A.M. Best Affirms the Ratings of ACE European Group Limited

April 30 2015 - 12:34PM

Business Wire

A.M. Best has affirmed the financial strength rating of

A++ (Superior) and the issuer credit rating of “aa+” of ACE

European Group Limited (AEGL) (United Kingdom). The outlook for

both ratings is stable.

The ratings reflect AEGL’s excellent stand-alone risk-adjusted

capitalisation, consistently strong operating performance and

excellent business profile. The ratings also reflect the support

provided to AEGL by its parent company, ACE Limited (ACE)

(Switzerland) [NYSE: ACE], and AEGL’s importance within the ACE

group. AEGL continues to be of strategic significance to its parent

company as its main underwriting operation in the United Kingdom

and Europe. In addition, the company receives significant

reinsurance support from ACE group affiliates.

AEGL’s excellent stand-alone risk-adjusted capitalisation

reflects the company’s strong operating performances in recent

years and has been achieved in spite of dividend payments. In 2014,

an interim dividend of GBP 50 million was paid (2013: GBP 75

million) but no final dividend was proposed.

AEGL achieved an excellent operating performance in 2014 with a

profit before tax, but after equalisation reserve movement, of GBP

251.9 million (2013: GBP 57.3 million). Net catastrophe losses were

relatively light at GBP 10.0 million (2013: GBP 3.8 million) and

the underwriting result was supported by a substantial prior year

reserve release. With market conditions continuing to be generally

difficult throughout 2014, AEGL reported a 3% reduction in its

gross written premiums to GBP 2.32 billion from GBP 2.39 billion in

2013. Assuming a normal level of catastrophes during 2015, AEGL is

expected to achieve a similar technical result in 2015 to that

reported in 2014, reflecting targeted business growth although

market conditions remain challenging.

AEGL has an excellent business profile in its core U.K. and

continental European markets, as an underwriter of a

well-diversified portfolio of property and casualty, accident and

health and specialty personal lines insurance.

A positive or negative rating action for AEGL could arise

following positive or negative action with respect to the ACE

group’s ratings, although this is considered unlikely in the near

term. Weaker than expected operating performance or a material

reduction in AEGL’s contribution to the group could exert negative

pressure on AEGL’s ratings.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilised:

- Catastrophe Analysis in A.M. Best

Ratings

- Rating Members of Insurance Groups

- Risk Management and the Rating Process

for Insurance Companies

- Understanding Universal BCAR.

In accordance with Regulation (EC) No. 1060/2009, the

following is a link to required disclosures: A.M. Best Europe -

Rating Services Limited Supplementary Disclosure.

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

A.M. Best CompanyDavid Drummond, +(44) 20 7397

0327Senior Financial

Analystdavid.drummond@ambest.comorCatherine Thomas,

+(44) 20 7397 0281Director,

Analyticscatherine.thomas@ambest.comorChristopher Sharkey,

+(1) 908 439 2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy, +(1) 908

439 2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

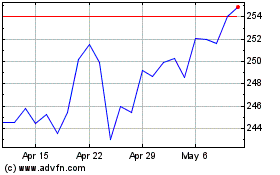

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Mar 2024 to Apr 2024

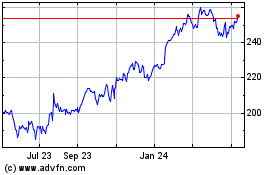

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Apr 2023 to Apr 2024