Abbott Labs Profit Falls, Hurt by Currency

January 28 2016 - 9:22AM

Dow Jones News

By Anne Steele

Abbott Laboratories Inc. on Thursday reported its profit fell

15% in the final quarter of the year, as the stronger dollar

weighed on results despite growth in emerging markets.

Abbott also gave annual guidance sharply below Wall Street

expectations, citing challenging market conditions in Venezuela.

The company expects earnings between $2.10 to $2.20 a share,

compared with analyst estimates for $2.26 a share, according to

Thomson Reuters.

Shares, which have fallen 9.9% over the past three months, fell

another 6.1% premarket to $38.

Overall, the company posted a profit of $767 million, or 51

cents a share, down from $905 million, or 59 cents a share, a year

earlier. Excluding certain items, earnings per share were 62 cents.

Revenue decreased 3.1% to $5.19 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

of 61 cents on revenue of $5.23 billion.

Sales in emerging markets provided a 17% boon for the

Illinois-based health-care company. Operational sales growth in the

quarter was led by double-digit growth in India, China and Russia.

Revenue in the U.S., however, declined 5.7%.

Worldwide pediatric nutrition revenue fell 1.3%, hurt by a 5%

currency impact. In the U.S., sales growth was led by continued

uptake of several recently launched non-GMO products.

Worldwide adult nutrition sales rose 1.3%, which included a 6.6%

foreign exchange drag. Worldwide medical devices and world-wide

diabetes care sales dipped 5.9% and 5.2%, respectively.

Established pharmaceuticals sales fell 4%, dented 15% by

unfavorable currency exchange.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 28, 2016 09:07 ET (14:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

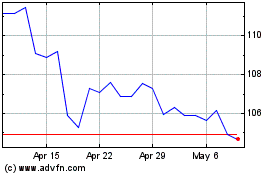

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

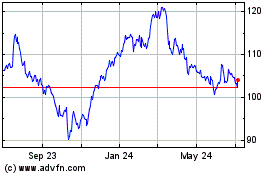

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024