Abbott Labs Profit Rises, Helped by Emerging Markets

October 21 2015 - 10:50AM

Dow Jones News

By Ezequiel Minaya

Abbott Laboratories Inc. said Wednesday that profit grew 7.8% in

its latest quarter as results were aided by emerging markets

growth.

Shares rose 2.5% to $42.78 in early trading as revenue and

adjusted profit edged above Wall Street's estimates.

In the wake of the results, Abbott narrowed its annual guidance

range for earnings per share, excluding specified items, to $2.14

to $2.16 from a previous range of $2.10 to $2.20.

Sales in emerging markets provided a boost for the

Illinois-based health-care company, jumping 8.2%. Operational sales

growth in the quarter was led by India, Russia, Brazil, China, and

several markets throughout Latin America, the company reported.

Revenue in the U.S. declined 0.7%.

Analysts for Evercore ISI said relative to investors' fears of a

slowdown in emerging markets, Abbott delivered solid results.

"We also note that the nutritional segment growth was

exceptionally strong despite the tougher comps and fears around

potential consumer weakness impacting China nutritionals," they

added.

Worldwide pediatric nutrition revenue increased 4.1%, with

growth led by the Eleva product in China and Similac Advance in the

U.S.

Worldwide adult nutrition dipped 4.5%, which included a 7.1%

foreign exchange drag. Worldwide medical devices and worldwide

diabetes care sales dipped 7.4% and 8.4%, respectively.

Established pharmaceuticals sales climbed 24.6%, shaking off an

18% dent from currency impacts.

Overall, the company posted a profit of $580 million, or 38

cents a share, up from $538 million, or 36 cents a share, a year

earlier. Excluding certain items, earnings per share remained flat

at 54 cents.

Revenue rose 1.4% to $5.15 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

of 53 cents on revenue of $5.14 billion.

Abbott has been realigning its business in a series of deals.

Last year, Abbott reached an agreement to shed a portion of its

generics pharmaceuticals business to Mylan Inc., a transaction that

underscored a trend of health-care mergers-and-acquisitions driven

in part to seek tax advantages.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 10:35 ET (14:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

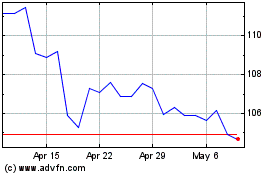

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

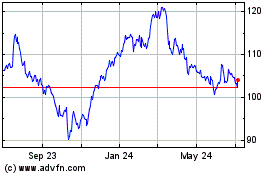

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024