Drug pricing, a key issue in the federal investigation of

Valeant Pharmaceuticals International Inc., has been a frequent

focus of federal prosecutions and whistleblower lawsuits in recent

years.

Pharmaceutical companies have paid more than $3 billion in fines

to resolve pricing cases over the past decade, according to Patrick

Burns, co-director of Taxpayers Against Fraud, a group that

promotes whistleblowing.

Valeant said late Wednesday that it had received subpoenas from

U.S. attorneys' offices in Manhattan and Boston seeking materials

on a range of matters, including the financial aid it gives

patients to pay for out-of-pocket costs as well as the pricing of

its drugs. The company said it plans to cooperate with the

investigation.

The news sent Valeant shares down 4.8% to $168.87 on Thursday.

Valeant has lost more than a third of its value since its shares

peaked at $262.52 in early August, partly on worries about scrutiny

of its drug-price increases.

Valeant said Thursday that it "has been shifting away from

transactions that are dependent on price increases in order to meet

our internal target returns" and that it doesn't boost prices on

the "vast majority of the thousands of" company products.

Democrats in Congress have asked Valeant to provide information

about steep price increases by the company for two drugs that were

featured in an April article in The Wall Street Journal. In

response to one such request from Sen. Claire McCaskill of

Missouri, Valeant said Wednesday that the price increases had no

effect on patient access and little impact on most hospital budgets

and Valeant's revenues.

It isn't clear what specific information federal prosecutors are

seeking about Valeant's pricing. But past probes highlight some key

ways that drug makers can run afoul of the law, in particular in

the way they charge Medicare and Medicaid.

Among the biggest settlements was the more than $650 million

that Merck & Co. agreed in 2008 to pay to settle allegations

that it, in part, failed to give the federal Medicaid

health-insurance program the same levels of rebates it gave other

customers for drugs including cholesterol pill Zocor and the

now-withdrawn painkiller Vioxx. Merck said at the time that it had

long since taken the initiative to enhance its compliance program,

and that the pricing allegations resulted from differing

interpretations of Medicaid rules.

Generally in such cases, "the legal issue would be whether or

not they are giving the best price to Medicaid," says Michael

Mustokoff, a partner at the law firm Duane Morris who has both

defended and prosecuted drug companies.

Federal law requires drug companies give Medicaid the best price

for a drug offered to any customers except charitable

organizations.

Other drug-pricing cases involved allegations that Medicare and

other government health-insurance programs have paid more than they

should have because companies inflated costs when reporting their

prices to the federal government.

In 2010, Abbott Laboratories Inc., Roxane Laboratories Inc. and

B. Braun Medical Inc. agreed to pay $421 million to settle U.S.

government claims they each reported false prices for various drugs

including the antibiotic vancomycin to get larger Medicare or

Medicaid reimbursements. The companies didn't admit any wrongdoing,

and said they had settled in order to avoid the expense of

litigation.

There are several drug-pricing investigations now under way.

Pfizer Inc. is fighting a Justice Department lawsuit accusing the

company's Wyeth unit of overcharging Medicaid by hundreds of

millions of dollars for heartburn drug Protonix. Pfizer said the

government's allegations have no merit.

The federal government has taken some steps to prevent

overcharging. For instance, it has altered the formula companies

must use to determine the drug prices they report to Medicare for

reimbursement decisions.

Yet when it comes to drug pricing, "there's still potential for

wrongdoing in the area, and it has not gone away," says Patrick

O'Connell, a former Texas assistant attorney general who prosecuted

drug-pricing cases and now represents drug-company

whistleblowers.

Manufacturer-supported patient-assistance programs also can

potentially run afoul of federal rules. Federal law considers it to

be an illegal kickback if a company gives financial help to

Medicare patients so they can pay the out-of-pocket costs of their

prescriptions.

"We are concerned about the use of cost-sharing subsidies to

shield beneficiaries from the economic effects of drug pricing,

thus eliminating a market safeguard against inflated prices," the

Health and Human Services Department's office of inspector general

said in a 2005 bulletin, before Medicare's Part D drug-benefits

program went into effect.

To help Medicare patients fill their prescriptions, Valeant and

other drug companies have contributed funds to independent

charities, which then subsidize the out-of-pocket costs.

Such donations are legal. Last year, however, the inspector

general issued another bulletin saying a drug maker could be

violating the federal law against kickbacks if it made donations to

"induce" a charity to steer patients toward the company's

drugs.

In another continuing case, federal prosecutors allege in a

complaint that Novartis AG "paid kickbacks…under the guise of

performance rebates" to a Missouri pharmacy that served

kidney-transplant patients who received patient assistance and, in

exchange, the pharmacy recommended use of the Novartis drug

Myfortic.

Novartis said it contracted with a number of pharmacies, which

were eligible to receive rebates in connection with dispensing

Myfortic, but it was up to doctors to decide which drug a patient

received.

In the letter sent Wednesday to Sen. McCaskill about its drugs

Isuprel and Nitropress, Valeant said it spent $544 million on

patient assistance last year and expects to spend another $630

million this year. Valeant also said it had raised the list prices

of Isuprel and Nitropress "to ensure that the prices reflected the

value of the drugs to hospitals and patients."

Sen. McCaskill said she wasn't satisfied by Valeant's response.

"Valeant has been anything but responsive or transparent—it refused

to take any action until served with federal subpoenas, and it is

still refusing to provide answers to many of the questions I've

asked," she said in a statement.

She said she planned to keep investigating drug pricing and

Valeant's response.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

Access Investor Kit for "CitiGroup Inc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US1729674242

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 16, 2015 01:25 ET (05:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

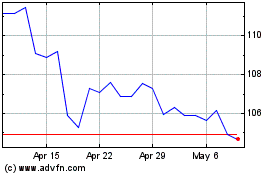

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

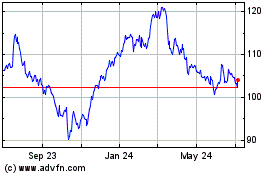

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024