Syngenta Sues Grain-Trading Firms in Corn Dispute

November 20 2015 - 1:30AM

Dow Jones News

Syngenta AG sued several grain-trading firms over losses some

U.S. farmers say they sustained after China rejected shipments of

genetically modified corn, escalating a legal battle over the way

biotech seeds are introduced to farm fields.

The lawsuit, filed late Thursday in U.S. District Court in

Kansas, stems from a legal dispute that arose last year when grain

companies and farmers sued Syngenta, arguing the company should

compensate them for lost sales and depressed corn prices that they

claim arose from the rejected shipments.

The Swiss seed and pesticide giant, which is contesting those

allegations, argued in the new lawsuit that big grain merchants,

including Cargill Inc. and Archer Daniels Midland Co., should be on

the hook for losses that crop producers say they are due in the

matter.

"We don't think there is any liability here, but to the extent

there is, at a minimum, the lion's share of the duty falls on the

grain trade," said Michael Jones, a lawyer for Kirkland & Ellis

LLP representing Syngenta in the matter.

Representatives for ADM and Cargill had no immediate

comment.

Syngenta in 2011 began selling a new variety of biotech corn

seeds—called Viptera and engineered to resist pests—to farmers in

the U.S., Argentina and Brazil after those governments granted

approval for its cultivation. In late 2013, Chinese officials began

turning away shipments of U.S. corn bound for Chinese ports after

detecting the Syngenta strain, which the country had yet to approve

for import.

Last year, Cargill sued Syngenta over the corn, alleging that

Syngenta's decision to market the seeds without first securing

Chinese import approval cost the Minnesota-based agribusiness $90

million when Beijing began rejecting corn shipments.

Other grain shippers, including Archer Daniels Midland Co., also

sued Syngenta. The grain firms' cases touched off a wave of

separate lawsuits filed by farmers across the country, who argued

that they too lost money because China's rejections of U.S. corn

shipments depressed the overall price of corn by closing off a key

market.

Syngenta has defended its move to sell the seeds, saying it

followed the law, was fully transparent and provided to farmers a

valuable new tool for defending their crops against insect

pests.

The judge for the U.S. District Court for the District of

Kansas, who is handling the farmers' lawsuits, in September ruled

that the farmers can bring legal claims against a seed company over

its duty to ensure that any biotech seeds don't damage other

players in the "interconnected" U.S. corn supply chain.

That ruling allowed the farmers' case against Syngenta to move

forward. But Syngenta's new lawsuit argues that it also places

responsibility on the grain traders, as participants in the grain

market, to shield farmers and other players against the same

potential economic damage that could arise if shipments are

rejected for containing unapproved biotech traits.

If the judge determines the farmers are due damages, Syngenta's

lawsuit argues that Cargill, ADM and two smaller grain companies

should bear some or all of the liability. Syngenta could add

additional grain companies to the lawsuit, Mr. Jones said.

Write to Jacob Bunge at jacob.bunge@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 01:15 ET (06:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

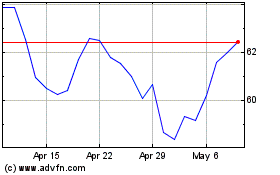

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

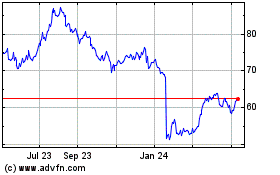

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024