Third-Quarter Financial Highlights

- Net sales were $178.8 million, a

decrease of 0.6% compared to Q3 2014. Excluding currency effects,

net sales increased 4.7% (see Table 1).

- Adjusted EBITDA was $42.0 million,

compared to $33.5 million in Q3 2014 (see Tables 6 and 7).

- Q3 2015 income attributable to the

Company was $0.30 per share, compared to $0.37 in Q3 2014.

Excluding adjustments (see Table 15), income attributable to the

Company was $0.47 per share, compared to $0.31 in Q3 2014.

- Year-to-date net sales were $532.4

million, a decrease of 3.8%. Excluding currency effects,

year-to-date net sales increased 1.9% compared to 2014 (see Table

8).

- Including a $14.0 million charge in Q2

related to an AEC contract, year-to-date Adjusted EBITDA was $102.3

million in 2015, compared to $108.5 million in 2014 (see Tables 9

and 10).

Albany International Corp. (NYSE:AIN) reported that Q3 2015

income attributable to the Company was $9.7 million, including net

charges of $3.9 million for income tax adjustments. Income

attributable to the Company in Q3 2014 was $11.8 million, including

net charges of $0.3 million for income tax adjustments.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20151027006736/en/

Q3 2015 income before income taxes was $21.9 million, including

restructuring charges of $3.7 million and gains of $1.0 million

from foreign currency revaluation. Q3 2014 income before income

taxes was $18.5 million, including restructuring charges of $0.9

million, and gains of $4.1 million from foreign currency

revaluation and $0.2 million from an insurance recovery.

Table 1 summarizes net sales and the effect of changes in

currency translation rates:

Table 1

Net SalesThree Months endedSeptember,

Percent

Impact ofChangesin CurrencyTranslation

PercentChangeexcludingCurrency

(in thousands)

2015

2014

Change

Rates

Rate Effect

Machine Clothing (MC) $154,522

$157,891 -2 .1%

($9,364 ) 3 .8% Albany Engineered Composites

(AEC) 24,267 21,970

10 .5% (166 )

11 .2% Total $178,789

$179,861 -0 .6%

($9,530 ) 4 .7%

Changes in currency translation rates, driven mainly by the

stronger U.S. dollar, resulted in a $9.5 million decline in sales .

Excluding that effect, MC sales were up 3.8% compared to Q3 2014,

principally due to global strength in the packaging and pulp

grades, which offset declines in publication grades. Excluding

currency translation effects, AEC sales increased 11.2% due to

growth in the LEAP program.

Q3 2015 gross profit was $75.7 million, or 42.4% of net sales,

compared to $68.6 million, or 38.2% of net sales, in the same

period of 2014. MC gross profit improved to $74.7 million, or 48.4%

of net sales, compared to $66.1 million, or 41.9% of net sales, in

Q3 2014, reflecting very good capacity utilization and strong sales

volume. Even though changes in currency translation rates had a

significant effect on MC net sales, they had only a minor negative

effect on gross profit. AEC gross profit was $1.4 million in Q3

2015, compared to $2.9 million in Q3 2014, as gross profit from the

LEAP program was offset by continued weak profitability in legacy

programs.

Selling, technical, general, and research (STG&R) expenses

were $46.2 million, or 25.8% of net sales, in the third quarter of

2015, compared to $48.5 million, or 27.0% of net sales, in the

third quarter of 2014. The revaluation of nonfunctional-currency

assets and liabilities resulted in third-quarter gains of $2.0

million in 2015 and $2.2 million in 2014. The decrease in STG&R

compared to 2014 was mostly due to changes in currency translation

rates.

The following table presents expenses associated with internally

funded research and development by segment:

Table 2

Research and development expenses by

segment Three Months ended

September 30,

(in thousands)

2015

2014

Machine Clothing $4,775 $4,510 Albany Engineered

Composites 2,769 3,593 Corporate expenses 190

159 Total $7,734 $8,262

The following table summarizes third-quarter operating income by

segment:

Table 3

Operating Income/(loss) Three Months

ended

September 30,

(in thousands)

2015

2014

Machine Clothing $41,956 $33,308 Albany

Engineered Composites (4,191 ) (2,765 ) Corporate

expenses (11,922 ) (11,385 ) Total $25,843

$19,158

Segment operating income was affected by restructuring and

currency revaluation as shown in Table 4 below. Q3 2015

restructuring charges included a noncash charge of $3.2 million for

a write-down in the value of our former manufacturing building in

Germany which is being held for sale.

Table 4

Expenses/(gain) in Q3 2015 Expenses/(gain) in Q3 2014

resulting from resulting from (in thousands)

Restructuring

Revaluation

Restructuring

Revaluation

Machine Clothing $3,717 ($2,005 )

$968 ($2,308 ) Albany Engineered Composites

- - (49 ) 135

Corporate expenses - 4

- 1 Total $3,717 ($2,001

) $919 ($2,172 )

Q3 2015 Other income/expense, net, was expense of $1.2 million,

including losses related to the revaluation of

nonfunctional-currency balances of $1.0 million. Q3 2014 Other

income/expense, net, was income of $1.9 million, including gains

related to the revaluation of nonfunctional-currency balances of

$1.9 million, and an insurance-recovery gain of $0.2 million.

The following table summarizes currency revaluation effects on

certain financial metrics:

Table 5

Income/(loss) attributable to currency

revaluation Three Months ended

September 30,

(in thousands)

2015

2014

Operating income $2,001 $2,172 Other

income/(expense), net (953 ) 1,916 Total

$1,048 $4,088

The Company’s income tax rate, excluding tax adjustments, was

38.0% for Q3 2015, compared to 34.9% for the same period of 2014.

The higher tax rate in Q3 2015 was due primarily to the impact of

restructuring charges in Germany, where the Company is unable to

record a tax benefit related to the expense. In addition, the

Company recorded net discrete tax charges of $4.9 million,

principally related to changes in the expected outcome of a tax

appeal in Germany to recover prepaid taxes; this was partially

offset by a $1.0 million income tax reduction due to a decrease in

the estimated tax rate. Discrete tax charges and the effect of a

change in the estimated tax rate increased income tax expense by

$0.3 million for the third quarter of 2014.

The following tables summarize Adjusted EBITDA:

Table 6

Three Months ended September 30,

2015

(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Net income $41,956

($4,191 ) ($28,085 )

$9,680 Interest expense, net -

- 2,671

2,671 Income tax expense

- -

12,243 12,243 Depreciation and

amortization 9,660

2,981 2,102

14,743

EBITDA 51,616

(1,210 )

(11,069 ) 39,337

Restructuring expenses, net 3,717

- -

3,717 Foreign currency revaluation

(gains)/losses (2,005 ) -

957 (1,048

) Pretax income attributable to noncontrolling interest in ASC

- (25 )

- (25 )

Adjusted

EBITDA $53,328

($1,235 ) ($10,112

) $41,981

Table 7

Three Months ended September 30,

2014

(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Net income $33,308

($2,765 ) ($18,769 )

$11,774 Interest expense, net -

- 2,486

2,486 Income tax expense

- -

6,762 6,762 Depreciation and

amortization 11,060

2,607 2,069

15,736

EBITDA

44,368 (158 )

(7,452 )

36,758 Restructuring and other, net

968 (49 ) -

919 Foreign currency revaluation

(gains)/losses (2,308 )

135 (1,915 )

(4,088 ) Gain on insurance recovery -

- (165 )

(165 ) Pretax loss attributable to noncontrolling

interest in ASC -

77 - 77

Adjusted EBITDA $43,028

$5

($9,532 ) $33,501

Capital spending was $9.3 million for Q3 2015, compared to $18.9

million for Q3 2014. Depreciation and amortization was $14.7

million for Q3 2015, compared to $15.7 million for Q3 2014.

CFO Comments

CFO and Treasurer John Cozzolino commented, “Cash flow was

strong during the quarter due to the improved operating results.

Net debt (total debt less cash) decreased $21 million to $99

million (see Table 16). Total debt declined to $270 million at the

end of Q3, compared to $303 million at the end of Q2, as the

Company repatriated $30 million from its non-U.S. operations. The

Company’s leverage ratio, as defined in our primary debt

agreements, decreased from 1.55 at the end of Q2 to 1.29 at the end

of Q3. Capital expenditures during Q3 were about $9 million, and we

currently estimate full-year spending in 2015 to be $45 million to

$55 million.

“The Company’s tax rate in Q3, excluding tax adjustments, was

38%, which is in-line with our full-year expectation. Cash paid for

income taxes was about $4 million in Q3, and we estimate cash taxes

in 2015 to range from $20 million to $22 million.

“Net sales continue to be reduced by currency rates, as compared

to currency rates in effect during Q3 2014. However, due to our mix

of sales and costs by currency (e.g., net cost positions in Brazil

and Mexico), currency rates have had a positive impact on Adjusted

EBITDA when compared to prior-year rates. Adjusted EBITDA in future

quarters could be negatively impacted by significant currency rate

changes related to our key exposures, such as the peso and the

real.”

CEO Comments

President & CEO Joe Morone said, “Q3 2015 was a strong

quarter for Albany International. Compared to Q3 2014, sales

excluding currency effects improved by 5%, and Adjusted EBITDA

improved 25%. Net debt declined by $21 million. Both businesses

performed well, and as they have all year, are firmly on track

toward their long-term strategic objectives of steady annual

Adjusted EBITDA and cash flow in MC, and rapid, profitable growth

in AEC.

“In MC, sales excluding currency effects were 4% ahead of Q3

2014; Adjusted EBITDA was 24% ahead. Year-to-date sales excluding

currency effects were flat compared to 2014; Adjusted EBITDA was 8%

ahead. All regions performed well in Q3. Consistent with our

long-term view of this business, the publication grades declined in

every region of the world, but the decline was more than offset by

good performance across all of our growth grades and regions. On a

year-over-year basis, Asia and South America grew modestly, despite

economic weakness in those regions; North America rebounded back to

normal levels, despite much lower publication grade sales; and

Europe was stable. Margins were exceptional, and reflect continuing

efforts to improve productivity and consolidate operations. The

strong dollar relative to the Mexican peso and Brazilian real also

contributed to the improvement in gross margin and Adjusted

EBITDA.

“AEC once again performed well. Sales were 11% ahead of Q3 2014,

while Adjusted EBITDA continued to hover slightly below breakeven

and about $1 million behind last year. Until the LEAP ramp begins

in earnest a year from now, the most important metrics for AEC are

performance to schedule, manufacturing yield, manufacturing cycle

time, and of course, market demand. Against these four metrics,

performance was very strong in Q3. On the development front, broad

progress continued in all areas of focus – that is, on applications

for aircraft engines, airframes, and the high end of the automotive

market. Two milestones of particular note this quarter were the

production of the first three prototype fan cases for the GE9X

engine, and the entry into initial production of a family of woven,

semi-finished components that are used to connect the skin of

aircraft to their underlying structure in a variety of defense

applications. While this family of components has only modest

revenue potential – roughly $5 million to $10 million per year by

the end of this decade, it represents what could be the first of

several emerging AEC opportunities aimed at the defense aerospace

market.

“Turning to our short-term outlook, in MC the normal seasonal

year-end slowdown is likely to be magnified by continued economic

weakness in key markets, and so we expect Q4 Adjusted EBITDA to be

at best comparable to, and quite possibly a bit lower than, Q4

2014. Full-year Adjusted EBITDA should be well ahead of full-year

2014.

“This expectation of full-year growth in Adjusted EBITDA in no

way alters our long-term view of this business, just as it remained

unaltered by the relatively weak Q2 results. While performance may

continue to fluctuate from period to period and with general

macroeconomic conditions, we maintain our long-term view of this

business as capable of generating steady year-over-year Adjusted

EBITDA and cash flow - with annual Adjusted EBITDA ranging from

$180 million to $195 million, depending on currency translation

effects.

“The short-term outlook for AEC is of course dominated by

preparations for the LEAP ramp. Revenue could be subject to a good

deal of quarter-to-quarter volatility over the next four quarters,

as the rate at which Safran pulls parts out of our finished goods

inventory fluctuates with their short-term need for parts during

this final stage of development, testing, and certification.

Assuming the LEAP program stays on schedule, we expect production

to begin to ramp in Q4 of next year and then to increase rapidly,

growing from roughly 200 shipsets in 2016 to at least 1,800 a year

by the end of the decade.

“In sum, this was a good quarter for Albany; both businesses

performed very well in Q3 and remain firmly on track toward their

long-term objectives of steady Adjusted EBITDA and cash flow in MC,

and rapid, profitable growth for AEC.”

The Company plans a webcast to discuss third-quarter 2015

financial results on Wednesday, October 28, 2015, at 9:00 a.m.

Eastern Time. For access, go to www.albint.com.

About Albany International Corp.

Albany International is a global advanced textiles and materials

processing company, with two core businesses. Machine Clothing is

the world’s leading producer of custom-designed fabrics and belts

essential to production in the paper, nonwovens, and other process

industries. Albany Engineered Composites is a rapidly growing

supplier of highly engineered composite parts for the aerospace

industry. Albany International is headquartered in Rochester, New

Hampshire, operates 19 plants in 10 countries, employs 4,000 people

worldwide, and is listed on the New York Stock Exchange (Symbol

AIN). Additional information about the Company and its products and

services can be found at www.albint.com.

This release contains certain items, such as earnings before

interest, taxes, depreciation and amortization (EBITDA), Adjusted

EBITDA, sales excluding currency effects, income tax rate excluding

adjustments, net debt, net income attributable to the Company,

excluding adjustments (on an absolute and per-share basis), and

certain income and expense items on a per-share basis that could be

considered non-GAAP financial measures. Such items are provided

because management believes that, when presented together with the

GAAP items to which they relate, they provide additional useful

information to investors regarding the Company’s operational

performance. Presenting increases or decreases in sales, after

currency effects are excluded, can give management and investors

insight into underlying sales trends. An understanding of the

impact in a particular quarter of specific restructuring costs, or

other gains and losses, on operating income or EBITDA can give

management and investors additional insight into quarterly

performance, especially when compared to quarters in which such

items had a greater or lesser effect, or no effect. All non-GAAP

financial measures in this release relate to the Company’s

continuing operations.

The effect of changes in currency translation rates is

calculated by converting amounts reported in local currencies into

U.S. dollars at the exchange rate of a prior period. That amount is

then compared to the U.S. dollar amount reported in the current

period. The Company calculates Income tax adjustments by adding

discrete tax items to the effect of a change in tax rate for the

reporting period. The Company calculates its income tax rate,

exclusive of income tax adjustments, by removing income tax

adjustments from total Income tax expense, then dividing that

result by Income before income taxes. The Company calculates EBITDA

by removing the following from Net income: Interest expense net,

Income tax expense, Depreciation and amortization, and Income or

loss from Discontinued Operations. Adjusted EBITDA is calculated

by: adding to EBITDA costs associated with restructuring and

pension settlement charges; adding (or subtracting) revaluation

losses (or gains); subtracting (or adding) gains (or losses) from

the sale of buildings or investments; subtracting insurance

recovery gains; and subtracting Income attributable to the

noncontrolling interest in Albany Safran Composites (ASC). The

Company believes that EBITDA and Adjusted EBITDA provide useful

information to investors because they provide an indication of the

strength and performance of the Company's ongoing business

operations, including its ability to fund discretionary spending

such as capital expenditures and strategic investments, as well as

its ability to incur and service debt. While depreciation and

amortization are operating costs under GAAP, they are noncash

expenses equal to current period allocation of costs associated

with capital and other long-lived investments made in prior

periods.

While restructuring expenses, foreign currency revaluation

losses or gains, pension settlement charges, insurance-recovery

gains, and gains or losses from sales of buildings or investments

have an impact on the Company's net income, removing them from

EBITDA can provide, in the opinion of the Company, a better measure

of operating performance. EBITDA is also a calculation commonly

used by investors and analysts to evaluate and compare the periodic

and future operating performance and value of companies. EBITDA, as

defined by the Company, may not be similar to EBITDA measures of

other companies. Such EBITDA measures may not be considered

measurements under GAAP, and should be considered in addition to,

but not as substitutes for, the information contained in the

Company’s statements of income.

The Company discloses certain income and expense items on a

per-share basis. The Company believes that such disclosures provide

important insight into underlying quarterly earnings and are

financial performance metrics commonly used by investors. The

Company calculates the quarterly per-share amount for items

included in continuing operations by using the estimated effective

annual tax rate and the weighted average number of shares

outstanding for each period. Year-to-date earnings per-share

effects are determined by adding the amounts calculated at each

reporting period.

Table 8

Impact of

Percent

Net Sales

Changes

Change

Nine Months ended

Percent

in Currency

excluding

September,

Change

Translation

Currency

(in thousands)

2015

2014

Rates

Rate Effect

Machine Clothing (MC) $463,577

$494,788 -6.3 %

($30,651 ) -0.1 % Albany Engineered Composites

(AEC) 68,825 58,898

16.9 % (906 )

18.4 % Total $532,402

$553,686 -3.8 %

($31,557 ) 1.9 %

Table 9

Nine Months

ended September 30, 2015

(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Net income $110,969

($26,635

)*

($64,535 ) $19,799

Interest expense, net -

- 8,049

8,049 Income tax expense -

- 20,398

20,398 Depreciation and

amortization 30,077

8,845 6,359

45,281

EBITDA

141,046 (17,790 )

(29,729 )

93,527 Restructuring expenses, net

13,929 -

- 13,929 Foreign currency

revaluation losses/(gains) (4,534 )

(17 ) 406

(4,145 ) Gain on sale of investment -

- (872 )

(872 ) Pre-tax income attributable to

noncontrolling interest in ASC -

(115 ) -

(115 )

Adjusted EBITDA

$150,441 ($17,922

) ($30,195 )

$102,324

*includes $14 million BR725 charge

Table 10

Nine Months ended September 30,

2014

(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Net income $103,329

($9,785 ) ($59,900 )

$33,644 Interest expense, net -

- 8,121

8,121 Income tax expense

- -

21,435 21,435

Depreciation and amortization 34,069

7,382 6,290

47,741

EBITDA

137,398 (2,403

) (24,054 )

110,941 Restructuring and other, net

3,127 931

- 4,058 Foreign

currency revaluation (gains)/losses (1,806 )

234 (3,815 )

(5,387 ) Gain on insurance recovery

- -

(1,126 ) (1,126 ) Pretax loss

attributable to noncontrolling interest in ASC

- 63 -

63

Adjusted EBITDA

$138,719

($1,175 ) ($28,995

) $108,549

Table 11

Three Months

ended September 30, 2015

(in thousands, except per share

amounts)

Pre-taxamounts

TaxEffect

After-taxEffect

Per ShareEffect

Restructuring and other, net $3,717

$1,412 $2,305

$0 .07 Foreign currency revaluation gains

1,048 398 650

0 .02 Net discrete income tax charge

- 4,914

4,914 0 .15 Favorable effect of change in

income tax rate - 1,002

1,002 0 .03

Table 12

Three Months

ended September 30, 2014

(in thousands, except per share

amounts)

Pre-taxamounts

TaxEffect

After-taxEffect

Per ShareEffect

Restructuring and other, net $919

$321 $598

$0 .02 Foreign currency revaluation gains

4,088 1,427 2,661

0 .08 Gain on insurance recovery

165 - 165

0 .01 Net discrete income tax charge -

536 536

0 .02 Favorable effect of change in income tax rate

- 243 243

0 .01

Table 13

Nine Months

ended September 30, 2015

(in thousands, except per share

amounts)

Pre-taxamounts

TaxEffect

After-taxEffect

Per ShareEffect

Restructuring and other, net $13,929

$5,280 $8,649

$0 .27 Foreign currency revaluation gains

4,145 1,597 2,548

0 .08 Gain on sale of investment

872 331 541

0 .02 Net discrete income tax charge

- 5,113 5,113

0 .16 Charge for revision in estimated

contract profitability 14,000

5,180 8,820 0 .28

Table 14

Nine Months

ended September 30, 2014

(in thousands, except per share

amounts)

Pre-taxamounts

TaxEffect

After-taxEffect

Per ShareEffect

Restructuring and other, net $4,058

$1,449 $2,609

$0 .08 Foreign currency revaluation gains

5,387 1,896 3,491

0 .11 Gain on insurance recovery

1,126 - 1,126

0 .04 Net discrete income tax charge

- 2,209

2,209 0 .07

The following table contains the calculation of net income per

share attributable to the Company, excluding adjustments:

Table 15

Three Months ended

Nine Months ended

September 30,

September 30,

Per share amounts (Basic)

2015

2014

2015

2014

Net income/(loss) attributable to the Company, reported

$0.30 $0.37

$0.62

*

$1.06 Adjustments:

Restructuring charges

0.07 0.02

0.27 0.08 Discrete

tax charges and effect of change in income tax rate

0.12 0.01

0.16 0.07 Foreign

currency revaluation (gains)/ losses (0.02 )

(0.08 ) (0.08 )

(0.11 ) Gain on insurance recovery

- (0.01 ) -

(0.04 ) Gain on the sale of investment

- -

(0.02 ) - Net income

attributable to the Company, excluding adjustments

$0.47 $0.31

$0.95 $1.06

*includes $0.28 per share for BR725

charge

The following table contains the calculation of net debt:

Table 16

(in thousands)

September 30,2015

June 30,2015

March 31,2015

December 31,2014

September 30,2014

June 30,2014

Notes and loans payable $390

$543 $496 $661

$551 $692 Current

maturities of long-term debt 50,016

50,015 50,015

50,015 15 1,265

Long-term debt 220,084

252,088 232,092 222,096

283,100 283,104

Total

debt 270,490

302,646 282,603

272,772 283,666

285,061 Cash and cash equivalents

171,780 182,474

170,838 179,802

195,461 206,836

Net debt

$98,710 $120,172

$111,765 $92,970

$88,205

$78,225

This press release may contain statements, estimates, or

projections that constitute “forward-looking statements” as defined

under U.S. federal securities laws. Generally, the words “believe,”

“expect,” “intend,” “estimate,” “anticipate,” “project,” “will,”

“should,” “look for,” and similar expressions identify

forward-looking statements, which generally are not historical in

nature. Forward-looking statements are subject to certain risks and

uncertainties (including, without limitation, those set forth in

the Company’s most recent Annual Report on Form 10-K or Quarterly

Report on Form 10-Q) that could cause actual results to differ

materially from the Company’s historical experience and our present

expectations or projections.

Forward-looking statements in this release or in the webcast

include, without limitation, statements about macroeconomic and

paper industry trends and conditions during 2015 and in future

years; expectations in 2015 and in future periods of sales, EBITDA,

Adjusted EBITDA, income, gross profit, gross margin and other

financial items in each of the Company’s businesses and for the

Company as a whole; the timing and impact of production and

development programs in the Company’s AEC business segment and AEC

sales growth potential; the amount and timing of capital

expenditures, future tax rates and cash paid for taxes,

depreciation and amortization; future debt and net debt levels and

debt covenant ratios; the timeline for ASC’s planned facility in

Mexico; and changes in currency rates and their impact on future

revaluation gains and losses. Furthermore, a change in any one or

more of the foregoing factors could have a material effect on the

Company’s financial results in any period. Such statements are

based on current expectations, and the Company undertakes no

obligation to publicly update or revise any forward-looking

statements.

Statements expressing management’s assessments of the growth

potential of its businesses, or referring to earlier assessments of

such potential, are not intended as forecasts of actual future

growth, and should not be relied on as such. While management

believes such assessments to have a reasonable basis, such

assessments are, by their nature, inherently uncertain. This

release and earlier releases set forth a number of assumptions

regarding these assessments, including historical results,

independent forecasts regarding the markets in which these

businesses operate, and the timing and magnitude of orders for our

customers’ products. Historical growth rates are no guarantee of

future growth, and such independent forecasts and assumptions could

prove materially incorrect, in some cases.

ALBANY INTERNATIONAL CORP. CONSOLIDATED

STATEMENTS OF INCOME (in thousands, except per share data)

(unaudited) Three Months Ended Nine Months Ended September

30, September 30, 2015 2014 2015 2014 $178,789 $179,861 Net

sales $532,402 $553,686 103,045 111,242 Cost of goods sold

325,382 334,915 75,744 68,619 Gross profit 207,020

218,771 35,509 33,618 Selling, general, and administrative expenses

110,674 112,787 10,675 14,924 Technical, product engineering, and

research expenses 33,387 43,190 3,717 919 Restructuring

expenses, net 13,929 4,058 25,843 19,158 Operating

income 49,030 58,736 2,671 2,486 Interest expense, net 8,049 8,121

1,249 (1,864 ) Other expense/(income), net 784 (4,464 )

21,923 18,536 Income before income taxes 40,197 55,079 12,243 6,762

Income tax expense 20,398 21,435 9,680 11,774

Net income 19,799 33,644 22 (38 ) Net income/(loss) attributable to

the noncontrolling interest 100 (8 ) $9,658 $11,812 Net

income attributable to the Company $19,699 $33,652

$0.30 $0.37 Earnings per share attributable to Company shareholders

- Basic $0.62 $1.06 $0.30 $0.37 Earnings per share

attributable to Company shareholders - Diluted $0.62 $1.05

Shares of the Company used in computing earnings per share: 32,012

31,848 Basic 31,965 31,822 32,055 31,946 Diluted 32,028

31,924 $0.17 $0.16 Dividends per share $0.50 $0.47

ALBANY INTERNATIONAL

CORP. CONSOLIDATED BALANCE SHEETS (in thousands, except share data)

(unaudited)

September 30,

December 31,

2015 2014 ASSETS Cash and cash equivalents $171,780 $179,802

Accounts receivable, net 151,908 158,237 Inventories 110,265

107,274 Deferred income taxes 6,979 6,743 Asset held for sale 5,112

9,102 Prepaid expenses and other current assets 8,410 8,074

Total current assets 454,454 469,232 Property, plant

and equipment, net 365,742 386,011 Intangibles 212 385 Goodwill

67,590 71,680 Income taxes receivable and deferred 61,732 69,540

Other assets 25,704 32,456 Total assets $975,434

$1,029,304 LIABILITIES AND SHAREHOLDERS'

EQUITY Notes and loans payable $390 $661 Accounts payable 28,668

34,787 Accrued liabilities 91,026 95,149 Current maturities of

long-term debt 50,016 50,015 Income taxes payable and deferred

4,099 2,786 Total current liabilities 174,199 183,398

Long-term debt 220,084 222,096 Other noncurrent liabilities

99,845 103,079 Deferred taxes and other credits 3,546 7,163

Total liabilities 497,674 515,736

SHAREHOLDERS' EQUITY Preferred stock, par value $5.00 per share;

authorized 2,000,000 shares; none issued - - Class A Common Stock,

par value $.001 per share; authorized 100,000,000 shares; issued

37,234,213 in 2015 and 37,085,489 in 2014 37 37 Class B Common

Stock, par value $.001 per share; authorized 25,000,000 shares;

issued and outstanding 3,235,048 in 2015 and 2014 3 3 Additional

paid in capital 422,567 418,972 Retained earnings 459,813 456,105

Accumulated items of other comprehensive income: Translation

adjustments (99,556 ) (55,240 ) Pension and postretirement

liability adjustments (49,217 ) (51,666 ) Derivative valuation

adjustment (2,296 ) (861 ) Treasury stock (Class A), at cost

8,455,293 shares in 2015 and 8,459,498 in 2014 (257,391 ) (257,481

) Total Company shareholders' equity 473,960 509,869 Noncontrolling

interest 3,800 3,699 Total equity 477,760

513,568 Total liabilities and shareholders' equity $975,434

$1,029,304

ALBANY

INTERNATIONAL CORP. CONSOLIDATED STATEMENTS OF CASH FLOW (in

thousands) (unaudited) Three Months Ended Nine Months

Ended September 30, September 30, 2015 2014 2015 2014

OPERATING ACTIVITIES

$9,680 $11,774

Net income

$19,799 $33,644

Adjustments to reconcile net income to net

cash provided by operating activities:

12,953 13,737 Depreciation 39,850 42,120 1,790 1,999 Amortization

5,431 5,621 7,134 (2,637 ) Change in long-term liabilities,

deferred taxes and other credits 937 95 (156 ) 557 Provision for

write-off of property, plant and equipment 259 1,286 3,225 - Fair

value adjustment on available-for-sale assets 3,225 - - - Gain on

disposition or involuntary conversion of assets (1,056 ) (961 ) -

(16 ) Excess tax benefit of options exercised (603 ) (161 ) 290 213

Compensation and benefits paid or payable in Class A Common Stock

1,285 1,160

Changes in operating assets and

liabilities that provide/(use) cash:

5,100 (4,368 ) Accounts receivable (4,387 ) 9,929 (3,626 ) (1,279 )

Inventories (10,757 ) (12,238 ) 133 661 Prepaid expenses and other

current assets (857 ) 275 (518 ) 100 Income taxes prepaid and

receivable (592 ) 114 (3,126 ) (2,128 ) Accounts payable (4,467 )

(2,867 ) 3,381 4,414 Accrued liabilities 861 (8,265 ) 3,910 1,819

Income taxes payable 3,987 760 1,723 (2,383 ) Other, net

6,330 (6,512 ) 41,893 22,463 Net cash provided

by operating activities 59,245 64,000

INVESTING ACTIVITIES

(9,023 ) (18,704 ) Purchases of property, plant and equipment

(39,689 ) (46,106 ) (252 ) (189 ) Purchased software (589 ) (504 )

- - Proceeds from sale or involuntary conversion of

assets 2,797 961 (9,275 ) (18,893 ) Net cash used in

investing activities (37,481 ) (45,649 )

FINANCING ACTIVITIES

5,198 5,420 Proceeds from borrowings 44,818 10,090 (37,354 ) (6,815

) Principal payments on debt (47,100 ) (30,924 ) (41 ) - Debt

acquisition costs (1,671 ) - 75 223 Proceeds from options exercised

1,799 610 - 16 Excess tax benefit of options exercised 603 161

(5,441 ) (5,094 ) Dividends paid (15,646 ) (14,633 ) (37,563 )

(6,250 ) Net cash used in financing activities (17,197 ) (34,696 )

(5,749 ) (8,695 )

Effect of exchange rate changes on cash

and cash equivalents

(12,589 ) (10,860 ) (10,694 ) (11,375 )

Decrease in cash and cash equivalents

(8,022 ) (27,205 ) 182,474 206,836

Cash and cash equivalents at beginning of

period

179,802 222,666 $171,780 $195,461

Cash and cash equivalents at end of

period

$171,780 $195,461

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151027006736/en/

Albany International Corp.InvestorsJohn Cozzolino,

518-445-2281john.cozzolino@albint.comorMediaSusan Siegel,

603-330-5866susan.siegel@albint.com

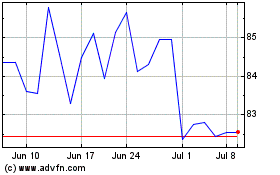

Albany (NYSE:AIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albany (NYSE:AIN)

Historical Stock Chart

From Apr 2023 to Apr 2024