Dutch Insurer Aegon Replaces Generali on 'Too Big to Fail' List -- Update

November 03 2015 - 11:13AM

Dow Jones News

By Archie van Riemsdijk

Dutch insurer Aegon NV is now one of the nine insurance

companies that are essential to the stability of the global

financial system, according to the international Financial

Stability Board.

The board, a global committee of financial regulators, said on

Tuesday that Aegon has replaced Italian rival Assicurazioni

Generali SpA on the list of insurers that are considered "too big

to fail".

The move comes as many international banks and insurers face

more stringent regulation as policy makers strive to shore up the

global financial system from possible shocks of the sort that

followed the collapse of Lehman Brothers seven years ago.

Designating Aegon as one of the so-called global systemically

important insurers, or G-SIIs, may require the group to bolster its

finances to meet more onerous regulatory requirements. Aegon earns

most of its income through its U.S. subsidiary Transamerica.

A higher loss-absorbency requirement for will be implemented for

the nine insurers in 2019, according to the FSB, which is based in

Basel, Switzerland.

Aegon spokeswoman Debora De Laaf said the implications of the

designation for the Dutch company are not yet clear. "It is too

early to say anything", Ms. De Laaf said.

Aegon had received the FSB news release on Tuesday morning, Ms.

De Laaf said, when asked whether the company was surprised by the

decision. "It is a designation process that takes place annually,"

she said.

Aegon could still hope to drop off the list again in coming

years, as a result of a new methodology that is currently under

review.

A higher capital requirement will be applied as of 2019 to those

nine G-SII's that will be included on the list in November 2017,

the FSB stated.

This will include an uplift of basic capital requirements by

33%, for all activities other than banking, the agency that

develops the new standard, the International Association of

Insurance Supervisors, or IAIS, announced last month.

Analyst Marcell Houben at Dutch broker SNS Securities said total

capital requirements for G-SII's could rise by an average 10% in

future industry standards. He recently raised his rating on Aegon

to buy, on valuation grounds.

The inclusion of Aegon and the exclusion of Generali in the list

of nine G-SII's for 2015 reflect changes in the level or type of

activity undertaken by the two insurance companies, combined with

supervisory judgment, the FSB said.

"We see this as an entirely logical decision given the

significant transformation of the Group over the past few years

including a refocus on our core insurance business and

strengthening of our balance sheet," said a Generali spokesman.

This is "excellent" news as those on that list need an

additional capital buffer, said Matteo Ghilotti, an analyst at

Milan-based Equita SIM, adding Generali was probably removed from

the list as a result of the sale of the BSI unit. He has a hold

rating on the insurer.

According to the FSB, the Dutch insurance company will require

enhanced group-wide supervision. Aegon operates mainly in the

Netherlands, the U.S., and U.K., though it has some activities

elsewhere in Europe and in Asia.

A group-wide supervisor will be assigned to Aegon, with direct

powers over its holding companies and overseeing systemic risk and

liquidity planning, the FSB said. Aegon will need to set up a

resolution plan to enable the supervisor to wind up the company if

it gets into trouble in a future financial crisis.

Aegon said it would comply with the FSB's requirements and take

part in the debate on the definition of G-SII's.

Liam Moloney contributed to this article.

Write to Archie van Riemsdijk at archie.vanriemsdijk@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 10:58 ET (15:58 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

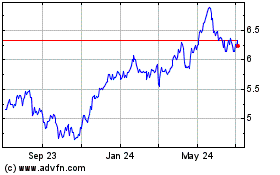

Aegon (NYSE:AEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

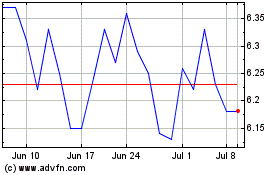

Aegon (NYSE:AEG)

Historical Stock Chart

From Apr 2023 to Apr 2024