US Aviation-Biofuel Production Could Be Poised To Take Flight

June 10 2011 - 4:05PM

Dow Jones News

Biofuel production in the U.S. has a mixed track record. But for

the aerospace sector, it is a dead serious business.

Fuel represents about 40% of airline carriers' total cost--and

oil that costs $100 a barrel is a major incentive for airlines and

aviation companies to find an alternative. Companies such as Boeing

Co. (BA), US Airways Group Inc. (LCC) and Alaska Airlines are

aggressively pursuing renewable jet fuel, or "biojet," made from

waste grease and vegetable oil to replace some of the 17 billion

gallons of petroleum-based fuel the aviation industry consumes

every year in the U.S.

"Our goal is to have 1% of all aviation fuel have some

bio-content within the next five years," said Billy Glover, vice

president of environment and aviation at Boeing, which has funded

biofuels studies and participated in test flights using renewable

jet fuel.

The aviation sector's keen interest in biofuels contrasts with

that of the greater consumer market, where renewable fuels seem to

have stalled. Corn ethanol, which represents 10% of fuel

consumption in the U.S., has been criticized for having a dubious

environmental record, and auto makers and refiners are resisting

U.S. government attempts to increase the amount of ethanol blended

into gasoline. Biodiesel production, a hot industry in 2007, has

ground to a halt. Some point to electric cars as being a better

alternative than biofuels to reduce fossil-fuel consumption in the

U.S.

But airlines, unable to electrify their planes, have been

pushing biojet fuel forward. On June 6, the renewable replacement

won approval for use in jet engines from ASTM International, the

international technical standards-setting group.

Biojet fuel is an advanced biofuel, chemically indistinguishable

from petroleum-based jet fuel. The high cost and decades-long

lifespan of aircraft make major changes in engine design

impractical, making "drop in" liquid biofuels that work with

existing infrastructure the best alternative, said Paul McElroy,

spokesman for Alaska Air Group Inc. (ALK), which operates Alaska

Airlines.

"There are many details that need to be addressed [with biojet],

but we believe this is certainly worth pursing," McElroy said.

One such detail is obtaining steady supply. Only a handful of

producers make the fuel, mostly in relatively small batches for

testing with the U.S. military. These include Solazyme Inc. (SZYM),

Honeywell International Inc. (HON) subsidiary UOM LLC and Dynamic

Fuels, a joint venture co-owned by Tyson Foods Inc. (TSN) and

Syntroleum Corp. (SYNM) that converts chicken fat into biojet.

Although Astmi's seal of approval for use of the fuel should

help to coax investors to the industry, production issues still

remain, including developing raw materials that will yield the most

amount of fuel. And some in the aviation industry believe the

military might have to prime the biojet production pump before the

fuel can conquer the wider market. Biojet currently can cost up to

five times more than petroleum-based jet fuel and won't fall in

price until production increases enough to reach economy of

scale.

Congress is currently mulling over bills introduced in May that

would allow the Department of Defense, the single-largest energy

consumer in the country, to extend its biofuel supply contracts to

15 years from the current five years.

If renewable jet-fuel production can ramp up enough to displace

even 1% of total aviation fuel needs, further growth would be

almost guaranteed, said Steve Lott, spokesman for airlines trade

group Air Transport Association.

"That first 1% is going to be the hardest," Lott said. "Once we

reach economy of scale, it will go that much faster."

-By Ben Lefebvre, Dow Jones Newswires; 713-547-9201;

ben.lefebvre@dowjones.com

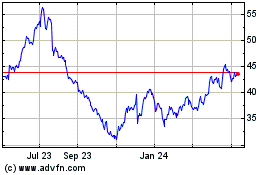

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

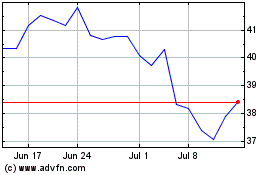

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024