|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 8-K

|

| CURRENT REPORT |

|

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

|

| Date of Report (Date of earliest event reported) |

January 1, 2016 |

|

ALBANY INTERNATIONAL CORP. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

1-10026 |

14-0462060 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| 216 Airport Drive, Rochester, NH |

03867 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code (518) 445-2200 |

| None |

| (Former name or former address, if changed since last report.) |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

| |

|

|

|

|

TABLE OF CONTENTS

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangement of Certain Officers

Item 9.01 Exhibits

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangement of Certain Officers

Albany International Corp. (the “Company”)

has entered into Severance Agreements (collectively the “Severance Agreements”) with various corporate officers or

key executives including named executive officers, but excluding its principal executive officer (each a “Counterparty”).

The Severance Agreements become effective January 1, 2016 and are intended to replace similar severance agreements entered into

in January 2013 which, by their terms, expired December 31, 2015. The new Severance Agreements have been revised and updated to

conform to current best practices. The material terms of the Severance Agreements provide that in the event a Counterparty’s

employment is terminated by the Company at any time before the expiration of the applicable Severance Agreement for any reason

other than Cause, or if the Counterparty’s employment is terminated by the Counterparty for Good Cause (as those terms are

defined in the Severance Agreement, and in either case, a “Qualifying Termination”), the Counterparty shall be entitled

to receive his or her gross monthly base salary in effect at the time of the Qualifying Termination, less applicable withholdings

and deductions, for a period of 24 months. In the event the Qualifying Termination occurs within 12 months of a Change in Control

(as defined in the Severance Agreement) the Counterparty shall be entitled to receive his or her gross monthly base salary in effect

at the time of the Qualifying Termination, less applicable withholdings and deductions, for a period of 36 months, although in

that case some of the monthly payments would be accelerated and paid as a lump sum to comply with applicable tax laws. The Counterparty

would also remain eligible for a prorated payment of any bonus earned, if any, during the year in which the Qualifying Termination

occurs, and 12 months of executive outplacement services. In addition, if elected, the Company will pay the required premium to

continue healthcare coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”). In order to receive

the severance benefits, the Counterparty is obligated to execute a release in favor of the Company at the time of termination.

The Counterparty is also bound to a restrictive covenant for the period during which the severance benefits are being paid. The

initial term of the Severance Agreement is for a period of three years, but it will thereafter automatically renew for one-year

periods unless the Company timely notifies the Counterparty of its intent not to renew. A copy of the form of Severance Agreement

is attached and being filed as an exhibit to this current report on Form 8-K. The summary of its provisions is not complete and

reference is made to the exhibit for its complete terms.

|

Item 9.01 Financial Statements and Exhibits

Exhibit 10(l) (viii) Form of Severance Agreement (filed herewith)

|

Signature

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ALBANY INTERNATIONAL CORP.

By: /s/ John B. Cozzolino_______________

Name: John B. Cozzolino

Title: Chief Financial Officer and Treasurer

(Principal Financial Officer)

Date: January 4, 2016

Exhibit 10(l)(viii)

SEVERANCE AGREEMENT

THIS

SEVERANCE AGREEMENT (the "Agreement"), is made and entered into with effect as of the 1st day of January,

2016 (the "Effective Date") by and between Albany International Corp., a Delaware corporation with its principal place

of business at 216 Airport Drive, Rochester, New Hampshire (the "Company"), and ____________ ("Employee").

RECITALS

WHEREAS,

Employee has been, and is currently, employed by the Company as an officer, or a key employee, in a critical managerial position;

and

WHEREAS,

Employee is employed by the Company on an at-will basis; and

WHEREAS, the Company wishes to encourage

Employee’s continued service and dedication to the performance of his or her duties; and

WHEREAS,

Employee and the Company each believe it to be in their best interests to provide Employee with certain severance protections;

and

WHEREAS, in order to induce Employee

to remain in the employ of the Company, and in consideration for Employee’s continued service to the Company, the Company

agrees that Employee shall receive the benefits set forth in this Agreement in the event that Employee’s employment with

the Company is terminated in the circumstances described herein.

NOW,

THEREFORE, in consideration of the mutual covenants and promises contained herein, and other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Employment. The

Company hereby agrees to continue Employee's current employment on an at-will basis in accordance with provisions contained herein

below. Employee shall continue to work from the Company's offices at ____________________, or such other place as may be reasonably

agreed upon. Employee shall be subject to the supervision of, and shall have such authority as is delegated to him or her by the

Chief Executive Officer, or the Board of Directors (the "Board"), as the case may be.

2. Effect

of a Qualifying Termination. In the event of a Qualifying Termination of Employee's employment at any

time before the termination of this Agreement, the Company shall pay to Employee, as severance, his or her gross monthly salary

in effect as of the date of such termination (the “Termination Date”), less applicable withholdings and deductions

required by law or otherwise agreed to by the parties, for a period of twenty-four (24) months. However, in the event such Qualifying

Termination occurs within twelve (12) months following a Change of Control, the Company shall pay to Employee his or her gross

monthly salary in effect as of the Termination Date, less applicable withholdings and deductions required by law or otherwise agreed

to by the parties, for a period of thirty six (36) months. The amount that may come due under this paragraph 2 shall hereinafter

be referred to as the “Severance Amount” and the number of months over which the Severance Amount shall be paid shall

hereinafter be referred to as the "Severance Period". The Severance Amount shall be paid in monthly installments during

the Severance Period in accordance with the Company’s customary payroll practices by check or direct deposit until paid in

full and may contain a pro rata payment for any partial month or to account for any prepaid, but unearned salary. Notwithstanding

the foregoing, any payments that otherwise would be due after the second anniversary of the Termination Date shall be paid in a

lump sum on the Company’s regular payroll date immediately preceding said second anniversary, together with any other severance

payment due on that date.

For the

purposes of this Section 2,

“Qualifying

Termination” shall mean an involuntary termination of Employee’s employment without Cause, or a termination of

Employee’s employment by Employee for Good Cause.

"Cause"

shall be deemed to exist upon:

(i) the conviction of Employee for, or the entry of a plea

of guilty or nolo contendere by Employee to, a felony charge or any crime involving moral turpitude;

(ii) Unlawful conduct on the part of Employee that may reasonably

be considered to reflect negatively on the Company or compromise the effective performance of Employee’s duties as determined

by the Company in its sole discretion;

(iii) Employee’s willful misconduct in connection with

his or her duties or willful failure to use reasonable effort to perform substantially his or her responsibilities in the best

interest of the Company (including, without limitation, breach by the Employee of this Agreement), except in cases involving Employee’s

mental or physical incapacity or disability;

(iv) Employee’s willful violation of the Company’s

Business Ethics Policy or any other Company policy that may reasonably be considered to reflect negatively on the Company or compromise

the effective performance of Employee’s duties as determined by the Company in its sole discretion;

(v) fraud, material dishonesty, or gross misconduct in connection

with the Company perpetrated by Employee;

(vi) Employee undertaking a position in competition with

Company;

(vii) Employee having caused substantial harm to the Company

with intent to do so or as a result of gross negligence in the performance of his or her duties; or

(viii)

Employee having wrongfully and substantially enriched himself or herself at the expense of the Company.

“Good

Cause” shall mean a termination of Employee’s employment as a result of the occurrence of any of the following,

without Employee’s consent: (i) a material adverse change in Employee’s authority and responsibilities, (ii)

a material reduction in Employee’s compensation, not proportionally and similarly affecting other senior executives, (iii)

failure of the Company or any successor to fully honor the terms of any contractual agreements with Employee, or (iv) a change

in Employee’s principal place of business to a location more than 50 miles from such Employee’s location on the date

of this Agreement; provided, that, in any case, Employee shall have delivered written notice to the Company of his

or her intention to terminate his or her employment for Good Reason, which notice specifies in reasonable detail the circumstances

claimed to give rise to the Employee’s right to terminate employment for Good Reason, and the Company shall not have cured

such circumstances within 30 days following receipt of such notice.

“Change

in Control” shall be deemed to have occurred if (i) there is a change of ownership of the Company as a result of one

person, or more than one person acting as a group, acquiring ownership of stock of the Company that, together with stock held

by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of the Company,

provided, however, that the acquisition of additional stock by a person or group who already owns 50% of the total fair market

value or total voting power of the stock of the Company shall not be considered a Change in Control; (ii) notwithstanding that

the Company has not undergone a change in ownership as described in subsection (i) above, there is a change in the effective control

of the Company as a result of either (a) one person, or more than one person acting as a group, acquiring (or having acquired

during the 12 month period ending on the date of the most recent acquisition) ownership of stock of the Company possessing 30%

or more of the total voting power of the stock of the Company, or (b) a majority of the members of the Board is replaced during

any 12 month period by directors whose appointment or election is not endorsed by a majority of the members of the Board before

the date of appointment or election, provided, however, that in either case the acquisition of additional control by a person

or group who already is considered to effectively control the Company shall not be considered a Change in Control; or (iii) there

is a change in ownership of a substantial portion of the Company’s assets as a result of one person, or more than one person

acting as a group, acquiring (or having acquired during the 12 month period ending on the date of the most recent acquisition)

assets from the Company that have a total gross fair market value equal to or more than 40% of the total gross fair market value

of all the assets of the Company immediately before such acquisition or

acquisitions, provided, however, that there is no Change

in Control if the transfer of assets is to the shareholders of the Company or an entity controlled by the shareholders of the

Company.

3. Additional Severance Benefits.

In the event of a termination of employment under any of the situations described in paragraph 2 above, the Company agrees

to provide Employee the following additional severance benefits which he/she would not otherwise be entitled. Employee acknowledges

and agrees that the totality of severance benefits set forth in this Agreement constitute adequate legal consideration for the

promises and representations made by him/her in this Agreement, and are in lieu of any benefits payable under any severance plan

now in existence or hereafter adopted.

(a) Should Employee elect, pursuant

to the protections afforded by the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), to continue group health

care coverage as is from time to time provided by or through the Company to all similarly situated eligible employees, the Company

shall pay the then applicable COBRA contribution for each month of Employee’s eligibility through the Severance Period, or

until Employee terminates such coverage, whichever shall occur first. Thereafter, Employee shall pay the COBRA contribution for

the remaining months of eligibility or until Employee terminates coverage, whichever shall occur first.

(b) The Company reserves the right

to modify, supplement, amend or eliminate the coverages described in clause (a) above including, without limitation, the eligibility

requirements and/or premiums, deductibles, co-payments or other charges relating thereto, provided it does so for all similarly

situated employees.

(c) The Company shall pay Employee

for any accrued, unused vacation pursuant to existing company policy at Employee’s last rate of pay, less applicable withholdings

and deductions required by law or otherwise agreed to by the parties.

(d)

To assist Employee in obtaining employment, the Company shall make available and bear the cost of executive outplacement

services to be provided by an outplacement firm chosen by the Company. Said services will be provided for a period of up to 12

months, or until Employee finds employment, whichever occurs sooner and shall be made available immediately upon execution of this

Agreement.

(e)

In addition, Employee shall, at the discretion of the Company, be eligible for a bonus relating to the services he/she performs

in the year in which his/her employment is terminated. Any such bonus shall be calculated at the same time and in the same manner

in which bonuses are awarded to similarly situated employees under the then current and prevailing bonus program, except that any

such bonus paid to Employee pursuant to this Agreement shall be pro-rated to reflect that actual time Employee was employed by

the Company during the year.

All unpaid

severance or other benefits hereunder shall be suspended if Employee remains employed, or is re-employed, by the Company in any

capacity during the Severance Period. Employee acknowledges and agrees that, except for this Agreement, Employee would have no

right to receive all of the benefits described herein. Payment of the severance benefits provided for under this Agreement shall

be contingent upon Employee’s timely execution, and nonrevocation, of a General Release and Separation Agreement substantially

in the form attached hereto as Exhibit A. Payment of the severance benefits provided for under this Agreement shall

not commence prior to the effective date of said General Release and Separation Agreement.

4. Restrictive

Covenants. Employee acknowledges the highly competitive nature of the Company’s business and in recognition thereof

agrees as follows:

A. During

the Severance Period, whether on Employee’s own behalf or on behalf of or in conjunction with any person, firm, partnership,

joint venture, association, corporation or other business, organization, entity or enterprise whatsoever (“Person”),

Employee shall not directly or indirectly:

(i) engage in any business which is

in competition with the Company or any of its subsidiaries or affiliates in the same geographical areas as the Company or any of

its subsidiaries or affiliates are engaged in their business (a “Competitive Business”);

(ii) enter into the employ of, or render

any services to, any Person in respect of any Competitive Business;

(iii) acquire a financial interest in,

or otherwise become actively involved with, any Competitive Business, directly or indirectly, as an individual, partner, shareholder,

officer, director, principal, agent, trustee or consultant; provided, however, that in no event shall ownership of less than 2%

of the outstanding capital stock of any corporation, in and of itself, be deemed a violation of this covenant if such capital stock

is listed on a national securities exchange or regularly traded in an over-the-counter market; or

(iv) interfere

with, or attempt to interfere with, any business relationships (whether formed before or after the Termination Date) between the

Company or any of its subsidiaries or affiliates and their customers, clients, suppliers or investors.

B. During

the Severance Period, whether on Employee’s own behalf or on behalf of or in conjunction with any Person, Employee shall

not directly or indirectly:

(i) solicit

or encourage any employee of the Company or any of its subsidiaries or affiliates to leave the employment of the Company or any

of its subsidiaries or affiliates; or

(ii) hire

any such employee who was employed by the Company or any of its subsidiaries or affiliates as of the Termination Date or, if later,

within the six-month period prior to such date of hire.

It is

expressly understood and agreed that although the parties consider the restrictions in this Paragraph 4 to be reasonable, if a

final determination is made by a court of competent jurisdiction that the time or territory or any other restriction contained

in this paragraph is an unenforceable restriction against the Employee, the provisions of this paragraph shall not be rendered

void but shall be deemed amended to apply as to such maximum time and territory and to such maximum extent as such court may determine

to be enforceable.

5. Confidential

Information. Employee acknowledges that as a consequence of his or her employment with the Company proprietary and confidential

information relating to the Company’s business may be, or have been, disclosed to or developed or acquired by the Employee

which is not generally known to the trade or the general public and which is of actual or potential value to the Company (“Proprietary

Information”). Such Proprietary Information includes, without limitation, information about trade secrets, inventions, patents,

licenses, research projects, costs, profits, markets, sales, customer lists, proprietary computer programs, proprietary records,

and proprietary software; plans for future development, and any other information not available to the trade or the general public,

including information obtained from or developed in conjunction with a third party that is subject to a confidentiality or similar

agreement between the Company and such third party. The Employee acknowledges and agrees that his or her relationship with the

Company with respect to such Proprietary Information has been and shall be fiduciary in nature. Consequently, during the remainder

of, and after, his or her employment by the Company, the Employee shall not use any Proprietary Information for his or her own

benefit, or for the benefit of any other person or entity or for any other purpose whatsoever other than the performance of his

or her work for the Company, and the Employee shall maintain all such information in confidence and shall not disclose any thereof

to any person other than employees of the Company authorized to receive such information. This obligation is in addition to any

similar obligations the Employee may have pursuant to any other agreement, statute or common-law. Nothing herein, however, shall

preclude the Employee from describing his or her duties with the Company in future job interviews. After the fifth anniversary

of the end of the Employee’s employment by the Company, the term Proprietary Information shall be limited to information

constituting trade secrets of the Company.

6. Non-disparagement. Employee

specifically agrees and covenants that he or she will not directly or indirectly disparage the Company or any subsidiary or affiliate

of the Company, or any of their respective officers, directors, employees, attorneys or representatives, or any of their respective

products or services in any manner, at any time, to any person or entity. “Disparage” is defined as, but not limited

to, any utterance whatsoever either verbal, in writing, by gesture or any behavior of any kind that might tend to or actually harm

or injure the Company or any subsidiary or affiliate of the Company, whether intended or not.

7. Clawback.

Employee shall forfeit any unpaid Severance Amount due pursuant to this Agreement and shall, upon demand, repay any Severance Amounts

already paid hereunder if, after the Termination Date:

(a) there

is a significant restatement of the Company’s financial results, caused or substantially caused by the fraud or intentional

misconduct of the Employee;

(b) Employee

breaches any provision of this Agreement, including, without limitation, the covenants set for in paragraphs 4, 5 and 6 or

(c) the

Company discovers conduct by Employee that would have permitted termination for Cause, provided that such conduct occurred prior

to the Termination Date.

8. Remedies for Breach. The

Company and Employee agree that a breach by Employee of the provisions of this Agreement may cause irreparable harm to the Company

which will be difficult to quantify and for which money damages will not be adequate. Accordingly, the Employee agrees that the

Company shall have the right to obtain an injunction against the Employee, without any requirement for posting any bond or other

security, enjoining any such breach or threatened breach in addition to any other rights or remedies available to the Company on

account of any breach or threatened breach of this Agreement. Employee and the Company each further agree that if an action is

commenced by any party alleging breach of this Agreement, the non-prevailing party shall be liable to the prevailing party for

any and all available legal and equitable relief, as well as reasonable attorneys' fees and costs associated with pursuing or defending

such legal action.

9. Internal

Revenue Code Section 409A.

(A) The

payments and the payment schedules set forth herein are intended to be exempt from, or comply with, Section 409A of the Internal

Revenue Code (“Section 409A”). Accordingly, the Agreement shall be interpreted and performed so as to be exempt from

Section 409A, but if that is not possible, the Agreement shall be interpreted and performed so as to comply with Section 409A.

In the event any payments or benefits are deemed by the IRS to be non-compliant, this Agreement, at Employee’s option, shall

be modified, to the extent practical, so as to make it compliant by altering the payments or the timing of their receipt. The

methodology to effect or address any necessary modifications shall be subject to reasonable and mutual agreement between the parties.

(B) It

is the intent of the parties that this Agreement provides payments and benefits that are either exempt from the distribution requirements

of Section 409A of Code, or satisfy those requirements. Any distribution that is subject to the requirements of Section 409A may

only be made based on the Employee's "separation from service" (as that term is defined under the final regulations

under Section 409A).

(C) Notwithstanding

anything to the contrary in this Agreement, in the event that (i) a distribution of benefits is subject to Section 409A, (ii)

at the time the distribution would otherwise be made to the Employee, the Employee is a "specified employee" (as that

term is defined in the final regulations under Section 409A), and (iii) the distribution would otherwise be made during the 6-month

period commencing on the date of the Employee's separation from service, then such distribution will instead be paid to the Employee

in a lump sum at the end of the 6-month period. The foregoing delay in the distribution of benefits shall be made in conformance

with the final regulations under Section 409A.

10. Severability. Employee

and the Company intend for every provision of this Agreement to be fully enforceable. But, if a court with jurisdiction over this

Agreement determines that all or part of any provision of this Agreement is unenforceable for any reason, the Company and Employee

intend for each remaining provision and part to be fully enforceable as though the unenforceable provision or part had not been

included in this Agreement.

11. Entire

Agreement. This Agreement and the exhibit hereto constitutes the entire agreement between the parties

and supersedes all prior agreements and understandings, whether written or oral, relating to the subject matter of this Agreement.

12. Amendment. This

Agreement may be amended or modified only by a written instrument executed by both the Company and Employee.

13. Governing

Law. This Agreement shall be construed, interpreted and enforced in accordance with the laws of the

State of New York, except to the extent preempted by federal law.

14. Term. The

initial term of this Agreement shall be for a three year period expiring on December 31, 2018; provided, however, that that the

term of the Agreement shall automatically renew for successive one-year terms unless The Company shall have given Employee written

notice at least six months before the end of the initial term, or any renewal term, of its intent not to renew the Agreement. Notwithstanding

the preceding sentence, the Company shall be precluded from giving such written notice for a period of twelve (12) months following

a Change of Control, as defined in Paragraph 2, above.

15. Successors

and Assigns. This Agreement will be binding upon and inure to the benefit of (a) the heirs, executors,

and legal representatives of Employee upon Employee's death, and (b) any successor of the Company. Any such successor of the Company

will be deemed substituted for the Company under the terms of this Agreement for all purposes. For this purpose, "successor"

means any person, firm, corporation, or other business entity which at any time, whether by purchase, merger, or otherwise, directly

or indirectly acquires all or substantially all of the assets or business of the Company. None of the rights of Employee to receive

any payment pursuant to this Agreement may be assigned or transferred except by will or the laws of descent and distribution. Any

other attempted assignment, transfer, conveyance, or other disposition of any right of the Employee under this Agreement will be

null and void.

16. Waiver

of Jury Trial. The parties agree that they have waived, and hereby waive, their right to a jury trial

with respect to any controversy, claim, or dispute arising out of or relating to this Agreement, or the breach thereof, or arising

out of or relating to the employment of the Employee, or the termination thereof, including any claims under federal, state, or

local law, and that any such controversy, claim, or dispute shall be heard and adjudicated in the state courts of the State of

New York, in Albany County.

17. Non-admission of Liability. This

Agreement does not constitute an admission by the Company of any liability to Employee, and Employee understands and agrees that

the Company denies any such liability to Employee.

18. Headings. All captions

and Section headings used in this Agreement are for convenient reference only and do not form a part of this Agreement.

IN WITNESS WHEREOF, Employee and a duly

authorized representative of the Company have signed this Agreement as of the dates set forth below.

| Employee |

Albany International Corp. |

|

| |

|

|

| |

|

|

| |

|

|

| ___________________ |

By: |

|

| |

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| Dated: ____________, 2016 |

Dated: _____________, 2016 |

|

EXHIBIT A

General Release and Separation Agreement

This General Release and Separation Agreement

(the, or this “Agreement”) is made and entered into this ____ day of ___________, 20___ by and between Albany International

Corp. (the "Company") and ____________ ("Employee").

In consideration of the acknowledgements and mutual covenants

hereinafter set forth, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto agree as follows:

1. Presentation of Agreement. Employee acknowledges

that on ____________ ___, 20___ he or she was given this Agreement and was afforded _____ days to consider same.

2. Legal Advice. Employee was, and hereby

is, advised to consult a lawyer before signing this Agreement.

3. Acceptance of Agreement. Employee may

accept this Agreement only by signing, dating and delivering the Agreement to the Company (in the manner set forth in Section 12)

on or before the Company’s normal close of business on ___________ ___, 20___. Time is of the essence with regard to this

Section 3.

4. Revocation. Employee may revoke this

Agreement at any time within seven (7) days after signing and delivering it to the Company by notifying the Company in writing

(in the manner set forth in Section 12) of Employee’s decision to revoke. Time is of the essence with regard to this Section

4.

5. Effective Date. The effective date of

this Agreement shall be the eighth (8th) day after Employee signs and delivers it to the Company in accordance with Section 3 above,

unless Employee revokes the Agreement before then in accordance with Section 4 above. If Employee fails to accept this Agreement

in accordance with Section 3 above, or timely revokes the Agreement in accordance with Section 4 above, the Agreement will not

become effective and will not be binding on Employee or the Company.

6. Termination of Employment. Employee’s

employment by the Company has been terminated effective ___________ ____, 20__. The parties agree that said termination of employment

was a termination by the Company other than for Cause within the meaning of Section 2 of that certain Severance Agreement (the

“Severance Agreement”) entered into by and between the parties with an effective date of January 1, 2016.

7. Severance Payments. In accordance with,

and subject to, the terms of the Severance Agreement, the Company shall pay to Employee the Severance Amount as specified in the

Severance Agreement.

8. Employee’s Acknowledgement. Employee

acknowledges and agrees that, except for this Agreement, Employee would have no right to receive the benefits described in Section

7.

9. Defined Term. As used in this Agreement,

the term “Albany” means, individually and collectively, Albany, each subsidiary and affiliate of Albany, and their

respective employee welfare benefit plans, employee pension benefit plans, successors and assigns, as well as all present and former

shareholders, directors, officers, fiduciaries, agents, representatives and employees of those companies and other entities.

10. General Release. By signing this Agreement

Employee immediately gives up and releases Albany from, and with respect to, any and all rights and claims that Employee may have

against Albany (except as expressly state in subsection 10(c) below), whether or not Employee presently is aware of such rights

or claims or suspects them to exist. In addition, and without limiting the foregoing:

| (a) | The Employee on behalf of himself or herself, his or her agents, spouse, representatives, assignees, attorneys, heirs, executors

and administrators, fully releases Albany and Albany’s past and present successors, assigns, parents, divisions, subsidiaries,

affiliates, officers, directors, shareholders, employees, agents and representatives from any and all liability, claims, demands,

actions, causes of action, suits, grievances, debts, sums of moneys, controversies, agreements, promises, damages, back and front

pay, costs, expenses, attorneys fees, and remedies of any type, which Employee now has or hereafter may have, by reason of any

matter, cause, act or omission arising out of or in connection with Employee’s employment or the termination of his or her

employment with Albany prior to Employee signing this Agreement, including, without limiting the generality of the foregoing, any

claims, demands or actions arising under the Age Discrimination in Employment Act of 1967, the Older Workers Benefit Protection

Act, the Employee Retirement Income Security Act of 1974, Title VII of the Civil Rights Act of 1964, the Civil Rights act of 1991,

the Civil Rights Act of 1866, the Rehabilitation Act of 1973, the Americans with Disabilities Act of 1990, and any other federal,

state or local statute, ordinance or common law regarding employment, discrimination in employment, or the termination of employment.

Notwithstanding the foregoing, Employee is not waiving any right that cannot, as a matter of law, be voluntarily waived, including

the right to file a charge or complaint with, or participate in the adjudication of charge or complaint of discrimination filed

with, any federal, state or local administrative agency, though Employee expressly waives any right to recover any money or obtain

any other relief or benefit as a result of any complaint or charge being filed with any federal, state or local administrative

agency. |

The foregoing release includes, but is not limited

to, any claim of discrimination on the basis of race, sex, religion, marital status, sexual orientation, national origin, handicap

or disability, age, veteran status, special disabled veteran status, citizenship status; any other claim based on a statutory prohibition;

any claim arising out of or related to an express or implied employment contract, any other contract affecting terms and conditions

of employment, or any covenant of good faith and fair dealing; all tort claims; and all claims for attorney’s fees or expenses.

The Employee represents that he or she understands

the foregoing release, that rights and claims under the Age Discrimination in Employment Act of 1967, as amended, are among the

rights and claims against Albany he or she is releasing, and that he or she understands that he or she is not releasing any rights

or claims arising after the date Employee signs this Agreement.

| (b) | If Employee breaches any obligation under this Agreement, Employee agrees that Albany shall not be obligated to continue to

make payments under Section 7, and that Employee shall reimburse Albany for all payments made pursuant to Section 7. |

| (c) | Nothing in this Agreement, however, shall be deemed a waiver of any vested rights or entitlements Employee may have under any

retirement or other employee benefit plans administered by Albany. Nor shall anything in this Agreement operate to release Albany

from its obligations under this Agreement. |

11. Non-admission of Liability. This Agreement

does not constitute an admission by Albany of any liability to Employee, and Employee understands and agrees that Albany denies

any such liability to Employee.

12. Notices. Notices or other deliveries

required or permitted to be given or made under this Agreement by Employee to Albany shall, except to the extent otherwise required

by law, be deemed given or made if delivered by hand or by express mail or overnight courier service to Albany International Corp.,

216 Airport Drive, Rochester, New Hampshire 03867, Attention: General Counsel.

13. Headings. All captions

and Section headings used in this Agreement are for convenient reference only and do not form a part of this Agreement.

IN WITNESS WHEREOF, Employee and a duly

authorized representative of the Company have signed this Agreement as of the dates set forth below.

| Employee |

Albany International Corp. |

|

| |

|

|

| |

|

|

| |

|

|

| ___________________ |

By: |

|

| |

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| Dated: ____________, 20___ |

Dated: _____________, 20___ |

|

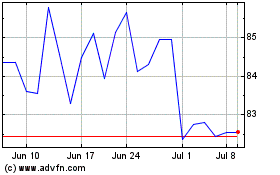

Albany (NYSE:AIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albany (NYSE:AIN)

Historical Stock Chart

From Apr 2023 to Apr 2024