Current Report Filing (8-k)

January 19 2016 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 8, 2016

|

|

|

|

|

| Commission File Number |

|

Exact Name of Registrant as

Specified in Charter; State

of Incorporation; Address and Telephone

Number |

|

IRS Employer Identification

Number |

|

|

|

| 1-14756 |

|

Ameren Corporation

(Missouri Corporation)

1901 Chouteau Avenue St.

Louis, Missouri 63103 (314) 621-3222 |

|

43-1723446 |

|

|

|

| 1-2967 |

|

Union Electric Company

(Missouri Corporation)

1901 Chouteau Avenue St.

Louis, Missouri 63103 (314) 621-3222 |

|

43-0559760 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Reference is made to Note 2 – Rate and Regulatory Matters to the

financial statements under Part I, Item 1, Financial Statements, and to Results of Operations and Outlook under Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations, each in the

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015, and to Note 2 – Rate and Regulatory Matters to the financial statements under Part II, Item 8, Financial Statements and Supplementary Data, in the Annual

Report on Form 10-K for the year ended December 31, 2014 (the “2014 Form 10-K”), of registrants Ameren Corporation (“Ameren”) and Union Electric Company, doing business as Ameren Missouri (“Ameren Missouri”), for a

discussion of Ameren Missouri’s July 2014 electric rate case filing and the April 2015 order issued by the Missouri Public Service Commission (“MoPSC”) in such rate case, as well as Ameren Missouri’s long-term power supply

agreement with Noranda Aluminum, Inc. (“Noranda”).

Ameren Missouri supplies electricity to Noranda’s aluminum smelter in

southeast Missouri. On January 8, 2016, Noranda announced that production had been idled at two of its three pot lines at the smelter following an electric supply circuit failure. The circuit failure did not occur on assets owned by Ameren

Missouri. The third pot line was not directly affected and that line’s production has continued. On January 13, 2016, Noranda announced that the smelter’s “remaining operations will be curtailed on or before March 12, 2016,

unless [Noranda] is able to secure a substantially more sustainable power rate for the smelter and materially improve [Noranda’s] overall liquidity.” Ameren Missouri has been working, well in advance of recent events, with Noranda,

legislators and other stakeholders on a potential legislative solution to support Noranda’s operations.

In its April 2015 electric

rate order, the MoPSC approved a rate design that established $78 million in annual revenues, net of fuel and purchased power costs, as Noranda’s portion of Ameren Missouri’s revenue requirement. The portion of Ameren Missouri’s

annual revenue requirement reflected in Noranda’s electric rate is based on the smelter using approximately 4.2 million megawatthours annually, which is approximately 100% of its operating capacity. Ameren Missouri’s rates, including

those for Noranda, are seasonal. Noranda’s summer base rate (June through September) is $45.78 per megawatthour and its winter base rate (October through May) is $31.11 per megawatthour.

To the extent actual sales volumes to Noranda are below the sales volumes reflected in rates due to operating, financial, or other

difficulties at Noranda, Ameren Missouri may not fully recover its revenue requirement until rates are adjusted by the MoPSC in a future electric rate case to accurately reflect Noranda’s actual sales volumes. In light of the Noranda

announcements described above, Ameren Missouri expects to employ a provision in its fuel adjustment clause (“FAC”) tariff that, under certain circumstances, allows Ameren Missouri to retain a portion of the revenues from any off-system

sales it makes as a result of the reduced tariff sales to Noranda. The current market price of electricity is less than Noranda’s electric rate, and Ameren Missouri expects market prices to remain below Noranda’s electric rate during 2016.

Accordingly, this FAC provision would not enable Ameren Missouri to fully cover its revenue requirement under current market conditions.

Ameren Missouri may request an accounting authority order from the MoPSC pursuant to which Ameren

Missouri could be allowed to seek additional revenue in a subsequent rate case for certain costs incurred but not contemporaneously recovered as a result of Noranda’s reduced operations. Although Ameren Missouri has not decided when to file its

next electric rate case, on January 11, 2016, Ameren Missouri filed a notice with the MoPSC which would enable Ameren Missouri to file a rate case after 60 days. If Ameren Missouri elects to file a rate case to request adjustment of its

electric rates to reflect Noranda’s actual sales volumes and mitigate the revenue shortfall, the proceedings in any such rate case would take place over a period of up to 11 months from the date of filing. Ameren Missouri will continue to

monitor Noranda’s sales volumes and evaluate its regulatory and legislative options to mitigate adverse financial impacts. If these efforts are not successful, the reduction in Noranda’s sales volumes would adversely affect Ameren’s

and Ameren Missouri’s results of operations, financial condition, and liquidity until customer rates are adjusted in a future rate case.

Forward-Looking Statements

Statements in this report not based on historical facts are considered “forward-looking” and, accordingly, involve risks and

uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results

will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions, and financial performance. In connection with the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause actual results to differ materially from those anticipated. The following factors, in addition to those

discussed under Risk Factors in the 2014 Form 10-K, and elsewhere in this report and in our other filings with the Securities and Exchange Commission, could cause actual results to differ materially from management expectations suggested in such

forward-looking statements:

| |

• |

|

regulatory, judicial, or legislative actions, including changes in regulatory policies and ratemaking determinations, and future regulatory, judicial, or legislative actions that seek to change regulatory recovery

mechanisms; |

| |

• |

|

our ability to align our overall spending, both operating and capital, with regulatory frameworks established by our regulators in an attempt to earn our allowed return on equity; |

| |

• |

|

changes in laws and other governmental actions, including monetary, fiscal, tax, and energy policies; |

| |

• |

|

the timing of increasing capital expenditure and operating expense requirements and our ability to recover these costs in a timely manner; |

| |

• |

|

the cost and availability of fuel such as coal, natural gas, and enriched uranium used to produce electricity; the cost and availability of purchased power and natural gas for distribution; and the level and volatility

of future market prices for such commodities, including our ability to recover the costs for such commodities and our customers’ tolerance for the related rate increases; |

| |

• |

|

business and economic conditions, including their impact on key customers, interest rates, collection of our receivable balances, and demand for our products; |

| |

• |

|

the financial condition of Noranda and the impact of the current and any future significant reductions in the sales volumes used by its aluminum smelter in southeast Missouri below the sales volumes assumed in

determining Ameren Missouri’s electric rates; |

| |

• |

|

revisions to Ameren Missouri’s long-term power supply agreement with Noranda, including Ameren Missouri’s notification to terminate the agreement effective June 1, 2020 and Ameren Missouri’s decision

whether to seek MoPSC approval to cease providing electricity to Noranda thereafter; |

| |

• |

|

disruptions of the capital markets, deterioration in credit metrics of the Ameren companies, or other events that may have an adverse effect on the cost or availability of capital, including short-term credit and

liquidity; |

| |

• |

|

the impact of weather conditions and other natural phenomena on us and our customers, including the impact of system outages; |

| |

• |

|

the impact of current environmental regulations and new, more stringent, or changing requirements, including those related to greenhouse gases, other emissions and discharges, cooling water intake structures, coal

combustion residuals, and energy efficiency, that are enacted over time and that could limit or terminate the operation of certain of our energy centers, increase our costs or investment requirements, result in an impairment of our assets, cause us

to sell our assets, reduce our customers’ demand for electricity or natural gas, or otherwise have a negative financial effect; |

| |

• |

|

legal and administrative proceedings; and |

| |

• |

|

acts of sabotage, war, terrorism, cyber attacks, or other intentionally disruptive acts. |

New

factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained or implied in any forward-looking statement. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. Except to the extent required by the federal

securities laws, we undertake no obligation to update or revise publicly any forward-looking statements to reflect new information or future events.

This combined

Form 8-K is being filed separately by Ameren Corporation and Union Electric Company. Information contained herein relating to any individual registrant has been filed by such registrant on its own behalf. No registrant makes any representation as to

information relating to any other registrant.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized. The signature for each undersigned company shall be deemed to relate only to matters having reference to such company or its subsidiaries.

|

|

|

| AMEREN CORPORATION |

| (Registrant) |

|

|

| By: |

|

/s/ Martin J. Lyons, Jr. |

| Name: |

|

Martin J. Lyons, Jr. |

| Title: |

|

Executive Vice President and Chief Financial Officer |

|

| UNION ELECTRIC COMPANY |

| (Registrant) |

|

|

| By: |

|

/s/ Michael L. Moehn |

| Name: |

|

Michael L. Moehn |

| Title: |

|

Chairman and President |

Date: January 19, 2016

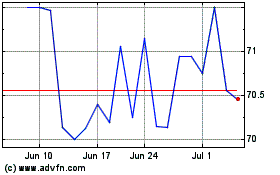

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

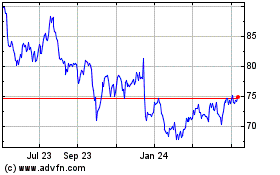

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024