China's Fosun Close to Deal for India's Gland Pharma

July 28 2016 - 8:10AM

Dow Jones News

HONG KONG—China's Fosun Group is near to buying control of Gland

Pharma Ltd. from shareholders including KKR & Co. in a deal

that values the Indian pharmaceutical company at more than $1.35

billion, according to a person familiar with the situation.

Expected to be announced in the coming days, the deal would be

China's largest takeover of a company in India. The largest Chinese

deal maker in India had been China's top online-shopping company,

Alibaba Group Holding Ltd. Last year, its financial affiliate put

$1 billion into the operator of Indian payment firm Paytm, and an

Alibaba-led group invested in Indian online retailer

Snapdeal.com.

India's multibillion-dollar pharmaceutical industry dominates

the world's generic-drug market. Gland Pharma's generic

injectables—including Heparin, which prevents blood clots following

surgery—are sold primarily in the U.S. market.

Foreign businesses and investors can now buy up to 74% of Indian

drugmakers without government approval, a change announced last

month as one of a series of measures relaxing rules on foreign

investment and further liberalizing India's economy. Foreign

takeovers of pharmaceutical companies had previously required

government approval, which led to long delays.

The Gland Pharma deal will be the first in India by Fosun, one

of China's most acquisitive conglomerates. Chairman Guo Guangchang

told The Wall Street Journal in March that a rapid rise of asset

prices in the U.S. and Europe has Fosun looking for deals in

developing markets, including India.

KKR, the U.S. private-equity firm, is a major investor in Gland,

and the sale of its shares along with those of other existing

shareholders will give Fosun a controlling stake, the person

familiar with the situation said.

Trading in two Fosun units—Shanghai Fosun Pharmaceutical (Group)

Co. Ltd. and Fosun International Ltd.—were halted in Hong Kong

Thursday pending an announcement. India's Economic Times newspaper

first reported Fosun's plan.

Established in 1978 and based in Hyderabad, Gland Pharma

pioneered prefilled, single-use syringes in India and has a

presence in about 90 countries. KKR bought a minority stake for

about $200 million in November 2013, saying the company had a

record of strong financial performance.

Fosun has global interests in property, entertainment, and

insurance. Its portfolio includes French resorts operator Club Mé

diterrané e SA, a stake in Canadian circus troupe Cirque du Soleil

and One Chase Manhattan Plaza, a prime property in lower

Manhattan.

Indian health-care companies have been a popular target for

global acquirers. Two of the country's 10 largest foreign

acquisitions have been of drugmakers: Ranbaxy Laboratories Ltd.,

bought by Japan's Daiichi Sankyo Co. for $5.5 billion in 2008, and

the generics unit of Piramal Healthcare Ltd., bought by Abbott

Laboratories of the U.S. $3.8 billion in 2010.

Shefali Anand Mumbai and Wei Gu in Hong Kong contributed to this

article.

(END) Dow Jones Newswires

July 28, 2016 07:55 ET (11:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

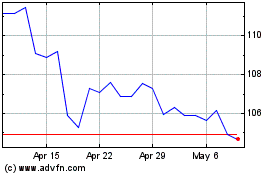

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

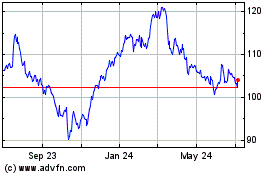

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024