UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 28, 2016

Date of Report (Date of earliest event reported)

ABBOTT LABORATORIES

(Exact name of registrant as specified in charter)

|

Illinois |

|

1-2189 |

|

36-0698440 |

|

(State or other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

|

of Incorporation) |

|

|

|

Identification No.) |

100 Abbott Park Road

Abbott Park, Illinois 60064-6400

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (224) 667-6100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On January 28, 2016, Abbott Laboratories announced its results of operations for the fourth quarter and full year 2015.

Furnished as Exhibit 99.1, and incorporated herein by reference, is the news release issued by Abbott announcing those results. In that news release, Abbott uses various non-GAAP financial measures including, among others, net earnings from continuing operations excluding specified items. These non-GAAP financial measures adjust for factors that are unusual or unpredictable, such as cost reduction initiatives; transaction-related costs; tax expense associated with a one-time repatriation of ex-U.S. earnings; resolution of various tax positions and adjustment of tax uncertainties from prior years; gain on the sale of a portion of Abbott’s position in Mylan stock; and a decrease in the fair value of contingent consideration related to a business acquisition. These non-GAAP financial measures also exclude intangible amortization expense to provide greater visibility on the results of operations excluding these costs, similar to how Abbott’s management internally assesses performance. Abbott’s management believes the presentation of these non-GAAP financial measures provides useful information to investors regarding Abbott’s results of operations as these non-GAAP financial measures allow investors to better evaluate ongoing business performance. Abbott’s management also uses these non-GAAP financial measures internally to monitor performance of the businesses. Abbott, however, cautions investors to consider these non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No. |

|

Exhibit |

|

|

|

|

|

99.1 |

|

Press Release dated January 28, 2016 (furnished pursuant to Item 2.02). |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ABBOTT LABORATORIES |

|

|

|

|

|

|

|

|

|

Date: January 28, 2016 |

|

By: |

/s/ Brian B. Yoor |

|

|

|

|

Brian B. Yoor |

|

|

|

|

Senior Vice President, Finance |

|

|

|

|

and Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit No. |

|

Exhibit |

|

|

|

|

|

99.1 |

|

Press Release dated January 28, 2016 (furnished pursuant to Item 2.02). |

4

Exhibit 99.1

|

|

News Release |

Abbott Reports Fourth-Quarter 2015 Results

· FOURTH-QUARTER ADJUSTED EPS FROM CONTINUING OPERATIONS OF $0.62; GAAP EPS FROM CONTINUING OPERATIONS OF $0.46

· FULL-YEAR OPERATIONAL SALES GROWTH OF 9.1 PERCENT, INCLUDING 17.1 PERCENT GROWTH IN EMERGING MARKETS; FULL-YEAR REPORTED SALES GROWTH OF 0.8 PERCENT

· FULL-YEAR ADJUSTED EPS GROWTH FROM CONTINUING OPERATIONS OF 8.6 PERCENT AND GAAP EPS GROWTH FROM CONTINUING OPERATIONS OF 53.6 PERCENT

· SIGNIFICANT EXPANSION OF FULL-YEAR GROSS AND OPERATING MARGIN RATIOS

· ISSUES EARNINGS OUTLOOK FOR 2016, REFLECTING DOUBLE-DIGIT UNDERLYING GROWTH OFFSET BY FOREIGN EXCHANGE AND A SIGNIFICANTLY LOWER CONTRIBUTION FROM VENEZUELAN OPERATIONS

ABBOTT PARK, Ill., Jan. 28, 2016 — Abbott today announced financial results for the fourth quarter ended Dec. 31, 2015.

· Adjusted diluted EPS from continuing operations, which excludes specified items, was $0.62 in the fourth quarter and $2.15 for the full year, at the midpoint of Abbott’s previous guidance range and reflecting 8.6 percent growth for the full year. Reported diluted EPS from continuing operations under GAAP was $0.46 in the fourth quarter and $1.72 for the full year.

· Fourth-quarter worldwide sales of $5.2 billion increased 4.9 percent on an operational basis and decreased 3.1 percent on a reported basis.

· Full-year sales increased 9.1 percent on an operational basis and 0.8 percent on a reported basis. Full-year sales in emerging markets increased double digits excluding the impact of 2014 acquisitions and foreign exchange.

· For the full year 2015, Abbott expanded its adjusted gross and operating margin ratios by 260 and 90 basis points over the prior year, respectively. The gross and operating margin ratios under GAAP improved by 250 and 120 basis points over the prior year, respectively.

· Abbott issues full-year 2016 adjusted EPS guidance range of $2.10 to $2.20. Projected full-year 2016 EPS under GAAP is $1.55 to $1.65. Abbott’s 2016 forecast assumes a significantly lower contribution from Venezuelan operations as a result of challenging market conditions in that country. Excluding the impact of foreign exchange and Venezuela, the midpoint of Abbott’s 2016 adjusted EPS guidance range would reflect strong double-digit growth.

“In 2015, we achieved top-tier sales and earnings growth despite a challenging currency environment,” said Miles D. White, chairman and chief executive officer, Abbott. “Our underlying performance continues to be strong.”

FOURTH-QUARTER BUSINESS OVERVIEW

Note: Prior year financial results have been adjusted to exclude the sales from Abbott’s developed markets branded generics pharmaceuticals and animal health businesses that were sold to Mylan and Zoetis, respectively, in the first quarter 2015. Therefore, sales and growth rates shown in the following charts represent continuing operations.

Following are sales by business segment and commentary for the fourth quarter and the full year:

Total Company

($ in millions)

|

|

|

|

|

|

|

|

|

% Change vs. 4Q14 |

|

|

|

|

Sales 4Q15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total * |

|

1,603 |

|

3,585 |

|

5,188 |

|

3.2 |

|

5.6 |

|

(5.7 |

) |

4.9 |

|

(3.1 |

) |

|

Nutrition |

|

725 |

|

1,075 |

|

1,800 |

|

5.5 |

|

5.4 |

|

(3.7 |

) |

5.5 |

|

(0.2 |

) |

|

Diagnostics |

|

367 |

|

853 |

|

1,220 |

|

5.1 |

|

7.7 |

|

(3.6 |

) |

7.0 |

|

(1.1 |

) |

|

Established Pharmaceuticals |

|

— |

|

885 |

|

885 |

|

n/a |

|

10.9 |

|

(4.0 |

) |

10.9 |

|

(4.0 |

) |

|

Medical Devices |

|

503 |

|

794 |

|

1,297 |

|

(0.7 |

) |

1.5 |

|

(9.0 |

) |

0.7 |

|

(5.9 |

) |

* Total Abbott Sales from continuing operations include adjustments in Other Sales of $14 million.

|

|

|

|

|

|

|

|

|

% Change vs. 12M14 |

|

|

|

|

Sales 12M15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total * |

|

6,271 |

|

14,134 |

|

20,405 |

|

2.2 |

|

12.1 |

|

0.2 |

|

9.1 |

|

0.8 |

|

|

Nutrition |

|

2,868 |

|

4,107 |

|

6,975 |

|

1.2 |

|

8.5 |

|

(0.3 |

) |

5.5 |

|

0.3 |

|

|

Diagnostics |

|

1,392 |

|

3,254 |

|

4,646 |

|

6.2 |

|

7.8 |

|

(4.6 |

) |

7.3 |

|

(1.6 |

) |

|

Established Pharmaceuticals |

|

— |

|

3,720 |

|

3,720 |

|

n/a |

|

34.1 |

|

19.3 |

|

34.1 |

|

19.3 |

|

|

Medical Devices |

|

1,982 |

|

3,060 |

|

5,042 |

|

1.2 |

|

1.7 |

|

(10.9 |

) |

1.5 |

|

(6.5 |

) |

* Total Abbott Sales from continuing operations include Other Sales of $22 million.

n/a = Not Applicable.

Note: Operational growth reflects percentage change over the prior year excluding the impact of exchange rates.

Fourth-quarter 2015 worldwide sales of $5.2 billion increased 4.9 percent on an operational basis and decreased 3.1 percent on a reported basis, including an unfavorable 8.0 percent effect of foreign exchange.

International sales increased 5.6 percent on an operational basis and decreased 5.7 percent on a reported basis in the fourth quarter.

Full-year 2015 worldwide sales of $20.4 billion increased 9.1 percent on an operational basis and 0.8 percent on a reported basis, including an unfavorable 8.3 percent effect of foreign exchange. Full-year sales in emerging markets increased double digits excluding the impact of 2014 acquisitions and foreign exchange, driven by double-digit growth in Established Pharmaceuticals, Diagnostics and Nutrition.

2

Nutrition

($ in millions)

|

|

|

|

|

|

|

|

|

% Change vs. 4Q14 |

|

|

|

|

Sales 4Q15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

725 |

|

1,075 |

|

1,800 |

|

5.5 |

|

5.4 |

|

(3.7 |

) |

5.5 |

|

(0.2 |

) |

|

Pediatric |

|

409 |

|

625 |

|

1,034 |

|

6.0 |

|

2.3 |

|

(5.6 |

) |

3.7 |

|

(1.3 |

) |

|

Adult |

|

316 |

|

450 |

|

766 |

|

4.8 |

|

9.9 |

|

(1.1 |

) |

7.9 |

|

1.3 |

|

|

|

|

|

|

|

|

|

|

% Change vs. 12M14 |

|

|

|

|

Sales 12M15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

2,868 |

|

4,107 |

|

6,975 |

|

1.2 |

|

8.5 |

|

(0.3 |

) |

5.5 |

|

0.3 |

|

|

Pediatric |

|

1,592 |

|

2,378 |

|

3,970 |

|

3.9 |

|

8.1 |

|

0.7 |

|

6.4 |

|

2.0 |

|

|

Adult |

|

1,276 |

|

1,729 |

|

3,005 |

|

(2.1 |

) |

9.1 |

|

(1.5 |

) |

4.3 |

|

(1.8 |

) |

Worldwide Nutrition sales increased 5.5 percent in the fourth quarter on an operational basis and decreased 0.2 percent on a reported basis, including an unfavorable 5.7 percent effect of foreign exchange.

Worldwide Pediatric Nutrition sales increased 3.7 percent on an operational basis and decreased 1.3 percent on a reported basis in the quarter, including an unfavorable 5.0 percent effect of foreign exchange. In the U.S., sales growth in the quarter was led by continued consumer uptake of several recently launched non-GMO products. International growth was led by share expansion of ElevaTM in the premium segment of the Chinese market and double-digit operational growth across several Latin American countries, partially offset by a difficult comparison to the fourth quarter 2014, when sales increased strong double digits.

Worldwide Adult Nutrition sales increased 7.9 percent on an operational basis and 1.3 percent on a reported basis in the quarter, including an unfavorable 6.6 percent effect of foreign exchange. International growth was led by continued category expansion in Latin America and other priority international markets. U.S. adult nutrition sales increased 4.8 percent led by growth of Ensure® in the retail and institutional segments of the market.

3

Diagnostics

($ in millions)

|

|

|

|

|

|

|

|

|

% Change vs. 4Q14 |

|

|

|

|

Sales 4Q15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

367 |

|

853 |

|

1,220 |

|

5.1 |

|

7.7 |

|

(3.6 |

) |

7.0 |

|

(1.1 |

) |

|

Core Laboratory |

|

217 |

|

752 |

|

969 |

|

6.3 |

|

7.7 |

|

(3.9 |

) |

7.4 |

|

(1.8 |

) |

|

Molecular |

|

46 |

|

80 |

|

126 |

|

(7.1 |

) |

8.6 |

|

(1.8 |

) |

2.6 |

|

(3.9 |

) |

|

Point of Care |

|

104 |

|

21 |

|

125 |

|

9.0 |

|

6.5 |

|

(0.4 |

) |

8.6 |

|

7.3 |

|

|

|

|

|

|

|

|

|

|

% Change vs. 12M14 |

|

|

|

|

Sales 12M15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

1,392 |

|

3,254 |

|

4,646 |

|

6.2 |

|

7.8 |

|

(4.6 |

) |

7.3 |

|

(1.6 |

) |

|

Core Laboratory |

|

813 |

|

2,894 |

|

3,707 |

|

6.3 |

|

7.4 |

|

(5.1 |

) |

7.2 |

|

(2.8 |

) |

|

Molecular |

|

191 |

|

275 |

|

466 |

|

(3.9 |

) |

11.6 |

|

(1.1 |

) |

5.2 |

|

(2.2 |

) |

|

Point of Care |

|

388 |

|

85 |

|

473 |

|

12.0 |

|

10.7 |

|

2.6 |

|

11.7 |

|

10.2 |

|

Worldwide Diagnostics sales increased 7.0 percent in the fourth quarter on an operational basis, driven by continued above-market growth in both emerging and developed markets. Sales decreased 1.1 percent on a reported basis, including an unfavorable 8.1 percent effect of foreign exchange.

Core Laboratory Diagnostics sales increased 7.4 percent in the quarter on an operational basis and decreased 1.8 percent on a reported basis, including an unfavorable 9.2 percent effect of foreign exchange. Operational sales growth in the quarter was driven by double-digit growth in emerging markets and continued share gains in the U.S. and internationally.

Molecular Diagnostics sales increased 2.6 percent in the quarter on an operational basis and decreased 3.9 percent on a reported basis, including an unfavorable 6.5 percent effect of foreign exchange. Strong growth in the infectious disease testing business, which remains Abbott’s core focus area in Molecular Diagnostics, led operational growth in the quarter. As expected, U.S. growth was impacted by the planned scale down of the genetics business.

Point of Care Diagnostics sales increased 8.6 percent in the quarter on an operational basis as this business continues to expand its product offering and geographic presence in targeted developed and emerging markets. Sales increased 7.3 percent on a reported basis, including an unfavorable 1.3 percent effect of foreign exchange.

4

Established Pharmaceuticals

($ in millions)

Note: Prior year financial results have been adjusted to exclude the sales from the developed markets branded generics pharmaceuticals business, which was sold to Mylan on Feb. 27, 2015. Therefore, sales and growth rates shown in the following charts represent continuing operations.

|

|

|

|

|

|

|

|

|

% Change vs. 4Q14 |

|

|

|

|

Sales 4Q15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

— |

|

885 |

|

885 |

|

n/a |

|

10.9 |

|

(4.0 |

) |

10.9 |

|

(4.0 |

) |

|

Key Emerging Markets |

|

— |

|

703 |

|

703 |

|

n/a |

|

12.1 |

|

(4.3 |

) |

12.1 |

|

(4.3 |

) |

|

Other |

|

— |

|

182 |

|

182 |

|

n/a |

|

6.2 |

|

(3.1 |

) |

6.2 |

|

(3.1 |

) |

|

|

|

|

|

|

|

|

|

% Change vs. 12M14 |

|

|

|

|

Sales 12M15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

— |

|

3,720 |

|

3,720 |

|

n/a |

|

34.1 |

|

19.3 |

|

34.1 |

|

19.3 |

|

|

Key Emerging Markets |

|

— |

|

2,781 |

|

2,781 |

|

n/a |

|

32.4 |

|

16.7 |

|

32.4 |

|

16.7 |

|

|

Other |

|

— |

|

939 |

|

939 |

|

n/a |

|

39.6 |

|

27.8 |

|

39.6 |

|

27.8 |

|

Established Pharmaceuticals sales increased 10.9 percent in the fourth quarter on an operational basis and decreased 4.0 percent on a reported basis, including an unfavorable 14.9 percent effect of foreign exchange.

Sales in Key Emerging Markets increased 12.1 percent on an operational basis, driven by continued double-digit growth in India, China, and Russia. Sales decreased 4.3 percent on a reported basis, including an unfavorable 16.4 percent effect of foreign exchange.

For the full year 2015, Established Pharmaceutical sales increased double digits excluding the impact of acquisitions and foreign exchange. Growth was driven by commercial initiatives and locally-relevant portfolio expansion in key geographies.

During the year, Abbott successfully integrated the acquisitions of CFR Pharmaceuticals in Latin America and Veropharm in Russia. These businesses strengthened Abbott’s capabilities, relevant product portfolios, and leadership in key geographies.

5

Medical Devices

($ in millions)

|

|

|

|

|

|

|

|

|

% Change vs. 4Q14 |

|

|

|

|

Sales 4Q15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

503 |

|

794 |

|

1,297 |

|

(0.7 |

) |

1.5 |

|

(9.0 |

) |

0.7 |

|

(5.9 |

) |

|

Vascular |

|

286 |

|

414 |

|

700 |

|

(0.8 |

) |

(0.3 |

) |

(10.8 |

) |

(0.5 |

) |

(7.0 |

) |

|

Diabetes Care |

|

101 |

|

196 |

|

297 |

|

(7.1 |

) |

7.5 |

|

(4.3 |

) |

2.4 |

|

(5.2 |

) |

|

Medical Optics |

|

116 |

|

184 |

|

300 |

|

5.7 |

|

(0.2 |

) |

(9.4 |

) |

1.9 |

|

(4.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vascular Product Lines: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coronary Devices(a) |

|

197 |

|

353 |

|

550 |

|

3.5 |

|

(1.4 |

) |

(11.6 |

) |

0.2 |

|

(6.8 |

) |

|

Endovascular(b) |

|

72 |

|

60 |

|

132 |

|

1.3 |

|

5.8 |

|

(6.2 |

) |

3.4 |

|

(2.3 |

) |

(a) Includes DES / BVS product portfolio, structural heart, guidewires, balloon catheters, and other coronary products.

(b) Includes vessel closure, carotid stents and other peripheral products.

|

|

|

|

|

|

|

|

|

% Change vs. 12M14 |

|

|

|

|

Sales 12M15 |

|

|

|

Int’l |

|

Total |

|

|

|

|

U.S. |

|

Int’l |

|

Total |

|

U.S. |

|

Operational |

|

Reported |

|

Operational |

|

Reported |

|

|

Total |

|

1,982 |

|

3,060 |

|

5,042 |

|

1.2 |

|

1.7 |

|

(10.9 |

) |

1.5 |

|

(6.5 |

) |

|

Vascular |

|

1,145 |

|

1,647 |

|

2,792 |

|

2.6 |

|

0.6 |

|

(11.9 |

) |

1.3 |

|

(6.5 |

) |

|

Diabetes Care |

|

394 |

|

723 |

|

1,117 |

|

(2.7 |

) |

5.8 |

|

(7.9 |

) |

2.9 |

|

(6.1 |

) |

|

Medical Optics |

|

443 |

|

690 |

|

1,133 |

|

1.3 |

|

0.2 |

|

(11.5 |

) |

0.6 |

|

(6.9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vascular Product Lines: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coronary Devices(a) |

|

768 |

|

1,408 |

|

2,176 |

|

4.7 |

|

(0.3 |

) |

(12.5 |

) |

1.3 |

|

(7.1 |

) |

|

Endovascular(b) |

|

282 |

|

238 |

|

520 |

|

5.7 |

|

5.5 |

|

(8.3 |

) |

5.6 |

|

(1.2 |

) |

(a) Includes DES / BVS product portfolio, structural heart, guidewires, balloon catheters, and other coronary products.

(b) Includes vessel closure, carotid stents and other peripheral products.

Worldwide Medical Devices sales increased 0.7 percent in the fourth quarter on an operational basis and decreased 5.9 percent on a reported basis, including an unfavorable 6.6 percent effect of foreign exchange.

Worldwide sales of Vascular products decreased 0.5 percent in the quarter on an operational basis and 7.0 percent on a reported basis, including an unfavorable 6.5 percent effect of foreign exchange. Sales of Abbott’s MitraClip® device for the treatment of mitral regurgitation increased double digits globally, as Abbott continues to build the market for this first-in-class device. In October, at the Transcatheter Cardiovascular Therapeutics conference, Abbott presented trial results for AbsorbTM, its first-of-its-kind fully dissolving stent, showing comparable outcomes to XIENCETM, its highly successful drug-eluting stent. In 2015, Abbott completed submissions for regulatory approval of Absorb in Japan and the U.S.

Worldwide Diabetes Care sales increased 2.4 percent in the quarter on an operational basis and decreased 5.2 percent on a reported basis, including an unfavorable 7.6 percent effect of foreign exchange. Internationally, operational sales growth was driven by continued uptake of Abbott’s FreeStyle® Libre Flash Glucose Monitoring System. Abbott recently completed a significant expansion of its manufacturing capacity for FreeStyle Libre to meet strong customer demand.

6

Worldwide Medical Optics sales increased 1.9 percent in the quarter on an operational basis and decreased 4.1 percent on a reported basis, including an unfavorable 6.0 percent effect of foreign exchange. Operational sales growth was driven by uptake of new cataract products in the premium intraocular lens segment. This growth was partially offset by market dynamics in the refractive business.

7

ABBOTT ISSUES EARNINGS-PER-SHARE OUTLOOK FOR 2016

Abbott is issuing full-year 2016 guidance for earnings per share, excluding specified items, of $2.10 to $2.20. Abbott’s 2016 forecast assumes a significantly lower contribution from Venezuelan operations as a result of challenging market conditions in that country. Excluding the impact of foreign exchange and Venezuela, the midpoint of Abbott’s 2016 adjusted EPS guidance range would reflect strong double-digit growth.

Abbott forecasts net specified items for the full year 2016 of approximately $0.55 per share. Specified items include intangible amortization expense, charges associated with cost reduction initiatives and deal and other expenses.

Including net specified items, projected earnings per share under Generally Accepted Accounting Principles (GAAP) would be $1.55 to $1.65 for the full year 2016.

Abbott is issuing first-quarter 2016 guidance for earnings per share, excluding specified items, of $0.38 to $0.40. Abbott forecasts specified items for the first quarter 2016 of $0.15 related to the same items discussed above for the full year 2016. Including specified items, projected earnings per share under GAAP would be $0.23 to $0.25 for the first quarter.

ABBOTT ANNOUNCES INCREASE IN QUARTERLY DIVIDEND

On Dec. 11, 2015, the board of directors of Abbott increased the company’s quarterly dividend to $0.26 per share from $0.24 per share. Abbott’s cash dividend is payable Feb. 16, 2016, to shareholders of record at the close of business on Jan. 15, 2016. This marks the 368th consecutive quarterly dividend paid by Abbott.

Abbott is a member of the S&P 500 Dividend Aristocrats Index, which tracks companies that have annually increased their dividend for 25 consecutive years.

8

About Abbott:

Abbott is a global healthcare company devoted to improving life through the development of products and technologies that span the breadth of healthcare. With a portfolio of leading, science-based offerings in diagnostics, medical devices, nutritionals and branded generic pharmaceuticals, Abbott serves people in more than 150 countries and employs approximately 74,000 people.

Visit Abbott at www.abbott.com and connect with us on Twitter at @AbbottNews.

Abbott will webcast its live fourth-quarter earnings conference call through its Investor Relations website at www.abbottinvestor.com at 8 a.m. Central time today. An archived edition of the call will be available after 11 a.m. Central time.

— Private Securities Litigation Reform Act of 1995 —

A Caution Concerning Forward-Looking Statements

Some statements in this news release may be forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. Abbott cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Economic, competitive, governmental, technological and other factors that may affect Abbott’s operations are discussed in Item 1A, “Risk Factors,’’ to our Annual Report on Securities and Exchange Commission Form 10-K for the year ended Dec. 31, 2014, and are incorporated by reference. Abbott undertakes no obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

Abbott Financial:

Scott Leinenweber, (224) 668-0791

Michael Comilla, (224) 668-1872

Jeffrey Byrne, (224) 668-8808

Abbott Media:

Scott Stoffel, (224) 668-5201

Elissa Maurer, (224) 668-3309

9

Abbott Laboratories and Subsidiaries

Consolidated Statement of Earnings

Fourth Quarter Ended December 31, 2015 and 2014

(in millions, except per share data)

(unaudited)

|

|

|

4Q15 |

|

4Q14 |

|

% Change |

|

|

|

Net Sales |

|

$ |

5,188 |

|

$ |

5,356 |

|

(3.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold, excluding amortization expense |

|

2,206 |

|

2,337 |

|

(5.6 |

) |

|

|

Amortization of intangible assets |

|

143 |

|

163 |

|

(12.7 |

) |

|

|

Research and development |

|

369 |

|

361 |

|

2.4 |

|

|

|

Selling, general, and administrative |

|

1,655 |

|

1,666 |

|

(0.6 |

) |

|

|

Total Operating Cost and Expenses |

|

4,373 |

|

4,527 |

|

(3.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

815 |

|

829 |

|

(1.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

9 |

|

19 |

|

(54.7 |

) |

|

|

Net loss on extinguishment of debt |

|

— |

|

18 |

|

n/m |

|

|

|

Net foreign exchange (gain) loss |

|

(30 |

) |

(24 |

) |

21.6 |

|

|

|

Other (income) expense, net |

|

6 |

|

12 |

|

(55.0 |

) |

|

|

Earnings from Continuing Operations before taxes |

|

830 |

|

804 |

|

3.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

135 |

|

170 |

|

(20.6 |

) |

|

|

Earnings from Continuing Operations |

|

695 |

|

634 |

|

9.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Discontinued Operations, net of taxes |

|

72 |

|

271 |

|

(73.5 |

) |

1) |

|

Gain on Sale of Discontinued Operations, net of taxes |

|

— |

|

— |

|

n/m |

|

|

|

Net Earnings from Discontinued Operations, net of taxes |

|

72 |

|

271 |

|

(73.5 |

) |

1) |

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

|

$ |

767 |

|

$ |

905 |

|

(15.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings from Continuing Operations, excluding Specified Items, as described below |

|

$ |

932 |

|

$ |

943 |

|

(1.2 |

) |

2) |

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Common Share from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Operations |

|

$ |

0.46 |

|

$ |

0.41 |

|

12.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations |

|

0.05 |

|

0.18 |

|

(72.2 |

) |

1) |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

0.51 |

|

$ |

0.59 |

|

(13.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Common Share from Continuing Operations, excluding Specified Items, as described below |

|

$ |

0.62 |

|

$ |

0.62 |

|

— |

|

2) |

|

|

|

|

|

|

|

|

|

|

|

Average Number of Common Shares Outstanding Plus Dilutive Common Stock Options |

|

1,498 |

|

1,522 |

|

|

|

|

NOTES:

See tables on page 14 for an explanation of certain non-GAAP financial information.

n/m = Percent change is not meaningful.

See footnotes on the following page.

10

1) 2015 Earnings and Diluted Earnings per Common Share from Discontinued Operations primarily reflect net favorable adjustments to tax expense as a result of the resolution of various tax positions from previous years related to discontinued operations.

2014 Earnings and Diluted Earnings per Common Share from Discontinued Operations reflect financial results from the developed markets branded generics pharmaceuticals and animal health businesses, and a net favorable adjustment to tax expense as a result of the resolution of various tax positions from previous years related to AbbVie operations.

2) 2015 Net Earnings from Continuing Operations, excluding Specified Items, excludes net after-tax charges of $237 million, or $0.16 per share, for intangible amortization expense, expenses associated with cost reduction initiatives and other expenses related to acquisitions.

2014 Net Earnings from Continuing Operations, excluding Specified Items, excludes net after-tax charges of $309 million, or $0.21 per share, for intangible amortization expense, expenses associated with cost reduction initiatives and deal and other expenses related to the acquisitions, as well as the tax expense associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

11

Abbott Laboratories and Subsidiaries

Consolidated Statement of Earnings

Fiscal Year Ended December 31, 2015 and 2014

(in millions, except per share data)

(unaudited)

|

|

|

12M15 |

|

12M14 |

|

% Change |

|

|

|

Net Sales |

|

$ |

20,405 |

|

$ |

20,247 |

|

0.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold, excluding amortization expense |

|

8,747 |

|

9,218 |

|

(5.1 |

) |

|

|

Amortization of intangible assets |

|

601 |

|

555 |

|

8.2 |

|

|

|

Research and development |

|

1,405 |

|

1,345 |

|

4.5 |

|

|

|

Selling, general, and administrative |

|

6,785 |

|

6,530 |

|

3.9 |

|

|

|

Total Operating Cost and Expenses |

|

17,538 |

|

17,648 |

|

(0.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

2,867 |

|

2,599 |

|

10.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

58 |

|

73 |

|

(21.2 |

) |

|

|

Net loss on extinguishment of debt |

|

— |

|

18 |

|

n/m |

|

|

|

Net foreign exchange (gain) loss |

|

(93 |

) |

(24 |

) |

n/m |

|

|

|

Other (income) expense, net |

|

(281 |

) |

14 |

|

n/m |

|

1) |

|

Earnings from Continuing Operations before taxes |

|

3,183 |

|

2,518 |

|

26.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

577 |

|

797 |

|

(27.6 |

) |

|

|

Earnings from Continuing Operations |

|

2,606 |

|

1,721 |

|

51.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Discontinued Operations, net of taxes |

|

65 |

|

563 |

|

(88.5 |

) |

|

|

Gain on Sale of Discontinued Operations, net of taxes |

|

1,752 |

|

— |

|

n/m |

|

|

|

Net Earnings from Discontinued Operations, net of taxes |

|

1,817 |

|

563 |

|

n/m |

|

2) |

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

|

$ |

4,423 |

|

$ |

2,284 |

|

93.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings from Continuing Operations, excluding Specified Items, as described below |

|

$ |

3,258 |

|

$ |

3,038 |

|

7.2 |

|

3) |

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Common Share from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Operations |

|

$ |

1.72 |

|

$ |

1.12 |

|

53.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations |

|

1.20 |

|

0.37 |

|

n/m |

|

2) |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

2.92 |

|

$ |

1.49 |

|

96.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Common Share from Continuing Operations, excluding Specified Items, as described below |

|

$ |

2.15 |

|

$ |

1.98 |

|

8.6 |

|

3) |

|

|

|

|

|

|

|

|

|

|

|

Average Number of Common Shares Outstanding Plus Dilutive Common Stock Options |

|

1,506 |

|

1,527 |

|

|

|

|

NOTES:

See tables on page 15 for an explanation of certain non-GAAP financial information.

n/m = Percent change is not meaningful.

See footnotes on the following page.

12

1) 2015 Other (income) expense includes a gain on the sale of a portion of Abbott’s position in Mylan stock and a decrease in the fair value of contingent consideration related to a business acquisition, both reported as specified items.

2) 2015 Earnings and Diluted Earnings per Common Share from Discontinued Operations reflect the after-tax gain of $1.752 billion on the sale of the developed markets branded generics pharmaceuticals and animal health businesses to Mylan on Feb. 27, 2015 and Zoetis on Feb. 10, 2015, respectively; the first-quarter financial results from these businesses up to the date of sale; and a favorable adjustment to tax expense as a result of the resolution of various tax positions from previous years related to discontinued operations.

2014 Earnings and Diluted Earnings per Common Share from Discontinued Operations reflect financial results from the developed markets branded generics pharmaceuticals and animal health businesses, and a net favorable adjustment to tax expense as a result of the resolution of various tax positions from previous years related to AbbVie operations.

3) 2015 Net Earnings from Continuing Operations, excluding Specified Items, excludes net after-tax charges of $652 million, or $0.43 per share, for intangible amortization expense, expenses associated with cost reduction initiatives and other expenses related to acquisitions, partially offset by a gain on the sale of a portion of Abbott’s position in Mylan stock and a decrease in the fair value of contingent consideration related to a business acquisition.

2014 Net Earnings from Continuing Operations, excluding Specified Items, excludes net after-tax charges of $1.317 billion, or $0.86 per share, for intangible amortization expense, expenses associated with cost reduction initiatives and deal and other expenses related to acquisitions, as well as the tax expense associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

13

NON-GAAP RECONCILIATION OF FINANCIAL INFORMATION FROM CONTINUING OPERATIONS

Abbott Laboratories and Subsidiaries

Non-GAAP Reconciliation of Financial Information From Continuing Operations

Fourth Quarter Ended December 31, 2015 and 2014

(in millions, except per share data)

(unaudited)

|

|

|

4Q15 |

|

|

|

|

As

Reported

(GAAP) |

|

Specified

Items |

|

As

Adjusted |

|

% to

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible Amortization |

|

$ |

143 |

|

$ |

(143 |

) |

— |

|

|

|

|

Gross Margin |

|

2,839 |

|

178 |

|

$ |

3,017 |

|

58.2 |

% |

|

R&D |

|

369 |

|

(4 |

) |

365 |

|

7.0 |

% |

|

SG&A |

|

1,655 |

|

(117 |

) |

1,538 |

|

29.6 |

% |

|

Other (Income) Expense, Net |

|

6 |

|

(6 |

) |

— |

|

|

|

|

Earnings from Continuing Operations before taxes |

|

830 |

|

305 |

|

1,135 |

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

135 |

|

68 |

|

203 |

|

|

|

|

Net Earnings from Continuing Operations |

|

695 |

|

237 |

|

932 |

|

|

|

|

Diluted Earnings per Share from Continuing Operations |

|

$ |

0.46 |

|

$ |

0.16 |

|

$ |

0.62 |

|

|

|

Specified items reflect intangible amortization expense of $143 million and other expenses of $162 million, primarily associated with cost reduction initiatives and acquisitions.

|

|

|

4Q14 |

|

|

|

|

As

Reported

(GAAP) |

|

Specified

Items |

|

As

Adjusted |

|

% to

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible Amortization |

|

$ |

163 |

|

$ |

(163 |

) |

— |

|

|

|

|

Gross Margin |

|

2,856 |

|

191 |

|

$ |

3,047 |

|

56.9 |

% |

|

R&D |

|

361 |

|

(19 |

) |

342 |

|

6.4 |

% |

|

SG&A |

|

1,666 |

|

(86 |

) |

1,580 |

|

29.5 |

% |

|

Net loss on extinguishment of debt |

|

18 |

|

(18 |

) |

— |

|

|

|

|

Other (Income) Expense, Net |

|

12 |

|

(1 |

) |

11 |

|

|

|

|

Earnings from Continuing Operations before taxes |

|

804 |

|

315 |

|

1,119 |

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

170 |

|

6 |

|

176 |

|

|

|

|

Net Earnings from Continuing Operations |

|

634 |

|

309 |

|

943 |

|

|

|

|

Diluted Earnings per Share from Continuing Operations |

|

$ |

0.41 |

|

$ |

0.21 |

|

$ |

0.62 |

|

|

|

Specified items reflect intangible amortization expense of $163 million and other expenses of $152 million, primarily associated with cost reduction initiatives and deal and other expenses related to acquisitions, as well as tax expense of $175 million associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

14

Abbott Laboratories and Subsidiaries

Non-GAAP Reconciliation of Financial Information From Continuing Operations

Fiscal Year Ended December 31, 2015 and 2014

(in millions, except per share data)

(unaudited)

|

|

|

12M15 |

|

|

|

|

As

Reported

(GAAP) |

|

Specified

Items |

|

As

Adjusted |

|

% to

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible Amortization |

|

$ |

601 |

|

$ |

(601 |

) |

— |

|

|

|

|

Gross Margin |

|

11,057 |

|

755 |

|

$ |

11,812 |

|

57.9 |

% |

|

R&D |

|

1,405 |

|

(85 |

) |

1,320 |

|

6.5 |

% |

|

SG&A |

|

6,785 |

|

(272 |

) |

6,513 |

|

31.9 |

% |

|

Other (Income) Expense, Net |

|

(281 |

) |

288 |

|

7 |

|

|

|

|

Earnings from Continuing Operations before taxes |

|

3,183 |

|

824 |

|

4,007 |

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

577 |

|

172 |

|

749 |

|

|

|

|

Net Earnings from Continuing Operations |

|

2,606 |

|

652 |

|

3,258 |

|

|

|

|

Diluted Earnings per Share from Continuing Operations |

|

$ |

1.72 |

|

$ |

0.43 |

|

$ |

2.15 |

|

|

|

Specified items reflect intangible amortization expense of $601 million and other expenses of $510 million, primarily associated with cost reduction initiatives and acquisitions, partially offset by a gain on the sale of a portion of Abbott’s position in Mylan stock of $207 million and a decrease in the fair value of contingent consideration related to a business acquisition.

|

|

|

12M14 |

|

|

|

|

As

Reported

(GAAP) |

|

Specified

Items |

|

As

Adjusted |

|

% to

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible Amortization |

|

$ |

555 |

|

$ |

(555 |

) |

— |

|

|

|

|

Gross Margin |

|

10,474 |

|

721 |

|

$ |

11,195 |

|

55.3 |

% |

|

R&D |

|

1,345 |

|

(72 |

) |

1,273 |

|

6.3 |

% |

|

SG&A |

|

6,530 |

|

(367 |

) |

6,163 |

|

30.4 |

% |

|

Net loss on extinguishment of debt |

|

18 |

|

(18 |

) |

— |

|

|

|

|

Other (Income) Expense, Net |

|

14 |

|

(9 |

) |

5 |

|

|

|

|

Earnings from Continuing Operations before taxes |

|

2,518 |

|

1,187 |

|

3,705 |

|

|

|

|

Taxes on Earnings from Continuing Operations |

|

797 |

|

(130 |

) |

667 |

|

|

|

|

Net Earnings from Continuing Operations |

|

1,721 |

|

1,317 |

|

3,038 |

|

|

|

|

Diluted Earnings per Share from Continuing Operations |

|

$ |

1.12 |

|

$ |

0.86 |

|

$ |

1.98 |

|

|

|

Specified items reflect intangible amortization expense of $555 million and other expenses of $632 million, primarily associated with cost reduction initiatives and deal and other expenses related to acquisitions, as well as tax expense of $440 million associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

15

RECONCILIATION OF TAX RATE FOR CONTINUING OPERATIONS

A reconciliation of the fourth-quarter tax rates for continuing operations for 2015 and 2014 is shown below:

|

|

|

4Q15 |

|

|

|

|

($ in millions) |

|

Pre-Tax

Income |

|

Taxes on

Earnings |

|

Tax

Rate |

|

|

|

|

As reported (GAAP) |

|

$ |

830 |

|

$ |

135 |

|

16.3 |

% |

|

|

|

Specified items |

|

305 |

|

68 |

|

|

|

|

|

|

Excluding specified items |

|

$ |

1,135 |

|

$ |

203 |

|

17.9 |

% |

1) |

|

|

|

|

4Q14 |

|

|

|

|

($ in millions) |

|

Pre-Tax

Income |

|

Taxes on

Earnings |

|

Tax

Rate |

|

|

|

|

As reported (GAAP) |

|

$ |

804 |

|

$ |

170 |

|

21.1 |

% |

2) |

|

|

Specified items |

|

315 |

|

6 |

|

|

|

|

|

|

Excluding specified items |

|

$ |

1,119 |

|

$ |

176 |

|

15.7 |

% |

1) |

|

1) Fourth-quarter 2014 and 2015 tax rates include the year-to-date impact of U.S. tax legislation passed in Dec. 2014 and 2015, respectively, including the R&D tax credit.

2) Reported tax rate on a GAAP basis includes the impact of tax expense of $175 million associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability of $133 million as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

A reconciliation of the full-year tax rates for continuing operations for 2015 and 2014 is shown below:

|

|

|

12M15 |

|

|

|

|

($ in millions) |

|

Pre-Tax

Income |

|

Taxes on

Earnings |

|

Tax

Rate |

|

|

|

|

As reported (GAAP) |

|

$ |

3,183 |

|

$ |

577 |

|

18.1 |

% |

|

|

|

Specified items |

|

824 |

|

172 |

|

|

|

|

|

|

Excluding specified items |

|

$ |

4,007 |

|

$ |

749 |

|

18.7 |

% |

3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12M14 |

|

|

|

|

($ in millions) |

|

Pre-Tax

Income |

|

Taxes on

Earnings |

|

Tax

Rate |

|

|

|

|

As reported (GAAP) |

|

$ |

2,518 |

|

$ |

797 |

|

31.7 |

% |

4) |

|

|

Specified items |

|

1,187 |

|

(130 |

) |

|

|

|

|

|

Excluding specified items |

|

$ |

3,705 |

|

$ |

667 |

|

18.0 |

% |

3) |

|

3) Full-year 2014 and 2015 tax rates include the impact of U.S. tax legislation passed in Dec. 2014 and 2015, respectively, including the R&D tax credit.

4) Reported tax rate on a GAAP basis includes the impact of tax expense of $440 million associated with a one-time repatriation of 2014 ex-U.S. earnings, partially offset by favorability of $126 million as a result of the resolution of various tax positions and adjustment of tax uncertainties from prior years.

###

16

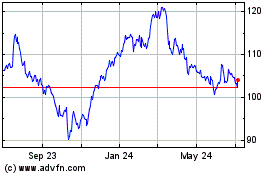

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

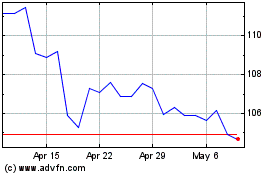

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024