UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 15, 2015

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-44 |

|

41-0129150 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

77 West Wacker Drive, Suite 4600

Chicago, Illinois |

|

60601 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (312) 634-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

Archer-Daniels-Midland Company (the “Company”) announced on June 15, 2015 the initial results and the pricing of its previously announced tender

offers for up to a maximum payment amount of certain outstanding debentures of the Company. Copies of the press releases, each dated June 15, 2015, related to the tender offer are filed with this Current Report as Exhibits 99.1 and 99.2.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

|

|

|

| 99.1 |

|

Press Release of Archer-Daniels-Midland Company dated June 15, 2015 announcing the initial results of the tender offers. |

|

|

| 99.2 |

|

Press Release of Archer-Daniels-Midland Company dated June 15, 2015 announcing the pricing of the tender offers. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ARCHER-DANIELS-MIDLAND COMPANY |

|

|

|

|

| Date: June 15, 2015 |

|

|

|

By |

|

/s/ D. Cameron Findlay |

|

|

|

|

|

|

D. Cameron Findlay |

|

|

|

|

|

|

Senior Vice President, General Counsel, and Secretary |

EXHIBIT INDEX

|

|

|

|

|

|

|

| Exhibit |

|

Description |

|

Method of Filing |

|

|

|

|

| 99.1 |

|

Press Release of Archer-Daniels-Midland Company dated June 15, 2015 announcing the initial results of the tender offers. |

|

|

Filed Electronically |

|

|

|

|

| 99.2 |

|

Press Release of Archer-Daniels-Midland Company dated June 15, 2015 announcing the pricing of the tender offers. |

|

|

Filed Electronically |

|

Exhibit 99.1

Archer Daniels Midland Company Announces Initial Results of Pending Tender Offers and the Extension of Early Tender Time

for all Debentures

CHICAGO, June 15, 2015—Archer Daniels Midland Company (NYSE: ADM) today announced that as of 5:00 p.m., New York City

time, June 12, 2015, the below-listed amounts of the following debentures (the “Debentures”) have been validly tendered and not validly withdrawn in connection with the cash tender offers, as reported by the depositary. These

Debentures, if accepted, will be eligible for the early tender payment of $30.00 per $1,000.00 principal amount of Debentures. Debentures tendered pursuant to the offers can no longer be withdrawn. The terms and conditions of the tender offers are

described in detail in the Offer to Purchase dated June 1, 2015, and the related Letter of Transmittal.

The previously announced early tender time

for each series of Debentures has been extended to 5:00 p.m., New York City time, on June 30, 2015, which is the current expiration date for the offers. Holders of Debentures that are validly tendered prior to the expiration date will be

eligible to receive the early tender payment of $30.00 per $1,000.00 principal amount of Debentures. All other terms of the offers, as previously announced, remain unchanged except that all holders will be eligible to receive the early tender

payment regardless when their Debentures were tendered.

Up to $1,000,000,000 Aggregate Purchase Price of the Outstanding Debentures

Listed Below

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Security (CUSIP No.) |

|

Principal

Amount

Outstanding |

|

|

Maximum

Tender

Amount |

|

|

Acceptance

Priority

Level |

|

Early

Tender

Payment* |

|

|

Principal

Amount

Tendered |

|

|

Percent of

Outstanding

Principal

Amount

Tendered

to Date |

|

| 6.950% Debentures due 2097 (039483 AP7) |

|

$ |

172,103,000 |

|

|

|

N/A |

|

|

1 |

|

$ |

30.00 |

|

|

$ |

13,559,000 |

|

|

|

7.88% |

|

| 5.375% Debentures due 2035 (039483 AU6) |

|

$ |

600,000,000 |

|

|

|

N/A |

|

|

2 |

|

$ |

30.00 |

|

|

$ |

129,988,000 |

|

|

|

21.66% |

|

| 5.765% Debentures due 2041 (039483 BC5) |

|

$ |

595,796,000 |

|

|

|

N/A |

|

|

3 |

|

$ |

30.00 |

|

|

$ |

216,769,000 |

|

|

|

36.38% |

|

| 5.935% Debentures due 2032 (039483 AT9) |

|

$ |

420,208,000 |

|

|

|

N/A |

|

|

4 |

|

$ |

30.00 |

|

|

$ |

37,299,000 |

|

|

|

8.88% |

|

| 6.625% Debentures due 2029 (039483 AR3) |

|

$ |

182,213,000 |

|

|

|

N/A |

|

|

5 |

|

$ |

30.00 |

|

|

$ |

22,280,000 |

|

|

|

12.23% |

|

| 6.750% Debentures due 2027 (039483 AN2) |

|

$ |

123,580,000 |

|

|

|

N/A |

|

|

6 |

|

$ |

30.00 |

|

|

$ |

4,936,000 |

|

|

|

3.99% |

|

| 7.500% Debentures due 2027 (039483 AM4) |

|

$ |

186,668,000 |

|

|

|

N/A |

|

|

7 |

|

$ |

30.00 |

|

|

$ |

35,224,000 |

|

|

|

18.87% |

|

| 7.000% Debentures due 2031 (039483 AS1) |

|

$ |

184,580,000 |

|

|

|

N/A |

|

|

8 |

|

$ |

30.00 |

|

|

$ |

20,127,000 |

|

|

|

10.90% |

|

| 6.450% Debentures due 2038 (039483 AX0) |

|

$ |

153,683,000 |

|

|

|

N/A |

|

|

9 |

|

$ |

30.00 |

|

|

$ |

26,882,000 |

|

|

|

17.49% |

|

| 8.375% Debentures due 2017 (039483 AH5) |

|

$ |

295,300,000 |

|

|

|

N/A |

|

|

10 |

|

$ |

30.00 |

|

|

$ |

33,254,000 |

|

|

|

11.26% |

|

| 4.479% Debentures due 2021 (039483 BB7) |

|

$ |

750,000,000 |

|

|

$ |

250,000,000 |

(a) |

|

11 |

|

$ |

30.00 |

|

|

$ |

312,797,000 |

(b) |

|

|

41.71% |

|

| * |

Per $1,000 principal amount of Debentures accepted for purchase |

| (a) |

Subject to a maximum tender amount of $250,000,000 aggregate principal amount as described in the Offer to Purchase |

| (b) |

The principal amount tendered exceeds the maximum tender amount of $250,000,000 aggregate principal amount as described in the Offer to Purchase |

The tender offers will expire at 5:00 p.m., New York City time, on June 30, 2015, unless extended.

The company will only purchase up to $1,000,000,000 aggregate purchase price of the Debentures in the tender offers, and the amount of each series of

Debentures that will be purchased will be determined in accordance with the Acceptance Priority Levels set forth above and may be prorated as described in the Offer to Purchase. In addition, the aggregate principal amount of the 4.479% Debentures

due 2021 (the “2021 Notes”) that may be purchased is subject to a maximum tender amount of $250,000,000 as described in the Offer to Purchase. Because the principal amount of the 2021 Notes tendered already exceeds such maximum tender

amount, any 2021 Notes that are purchased after applying the aggregate purchase price limitation and the Acceptance Priority Levels will be prorated.

The

settlement date is expected to be one business day following the expiration of the tender offers. Payments for Debentures purchased will include accrued interest up to, but not including, the settlement date.

The consummation of the tender offers is conditioned upon the satisfaction or waiver of the conditions, including the financing condition, set forth in the

Offer to Purchase. Any tendered Debentures not accepted will be promptly returned to the tendering parties.

ADM has retained Barclays Capital Inc., BofA

Merrill Lynch, Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as lead dealer managers, and D.F. King & Co., Inc. as the tender and information agent for the tender offers.

For additional information regarding the terms of the tender offers, please contact: Barclays Capital Inc. at (800) 438-3242 (toll-free) or

(212) 528-7581 (collect); BofA Merrill Lynch at (888) 292-0070 (toll-free) or (980) 387-3907 (collect); Citigroup Global Markets Inc. at (800) 558-3745 (toll-free) or (212) 723-6106 (collect); or J.P. Morgan Securities LLC

at (800) 834-4666 (toll-free) or (212) 834-4811 (collect). Requests for documents and questions regarding the tendering of Debentures may be directed to D.F. King & Co., Inc. at (866) 342-8290 (toll free) or

(212) 269-5550 (collect) or at adm@dfking.com.

ADM’s obligations to accept any Debentures tendered and to pay the applicable consideration for

them are set forth solely in the Offer to Purchase and related Letter of Transmittal. This press release is not an offer to purchase or a solicitation of acceptance of the tender offers. Subject to applicable law, ADM may amend, extend or, subject

to certain conditions, terminate the tender offers.

About ADM

For more than a century, the people of Archer Daniels Midland Company (NYSE: ADM) have transformed crops into products that serve the vital needs of a growing

world. Today, we’re one of the world’s largest agricultural processors and food ingredient providers, with more than 33,000 employees serving customers

in more than 140 countries. With a global value chain that includes more than 460 crop procurement locations, 300 ingredient manufacturing facilities, 40 innovation centers and the world’s

premier crop transportation network, we connect the harvest to the home, making products for food, animal feed, chemical and energy uses.

Archer

Daniels Midland Company

Media Relations

Jackie

Anderson

media@adm.com

312-634-8484

Exhibit 99.2

Archer Daniels Midland Company Announces Pricing of Offers to Purchase Certain Outstanding Debentures

CHICAGO, June 15, 2015—Archer Daniels Midland Company (NYSE: ADM) today announced the following consideration to be paid in its previously announced

cash tender offers for up to $1,000,000,000 aggregate purchase price of its outstanding debentures (the “Debentures”).

Up to

$1,000,000,000 Aggregate Purchase Price of the Outstanding Debentures Listed Below

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Security (CUSIP No.) |

|

Maximum

Tender

Amount |

|

Acceptance

Priority

Level |

|

U.S. Treasury

Reference

Security |

|

Fixed

Spread

(Basis

Points) |

|

|

Early

Tender

Payment* |

|

|

Total

Consideration* |

|

| 6.950% Debentures due 2097 (039483 AP7) |

|

N/A |

|

1 |

|

2.500% due

February 15,

2045 |

|

|

+170 bps |

|

|

$ |

30.00 |

|

|

$ |

1,438.63 |

|

| 5.375% Debentures due 2035 (039483 AU6) |

|

N/A |

|

2 |

|

2.500% due

February 15,

2045 |

|

|

+95 bps |

|

|

$ |

30.00 |

|

|

$ |

1,181.42 |

|

| 5.765% Debentures due 2041 (039483 BC5) |

|

N/A |

|

3 |

|

2.500% due

February 15,

2045 |

|

|

+100 bps |

|

|

$ |

30.00 |

|

|

$ |

1,262.55 |

|

| 5.935% Debentures due 2032 (039483 AT9) |

|

N/A |

|

4 |

|

2.500% due

February 15,

2045 |

|

|

+85 bps |

|

|

$ |

30.00 |

|

|

$ |

1,246.38 |

|

| 6.625% Debentures due 2029 (039483 AR3) |

|

N/A |

|

5 |

|

2.125% due

May 15,

2025 |

|

|

+155 bps |

|

|

$ |

30.00 |

|

|

$ |

1,288.40 |

|

| 6.750% Debentures due 2027 (039483 AN2) |

|

N/A |

|

6 |

|

2.125% due

May 15,

2025 |

|

|

+145 bps |

|

|

$ |

30.00 |

|

|

$ |

1,289.85 |

|

| 7.500% Debentures due 2027 (039483 AM4) |

|

N/A |

|

7 |

|

2.125% due

May 15,

2025 |

|

|

+145 bps |

|

|

$ |

30.00 |

|

|

$ |

1,346.23 |

|

| 7.000% Debentures due 2031 (039483 AS1) |

|

N/A |

|

8 |

|

2.500% due

February 15,

2045 |

|

|

+95 bps |

|

|

$ |

30.00 |

|

|

$ |

1,338.26 |

|

| 6.450% Debentures due 2038 (039483 AX0) |

|

N/A |

|

9 |

|

2.500% due

February 15,

2045 |

|

|

+105 bps |

|

|

$ |

30.00 |

|

|

$ |

1,334.42 |

|

| 8.375% Debentures due 2017 (039483 AH5) |

|

N/A |

|

10 |

|

0.625% due

May 31,

2017 |

|

|

+25 bps |

|

|

$ |

30.00 |

|

|

$ |

1,131.43 |

|

| 4.479% Debentures due 2021 (039483 BB7) |

|

$250,000,000(a) |

|

11 |

|

1.375% due

April 30,

2020 |

|

|

+50 bps |

|

|

$ |

30.00 |

|

|

$ |

1,120.94 |

|

| * |

Per $1,000 principal amount of Debentures accepted for purchase |

| (a) |

Subject to a maximum tender amount of $250,000,000 aggregate principal amount as described in the Offer to Purchase |

The reference yield was determined by Barclays Capital Inc., BofA Merrill Lynch, Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, the lead dealer

managers for the tender offers, based on the bid-side price for the applicable U.S. Treasury security at 11:00 a.m., New York City time, today, as described in the Offer to Purchase dated June 1, 2015.

Holders who tender Debentures by 5:00 p.m., New York City time, on June 30, 2015, will be eligible to

receive the applicable total consideration (which includes the applicable early tender payment set out above).

In addition, holders of Debentures

accepted for purchase will be paid accrued interest to but excluding the settlement date. Withdrawal rights for the tender offers expired at 5:00 p.m., New York City time, on June 12, 2015.

The company will only purchase up to $1,000,000,000 aggregate purchase price of the Debentures in the tender offers, and the amount of each series of

Debentures that will be purchased will be determined in accordance with the Acceptance Priority Levels set forth above and may be prorated as described in the Offer to Purchase. In addition, the aggregate principal amount of the 4.479% Debentures

due 2021 (the “2021 Notes”) that may be purchased is subject to a maximum tender amount of $250,000,000 as described in the Offer to Purchase. Because, as previously disclosed, the principal amount of the 2021 Notes tendered already

exceeds such maximum tender amount, any 2021 Notes that are purchased after applying the aggregate purchase price limitation and the Acceptance Priority Levels will be prorated.

The consummation of the tender offers is conditioned upon the satisfaction or waiver of the conditions, including the financing condition, set forth in the

Offer to Purchase.

For additional information regarding the terms of the tender offers, please contact: Barclays Capital Inc. at (800) 438-3242

(toll-free) or (212) 528-7581 (collect); BofA Merrill Lynch at (888) 292-0070 (toll-free) or (980) 387-3907 (collect); Citigroup Global Markets Inc. at (800) 558-3745 (toll-free) or (212) 723-6106 (collect); or J.P. Morgan

Securities LLC at (800) 834-4666 (toll-free) or (212) 834-4811 (collect). Requests for documents and questions regarding the tendering of Debentures may be directed to D.F. King & Co., Inc. at (866) 342-8290 (toll free) or

(212) 269-5550 (collect) or at adm@dfking.com.

ADM’s obligations to accept any Debentures tendered and to pay the applicable consideration for

them are set forth solely in the Offer to Purchase and related Letter of Transmittal. This press release is not an offer to purchase or a solicitation of acceptance of the tender offers. Subject to applicable law, ADM may amend, extend or, subject

to certain conditions, terminate the tender offers.

About ADM

For more than a century, the people of Archer Daniels Midland Company (NYSE: ADM) have transformed crops into products that serve the vital needs of a growing

world. Today, we’re one of the world’s largest agricultural processors and food ingredient providers, with more than 33,000 employees serving customers in more than 140 countries. With a global value chain that includes more than 460 crop

procurement locations, 300 ingredient manufacturing facilities, 40 innovation centers and the world’s premier crop transportation network, we connect the harvest to the home, making products for food, animal feed, chemical and energy uses.

Archer Daniels Midland Company

Media Relations

Jackie Anderson

media@adm.com

312-634-8484

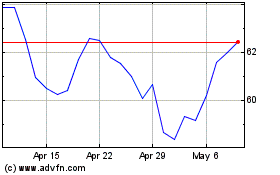

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

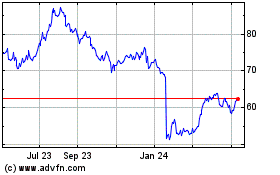

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024