Mortgage Cadence Launches New Version of Its Enterprise Lending Center, with Extensibility, Compliance & Integration Enhancem...

March 21 2017 - 7:57AM

Business Wire

Mortgage Cadence, an Accenture (NYSE:ACN) company, announces it

will launch a new version of its Enterprise Lending Center (ELC)

platform, with major enhancements designed to offer lenders greater

extensibility, enhanced service ordering, additional regulatory

support, and the framework for the third-generation Borrower

Center.

Paul Wetzel, Mortgage Cadence’s executive vice president of

Product Management, said, “The latest ELC features go beyond

compliance-related and general system updates, bringing to the

table key enhancements that position our clients for continued

success while giving us the framework on which to stay ahead of

trends as the pace of technology evolution accelerates.”

Specific enhancements to the ELC Platform include:

- Brand-New API Functionality. The latest

version of the ELC includes a new application program interface

(API) layer designed with scalability and data integrity in mind,

which maximizes configuration and enables extensibility through the

software development kit (SDK). As a result, SDK users will have

the ability to seamlessly integrate ELC functionality across their

operations, from consumer mobile apps through servicing and

secondary management, all while using the latest in design

standards.

- Third-Party Integrations. Mortgage

Cadence continually expands its ELC interface list to include

access to best-of-breed third-party service providers, giving

lenders ever-increasing flexibility to choose their preferred

providers. Most recently, the company integrated MGIC as an

additional mortgage insurance provider option to its ELC

platform.

- HMDA and UCD Compliance. Mortgage

Cadence’s commitment to help clients stay compliant with the latest

regulations continues with this latest release of ELC, which lays

the framework for client HMDA requirements, including all new data

points across all origination channels. The release also includes

the new data points for collection of government monitoring

information; provides the ability to collect via a URLA addendum;

and adds the data points necessary to generate the UCD File.

- Borrower Center for ELC Framework. Next

week, Mortgage Cadence will debut the third generation of its

Borrower Center, building on the company’s proprietary technology

that elevated the online mortgage lending experience more than 15

years ago. This release will expand ELC’s borrower self-service

capabilities, providing borrowers with a superior experience and

lenders with a more-efficient, cost-effective process.

“This latest ELC release reinforces the highly regarded

technical team we have put in place, showcasing our commitment to

providing our clients with forward-looking functionality,” said

Damir Matic, Mortgage Cadence’s executive vice president of

Technology Architecture and Engineering. “Since joining Accenture

nearly three years ago, Mortgage Cadence has more than doubled in

size by focusing on hiring the industry’s best talent.”

About Mortgage Cadence

Mortgage Cadence has been working with lenders since 1999,

offering a one-stop shop mortgage technology solution designed for

point-of-sale through post-closing. In a time when efficiency,

speed and the customer experience are paramount to the success of

lenders, Mortgage Cadence offers reliable software and dedicated

people, supporting lenders every step of the way. Visit

www.mortgagecadence.com for more information.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170321005062/en/

Mortgage Cadence, an Accenture CompanySarah Volling, +1

303-906-4136sarah.a.volling@mortgagecadence.com

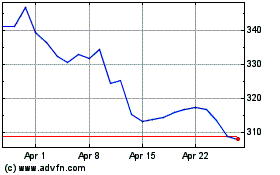

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024