Abbott CEO Declines to Confirm Commitment to Alere Acquisition

April 20 2016 - 12:04PM

Dow Jones News

By Joseph Walker

Abbott Laboratories Chief Executive Miles D. White on Wednesday

declined to affirm his commitment to completing a proposed $5.8

billion acquisition of Alere Inc., the health-care diagnostics

company that is grappling with foreign corruption probes.

Mr. White's comments, made during a conference call to discuss

Abbott's first-quarter earnings with analysts, sent shares of Alere

plunging 12.6% to $43.22.

Abbott agreed in February to pay $56 per share to acquire Alere,

a 51% premium to the company's share price prior to the deal's

announcement. Abbott, based in Chicago suburb of Abbott Park, Ill.,

said it would also take on $2.6 billion of Alere's debt.

Mr. White was noncommittal when asked on the call to reaffirm

that the transaction would be completed. Mr. White said it was

unclear when Alere, which has been delayed in filing certain

disclosures with the Securities and Exchange Commission, would hold

a shareholder vote necessary to approve the acquisition.

"I'd say it's not appropriate for me to comment on Alere," Mr.

White told analysts. He didn't mention the corruption probes.

An Abbott spokeswoman declined to comment further on Mr. White's

comments. Alere didn't immediately respond to requests for

comment.

Mr. White's comments cast uncertainty over the merger as Alere

grapples with probes by federal prosecutors and the SEC into its

overseas operations.

Alere said last month it wouldn't be able to file its 2015

annual report with the SEC by a deadline of March 15 because it was

still analyzing certain aspects of how it recognizes revenue in

Africa and China for the years 2015, 2014 and 2013.

Alere said it wouldn't send its shareholders a definitive proxy

statement, which is necessary to approve the merger with Abbott,

until after it filed the annual report. Alere said it still

expected the Abbott deal to be completed by the end of 2016, and

that it would file its 2015 annual report "as soon as

practicable."

On Wednesday, Mr. White cited those delays.

"I'm going to be careful how I answer any questions about

Alere," Mr. White said, "because as you know they've had delays

filing their [annual report]. We don't know when they will file

their proxy. We don't know when they are going to have a

shareholder vote. So right now I'd say it's not appropriate for me

to comment on Alere."

Alere, based in Waltham, Mass., specializes in diagnostic tests

that are used in doctors' offices or clinics to quickly diagnose

disease or infection. The company, which has grown rapidly through

acquisitions, had sales of $602 million in the third quarter of

2015.

In March, Alere disclosed that it had received a grand jury

subpoena from the U.S. Department of Justice requiring the company

to produce documents related to its sales practices, and its

dealings with distributors and foreign government officials, in

Africa, Asia and Latin America.

Alere said the Justice Department subpoena was related to the

U.S. Foreign Corrupt Practices Act, which bars using bribes or

gifts to foreign officials to win or keep business. Alere said it

was in the process of responding to the subpoena and intended to

cooperate with the government's investigation.

In a November 2015 financial statement, prior to the

announcement of the proposed merger with Abbott, Alere disclosed

that it had received a subpoena from the SEC in August 2015 about

some of Alere's accounting practices and its "sales practices and

dealings" with distributors and foreign government officials in

Africa related to sales to government entities. The subpoena

indicated that the SEC was conducting a formal investigation of

Alere, the company said in the filing.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

April 20, 2016 11:49 ET (15:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

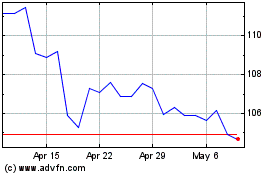

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

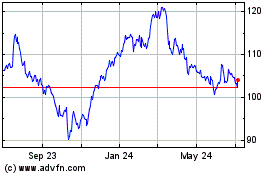

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024