Medical Technology Firms Branch Out

February 01 2016 - 5:42PM

Dow Jones News

By Joseph Walker

Medical technology firms Abbott Laboratories and Stryker Corp.

announced separate acquisitions with a combined value of $8.6

billion, aiming to further expand their portfolios beyond implanted

devices and appeal to hospitals and clinics looking to bring down

costs.

Abbott agreed to pay $5.8 billion for diagnostic-testing company

Alere Inc., whose tests for HIV, malaria and the flu can deliver

results faster than traditional laboratory tests that can take days

to process. Abbott said it would pay $56 a share, a 51% premium to

Alere's closing price on Friday. Alere has $2.6 billion in debt,

which Abbott said it would take on or refinance.

Stryker said on Monday it would buy closely held Sage Products

LLC for $2.78 billion in cash. Sage, whose revenue increased 13% to

$430 million in 2015, makes a broad array of products used to

reduce the risk of patients acquiring new infections or conditions

while in the hospital. Sage's products include antiseptic cloths to

clean patients and an inflatable device for moving patients between

beds or surfaces.

Monday's deals are the latest in which medical technology

companies have aimed to diversify their businesses outside of

expensive medical-device implants. Both Stryker, which makes

replacement hip and knee implants, and Abbott, maker of devices for

heart disease, have faced increased price pressure from hospitals

looking to cut costs by negotiating better discounts on implanted

devices.

"Device companies are a cost that hospitals are managing," said

Raj Denhoy, an analyst at Jefferies LLC, in an interview. "If

you're just offering an implant that's used in a one-off procedure,

that's going to be difficult business over time, and it already is

a difficult business."

Abbott, based outside of Chicago, already has a diagnostic

business that had global sales of $4.65 billion in 2015,

representing nearly a quarter of the company's $20.41 billion in

total revenue last year.

About 10% of Abbott's diagnostics revenue came from the type of

testing Alere specializes in--so-called point-of-care testing,

which is performed at the doctor's office or clinic where the

patient is being treated. Abbott Chief Executive Miles White said

he didn't see a "high risk" of antitrust regulators challenging the

deal.

"Demand for point-of-care testing is accelerating as health-care

providers and consumers look for better ways to get fast, accurate

and actionable information," Abbott's Mr. White said during a

conference call with analysts on Monday to discuss the

acquisition.

Point-of-care tests are often more expensive than those done at

a central, off-site lab, Jefferies's Mr. Denhoy said. But the tests

are also much faster at diagnosing disease and infection, which, if

treated quickly, can prevent or reduce even greater costs down the

road, he said.

Alere, based in Waltham, Mass., had grown rapidly through

acquisitions, but more recently sold off some of its noncore

businesses such as its analytics business for disease

management.

Alere struggled in 2015, missing analyst estimates in the second

half of the year, in part due to challenges in its malaria and HIV

testing business in Africa, Mr. Denhoy said. Last August, Alere was

subpoenaed by the U.S. Securities and Exchange Commission in

relation to its tax strategies and policies, and its sales

practices related to government entities in Africa. Alere didn't

immediately respond to request for comment about the subpoena.

Alere shares jumped 45% on Monday, to $54.11, and Abbott's

shares were up 1.6%.

Stryker's deal for Sage is its latest geared toward reducing

infections and medical mishaps that can cost hospitals money. In

December 2013, Stryker purchased the maker of software designed to

track surgical sponges and prevent them from being left in

patients' bodies during surgery. Stryker is based in Kalamazoo,

Mich. Sage is based in Cary, Ill.

Stryker Chief Executive Kevin Lobo said on a conference call

with analysts on Monday that the acquisition of Sage shouldn't be

viewed as a strategic shift away from orthopedic devices.

"The next deal we do could very well be in the implant side of

the business or it may not," Mr. Lobo said. Stryker shares were

trading flat at Monday's close.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

February 01, 2016 17:27 ET (22:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

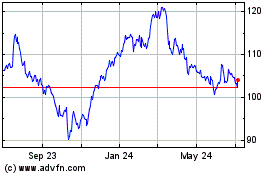

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

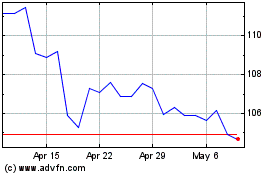

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024