Consumers Willing to Pay Extra for In-Car Technologies, Accenture Research Reveals

April 28 2016 - 12:59AM

Business Wire

Survey indicates potential stand-alone pricing,

high demand for location-based services, remote and diagnostic

services among drivers in China, Germany and the US

Drivers would opt to pay up to an additional 10 percent of a new

car’s price to get the in-car technology that they want, according

to a new survey conducted by Accenture (NYSE:ACN).

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160427006848/en/

By 2025, all new cars sold will be

connectivity enabled (Graphic: Business Wire)

The survey polled drivers in China, Germany and the United

States about their current and future use of in-car technologies,

including entertainment, information, remote and driver support

services, as well as the features they would consider paying a

premium for over the vehicle price. Accenture believes that by

2025, all new cars sold will be connectivity-enabled.

When asked what percentage of a new car’s selling price drivers

would be willing to spend on infotainment services relevant to

their needs, seven in ten of all respondents, 71 percent, would pay

up to 10 percent of the car price.

The research found that the functionalities consumers would be

most willing to spend more on include remote services like eCall,

where the vehicle automatically sends a distress message to the

nearest emergency center when a life-threatening situation occurs,

and bCall, a system which alerts a vehicle recovery organization

when a vehicle breaks down. Sixty-three percent of respondents are

interested in the e-Call feature, and 41 percent is willing to pay

for the service.

According to the survey, there is a high interest in remote

diagnostics and location-based services. Seventy-five percent are

interested in receiving vehicle health reports and 71 percent would

consider, or are very likely to start using vehicle lifecycle

management reports; with nearly half of the respondents (43

percent) willing to spend extra on these features. Over half

(55 percent) want location functionalities like stolen vehicle

tracking and recovery, navigation, and remote parked car locator

systems. A third (29 percent) would pay more for these in-car

services.

“Consumers are becoming more inclined to make separate purchases

of the in-car functions they want most, offering automakers the

opportunity to increase revenues and create after-sales

relationships with their customers – but only they can better

accommodate demand for the right functionality and services,” said

Axel Schmidt, managing director in Accenture’s automotive practice.

“We believe that the demand for a range of features, from safety

systems and remote services to parking assist technology, will

increase in the coming years.”

Future Demand

The survey reveals consumer interest in key in-car technologies

is likely to grow. For example, nearly three-quarters of the

respondents say they will very likely start using or consider using

the eCall feature in the future. In terms of future use of remote

diagnostics, 75 percent and 71 percent respectively expect to use

vehicle health and vehicle lifecycle management services. Appeal

for location-based services is also anticipated to gain popularity,

as 78 percent of respondents are interested in having the stolen

vehicle recovery and tracking system, 71 percent want features like

the remote parked car locator, and just under two-thirds, or 59

percent, would welcome the use of high-quality, in-car navigation

systems in the future.

In addition, 35 percent of drivers questioned wanted concierge

services, such as voice-activated responses to location-based

questions, with 19 percent willing to pay an additional fee for

this. Thirty-two percent want smart home integration, which

provides the ability to control automated devices within the home

from a connected vehicle, and 20 percent would pay more for it.

Twenty-eight percent indicated an interest in online service

booking, with 13 percent willing to pay a premium for the

convenience.

With regard to payments for in-car services, nearly half of

respondents (47 percent) are willing to make an upfront payment

when buying a new car, or pay for connected services over the

lifetime of the services. More than one-third of those polled (34

percent) want free basic services subject to in-car advertising

with the option to upgrade to premium versions of

services. And 32 percent would consider paying a monthly fee

for connected vehicle services using a credit card or PayPal.

The research also found:

- Vehicle Diagnostics Use – U.S.

drivers are very interested in using this technology with 63

percent of respondents indicating they are very likely to start

using it or would consider its use in the future. Respondents in

China show a strong interest in remote diagnostics (65 percent) and

remote health check (72 percent). Of the drivers polled in

Germany, 47 percent were interested in vehicle diagnostics.

- Willing to Pay More – Drivers

surveyed in China would be willing to spend an average of 16

percent of the new car’s price on infotainment features. U.S.

drivers polled would consider spending an additional 15 percent,

with drivers in Germany willing to pay 11 percent more than the

price of the car for these services. For convenience services,

drivers in the U.S. are willing to spend on average up to 16

percent of a car’s price, followed by those in China, at 15 percent

and Germany at 11 percent.

- Preferred payment methods –

Nearly half of German respondents (49 percent) would opt to pay

upfront in the car’s price for additional services, or would choose

the option of paying for connected services during the life of the

service. Forty-six percent of Chinese drivers and 45 percent

of U.S. respondents would prefer this method.

- Connected Vehicle Data Ownership

– More than half of the German respondents believe that the data

generated by connected services is owned by the provider of the

services. In contrast, a majority of U.S. and China drivers believe

that they own the data.

- Data-Sharing with Third Parties

– Seventy-five percent of German respondents say they would only

share their data if it was kept anonymous. This view is shared

by 72 percent and 71 percent of those surveyed in China and the

U.S, respectively. However, 68 percent of U.S. and Chinese

drivers would share their data if it were to improve their current

technology services, and 53 percent of German participants

agree.

“Consumer interest in spending more on desired in-car

functionality and services in three of the world’s largest

automotive markets reinforces Accenture’s belief that in-car

technologies - and the concept of the connected vehicle itself –

are defining the automotive industry, and transforming the way

consumers view the automobile,” said Schmidt. “We also believe that

the willingness of consumers to pay for in-car services separately

from a new vehicle’s purchase price will provide the industry with

new sources of revenue, further enhancing the global connected

vehicle market. We estimate that in China alone, the value of the

connected vehicle market could be as much as $216.2 billion by

2025.”

Country-Specific Findings

- Among the three markets, U.S.

respondents (71 percent) and China respondents (70 percent) show

the most interest in using connected information technologies that

would enable them to receive streaming music from their smartphone.

German respondents are not far behind, as 63 percent want the same

capability.

- US drivers, at 80 percent, are the most

interested in having a stolen vehicle recovery/tracker system.

- Forty-three percent of respondents in

both China and the US are interested in the delivery services trunk

feature, where delivery companies can access the car’s trunk or

boot, and deliver parcels. German drivers are the least interested

in this feature, at 34 percent.

- High quality navigation solutions hold

the most appeal for Chinese respondents in comparison with other

participants. China drivers mirror their U.S. counterparts in terms

of interest in a remote engine start function with 62 percent of

respondents in the two markets wanting this function.

The research questioned 5,111 respondents in China, Germany and

the United States. All respondents were over the age of 18 and

drive a car regularly, own a smartphone or plan to buy one in the

next 6-12 months.

About Accenture

Accenture is a leading global professional services company,

providing a broad range of services and solutions in strategy,

consulting, digital, technology and operations. Combining unmatched

experience and specialized skills across more than 40 industries

and all business functions – underpinned by the world’s largest

delivery network – Accenture works at the intersection of business

and technology to help clients improve their performance and create

sustainable value for their stakeholders. With approximately

373,000 people serving clients in more than 120 countries,

Accenture drives innovation to improve the way the world works and

lives. Visit us at www.accenture.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160427006848/en/

AccentureAnthony Hatter, + 44 7810 756

138anthony.hatter@accenture.com

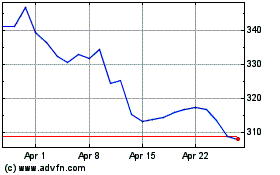

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024