U.S. regulators cut annual requirements for how much ethanol

must be mixed into the nation's fuel supply. But the reductions

were smaller than originally proposed, softening the blow to

ethanol companies and their Farm Belt supporters.

The Environmental Protection Agency on Monday said fuel

companies will have to blend 18.11 billion gallons of corn-based

ethanol and other biofuels into gasoline next year, up from the

17.4 billion it proposed in May, but well below targets laid out in

a 2007 law. The EPA also eased rules retroactively for 2014 and

2015.

Ethanol-company shares jumped Monday because the EPA's

reductions were less severe than investors had feared. Shares of

Green Plains Inc., one of the biggest U.S. ethanol processors, rose

5%, while shares of smaller Pacific Ethanol Inc. surged 21%. Stock

in Archer Daniels Midland Co., the biggest U.S. ethanol producer by

capacity, edged up 0.1%, shedding earlier losses after the EPA

numbers were released.

The agency moved to ease the annual biofuels-blending

requirements because of market constraints and other challenges

that it said have kept it from meeting the goals of a federal law

first passed a decade ago.

The renewable-fuel standard, first established by Congress as

part of a 2005 energy law and significantly expanded in 2007, was

designed to help reduce carbon emissions and wean the U.S. off

foreign oil.

But today the U.S. imports much less oil than it did in the

mid-2000s, thanks to a domestic oil-production boom and higher

fuel-economy standards. Americans also are consuming less gasoline

than the 2005 and 2007 laws envisioned. Energy-industry groups have

been harshly critical of the law and the government's

implementation of it, saying the standard burdens companies and

raises fuel prices for consumers.

The law includes a "waiver" provision, which the EPA used to

issue lower amounts than what the law requires, based on multiple

factors, including what the agency described as a lack of

infrastructure to blend biofuels into gasoline.

The EPA on Monday retroactively set the total amount of ethanol

to be blended in 2014 at 16.28 billion gallons, roughly what was

actually produced. For 2015, EPA set the total level at 16.93

billion gallons, close to the estimated production for this

year.

Reaction in the U.S. Farm Belt was mixed. Some leaders in the

ethanol and corn industries applauded the upward revisions to the

EPA's earlier proposal, but expressed disappointment that the

requirements are below those laid out in 2007. For 2016, for

example, the statute level was 22.25 billion gallons.

"The EPA volumes announced today are a move in the right

direction," said Jeff Broin, chief executive of South Dakota-based

Poet LLC, a large ethanol producer. "However, these numbers fall

well short of our capability to provide clean, domestic ethanol to

America's drivers."

Bob Stallman, president of the American Farm Bureau Federation,

a trade group for farmers, said it was disappointed to see the EPA

"move forward with a decision that will stall growth and progress

in renewable fuels."

The Illinois Corn Growers Association, which represents farmers

in the nation's No. 2 corn-producing state after Iowa, said the

EPA's move amounted to a victory for the oil industry and a blow to

farmers. The agency's action comes at a time when net farm income

in the state already is expected to decline 68% from its high in

2013, because of depressed crop prices.

The American Fuel & Petrochemical Manufacturers, an industry

group that represents refiners, applauded the EPA for reducing

blending requirements. But it accused the EPA of bowing to pressure

from the biofuels lobby in making its final decision and said it

believes the RFS program is dysfunctional and should be

repealed.

"Today's rule is further proof that the RFS program is

irreparably broken and that the only solution is for Congress to

repeal it outright," said AFPM President Chet Thompson. "The simple

truth is that 10 years after promulgation of the program, the

advanced biofuels industry still has not delivered on its promise

of commercially viable fuels, and only the corn ethanol and

biodiesel industries benefit from the RFS."

Biofuels have represented about 10% of total gasoline

consumption in the U.S. since 2011, with nearly all of that coming

from corn-based ethanol.

The EPA faced a court-ordered deadline to issue the 2014 and

2015 levels by Monday.

The overall quotas for 2016 go slightly beyond what the oil

industry has coined the "blend wall"—when the amount of ethanol

mandated by EPA exceeds the amount that can be realistically

blended into the gasoline supply.

That limit is pegged by the industry at about 10%. It stems from

factors such as resistance from refineries that would rather blend

their own product of crude oil and car makers' reluctance to issue

warranties for cars that can take more than 10% ethanol blended

into gasoline because of concerns about damage to engines.

"Over time more and more renewable fuels are available to

consumers and that means more available than what people refer to

as the blend wall," said Janet McCabe, the acting assistant

administrator for EPA's Office of Air and Radiation, on a

conference call with reporters.

Alison Sider

Write to Amy Harder at amy.harder@wsj.com and Jesse Newman at

jesse.newman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 30, 2015 20:15 ET (01:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

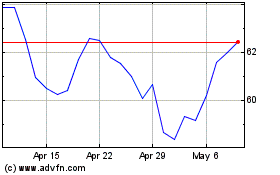

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

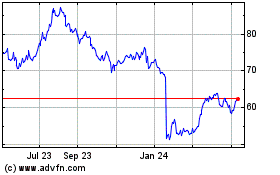

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024