Alere Expects to Restate Financial Results

July 14 2016 - 7:00PM

Dow Jones News

Alere Inc., which previously disclosed revenue-recognition

issues in Africa and China, expects to determine that it had

material weakness in its internal controls and plans to restate

certain results.

The health-care diagnostics company said in March that it was

looking into revenue cutoff issues for 2013 through 2015. On

Thursday, the company said incorrect revenue timing mostly involved

transactions in Africa in which it recognized revenue when the

product shipped to the distributor, and "bill and hold"

transactions in China.

Alere said the effect of the misstatements "is not expected to

be material" but "expects that the cumulative effect of reflecting

these misstatements in the current year would be material" to

2015.

Less than three months after Abbott Laboratories announced a

$5.8 billion deal to buy Alere, the deal was in jeopardy. Alere

said in late April that it rejected an offer of up to $50 million

by Abbott to terminate their agreement.

In March, Alere disclosed it received a subpoena regarding a

foreign corruption investigation over payments in Africa, Asia and

Latin America.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 14, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

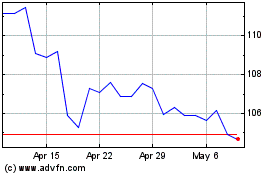

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

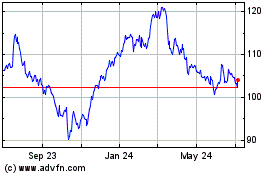

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024