UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

_____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 5, 2015

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-44 | 41-0129150 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| | |

77 West Wacker Drive, Suite 4600 Chicago, Illinois | | 60601 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant's telephone number, including area code: (312) 634-8100 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On May 5, 2015, Archer-Daniels-Midland Company (ADM) issued a press release announcing first quarter results. A copy of such press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ADM is making reference to non-GAAP financial measures in both the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits The following exhibits are furnished or filed, as applicable, herewith:

99.1 Press release dated May 5, 2015 announcing first quarter results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ARCHER-DANIELS-MIDLAND COMPANY |

|

| | | | |

Date: | May 5, 2015 | | By | /s/ D. Cameron Findlay |

| | | | D. Cameron Findlay |

| | | | Senior Vice President, General Counsel, and Secretary |

EXHIBIT INDEX

Exhibit Description

99.1 Press Release dated May 5, 2015

ADM Reports First Quarter Adjusted Earnings of $0.77 per Share

•Adjusted EPS up 40 percent from year-ago period

•Net earnings of $493 million, or $0.77 per share

CHICAGO, May 5, 2015 – Archer Daniels Midland Company (NYSE: ADM) today reported financial results for the quarter ended March 31, 2015.

The company reported adjusted earnings per share1 of $0.77, up from $0.55 in the same period last year. Adjusted segment operating profit1 was $883 million, up 12 percent from $789 million in the year-ago period. Net earnings for the quarter were $493 million, or $0.77 per share, and segment operating profit1 was $855 million.

“In the first quarter, the ADM team demonstrated their ability to leverage the strengths of our diversified business model,” said ADM Chief Executive Officer Juan Luciano. “The Oilseeds team capitalized on favorable market conditions and delivered outstanding results, with strong performances in each region. In Ag Services, our recently created global trade desk (GTD) platform drove higher merchandised volumes. Our new WILD Flavors and Specialty Ingredients business got off to a great start toward achieving the cost and revenue synergies we identified last year. Together, these performances helped deliver a good quarter overall, even as lower industry ethanol margins limited earnings in Corn, and the strong dollar limited U.S. grain exports.

“We have continued to advance the strategic plan we shared at our December investor day. In the area of optimizing the core, we announced the acquisition of a Belgian oil bottling business, helping us reach a wider customer base and creating a new output for our European crushing assets. And the WFSI team has been working with customers as they developed and launched new products using SCI, WILD and ADM ingredients. We had more than 200 joint customer engagements, building a pipeline of more than 400 projects, resulting already in more than 30 revenue synergy wins, across a number of regions and business units in Q1 alone. In the area of driving operational efficiencies, we have already identified more than $200 million in run-rate savings opportunities, toward our goal of $550 million in five years. And, in the area of strategic expansion, the corn processing business expanded in high-growth geographies, with the acquisition of the remaining stake of corn wet mills in Bulgaria and Turkey, and an increased stake in a facility in Hungary.”

First Quarter 2015 Highlights1

| |

• | Adjusted EPS of $0.77 is consistent with the reported EPS. |

| |

• | Agricultural Services increased $52 million as improved U.S. and global grain merchandising results were partially offset by limited U.S. export competitiveness. |

| |

• | Corn Processing decreased $124 million on lower ethanol production volumes and weaker industry margins. |

| |

• | Oilseeds Processing increased $153 million with record soybean crushing volumes in Europe and North America and improved grain origination in South America. |

| |

• | Wild Flavors and Specialty Ingredients earned $68 million in the first reporting period for this business unit. |

| |

• | Trailing four-quarter-average adjusted ROIC was 9.5 percent, up 250 basis points year over year and 290 basis points above annual WACC of 6.6 percent. |

| |

• | During the first quarter, the company returned $0.7 billion to shareholders through dividends and the repurchase of 12 million shares. |

1 Non-GAAP financial measures; see pages 4 and 9 for explanations and reconciliations, including after-tax amounts.

Agricultural Services Results Improve on Grain Merchandising

Agricultural Services operating profit was $194 million, up $52 million from the year-ago period.

Merchandising and handling earnings improved $38 million to $107 million. ADM's new global trade desk (GTD) merchandising platform saw increased volumes and margins. In North America, volumes and margins improved, despite a very active fourth quarter, the start of the South American harvest and the impact of a strong dollar on U.S. export competitiveness.

Transportation results were essentially flat, with increased demand for northbound U.S. barge freight mostly offsetting decreased southbound demand due to lower exports from the Gulf.

Milling and other results improved $15 million to $55 million, due primarily to strong margins for flour, grain and feed.

Corn Processing Results Decline on Lower Ethanol Margins

Corn Processing operating profit decreased from $251 million to $127 million.

Sweeteners and starches results declined $10 million to $85 million with increased North American volumes offset by lower contributions from coproducts, reduced equity earnings from joint-ventures, and startup costs related to the Tianjin sweetener facility.

Bioproducts results declined from $156 million to $42 million due to lower ethanol production volumes amid weaker industry margins. Supply/demand imbalances challenged industry ethanol margins most of the quarter, though conditions and margins have been improving since late March.

Oilseeds Earnings Excellent with Record Global Soybean Crushing Results

Oilseeds operating profit of $483 million increased $153 million from strong year-ago results.

Crushing and origination operating profit increased $173 million to $334 million. Soybean crushing results for the quarter were the strongest ever, with record volumes in Europe and North America and strong margins globally, driven by strong U.S. and global meal demand. Improved farmer selling helped support a significant improvement in South American origination results.

Refining, packaging, biodiesel and other generated a profit of $52 million for the quarter, down $33 million. Improved biodiesel results in South America—from the enactment of increased blending standards in Brazil—were offset by lower margins in North America and weaker demand in Europe.

Oilseeds results in Asia for the quarter improved from the year-ago period, primarily driven by stronger Wilmar results.

Wild Flavors and Specialty Ingredients First Reporting Quarter

During the fourth quarter of 2014, ADM closed on the acquisitions of WILD Flavors GmbH and Specialty Commodities, Inc. Starting with the first quarter of 2015, ADM has created a new business segment—Wild Flavors and Specialty Ingredients—which includes the results of these two businesses as well as ADM’s legacy specialty ingredients businesses.

In the first quarter, WILD Flavors and Specialty Ingredients operating profit was $68 million. Globally, the WILD Flavors business is off to a great start towards achieving the cost and revenue synergies that were identified last year. There have been more than 200 joint customer engagements, more than 400 projects in the pipeline and 30 revenue synergy wins across the business units and geographies.

Other Items of Note

For the first quarter, the effective tax rate was 29 percent, versus 27 percent in the same period last year.

As additional information to help clarify underlying business performance, the tables on page 9 include both adjusted EPS as well as adjusted EPS excluding significant timing effects.

Conference Call Information

ADM will host a conference call and audio webcast on May 5, 2015, at 8 a.m. Central Time to discuss financial results and provide a company update. A financial summary slide presentation will be available to download approximately 60 minutes prior to the call. To listen to the call via the Internet or to download the slide presentation, go to www.adm.com/webcast. To listen by telephone, dial (888) 522-5398 in the U.S. or (706) 902-2121 if calling from outside the U.S. The access code is 20922629.

Replay of the call will be available from May 6, 2015, to May 12, 2015. To listen to the replay by telephone, dial (855) 859-2056 in the U.S. or (404) 537-3406 if calling from outside the U.S. The access code is 20922629. The replay will also be available online for an extended period of time at www.adm.com/webcast.

About ADM

For more than a century, the people of Archer Daniels Midland Company (NYSE: ADM) have transformed crops into products that serve the vital needs of a growing world. Today, we’re one of the world’s largest agricultural processors and food ingredient providers, with more than 33,000 employees serving customers in more than 140 countries. With a global value chain that includes more than 460 crop procurement locations, 300 ingredient manufacturing facilities, 40 innovation centers and the world’s premier crop transportation network, we connect the harvest to the home, making products for food, animal feed, chemical and energy uses. Learn more at www.adm.com.

Archer Daniels Midland Company

Media Relations Investor Relations

David Weintraub Mark Schweitzer

312-634-8484 217-451-8286

Financial Tables Follow

Segment Operating Profit and Corporate Results

A non-GAAP financial measure

(unaudited)

|

| | | | | | | | | | | |

| Quarter ended

March 31 | | |

(In millions) | 2015 | | 2014 | | Change |

| | | | | |

Agricultural Services Operating Profit | | | | | |

Merchandising and handling | $ | 107 |

| | $ | 69 |

| | $ | 38 |

|

Milling and other | 55 |

| | 40 |

| | 15 |

|

Transportation | 32 |

| | 33 |

| | (1 | ) |

Total Agricultural Services | $ | 194 |

| | $ | 142 |

| | $ | 52 |

|

Corn Processing Operating Profit | |

| | |

| | |

|

Sweeteners and starches (excluding timing effects) | $ | 85 |

| | $ | 95 |

| | $ | (10 | ) |

Bioproducts (excluding timing effects) | 42 |

| | 156 |

| | (114 | ) |

Corn hedge timing effects* | (14 | ) | | (65 | ) | | 51 |

|

Total Corn Processing | $ | 113 |

| | $ | 186 |

| | $ | (73 | ) |

Oilseeds Processing Operating Profit | | | | | |

Crushing and origination | $ | 334 |

| | $ | 161 |

| | $ | 173 |

|

Refining, packaging, biodiesel, and other (excluding specified item) | 52 |

| | 85 |

| | (33 | ) |

Cocoa and other (excluding timing effects) | 29 |

| | 30 |

| | (1 | ) |

Biodiesel credits* | — |

| | (9 | ) | | 9 |

|

Cocoa hedge timing effects* | (14 | ) | | (24 | ) | | 10 |

|

Asia | 68 |

| | 54 |

| | 14 |

|

Total Oilseeds Processing | $ | 469 |

| | $ | 297 |

| | $ | 172 |

|

Wild Flavors and Specialty Ingredients Operating Profit | | | | | |

Wild Flavors and Specialty Ingredients | $ | 68 |

| | $ | 58 |

| | $ | 10 |

|

Total Wild Flavors and Specialty Ingredients | $ | 68 |

| | $ | 58 |

| | $ | 10 |

|

Other Operating Profit | |

| | |

| | |

|

Financial | 11 |

| | 8 |

| | 3 |

|

Total Other | $ | 11 |

| | $ | 8 |

| | $ | 3 |

|

| | | | | |

Segment Operating Profit | $ | 855 |

| | $ | 691 |

| | $ | 164 |

|

*Memo: Adjusted Segment Operating Profit | $ | 883 |

| | $ | 789 |

| | $ | 94 |

|

| | | | | |

Corporate Results | |

| | |

| | |

|

LIFO credit (charge) | $ | 2 |

| | $ | (159 | ) | | $ | 161 |

|

Interest expense - net | (78 | ) | | (93 | ) | | 15 |

|

Unallocated corporate costs | (103 | ) | | (80 | ) | | (23 | ) |

Minority interest and other | 14 |

| | 7 |

| | 7 |

|

Total Corporate | $ | (165 | ) | | $ | (325 | ) | | $ | 160 |

|

Earnings Before Income Taxes | $ | 690 |

| | $ | 366 |

| | $ | 324 |

|

Segment operating profit is ADM’s consolidated income from operations before income tax excluding corporate items. Adjusted segment operating profit is segment operating profit adjusted, where applicable, for specified items and timing effects (see items denoted*). Timing effects relate to hedge ineffectiveness and mark-to-market hedge timing effects. Management believes that segment operating profit and adjusted segment operating profit are useful measures of ADM’s performance because they provide investors information about ADM’s business unit performance excluding corporate overhead costs as well as specified items and timing effects. Segment operating profit and adjusted segment operating profit are non-GAAP financial measures and are not intended to replace earnings before income tax, the most directly comparable GAAP financial measure. Segment operating profit and adjusted segment operating profit are not measures of consolidated operating results under U.S. GAAP and should not be considered alternatives to income before income taxes or any other measure of consolidated operating results under U.S. GAAP.

Consolidated Statements of Earnings

(unaudited)

|

| | | | | | | | |

| | Quarter ended

March 31 |

| | 2015 | | 2014 |

| | (in millions, except per share amounts) |

Revenues | | $ | 17,506 |

| | $ | 20,696 |

|

Cost of products sold | | 16,404 |

| | 20,021 |

|

Gross profit | | 1,102 |

| | 675 |

|

Selling, general, and administrative expenses | | 498 |

| | 393 |

|

Equity in (earnings) losses of unconsolidated affiliates | | (139 | ) | | (132 | ) |

Interest income | | (18 | ) | | (22 | ) |

Interest expense | | 81 |

| | 93 |

|

Other (income) expense - net | | (10 | ) | | (23 | ) |

Earnings before income taxes | | 690 |

| | 366 |

|

Income taxes | | (197 | ) | | (98 | ) |

Net earnings including noncontrolling interests | | 493 |

| | 268 |

|

Less: Net earnings (losses) attributable to noncontrolling interests | | — |

| | 1 |

|

Net earnings attributable to ADM | | $ | 493 |

| | $ | 267 |

|

| | | | |

Diluted earnings per common share | | $ | 0.77 |

| | $ | 0.40 |

|

| | | | |

Average number of shares outstanding | | 639 |

| | 663 |

|

| | | | |

| | | | |

Other (income) expense - net consists of: | | |

| | |

|

Gain on sale of assets/business (a) | | $ | (3 | ) | | $ | (23 | ) |

Other - net | | (7 | ) | | — |

|

| | $ | (10 | ) | | $ | (23 | ) |

(a) Current period gain includes individually insignificant disposals in Oilseeds ($2 million) and Ag Services ($1 million). Prior period gain includes individually insignificant disposals in Oilseeds ($15 million) and Ag Services ($8 million).

Summary of Financial Condition

(Unaudited)

|

| | | | | | | | |

| | March 31,

2015 | | March 31,

2014 |

| | (in millions) |

NET INVESTMENT IN | | | | |

Cash and cash equivalents (b) | | $ | 890 |

| | $ | 1,083 |

|

Short-term marketable securities (b) | | 406 |

| | 452 |

|

Operating working capital (a) | | 8,147 |

| | 11,555 |

|

Property, plant, and equipment | | 9,833 |

| | 10,102 |

|

Investments in and advances to affiliates | | 3,959 |

| | 3,580 |

|

Long-term marketable securities | | 507 |

| | 537 |

|

Goodwill and other intangibles | | 3,124 |

| | 758 |

|

Other non-current assets | | 396 |

| | 241 |

|

Net current assets held for sale | | 1,084 |

| | — |

|

| | $ | 28,346 |

| | $ | 28,308 |

|

FINANCED BY | | |

| | |

|

Short-term debt (b) | | $ | 848 |

| | $ | 300 |

|

Long-term debt, including current maturities (b) | | 5,593 |

| | 5,373 |

|

Deferred liabilities | | 3,148 |

| | 2,573 |

|

Shareholders' equity | | 18,757 |

| | 20,062 |

|

| | $ | 28,346 |

| | $ | 28,308 |

|

| |

(a) | Current assets (excluding cash and cash equivalents, short-term marketable securities, and current assets held for sale) less current liabilities (excluding short-term debt, current maturities of long-term debt, and current liabilities held for sale). |

| |

(b) | Net debt is calculated as short-term debt plus long-term debt, including current maturities less cash and cash equivalents and short-term marketable securities. |

Summary of Cash Flows

(unaudited)

|

| | | | | | | | |

| | Three months ended

March 31 |

| | 2015 | | 2014 |

| | (in millions) |

Operating Activities | | | | |

Net earnings | | $ | 493 |

| | $ | 268 |

|

Depreciation and amortization | | 216 |

| | 219 |

|

Other - net | | (132 | ) | | (259 | ) |

Changes in operating assets and liabilities | | (532 | ) | | (586 | ) |

Total Operating Activities | | 45 |

| | (358 | ) |

| | | | |

Investing Activities | | |

| | |

|

Purchases of property, plant and equipment | | (244 | ) | | (188 | ) |

Proceeds from sale of business/assets | | 6 |

| | 6 |

|

Marketable securities - net | | 100 |

| | (41 | ) |

Other investing activities | | (123 | ) | | 78 |

|

Total Investing Activities | | (261 | ) | | (145 | ) |

| | | | |

Financing Activities | | |

| | |

|

Long-term debt borrowings | | 8 |

| | 1 |

|

Long-term debt payments | | (7 | ) | | (1,154 | ) |

Net borrowings (payments) under lines of credit | | 742 |

| | (63 | ) |

Purchases of treasury stock | | (566 | ) | | (175 | ) |

Cash dividends | | (177 | ) | | (158 | ) |

Other | | 7 |

| | 14 |

|

Total Financing Activities | | 7 |

| | (1,535 | ) |

| | | | |

Increase (decrease) in cash and cash equivalents | | (209 | ) | | (2,038 | ) |

Cash and cash equivalents - beginning of period | | 1,099 |

| | 3,121 |

|

Cash and cash equivalents - end of period | | $ | 890 |

| | $ | 1,083 |

|

Segment Operating Analysis

(unaudited)

|

| | | | | | | | |

| | Quarter ended

March 31 |

| | 2015 | | 2014 |

| | (in '000s metric tons) |

Processed volumes | | | | |

Oilseeds | | 8,849 |

| | 8,689 |

|

Corn | | 5,302 |

| | 5,749 |

|

Milling and Cocoa | | 1,750 |

| | 1,773 |

|

Total processed volumes | | 15,901 |

| | 16,211 |

|

| | | | |

| | | | |

| | Quarter ended

March 31 |

| | 2015 | | 2014 |

| | (in millions) |

Revenues | | |

| | |

|

Agricultural Services | | $ | 8,045 |

| | $ | 9,711 |

|

Corn Processing | | 2,466 |

| | 2,984 |

|

Oilseeds Processing | | 6,293 |

| | 7,655 |

|

Wild Flavors and Specialty Ingredients | | 606 |

| | 257 |

|

Other | | 96 |

| | 89 |

|

Total revenues | | $ | 17,506 |

| | $ | 20,696 |

|

Adjusted Earnings Per Share

A non-GAAP financial measure

(unaudited)

|

| | | | | | | | |

| | Quarter ended

March 31 |

| | 2015 | | 2014 |

Reported EPS (fully diluted) | | $ | 0.77 |

| | $ | 0.40 |

|

Adjustments: | | |

| | |

|

LIFO (credit) charge (a) | | — |

| | 0.15 |

|

U.S. biodiesel credits (b) | | — |

| | 0.01 |

|

Effective tax rate adjustment (c) | | — |

| | (0.01 | ) |

Sub-total adjustments | | — |

| | 0.15 |

|

Adjusted earnings per share (non-GAAP) | | $ | 0.77 |

| | $ | 0.55 |

|

| | | | |

Memo: Timing effects (gain) loss | | | | |

Corn (d) | | 0.01 |

| | 0.06 |

|

Cocoa (e) | | 0.02 |

| | 0.03 |

|

Sub-total timing effects | | 0.03 |

| | 0.09 |

|

Adjusted EPS excluding timing effects (non-GAAP) | | $ | 0.80 |

| | $ | 0.64 |

|

| |

(a) | The company’s pretax changes in its LIFO reserves during the period, tax effected using the Company’s U.S. effective income tax rate. |

| |

(b) | Prior period credits of $9 million, pretax, ($10 million, after tax) related to U.S. biodiesel blending credits recorded in a later period. |

| |

(c) | Impact to EPS due to the change in annual effective tax rate. |

| |

(d) | Corn timing effects for corn hedge ineffectiveness losses tax effected using the Company's U.S. effective income tax rate. |

| |

(e) | Cocoa timing effects tax effected using the Company's effective income tax rate. |

Adjusted EPS and adjusted EPS excluding timing effects reflect ADM’s fully diluted EPS after removal of the effect on Reported EPS of certain specified items and timing effects as more fully described above. Management believes that these are useful measures of ADM’s performance because they provide investors additional information about ADM’s operations allowing better evaluation of ongoing business performance. These non-GAAP financial measures are not intended to replace or be an alternative to Reported EPS, the most directly comparable GAAP financial measure, or any other measures of operating results under GAAP. Earnings amounts described above have been divided by the company’s diluted shares outstanding for each respective quarter in order to arrive at an adjusted EPS amount for each specified item and timing effect.

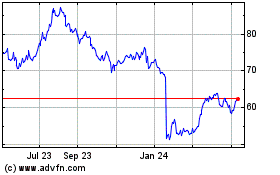

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

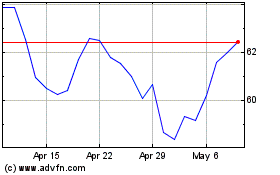

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024