UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 5, 2015

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Federally chartered instrumentality of the United States | | 001-14951 | | 52-1578738 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

1999 K Street, N.W., 4th Floor, Washington D.C. | | 20006 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (202) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On February 5, 2015, the Board of Directors (the “Board”) of the Federal Agricultural Mortgage Corporation (“Farmer Mac”) declared a quarterly dividend on each of Farmer Mac’s three classes of common stock – Class A Voting Common Stock, Class B Voting Common Stock, and Class C Non-Voting Common Stock. The quarterly dividend of $0.16 per share of common stock will be payable on March 31, 2015 to holders of record of Farmer Mac’s common stock as of March 16, 2015.

Also on February 5, 2015, the Board declared a dividend on each of Farmer Mac’s three classes of preferred stock – 5.875% Non-Cumulative Preferred Stock, Series A (the “Series A Preferred Stock”), 6.875% Non-Cumulative Preferred Stock, Series B (the “Series B Preferred Stock”), and 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C (the “Series C Preferred Stock”). The quarterly dividend of $0.3672 per share of Series A Preferred Stock, $0.4297 per share of Series B Preferred Stock, and $0.375 per share of Series C Preferred Stock is for the period from but not including January 17, 2015 to and including April 17, 2015 and will be payable on April 17, 2015 to holders of record of the Series A Preferred Stock, the Series B Preferred Stock, and the Series C Preferred Stock, respectively, as of April 2, 2015. Each share of Series A Preferred Stock, Series B Preferred Stock, and Series C Preferred Stock has a par value and liquidation preference of $25.00 per share.

Information about the dividends is also included in the press release attached to this report as Exhibit 99. All references to www.farmermac.com in Exhibit 99 are inactive textual references only and the information contained on Farmer Mac’s website is not incorporated by reference into this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99 Press Release, dated February 5, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Senior Vice President – General Counsel

Dated: February 5, 2015

Farmer Mac Announces 4th Consecutive

Annual Dividend Increase

WASHINGTON, February 5, 2015 — The Federal Agricultural Mortgage Corporation (Farmer Mac, NYSE: AGM and AGM.A) announced today that it has increased the quarterly dividend paid on Farmer Mac’s common stock by 14 percent from the previous quarter. Farmer Mac’s board of directors has declared a first quarter dividend of $0.16 per share on each of Farmer Mac’s three classes of common stock – Class A Voting Common Stock (NYSE: AGM.A), Class B Voting Common Stock (not listed on any exchange), and Class C Non-Voting Common Stock (NYSE: AGM). The quarterly dividend of $0.16 will be payable on March 31, 2015 to holders of record of common stock as of March 16, 2015.

Farmer Mac’s board of directors has also declared a dividend on each of Farmer Mac’s three classes of preferred stock – Series A Non-Cumulative Preferred Stock (NYSE: AGM.PR.A), Series B Non-Cumulative Preferred Stock (NYSE: AGM.PR.B), and Series C Fixed-to-Floating Rate Non-Cumulative Preferred Stock (NYSE: AGM.PR.C). The quarterly dividend of $0.3672 per share of Series A Non-Cumulative Preferred Stock, $0.4297 per share of Series B Non-Cumulative Preferred Stock, and $0.375 per share of Series C Fixed-to-Floating Rate Non-Cumulative Preferred Stock is for the period from but not including January 17, 2015 to and including April 17, 2015, and shall be payable on April 17, 2015 to holders of record of preferred stock as of April 2, 2015. Each share of Series A Non-Cumulative Preferred Stock, Series B Non-Cumulative Preferred Stock, and Series C Fixed-to-Floating Rate Non-Cumulative Preferred Stock has a par value and liquidation preference of $25.00 per share.

Farmer Mac’s President and Chief Executive Officer Tim Buzby stated, “Today’s increase in common stock dividends marks the fourth straight year of dividend increases and is consistent with our goal of delivering a steadily growing, sustainable dividend for our stockholders over the long-term. Farmer Mac had another great year in 2014 and we look forward to continuing to increase stockholder value in the future while fulfilling our mission of delivering capital and liquidity to rural America.”

Forward-Looking Statements

In addition to historical information, this release includes forward-looking statements that reflect management’s current expectations as to Farmer Mac’s future financial results, business prospects, and business developments. Management’s expectations for Farmer Mac’s future necessarily involve a number of assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward-looking statements, including uncertainties regarding:

| |

• | the availability to Farmer Mac and Farmer Mac II LLC of debt and equity financing and, if available, the reasonableness of rates and terms; |

| |

• | legislative or regulatory developments that could affect Farmer Mac or its sources of business; |

| |

• | fluctuations in the fair value of assets held by Farmer Mac and Farmer Mac II LLC; |

| |

• | the rate and direction of development of the secondary market for agricultural mortgage and rural utilities loans, including lender interest in Farmer Mac credit products and the secondary market provided by Farmer Mac; |

| |

• | the general rate of growth in agricultural mortgage and rural utilities indebtedness; |

| |

• | the impact of economic conditions, including the effects of drought and other weather-related conditions and fluctuations in agricultural real estate values, on agricultural mortgage lending and borrower repayment capacity; |

| |

• | developments in the financial markets, including possible investor, analyst, and rating agency reactions to events involving government-sponsored enterprises, including Farmer Mac; |

| |

• | changes in the level and direction of interest rates, which could, among other things, affect the value of collateral securing Farmer Mac’s agricultural mortgage loan assets; and |

| |

• | volatility in commodity prices relative to costs of production and/or export demand for U.S. agricultural products. |

Other risk factors are discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended December 31, 2013 (filed with the SEC on March 13, 2014), Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 (filed with the SEC on May 12, 2014), Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 (filed with the SEC on August 11, 2014), and Quarterly Report on Form 10-Q for the quarter ended September 30, 2014, (filed with the SEC on November 10, 2014). In light of these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this release. The forward-looking statements contained in this release represent management’s expectations as of the date of this release. Farmer Mac undertakes no obligation to release publicly the results of revisions to any forward-looking statements included in this release to reflect new information or any future events or circumstances, except as the SEC otherwise requires.

About Farmer Mac

Farmer Mac is the stockholder-owned company created to deliver capital and increase lender competition for the benefit of American agriculture and rural communities. Additional information about Farmer Mac is available on Farmer Mac’s website at www.farmermac.com.

CONTACT: Jalpa Nazareth, Investor Relations

Chris Bohanon, Media Inquiries

(202) 872-7700

* * * *

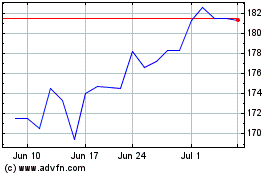

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Apr 2023 to Apr 2024