Abbott Agreed to Buy St. Jude in $25 Billion Deal--Update

April 28 2016 - 7:57AM

Dow Jones News

By George Stahl

Abbott Laboratories agreed to acquire St. Jude Medical Inc. in a

cash-and-stock deal valued at $25 billion that merges two of the

leading makers of heart-related devices.

Under the deal, Abbott agreed to swap $46.75 in cash and 0.8708

shares for each St. Jude share. The offer values each St. Jude

share at about $85, representing a 37% premium to the stock's

closing price Wednesday.

The companies said the deal merges St. Jude Medical's strong

positions in heart-failure devices, heart catheters and

defibrillators with Abbott's strength in coronary intervention and

heart-valve repair.

The merger is occurring as heart disease becomes a bigger

problem. According to the companies, more than 40% of adults in the

U.S. are expected to have one or more forms of heart disease by

2040.

The boards from both companies have approved the transaction,

which still requires shareholder and regulatory approvals. The

companies expect the deal to close in the fourth quarter.

Abbott sees the deal adding to its adjusted earnings in the

first full year after closing. On a per-share basis, Abbott

estimates the buy increasing earning by 21 cents in 2017 and 29

cents in 2018. The companies see sales and operational benefits of

$500 million by 2020.

Write to George Stahl at george.stahl@wsj.com

(END) Dow Jones Newswires

April 28, 2016 07:42 ET (11:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

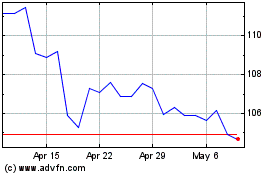

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

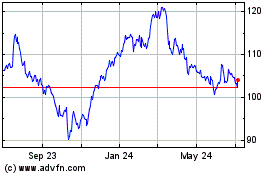

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024