) | 206 | | 193 | | 6.7% | | 1,130 | | 1,061 | | 6.5% |

ASMs (in millions) | 251 | | 238 | | 5.5% | | 1,420 | | 1,345 | | 5.6% |

Passenger load factor | 82.0% | | 81.1% | | 0.9 pts | | 79.6% | | 78.8% | | 0.8 pts |

On-time arrivals as reported to U.S. DOT | 86.6% | | 92.9% | | (6.3) pts | | 87.5% | | 88.9% | | (1.4) pts |

Alaska Airlines, a subsidiary of Alaska Air Group (NYSE: ALK), together with its partner regional airlines, serves more than 100 cities through an expansive network in the United States, Canada and Mexico. Alaska Airlines ranked “Highest in Customer Satisfaction Among Traditional Carriers in North America” in the J.D. Power North American Airline Satisfaction Study for eight consecutive years from 2008 to 2015. Alaska Airlines’ Mileage Plan also ranked “Highest in Customer Satisfaction with Airline Loyalty Rewards Programs” in the J.D. Power 2014 and 2015 Airline Loyalty/Rewards Program Satisfaction Report. For reservations, visit www.alaskaair.com. For more news and information, visit Alaska Airlines’ newsroom at www.alaskaair.com/newsroom.

# # #

Exhibit 99.2

Investor Update - July 10, 2015

Note to Investors

This abbreviated Investor Update is being provided to communicate certain actual second quarter 2015 mainline and consolidated operating statistics. It includes forecasted mainline and consolidated passenger unit revenue (PRASM), total unit revenue (RASM), unit cost excluding fuel (CASMex), estimated economic fuel cost per gallon for the quarter, expected consolidated non-operating income, and second quarter share repurchase information.

Unit revenue, unit cost and other financial forecasts are estimates only. Actual amounts reported may differ and are dependent on our normal quarter-end closing process.

A full Investor Update with information about fuel hedge positions, planned capital expenditures, fleet information, and share repurchase activity will be provided in connection with our second quarter earnings release scheduled for July 23, 2015.

References in this update to “Air Group,” “Company,” “we,” “us,” and “our” refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified.

Information about Non-GAAP Financial Measures

This update includes forecasted operational and financial information for our mainline and consolidated operations. Our disclosure of operating cost per available seat mile excluding fuel and other items provides us (and may provide investors) with the ability to measure and monitor our performance. The most directly comparable GAAP measure is total operating expense per available seat mile. However, due to the large fluctuations in fuel prices, we are unable to predict total operating expense for any future period with any degree of certainty. In addition, we believe the disclosure of fuel expense on an economic basis is useful to investors in evaluating our ongoing operational performance. Please see the cautionary statement under “Forward-Looking Information.”

We are providing unaudited information about fuel price movements and the impact of our hedging program on our financial results. Management believes it is useful to compare results between periods on an “economic basis.” Economic fuel expense is defined as the raw or “into-plane” fuel cost less any cash we receive from hedge counterparties for hedges that settle during the period, offset by the recognition of premiums originally paid for those hedges that settle during the period. Economic fuel expense more closely approximates the net cash outflow associated with purchasing fuel for our operation.

Forward-Looking Information

This update contains forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by any forward-looking statements. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2014. Some of these risks include general economic conditions, increases in operating costs including fuel, competition, labor costs and relations, inability to meet cost reduction goals, seasonal fluctuations in our financial results, an aircraft accident, and changes in laws and regulations. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed therein. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements after the date of this report to conform them to actual results. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance, or achievements that are expressed or implied by our forward-looking statements, and such differences might be significant and materially adverse.

Operating Statistics

|

| | | |

| Q2 2015 | | Change Y-O-Y |

Revenue passengers (in thousands) | 8,024 | | 9.1% |

Traffic (RPMs in millions) | 8,451 | | 9.0% |

Capacity (ASMs in millions) | 9,949 | | 10.7% |

Load factor | 84.9% | | (1.4) pts |

Forecast Information

|

| | | | | | | |

| Forecast Q2 2015 | | Change

Y-O-Y | | Prior Guidance June 15, 2015 |

Passenger revenue per ASM (cents) | 12.32¢ - 12.37¢ | | ~ (5.5) % | | N/A | | N/A |

Revenue per ASM (cents) | 14.39¢ - 14.44¢ | | ~ (5.5) % | | N/A | | N/A |

Cost per ASM excluding fuel and special items (cents) | 8.08¢ - 8.13¢ | | ~ (3.0) % | | 8.17¢ - 8.22¢ | | ~ (2.0) % |

Fuel gallons (000,000) | 126 | | ~ 8.0% | | 126 | | ~ 8.0 % |

Economic fuel cost per gallon(a) | $2.12 | | ~ (33.5) % | | $2.14 | | ~ (33.0) % |

(a) Our economic fuel cost per gallon estimate for the second quarter includes the following per-gallon assumptions: crude oil cost - $1.38 ($58 per barrel); refining margin - 57 cents, cost of settled hedges - 4 cents, with the remaining difference due to taxes and other into-plane costs.

Nonoperating Income

We expect that our consolidated nonoperating income will be approximately $2 million in the second quarter of 2015.

Stock Repurchase and Share Count

In the second quarter of 2015, Air Group repurchased a total of 2,480,807 shares of its common stock for approximately $160 million. We expect our weighted-average basic and diluted share counts will be 129.2 million and 130.3 million, respectively, for the second quarter of 2015.

For the first six months of 2015, Air Group repurchased a total of 4,061,554 shares for approximately $262 million. As of June 30, 2015, we have $122.0 million remaining under the current repurchase program.

|

|

ALASKA AIRLINES - MAINLINE |

Operating Statistics

|

| | | |

| Q2 2015 | | Change Y-O-Y |

Revenue passengers (in thousands) | 5,787 | | 9.0% |

Traffic (RPMs in millions) | 7,662 | | 9.0% |

Capacity (ASMs in millions) | 8,984 | | 11.0% |

Load factor | 85.3% | | (1.5) pts |

Forecast Information

|

| | | | | | | |

| Forecast Q2 2015 | | Change

Y-O-Y | | Prior Guidance June 15, 2015 |

Passenger revenue per ASM (cents) | 11.29¢ - 11.34¢ | | ~ (6.0) % | | N/A | | N/A |

Revenue per ASM (cents) | 13.35¢ - 13.40¢ | | ~ (6.0) % | | N/A | | N/A |

Cost per ASM excluding fuel and special items (cents) | 7.17¢ - 7.22¢ | | ~ (3.5) % | | 7.27¢ - 7.32¢ | | ~ (2.0) % |

Fuel gallons (000,000) | 110 | | ~ 8.0 % | | 110 | | ~ 8.0 % |

Economic fuel cost per gallon(a) | $2.12 | | ~ (33.5) % | | $2.14 | | ~ (33.0) % |

| |

(a) | Refer to note(a) in the Consolidated forecast section for information on the economic fuel cost per gallon. |

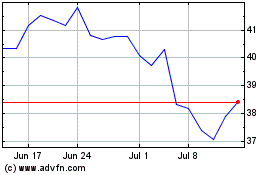

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

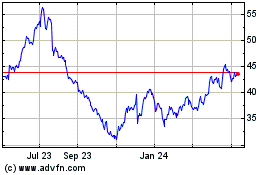

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024