UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): May 4, 2015

|

ALBANY

INTERNATIONAL CORP.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

1-10026

|

14-0462060

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S Employer

Identification No.)

|

|

216 Airport Drive, Rochester, New Hampshire

|

03867

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code (518) 445-2200

|

None

|

|

(Former name or former address, if changed since last report.)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On May 4, 2015, Albany International issued a news release reporting

first-quarter 2015 financial results. The Company will host a webcast

to discuss earnings at 9:00 a.m. Eastern Time on Tuesday, May 5. Copies

of the news release and management’s related earnings call slide

presentation are furnished as Exhibits 99.1 and 99.2, respectively, to

this report.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

(d)

|

Exhibits. The following exhibit is being furnished herewith:

|

|

|

|

|

99.1 News release dated May 4, 2015 reporting first-quarter 2015

financial results.

|

|

|

99.2 Albany International Corp. first-quarter 2015 Earnings Call

Slide Presentation.

|

Signature

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

ALBANY INTERNATIONAL CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John B. Cozzolino

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: John B. Cozzolino

|

|

|

|

|

|

Title: Chief Financial Officer and Treasurer

|

|

|

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

May 4, 2015

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

News release dated May 4, 2015 reporting first-quarter 2015

financial results.

|

|

99.2

|

|

Albany International Corp. first-quarter 2015 Earnings Call Slide

Presentation.

|

Exhibit 99.1

Albany

International Reports First-Quarter Results

First-Quarter

Financial Highlights

-

Net

sales were $181.3 million, an increase of 0.6 percent compared to Q1

2014. Excluding currency effects, net sales increased 7.0 percent (see

Table 1).

-

Adjusted

EBITDA for Q1 2015 was $41.5 million, compared to $37.8 million in Q1

2014 (see Tables 6 and 7).

-

Q1 2015

income attributable to the Company was $0.38 per share. Earnings were

reduced by restructuring charges of $0.18 and income tax adjustments

of $0.01, and were increased by foreign currency revaluation gains of

$0.10 and a gain on the sale of an investment of $0.02 (see Table 10).

-

Q1 2014

income attributable to the Company was $0.33 per share. Earnings were

reduced by restructuring charges of $0.02 and income tax adjustments

of $0.03, and were increased by foreign currency revaluation gains of

$0.01 (see Table 10).

ROCHESTER, N.H.--(BUSINESS WIRE)--May 4, 2015--Albany International

Corp. (NYSE:AIN) reported Q1 2015 income attributable to the Company of

$12.2 million, including charges of $0.2 million for income tax

adjustments. Income attributable to the Company in Q1 2014 was $10.6

million, including unfavorable income tax adjustments of $1.1 million.

Income before taxes in Q1 2015 was $20.8 million, including

restructuring charges of $9.0 million, gains of $5.4 million from

foreign currency revaluation, and a gain of $0.9 million related to the

sale of an investment that had been written off in a prior year. Income

before taxes in Q1 2014 was $18.2 million, including restructuring

charges of $1.2 million and foreign currency revaluation gains of $0.3

million.

Table 1 summarizes net sales and the effect of changes in currency

translation rates:

|

|

|

Table 1

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of

|

|

|

Percent

|

|

|

|

|

|

|

Net Sales

|

|

|

|

|

|

Changes

|

|

|

Change

|

|

|

|

|

|

|

Three Months ended

|

|

|

|

|

|

in Currency

|

|

|

excluding

|

|

|

|

|

|

|

March 31,

|

|

|

Percent

|

|

|

Translation

|

|

|

Currency

|

|

(in thousands)

|

|

|

|

|

2015

|

|

|

|

2014

|

|

|

Change

|

|

|

Rates

|

|

|

Rate Effect

|

|

Machine Clothing (MC)

|

|

|

|

|

$

|

158,494

|

|

|

$

|

164,088

|

|

|

-3.4

|

%

|

|

|

($11,317

|

)

|

|

|

3.5

|

%

|

|

Albany Engineered Composites (AEC)

|

|

|

|

|

|

22,830

|

|

|

|

16,219

|

|

|

40.8

|

%

|

|

|

(337

|

)

|

|

|

42.8

|

%

|

|

Total

|

|

|

|

|

$

|

181,324

|

|

|

$

|

180,307

|

|

|

0.6

|

%

|

|

|

($11,654

|

)

|

|

|

7.0

|

%

|

|

|

Changes in currency translation rates, driven mainly by the

strengthening U.S. dollar, resulted in an $11.7 million decline in sales

for the first quarter of 2015. Excluding that effect, MC sales were up

3.5 percent compared to Q1 2014, reflecting strength in every major

region. AEC sales in Q1 2015 increased $6.6 million compared to Q1 2014.

About half of AEC sales were related to LEAP production activities,

which were $4.6 million ahead of a weak Q1 2014, when sales were

affected by a temporary lag due to start-up and inventory effects.

Q1 2015 gross profit was $76.7 million, or 42.3 percent of net sales,

compared to $74.8 million, or 41.5 percent of net sales, in the same

period of 2014. MC gross profit increased from $73.9 million, or 45.0

percent of net sales, in Q1 2014 to $75.3 million, or 47.5 percent of

net sales, in Q1 2015. Changes in currency rates had a negative effect

on Q1 2015 MC gross profit which was more than offset by higher sales

volume, a favorable product mix, and the impact of cost-reduction

activities. AEC gross profit increased from $1.3 million in Q1 2014 to

$1.8 million in Q1 2015 due to higher sales.

Selling, technical, general, and research (STG&R) expenses were $47.5

million, or 26.2 percent of net sales, in the first quarter of 2015,

including income of $2.9 million related to the revaluation of

nonfunctional-currency assets and liabilities. Excluding the impact of

revaluation, STG&R was 27.8 percent of sales in the first quarter of

2015. In Q1 2014, STG&R expenses were $53.0 million, or 29.4 percent of

net sales, including losses of $0.2 million related to the revaluation

of nonfunctional-currency assets and liabilities.

The following table presents expenses associated with internally funded

research and development by segment:

|

|

|

Table 2

|

|

|

|

|

|

|

Research and development

|

|

|

|

|

|

|

expenses by segment

|

|

|

|

|

|

|

Three Months ended

|

|

|

|

|

|

|

March 31,

|

|

(in thousands)

|

|

|

|

|

2015

|

|

|

2014

|

|

Machine Clothing

|

|

|

|

|

$

|

4,796

|

|

|

$

|

4,838

|

|

Albany Engineered Composites

|

|

|

|

|

|

2,873

|

|

|

|

2,318

|

|

Corporate expenses

|

|

|

|

|

|

294

|

|

|

|

192

|

|

Total

|

|

|

|

|

$

|

7,963

|

|

|

$

|

7,348

|

|

|

The following table summarizes first-quarter operating income by segment:

|

|

|

Table 3

|

|

|

|

|

|

|

Operating Income/(loss)

|

|

|

|

|

|

|

Three Months ended

|

|

|

|

|

|

|

March 31,

|

|

(in thousands)

|

|

|

|

|

2015

|

|

|

2014

|

|

Machine Clothing

|

|

|

|

|

$

|

35,689

|

|

|

|

$

|

36,142

|

|

|

Albany Engineered Composites

|

|

|

|

|

|

(3,811

|

)

|

|

|

|

(3,475

|

)

|

|

Corporate expenses

|

|

|

|

|

|

(11,729

|

)

|

|

|

|

(12,066

|

)

|

|

Total

|

|

|

|

|

$

|

20,149

|

|

|

|

$

|

20,601

|

|

|

|

Segment operating income was affected by restructuring and currency

revaluation as shown in Table 4 below. Restructuring expense in Q1 2015

was principally related to the Company’s plan to discontinue

manufacturing operations at its press fabric manufacturing facility in

Göppingen, Germany, which was announced in February 2015. The charge

recorded in Q1 2015 represents an estimate of severance costs related to

this announcement. Annual savings from this restructuring, likely to be

fully realized by Q1 2016, are estimated to be $4-$5 million.

|

|

|

Table 4

|

|

|

|

|

|

|

Expenses/(gain) in Q1 2015

|

|

|

Expenses/(gain) in Q1 2014

|

|

|

|

|

|

|

resulting from

|

|

|

resulting from

|

|

(in thousands)

|

|

|

|

|

Restructuring

|

|

|

Revaluation

|

|

|

Restructuring

|

|

|

Revaluation

|

|

Machine Clothing

|

|

|

|

|

$

|

9,001

|

|

|

($2,923

|

)

|

|

|

$

|

862

|

|

|

$

|

152

|

|

Albany Engineered Composites

|

|

|

|

|

|

-

|

|

|

(17

|

)

|

|

|

|

320

|

|

|

|

38

|

|

Corporate expenses

|

|

|

|

|

|

-

|

|

|

(4

|

)

|

|

|

|

-

|

|

|

|

-

|

|

Total

|

|

|

|

|

$

|

9,001

|

|

|

($2,944

|

)

|

|

|

$

|

1,182

|

|

|

$

|

190

|

|

|

Q1 2015 Other income/expense, net, was income of $3.3 million, including

gains related to the revaluation of nonfunctional-currency balances of

$2.4 million, and a gain of $0.9 million related to the sale of the

Company’s total equity investment in an unaffiliated company. The value

of this investment was written off in 2004. Q1 2014 Other

income/expense, net, was income of $0.5 million, including gains related

to the revaluation of nonfunctional-currency balances of $0.5 million.

The following table summarizes currency revaluation effects on certain

financial metrics:

|

|

|

Table 5

|

|

|

|

|

|

|

Income/(loss) attributable

|

|

|

|

|

|

|

to currency revaluation

|

|

|

|

|

|

|

Three Months ended

|

|

|

|

|

|

|

March 31,

|

|

(in thousands)

|

|

|

|

|

2015

|

|

|

2014

|

|

Operating income

|

|

|

|

|

$

|

2,944

|

|

|

|

($190

|

)

|

|

Other income/(expense), net

|

|

|

|

|

|

2,427

|

|

|

|

505

|

|

|

Total

|

|

|

|

|

$

|

5,371

|

|

|

$

|

315

|

|

|

|

The Company ’s income tax rate, excluding tax adjustments, was 40.0

percent for Q1 2015, compared to 35.0 percent for the same period of

2014. The increase in the tax rate for Q1 2015 was due primarily to the

impact of restructuring charges in Germany, where the Company is unable

to record a tax benefit related to the expense. Discrete tax charges

increased income tax expense by $0.2 million in 2015, and $1.1 million

in 2014.

The following tables summarize Adjusted EBITDA:

|

|

|

Table 6

|

|

Three Months ended March 31, 2015

|

|

|

|

|

|

|

|

Albany

|

|

|

Corporate

|

|

|

|

|

|

|

|

|

|

Machine

|

|

|

Engineered

|

|

|

expenses

|

|

|

Total

|

|

(in thousands)

|

|

|

|

|

Clothing

|

|

|

Composites

|

|

|

and other

|

|

|

Company

|

|

Net income

|

|

|

|

|

$

|

35,689

|

|

|

|

($3,811

|

)

|

|

|

($19,639

|

)

|

|

|

$

|

12,239

|

|

|

Interest expense, net

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,676

|

|

|

|

|

2,676

|

|

|

Income tax expense

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

8,519

|

|

|

|

|

8,519

|

|

|

Depreciation and amortization

|

|

|

|

|

|

10,205

|

|

|

|

2,995

|

|

|

|

2,154

|

|

|

|

|

15,354

|

|

|

EBITDA

|

|

|

|

|

|

45,894

|

|

|

|

(816

|

)

|

|

|

(6,290

|

)

|

|

|

|

38,788

|

|

|

Restructuring and other, net

|

|

|

|

|

|

9,001

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

9,001

|

|

|

Foreign currency revaluation (gains)/losses

|

|

|

|

|

|

(2,923

|

)

|

|

|

(17

|

)

|

|

|

(2,431

|

)

|

|

|

|

(5,371

|

)

|

|

Gain on sale of investment

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(872

|

)

|

|

|

|

(872

|

)

|

|

Pretax income attributable to noncontrolling interest in ASC

|

|

|

|

|

|

-

|

|

|

|

(26

|

)

|

|

|

-

|

|

|

|

|

(26

|

)

|

|

Adjusted EBITDA

|

|

|

|

|

$

|

51,972

|

|

|

|

($859

|

)

|

|

|

($9,593

|

)

|

|

|

$

|

41,520

|

|

|

|

|

|

|

Table 7

|

|

Three Months ended March 31, 2014

|

|

|

|

|

|

|

|

Albany

|

|

|

Corporate

|

|

|

|

|

|

|

|

|

|

Machine

|

|

|

Engineered

|

|

|

expenses

|

|

|

Total

|

|

(in thousands)

|

|

|

|

|

Clothing

|

|

|

Composites

|

|

|

and other

|

|

|

Company

|

|

Net income

|

|

|

|

|

$

|

36,142

|

|

|

($3,475

|

)

|

|

|

($21,974

|

)

|

|

|

$

|

10,693

|

|

|

Interest expense, net

|

|

|

|

|

|

-

|

|

|

-

|

|

|

|

2,918

|

|

|

|

|

2,918

|

|

|

Income tax expense

|

|

|

|

|

|

-

|

|

|

-

|

|

|

|

7,457

|

|

|

|

|

7,457

|

|

|

Depreciation and amortization

|

|

|

|

|

|

11,455

|

|

|

2,322

|

|

|

|

2,131

|

|

|

|

|

15,908

|

|

|

EBITDA

|

|

|

|

|

|

47,597

|

|

|

(1,153

|

)

|

|

|

(9,468

|

)

|

|

|

|

36,976

|

|

|

Restructuring and other, net

|

|

|

|

|

|

862

|

|

|

320

|

|

|

|

-

|

|

|

|

|

1,182

|

|

|

Foreign currency revaluation (gains)/losses

|

|

|

|

|

|

152

|

|

|

38

|

|

|

|

(505

|

)

|

|

|

|

(315

|

)

|

|

Pretax income attributable to noncontrolling interest in ASC

|

|

|

|

|

|

-

|

|

|

(59

|

)

|

|

|

-

|

|

|

|

|

(59

|

)

|

|

Adjusted EBITDA

|

|

|

|

|

$

|

48,611

|

|

|

($854

|

)

|

|

|

($9,973

|

)

|

|

|

$

|

37,784

|

|

|

|

Capital spending for equipment and software was $12.2 million for Q1

2015, including $6.2 million for Engineered Composites. Depreciation and

amortization was $15.4 million for Q1 2015 compared to $15.9 million for

Q1 2014.

CFO Comments

CFO and Treasurer John Cozzolino commented, “Net debt (total debt less

cash) increased $19 million to $112 million (see Table 11), with total

cash of $171 million negatively affected by about $9 million due to

unfavorable changes in foreign currency rates as compared to the end of

Q4, incentive compensation payments which typically occur in the first

quarter of each year, and higher accounts receivable and inventory. The

Company’s leverage ratio, as defined in our primary debt agreements,

decreased from 1.30 at the end of 2014 to 1.28 at the end of Q1. Capital

expenditures in Q1 were $12 million, and we continue to estimate

full-year spending in 2015 to be $65 to $75 million. Cash paid for

income taxes was about $7 million in Q1, and we estimate cash taxes in

2015 to range from $20 million to $23 million.

“During Q1, the Company recorded about $5 million of foreign currency

revaluation gains. As discussed last quarter, the primary exposures are

in Europe and they relate to the monthly revaluation of cash and trade

and intercompany receivables and payables. Regarding the currency impact

of translating sales and expenses to U.S. dollars, net sales were

negatively impacted by the broadly stronger U.S. dollar. However, since

the Company also has foreign currency expense exposures which help to

offset the impact of a decline in sales, currency did not have a

significant impact on Q1 Adjusted EBITDA.”

CEO Comments

President and CEO Joe Morone said, “Q1 2015 was an outstanding quarter

for Albany International. In comparison to a strong Q1 2014, sales

excluding currency effects improved by 7 percent; Adjusted EBITDA

improved by 10 percent. MC had an exceptional quarter across the board,

and AEC continued to make good progress toward the LEAP ramp and

development of the next generation of new products.

“As we have mentioned many times, because of seasonal factors, the first

half of the year for MC is generally stronger than the second half. In a

normal business cycle, sales tend to be strong in Q1, peak in Q2, and

then weaken in the second half of the year. Gross margin typically peaks

in the first quarter, and then for a variety of reasons – for example,

annual salary increases in North America go into effect in April –

declines as the year progresses. So we ordinarily expect relatively good

sales and gross margin in Q1, but even with this expectation, this was a

very good start to the year. Sales were strong in every region,

particularly in Europe and Asia. A number of factors contributed, most

notably the relatively healthy U.S. economy, improvement in the European

economy, and strong new product performance in just about every major

product line. We were also encouraged in Q1 by progress in the

development of our new technology platform both in pre-commercial trials

and actual performance in early commercial applications.

“Q1 was also a strong quarter for AEC. Sales were in line with our

expectations, and much stronger than a year ago, when LEAP revenue was

held back by inventory and plant start-up effects. We made important

strides in Q1 toward LEAP production readiness, even as orders for LEAP

continue to grow. On the R&D front, we continue to be encouraged by

progress in each of our two major application areas – aircraft engine

and airframe components – as well as in our probe into the automotive

market.

“As for our operations in Boerne, Texas, two important programs for

Rolls-Royce, long in development, are now entering into production:

composite components for the LiftFan® on the Joint

Strike Fighter and for the BR725, the engine that powers the Gulfstream

650. Together these two account for over half of Boerne’s roughly $25

million of annualized sales. We are meeting critical delivery and yield

targets for both these programs. The contract for the BR725 program,

which was signed in 2007, sets very aggressive pricing levels. We will

have to pay careful attention in the coming quarters to the projected

life-of-program profitability as we gain more production experience.

“Turning to our outlook, in MC the same factors that contributed to the

good Q1 sales should hold in Q2. The one exception is China, where the

paper industry is still suffering from the combination of a slowing

economy, weak exports, and overcapacity. Even though our sales there

were strong in Q1, our customers in the packaging market took prolonged

downtimes, which hurt our Q1 orders and will thus hold back Q2 sales.

“Apart from this softness in China, we expect Q2 to conform to the

normal seasonal pattern: sales should be strong and, excluding currency

effects, roughly comparable to the strong sales in Q2 2014; gross

margins should seasonally weaken; and Adjusted EBITDA should be roughly

comparable to Q2 2014.

“In AEC, our overall outlook, both short- and long-term, remains

unchanged. For 2015, we continue to expect revenue to be 5-10 percent

ahead of last year, with intense focus on preparing for the LEAP ramp.

As has been the case for the past five quarters, we expect choppiness in

revenue from quarter to quarter, as production levels in our LEAP plants

respond to short-term shifts in demand for parts for engine tests and

for periodic production runs to assess our readiness to ramp.

“In sum, Q1 2015 was a very strong quarter, marked by outstanding

across-the-board performance in MC, and continued progress in AEC toward

the LEAP ramp. Our outlook for Q2 is for comparable performance to a

strong Q2 2014. And, given the continued growth in LEAP orders, the

steady progress by AEC in new product development, and the promising

results from initial applications of our new technology platform in MC,

we continue to be optimistic about the long-term, technology-enabled

outlook for both businesses.”

The Company plans a webcast to discuss first-quarter 2015 financial

results on Tuesday, May 5, 2015, at 9:00 a.m. Eastern Time. For access,

go to www.albint.com.

About Albany International Corp.

Albany International is a global advanced textiles and materials

processing company, with two core businesses. Machine Clothing is the

world’s leading producer of custom-designed fabrics and belts essential

to production in the paper, nonwovens, and other process industries.

Albany Engineered Composites is a rapidly growing supplier of highly

engineered composite parts for the aerospace industry. Albany

International is headquartered in Rochester, New Hampshire, operates 19

plants in 10 countries, employs 4,000 people worldwide, and is listed on

the New York Stock Exchange (Symbol AIN). Additional information about

the Company and its products and services can be found at www.albint.com.

This release contains certain items, such as earnings before

interest, taxes, depreciation and amortization (EBITDA), Adjusted

EBITDA, sales excluding currency effects, income tax rate excluding

adjustments, net debt, net income attributable to the Company, excluding

adjustments (on an absolute and per-share basis), and certain income and

expense items on a per-share basis that could be considered non-GAAP

financial measures. Such items are provided because management believes

that, when presented together with the GAAP items to which they relate,

they provide additional useful information to investors regarding the

Company’s operational performance. Presenting increases or decreases in

sales, after currency effects are excluded, can give management and

investors insight into underlying sales trends. An understanding of the

impact in a particular quarter of specific restructuring costs, or other

gains and losses, on operating income or EBITDA can give management and

investors additional insight into quarterly performance, especially when

compared to quarters in which such items had a greater or lesser effect,

or no effect. All non-GAAP financial measures in this release relate to

the Company’s continuing operations.

The effect of changes in currency translation rates is calculated by

converting amounts reported in local currencies into U.S. dollars at the

exchange rate of a prior period. That amount is then compared to the

U.S. dollar amount reported in the current period. The Company

calculates Income tax adjustments by adding discrete tax items to the

effect of a change in tax rate for the reporting period. The Company

calculates its income tax rate, exclusive of income tax adjustments, by

removing income tax adjustments from total Income tax expense, then

dividing that result by Income before income taxes. The Company

calculates EBITDA by removing the following from Net income: Interest

expense net, Income tax expense, Depreciation and amortization, and

Income or loss from Discontinued Operations. Adjusted EBITDA is

calculated by: adding to EBITDA costs associated with restructuring and

pension settlement charges; adding (or subtracting) revaluation losses

(or gains); subtracting (or adding) gains (or losses) from the sale of

buildings or investments; subtracting insurance recovery gains; and

subtracting Income attributable to the noncontrolling interest in Albany

Safran Composites (ASC). The Company believes that EBITDA and Adjusted

EBITDA provide useful information to investors because they provide an

indication of the strength and performance of the Company's ongoing

business operations, including its ability to fund discretionary

spending such as capital expenditures and strategic investments, as well

as its ability to incur and service debt. While depreciation and

amortization are operating costs under GAAP, they are non-cash expenses

equal to current period allocation of costs associated with capital and

other long-lived investments made in prior periods.

While restructuring expenses, foreign currency revaluation losses or

gains, pension settlement charges, insurance-recovery gains, and gains

or losses from sales of buildings or investments have an impact on the

Company's net income, removing them from EBITDA can provide, in the

opinion of the Company, a better measure of operating performance.

EBITDA is also a calculation commonly used by investors and analysts to

evaluate and compare the periodic and future operating performance and

value of companies. EBITDA, as defined by the Company, may not be

similar to EBITDA measures of other companies. Such EBITDA measures may

not be considered measurements under GAAP, and should be considered in

addition to, but not as substitutes for, the information contained in

the Company’s statements of income.

The Company discloses certain income and expense items on a per-share

basis. The Company believes that such disclosures provide important

insight into underlying quarterly earnings and are financial performance

metrics commonly used by investors. The Company calculates the quarterly

per-share amount for items included in continuing operations by using

the estimated effective annual tax rate and the weighted average number

of shares outstanding for each period. Year-to-date earnings per-share

effects are determined by adding the amounts calculated at each

reporting period.

|

|

|

Table 8

|

|

Three Months ended March 31, 2015

|

|

|

|

|

|

|

Pre-tax

|

|

|

Tax

|

|

|

After-tax

|

|

|

Per Share

|

|

(in thousands, except per share amounts)

|

|

|

|

|

amounts

|

|

|

Effect

|

|

|

Effect

|

|

|

Effect

|

|

Restructuring and other, net

|

|

|

|

|

$

|

9,001

|

|

|

$

|

3,420

|

|

|

$

|

5,581

|

|

|

$

|

0.18

|

|

Foreign currency revaluation gains

|

|

|

|

|

|

5,371

|

|

|

|

2,041

|

|

|

|

3,330

|

|

|

|

0.10

|

|

Gain on sale of investment

|

|

|

|

|

|

872

|

|

|

|

331

|

|

|

|

541

|

|

|

|

0.02

|

|

Net discrete income tax charge

|

|

|

|

|

|

-

|

|

|

|

219

|

|

|

|

219

|

|

|

|

0.01

|

|

|

|

Table 9

|

|

Three Months ended March 31, 2014

|

|

|

|

|

|

|

Pre-tax

|

|

|

Tax

|

|

|

After-tax

|

|

|

Per Share

|

|

(in thousands, except per share amounts)

|

|

|

|

|

amounts

|

|

|

Effect

|

|

|

Effect

|

|

|

Effect

|

|

Restructuring and other, net credit

|

|

|

|

|

$

|

1,182

|

|

|

$

|

414

|

|

|

$

|

768

|

|

|

$

|

0.02

|

|

Foreign currency revaluation gains

|

|

|

|

|

|

315

|

|

|

|

110

|

|

|

|

205

|

|

|

|

0.01

|

|

Net discrete income tax charge

|

|

|

|

|

|

-

|

|

|

|

1,104

|

|

|

|

1,104

|

|

|

|

0.03

|

|

|

The following table contains the calculation of net income per share

attributable to the Company, excluding adjustments:

|

|

|

Table 10

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

|

|

March 31,

|

|

Per share amounts (Basic)

|

|

|

|

|

2015

|

|

|

2014

|

|

Net income attributable to the Company, as reported

|

|

|

|

|

$

|

0.38

|

|

|

|

$

|

0.33

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Restructuring charges, net

|

|

|

|

|

|

0.18

|

|

|

|

|

0.02

|

|

|

Discrete tax charge/(credit)

|

|

|

|

|

|

0.01

|

|

|

|

|

0.03

|

|

|

Foreign currency revaluation (gains)/ losses

|

|

|

|

|

|

(0.10

|

)

|

|

|

|

(0.01

|

)

|

|

Gain on the sale of investment

|

|

|

|

|

|

(0.02

|

)

|

|

|

|

-

|

|

|

Net income attributable to the Company, excluding adjustments

|

|

|

|

|

$

|

0.45

|

|

|

|

$

|

0.37

|

|

|

|

The following table contains the calculation of net debt:

|

|

|

Table 11

|

|

|

|

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

(in thousands)

|

|

|

|

|

2015

|

|

|

2014

|

|

|

30, 2014

|

|

|

2014

|

|

|

2014

|

|

|

2013

|

|

Notes and loans payable

|

|

|

|

|

$

|

496

|

|

|

$

|

661

|

|

|

$

|

551

|

|

|

$

|

692

|

|

|

$

|

797

|

|

|

$

|

625

|

|

Current maturities of long-term debt

|

|

|

|

|

|

50,015

|

|

|

|

50,015

|

|

|

|

15

|

|

|

|

1,265

|

|

|

|

2,514

|

|

|

|

3,764

|

|

Long-term debt

|

|

|

|

|

|

232,092

|

|

|

|

222,096

|

|

|

|

283,100

|

|

|

|

283,104

|

|

|

|

299,108

|

|

|

|

300,111

|

|

Total debt

|

|

|

|

|

|

282,603

|

|

|

|

272,772

|

|

|

|

283,666

|

|

|

|

285,061

|

|

|

|

302,419

|

|

|

|

304,500

|

|

Cash

|

|

|

|

|

|

170,838

|

|

|

|

179,802

|

|

|

|

195,461

|

|

|

|

206,836

|

|

|

|

208,379

|

|

|

|

222,666

|

|

Net debt

|

|

|

|

|

$

|

111,765

|

|

|

$

|

92,970

|

|

|

$

|

88,205

|

|

|

$

|

78,225

|

|

|

$

|

94,040

|

|

|

$

|

81,834

|

|

|

This press release may contain statements, estimates, or projections

that constitute “forward-looking statements” as defined under U.S.

federal securities laws. Generally, the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “will,” “should” and

similar expressions identify forward-looking statements, which generally

are not historical in nature. Forward-looking statements are subject to

certain risks and uncertainties (including, without limitation, those

set forth in the Company’s most recent Annual Report on Form 10-K or

Quarterly Report on Form 10-Q) that could cause actual results to differ

materially from the Company’s historical experience and our present

expectations or projections.

Forward-looking statements in this release or in the webcast include,

without limitation, statements about economic and paper industry trends

and conditions during 2015 and in future years; expectations in 2015 and

in future periods of sales, EBITDA, Adjusted EBITDA, income, gross

profit, gross margin and other financial items in each of the Company’s

businesses and for the Company as a whole; the timing and impact of

production and development programs in the Company’s AEC business

segment and AEC sales growth potential; the amount and timing of capital

expenditures, future tax rates and cash paid for taxes, depreciation and

amortization; future debt and net debt levels and debt covenant ratios;

and future revaluation gains and losses. Furthermore, a change in any

one or more of the foregoing factors could have a material effect on the

Company’s financial results in any period. Such statements are based on

current expectations, and the Company undertakes no obligation to

publicly update or revise any forward-looking statements.

Statements expressing management’s assessments of the growth

potential of its businesses, or referring to earlier assessments of such

potential, are not intended as forecasts of actual future growth, and

should not be relied on as such. While management believes such

assessments to have a reasonable basis, such assessments are, by their

nature, inherently uncertain. This release and earlier releases set

forth a number of assumptions regarding these assessments, including

historical results, independent forecasts regarding the markets in which

these businesses operate, and the timing and magnitude of orders for our

customers’ products. Historical growth rates are no guarantee of future

growth, and such independent forecasts and assumptions could prove

materially incorrect, in some cases.

|

|

|

ALBANY INTERNATIONAL CORP.

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

(in thousands, except per share data)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

|

|

|

$

|

181,324

|

|

|

|

|

$

|

180,307

|

|

|

Cost of goods sold

|

|

|

|

|

|

104,640

|

|

|

|

|

|

105,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

|

|

|

76,684

|

|

|

|

|

|

74,809

|

|

|

Selling, general, and administrative expenses

|

|

|

|

|

|

35,233

|

|

|

|

|

|

39,157

|

|

|

Technical, product engineering, and research expenses

|

|

|

|

|

|

12,301

|

|

|

|

|

|

13,869

|

|

|

Restructuring and other, net

|

|

|

|

|

|

9,001

|

|

|

|

|

|

1,182

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

|

|

20,149

|

|

|

|

|

|

20,601

|

|

|

Interest expense, net

|

|

|

|

|

|

2,676

|

|

|

|

|

|

2,918

|

|

|

Other (income)/expenses, net

|

|

|

|

|

|

(3,285

|

)

|

|

|

|

|

(467

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

|

20,758

|

|

|

|

|

|

18,150

|

|

|

Income tax expense

|

|

|

|

|

|

8,519

|

|

|

|

|

|

7,457

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

|

12,239

|

|

|

|

|

|

10,693

|

|

|

Net income attributable to the noncontrolling interest

|

|

|

|

|

|

26

|

|

|

|

|

|

72

|

|

|

Net income attributable to the Company

|

|

|

|

|

$

|

12,213

|

|

|

|

|

$

|

10,621

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Company shareholders - Basic

|

|

|

|

|

$

|

0.38

|

|

|

|

|

$

|

0.33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Company shareholders - Diluted

|

|

|

|

|

$

|

0.38

|

|

|

|

|

$

|

0.33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of the Company used in computing earnings per share:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

|

|

31,882

|

|

|

|

|

|

31,786

|

|

|

Diluted

|

|

|

|

|

|

31,972

|

|

|

|

|

|

31,892

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share

|

|

|

|

|

$

|

0.16

|

|

|

|

|

$

|

0.15

|

|

|

|

|

|

|

ALBANY INTERNATIONAL CORP.

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(in thousands, except share data)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

December 31,

|

|

|

|

|

|

|

2015

|

|

|

|

2014

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

$

|

170,838

|

|

|

|

|

$

|

179,802

|

|

|

Accounts receivable, net

|

|

|

|

|

|

163,409

|

|

|

|

|

|

158,237

|

|

|

Inventories

|

|

|

|

|

|

104,820

|

|

|

|

|

|

107,274

|

|

|

Deferred income taxes

|

|

|

|

|

|

6,576

|

|

|

|

|

|

6,743

|

|

|

Prepaid expenses and other current assets

|

|

|

|

|

|

10,412

|

|

|

|

|

|

8,074

|

|

|

Total current assets

|

|

|

|

|

|

456,055

|

|

|

|

|

|

460,130

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

|

|

|

380,864

|

|

|

|

|

|

395,113

|

|

|

Intangibles

|

|

|

|

|

|

328

|

|

|

|

|

|

385

|

|

|

Goodwill

|

|

|

|

|

|

65,724

|

|

|

|

|

|

71,680

|

|

|

Income taxes receivable and deferred

|

|

|

|

|

|

65,732

|

|

|

|

|

|

69,540

|

|

|

Other assets

|

|

|

|

|

|

32,916

|

|

|

|

|

|

32,456

|

|

|

Total assets

|

|

|

|

|

$

|

1,001,619

|

|

|

|

|

$

|

1,029,304

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

Notes and loans payable

|

|

|

|

|

$

|

496

|

|

|

|

|

$

|

661

|

|

|

Accounts payable

|

|

|

|

|

|

36,361

|

|

|

|

|

|

34,787

|

|

|

Accrued liabilities

|

|

|

|

|

|

88,987

|

|

|

|

|

|

95,149

|

|

|

Current maturities of long-term debt

|

|

|

|

|

|

50,015

|

|

|

|

|

|

50,015

|

|

|

Income taxes payable and deferred

|

|

|

|

|

|

1,810

|

|

|

|

|

|

2,786

|

|

|

Total current liabilities

|

|

|

|

|

|

177,669

|

|

|

|

|

|

183,398

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

|

|

|

232,092

|

|

|

|

|

|

222,096

|

|

|

Other noncurrent liabilities

|

|

|

|

|

|

98,496

|

|

|

|

|

|

103,079

|

|

|

Deferred taxes and other credits

|

|

|

|

|

|

6,918

|

|

|

|

|

|

7,163

|

|

|

Total liabilities

|

|

|

|

|

|

515,175

|

|

|

|

|

|

515,736

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $5.00 per share;

|

|

|

|

|

|

|

|

|

|

|

authorized 2,000,000 shares; none issued

|

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

Class A Common Stock, par value $.001 per share;

|

|

|

|

|

|

|

|

|

|

|

authorized 100,000,000 shares; issued 37,175,813

|

|

|

|

|

|

|

|

|

|

|

in 2015 and 37,085,489 in 2014

|

|

|

|

|

|

37

|

|

|

|

|

|

37

|

|

|

Class B Common Stock, par value $.001 per share;

|

|

|

|

|

|

|

|

|

|

|

authorized 25,000,000 shares; issued and

|

|

|

|

|

|

|

|

|

|

|

outstanding 3,235,048 in 2015 and 2014

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

Additional paid in capital

|

|

|

|

|

|

420,493

|

|

|

|

|

|

418,972

|

|

|

Retained earnings

|

|

|

|

|

|

463,238

|

|

|

|

|

|

456,105

|

|

|

Accumulated items of other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

Translation adjustments

|

|

|

|

|

|

(92,653

|

)

|

|

|

|

|

(55,240

|

)

|

|

Pension and postretirement liability adjustments

|

|

|

|

|

|

(49,679

|

)

|

|

|

|

|

(51,666

|

)

|

|

Derivative valuation adjustment

|

|

|

|

|

|

(1,240

|

)

|

|

|

|

|

(861

|

)

|

|

Treasury stock (Class A), at cost 8,459,498 shares

|

|

|

|

|

|

|

|

|

|

|

in 2015 and 2014

|

|

|

|

|

|

(257,481

|

)

|

|

|

|

|

(257,481

|

)

|

|

Total Company shareholders' equity

|

|

|

|

|

|

482,718

|

|

|

|

|

|

509,869

|

|

|

Noncontrolling interest

|

|

|

|

|

|

3,726

|

|

|

|

|

|

3,699

|

|

|

Total equity

|

|

|

|

|

|

486,444

|

|

|

|

|

|

513,568

|

|

|

Total liabilities and shareholders' equity

|

|

|

|

|

$

|

1,001,619

|

|

|

|

|

$

|

1,029,304

|

|

|

|

|

|

|

ALBANY INTERNATIONAL CORP.

|

|

CONSOLIDATED STATEMENTS OF CASH FLOW

|

|

(in thousands)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

$

|

12,239

|

|

|

|

$

|

10,693

|

|

|

Adjustments to reconcile net income to net cash provided by

operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

|

|

|

13,524

|

|

|

|

|

14,107

|

|

|

Amortization

|

|

|

|

|

|

1,830

|

|

|

|

|

1,801

|

|

|

Change in long-term liabilities, deferred taxes and other credits

|

|

|

|

|

|

(277

|

)

|

|

|

|

(214

|

)

|

|

Provision for write-off of property, plant and equipment

|

|

|

|

|

|

152

|

|

|

|

|

1

|

|

|

Gain on disposition of assets

|

|

|

|

|

|

(1,056

|

)

|

|

|

|

-

|

|

|

Excess tax benefit of options exercised

|

|

|

|

|

|

(261

|

)

|

|

|

|

(39

|

)

|

|

Compensation and benefits paid or payable in Class A Common Stock

|

|

|

|

|

|

576

|

|

|

|

|

542

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities that provide/(use) cash:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

|

|

|

(13,699

|

)

|

|

|

|

10,964

|

|

|

Inventories

|

|

|

|

|

|

(3,070

|

)

|

|

|

|

(8,996

|

)

|

|

Prepaid expenses and other current assets

|

|

|

|

|

|

(2,705

|

)

|

|

|

|

(2,148

|

)

|

|

Income taxes prepaid and receivable

|

|

|

|

|

|

84

|

|

|

|

|

21

|

|

|

Accounts payable

|

|

|

|

|

|

3,512

|

|

|

|

|

(1,294

|

)

|

|

Accrued liabilities

|

|

|

|

|

|

(1,587

|

)

|

|

|

|

(12,849

|

)

|

|

Income taxes payable

|

|

|

|

|

|

(398

|

)

|

|

|

|

(1,710

|

)

|

|

Other, net

|

|

|

|

|

|

(2,455

|

)

|

|

|

|

(2,031

|

)

|

|

Net cash provided by operating activities

|

|

|

|

|

|

6,409

|

|

|

|

|

8,848

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

|

|

|

|

(12,211

|

)

|

|

|

|

(14,603

|

)

|

|

Purchased software

|

|

|

|

|

|

(33

|

)

|

|

|

|

(294

|

)

|

|

Proceeds from sale of assets

|

|

|

|

|

|

2,797

|

|

|

|

|

-

|

|

|

Net cash used in investing activities

|

|

|

|

|

|

(9,447

|

)

|

|

|

|

(14,897

|

)

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from borrowings

|

|

|

|

|

|

15,274

|

|

|

|

|

4,435

|

|

|

Principal payments on debt

|

|

|

|

|

|

(5,443

|

)

|

|

|

|

(6,516

|

)

|

|

Proceeds from options exercised

|

|

|

|

|

|

685

|

|

|

|

|

126

|

|

|

Excess tax benefit of options exercised

|

|

|

|

|

|

261

|

|

|

|

|

39

|

|

|

Dividends paid

|

|

|

|

|

|

(5,098

|

)

|

|

|

|

(4,765

|

)

|

|

Net cash provided by/(used in) financing activities

|

|

|

|

|

|

5,679

|

|

|

|

|

(6,681

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

|

|

|

(11,605

|

)

|

|

|

|

(1,557

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents

|

|

|

|

|

|

(8,964

|

)

|

|

|

|

(14,287

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

|

|

|

179,802

|

|

|

|

|

222,666

|

|

|

Cash and cash equivalents at end of period

|

|

|

|

|

$

|

170,838

|

|

|

|

$

|

208,379

|

|

|

|

CONTACT:

Albany International Corp.

Investors

John

Cozzolino, 518-445-2281

john.cozzolino@albint.com

or

Media

Susan

Siegel, 603-330-5866

susan.siegel@albint.com

Exhibit 99.2

Albany International Corp.

Q1 Financial Performance May 4, 2015

‘Non‐GAAP’ Items and

Forward‐Looking Statements This presentation contains certain items,

such as net income attributable to the Company, excluding adjustments

(absolute as well as per‐share), earnings before interest, taxes,

depreciation and amortization (EBITDA), adjusted EBITDA and net debt,

that could be considered ‘non‐GAAP’ financial measures under SEC rules.

We think such items provide useful information to investors regarding

the Company’s operational performance. This presentation also may

contain statements, estimates, or projections that constitute

“forward‐looking statements” as defined under U.S. federal securities

laws. Forward‐looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially from

the Company’s historical experience and our present expectations or

projections. We disclaim any obligation to update any information in

this presentation to reflect any changes or developments after the date

on the cover page. Certain additional disclosures regarding our use of

these ‘non‐GAAP’ items and forward‐looking statements are set forth in

our fourth‐quarter earnings press release dated May 4, 2015, and in our

SEC filings, including our most recent quarterly reports and our annual

reports for the years ended December 31, 2012, 2013, and 2014. Our use

of such items in this presentation is subject to those additional

disclosures, which we urge you to read. 2

Net Sales by Segment (in

thousands) Net Sales Three Months ended March 31, 2015 2014 Percent

Change Impact of Changes in Currency Translation Rates Percent Change

excluding Currency Rate Effect Machine Clothing (MC) $158,494 $164,088

-3.4% ($11,317) 3.5% Albany Engineered Composites (AEC) 22,830 16,219

40.8% (337) 42.8% Total $181,324 $180,307 0.6% ($11,654) 7.0% 3

Gross Profit Margin by

Quarter Percentage of Net Sales 45.0% 42.4% 41.9% 43.0% 47.5% 41.5%

38.9% 38.2% 38.0% 42.3% 30% 35% 40% 45% 50% 55% Q1 2014 Q2 2014 Q3 2014

Q4 2014 Q1 2015 Machine Clothing Total Company 4

Earnings Per Share 5 Per

share amounts (Basic) Three Months ended March 31, 2015 2014 Net income

attributable to the Company, as reported $0.38 $0.33 Adjustments:

Restructuring charges 0.18 0.02 Income tax adjustments 0.01 0.03 Foreign

currency revaluation (gains)/losses (0.10) (0.01) Gain on sale of

investment (0.02) - Net income attributable to the Company, excluding

adjustments $0.45 $0.37

Adjusted EBITDA 6 Three

Months ended March 31, 2015 (in thousands) Machine Clothing Albany

Engineered Composites Corporate expenses and other Total Company Net

income $35,689 ($3,811) ($19,639) $12,239 Interest expense, net - -

2,676 2,676 Income tax expense - - 8,519 8,519 Depreciation and

amortization 10,205 2,995 2,154 15,354 EBITDA 45,894 (816) (6,290)

38,788 Restructuring and other, net 9,001 - - 9,001 Foreign currency

revaluation (gains)/losses (2,923) (17) (2,431) (5,371) Gain on sale of

investment - - (872) (872) Pretax (income)/loss attributable to

non-controlling interest in ASC - (26) - (26) Adjusted EBITDA $51,972

($859) ($9,593) $41,520 Three Months ended March 31, 2014 Machine

Clothing Albany Engineered Composites Corporate expenses and other Total

Company $36,142 ($3,475) ($21,974) $10,693 - - 2,918 2,918 - - 7,457

7,457 11,455 2,322 2,131 15,908 47,597 (1,153) (9,468) 36,976 862 320 -

1,182 152 38 (505) (315) - - - - - (59) - (59) $48,611 ($854) ($9,973)

$37,784

Debt $ thousands $94,040

$78,225 $88,205 $92,970 $111,765 $302,419 $285,061 $283,666 $272,772

$282,603 $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000

$350,000 March 31, 2014 June 30, 2014 September 30, 2014 December 31,

2014 March 31, 2015 Net Debt Total Debt 7

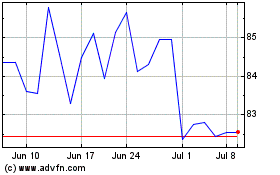

Albany (NYSE:AIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albany (NYSE:AIN)

Historical Stock Chart

From Apr 2023 to Apr 2024