UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

April 23, 2015

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

| | |

1-8957 | | 91-1292054 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

19300 International Boulevard, Seattle, Washington | | 98188 |

(Address of Principal Executive Offices) | | (Zip Code) |

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. Results of Operations And Financial Condition

Alaska Air Group, Inc. today issued a press release reporting financial results for the first quarter of 2015. The press release is filed as Exhibit 99.1.

ITEM 7.01. Regulation FD Disclosure

Pursuant to 17 CFR Part 243 (“Regulation FD”), the Company is submitting information relating to its financial and operational outlook in an Investor Update as attached in Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information under this item and Exhibit 99.2 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

ITEM 9.01 Financial Statements and Other Exhibits

Exhibit 99.1 First Quarter 2015 Earnings Press Release dated April 23, 2015

Exhibit 99.2 Investor Update dated April 23, 2015

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: April 23, 2015

/s/ Brandon S. Pedersen

Brandon S. Pedersen

Executive Vice President/Finance and Chief Financial Officer

Exhibit 99.1

|

| | |

Media contact: | | Investor contact: |

Bobbie Egan | | Lavanya Sareen |

Corporate Communications | | Managing Director, Investor Relations |

(206) 392-5134 | | (206) 392-5656 |

|

| | |

FOR IMMEDIATE RELEASE | | April 23, 2015 |

Alaska Air Group Reports Record First Quarter 2015 Results

Financial Highlights:

| |

• | Reported record first quarter net income, excluding special items, of $149 million - a 67% increase over the first quarter of 2014. |

| |

• | Reported adjusted earnings per share of $1.12 per diluted share, a 75% increase over the first quarter of 2014 and ahead of First Call analyst consensus estimate of $1.10 per share. |

| |

• | Earned net income for the first quarter under Generally Accepted Accounting Principles (GAAP) of $149 million or $1.12 per diluted share, compared to net income of $94 million, or $0.68 per diluted share in 2014. |

| |

• | Recorded $26 million of employee incentive pay in recognition of Air Group employees’ progress on meeting customer service, safety, operational and financial goals. |

| |

• | Increased fuel efficiency (as measured by seat-miles per gallon) by 2.5% compared to the first quarter of 2014, as part of our effort to be the airline leader in environmental stewardship. |

| |

• | Generated record adjusted pretax margin in the first quarter of 18.9% compared to 11.8% in 2014. |

| |

• | Generated 18.8% adjusted pretax margin for the trailing 12-month period ended March 31, 2015, compared to 13.6% for the same period in the prior year. |

| |

• | Achieved trailing 12-month after-tax return on invested capital of 20.1% compared to 14.8% in the 12-month period ended March 31, 2014. |

| |

• | Repurchased 1.6 million shares of common stock for $102 million in the first quarter of 2015, representing 1.2% of the total shares outstanding at the beginning of the year. |

| |

• | Paid a $0.20 per-share quarterly cash dividend on March 10, 2015, a 60% increase over the dividend declared in the first quarter of 2014. |

Operational Highlights:

| |

• | Held the No. 1 spot in U.S. Department of Transportation on-time performance among the eight largest U.S. airlines for the twelve months ended February 2015. |

| |

• | Named No. 1 on-time carrier in North America for the fifth year in a row by FlightStats in February 2015. |

| |

• | Increased members in our Mileage Plan by 14% and Visa Signature affinity cardholders by 10% from the first quarter of 2014. |

| |

• | Achieved our highest ever customer satisfaction score for the first quarter, improving 3 percentage points over prior year. |

| |

• | Ranked first in the Leadership 500 Excellence Awards, recognizing the success of Alaska's Gear Up leadership training. |

| |

• | Ranked in the Top 100 in the 2015 Forbes "America's Best Employers" survey. |

| |

• | Ordered six additional Boeing 737-900ER aircraft for delivery in 2016 and 2017. |

| |

• | Offered free checked first bag to all Mileage Plan members in January and all Alaska Airlines Visa Signature affinity credit card holders in February and March. |

| |

• | New routes launched and announced in the first quarter are as follows: |

|

| |

New Non-Stop Routes Launched in Q1 | New Non-Stop Routes Announced (Launch Dates) |

Las Vegas to Mammoth Lakes, California | Seattle to JFK, New York (9/16/15) |

San Diego to Kona, Hawaii | Orange County, California to Cabo San Lucas, Mexico (10/8/15) |

Seattle to Washington, D.C. Dulles | Orange County, California to Puerto Vallarta, Mexico (10/9/15) |

| Boise to Spokane, Washington (8/24/15) |

SEATTLE — Alaska Air Group, Inc., (NYSE: ALK) today reported first quarter 2015 GAAP net income of $149 million, or $1.12 per diluted share, compared to $94 million, or $0.68 per diluted share in the first quarter of 2014. Excluding the impact of mark-to-market fuel hedge adjustments, the company reported record adjusted net income of $149 million, or $1.12 per diluted share, compared to adjusted net income of $89 million, or $0.64 per diluted share, in 2014.

"Our record first quarter results reflect lower fuel prices, but more importantly the tremendous loyalty of our customers in Seattle and across our system” said CEO Brad Tilden. “It is gratifying to see such strong growth and financial results given unprecedented competition. I want to thank our incredible employees who continue to rise to the challenge and deliver outstanding experiences to our customers.”

The following table reconciles the company's reported GAAP net income and earnings per diluted share (EPS) during the first quarters of 2015 and 2014 to adjusted amounts:

|

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

(in millions, except per-share amounts) | Dollars | | Diluted EPS | | Dollars | | Diluted EPS |

Reported GAAP net income | $ | 149 |

| | $ | 1.12 |

| | $ | 94 |

| | $ | 0.68 |

|

Mark-to-market fuel hedge adjustments, net of tax | — |

| | — |

| | (5 | ) | | (0.04 | ) |

Non-GAAP adjusted income and per-share amounts | $ | 149 |

| | $ | 1.12 |

| | $ | 89 |

| | $ | 0.64 |

|

Statistical data, as well as a reconciliation of the reported non-GAAP financial measures, can be found in the accompanying tables. A glossary of financial terms can be found on the last page of this release.

A conference call regarding the first quarter results will be simulcast via the Internet at 8:30 a.m. Pacific time on April 23, 2015. It can be accessed through the company's website at www.alaskaair.com/investors. For those unable to listen to the live broadcast, a replay will be available after the conclusion of the call.

###

References in this news release to “Air Group,” “company,” “we,” “us” and “our” refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified. Alaska Airlines, Inc. and Horizon Air Industries, Inc. are referred to as “Alaska” and “Horizon,” respectively, and together as our “airlines.”

This news release may contain forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by any forward-looking statements. For a comprehensive discussion of potential risk factors, see Item 1A of the company's Annual Report on Form 10-K for the year ended December 31, 2014. Some of these risks include general economic conditions, increases in operating costs including fuel, competition, labor costs and relations, inability to meet cost reduction goals, seasonal fluctuations in our financial results, an aircraft accident, and changes in laws and regulations. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed therein. We operate in a continually changing business environment, and new risk factors emerge from time to time.

Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements after the date of this report to conform them to actual results. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such differences might be significant and materially adverse.

###

Alaska Airlines, a subsidiary of Alaska Air Group (NYSE: ALK), together with its partner regional airlines, serves nearly 100 cities through an expansive network in the United States, Canada and Mexico. For reservations, visit www.alaskaair.com. For more news and information, visit the Alaska Airlines Newsroom at www.alaskaair.com/newsroom.

|

| | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

Alaska Air Group, Inc. | | | | | |

| | | | | |

| Three Months Ended March 31, |

(in millions, except per-share amounts) | 2015 | | 2014 | | Change |

Operating Revenues: | | | | | |

Passenger | | | | | |

Mainline | $ | 901 |

| | $ | 854 |

| | 6 | % |

Regional | 186 |

| | 186 |

| | — | % |

Total passenger revenue | 1,087 |

| | 1,040 |

| | 5 | % |

Freight and mail | 23 |

| | 24 |

| | (4 | )% |

Other - net | 159 |

| | 158 |

| | 1 | % |

Total Operating Revenues | 1,269 |

| | 1,222 |

| | 4 | % |

| | | | | |

Operating Expenses: | | | | | |

Wages and benefits | 306 |

| | 272 |

| | 13 | % |

Variable incentive pay | 26 |

| | 25 |

| | 4 | % |

Aircraft fuel, including hedging gains and losses | 235 |

| | 358 |

| | (34 | )% |

Aircraft maintenance | 63 |

| | 51 |

| | 24 | % |

Aircraft rent | 26 |

| | 28 |

| | (7 | )% |

Landing fees and other rentals | 71 |

| | 69 |

| | 3 | % |

Contracted services | 67 |

| | 60 |

| | 12 | % |

Selling expenses | 53 |

| | 46 |

| | 15 | % |

Depreciation and amortization | 76 |

| | 70 |

| | 9 | % |

Food and beverage service | 25 |

| | 21 |

| | 19 | % |

Other | 83 |

| | 81 |

| | 2 | % |

Total Operating Expenses | 1,031 |

| | 1,081 |

| | (5 | )% |

Operating Income | 238 |

| | 141 |

| | 69 | % |

| | | | | |

Nonoperating Income (Expense): | | | | | |

Interest income | 5 |

| | 5 |

| | |

Interest expense | (11 | ) | | (12 | ) | | |

Interest capitalized | 8 |

| | 5 |

| | |

Other - net | — |

| | 13 |

| | |

| 2 |

| | 11 |

| | |

Income Before Income Tax | 240 |

| | 152 |

| | |

Income tax expense | 91 |

| | 58 |

| | |

Net Income | $ | 149 |

| | $ | 94 |

| | |

| | | | | |

Basic Earnings Per Share: | $ | 1.13 |

| | $ | 0.69 |

| | |

Diluted Earnings Per Share: | $ | 1.12 |

| | $ | 0.68 |

| | |

| | | | | |

Shares Used for Computation: | | | | | |

Basic | 131.120 |

| | 137.334 |

| | |

Diluted | 132.230 |

| | 138.822 |

| | |

| | | | | |

Cash dividend declared per share: | $ | 0.20 |

| | $ | 0.125 |

| | |

|

| | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) | | | |

Alaska Air Group, Inc. | | | |

| | | |

(in millions) | March 31, 2015 |

| | December 31, 2014 |

|

Cash and marketable securities | $ | 1,312 |

| | $ | 1,217 |

|

| |

| | |

|

Total current assets | 1,776 |

| | 1,756 |

|

Property and equipment-net | 4,497 |

| | 4,299 |

|

Other assets | 137 |

| | 126 |

|

Total assets | 6,410 |

| | 6,181 |

|

| | | |

Air traffic liability | 814 |

| | 631 |

|

Current portion of long-term debt | 118 |

| | 117 |

|

Other current liabilities | 948 |

| | 923 |

|

Current liabilities | 1,880 |

| | 1,671 |

|

Long-term debt | 650 |

| | 686 |

|

Other liabilities and credits | 1,714 |

| | 1,697 |

|

Shareholders' equity | 2,166 |

| | 2,127 |

|

Total liabilities and shareholders' equity | $ | 6,410 |

| | $ | 6,181 |

|

| |

| | |

|

Debt-to-capitalization ratio, adjusted for operating leases(a) | 29%:71% |

| | 31%:69% |

|

| |

| | |

|

Number of common shares outstanding | 130.444 |

| | 131.481 |

|

| |

(a) | Calculated using the present value of remaining aircraft lease payments. |

|

| | | | | | | | | | |

OPERATING STATISTICS SUMMARY (unaudited) |

Alaska Air Group, Inc. | | | | | |

| | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 | | Change |

Consolidated Operating Statistics:(a) | | | | | |

Revenue passengers (000) | 7,316 |

| | 6,649 |

| | 10.0 | % |

RPMs (000,000) "traffic" | 7,723 |

| | 7,078 |

| | 9.1 | % |

ASMs (000,000) "capacity" | 9,257 |

| | 8,352 |

| | 10.8 | % |

Load factor | 83.4 | % | | 84.7 | % | | (1.3 pts | ) |

Yield |

| 14.08 | ¢ | |

| 14.70 | ¢ | | (4.2 | %) |

PRASM |

| 11.74 | ¢ | |

| 12.45 | ¢ | | (5.7 | %) |

RASM |

| 13.71 | ¢ | |

| 14.64 | ¢ | | (6.4 | %) |

CASM excluding fuel(b) |

| 8.61 | ¢ | |

| 8.66 | ¢ | | (0.6 | %) |

Economic fuel cost per gallon(b) | $ | 1.98 |

| | $ | 3.32 |

| | (40.4 | %) |

Fuel gallons (000,000) | 119 |

| | 110 |

| | 8.2 | % |

ASM's per gallon | 77.8 |

| | 75.9 |

| | 2.5 | % |

Average number of full-time equivalent employees (FTE) | 13,274 |

| | 12,386 |

| | 7.2 | % |

| | | | | |

Mainline Operating Statistics: | | | | | |

Revenue passengers (000) | 5,236 |

| | 4,737 |

| | 10.5 | % |

RPMs (000,000) "traffic" | 6,994 |

| | 6,402 |

| | 9.2 | % |

ASMs (000,000) "capacity" | 8,347 |

| | 7,495 |

| | 11.4 | % |

Load factor | 83.8 | % | | 85.4 | % | | (1.6 pts | ) |

Yield |

| 12.88 | ¢ | |

| 13.34 | ¢ | | (3.4 | %) |

PRASM |

| 10.79 | ¢ | |

| 11.40 | ¢ | | (5.4 | %) |

RASM |

| 12.75 | ¢ | |

| 13.57 | ¢ | | (6.0 | %) |

CASM excluding fuel(b) |

| 7.66 | ¢ | |

| 7.68 | ¢ | | (0.3 | %) |

Economic fuel cost per gallon(b) | $ | 1.97 |

| | $ | 3.32 |

| | (40.7 | %) |

Fuel gallons (000,000) | 103 |

| | 96 |

| | 7.3 | % |

ASM's per gallon | 81.0 |

| | 78.1 |

| | 3.7 | % |

Average number of FTE's | 10,380 |

| | 9,591 |

| | 8.2 | % |

Aircraft utilization | 10.6 |

| | 10.2 |

| | 3.9 | % |

Average aircraft stage length | 1,199 |

| | 1,201 |

| | (0.2 | %) |

Operating fleet | 137 |

| | 133 |

| | 4 a/c |

|

| | | | | |

Regional Operating Statistics:(c) | | | | | |

Revenue passengers (000) | 2,080 |

| | 1,912 |

| | 8.8 | % |

RPMs (000,000) "traffic" | 728 |

| | 675 |

| | 7.9 | % |

ASMs (000,000) "capacity" | 910 |

| | 857 |

| | 6.2 | % |

Load factor | 80.0 | % | | 78.8 | % | | 1.2 pts |

|

Yield |

| 25.58 | ¢ | |

| 27.53 | ¢ | | (7.1 | %) |

PRASM |

| 20.46 | ¢ | |

| 21.69 | ¢ | | (5.7 | %) |

Operating fleet (Horizon only) | 52 |

| | 51 |

| | 1 | a/c |

| |

(a) | Except for full-time equivalent employees, data includes information related to third-party regional capacity purchase flying arrangements. |

| |

(b) | See a reconciliation of operating expenses excluding fuel, a reconciliation of economic fuel costs, and Note A in the accompanying pages, for a discussion of why these measures may be important to investors. |

| |

(c) | Data presented includes information related to flights operated by Horizon Air and third-party carriers. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

OPERATING SEGMENTS (unaudited) | | | | | | | |

Alaska Air Group, Inc. | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Three Months Ended March 31, 2015 |

| Alaska | | | | | | | | | | |

(in millions) | Mainline | | Regional | | Horizon | | Consolidating | | Air Group Adjusted(a) | | Special Items(b) | | Consolidated |

Operating revenues | | | | | | | | | | | | | |

Passenger | | | | | | | | | | | | | |

Mainline | $ | 901 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 901 |

| | $ | — |

| | $ | 901 |

|

Regional | — |

| | 186 |

| | — |

| | — |

| | 186 |

| | — |

| | 186 |

|

Total passenger revenues | 901 |

| | 186 |

| | — |

| | — |

| | 1,087 |

| | — |

| | 1,087 |

|

CPA revenues | — |

| | — |

| | 99 |

| | (99 | ) | | — |

| | — |

| | — |

|

Freight and mail | 22 |

| | 1 |

| | — |

| | — |

| | 23 |

| | — |

| | 23 |

|

Other-net | 142 |

| | 16 |

| | 1 |

| | — |

| | 159 |

| | — |

| | 159 |

|

Total operating revenues | 1,065 |

| | 203 |

| | 100 |

| | (99 | ) | | 1,269 |

| | — |

| | 1,269 |

|

| | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | |

Operating expenses, excluding fuel | 639 |

| | 164 |

| | 91 |

| | (98 | ) | | 796 |

| | — |

| | 796 |

|

Economic fuel | 203 |

| | 32 |

| | — |

| | — |

| | 235 |

| | — |

| | 235 |

|

Total operating expenses | 842 |

| | 196 |

| | 91 |

| | (98 | ) | | 1,031 |

| | — |

| | 1,031 |

|

| | | | | | | | | | | | | |

Nonoperating income (expense) | | | | | | | | | | | | | |

Interest income | 5 |

| | — |

| | — |

| | — |

| | 5 |

| | — |

| | 5 |

|

Interest expense | (7 | ) | | — |

| | (4 | ) | | — |

| | (11 | ) | | — |

| | (11 | ) |

Other | 7 |

| | — |

| | 1 |

| | — |

| | 8 |

| | — |

| | 8 |

|

| 5 |

| | — |

| | (3 | ) | | — |

| | 2 |

| | — |

| | 2 |

|

Income (loss) before income tax | $ | 228 |

| | $ | 7 |

| | $ | 6 |

| | $ | (1 | ) | | $ | 240 |

| | $ | — |

| | $ | 240 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2014 |

| Alaska | | | | | | | | | | |

(in millions) | Mainline | | Regional | | Horizon | | Consolidating | | Air Group Adjusted(a) | | Special Items(b) | | Consolidated |

Operating revenues | | | | | | | | | | | | | |

Passenger | | | | | | | | | | | | | |

Mainline | $ | 854 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 854 |

| | $ | — |

| | $ | 854 |

|

Regional | — |

| | 186 |

| | — |

| | — |

| | 186 |

| | — |

| | 186 |

|

Total passenger revenues | 854 |

| | 186 |

| | — |

| | — |

| | 1,040 |

| | — |

| | 1,040 |

|

CPA revenues | — |

| | — |

| | 91 |

| | (91 | ) | | — |

| | — |

| | — |

|

Freight and mail | 23 |

| | 1 |

| | — |

| | — |

| | 24 |

| | — |

| | 24 |

|

Other-net | 140 |

| | 17 |

| | 1 |

| | — |

| | 158 |

| | — |

| | 158 |

|

Total operating revenues | 1,017 |

| | 204 |

| | 92 |

| | (91 | ) | | 1,222 |

| | — |

| | 1,222 |

|

| | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | |

Operating expenses, excluding fuel | 576 |

| | 151 |

| | 86 |

| | (90 | ) | | 723 |

| | — |

| | 723 |

|

Economic fuel | 318 |

| | 48 |

| | — |

| | — |

| | 366 |

| | (8 | ) | | 358 |

|

Total operating expenses | 894 |

| | 199 |

| | 86 |

| | (90 | ) | | 1,089 |

| | (8 | ) | | 1,081 |

|

| | | | | | | | | | | | | |

Nonoperating income (expense) | | | | | | | | | | | | | |

Interest income | 5 |

| | — |

| | — |

| | — |

| | 5 |

| | — |

| | 5 |

|

Interest expense | (8 | ) | | — |

| | (4 | ) | | — |

| | (12 | ) | | — |

| | (12 | ) |

Other | 18 |

| | (1 | ) | | 1 |

| | — |

| | 18 |

| | — |

| | 18 |

|

| 15 |

| | (1 | ) | | (3 | ) | | — |

| | 11 |

| | — |

| | 11 |

|

Income (loss) before income tax | $ | 138 |

| | $ | 4 |

| | $ | 3 |

| | $ | (1 | ) | | $ | 144 |

| | $ | 8 |

| | $ | 152 |

|

| |

(a) | The adjusted column represents the financial information that is reviewed by management to assess performance of operations and determine capital allocations and does not include certain charges. See Note A in the accompanying pages for further information. |

| |

(b) | Includes mark-to-market fuel-hedge accounting adjustments. |

|

| | | | | | | |

Alaska Air Group, Inc. | | | |

| | | |

|

CASM EXCLUDING FUEL RECONCILIATION (unaudited) |

| Three Months Ended March 31, |

(in cents) | 2015 | | 2014 |

Consolidated: | | | |

CASM |

| 11.14 | ¢ | |

| 12.94 | ¢ |

Less the following components: | | | |

|

Aircraft fuel, including hedging gains and losses | 2.53 |

| | 4.28 |

|

CASM excluding fuel |

| 8.61 | ¢ | |

| 8.66 | ¢ |

| | | |

Mainline: | | | |

CASM |

| 10.09 | ¢ | |

| 11.82 | ¢ |

Less the following components: | | | |

|

Aircraft fuel, including hedging gains and losses | 2.43 |

| | 4.14 |

|

CASM excluding fuel |

| 7.66 | ¢ | |

| 7.68 | ¢ |

|

| | | | | | | | | | | | | | | |

FUEL RECONCILIATIONS (unaudited) |

| Three Months Ended March 31, |

| 2015 | | 2014 |

(in millions, except for per-gallon amounts) | Dollars | | Cost/Gallon | | Dollars | | Cost/Gallon |

Raw or "into-plane" fuel cost | $ | 229 |

| | $ | 1.93 |

| | $ | 348 |

| | $ | 3.16 |

|

Losses on settled hedges | 6 |

| | 0.05 |

| | 18 |

| | 0.16 |

|

Consolidated economic fuel expense | 235 |

| | 1.98 |

| | 366 |

| | 3.32 |

|

Mark-to-market fuel hedge adjustment | — |

| | — |

| | (8 | ) | | (0.07 | ) |

GAAP fuel expense | $ | 235 |

| | $ | 1.98 |

| | $ | 358 |

| | $ | 3.25 |

|

Fuel gallons | 119 |

| | | | 110 |

| | |

Note A: Pursuant to Regulation G, we are providing reconciliation of reported non-GAAP financial measures to their most directly comparable financial measures reported on a GAAP basis. We believe that consideration of these non-GAAP financial measures may be important to investors for the following reasons:

| |

• | By eliminating fuel expense and certain special items from our unit metrics, we believe that we have better visibility into the results of operations and our non-fuel cost-reduction initiatives. Our industry is highly competitive and is characterized by high fixed costs, so even a small reduction in non-fuel operating costs can result in a significant improvement in operating results. In addition, we believe that all domestic carriers are similarly impacted by changes in jet fuel costs over the long term, so it is important for management (and thus investors) to understand the impact of (and trends in) company-specific cost drivers such as labor rates and productivity, airport costs, maintenance costs, etc., which are more controllable by management. |

| |

• | Cost per ASM (CASM) excluding fuel and certain special items is one of the most important measures used by management and by the Air Group Board of Directors in assessing quarterly and annual cost performance. |

| |

• | Adjusted Income before income tax and CASM excluding fuel (and other items as specified in our plan documents) are important metrics for the employee incentive plan that covers all Air Group employees. |

| |

• | CASM excluding fuel and certain special items is a measure commonly used by industry analysts, and we believe it is the basis by which they compare our airlines to others in the industry. The measure is also the subject of frequent questions from investors. |

| |

• | Disclosure of the individual impact of certain noted items provides investors the ability to measure and monitor performance both with and without these special items. We believe that disclosing the impact of certain items, such as mark-to-market hedging adjustments or special revenues, is important because it provides information on significant items that are not necessarily indicative of future performance. Industry analysts and investors consistently measure our performance without these items for better comparability between periods and among other airlines. |

| |

• | Although we disclose our passenger unit revenues, we do not (nor are we able to) evaluate unit revenues excluding the impact that changes in fuel costs have had on ticket prices. Fuel expense represents a large percentage of our total operating expenses. Fluctuations in fuel prices often drive changes in unit revenues in the mid-to-long term. Although we believe it is useful to evaluate non-fuel unit costs for the reasons noted above, we would caution readers of these financial statements not to place undue reliance on unit costs excluding fuel as a measure or predictor of future profitability because of the significant impact of fuel costs on our business. |

Note B: Air Group has two operating airlines - Alaska Airlines and Horizon Air. Each is a regulated airline with separate management teams primarily in operational roles. To manage the two operating airlines, management views the business in three operating segments. Alaska operates a fleet of passenger jets (Alaska Mainline) and contracts with Horizon, SkyWest Airlines, Inc. (SkyWest), and Peninsula Airways, Inc. (PenAir) for regional capacity under which Alaska receives all passenger revenue from those flights (Alaska Regional). Horizon operates a fleet of turboprop aircraft and sells all of its capacity to Alaska pursuant to a capacity purchase arrangement (Horizon). The Company believes the amounts paid by Alaska to Horizon approximate current market rates received by other regional carriers for similar flying and are available to pay for various Horizon operating expenses such as crew expenses, maintenance, and aircraft ownership costs. All inter-company revenues and expenses between Alaska and Horizon are eliminated in consolidation.

Glossary of Terms

Aircraft Utilization - block hours per day; this represents the average number of hours our aircraft are flying

Aircraft Stage Length - represents the average miles flown per aircraft departure

ASMs - available seat miles, or “capacity”; represents total seats available across the fleet multiplied by the number of miles flown

CASM - operating costs per ASM, or "unit cost"; represents all operating expenses including fuel and special items

CASMex - operating costs excluding fuel and special items per ASM; this metric is used to help track progress toward reduction of non-fuel operating costs since fuel is largely out of our control

Debt-to-capitalization ratio - represents adjusted debt (long-term debt plus the present value of future operating lease payments) divided by total equity plus adjusted debt

Diluted Earnings per Share - represents earnings per share using fully diluted shares outstanding

Diluted Shares - represents the total number of shares that would be outstanding if all possible sources of conversion, such as stock options, were exercised

Economic Fuel - best estimate of the cash cost of fuel, net of the impact of our fuel-hedging program

Load Factor - RPMs as a percentage of ASMs; represents the number of available seats that were filled with paying passengers

Mainline - represents flying Boeing 737 jets and all associated revenues and costs

PRASM - passenger revenue per ASM; commonly called “passenger unit revenue”

Productivity - number of revenue passengers per full-time equivalent employee

RASM - operating revenue per ASMs, or "unit revenue"; operating revenue includes all passenger revenue, freight & mail, Mileage Plan, and other ancillary revenue; represents the average total revenue for flying one seat one mile

Regional - represents capacity purchased by Alaska from Horizon, SkyWest, and PenAir. In this segment, Alaska Regional records actual on-board passenger revenue, less costs such as fuel, distribution costs, and payments made to Horizon, SkyWest and PenAir under the respective capacity purchased arrangement (CPAs). Additionally, Alaska Regional includes an allocation of corporate overhead such as IT, finance, other administrative costs incurred by Alaska and on behalf of Horizon.

RPMs - revenue passenger miles, or "traffic"; represents the number of seats that were filled with paying passengers; one passenger traveling one mile is one RPM

Yield - passenger revenue per RPM; represents the average revenue for flying one passenger one mile

Exhibit 99.2

Investor Update - April 23, 2015

References in this update to “Air Group,” “Company,” “we,” “us,” and “our” refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified.

This update includes forecasted operational and financial information for our mainline and consolidated operations. Our disclosure of operating cost per available seat mile, excluding fuel and other items, provides us (and may provide investors) with the ability to measure and monitor our performance without these items. The most directly comparable GAAP measure is total operating expenses per available seat mile. However, due to the fluctuations in fuel prices, we are unable to predict total operating expenses for any future period with any degree of certainty. In addition, we believe the disclosure of fuel expense on an economic basis is useful to investors in evaluating our ongoing operational performance. Please see the cautionary statement under “Forward-Looking Information.”

We are providing information about estimated fuel prices and our hedging program. Management believes it is useful to compare results between periods on an “economic basis.” Economic fuel expense is defined as the raw or “into-plane” fuel cost less any cash we receive from hedge counterparties for hedges that settle during the period, offset by the recognition of premiums originally paid for those hedges that settle during the period. Economic fuel expense more closely approximates the net cash outflow associated with purchasing fuel for our operation.

Forward-Looking Information

This update contains forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by any forward-looking statements. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2014. Some of these risks include general economic conditions, increases in operating costs including fuel, competition, labor costs and relations, our indebtedness, inability to meet cost reduction goals, seasonal fluctuations in our financial results, an aircraft accident, and changes in laws and regulations. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed therein. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements after the date of this report to conform them to actual results. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such differences might be significant and materially adverse.

Forecast Information

|

| | | | | | | | | |

| Forecast

Q2 2015 | | Change

Y-O-Y | | Forecast

Full Year 2015 | | Change

Y-O-Y | | Prior Guidance

March 13, 2015 |

Capacity (ASMs in millions) | 9,900 - 9,950 | | ~ 10.5% | | 39,500 - 39,900 | | ~ 10.0% | | 39,400 - 39,900 |

Cost per ASM excluding fuel and special items (cents)(b) | 8.33¢ - 8.38¢ | | ~ flat | | 8.30¢ - 8.35¢ | | ~ (0.5)% | | 8.30¢ - 8.35¢ |

Fuel gallons (000,000) | 126 | | ~ 8.0% | | 506 | | ~ 8.0% | | 506 |

Economic fuel cost per gallon(a) | $2.03 | | ~ (36.5)% | | (b) | | (b) | | (b) |

| |

(a) | Our economic fuel cost per gallon estimate for the second quarter includes the following per-gallon assumptions: crude oil cost - $1.35 (approximately $57 per barrel), refining margin - 49 cents, cost of settled hedges - 4 cents, with the remaining difference due to taxes and other into-plane costs. |

| |

(b) | Because of the volatility of fuel prices, we do not provide full-year economic fuel estimates. |

Nonoperating Income

We expect that our consolidated nonoperating income will be approximately $1 million in the second quarter of 2015.

Capital Expenditures(a)

The table below reflects the full-year expectation for total capital expenditures and additional expenditures if options were exercised. These options will be exercised only if we believe return on invested capital targets can be met.

|

| | | | | | | | | | | | | | | |

| 2015 | | 2016 | | 2017 |

| | 2018 |

|

Aircraft and aircraft purchase deposits - firm | $ | 580 |

| | $ | 530 |

| | $ | 500 |

| | $ | 400 |

|

Other flight equipment | 55 |

| | 55 |

| | 30 |

| | 25 |

|

Other property and equipment | 100 |

| | 80 |

| | 80 |

| | 80 |

|

Total property and equipment additions | $ | 735 |

| | $ | 665 |

| | $ | 610 |

| | $ | 505 |

|

Option aircraft and aircraft deposits, if exercised(b) | $ | — |

| | $ | 60 |

| | $ | 140 |

| | $ | 290 |

|

| |

(a) | Preliminary estimate, subject to change. |

| |

(b) | Alaska has options to acquire 46 B737 aircraft with deliveries from 2018 through 2024. Horizon has options to acquire five Q400 aircraft with deliveries from 2018 through 2019. |

Projected Fleet Count(a)

|

| | | | | | | | | | | | | |

| Actual Fleet | | Expected Fleet Activity(b) |

Aircraft | Dec 31, 2014 | | 2015 Changes | | Dec 31, 2015 | | 2016-2017 Changes | Dec 31, 2017 |

737 Freighters & Combis | 6 |

| | — |

| | 6 |

| | (3 | ) | 3 |

|

737 Passenger Aircraft(c) | 131 |

| | 10 |

| | 141 |

| | 9 |

| 150 |

|

Total Mainline Fleet | 137 |

| | 10 |

| | 147 |

| | 6 |

| 153 |

|

Q400 | 51 |

| | 1 |

| | 52 |

| | 2 |

| 54 |

|

E-175(d) | — |

| | 5 |

| | 5 |

| | 2 |

| 7 |

|

CRJ700 | 8 |

| | — |

| | 8 |

| | — |

| 8 |

|

Total Regional Fleet | 59 |

| | 6 |

| | 65 |

| | 4 |

| 69 |

|

Total | 196 |

| | 16 |

| | 212 |

| | 10 |

| 222 |

|

| |

(a) | The expected fleet counts at December 31, 2015 and 2016 are subject to change. |

| |

(b) | Expected fleet activity includes aircraft deliveries, net of planned retirements and lease returns. |

| |

(c) | In 2015, we take delivery of 11 900ERs and return one 400. |

| |

(d) | Operated under our capacity purchase agreement (CPA) with Skywest and should enter service in June 2015. |

|

|

AIR GROUP - CONSOLIDATED (continued) |

Fuel Hedge Positions

All of our current oil positions are call options, which are designed to effectively cap the cost of the crude oil component of our jet fuel purchases. With call options, we benefit from a decline in crude oil prices, as there is no cash outlay other than the premiums we pay to enter into the contracts. Our crude oil positions are as follows:

|

| | | | | | |

| Approximate % of Expected Fuel Requirements | | Weighted-Average Crude Oil Price per Barrel | | Average Premium Cost per Barrel |

Second Quarter 2015 | 50 | % | | $97 | | $3 |

Third Quarter 2015 | 50 | % | | $90 | | $3 |

Fourth Quarter 2015 | 40 | % | | $86 | | $3 |

Remainder 2015 | 47 | % | | $95 | | $3 |

First Quarter 2016 | 30 | % | | $82 | | $3 |

Second Quarter 2016 | 20 | % | | $72 | | $3 |

Third Quarter 2016 | 10 | % | | $72 | | $3 |

Full Year 2016 | 15 | % | | $77 | | $3 |

Fuel Price Sensitivity

The following table depicts a forward-looking sensitivity of our full year 2015 economic fuel price per gallon given actual economic costs incurred to date, our current crude oil positions, and a range of possible future crude oil and refining margin prices:

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Crude Price per Barrel |

| | | $ | 30 |

| | $ | 40 |

| | $ | 50 |

| | $ | 60 |

| | $ | 70 |

|

Refining Margin

(cents per Gallon) | 30 |

| | $ | 1.42 |

| | $ | 1.60 |

| | $ | 1.78 |

| | $ | 1.97 |

| | $ | 2.14 |

|

40 |

| | $ | 1.50 |

| | $ | 1.68 |

| | $ | 1.86 |

| | $ | 2.04 |

| | $ | 2.22 |

|

50 |

| | $ | 1.57 |

| | $ | 1.76 |

| | $ | 1.94 |

| | $ | 2.12 |

| | $ | 2.29 |

|

60 |

| | $ | 1.65 |

| | $ | 1.83 |

| | $ | 2.01 |

| | $ | 2.20 |

| | $ | 2.37 |

|

70 |

| | $ | 1.73 |

| | $ | 1.91 |

| | $ | 2.09 |

| | $ | 2.27 |

| | $ | 2.45 |

|

|

|

ALASKA AIRLINES - MAINLINE |

Forecast Information

|

| | | | | | | | | |

| Forecast

Q2 2015 | | Change

Y-O-Y | | Forecast

Full Year 2015 | | Change

Y-O-Y | | Prior Guidance

March 13, 2015 |

Capacity (ASMs in millions) | 8,925 - 8,975 | | ~ 10.5% | | 35,600 - 36,000 | | ~ 10.0% | | 35,500 - 36,000 |

Cost per ASM excluding fuel and special items (cents)(b) | 7.43¢ - 7.48¢ | | ~ flat | | 7.40¢ - 7.45¢ | | ~ (0.5)% | | 7.40¢ - 7.45¢ |

Fuel gallons (000,000) | 110 | | ~ 8.0% | | 440 | | ~ 8.0% | | 440 |

Economic fuel cost per gallon(a) | $2.03 | | ~ (36.5)% | | (b) | | (b) | | (b) |

| |

(a) | Please see note(a) in Consolidated. |

| |

(b) | Because of the volatility of fuel prices, we do not provide full-year economic fuel estimates. |

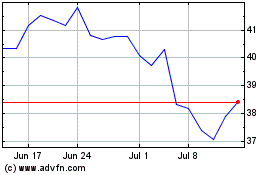

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

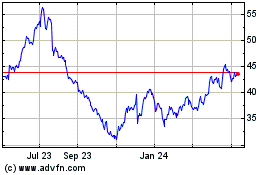

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024