UNITED STATES

SECURITIES AND EXCHANGE COMMISISION

WASHINGTON, DC 20549

FORM 11-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 1-14756

| A. |

Full title of the plan and the address of the plan, if different from that of the issuer named below: |

AMEREN CORPORATION

SAVINGS INVESTMENT PLAN

| B. |

Name of issuer of securities held pursuant to the plan and the address of its principal executive office: |

Ameren Corporation

1901 Chouteau Avenue

St. Louis, Missouri 63103

Ameren Corporation

Savings Investment Plan

Financial Statements and Supplemental Schedule

December 31, 2014 and 2013

Ameren Corporation

Savings Investment Plan

Index

| * |

Other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income

Security Act of 1974 (“ERISA”), as amended, have been omitted because they are not applicable. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and Administrator of the

Ameren Corporation Savings Investment Plan

St. Louis, Missouri

We have audited the accompanying statements of net assets available for benefits of the Ameren Corporation Saving Investment Plan as of December 31,

2014 and 2013 and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present

fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013 and the changes in net assets available for benefits for the years then ended in conformity with U.S. generally accepted

accounting principles.

The supplemental Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2014 has

been subjected to audit procedures performed in conjunction with the audit of the Ameren Corporation Saving Investment Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit

procedures included determining whether the information presented in the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness

and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the

Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated in all material respects in relation to the financial

statements as a whole.

|

|

| /s/ Crowe Horwath LLP |

| Crowe Horwath LLP |

South Bend, Indiana

June 26, 2015

Ameren Corporation

Savings Investment Plan

Statements of Net Assets Available for

Benefits

December 31, 2014 and 2013

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Investments at fair value (Notes 3 and 4) |

|

$ |

1,986,811,183 |

|

|

$ |

1,883,823,892 |

|

| Cash |

|

|

1,376,760 |

|

|

|

649,966 |

|

|

|

|

| Receivables |

|

|

|

|

|

|

|

|

| Notes receivable from participants |

|

|

34,286,429 |

|

|

|

34,168,061 |

|

| Participant contributions |

|

|

1,207,220 |

|

|

|

977,076 |

|

| Employer contributions |

|

|

408,803 |

|

|

|

341,156 |

|

| Dividends and interest |

|

|

543,657 |

|

|

|

168,492 |

|

| Due from brokers for securities sold |

|

|

2,572,524 |

|

|

|

9,798,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total receivables |

|

|

39,018,633 |

|

|

|

45,453,708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

2,027,206,576 |

|

|

|

1,929,927,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Accrued expenses |

|

|

512,195 |

|

|

|

526,670 |

|

| Due to brokers for securities purchased |

|

|

2,737,609 |

|

|

|

8,465,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

3,249,804 |

|

|

|

8,992,131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets reflecting all investments at fair value |

|

|

2,023,956,772 |

|

|

|

1,920,935,435 |

|

|

|

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(671,952 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits |

|

$ |

2,023,284,820 |

|

|

$ |

1,920,935,435 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

2

Ameren Corporation

Savings Investment Plan

Statements of Changes in Net Assets

Available for Benefits

Years Ended December 31, 2014 and 2013

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Additions: |

|

|

|

|

|

|

|

|

| Investment income |

|

|

|

|

|

|

|

|

| Interest and dividends |

|

$ |

19,487,310 |

|

|

$ |

17,354,784 |

|

| Net appreciation in fair value of investments (Note 3) |

|

|

133,252,528 |

|

|

|

296,520,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment income |

|

|

152,739,838 |

|

|

|

313,875,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on notes receivable from participants |

|

|

1,360,540 |

|

|

|

1,380,670 |

|

| Participant contributions |

|

|

75,475,166 |

|

|

|

77,742,838 |

|

| Employer contributions |

|

|

27,956,504 |

|

|

|

28,722,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total additions |

|

|

257,532,048 |

|

|

|

421,722,230 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deductions: |

|

|

|

|

|

|

|

|

| Benefits paid to participants |

|

|

151,955,091 |

|

|

|

108,842,718 |

|

| Administrative expenses (Note 6) |

|

|

3,227,572 |

|

|

|

2,955,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deductions |

|

|

155,182,663 |

|

|

|

111,797,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase |

|

|

102,349,385 |

|

|

|

309,924,446 |

|

|

|

|

| Net assets available for benefits |

|

|

|

|

|

|

|

|

| Beginning of year |

|

|

1,920,935,435 |

|

|

|

1,611,010,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| End of year |

|

$ |

2,023,284,820 |

|

|

$ |

1,920,935,435 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| 1. |

Description of the Plan |

General

The following is a summary of the various provisions of the Ameren Corporation Savings Investment Plan (the “Plan”).

Participants should refer to the Plan document for more complete information.

The Plan is a defined contribution plan. Its

purpose is to provide employees eligible to participate (the “Participants”) of Ameren Corporation (the “Company”) and its wholly owned subsidiaries the option to defer a portion of their compensation for federal income tax

purposes in accordance with Section 401(k) of the Internal Revenue Code (the “Code”). The Plan is subject to certain provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended, and regulations of

the Securities and Exchange Commission.

The Company serves as sponsor of the Plan, and, consequently, has the authority to

amend or terminate the Plan subject to certain restrictions. The Board of Directors of the Company has the authority and responsibility for the general administration of the Plan. Fidelity Management Trust Company, as Trustee, has the authority and

responsibility to hold and protect the assets of the Plan in accordance with Plan provisions and with the Trust and Administrative Agreement.

Participation

All regular full-time employees are eligible to participate

upon employment, and part-time or temporary employees are eligible to participate upon completion of a year of service of at least 1,000 hours. Employees covered by a collective bargaining agreement (“CBA”) are eligible to participate only

if the CBA provides for such participation.

If employees do not make an election, nor opt-out within 30 days of employment;

they are automatically enrolled at a 6% pre-tax contribution rate, invested in a Target Date fund based upon the date at which the participant is or will be age 65, and further enrolled in auto-escalation increasing their pre-tax contribution 1%

annually. Employees may opt-out or make alternative elections at any time.

Contributions

Each year, Participants may contribute up to 100% of eligible compensation, as defined in the Plan, and subject to annual limitations

imposed by the Code.

The Company makes an Employer Basic Matching Contribution plus an Employer Additional Matching

Contribution in an amount equal to a percent of the amount each Participant contributes to the Plan, up to a certain maximum percentage of the Participant’s compensation that he or she elects to contribute to the Plan each year. The amount of

Company matching contribution depends on the Participant’s employment classification, and for contract employees is determined by the collective bargaining agreement with the specific union representing the Participants. The Company also makes

true-up Employer Basic Matching Contributions for Participants who contribute the IRS maximum before the end of the year and, as a result, do not receive the full company match. The Employer Additional Matching Contributions are invested in the

Ameren Stock Fund.

4

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The Plan permits “catch-up” contributions for all employees age 50 and older.

Eligible employees could contribute $5,500 in 2014 and 2013 as a “catch-up” contribution. The Company does not match “catch-up” contributions.

Participants direct the investment of their contributions and the Employer Basic Matching Contributions to his or her account to any of the investment options available under the Plan, including Company

stock. Contributions may be allocated to a single investment option or allocated in increments of one percent to any combination of investment options. Such elections may be changed daily.

Earnings derived from the assets of any investment fund are reinvested in the fund to which they relate. Participants may elect daily to

reallocate, by actual dollar or percentage in one percent increments, the value of their accounts between funds. Pending investment of the assets into any investment fund, the Trustee may temporarily make certain short-term investments.

Participant Accounts

Each Participant’s account is credited with the Participant’s contributions and an allocation of (a) the Company’s contributions, and (b) Plan earnings, and is charged with an

allocation of administrative expenses. Allocations are based on Participant contributions, eligible compensation, Participant account balances, or specific Participant transactions, as defined. The benefit to which the Participant is entitled is the

benefit which can be provided from the Participant’s account. Each Participant directs the investment of his or her account to any of the investment options available under the Plan.

Notes Receivable from Participants

The Plan permits Participants to borrow from their accounts within the Plan. Such borrowings may be made subject to the following: (1) the minimum amount of the loan is $1,000, (2) the amount of

the loan may not exceed the lesser of $50,000 or 50% of the vested amount in the Participant’s account, (3) the loan will bear a fixed interest rate and repayments will be made through mutual agreement subject to certain statutory

repayment time limits, (4) each loan shall bear a reasonable interest rate as determined under policies established for the Plan and (5) such other rules and regulations as may be adopted by the Company. At December 31, 2014 and 2013,

the interest rates on participant loans ranged from 4.00 percent to 10.50 percent.

Vesting

The amounts in Participants’ accounts, including Company contributions, are fully vested at all times.

Payment of Benefits

The total amount of a Participant’s account shall be distributed to the Participant according to one of the options as described in the Plan document and as elected by the Participant after

termination of employment. All distributions shall be in the form of cash except that Participants may elect to have his or her interest in the Ameren Stock Fund distributed in shares of Ameren common stock. Participants may withdraw certain basic

contributions, rollover contributions and related earnings thereon upon reaching age 59 1/2, in the event of total disability or financial hardship as defined by the Plan or the Code. For purposes of distributions, the Participant’s account

value will be determined as of the last business day coincident with or immediately preceding the day of distribution. Contributions to the Plan and investment income thereon are taxable to Participants upon distribution pursuant to the rules

provided for under the Plan and the Code.

5

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The Plan also allows, at the discretion of the Company, participants of the former Union

Electric Company Employee Stock Ownership Plan and the former Ameren Corporation Employee Stock Ownership Plan for Certain Employees of AmerenCIPS, to receive certain distributions prior to termination of employment.

Plan Termination

The Company intends to continue the Plan indefinitely. However, the Company may at any time and for any reason, subject to ERISA and Internal Revenue Service regulations, suspend or terminate the Plan

provided that such action does not retroactively adversely affect the rights of any Participant under the Plan.

| 2. |

Summary of Significant Accounting Policies |

Basis of Accounting

The accompanying financial statements of the Plan are

prepared on the accrual basis of accounting, except that benefit payments to Participants are recorded upon distribution.

Through its investment in a stable value separate account, and prior to February 3, 2014, a stable value collective trust, the Plan

has invested in fully benefit-responsive investment contracts. Investment contracts held by defined-contribution plans are required to be reported at fair value. However, contract value is the relevant measurement attribute for that portion of the

net assets available for benefits of a defined-contribution plan attributable to fully benefit-responsive investment contracts, as contract value is the amount Participants would receive if they were to initiate permitted transactions under the

terms of the Plan. Contract value represents contributions made to a contract, plus earnings, less participant withdrawals and administrative expenses. On December 9, 2013, in conjunction with the announcement to terminate the stable value

collective trust, the investment contracts held in the collective trust were terminated and the underlying assets were liquidated and invested in a money market fund. Therefore, at December 31, 2013, no adjustment from fair value to contract

value is presented in the Statement of Net Assets Available for Benefits. On February 3, 2014, the Plan liquidated its investment in the stable value collective trust and invested in a stable value separate account. Thus, as of

December 31, 2014, the Statement of Net Assets Available for Benefits presents the fair value of the fully benefit-responsive investment contracts, as well as the adjustment of investment contracts from fair value to contract value.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of changes in net assets available for benefits during the reporting period. Actual

results could differ from those estimates.

6

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

Investment Valuation and Income Recognition

All investments are presented at fair value as of December 31, 2014 and 2013. Fair value is the price that would be received to sell

an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 4 for discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Net appreciation in fair value

of investments includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants

Notes receivable from Participants are measured at their unpaid principal balance plus any accrued but unpaid interest, with no allowance for credit losses, as repayments of principal and interest are

received through payroll deductions and the notes are collateralized by the Participants’ account balances. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Administrative Expenses

Fees associated with administering the Plan are generally paid by the Plan. Trustee and recordkeeping fees are primarily paid via (1) revenue sharing payments (payments made directly from investment

managers to the recordkeeper), (2) fees accrued in the investment funds that do not pay revenue sharing, and (3) flat dollar fees that are assessed to all Participants quarterly.

Risks and Uncertainties

Investment securities are exposed to various risks, such as interest rate, market and credit. Due to the level of risk associated with certain investment securities and the level of uncertainty related to

changes in the value of investment securities, it is at least reasonably possible that changes in risks in the near term could materially affect the amounts reported in the Statement of Net Assets Available for Benefits.

Concentrations

Company common stock comprised 12% and 11% of investments at December 31, 2014 and December 31, 2013, respectively.

7

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The

following table presents investments of the Plan at December 31, 2014 and 2013, respectively:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Investments at Fair Value |

|

|

|

|

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

| Ameren Corporation(1) |

|

$ |

248,306,627 |

|

|

$ |

203,615,803 |

|

| Jennison Large Cap Growth Equity Portfolio(2) |

|

|

91,969,971 |

|

|

|

87,038,886 |

|

| William Blair Small/Mid Cap Growth Portfolio(2) |

|

|

52,197,747 |

|

|

|

56,134,793 |

|

| Columbus Circle Small/Mid Cap Growth Portfolio(2) |

|

|

43,131,102 |

|

|

|

48,055,498 |

|

| Investment Contracts |

|

|

|

|

|

|

|

|

| Galliard Stable Value Portfolio(1)(3) |

|

|

271,318,703 |

|

|

|

– |

|

| Managed Domestic Equity Funds |

|

|

|

|

|

|

|

|

| BlackRock Equity Index Fund(1)(4) |

|

|

216,739,324 |

|

|

|

185,113,320 |

|

| BlackRock Russell 2500 NL Fund(1)(4) |

|

|

138,419,624 |

|

|

|

134,604,063 |

|

| AllianzGI NFJ Dividend Value CIT(1)(4) |

|

|

138,865,150 |

|

|

|

126,067,370 |

|

| NWQ Small/Mid Cap Value Fund(4) |

|

|

79,241,954 |

|

|

|

86,627,893 |

|

| Touchstone Sands Capital Institutional Growth Fund(5) |

|

|

50,151,187 |

|

|

|

47,753,206 |

|

| Managed International Equity Funds |

|

|

|

|

|

|

|

|

| American Funds EuroPacific Growth Fund(1)(5) |

|

|

122,967,205 |

|

|

|

135,585,724 |

|

| BlackRock MSCI ACWI ex-US IMI Index NL Fund(4) |

|

|

46,952,719 |

|

|

|

34,969,961 |

|

| Managed Stable Value Fund |

|

|

|

|

|

|

|

|

| Northern Trust Company Collective Stable Asset Fund(1)(4)(6) |

|

|

– |

|

|

|

329,987,916 |

|

| Managed Fixed Income Funds |

|

|

|

|

|

|

|

|

| PIMCO Total Return Fund(5) |

|

|

73,200,714 |

|

|

|

76,347,473 |

|

| BlackRock US Debt Index NL Fund(4) |

|

|

38,198,496 |

|

|

|

19,476,360 |

|

| BlackRock TIPS Bond Index Fund(4) |

|

|

15,630,986 |

|

|

|

15,383,178 |

|

| Fidelity Management Trust Co. Institutional Cash Portfolio(5) |

|

|

23,665,552 |

|

|

|

753,684 |

|

| Managed Target Retirement Funds |

|

|

|

|

|

|

|

|

| BlackRock LifePath Index NL 2020 Fund(4) |

|

|

90,104,434 |

|

|

|

75,592,791 |

|

| BlackRock LifePath Index NL 2025 Fund(4) |

|

|

68,739,236 |

|

|

|

60,287,860 |

|

| BlackRock LifePath Index NL 2030 Fund(4) |

|

|

45,847,351 |

|

|

|

38,412,030 |

|

| BlackRock LifePath Index NL 2015 Fund(4) |

|

|

– |

|

|

|

36,768,758 |

|

| BlackRock LifePath Index NL 2035 Fund(4) |

|

|

23,818,265 |

|

|

|

18,864,527 |

|

| BlackRock LifePath Index NL 2040 Fund(4) |

|

|

21,325,453 |

|

|

|

17,117,021 |

|

| BlackRock LifePath Index NL 2045 Fund(4) |

|

|

17,629,758 |

|

|

|

14,366,532 |

|

| BlackRock LifePath Index NL Retirement Fund(4) |

|

|

44,158,903 |

|

|

|

13,497,446 |

|

| BlackRock LifePath Index NL 2050 Fund(4) |

|

|

15,642,916 |

|

|

|

12,082,270 |

|

| BlackRock LifePath Index NL 2055 Fund(4) |

|

|

6,928,616 |

|

|

|

4,369,855 |

|

| Overnight Deposit Instrument |

|

|

|

|

|

|

|

|

| BBH&Co. Cash Management Service |

|

|

1,659,190 |

|

|

|

4,949,674 |

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

$ |

1,986,811,183 |

|

|

$ |

1,883,823,892 |

|

|

|

|

|

|

|

|

|

|

8

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| |

(1) |

Investments that represent 5% or more of the Plan’s net assets at December 31, 2014 and December 31, 2013. |

| |

(2) |

This portfolio is structured as a separate account and holds individual equity securities. |

| |

(3) |

This portfolio holds individual investment contracts, which include synthetic guaranteed investment contracts (“synthetic GICs”) and separate account

guaranteed investment contracts (“separate account GICs”) that have collective trusts and pooled separate accounts as underlying investments, respectively. |

| |

(4) |

This managed account is structured as a collective trust. |

| |

(5) |

This managed account is structured as a mutual fund. |

| |

(6) |

As of December 31, 2013, the Northern Trust Company Collective Stable Asset Fund had terminated its investment contracts and the underlying assets were invested in

a money market fund. |

During 2014 and 2013, the Plan’s investments (including investments bought, sold, and

held during the year) appreciated/(depreciated) in value as follows:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Net appreciation (depreciation) |

|

|

|

|

|

|

|

|

|

|

|

| Collective Investment Trusts |

|

$ |

67,449,298 |

|

|

$ |

184,207,306 |

|

| Common Stocks |

|

|

69,975,637 |

|

|

|

84,363,075 |

|

| Pooled Separate Accounts |

|

|

1,018,685 |

|

|

|

– |

|

| Mutual Funds |

|

|

(5,191,092 |

) |

|

|

27,950,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net appreciation in fair value of investments |

|

$ |

133,252,528 |

|

|

$ |

296,520,990 |

|

|

|

|

|

|

|

|

|

|

| 4. |

Fair Value Measurements |

The authoritative guidance issued by the FASB regarding fair value measurement provides a framework for measuring fair value for all

assets and liabilities that are measured and reported at fair value. The guidance defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous

market for the asset or liability in an orderly transaction between market participants on the measurement date. Certain assumptions that market participants would use in pricing the asset or liability, including assumptions about risk or the risks

inherent in the inputs to the valuation, were used in the valuation process. Inputs to valuation can be readily observable, market corroborated, or unobservable. Valuation techniques that maximize the use of observable inputs and minimize the use of

unobservable inputs were used. The provisions also establish a fair value hierarchy that prioritizes the inputs used to measure fair value. All financial assets and liabilities carried at fair value were classified in one of the following three

hierarchy levels:

Level 1: Inputs based on quoted prices in active markets for identical assets or liabilities that the Plan

has the ability to access at the reporting date.

Level 2: Inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly or indirectly. Inputs to the valuation methodology include:

| |

• |

|

Quoted prices for similar assets or liabilities in active markets; |

| |

• |

|

Quoted prices for identical or similar assets or liabilities in inactive markets; |

9

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| |

• |

|

Inputs other than quoted prices that are observable for the asset or liability; |

| |

• |

|

Inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

Level 3: Inputs to the valuation methodology that are unobservable and significant to the fair value measurement.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that

is significant to the fair value measurement.

Following is a description of the valuation methodologies used for assets

measured at fair value.

There have been no changes in the methodologies used during 2014.

| |

• |

|

Common stocks: Valued at the closing price reported on the active markets on which the individual securities are traded (Level 1 inputs).

|

| |

• |

|

Mutual funds: Valued at the daily closing price as reported by the fund (Level 1 inputs). Mutual funds held by the Plan are open-end mutual funds that

are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (NAV) and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

|

| |

• |

|

Collective trust funds, excluding the stable value collective trust fund: Valued at the NAV of a bank collective trust. The NAV, as provided by the

trustee, is used as a practical expedient to estimate fair value. The NAV is based on the underlying investments held by the fund less its liabilities (Level 2 inputs). This practical expedient is not used when it is determined to be probable that

the fund will sell the investment for an amount different than the reported NAV. Under ordinary market conditions, redemptions of investments in collective trusts are permitted as of daily or monthly valuation dates, as applicable, and are executed

at NAV. The investment objective of each of the equity trusts is to track the performance or outperform one of the following indices: the S&P 500 Index, the Russell 1000 Value Index, the Russell 2500 Index, the Russell 2500 Value Index, and the

MSCI All Country World Ex-US IMI Index. The investment objective of each of the fixed income trusts is to track the performance or outperform one of the following indices: the Barclays U.S. Aggregate Bond Index, the Barclays U.S. TIPS Index, The

Barclays 1-3 Year Government Index, the Barclays Intermediate Aggregate Index, and the Barclays 3 Year Treasury Bellwether Index + 75. The investment objective of each of the target retirement trusts is to provide exposure to markets from around the

world in one fund, with each fund becoming more conservative as it moves toward its target date. |

| |

• |

|

Stable value collective trust fund: The fair values of participation units in the stable value collective trust fund were based upon the net asset

values of such fund, after adjustments to reflect all fund investments at fair value, including any direct and indirect interests in fully benefit-responsive contracts, as reported in the audited financial statements of the fund as of the

Plan’s financial statement date (Level 2 inputs). The fund generally provided for daily redemptions by the Plan at reported net asset value per share with no advance notice

|

10

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| |

requirements. If the Plan requested a full redemption of its interest in the fund, the collective trust provided for payment within 12 months following the redemption request. See Note 2 for a

discussion of the fund’s termination of the fully benefit-responsive contracts in December 2013. Through December 9, 2013, the fund invested in conventional and synthetic investment contracts issued by life insurance companies, banks, and

other financial institutions, with the objective of providing a competitive, short-term total rate of return while preserving the safety of capital and limiting market risk. Beginning December 10, 2013, in preparation for the fund’s

termination, all fund assets were invested in a money market fund. The Plan liquidated its interest in the stable value collective trust fund on February 3, 2014. |

| |

• |

|

Investment contracts: The fair values of investment contracts are based on the cumulative fair value of the wrapper contracts and the underlying

portfolios. The Plan invests in two types of investment contracts: synthetic GICs and separate account GICs. Synthetic GICs are comprised of two components: (1) wrapper contracts issued by a financial institution and

(2) collective trust funds which hold fixed income investments whose market prices fluctuate. The fair values of the wrapper contracts are the present values of the difference between the wrapper fees the issuer would charge (i.e., fees re-bid

as of year-end provided by the issuer for accounting purposes) and the contracted wrapper fees currently being charged (Level 2 inputs). Units of collective trust funds are valued at NAV, as previously described. Separate account GICs

are comprised of two components: (1) wrapper contracts issued by an insurance company and (2) pooled separate accounts which hold segregated portfolios of fixed income securities whose market prices fluctuate. The fair values of wrapper

contracts are the present values of the difference between the wrapper fees the issuer would charge (i.e., fees re-bid as of year-end provided by the issuer for accounting purposes) and the contracted wrapper fees currently being charged (Level 2

inputs). The pooled separate accounts are valued daily by the insurance company. The NAV, as provided by the insurance company, is used as a practical expedient to estimate fair value. The NAV is based on the underlying investments held less its

liabilities (Level 2 inputs). Under ordinary market conditions, redemptions of investments in pooled separate accounts are permitted as of daily or monthly valuation dates, as applicable, and are executed at NAV. |

| |

• |

|

Overnight deposit instrument: The fair value is estimated to approximate deposit account balances, payable on demand, as no discounts for credit

quality or liquidity were determined to be applicable (Level 2 inputs). |

11

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The following table sets forth, by level within the fair value hierarchy, Plan assets

measured at fair value on a recurring basis as of December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quoted Prices In

Active Markets for

Identified Assets

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant

Other

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US large capitalization - Plan sponsor stock |

|

$ |

248,306,627 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

248,306,627 |

|

| US large capitalization - other |

|

|

91,969,971 |

|

|

|

– |

|

|

|

– |

|

|

|

91,969,971 |

|

| US small and mid-capitalization |

|

|

95,328,849 |

|

|

|

– |

|

|

|

– |

|

|

|

95,328,849 |

|

| Mutual funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic equity funds |

|

|

50,151,187 |

|

|

|

– |

|

|

|

– |

|

|

|

50,151,187 |

|

| International equity funds |

|

|

122,967,205 |

|

|

|

– |

|

|

|

– |

|

|

|

122,967,205 |

|

| Fixed income funds |

|

|

96,866,266 |

|

|

|

– |

|

|

|

– |

|

|

|

96,866,266 |

|

| Collective trust funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic equity funds - indexed |

|

|

– |

|

|

|

355,158,948 |

|

|

|

– |

|

|

|

355,158,948 |

|

| Domestic equity funds - actively managed |

|

|

– |

|

|

|

218,107,104 |

|

|

|

– |

|

|

|

218,107,104 |

|

| International equity funds |

|

|

– |

|

|

|

46,952,719 |

|

|

|

– |

|

|

|

46,952,719 |

|

| Fixed income funds |

|

|

– |

|

|

|

228,205,708 |

|

|

|

– |

|

|

|

228,205,708 |

|

| Target retirement date funds |

|

|

– |

|

|

|

334,194,932 |

|

|

|

– |

|

|

|

334,194,932 |

|

| Pooled separate accounts - fixed income |

|

|

– |

|

|

|

96,925,104 |

|

|

|

– |

|

|

|

96,925,104 |

|

| Overnight deposit instrument |

|

|

– |

|

|

|

1,659,190 |

|

|

|

– |

|

|

|

1,659,190 |

|

| Investment contract |

|

|

– |

|

|

|

17,373 |

|

|

|

– |

|

|

|

17,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

705,590,105 |

|

|

$ |

1,281,221,078 |

|

|

$ |

– |

|

|

$ |

1,986,811,183 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table sets forth, by level within the fair value hierarchy, Plan assets measured at fair

value on a recurring basis as of December 31, 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quoted Prices In

Active Markets for

Identified Assets

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant Other

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US large capitalization - Plan sponsor stock |

|

$ |

203,615,803 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

203,615,803 |

|

| US large capitalization - other |

|

|

87,038,886 |

|

|

|

– |

|

|

|

– |

|

|

|

87,038,886 |

|

| US small and mid-capitalization |

|

|

104,190,291 |

|

|

|

– |

|

|

|

– |

|

|

|

104,190,291 |

|

| Mutual funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic equity funds |

|

|

47,753,206 |

|

|

|

– |

|

|

|

– |

|

|

|

47,753,206 |

|

| International equity funds |

|

|

135,585,724 |

|

|

|

– |

|

|

|

– |

|

|

|

135,585,724 |

|

| Fixed income funds |

|

|

77,101,157 |

|

|

|

– |

|

|

|

– |

|

|

|

77,101,157 |

|

| Collective trust funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic equity funds - indexed |

|

|

– |

|

|

|

319,717,383 |

|

|

|

– |

|

|

|

319,717,383 |

|

| Domestic equity funds - actively managed |

|

|

– |

|

|

|

212,695,263 |

|

|

|

– |

|

|

|

212,695,263 |

|

| International equity funds |

|

|

– |

|

|

|

34,969,961 |

|

|

|

– |

|

|

|

34,969,961 |

|

| Stable asset fund |

|

|

– |

|

|

|

329,987,916 |

|

|

|

– |

|

|

|

329,987,916 |

|

| Fixed income funds |

|

|

– |

|

|

|

34,859,538 |

|

|

|

– |

|

|

|

34,859,538 |

|

| Target retirement date funds |

|

|

– |

|

|

|

291,359,090 |

|

|

|

– |

|

|

|

291,359,090 |

|

| Overnight Deposit Instrument |

|

|

– |

|

|

|

4,949,674 |

|

|

|

– |

|

|

|

4,949,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

655,285,067 |

|

|

$ |

1,228,538,825 |

|

|

$ |

– |

|

|

$ |

1,883,823,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The Plan does not hold any investments requiring Level 3 measurements, and there have

not been any transfers between measurement input levels in 2014 or 2013.

In

February 2014, the Plan invested in a stable value separate account managed by Galliard Capital Management (“Galliard”). The separate account holds an investment in a money market mutual fund and investment contracts issued by the

following insurance companies:

| |

• |

|

American General Life Insurance Company (“AGL”) |

| |

• |

|

Prudential Insurance Company of America (“Prudential”) |

| |

• |

|

New York Life Insurance Company (“NYL”) |

| |

• |

|

Massachusetts Mutual Life Insurance Company (“Mass Mutual”) |

| |

• |

|

Metropolitan Life Insurance Company (Met Life”) |

The investment contracts with AGL, Prudential, and NYL are generally referred to as security-backed investment contracts and the underlying investments of these contracts are units of collective trust

funds. The investment contracts with Mass Mutual and Met Life are generally referred to as separate account GICs and the underlying investments of these contracts are segregated portfolios of fixed income securities.

The interest crediting rates of the investment contracts are based on the contract values, and the fair value, duration, and yield to

maturity of the underlying portfolios. These contracts allow for realized and unrealized gains and losses on the underlying assets to be amortized over the duration of the underlying investments, through adjustments to the future interest crediting

rate. Also, the net crediting rate reflects fees paid to investment contract issuers, the contracts are designed to reset their respective crediting rates on a quarterly basis although they can be reset at other times based on portfolio activity or

allocation, and the contracts cannot credit an interest rate that is less than zero percent. The crediting rates of the contracts will track current market yields on a trailing basis. The rate reset allows the contract value to converge with the

fair value of the underlying portfolio over time, assuming the portfolio continues to earn the current yield for a period of time equal to the current portfolio duration. To the extent that the underlying portfolio of a contract has unrealized

and/or realized losses, a positive adjustment is made to the adjustment from fair value to contract value under contract value accounting. As a result, the future crediting rate may be lower over time than the

then-current market rates. Similarly, if the underlying portfolio generates unrealized and/or realized gains, a negative adjustment is made to the adjustment from fair value to contract value, and the future

crediting rate may be higher than the then-current market rates.

The primary

variables impacting the future crediting rates of the investment contracts include:

| |

• |

|

the current yield of the assets underlying the contracts, |

| |

• |

|

the duration of the assets underlying the contracts, and |

| |

• |

|

the existing difference between the fair values and contract values of the assets within the contracts. |

13

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

The contracts use the following compound crediting rate formula:

CR = [(FV/CV)(1/D)*(1+Y)]-1, where:

CR = crediting rate

FV = fair value of underlying portfolio

CV = contract value

D = weighted average duration of the underlying portfolio

Y = annualized weighted average yield to maturity of the underlying portfolio

The

yield earned by the account at December 31, 2014 was 1.42%. This represents the annualized earnings of all investments in the account divided by the fair value of all investments in the account at December 31, 2014.

The yield earned by the account with an adjustment to reflect the actual interest rate credited to Participants at December 31, 2014

was 1.18%. This represents the annualized earnings credited to Participants divided by the fair value of all investments in the account at December 31, 2014.

Investment contracts generally provide for withdrawals associated with certain events which are not in the ordinary course of operations. These withdrawals are paid with a market value adjustment applied

to the withdrawal as defined in the investment contract. Each contract issuer specifies the events which may trigger a market value adjustment; however, such events may include all or a portion of the following:

| |

• |

|

material amendments to the account’s structure or administration; |

| |

• |

|

changes to the Plans’ competing investment options including the elimination of equity wash provisions; |

| |

• |

|

complete or partial termination of the investment, including a merger with another investment account; |

| |

• |

|

the failure of the Plan to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA;

|

| |

• |

|

the redemption of all or a portion of the interests in the account held by a participating plan at the direction of the participating plan sponsor,

including withdrawals due to the removal of a specifically identifiable group of employees from coverage under the participating plan (such as a group layoff or early retirement incentive program), the closing or sale of a subsidiary, employing

unit, or affiliate, the bankruptcy or insolvency of a plan sponsor, the merger of the Plan with another plan, or the Plan sponsor’s establishment of another tax qualified defined contribution plan; |

| |

• |

|

any change in law, regulation, ruling, administrative or judicial position, or accounting requirement, applicable to the account or participating

plans; |

| |

• |

|

the delivery of any communication to Participants designed to influence a participant not to invest in the investment option.

|

At this time, the Company does not believe that the occurrence of any such market value event, which would

limit the account’s ability to transact at contract value with participants, is probable.

These contracts contain

termination provisions, allowing the contract issuer to terminate with notice, at any time at fair value, and providing for automatic termination of the contract if the contract value or the fair value of the underlying portfolio equals zero. The

issuer is obligated to

14

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

pay the excess contract value when the fair value is below contract value at the time of termination. In addition, if the Company defaults in its obligations under the contract (including the

issuer’s determination that the agreement constitutes a non-exempt prohibited transaction as defined under ERISA), and such default is not corrected within the time permitted by the contract, then the

contract may be terminated by the issuer and the Plan will receive the fair value as of the date of termination.

| 6. |

Transactions with Parties-in-Interest |

Parties-in-interest are defined under Department of Labor regulations as any fiduciary of the Plan, any party rendering service to the Plan, the employer, and certain others.

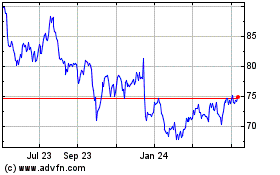

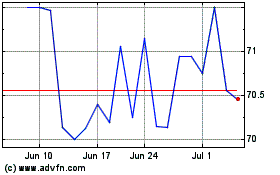

At December 31, 2014, the Plan held Company common stock with a cost and fair value of $188,255,416 and $248,306,627, respectively.

During 2014, the Plan purchased shares at a cost of $27,122,220 and sold shares valued at $35,008,574.

At December 31,

2013, the Plan held Company common stock with a cost and fair value of $193,124,708 and $203,615,803, respectively. During 2013, the Plan purchased shares at a cost of $23,776,362 and sold shares valued at $27,778,272.

Dividend income from Company common stock was $8,501,427 and $8,541,962 for the years ended December 31, 2014 and December 31,

2013, respectively.

At December 31, 2014, the Plan held shares in the Fidelity Management Trust Company Institutional

Cash Portfolio (Note 3). This portfolio is managed by the Trustee, and therefore, qualifies as party-in-interest transactions. Notes receivable from Participants also reflect party-in-interest transactions.

Fees paid by the Plan to the Trustee for recordkeeping and trust services were $1,094,988 and $1,007,262 for the years ended

December 31, 2014 and December 31, 2013, respectively.

Fees paid to and investments issued by various Plan

investment managers also reflect party-in-interest transactions.

These transactions are allowable party-in-interest

transactions under Section 408(b)(8) of ERISA.

15

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| 7. |

Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 at December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Net assets available for benefits per the financial statements |

|

$ |

2,023,284,820 |

|

|

$ |

1,920,935,435 |

|

| Amounts allocated to deemed distributions of notes receivable from Participants |

|

|

(1,172,844 |

) |

|

|

(1,045,123 |

) |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts |

|

|

671,952 |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits per the Form 5500 |

|

$ |

2,022,783,928 |

|

|

$ |

1,919,890,312 |

|

|

|

|

|

|

|

|

|

|

Deemed distributions of notes receivable from Participants, resulting from defaults of notes receivable

from Participants, are no longer considered assets of the Plan with respect to Form 5500 filings.

The following is a

reconciliation of total additions per the financial statements to total income per the Form 5500 for the years ended December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Total additions per the financial statements |

|

$ |

257,532,048 |

|

|

$ |

421,722,230 |

|

| Add: Adjustment from contract value to fair value for fully benefit-responsive investment contracts as of the current

year-end |

|

|

671,952 |

|

|

|

– |

|

| Less: Adjustment from contract value to fair value for fully benefit-responsive investment contracts as of the prior

year-end |

|

|

– |

|

|

|

(19,429,644 |

) |

| Less: Interest income of defaulted notes receivable from Participants |

|

|

(85,152 |

) |

|

|

(77,703 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total income per the Form 5500 |

|

$ |

258,118,848 |

|

|

$ |

402,214,883 |

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of total deductions per the financial statements to total expenses per

the Form 5500 for the years ended December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Total deductions per the financial statements |

|

$ |

155,182,663 |

|

|

$ |

111,797,784 |

|

| Add: Net increase (decrease) in defaulted notes receivable from Participants |

|

|

42,569 |

|

|

|

(15,622 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses per the Form 5500 |

|

$ |

155,225,232 |

|

|

$ |

111,782,162 |

|

|

|

|

|

|

|

|

|

|

16

Ameren Corporation

Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

| 8. |

Federal Income Tax Status |

The Company obtained its latest determination letter September 18, 2013, in which the Internal Revenue Service stated that the Plan

was in compliance with the applicable requirements of the Code. Although the Plan has been amended since receiving the determination letter, the Plan’s administrator believe that the Plan is designed and is currently being operated in

compliance with the applicable requirements of the Code.

Accounting principles generally accepted in the United States of

America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal

Revenue Service. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014 and 2013, there are no uncertain positions taken or expected to be taken that would require recognition of

a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer

subject to income tax examinations for years prior to 2011.

17

Ameren Corporation

Savings Investment Plan

SCHEDULE H, Line 4i – SCHEDULE OF

ASSETS (HELD AT END OF YEAR)

December 31, 2014

Name of plan sponsor: Ameren Corporation

Employer identification number: 43-1723446

Three-digit plan number: 003

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) |

|

(c) |

|

(d) |

|

|

(e) |

|

| |

|

Identity of issue, borrower, lessor, or

similar party |

|

Description of investment including

maturity date, rate of interest, collateral, par, or maturity value |

|

Cost |

|

|

Current value |

|

|

|

|

|

|

|

|

Mutual Funds |

|

|

|

|

|

|

|

|

|

|

|

|

American Funds Group |

|

EuroPacific Growth Fund |

|

$ |

106,315,363 |

|

|

$ |

122,967,205 |

|

|

|

Pacific Investment Management Company |

|

PIMCO Total Return Fund |

|

|

74,879,612 |

|

|

|

73,200,714 |

|

|

|

Sands Capital Management |

|

Touchstone Sands Capital Institutional Growth Fund |

|

|

42,819,670 |

|

|

|

50,151,187 |

|

| * |

|

Fidelity Management Trust Company |

|

FMTC Institutional Cash Portfolio |

|

|

23,665,553 |

|

|

|

23,665,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Mutual Funds |

|

|

|

|

247,680,198 |

|

|

|

269,984,658 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collective Investment Trusts |

|

|

|

|

|

|

|

|

|

|

|

|

Allianz Global Investors Fund Management |

|

AllianzGI NFJ Dividend Value CIT |

|

|

100,856,568 |

|

|

|

138,865,150 |

|

|

|

Nuveen Fund Advisors |

|

NWQ Small/Mid Cap Value Fund |

|

|

56,330,236 |

|

|

|

79,241,954 |

|

|

|

Wells Fargo Bank, N.A. |

|

Wells Fargo Fixed Income Fund F |

|

|

91,393,003 |

|

|

|

92,272,061 |

|

|

|

Wells Fargo Bank, N.A. |

|

Wells Fargo Fixed Income Fund L |

|

|

22,800,000 |

|

|

|

23,449,626 |

|

|

|

Wells Fargo Bank, N.A. |

|

Wells Fargo Fixed Income Fund N |

|

|

25,600,000 |

|

|

|

26,320,296 |

|

|

|

Wells Fargo Bank, N.A. |

|

Wells Fargo Fixed Income Fund Q |

|

|

31,941,154 |

|

|

|

32,334,243 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock Equity Index Fund |

|

|

130,758,025 |

|

|

|

216,739,324 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock Russell 2500 NL Fund |

|

|

154,911,385 |

|

|

|

138,419,624 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2020 Fund |

|

|

77,141,738 |

|

|

|

90,104,434 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2025 Fund |

|

|

56,823,898 |

|

|

|

68,739,236 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2030 Fund |

|

|

37,458,047 |

|

|

|

45,847,351 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock MSCI ACWI ex-US IMI Index NL Fund |

|

|

45,453,251 |

|

|

|

46,952,719 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL Retirement Fund |

|

|

42,665,139 |

|

|

|

44,158,903 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock US Debt Index NL Fund |

|

|

37,084,617 |

|

|

|

38,198,496 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2035 Fund |

|

|

19,453,280 |

|

|

|

23,818,265 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2040 Fund |

|

|

17,383,532 |

|

|

|

21,325,453 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2045 Fund |

|

|

14,346,410 |

|

|

|

17,629,758 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2050 Fund |

|

|

12,542,486 |

|

|

|

15,642,916 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock TIPS Bond Index Fund |

|

|

15,624,887 |

|

|

|

15,630,986 |

|

|

|

BlackRock Institutional Trust Company, N.A. |

|

BlackRock LifePath Index NL 2055 Fund |

|

|

6,296,337 |

|

|

|

6,928,616 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Collective Investment Trusts |

|

|

|

|

996,863,993 |

|

|

|

1,182,619,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pooled Separate Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts Mutual Life Ins. Co. |

|

Separate Account #SB43 |

|

|

31,918,376 |

|

|

|

32,297,606 |

|

|

|

Metropolitan Life Ins Co. |

|

Separate Account #690 |

|

|

31,906,840 |

|

|

|

32,181,096 |

|

|

|

Metropolitan Life Ins Co. |

|

Separate Account #695 |

|

|

31,810,551 |

|

|

|

32,446,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Pooled Separate Accounts |

|

|

|

|

95,635,767 |

|

|

|

96,925,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks |

|

|

|

|

|

|

|

|

|

|

| * |

|

Ameren Corporation |

|

5,382,758.000000 Shares |

|

|

188,255,416 |

|

|

|

248,306,627 |

|

|

|

ACTAVIS PLC |

|

4,219.000000 Shares |

|

|

1,124,408 |

|

|

|

1,086,013 |

|

|

|

PERRIGO CO PLC |

|

7,076.000000 Shares |

|

|

1,093,685 |

|

|

|

1,182,824 |

|

|

|

ABBOTT LABORATORIES |

|

45,833.000000 Shares |

|

|

1,696,861 |

|

|

|

2,063,402 |

|

|

|

ADOBE SYSTEMS INC |

|

19,464.000000 Shares |

|

|

1,121,924 |

|

|

|

1,415,033 |

|

|

|

ALEXION PHARMACEUTICALS |

|

7,489.000000 Shares |

|

|

830,942 |

|

|

|

1,385,690 |

|

|

|

ALIBABA GROUP HLD SPON AD |

|

13,134.000000 Shares |

|

|

1,025,115 |

|

|

|

1,365,148 |

|

|

|

ALLERGAN INC |

|

5,336.000000 Shares |

|

|

594,920 |

|

|

|

1,134,380 |

|

|

|

AMAZON.COM INC |

|

8,597.000000 Shares |

|

|

2,181,675 |

|

|

|

2,668,079 |

|

|

|

AMERICAN TOWER CORP |

|

10,391.000000 Shares |

|

|

747,886 |

|

|

|

1,027,150 |

|

|

|

ANADARKO PETROLEUM CORP |

|

11,861.000000 Shares |

|

|

869,860 |

|

|

|

978,533 |

|

|

|

APPLE INC |

|

34,906.000000 Shares |

|

|

3,227,455 |

|

|

|

3,852,924 |

|

|

|

APPLIED MATERIALS INC |

|

10,308.000000 Shares |

|

|

242,775 |

|

|

|

256,875 |

|

|

|

BIOMARIN PHARMACEUTICAL |

|

18,175.000000 Shares |

|

|

1,158,233 |

|

|

|

1,643,020 |

|

|

|

BIOGEN IDEC INC |

|

6,569.000000 Shares |

|

|

1,100,056 |

|

|

|

2,229,847 |

|

18

Ameren Corporation

Savings Investment Plan

SCHEDULE H, Line 4i – SCHEDULE OF ASSETS (HELD AT END OF

YEAR)

December 31, 2014

Name of plan sponsor: Ameren Corporation

Employer identification number: 43-1723446

Three-digit plan number: 003

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) |

|

(c) |

|

(d) |

|

|

(e) |

|

| |

|

Identity of issue, borrower, lessor, or

similar party |

|

Description of investment including

maturity date, rate of interest, collateral, par, or maturity value |

|

Cost |

|

|

Current value |

|

|

|

BOEING CO |

|

12,294.000000 Shares |

|

|

936,785 |

|

|

|

1,597,974 |

|

|

|

BRISTOL-MYERS SQUIBB CO |

|

34,336.000000 Shares |

|

|

1,722,726 |

|

|

|

2,026,854 |

|

|

|

CANADIAN PAC RAILWAY (W/I |

|

7,373.000000 Shares |

|

|

883,706 |

|

|

|

1,420,703 |

|

|

|

CELGENE CORP |

|

16,114.000000 Shares |

|

|

1,144,660 |

|

|

|

1,802,512 |

|

|

|

CHIPOTLE MEXICAN GRILL |

|

1,268.000000 Shares |

|

|

475,474 |

|

|

|

867,959 |

|

|

|

CONCHO RESOURCES INC |

|

9,794.000000 Shares |

|

|

831,586 |

|

|

|

976,952 |

|

|

|

COSTCO WHOLESALE CORP |

|

13,547.000000 Shares |

|

|

1,376,718 |

|

|

|

1,920,287 |

|

|

|

DISNEY (WALT) CO |

|

15,989.000000 Shares |

|

|

837,438 |

|

|

|

1,506,004 |

|

|

|

DUNKIN BRANDS GROUP INC |

|

9,475.000000 Shares |

|

|

282,698 |

|

|

|

404,109 |

|

|

|

EOG RESOURCES INC |

|

10,526.000000 Shares |

|

|

617,452 |

|

|

|

969,129 |

|

|

|

FACEBOOK INC A |

|

38,818.000000 Shares |

|

|

1,335,292 |

|

|

|

3,028,580 |

|

|

|

FIREEYE INC |

|

18,426.000000 Shares |

|

|

843,676 |

|

|

|

581,893 |

|

|

|

FLEETCOR TECHNOLOGIES INC |

|

7,266.000000 Shares |

|

|

888,345 |

|

|

|

1,080,527 |

|

|

|

GILEAD SCIENCES INC |

|

12,774.000000 Shares |

|

|

458,433 |

|

|

|

1,204,077 |

|

|

|

GOLDMAN SACHS GROUP INC |

|

5,241.000000 Shares |

|

|

718,298 |

|

|

|

1,015,863 |

|

|

|

GOOGLE INC CL A |

|

3,599.000000 Shares |

|

|

1,407,584 |

|

|

|

1,909,845 |

|

|

|

GOOGLE INC CL C |

|

3,650.000000 Shares |

|

|

1,431,959 |

|

|

|

1,921,360 |

|

|

|

ILLUMINA INC |

|

7,847.000000 Shares |

|

|

464,088 |

|

|

|

1,448,399 |

|

|

|

INCYTE CORP |

|

5,522.000000 Shares |

|

|

356,938 |

|

|

|

403,713 |

|

|

|

LAS VEGAS SANDS CORP |

|

11,227.000000 Shares |

|

|

890,714 |

|

|

|

652,962 |

|

|

|

LENDINGCLUB CORP |

|

2,010.000000 Shares |

|

|

30,150 |

|

|

|

50,853 |

|

|

|

LINKEDIN CORP CL A |

|