UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 11-K

| |

[X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period __________ To __________

Commission file number 1-44

ARCHER-DANIELS-MIDLAND COMPANY

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

| |

B. | Name of the issuer of the securities held pursuant to the Plan and the address of its principal executive office: |

|

|

Archer-Daniels-Midland Company |

77 West Wacker Drive |

Suite 4600 |

Chicago, Illinois 60601 |

Financial Statements and Supplemental Schedules

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Years Ended December 31, 2014 and 2013

With Report of Independent Registered Public Accounting Firm

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Financial Statements and Supplemental Schedules

Years Ended December 31, 2014 and 2013

Contents

|

| |

Report of Independent Registered Public Accounting Firm | 1 |

| |

Financial Statements | |

| |

Statements of Net Assets Available for Benefits | 2 |

Statements of Changes in Net Assets Available for Benefits | 3 |

Notes to Financial Statements | 4 |

| |

Supplemental Schedules | |

| |

Schedule H, Line 4i – Schedules of Assets (Held at End of Year) | 18 |

Report of Independent Registered Public Accounting Firm

The Benefit Plans Committee

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

We have audited the accompanying statements of net assets available for benefits of ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees as of December 31, 2014 and 2013, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plans’ management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plans’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plans’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees at December 31, 2014 and 2013, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedules of assets (held at end of year) as of December 31, 2014, have been subjected to audit procedures performed in conjunction with the audits of ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees financial statements. The information in the supplemental schedules is the responsibility of the Plans’ management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

St. Louis, Missouri

June 24, 2015

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Statements of Net Assets Available for Benefits

|

| | | | | | |

| | |

| December 31, 2014 |

| Salaried Plan | Hourly Plan |

Assets | | |

Interest in Master Trust at fair value | $ | 1,421,798,081 |

| $ | 463,020,695 |

|

Notes receivable from participants | 23,875,555 |

| 25,223,059 |

|

Contributions receivable from employer | 2,289,469 |

| 1,572,702 |

|

Total assets available for benefits at fair value | $ | 1,447,963,105 |

| $ | 489,816,456 |

|

| | |

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | (2,663,417 | ) | (992,777 | ) |

Net assets available for benefits | $ | 1,445,299,688 |

| $ | 488,823,679 |

|

|

| | | | | | |

| December 31, 2013 |

| Salaried Plan | Hourly Plan |

Assets | | |

Interest in Master Trust at fair value | $ | 1,284,283,433 |

| $ | 418,699,099 |

|

Notes receivable from participants | 21,834,485 |

| 21,959,474 |

|

Contributions receivable from employer | 2,156,934 |

| 1,497,219 |

|

Total assets available for benefits at fair value | $ | 1,308,274,852 |

| $ | 442,155,792 |

|

| | |

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | (1,488,007 | ) | (566,648 | ) |

Net assets available for benefits | $ | 1,306,786,845 |

| $ | 441,589,144 |

|

See accompanying notes.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Statements of Changes in Net Assets Available for Benefits

|

| | | | | | |

| Year Ended December 31, 2014 |

| Salaried Plan | Hourly Plan |

Additions: | | |

Net investment gain from plan interest in Master Trust | $ | 146,948,732 |

| $ | 48,989,363 |

|

Interest income from participant notes receivable | 1,053,966 |

| 1,006,200 |

|

Contributions from employer | 28,176,376 |

| 18,152,279 |

|

Contributions from participating employees | 51,297,317 |

| 27,712,746 |

|

Transfers | 8,330,070 |

| 3,521,614 |

|

| 235,806,461 |

| 99,382,202 |

|

Deductions: | | |

Withdrawals | 94,213,800 |

| 42,240,260 |

|

Transfers | 3,079,818 |

| 9,907,407 |

|

| 97,293,618 |

| 52,147,667 |

|

| | |

Net increase | 138,512,843 |

| 47,234,535 |

|

| | |

Net assets available for benefits at beginning of year | 1,306,786,845 |

| 441,589,144 |

|

Net assets available for benefits at end of year | $ | 1,445,299,688 |

| $ | 488,823,679 |

|

|

| | | | | | |

| Year Ended December 31, 2013 |

| Salaried Plan | Hourly Plan |

Additions: | | |

Net investment gain from plan interest in Master Trust | $ | 313,262,685 |

| $ | 102,139,285 |

|

Interest income from participant notes receivable | 879,343 |

| 823,102 |

|

Contributions from employer | 26,668,393 |

| 17,699,541 |

|

Contributions from participating employees | 46,108,814 |

| 25,562,448 |

|

Transfers | 5,254,603 |

| 1,075,630 |

|

| 392,173,838 |

| 147,300,006 |

|

Deductions: | | |

Withdrawals | 95,922,300 |

| 36,250,776 |

|

Transfers | 1,493,942 |

| 6,013,396 |

|

| 97,416,242 |

| 42,264,172 |

|

| | |

Net increase | 294,757,596 |

| 105,035,834 |

|

| | |

Net assets available for benefits at beginning of year | 1,012,029,249 | 336,553,310 |

|

Net assets available for benefits at end of year | $ | 1,306,786,845 |

| $ | 441,589,144 |

|

See accompanying notes.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements

1. Description of the Plans

General

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees (the Salaried Plan) and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees (the Hourly Plan) (collectively, the Plans), each of which includes an employee stock ownership component, are defined contribution plans available to all eligible salaried and hourly employees of Archer-Daniels-Midland Company (ADM or the Company) and its participating affiliates. The Plans are subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). The following description of the Plans provides only general information regarding the Plans as of December 31, 2014. Participants should refer to the appropriate plan document and the prospectus for a more complete description of the applicable plan’s provisions.

Employee eligibility varies by employment class, location, and employment status. Complete information regarding employee eligibility is described in the plan documents, summary plan descriptions, and, in certain cases, an appendix to the appropriate plan.

Effective April 1, 2013, Mercer became the record-keeper and trustee for the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and the ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees. Due to the change in record-keeper, certain minor changes to the Plans’ terms were adopted effective April 1, 2013. In order to facilitate this change, the Plans were on blackout from March 19, 2013, 3 p.m. Central Time until April 3, 2013, 3 p.m. Central Time.

Effective April 1, 2014, participants in the Plans are assessed a plan-administration fee. This fee is deducted directly from participants' accounts to help offset the administrative costs associated with running the Plans.

Arrangement with Related Party and Investment in ADM Common Stock

Through March 31, 2013, the assets of the Plans were held by Hickory Point Bank & Trust, FSB, through a master trust agreement (the Master Trust). Hickory Point Bank & Trust was a fully consolidated entity within ADM prior to 2011 and an affiliate of ADM during 2011 and 2012. The remaining amounts of Hickory Point Bank & Trust common stock were sold by the Company on December 21, 2012. Effective April 1, 2013, Mercer Trust Company became the trustee for the Plans. The Plans hold investments in ADM common stock which are permitted parties-in-interest transactions. Furthermore, dividends paid on ADM common stock held in participant accounts are automatically reinvested in additional shares of the Company’s common stock purchased on the market unless the participant has elected to receive a distribution of such dividends in cash. The Master Trust held 11,472,018 and 12,643,123 shares of ADM common stock as of December 31, 2014 and 2013, respectively. There is no time requirement for holding common stock purchased with ordinary dividends. The total amount of dividends paid on ADM common stock for December 31, 2014 and 2013, was $11,637,673 and $10,491,678, respectively.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

1. Description of the Plans (continued)

Contributions

Under the terms of the Plans, employees electing to participate can contribute from 1% up to as much as 75% of their compensation to the plan, subject to certain Internal Revenue Service (IRS) limitations and the respective plan’s provisions for the participating location. Participants age 50 or older can make additional “catch-up” contributions, up to the limits allowed under the tax laws. Eligible new hires are automatically initially enrolled at 6% unless they file an affirmative election requesting a higher or lower participation percentage within the terms of the applicable plan.

ADM’s matching contributions are made in cash. The Company also makes a non-elective contribution of 1% of plan-defined compensation to all eligible employees’ accounts, subject to each plan’s provisions, which may vary by participating locations. The Company’s match and non-elective contributions vest over a two-year period. For the Hourly Plan, the vesting dates may vary for hourly bargaining unit employees. Employees should refer to the plan appendix applicable to their plan and participating location for more complete information regarding employee contributions, employer match, and non-elective contribution eligibility and limitations.

Forfeitures

Participants forfeit their nonvested balances upon the earlier of the full distribution of their vested account following termination of employment or a break in service of five years. If a participant receives a distribution of his or her vested account, and the participant is rehired before incurring a five-year break in service, any nonvested balance that previously was forfeited will be reinstated if the participant repays the vested balance that was distributed. Forfeited balances of terminated participant’s nonvested accounts are applied to pay administrative expenses, used to reduce employer contributions, or otherwise applied in accordance with the terms of the plan. As of December 31, 2014, unallocated forfeiture balances for the Salaried and Hourly Plans were $12,866 and $30,679, respectively. As of December 31, 2013, unallocated forfeiture balances for the Salaried and Hourly Plans were $23,960 and $77,739, respectively. In 2014, forfeitures used to reduce employer contributions for the Salaried and Hourly Plans were $122,186 and $780,012, respectively, and forfeitures used to pay administrative expenses for the Salaried and Hourly plans were $80,184 and $104,587, respectively. In 2013, forfeitures used to reduce employer contributions for the Salaried and Hourly Plans were $39,440 and $5,042, respectively, and forfeitures used to pay administrative expenses for the Salaried and Hourly Plans were $313,136 and $491,726, respectively.

Investment Options

Participants may invest their contributions in one or more of the investment options offered by the Plans, including ADM common stock. Participants can elect at any time to convert all or any number of the shares of ADM common stock held in their accounts to cash and have the cash transferred within the plan to be invested in the investment options available under the applicable plan.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

1. Description of the Plans (continued)

Participants can also elect to sell any portion of the investment options in their accounts and reinvest the proceeds in one or more of the other investment options.

Participant Loans

For eligible salaried and hourly employees, loans are allowed for general purposes or for home purchase. General purpose loans are available for terms of up to five years, and home purchase loans are available for terms of up to ten years.

Eligible participants may borrow from their plan accounts a minimum of $1,000, or the full amount available to them if less, or the amount available to the participant up to the lesser of $50,000 less the participant’s highest outstanding vested loan balance within the past year, 50% of their vested participant account balance, or 100% of their loan-eligible plan accounts. A “loan-eligible plan account” for this purpose is any plan account except an account reflecting Roth contributions (including Roth 401(k) contributions and Roth account rollovers) and earnings thereon. A maximum of one loan may be outstanding to a participant at any time.

The loans are secured by the balance in the participant’s account and bear interest at a rate equal to the prime rate at the time of the loan’s issuance plus 1%. Principal and interest are repaid ratably through payroll deductions, with payments taken from each paycheck. Eligibility for the general purpose loan varies by each plan’s provisions.

Complete information regarding participant loans is described in the plan document, summary plan description, participant loan policy statement, and, in certain cases, an appendix to the appropriate plan.

Participant Accounts

Each participant’s account contains the participant’s contributions, rollover or transferred accounts from other qualified plans, the Company’s matching and non-elective contributions, and investment earnings. The benefit to which a participant is entitled is the vested benefit that can be provided from the participant’s account.

Withdrawal

The vested value of an employee’s account is payable following termination of employment. Withdrawals by active employees are permitted in certain circumstances. Participants should refer to the appropriate plan document and the prospectus for a more complete description of the applicable plan’s provisions.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

1. Description of the Plans (continued)

Plan Mergers

In 2014, the Company completed the acquisition of Specialty Commodities, Inc. (SCI), the Wild Flavors businesses (Wild Flavors), and its remaining 20% interest in Alfred C. Toepfer International (Toepfer). In 2015, the 401(k) plan assets of SCI, Wild Flavors, and Toepfer were sold and transferred into the Plans. Former employees of SCI, Wild Flavors, and Toepfer began participating in the Plans on various dates in

2015. The net assets transferred to the Plans from SCI, Wild Flavors, and Toepfer consist of total assets of $8,573,759, $56,006,404, and $3,409,295, respectively.

2. Significant Accounting Policies

Basis of Accounting

The accounting records of the Plans are maintained on the accrual basis.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements, accompanying notes, and supplemental schedules. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investments in the Master Trust are reported at fair value. Further information regarding the valuation techniques used to measure the fair value of investment assets held by the Plans and the Master Trust is included in the Fair Value Measurements footnote (see Note 3).

As described in Accounting Standards Codification (ASC) Topic 962, Plan Accounting – Defined Contribution Pension Plans, investment contracts held by a defined contribution plan are required to be reported at fair value. However, contract value is the relevant measurement for fully benefit-responsive investment contracts, because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plans. The Master Trust’s investment in the Galliard Stable Value Fund (the Fund) is considered a fully benefit-responsive investment contract. As required by ASC 962, the statements of net assets available for benefits presents the fair value of the investment in the Fund as well as the adjustment from fair value to contract value for fully benefit-responsive

investment contracts. The fair value of the Fund has been estimated based on the fair value of the underlying investment contracts in the Fund as reported by the manager of the Fund. The contract value of the Fund represents contributions plus earnings, less participant withdrawals and administrative expenses.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of

December 31, 2014 and 2013. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

New Accounting Pronouncement

In May 2015, the FASB issued Accounting Standards Update 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value Per Share (or its Equivalent), (ASU 2015-07). ASU 2015-07 removes the requirement to categorize within the fair value hierarchy investments for which fair values are estimated using the net asset value practical expedient provided by Accounting Standards Codification 820, Fair Value Measurement. Disclosures about investments in certain entities that calculate net asset value per share are limited under ASU 2015-07 to those investments for which the entity has elected to estimate the fair value using the net asset value practical expedient. ASU 2015-07 is effective for entities (other than public business entities) for fiscal years beginning after December 15, 2016, for public entities ASU 2015-07 is effective for fiscal periods beginning after December 15, 2015, with retrospective application to all periods presented. Early application is permitted. Management has elected not to early adopt ASU 2015-07.

3. Fair Value Measurements

The Plans’ assets are valued as required by ASC 820. ASC 820 establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The three levels are described below:

| |

Level 1: | Quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| |

Level 2: | Observable inputs, including Level 1 prices that have been adjusted; quoted prices for similar assets or liabilities; quoted prices in markets that are less active than traded exchanges; and other inputs that are observable or can be substantially corroborated by observable market data. |

Level 3: Unobservable inputs that are supported by little or no market activity and that are a significant component of the fair value of the assets or liabilities.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

3. Fair Value Measurements (continued)

A financial instrument's level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. In evaluating the significance of fair value inputs, the Plans generally classify assets or liabilities as Level 3 when their fair value is determined

using unobservable inputs that, individually or when aggregated with other unobservable inputs, represent more than 10% of the fair value of the assets or liabilities.

Judgment is required in evaluating both quantitative and qualitative factors in the determination of significance for purposes of fair value level classification. Valuation techniques used are generally required to maximize the use of observable inputs and minimize the use of unobservable inputs.

Following is a description of the valuation techniques and inputs used for instruments measured at fair value, including the general classification of such instruments pursuant to the valuation hierarchy.

ADM and other common stock:

Equity securities are valued based on quoted exchange prices and are classified within Level 1 of the valuation hierarchy.

Common collective trust funds:

Common collective trust funds (CCTs) are classified within Level 2 of the valuation hierarchy. CCT fund units are not listed on national exchanges or over-the-counter markets and are valued at net asset value (NAV). The trusts invest in several underlying Vanguard mutual funds, gradually changing to a more conservative asset allocation as the target funds approach their target years (Vanguard Target Retirement Income Fund is an exception, with a static allocation). Upon request provided in a manner acceptable to the trustee, a participating trust may redeem one or more units at the unit price.

Mutual funds:

Mutual funds are valued at the closing price reported on the active market on which they are traded and are classified within Level 1 of the valuation hierarchy.

Galliard Stable Value Fund:

The fair value of the Fund, as discussed in Notes 2 and 4, is the fair value of the security-backed contracts and short-term investment fund held by the Fund. The fair value of the security-backed contracts is based on the fair value of the underlying securities and is determined by the net asset value of the fixed income collective trust fund multiplied by the number of units held by the Fund as reported by the investment manager. The assets within the Fund are classified within Level 2 of the valuation hierarchy.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

3. Fair Value Measurements (continued)

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plans believe the valuation methods are appropriate and consistent with other market participants’ methods, the use

of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The Plans’ policy regarding the timing of transfers between levels, including both transfers into and transfers out of Level 3, is to measure and record the transfers at the end of the reporting period.

For the years ended December 31, 2014 and 2013, the Plans had no transfers between Levels 1, 2, and 3.

The following table sets forth by Level within the fair value hierarchy the investments included in the Master Trust at fair value as at December 31, 2014. This table does not include Master Trust cash, accrued investment income, or the effect of pending transactions totaling $327,766 in accordance with the disclosure requirements of ASC 820.

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | |

Significant Other Observable Inputs (Level 2) | |

Significant Unobservable Inputs (Level 3) | |

Total |

Common stock: | | | | | | | |

ADM | $ | 596,062,765 |

| | | | $ | — |

| | $ | 596,062,765 |

|

U.S. companies | 2,811,888 |

| | | | — |

| | 2,811,888 |

|

Mutual funds: | | | | | | | |

Domestic equity | 472,840,401 |

| | | | — |

| | 472,840,401 |

|

International equity | 61,027,105 |

| | | | — |

| | 61,027,105 |

|

Balanced | 67,863,252 |

| | | | — |

| | 67,863,252 |

|

Fixed income | 48,156,801 |

| | | | — |

| | 48,156,801 |

|

Common collective trust funds | | | 355,760,185 |

| | — |

| | 355,760,185 |

|

Galliard Stable Value Fund: | | | | | | | |

Collective trust funds–fixed income | | | 279,968,613 |

| | — |

| | 279,968,613 |

|

Total assets at fair value | $ | 1,248,762,212 |

| | $ | 635,728,798 |

| | $ | — |

| | $ | 1,884,491,010 |

|

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

3. Fair Value Measurements (continued)

The following table sets forth by Level within the fair value hierarchy the investments included in the Master Trust at fair value as at December 31, 2013. This table does not include Master Trust cash, accrued investment income, or the effect of pending transactions totaling $908,059 in accordance with the disclosure requirements of ASC 820.

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | |

Significant Other Observable Inputs (Level 2) | |

Significant Unobservable Inputs (Level 3) | |

Total |

Common stock: | | | | | | | |

ADM | $ | 548,712,118 |

| | $ | — |

| | $ | — |

| | $ | 548,712,118 |

|

U.S. companies | 3,037,597 |

| | — |

| | — |

| | 3,037,597 |

|

Mutual funds: | | | | | | | |

Domestic equity | 426,449,421 |

| | — |

| | — |

| | 426,449,421 |

|

International equity | 62,125,306 |

| | — |

| | — |

| | 62,125,306 |

|

Balanced | 62,383,388 |

| | — |

| | — |

| | 62,383,388 |

|

Fixed income | 47,708,050 |

| | — |

| | — |

| | 47,708,050 |

|

Common collective trust funds | — |

| | 287,707,074 |

| | — |

| | 287,707,074 |

|

Galliard Stable Value Fund: | | | | | | |

|

|

Collective trust funds–fixed income | — |

| | 263,951,519 |

| | — |

| | 263,951,519 |

|

Total assets at fair value | $ | 1,150,415,880 |

| | $ | 551,658,593 |

| | $ | — |

| | $ | 1,702,074,473 |

|

Level 3 Gains and Losses:

There are no assets in the Master Trust classified as Level 3 in the fair value hierarchy; therefore there are no gains or losses to disclose.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

4. Galliard Stable Value Fund

The Fund is managed exclusively for participants of the Plans. The Fund seeks safety and stability in its investment approach. The Fund may utilize guaranteed investment contracts and/or synthetic investment contracts as part of its investment strategy. The Fund may utilize individual securities and/or pooled vehicles as underlying investments of synthetic investment contracts. Participant-directed redemptions generally have no restrictions; however, plan-initiated redemptions and/or other major events may necessitate restrictions. The fair value of the Fund has been estimated based on the fair value of the underlying investment contracts in the Fund as reported by the manager of the Fund. The fair value differs from the contract value. Contract value is the relevant measurement attributable to fully benefit-responsive investment contracts because contract value is the amount

participants would generally receive if they were to initiate permitted transactions under the terms of the plan.

The Master Trust invests in security-backed investment contracts through the Fund. The Fund primarily invests in common collective trusts, as well as wrapper contracts. The wrapper contracts

provide assurance that future adjustments to the variable crediting rates of investments in the common collective trust cannot result in a crediting rate less than zero.

The wrapper contracts are investment contracts issued by an insurance company or other financial institution, backed by the portfolio of bonds that are owned by the common collective trusts in which the Fund is invested. The portfolio underlying the contract is maintained separately from the contract issuer’s general assets by a third-party custodian. The interest crediting rate of the wrapper contracts is based on the contract value, the fair value, duration, and yield to maturity of the underlying portfolio. These contracts typically allow for realized and unrealized gains and losses on the underlying assets to be amortized; usually over the duration of the underlying investments, through adjustments to the future interest crediting rate, rather than reflected immediately in the net assets of the Fund. The issuer guarantees that all qualified participant withdrawals will be at contract value.

Risks arise when entering into any investment contract due to the potential inability of the issuer to meet the terms of the contract. In addition, security-backed investment contracts have the risk of default or the lack of liquidity of the underlying portfolio assets.

The primary variables impacting the future crediting rates of security-backed investment contracts include the current yield of the assets underlying the contract, the duration of the assets underlying the contract, and the existing difference between the fair value and contract value of the assets within the contract.

The Fund uses a compound net crediting rate formula, which reflects fees paid to security-backed contract issuers.

The security-backed investment contracts are designed to reset their respective crediting rates on a quarterly basis and cannot credit an interest rate that is less than zero percent.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

4. Galliard Stable Value Fund (continued)

The crediting rate of security-backed investment contracts will track current market yields on a trailing basis. The rate reset allows the contract value to converge with the fair value of the underlying portfolio over time, assuming the portfolio continues to earn the current yield for a period of time equal to the current portfolio duration.

To the extent that the underlying portfolio of a security-backed investment contract has unrealized and/or realized losses, a positive adjustment is made to the adjustment from fair value to contract value under contract value accounting. As a result, the future crediting rate may be lower over time than the then-current market rates.

Similarly, if the underlying portfolio generates unrealized and/or realized gains, a negative adjustment is made to the adjustment from fair value to contract value, and the future crediting rate may be higher than the then-current market rates.

The yield on the Fund at December 31, 2014 and 2013, was 1.40% and 1.43%, respectively. This represents the annualized earnings of all investments in the Fund divided by the fair value of all investments in the Fund at those dates. The yield on the Fund with an adjustment to reflect the actual interest rate credited to participants in the Fund at December 31, 2014 and 2013, was 1.60%

and 1.66%, respectively. This represents the annualized earnings credited to participants in the Fund divided by the fair value of all investments in the Fund at those dates.

Security-backed investment contracts generally provide for withdrawals associated with certain events that are not in the ordinary course of Fund operations. These withdrawals are paid with a market value adjustment applied to the withdrawal as defined in the investment contract. Each contract issuer specifies the events that may trigger a market value adjustment. At this time, the Fund does not believe that the occurrence of any such market value event, which would limit the Fund’s ability to transact at contract value with participants, is probable.

Security-backed investment contracts generally contain termination provisions, allowing the Fund or the contract issuer to terminate with notice at any time at fair value and providing for automatic termination of the contract if the contract value or the fair value of the underlying portfolio equals zero. The issuer is obligated to pay the excess contract value when the fair value of the underlying portfolio equals zero. In addition, if the Fund defaults on its obligations under the security-backed contract (including the issuer’s determination that the agreement constitutes a non‑exempt prohibited transaction as defined under ERISA), and such default is not corrected within the time permitted by the contract, then the contract may be terminated by the issuer and the Fund will receive the fair value as of the date of termination.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

5. Master Trust Investment Information

The Plans’ investments are held in the Master Trust. Investments and the income therefrom are allocated to participating plans based on each plan’s participation in investment options within the Master Trust. The Salaried and Hourly Plan’s interest in the net assets of the Master Trust was approximately 75% and 25% at December 31, 2014, respectively.

The following table presents the investments for the Master Trust:

|

| | | | | | | |

| December 31 |

| 2014 | | 2013 |

Assets | | | |

Investment securities at fair value: | | | |

ADM common stock | 596,062,765 |

| | 548,712,118 |

|

Mutual funds | 649,887,559 |

| | 598,666,165 |

|

Common collective trust funds | 355,760,185 |

| | 287,707,074 |

|

Galliard Stable Value Fund | 279,968,613 |

| | 263,951,519 |

|

Other common stock | 2,811,888 |

| | 3,037,597 |

|

| 1,884,491,010 |

| | 1,702,074,473 |

|

Pending transactions | 327,766 |

| | 908,059 |

|

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | (3,656,194 | ) | | (2,054,655 | ) |

| $ | 1,881,162,582 |

| | $ | 1,700,927,877 |

|

Summarized financial information with respect to the Master Trust’s net investment gain is as follows:

|

| | | | | | | |

| Year Ended December 31 |

| 2014 | | 2013 |

Net realized and unrealized appreciation in fair value of investments: | | | |

ADM common stock | $ | 104,086,017 |

| | $ | 222,799,601 |

|

Mutual funds | 14,898,154 |

| | 135,200,150 |

|

Common collective trust funds | 22,076,257 |

| | 22,619,483 |

|

Other common stock | 46,050 |

| | 796,472 |

|

| $ | 141,106,478 |

| | $ | 381,415,706 |

|

| | | |

Dividend and interest income | $ | 54,831,616 |

| | $ | 35,688,709 |

|

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

6. Plan expenses

Brokerage commissions, transfer taxes, and other charges and expenses in connection with the purchase or sale of securities are charged to the Master Trust fund and added to the cost of such securities, or deducted from the sale proceeds, as the case may be. The stable value fund, mutual funds and CCTs incur expenses in the course of their operations and distribute returns to shareholders

based on the funds’ net income. Accordingly, these costs are not shown in plan expenses. Costs of administering the Plans, including the trustee, record-keeper, and audit fees, are currently paid

by the Plans’ sponsor, ADM. The Plans permit the reasonable expenses of administering the Plans to be paid from the trust fund. In 2014, forfeitures used to pay administrative expenses for the Salaried and Hourly plans were $80,184 and $104,587, respectively. In 2013, forfeitures used to pay administrative expenses for the Salaried and Hourly Plans were $313,136 and $491,726, respectively.

7. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plans to discontinue its contributions at any time and to terminate the Plans subject to the provisions of ERISA. In the event of Plan termination, participants will be 100% vested in their accounts.

8. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the Plans’ financial statements to the Form 5500:

|

| | | | | | | |

| December 31, 2014 |

| Salaried Plan | | Hourly Plan |

| | | |

Net assets available for benefits per the financial statements | $ | 1,445,299,688 |

| | $ | 488,823,679 |

|

Adjustments to contract value for fully benefit-responsive investment contracts | 2,663,417 |

| | 992,777 |

|

Amounts allocated to deemed distributions | (489,323 | ) | | (506,263 | ) |

Amounts allocated to withdrawing participants | (174,998 | ) | | (56,188 | ) |

Net assets available for benefits per the Form 5500 | $ | 1,447,298,784 |

| | $ | 489,254,005 |

|

|

| | | | | | | |

| December 31, 2013 |

| Salaried Plan | | Hourly Plan |

| | | |

Net assets available for benefits per the financial statements | $ | 1,306,786,845 |

| | $ | 441,589,144 |

|

Adjustments to contract value for fully benefit-responsive investment contracts | 1,488,007 |

| | 566,648 |

|

Amounts allocated to deemed distributions | (268,230 | ) | | (281,673 | ) |

Amounts allocated to withdrawing participants | (135,524 | ) | | (55,152 | ) |

Net assets available for benefits per the Form 5500 | $ | 1,307,871,098 |

| | $ | 441,818,967 |

|

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

8. Reconciliation of Financial Statements to Form 5500 (continued)

The accompanying financial statements present fully benefit-responsive contracts at contract value. The Form 5500 requires fully benefit-responsive investment contracts to be reported at fair value. Therefore, the adjustment from fair value to contract value for fully benefit- responsive investment contracts represents a reconciling item.

The following is a reconciliation of net change in net assets per the Plans’ financial statements to the Form 5500:

|

| | | | | | | |

| Year Ended December 31, 2014 |

| Salaried Plan | | Hourly Plan |

| | | |

Net increase in net assets per the financial statements | $ | 138,512,843 |

| | $ | 47,234,535 |

|

Amounts allocated to deemed distributions | (221,093 | ) | | (224,590 | ) |

Amounts allocated to withdrawing participants | (39,474 | ) | | (1,036 | ) |

Adjustments to contract value for fully benefit- responsive investment contracts | 1,175,410 |

| | 426,129 |

|

Net increase in net assets per the Form 5500 | $ | 139,427,686 |

| | $ | 47,435,038 |

|

Amounts allocated to withdrawing participants were recorded on the Form 5500 for withdrawal requests that have been processed and approved for payment prior to December 31, 2014, but not yet paid.

9. Income Tax Status

The Salaried Plan and Hourly Plan received determination letters from the IRS dated September 16, 2013, stating the Plans are qualified under Section 401(a) of the Internal Revenue Code (the Code) and, therefore, the Master Trust is exempt from taxation. Subsequent to this determination by the IRS, the Plans were amended. Once qualified, the Plans are required to operate in conformity with the Code to maintain their qualification. ADM believes the Plans are being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plans, as amended, are qualified and the Master Trust is tax-exempt.

Accounting principles generally accepted in the United States require plan management to evaluate uncertain tax positions taken by the Plans. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plans and, has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken. The Plans have recognized no interest or penalties related to uncertain tax positions. The Plans are subject to routine audits by taxing jurisdictions; however, there are currently

no audits for any tax periods in progress. The plan administrator believes it is no longer subject to income tax examinations for years prior to 2011.

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

Notes to Financial Statements (continued)

10. Risks and Uncertainties

The Plans invest in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Supplemental Schedules

ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees

EIN: 41-0129150

Plan 029

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2014

|

| | | | |

Identity of Issuer, Borrower, Lessor, or Similar Party |

Description |

Current Value |

| | |

Participant loans* | Loans, interest rates from 4.25% to 9.25% |

| $23,875,555 |

|

* Parties in interest.

18

ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees

EIN: 41-0129150

Plan 030

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2014

|

| | | | |

Identity of Issuer, Borrower, Lessor, or Similar Party |

Description |

Current Value |

| | |

Participant loans* | Loans, interest rates from 4.25% to 9.50% |

| $25,223,059 |

|

* Parties in interest.

19

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Administrator has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| ARCHER-DANIELS-MIDLAND COMPANY |

| |

| /s/Ray G. Young |

| |

| Ray G. Young |

| Executive Vice President and Chief Financial Officer |

| |

Dated: June 24, 2015 | |

20

Exhibit Index

|

| |

Exhibit | Description |

| |

23 | Consent of Ernst & Young LLP |

| |

21

Exhibit 23

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 333-42612 dated July 31, 2000, as amended by Post-Effective Amendment No. 1 dated August 8, 2000) pertaining to the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees (formerly ADM 401(k) Plan for Salaried Employees) and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees (formerly ADM 401(k) Plan for Hourly Employees) and the Registration Statements (Form S-8 No. 333-75073 dated March 26, 1999, and Form S-8 No. 333-37690 dated May 24, 2000) pertaining to the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees (as successor in interest to the ADM Employee Stock Ownership Plan for Salaried Employees) and ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees (as successor in interest to the ADM Employee Stock Ownership Plan for Hourly Employees) of our report dated June 24, 2015, with respect to the financial statements and schedules of the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees and the ADM 401(k) and Employee Stock Ownership Plan for Hourly Employees included in this Annual Report (Form 11-K) for the year ended December 31, 2014.

|

| | | | |

| | | | /s/ Ernst & Young LLP |

| | | | Ernst & Young LLP |

St. Louis, MO

June 24, 2015

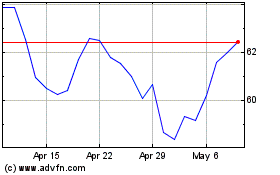

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

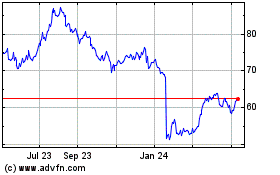

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024