At a medical meeting last winter, a drug-industry executive

flipped his nametag around so he could have more open conversations

with the liver-disease scientists who were presenting their

research.

"They didn't recognize who I am. No one does," recalled John

Milligan, who a few months later was named chief executive of

Gilead Sciences Inc.

Dr. Milligan may find it increasingly difficult to stay so

anonymous as he settles into the pilot seat at Gilead, a company

that has catapulted into one of the industry's biggest sellers and

most controversial drug pricers.

Since the company started launching costly new hepatitis C

treatments in 2013, Gilead sales have risen nearly 3½ times to

$32.2 billion last year, and shares have jumped more than 130%

since then. The company's Sovaldi and Harvoni commanded the biggest

drug launches ever, as 920,000 patients world-wide lined up for the

promise of a cure.

Yet Gilead has more recently been forced to heavily discount the

hepatitis C pills to cope with mounting competition, and faces

questions about the market's long-term prospects as more patients

get cured.

Scrutiny over the drugs' $1,000-a-day list price lingers,

despite the discounting. Gilead has faced heavy criticism and a

Senate probe. Massachusetts is also investigating whether the high

prices violate state laws on unfair trade practices.

Meantime, the company's HIV/AIDS franchise is aging.

Given such pressures, some on Wall Street question the company's

ability to keep up its heady pace of growth. Gilead shares trade at

less than eight times consensus earnings, a lower multiple than any

peer, according to Geoffrey Porges, a Leerink Partners analyst.

"The stock is trading as if it is facing an existential threat

that will result in a 30% to 40% erosion of its earnings," says Dr.

Porges, who recommends buying the stock. Many investors would feel

much better, he says, if Gilead added a new franchise to its

lineup.

Dr. Milligan, a trained biochemist who is a 26-year veteran of

Gilead, is tasked with finding that next source of growth and

shoring up faith that the company can continue delivering

blockbusters.

Investors have been looking for a new deal with the same kind of

impact as the $11 billion acquisition of Pharmasset Inc. in 2012,

which netted Gilead its lucrative hepatitis C franchise. But

industry officials such say such transactions are hard to find,

especially with biotech valuations relatively high.

He also must address the company's negative public image around

pricing, no easy task for a longtime insider.

"The lesson is we have to do a lot better job talking about the

value we provide," Dr. Milligan says.

Dr. Milligan, who brings home science journals to read and

watches TED talks in his spare time, says he intends to stay on top

of the science of drug discovery because it is so crucial in

identifying new growth opportunities. Gilead is investing nearly $3

billion on R&D. And he will keep attending medical meetings,

such as the liver-disease conference last November, and peppering

researchers with questions.

Dr. Milligan says he isn't counting on another deal of the scale

of the Pharmasset transaction. "My preference is to stay with the

smaller series of acquisitions for the company, rather than trying

to solve it all at once. But I reserve the right to change my

mind."

Among the diseases that Gilead is targeting through a

combination of in-house research and deal-making are a liver

condition called nonalcoholic steatohepatitis, or NASH, and

immune-system disorders like rheumatoid arthritis. Gilead is also

in cancer.

"Rather than having one opportunity, I would like to have

multiple opportunities for the future," Dr. Milligan says. The idea

isn't to find the single next "big thing, like Pharmasset, but work

three different angles that would all be growth" drivers.

Dr. Milligan says he wants Gilead to remain a lean, focused

drugmaker, and avoid the pitfalls of bigness, such as large

committee meetings that go on far too long and interminable email

chains. Spaces still aren't assigned in the parking garage at

Gilead's Foster City, Calif., headquarters, and Dr. Milligan says

he regularly eats lunch in the corporate cafeteria so he can chat

directly with staff. Dr. Milligan wants to keep the company's

employee count, now about 8,000, relatively low.

"I'm a little maniacal about preserving the culture," he

says.

He says he was inspired by two figures: his father, David

Milligan, who was a chief scientific officer at Abbott

Laboratories, as well as his father's boss George Rathmann, who

went on to run pioneering biotech Amgen Inc.

Dr. Rathmann, he says, showed how a biotech executive can stay

on top of scientific developments and let them drive

decision-making. "If I'm close to the science, it means everyone

else will stay close to the science as well," Dr. Milligan

says.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

June 06, 2016 12:05 ET (16:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

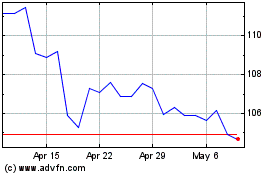

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

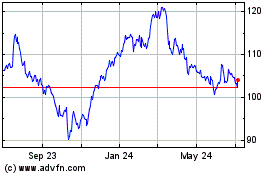

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024