In an environment where business-to-business (B2B) customers are

demanding a richer consumer-like experience, new research from

Accenture (NYSE:ACN) finds that only 23 percent of companies are

implementing truly effective customer experience programs and

achieving higher revenue growth.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20151201005023/en/

According to the Accenture Strategy report, 2015 B2B Customer

Experience, of the 1,350 B2B sales and customer service executives

surveyed in 10 countries, 66 percent believe that new entrants are

providing better customer experiences in today’s age of digital

disruption. To compete, incumbent businesses recognize they need to

make a significant shift in their business models: 78 percent of

executives think higher customer expectations for tailored B2B

solutions will have a substantial impact, and 76 percent feel that

customers are now more knowledgeable, self-directed, and

continually evaluating suppliers.

The poor self-assessed performance comes despite the fact that

86 percent of B2B supplier executives continue to view the overall

customer as ‘very important’ to their strategic priorities.

Furthermore, 74 percent of respondents recognize customer

experience will play an even larger role in overall corporate

strategy over the next two years.

“B2B companies overwhelmingly recognize the importance of

customer experience to their corporate strategy and bottom line,

but the majority are wasting their investments on changes that are

delivering mediocre results,” said Robert Wollan, senior managing

director, Accenture Strategy. “With consumer-like expectations and

a substantial threat from new entrants, B2B companies must be ready

to design and execute a transformed customer experience or not

invest in such improvements at all.”

Barriers to Success

In response to rapidly changing customer demands, new

competition and low returns on investment, 45 percent of executives

surveyed intend to increase spending by 6 percent or more to

improve customer experience programs.

However, internal roadblocks are preventing B2B companies from

meeting higher customer expectations. Only 32 percent of executives

(versus 40 percent polled in the same research in 2014) say they

are well-equipped with the skills, tools, and resources necessary

to deliver the desired B2B customer experience. Executives point to

a lack of C-suite attention, customer experience processes, and

necessary cross-organizational integration.

Leaders, Strivers and Laggards: More B2B Companies

Racing to Become Average

Accenture Strategy identifies three groups of B2B companies –

Leaders, Strivers and Laggards – differentiated by their ability to

plan and execute customer experience and deliver annual revenue

growth. With just over a fifth (23 percent) of organizations

remaining as Leaders since last year, more Laggards have moved up

to the Strivers category, increasing it from 48 to 57 percent.

The 2015 research shows Leaders generate an average of 13

percent annual revenue growth. Strivers achieve an average of six

percent annual revenue growth and Laggards record an average

decline in revenue growth of -1 percent.

“There’s a clear distinction between the Leaders and Strivers in

B2B customer experience,” said Wollan. “Strivers are ‘racing to

become average’ and average is a precarious position to be in these

days. Leaders see after-sales service as a critical part of the

customer lifecycle and they invest not just in new digital

technologies, but in traditional customer connection points too.

Leaders realize that a multi-channel approach is needed to reach

B2B customers seamlessly and consistently.”

How Leaders of Customer Experience Succeed

Among the main ways that Leaders generate outsized returns on

their customer experience investments compared to Strivers:

1.

Leaders “start from the back.”

Almost double the proportion of Leaders (61 percent to 34 percent

of Strivers) place greater value on after-sales service. They see

it as the most important point in the customer lifecycle.

2.

Leaders don’t avoid disruption – they

create it. Sixty-two percent of Leaders (versus 42 percent of

Strivers) see defending their business from new types of

competitors as a priority and a third (35 percent) are being more

proactive in using customer experience to become the disruptor

instead of the disruptee compared to 24 percent of Strivers.

3.

Leaders invest heavily in both digital

and legacy. Twice as many Leaders (44 percent versus 23 percent

of Strivers) believe their digital investments give them a

competitive advantage and allocate more of their customer

experience budget to digital (67 percent versus 41 percent). But,

Leaders also continue to invest in traditional channels, with 39

percent (versus 22 percent of Strivers) spending more on contact

centers, field service capabilities and even legacy CRM systems

over the past two years.

4.

Leaders understand the role and value

of the “connected ecosystem.” Leaders are more focused on

partner collaboration and performance monitoring to ensure optimal

customer experience. Notably, 51 percent of Leaders, versus 29

percent of Strivers, maintain vigorous vendor management programs

across several external partners.

Please visit www.accenture.com/B2BCustomerExperience to read the

report. Learn more about Digital Disruption. Join the conversation

at @AccentureStrat.

Methodology

Accenture conducted an online survey of more than 1,350 chief

sales, service and customer officers, vice presidents, directors

and managers from the sales and service functions, across 16

industry subgroups and 10 countries (including the US, UK, Germany,

France, Italy, Spain, Japan, Brazil, China and South Korea). The

survey explored the significance, scale and performance of B2B

companies’ initiatives to provide their business customers with a

differentiated customer experience across all sales, marketing and

service touch points. The survey was fielded in February and March,

2015. Respondents represented companies from 10 countries and 16

industries with the vast majority posting annual revenues of more

than US$1 billion.

About Accenture

Accenture is a leading global professional services company,

providing a broad range of services and solutions in strategy,

consulting, digital, technology and operations. Combining unmatched

experience and specialized skills across more than 40 industries

and all business functions – underpinned by the world’s largest

delivery network – Accenture works at the intersection of business

and technology to help clients improve their performance and create

sustainable value for their stakeholders. With more than 358,000

people serving clients in more than 120 countries, Accenture drives

innovation to improve the way the world works and lives. Visit us

at www.accenture.com.

Accenture Strategy operates at the intersection of business and

technology. We bring together our capabilities in business,

technology, operations and function strategy to help our clients

envision and execute industry-specific strategies that support

enterprise wide transformation. Our focus on issues related to

digital disruption, competitiveness, global operating models,

talent and leadership help drive both efficiencies and growth. For

more information, follow @AccentureStrat or visit

www.accenture.com/strategy.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151201005023/en/

AccentureLucy Davies, + 44 777 3044

808lucy.d.davies@accenture.com

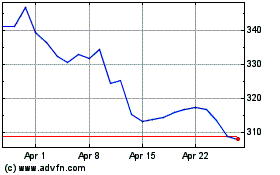

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024