FTC Requests Additional Info Before Approving Abbott Labs, St. Jude Tie-Up

July 12 2016 - 6:37PM

Dow Jones News

By Ezequiel Minaya

The Federal Trade Commission has requested additional

information from Abbott Laboratories and St. Jude Medical Inc.,

which are attempting to close a $25 billion deal combining two of

the leading makers of heart-related devices.

The request was made by federal authorities on Monday, Abbott

said in a regulatory filing.

Federal regulators may be taking a closer look out of concern of

the shrinking number of vendors supplying hospitals in the

merger-crazed health care sector.

In April, Abbott struck the deal to acquire St. Jude Medical.

For Abbott, the acquisition is a way to bulk up its medical-devices

business to better compete against rivals Medtronic PLC and Boston

Scientific Corp. Abbott said it was also aiming to gain a better

negotiating position with its hospital customers, which themselves

have become larger and more powerful in recent years.

Abbott has an eclectic mix of businesses that include

nutritional drinks like Ensure, glucose monitors for diabetes

patients, and selling branded generic pharmaceuticals in

international markets.

When combined, the merged company will have annual

cardiovascular sales of $8.7 billion. The companies expect the deal

to close in the fourth quarter.

Some analysts have expressed concern that the power balance may

toggle back to device-makers as the industry consolidates.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

July 12, 2016 18:22 ET (22:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

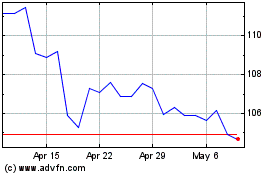

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

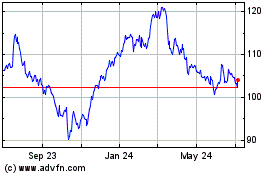

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024