UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 19, 2016

________________________________________________

AMEREN CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | |

| | |

Missouri | 1-14756 | 43-1723446 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1901 Chouteau Avenue, St. Louis, Missouri 63103

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: (314) 621-3222

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¬ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¬ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¬ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¬ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

ITEM 2.02 | Results of Operations and Financial Condition. |

On February 19, 2016, Ameren Corporation (“Ameren”) issued a press release announcing its earnings for the fourth quarter and fiscal year ended December 31, 2015, and providing 2016 earnings guidance. The press release is attached as Exhibit 99.1 and is incorporated herein by reference. The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Ameren under the Securities Act of 1933 or the Exchange Act.

In its press release dated February 19, 2016, Ameren disclosed the following unaudited consolidated financial statements: Statement of Income for the three months and twelve months ended December 31, 2015 and December 31, 2014, Balance Sheet at December 31, 2015 and December 31, 2014, and Statement of Cash Flows for the twelve months ended December 31, 2015 and December 31, 2014. The foregoing consolidated financial statements are attached as Exhibit 99.2 and Ameren hereby incorporates such consolidated financial statements into this Item 8.01 of this Current Report on Form 8-K.

|

| |

ITEM 9.01 | Financial Statements and Exhibits. |

|

| | |

| | |

Exhibit Number: | | Title: |

| |

99.1* | | Press release regarding earnings for the year and quarter ended December 31, 2015, and providing 2016 earnings guidance, issued on February 19, 2016, by Ameren. |

| |

99.2 | | Ameren’s unaudited consolidated Statement of Income for the three months and twelve months ended December 31, 2015 and December 31, 2014, Balance Sheet at December 31, 2015 and December 31, 2014, and Statement of Cash Flows for the twelve months ended December 31, 2015 and December 31, 2014. |

* Exhibit 99.1 is intended to be deemed furnished rather than filed pursuant to General Instruction B.2. of Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Ameren has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | |

| | AMEREN CORPORATION |

| | (Registrant) |

| |

| | By: /s/ Martin J. Lyons, Jr.___________________________ |

| | Name: Martin J. Lyons, Jr. |

| | Title: Executive Vice President and Chief Financial Officer |

Date: February 19, 2016

Exhibit Index

|

| | |

| | |

Exhibit Number: | | Title: |

| |

99.1* | | Press release regarding earnings for the year and quarter end December 31, 2015, and providing 2016 earnings guidance, issued on February 19, 2016, by Ameren. |

| |

99.2 | | Ameren’s unaudited consolidated Statement of Income for the three months and twelve months ended December 31, 2015 and December 31, 2014, Balance Sheet at December 31, 2015 and December 31, 2014, and Statement of Cash Flows for the twelve months ended December 31, 2015 and December 31, 2014. |

* Exhibit 99.1 is intended to be deemed furnished rather than filed pursuant to General Instruction B.2. of Form 8-K.

NEWS RELEASE

1901 Chouteau Avenue: St. Louis, MO 63103: Ameren.com

|

| | | |

Contacts | | | |

Media | Analysts | | Investors |

Joe Muehlenkamp | Doug Fischer | Andrew Kirk | Investor Services |

314.554.4135 | 314.554.4859 | 314.554.3942 | 800.255.2237 |

jmuehlenkamp@ameren.com | dfischer@ameren.com | akirk@ameren.com | invest@ameren.com |

For Immediate Release

Ameren Announces 2015 Results

and Issues Earnings Guidance

| |

• | 2015 Core (Non-GAAP) Diluted Earnings Per Share Were $2.56, Compared to $2.40 in 2014 |

| |

• | 2015 GAAP Diluted EPS were $2.59, Compared to $2.40 in 2014 |

| |

• | Lower Sales to Noranda Aluminum Estimated to Reduce 2016 Diluted EPS by 13 Cents |

| |

• | 2016 Diluted EPS Guidance Range Established at $2.40 to $2.60 |

| |

• | Expect Diluted EPS to Grow at 5% to 8% Compound Annual Rate from 2016 through 2020 |

ST. LOUIS (Feb. 19, 2016) — Ameren Corporation (NYSE: AEE) today announced 2015 net income attributable to common shareholders in accordance with generally accepted accounting principles (GAAP) of $630 million, or $2.59 per diluted share, compared to $586 million, or $2.40 per diluted share, for 2014. Excluding certain items discussed below, Ameren recorded core earnings of $622 million, or $2.56 per diluted share, for 2015, compared to core earnings of $587 million, or $2.40 per diluted share, for 2014.

The year-over-year increase in 2015 core earnings reflected increased investments in electric transmission and delivery infrastructure made under modern, constructive regulatory frameworks as well as the absence, in 2015, of a nuclear refueling and maintenance outage at the Callaway Energy Center, which is scheduled to occur every 18 months. The positive effects of these factors were partially offset by increased depreciation and amortization expenses and lower retail electric and gas sales volumes in 2015 driven by milder winter temperatures.

"We delivered strong earnings growth in 2015," said Warner L. Baxter, chairman, president and chief executive officer of Ameren Corporation. “Despite some challenges, including very mild fourth quarter weather, we were able to achieve this growth through the continued execution of our strategy, which includes allocating capital to jurisdictions with modern, constructive regulatory frameworks and managing costs in a disciplined manner."

Ameren recorded GAAP net income attributable to common shareholders for the three months ended Dec. 31, 2015, of $29 million, or 12 cents per diluted share, compared to $48 million, or 20 cents per diluted share, for the same period in 2014. Excluding results from discontinued operations discussed below, Ameren recorded core earnings of $30 million, or 12 cents per diluted share, for the three months ended Dec. 31, 2015, compared to $46 million, or 19 cents per diluted share, for the same period in 2014.

This year-over-year decrease in fourth quarter 2015 core earnings reflected lower retail electric and gas sales volumes primarily driven by milder winter temperatures, a higher effective income tax rate and the absence of a fourth quarter 2014 benefit resulting from a regulatory order regarding debt redemption costs. The negative effects of these factors were partially offset by the absence, in 2015, of a nuclear refueling and maintenance outage at the Callaway Energy Center and earnings on increased investments in electric transmission infrastructure.

The following items were excluded from core earnings for the three months and year ended Dec. 31, 2015 and 2014, as applicable:

| |

• | Results from discontinued operations, primarily reflecting recognition of a tax benefit related to the resolution of an uncertain tax position, which increased 2015 GAAP net income by $52 million. |

| |

• | A provision for discontinuing pursuit of a construction and operating license (COL) for a second nuclear unit at Ameren Missouri's Callaway Energy Center, which decreased 2015 net income from continuing operations by $43 million. |

A reconciliation of GAAP to core earnings per diluted share is as follows:

|

| | | | | | | | | |

| Three Months Ended | | Year Ended |

| Dec. 31, | | Dec. 31, |

| 2015 | 2014 | | 2015 | 2014 |

GAAP EPS | $0.12 | $0.20 | | $2.59 | $2.40 |

Results from discontinued operations | — |

| (0.01 | ) | | (0.21 | ) | — |

|

Provision for Callaway COL | — |

| — |

| | 0.18 |

| — |

|

Core EPS | $0.12 | $0.19 | | $2.56 | $2.40 |

Earnings Guidance

Ameren expects 2016 diluted earnings per share to be in a range of $2.40 to $2.60 including an estimated 13 cents per share reduction related to significantly lower expected electric sales volumes to Noranda Aluminum, Inc. (Noranda), Ameren Missouri's largest customer. Ameren also expects diluted earnings per share to grow at a 5% to 8% compound annual rate from 2016 through 2020, excluding the expected temporary net effect of lower sales to Noranda in 2016. These increasing earnings are expected to be driven by projected rate base growth of approximately 6.5% compounded annually from 2015 through 2020.

"Looking ahead, we expect to continue to deliver strong long-term earnings per share growth compared to our peers as we execute our strategy," Baxter said. "In addition, we will continue to work constructively with key stakeholders to modernize Missouri’s regulatory framework to better support investment in that state’s aging energy infrastructure for the long-term benefit of our customers and the state of Missouri."

Earnings guidance for 2016 assumes normal temperatures, and along with Ameren's growth expectations, is subject to the effects of, among other things: 30-year U.S. Treasury bond yields; regulatory decisions and legislative actions; energy center and energy delivery operations; Noranda sales levels; energy, economic, capital and credit market conditions; severe storms; unusual or otherwise unexpected gains or losses; and other risks and uncertainties outlined, or referred to, in the Forward-looking Statements section of this press release.

Ameren Missouri Segment Results

Ameren Missouri segment 2015 GAAP and core earnings were $352 million and $395 million, respectively, compared to 2014 GAAP and core earnings of $390 million. The difference between 2015 GAAP and core earnings reflected the provision for the Callaway COL described previously. The core earnings increase reflected the absence, in 2015, of a nuclear refueling and maintenance outage at the Callaway Energy Center. This benefit was partially offset by lower capitalized financing costs and higher depreciation and amortization expenses. The comparison was also negatively affected by lower retail electric sales volumes in 2015 driven by milder winter temperatures.

Ameren Illinois Segment Results

Ameren Illinois segment 2015 earnings were $214 million, compared to 2014 earnings of $201 million. This comparison benefited from earnings on increased investments in electric transmission and delivery infrastructure and an Illinois Commerce Commission (ICC) order approving recovery of cumulative power usage costs. These positive factors were partially offset by a reduced allowed return on equity for the electric delivery business due to lower 30-year U.S. Treasury bond yields, higher depreciation and amortization expenses related to natural gas delivery service and the absence of a 2014 benefit resulting from an ICC order regarding debt redemption costs. The comparison was also negatively affected by lower retail electric and gas sales volumes in 2015 driven by milder winter temperatures.

Other Results from Continuing Operations, including ATXI and Parent

Other earnings, including those of Ameren Transmission Company of Illinois (ATXI) and the parent company, for 2015 were $14 million, compared to a loss of $4 million for 2014. These improvements reflected an increase in earnings at ATXI to $31 million from $14 million as a result of increased investments in electric transmission infrastructure.

Analyst Conference Call

Ameren will conduct a conference call for financial analysts at 9 a.m. Central Time on Friday, Feb. 19, to discuss 2015 earnings, earnings guidance and growth expectations, and regulatory and other matters. Investors, the news media and the public may listen to a live Internet broadcast of the call at Ameren.com by clicking on “Q4 2015 Ameren Corporation Earnings Conference Call,” followed by the appropriate audio link. An accompanying slide presentation will be available on Ameren’s website. The conference call and this presentation will be accessible in the “Investors” section of the website under “Webcasts & Presentations.” The analyst call will be available for replay on Ameren’s website for one year. In addition, a telephone replay of the conference call will be available beginning at approximately noon Central Time from Feb. 19 through Feb. 26 by dialing U.S. and Canada 877.660.6853 or international 201.612.7415, and entering ID number 13629810.

About Ameren

St. Louis-based Ameren Corporation powers the quality of life for 2.4 million electric customers and more than 900,000 natural gas customers in a 64,000-square-mile area through its Ameren Missouri and Ameren Illinois rate-regulated utility subsidiaries. Ameren Illinois provides electric delivery and transmission service as well as natural gas delivery service while Ameren Missouri provides vertically integrated electric service, with generating capacity of over 10,200 megawatts, and natural gas delivery service. Ameren Transmission Company of Illinois develops regional electric transmission projects. Follow the company on Twitter @AmerenCorp. For more information, visit Ameren.com.

Use of Non-GAAP Financial Measures

In this release, Ameren has presented core earnings, which is a non-GAAP measure and may not be comparable to those of other companies. A reconciliation of GAAP to non-GAAP results has been included in this release. Generally, core earnings (or losses) include earnings or losses attributable to common stockholders and exclude income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as the Callaway COL provision. Ameren uses core earnings internally for financial planning and for analysis of performance. Ameren also uses core earnings as the primary performance measurement when communicating with analysts and investors regarding our earnings results and outlook, as the company believes that core earnings allow the company to more accurately compare its ongoing performance across periods. In providing core earnings guidance, there could be differences between core earnings and earnings prepared in accordance with GAAP as a result of our treatment of certain items, such as those described above. Ameren is unable to estimate the impact, if any, on future GAAP earnings of such items.

Forward-looking Statements

Statements in this release not based on historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions, and financial performance. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause actual results to differ materially from those anticipated. The following factors, in addition to those discussed under Risk Factors in Ameren’s Form 10-K for the year ended Dec. 31, 2014, and elsewhere in this release and in our other filings with the Securities and Exchange Commission, could cause actual results to differ materially from management expectations suggested in such forward-looking statements:

| |

• | regulatory, judicial, or legislative actions, including changes in regulatory policies and ratemaking determinations, that may result from the complaint cases filed with the Federal Energy Regulatory Commission (FERC) seeking a reduction in the allowed base return on common equity under the Midcontinent Independent System Operator tariff, the review of the calculation of the fuel adjustment clause provision that allows Ameren Missouri to retain a portion of off-system sales it makes as a result of reduced tariff sales to Noranda, and future regulatory, judicial, or legislative actions designed to change regulatory recovery mechanisms; |

| |

• | the effect of Ameren Illinois participating in a performance-based formula ratemaking process under the IEIMA, including the direct relationship between Ameren Illinois’ return on common equity and 30-year United States Treasury bond yields, the related financial commitments required by the IEIMA, and the resulting uncertain impact on Ameren Illinois' results of operations, financial position, and liquidity; |

| |

• | our ability to align our overall spending, both operating and capital, with regulatory frameworks established by our regulators in an attempt to earn our allowed return on equity; |

| |

• | the effects of changes in laws and other governmental actions, including monetary, fiscal, tax, and energy policies; |

| |

• | the effects of changes in federal, state, or local tax laws, regulations, interpretations, or rates and any challenges to the tax positions we have taken; |

| |

• | the effects on demand for our services resulting from technological advances, including advances in customer energy efficiency and distributed generation sources, which generate electricity at the site of consumption and are becoming more cost-competitive; |

| |

• | the effectiveness of Ameren Missouri’s customer energy efficiency programs and the related amount of any revenues and performance incentive earned under the MEEIA plans approved in August 2012, February 2016, and any future approved MEEIA plan; |

| |

• | the timing of increasing capital expenditure and operating expense requirements and our ability to recover these costs in a timely manner; |

| |

• | the cost and availability of fuel such as coal, natural gas, and enriched uranium used to produce electricity; the cost and availability of purchased power and natural gas for distribution; and the level and volatility of future market prices for such commodities, including our ability to recover the costs for such commodities and our customers’ tolerance for the related rate increases; |

| |

• | the effectiveness of our risk management strategies and our use of financial and derivative instruments; |

| |

• | the ability to obtain sufficient insurance, including insurance relating to Ameren Missouri’s Callaway Energy Center and insurance for cyber attacks, and to recover the costs of such insurance or, in the absence of insurance, the ability to recover uninsured losses; |

| |

• | business and economic conditions, including their impact on key customers, interest rates, collection of our receivable balances, and demand for our products; |

| |

• | Noranda's bankruptcy filing, the expected curtailment of operations at its aluminum smelter located in southeast Missouri, and the resulting impacts to Ameren Missouri's ability to recover its revenue requirement; |

| |

• | revisions to Ameren Missouri’s long-term power supply agreement with Noranda, including Ameren Missouri’s notification to terminate the agreement effective June 1, 2020, and Ameren Missouri’s decision as to whether to seek MoPSC approval to cease providing electricity to Noranda thereafter; |

| |

• | disruptions of the capital markets, deterioration in our credit metrics, or other events that may have an adverse effect on the cost or availability of capital, including short-term credit and liquidity; |

| |

• | the impact of the adoption of new accounting guidance and the application of appropriate technical accounting rules and guidance; |

| |

• | actions of credit rating agencies and the effects of such actions; |

| |

• | the impact of weather conditions and other natural phenomena on us and our customers, including the impact of system outages; |

| |

• | the construction, installation, performance, and cost recovery of generation, transmission, and distribution assets; |

| |

• | the effects of breakdowns or failures of equipment in the operation of natural gas distribution and transmission systems and storage facilities, such as leaks, explosions and mechanical problems, and compliance with natural gas safety regulations; |

| |

• | the effects of our increasing investment in electric transmission projects and the uncertainty as to whether we will achieve our expected returns in a timely fashion; |

| |

• | operation of Ameren Missouri’s Callaway Energy Center, including planned and unplanned outages, and decommissioning costs; |

| |

• | the effects of strategic initiatives, including mergers, acquisitions and divestitures, and any related tax implications; |

| |

• | the impact of current environmental regulations and new, more stringent, or changing requirements, including those related to carbon dioxide, other emissions and discharges, cooling water intake structures, coal combustion residuals, and energy efficiency, that are enacted over time and that could limit or terminate the operation of certain of our energy centers, increase our costs or investment requirements, result in an impairment of our assets, cause us to sell our assets, reduce our customers’ demand for electricity or natural gas, or otherwise have a negative financial effect; |

| |

• | the impact of complying with renewable energy portfolio requirements in Missouri; |

| |

• | labor disputes, work force reductions, future wage and employee benefits costs, including changes in discount rates, mortality tables, and returns on benefit plan assets; |

| |

• | the inability of our counterparties to meet their obligations with respect to contracts, credit agreements, and financial instruments; |

| |

• | the cost and availability of transmission capacity for the energy generated by Ameren Missouri’s energy centers or required to satisfy Ameren Missouri’s energy sales; |

| |

• | legal and administrative proceedings; |

| |

• | the impact of cyber attacks, which could result in the loss of operational control of energy centers and electric and natural gas transmission and distribution systems and/or the loss of data, such as utility customer data and account information; and |

| |

• | acts of sabotage, war, terrorism, or other intentionally disruptive acts. |

New factors emerge from time to time; it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. Except to the extent required by the federal securities laws, we undertake no obligation to update or revise publicly any forward-looking statements to reflect new information or future events.

# # #

AMEREN CORPORATION (AEE)

CONSOLIDATED STATEMENT OF INCOME

(Unaudited, in millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Operating Revenues: | | | | | | | |

Electric | $ | 1,087 |

| | $ | 1,049 |

| | $ | 5,180 |

| | $ | 4,913 |

|

Gas | 221 |

| | 321 |

| | 918 |

| | 1,140 |

|

Total operating revenues | 1,308 |

| | 1,370 |

| | 6,098 |

| | 6,053 |

|

Operating Expenses: | | | | | | | |

Fuel | 208 |

| | 188 |

| | 878 |

| | 826 |

|

Purchased power | 121 |

| | 121 |

| | 514 |

| | 461 |

|

Gas purchased for resale | 95 |

| | 183 |

| | 415 |

| | 615 |

|

Other operations and maintenance | 438 |

| | 453 |

| | 1,694 |

| | 1,684 |

|

Provision for Callaway construction and operating license | — |

| | — |

| | 69 |

| | — |

|

Depreciation and amortization | 202 |

| | 194 |

| | 796 |

| | 745 |

|

Taxes other than income taxes | 104 |

| | 106 |

| | 473 |

| | 468 |

|

Total operating expenses | 1,168 |

| | 1,245 |

| | 4,839 |

| | 4,799 |

|

Operating Income | 140 |

| | 125 |

| | 1,259 |

| | 1,254 |

|

Other Income and Expenses: | | | | | | | |

Miscellaneous income | 20 |

| | 19 |

| | 74 |

| | 79 |

|

Miscellaneous expense | 8 |

| | 2 |

| | 30 |

| | 22 |

|

Total other income | 12 |

| | 17 |

| | 44 |

| | 57 |

|

Interest Charges | 91 |

| | 75 |

| | 355 |

| | 341 |

|

Income Before Income Taxes | 61 |

| | 67 |

| | 948 |

| | 970 |

|

Income Taxes | 30 |

| | 20 |

| | 363 |

| | 377 |

|

Income from Continuing Operations | 31 |

| | 47 |

| | 585 |

| | 593 |

|

Income (Loss) from Discontinued Operations, Net of Taxes | (1 | ) | | 2 |

| | 51 |

| | (1 | ) |

Net Income | 30 |

| | 49 |

| | 636 |

| | 592 |

|

Less: Net Income from Continuing Operations Attributable to Noncontrolling Interests | 1 |

| | 1 |

| | 6 |

| | 6 |

|

Net Income (Loss) Attributable to Ameren Common Shareholders: | | | | | | | |

Continuing Operations | 30 |

| | 46 |

| | 579 |

| | 587 |

|

Discontinued Operations | (1 | ) | | 2 |

| | 51 |

| | (1 | ) |

Net Income Attributable to Ameren Common Shareholders | $ | 29 |

| | $ | 48 |

| | $ | 630 |

| | $ | 586 |

|

Earnings per Common Share – Basic: | | | | | | | |

Continuing Operations | $ | 0.12 |

| | $ | 0.19 |

| | $ | 2.39 |

| | $ | 2.42 |

|

Discontinued Operations | — |

| | 0.01 |

| | 0.21 |

| | — |

|

Earnings per Common Share – Basic | $ | 0.12 |

| | $ | 0.20 |

| | $ | 2.60 |

| | $ | 2.42 |

|

| | | | | | | |

Earnings per Common Share – Diluted: | | | | | | | |

Continuing Operations | $ | 0.12 |

| | $ | 0.19 |

| | $ | 2.38 |

| | $ | 2.40 |

|

Discontinued Operations | — |

| | 0.01 |

| | 0.21 |

| | — |

|

Earnings per Common Share – Diluted | $ | 0.12 |

| | $ | 0.20 |

| | $ | 2.59 |

| | $ | 2.40 |

|

| | | | | | | |

Average Common Shares Outstanding – Basic | 242.6 |

| | 242.6 |

| | 242.6 |

| | 242.6 |

|

Average Common Shares Outstanding – Diluted | 243.0 |

| | 244.5 |

| | 243.6 |

| | 244.4 |

|

AMEREN CORPORATION (AEE)

CONSOLIDATED BALANCE SHEET

(Unaudited, in millions)

|

| | | | | | | |

| December 31, 2015 | | December 31, 2014 |

ASSETS | | | |

Current Assets: | | | |

Cash and cash equivalents | $ | 292 |

| | $ | 5 |

|

Accounts receivable - trade (less allowance for doubtful accounts) | 388 |

| | 423 |

|

Unbilled revenue | 239 |

| | 265 |

|

Miscellaneous accounts and notes receivable | 98 |

| | 81 |

|

Materials and supplies | 538 |

| | 524 |

|

Current regulatory assets | 260 |

| | 295 |

|

Other current assets | 88 |

| | 86 |

|

Assets of discontinued operations | 14 |

| | 15 |

|

Total current assets | 1,917 |

| | 1,694 |

|

Property and Plant, Net | 18,799 |

| | 17,424 |

|

Investments and Other Assets: | | | |

Nuclear decommissioning trust fund | 556 |

| | 549 |

|

Goodwill | 411 |

| | 411 |

|

Regulatory assets | 1,382 |

| | 1,582 |

|

Other assets | 575 |

| | 629 |

|

Total investments and other assets | 2,924 |

| | 3,171 |

|

TOTAL ASSETS | $ | 23,640 |

| | $ | 22,289 |

|

LIABILITIES AND EQUITY | | | |

Current Liabilities: | | | |

Current maturities of long-term debt | $ | 395 |

| | $ | 120 |

|

Short-term debt | 301 |

| | 714 |

|

Accounts and wages payable | 777 |

| | 711 |

|

Taxes accrued | 43 |

| | 46 |

|

Interest accrued | 89 |

| | 85 |

|

Current regulatory liabilities | 80 |

| | 106 |

|

Other current liabilities | 379 |

| | 434 |

|

Liabilities of discontinued operations | 29 |

| | 33 |

|

Total current liabilities | 2,093 |

| | 2,249 |

|

Long-term Debt, Net | 6,880 |

| | 6,085 |

|

Deferred Credits and Other Liabilities: | | | |

Accumulated deferred income taxes, net | 3,885 |

| | 3,571 |

|

Accumulated deferred investment tax credits | 60 |

| | 64 |

|

Regulatory liabilities | 1,905 |

| | 1,850 |

|

Asset retirement obligations | 618 |

| | 396 |

|

Pension and other postretirement benefits | 580 |

| | 705 |

|

Other deferred credits and liabilities | 531 |

| | 514 |

|

Total deferred credits and other liabilities | 7,579 |

| | 7,100 |

|

Ameren Corporation Shareholders’ Equity: | | | |

Common stock | 2 |

| | 2 |

|

Other paid-in capital, principally premium on common stock | 5,616 |

| | 5,617 |

|

Retained earnings | 1,331 |

| | 1,103 |

|

Accumulated other comprehensive loss | (3 | ) | | (9 | ) |

Total Ameren Corporation shareholders’ equity | 6,946 |

| | 6,713 |

|

Noncontrolling Interests | 142 |

| | 142 |

|

Total equity | 7,088 |

| | 6,855 |

|

TOTAL LIABILITIES AND EQUITY | $ | 23,640 |

| | $ | 22,289 |

|

AMEREN CORPORATION (AEE)

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited, in millions)

|

| | | | | | | |

| Year Ended December 31, |

| 2015 | | 2014 |

Cash Flows From Operating Activities: | | | |

Net income | $ | 636 |

| | $ | 592 |

|

Loss (Income) from discontinued operations, net of tax | (51 | ) | | 1 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

Provision for Callaway construction and operating license | 69 |

| | — |

|

Depreciation and amortization | 777 |

| | 710 |

|

Amortization of nuclear fuel | 97 |

| | 81 |

|

Amortization of debt issuance costs and premium/discounts | 22 |

| | 22 |

|

Deferred income taxes and investment tax credits, net | 369 |

| | 451 |

|

Allowance for equity funds used during construction | (30 | ) | | (34 | ) |

Stock-based compensation costs | 24 |

| | 25 |

|

Other | (10 | ) | | (24 | ) |

Changes in assets and liabilities | 118 |

| | (267 | ) |

Net cash provided by operating activities – continuing operations | 2,021 |

| | 1,557 |

|

Net cash used in operating activities – discontinued operations | (4 | ) | | (6 | ) |

Net cash provided by operating activities | 2,017 |

| | 1,551 |

|

Cash Flows From Investing Activities: | | | |

Capital expenditures | (1,917 | ) | | (1,785 | ) |

Nuclear fuel expenditures | (52 | ) | | (74 | ) |

Purchases of securities – nuclear decommissioning trust fund | (363 | ) | | (405 | ) |

Sales and maturities of securities – nuclear decommissioning trust fund | 349 |

| | 391 |

|

Proceeds from note receivable – Illinois Power Marketing Company | 20 |

| | 95 |

|

Contributions to note receivable – Illinois Power Marketing Company | (8 | ) | | (89 | ) |

Other | 20 |

| | 11 |

|

Net cash used in investing activities – continuing operations | (1,951 | ) | | (1,856 | ) |

Net cash provided by (used in) investing activities – discontinued operations | (25 | ) | | 139 |

|

Net cash used in investing activities | (1,976 | ) | | (1,717 | ) |

Cash Flows From Financing Activities: | | | |

Dividends on common stock | (402 | ) | | (390 | ) |

Dividends paid to noncontrolling interest holders | (6 | ) | | (6 | ) |

Short-term debt, net | (413 | ) | | 346 |

|

Redemptions and maturities of long-term debt | (120 | ) | | (697 | ) |

Issuances of long-term debt | 1,197 |

| | 898 |

|

Capital issuance costs | (12 | ) | | (11 | ) |

Other | 2 |

| | 1 |

|

Net cash provided by financing activities – continuing operations | 246 |

| | 141 |

|

Net change in cash and cash equivalents | 287 |

| | (25 | ) |

Cash and cash equivalents at beginning of year | 5 |

| | 30 |

|

Cash and cash equivalents at end of year – continuing operations | $ | 292 |

| | $ | 5 |

|

AMEREN CORPORATION (AEE)

OPERATING STATISTICS FROM CONTINUING OPERATIONS

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Electric Sales - kilowatthours (in millions): | | | | | | | |

Ameren Missouri | | | | | | | |

Residential | 2,717 |

| | 3,170 |

| | 12,903 |

| | 13,649 |

|

Commercial | 3,320 |

| | 3,443 |

| | 14,574 |

| | 14,649 |

|

Industrial | 2,021 |

| | 2,089 |

| | 8,273 |

| | 8,600 |

|

Off-system | 1,870 |

| | 1,384 |

| | 7,380 |

| | 6,170 |

|

Other | 36 |

| | 35 |

| | 126 |

| | 124 |

|

Ameren Missouri total | 9,964 |

| | 10,121 |

| | 43,256 |

| | 43,192 |

|

Ameren Illinois | | | | | | | |

Residential | | | | | | | |

Power supply and delivery service | 1,034 |

| | 1,222 |

| | 4,797 |

| | 4,662 |

|

Delivery service only | 1,487 |

| | 1,591 |

| | 6,757 |

| | 7,222 |

|

Commercial | | | | | | | |

Power supply and delivery service | 663 |

| | 602 |

| | 2,837 |

| | 2,535 |

|

Delivery service only | 2,290 |

| | 2,413 |

| | 9,443 |

| | 9,643 |

|

Industrial | | | | | | | |

Power supply and delivery service | 259 |

| | 386 |

| | 1,589 |

| | 1,674 |

|

Delivery service only | 2,524 |

| | 2,656 |

| | 10,274 |

| | 10,576 |

|

Other | 130 |

| | 132 |

| | 524 |

| | 518 |

|

Ameren Illinois total | 8,387 |

| | 9,002 |

| | 36,221 |

| | 36,830 |

|

Eliminate affiliate sales | (179 | ) | | — |

| | (385 | ) | | (67 | ) |

Ameren Total from Continuing Operations | 18,172 |

| | 19,123 |

| | 79,092 |

| | 79,955 |

|

Electric Revenues (in millions): | | | | | | | |

Ameren Missouri | | | | | | | |

Residential | $ | 285 |

| | $ | 287 |

| | $ | 1,464 |

| | $ | 1,417 |

|

Commercial | 254 |

| | 247 |

| | 1,258 |

| | 1,203 |

|

Industrial | 99 |

| | 102 |

| | 469 |

| | 475 |

|

Off-system | 53 |

| | 36 |

| | 195 |

| | 173 |

|

Other | 27 |

| | 20 |

| | 84 |

| | 120 |

|

Ameren Missouri total | $ | 718 |

| | $ | 692 |

| | $ | 3,470 |

| | $ | 3,388 |

|

Ameren Illinois | | | | | | | |

Residential | | | | | | | |

Power supply and delivery service | $ | 113 |

| | $ | 115 |

| | $ | 495 |

| | $ | 468 |

|

Delivery service only | 75 |

| | 63 |

| | 363 |

| | 308 |

|

Commercial | | | | | | | |

Power supply and delivery service | 59 |

| | 53 |

| | 247 |

| | 233 |

|

Delivery service only | 50 |

| | 42 |

| | 227 |

| | 185 |

|

Industrial | | | | | | | |

Power supply and delivery service | 12 |

| | 19 |

| | 71 |

| | 87 |

|

Delivery service only | 13 |

| | 11 |

| | 53 |

| | 42 |

|

Other | 45 |

| | 57 |

| | 227 |

| | 199 |

|

Ameren Illinois total | $ | 367 |

| | $ | 360 |

| | $ | 1,683 |

| | $ | 1,522 |

|

ATXI | | | | | | | |

Transmission services | $ | 14 |

| | $ | 4 |

| | $ | 70 |

| | $ | 33 |

|

Other and intercompany eliminations | (12 | ) | | (7 | ) | | (43 | ) | | (30 | ) |

Ameren Total from Continuing Operations | $ | 1,087 |

| | $ | 1,049 |

| | $ | 5,180 |

| | $ | 4,913 |

|

AMEREN CORPORATION (AEE)

OPERATING STATISTICS FROM CONTINUING OPERATIONS

|

| | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Electric Generation - kilowatthours (in millions): | | | | | | |

Ameren Missouri | 9,648 |

| | 9,754 |

| | 42,424 |

| | 43,474 |

|

Fuel Cost per kilowatthour (in cents): | | | | | | | |

Ameren Missouri | 1.799 |

| | 1.962 |

| | 1.865 |

| | 1.928 |

|

Gas Sales - dekatherms (in thousands): | | | | | | | |

Ameren Missouri | 4,505 |

| | 5,504 |

| | 17,770 |

| | 19,054 |

|

Ameren Illinois | 41,539 |

| | 53,622 |

| | 165,157 |

| | 183,756 |

|

Ameren Total | 46,044 |

| | 59,126 |

| | 182,927 |

| | 202,810 |

|

| | | December 31, 2015 | | | | December 31, 2014 |

Common Stock: | | | | | | | |

Shares outstanding (in millions) | | | 242.6 |

| | | | 242.6 |

|

Book value per share | | | $ | 28.63 |

| | | | $ | 27.67 |

|

Capitalization Ratios: | | | | | | | |

Common equity | | | 48.3 | % | | | | 48.8 | % |

Preferred stock | | | 1.0 | % | | | | 1.0 | % |

Debt, net of cash | | | 50.7 | % | | | | 50.2 | % |

Exhibit 99.2

AMEREN CORPORATION (AEE)

CONSOLIDATED STATEMENT OF INCOME

(Unaudited, in millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Operating Revenues: | | | | | | | |

Electric | $ | 1,087 |

| | $ | 1,049 |

| | $ | 5,180 |

| | $ | 4,913 |

|

Gas | 221 |

| | 321 |

| | 918 |

| | 1,140 |

|

Total operating revenues | 1,308 |

| | 1,370 |

| | 6,098 |

| | 6,053 |

|

Operating Expenses: | | | | | | | |

Fuel | 208 |

| | 188 |

| | 878 |

| | 826 |

|

Purchased power | 121 |

| | 121 |

| | 514 |

| | 461 |

|

Gas purchased for resale | 95 |

| | 183 |

| | 415 |

| | 615 |

|

Other operations and maintenance | 438 |

| | 453 |

| | 1,694 |

| | 1,684 |

|

Provision for Callaway construction and operating license | — |

| | — |

| | 69 |

| | — |

|

Depreciation and amortization | 202 |

| | 194 |

| | 796 |

| | 745 |

|

Taxes other than income taxes | 104 |

| | 106 |

| | 473 |

| | 468 |

|

Total operating expenses | 1,168 |

| | 1,245 |

| | 4,839 |

| | 4,799 |

|

Operating Income | 140 |

| | 125 |

| | 1,259 |

| | 1,254 |

|

Other Income and Expenses: | | | | | | | |

Miscellaneous income | 20 |

| | 19 |

| | 74 |

| | 79 |

|

Miscellaneous expense | 8 |

| | 2 |

| | 30 |

| | 22 |

|

Total other income | 12 |

| | 17 |

| | 44 |

| | 57 |

|

Interest Charges | 91 |

| | 75 |

| | 355 |

| | 341 |

|

Income Before Income Taxes | 61 |

| | 67 |

| | 948 |

| | 970 |

|

Income Taxes | 30 |

| | 20 |

| | 363 |

| | 377 |

|

Income from Continuing Operations | 31 |

| | 47 |

| | 585 |

| | 593 |

|

Income (Loss) from Discontinued Operations, Net of Taxes | (1 | ) | | 2 |

| | 51 |

| | (1 | ) |

Net Income | 30 |

| | 49 |

| | 636 |

| | 592 |

|

Less: Net Income from Continuing Operations Attributable to Noncontrolling Interests | 1 |

| | 1 |

| | 6 |

| | 6 |

|

Net Income (Loss) Attributable to Ameren Common Shareholders: | | | | | | | |

Continuing Operations | 30 |

| | 46 |

| | 579 |

| | 587 |

|

Discontinued Operations | (1 | ) | | 2 |

| | 51 |

| | (1 | ) |

Net Income Attributable to Ameren Common Shareholders | $ | 29 |

| | $ | 48 |

| | $ | 630 |

| | $ | 586 |

|

Earnings per Common Share – Basic: | | | | | | | |

Continuing Operations | $ | 0.12 |

| | $ | 0.19 |

| | $ | 2.39 |

| | $ | 2.42 |

|

Discontinued Operations | — |

| | 0.01 |

| | 0.21 |

| | — |

|

Earnings per Common Share – Basic | $ | 0.12 |

| | $ | 0.20 |

| | $ | 2.60 |

| | $ | 2.42 |

|

| | | | | | | |

Earnings per Common Share – Diluted: | | | | | | | |

Continuing Operations | $ | 0.12 |

| | $ | 0.19 |

| | $ | 2.38 |

| | $ | 2.40 |

|

Discontinued Operations | — |

| | 0.01 |

| | 0.21 |

| | — |

|

Earnings per Common Share – Diluted | $ | 0.12 |

| | $ | 0.20 |

| | $ | 2.59 |

| | $ | 2.40 |

|

| | | | | | | |

Average Common Shares Outstanding – Basic | 242.6 |

| | 242.6 |

| | 242.6 |

| | 242.6 |

|

Average Common Shares Outstanding – Diluted | 243.0 |

| | 244.5 |

| | 243.6 |

| | 244.4 |

|

AMEREN CORPORATION (AEE)

CONSOLIDATED BALANCE SHEET

(Unaudited, in millions)

|

| | | | | | | |

| December 31, 2015 | | December 31, 2014 |

ASSETS | | | |

Current Assets: | | | |

Cash and cash equivalents | $ | 292 |

| | $ | 5 |

|

Accounts receivable - trade (less allowance for doubtful accounts) | 388 |

| | 423 |

|

Unbilled revenue | 239 |

| | 265 |

|

Miscellaneous accounts and notes receivable | 98 |

| | 81 |

|

Materials and supplies | 538 |

| | 524 |

|

Current regulatory assets | 260 |

| | 295 |

|

Other current assets | 88 |

| | 86 |

|

Assets of discontinued operations | 14 |

| | 15 |

|

Total current assets | 1,917 |

| | 1,694 |

|

Property and Plant, Net | 18,799 |

| | 17,424 |

|

Investments and Other Assets: | | | |

Nuclear decommissioning trust fund | 556 |

| | 549 |

|

Goodwill | 411 |

| | 411 |

|

Regulatory assets | 1,382 |

| | 1,582 |

|

Other assets | 575 |

| | 629 |

|

Total investments and other assets | 2,924 |

| | 3,171 |

|

TOTAL ASSETS | $ | 23,640 |

| | $ | 22,289 |

|

LIABILITIES AND EQUITY | | | |

Current Liabilities: | | | |

Current maturities of long-term debt | $ | 395 |

| | $ | 120 |

|

Short-term debt | 301 |

| | 714 |

|

Accounts and wages payable | 777 |

| | 711 |

|

Taxes accrued | 43 |

| | 46 |

|

Interest accrued | 89 |

| | 85 |

|

Current regulatory liabilities | 80 |

| | 106 |

|

Other current liabilities | 379 |

| | 434 |

|

Liabilities of discontinued operations | 29 |

| | 33 |

|

Total current liabilities | 2,093 |

| | 2,249 |

|

Long-term Debt, Net | 6,880 |

| | 6,085 |

|

Deferred Credits and Other Liabilities: | | | |

Accumulated deferred income taxes, net | 3,885 |

| | 3,571 |

|

Accumulated deferred investment tax credits | 60 |

| | 64 |

|

Regulatory liabilities | 1,905 |

| | 1,850 |

|

Asset retirement obligations | 618 |

| | 396 |

|

Pension and other postretirement benefits | 580 |

| | 705 |

|

Other deferred credits and liabilities | 531 |

| | 514 |

|

Total deferred credits and other liabilities | 7,579 |

| | 7,100 |

|

Ameren Corporation Shareholders’ Equity: | | | |

Common stock | 2 |

| | 2 |

|

Other paid-in capital, principally premium on common stock | 5,616 |

| | 5,617 |

|

Retained earnings | 1,331 |

| | 1,103 |

|

Accumulated other comprehensive loss | (3 | ) | | (9 | ) |

Total Ameren Corporation shareholders’ equity | 6,946 |

| | 6,713 |

|

Noncontrolling Interests | 142 |

| | 142 |

|

Total equity | 7,088 |

| | 6,855 |

|

TOTAL LIABILITIES AND EQUITY | $ | 23,640 |

| | $ | 22,289 |

|

AMEREN CORPORATION (AEE)

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited, in millions)

|

| | | | | | | |

| Year Ended December 31, |

| 2015 | | 2014 |

Cash Flows From Operating Activities: | | | |

Net income | $ | 636 |

| | $ | 592 |

|

Loss (Income) from discontinued operations, net of tax | (51 | ) | | 1 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

Provision for Callaway construction and operating license | 69 |

| | — |

|

Depreciation and amortization | 777 |

| | 710 |

|

Amortization of nuclear fuel | 97 |

| | 81 |

|

Amortization of debt issuance costs and premium/discounts | 22 |

| | 22 |

|

Deferred income taxes and investment tax credits, net | 369 |

| | 451 |

|

Allowance for equity funds used during construction | (30 | ) | | (34 | ) |

Stock-based compensation costs | 24 |

| | 25 |

|

Other | (10 | ) | | (24 | ) |

Changes in assets and liabilities | 118 |

| | (267 | ) |

Net cash provided by operating activities – continuing operations | 2,021 |

| | 1,557 |

|

Net cash used in operating activities – discontinued operations | (4 | ) | | (6 | ) |

Net cash provided by operating activities | 2,017 |

| | 1,551 |

|

Cash Flows From Investing Activities: | | | |

Capital expenditures | (1,917 | ) | | (1,785 | ) |

Nuclear fuel expenditures | (52 | ) | | (74 | ) |

Purchases of securities – nuclear decommissioning trust fund | (363 | ) | | (405 | ) |

Sales and maturities of securities – nuclear decommissioning trust fund | 349 |

| | 391 |

|

Proceeds from note receivable – Illinois Power Marketing Company | 20 |

| | 95 |

|

Contributions to note receivable – Illinois Power Marketing Company | (8 | ) | | (89 | ) |

Other | 20 |

| | 11 |

|

Net cash used in investing activities – continuing operations | (1,951 | ) | | (1,856 | ) |

Net cash provided by (used in) investing activities – discontinued operations | (25 | ) | | 139 |

|

Net cash used in investing activities | (1,976 | ) | | (1,717 | ) |

Cash Flows From Financing Activities: | | | |

Dividends on common stock | (402 | ) | | (390 | ) |

Dividends paid to noncontrolling interest holders | (6 | ) | | (6 | ) |

Short-term debt, net | (413 | ) | | 346 |

|

Redemptions and maturities of long-term debt | (120 | ) | | (697 | ) |

Issuances of long-term debt | 1,197 |

| | 898 |

|

Capital issuance costs | (12 | ) | | (11 | ) |

Other | 2 |

| | 1 |

|

Net cash provided by financing activities – continuing operations | 246 |

| | 141 |

|

Net change in cash and cash equivalents | 287 |

| | (25 | ) |

Cash and cash equivalents at beginning of year | 5 |

| | 30 |

|

Cash and cash equivalents at end of year – continuing operations | $ | 292 |

| | $ | 5 |

|

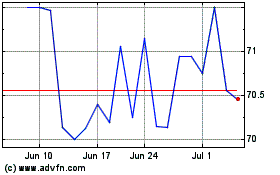

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

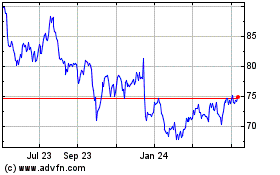

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024