As filed with the Securities and Exchange Commission on June 5, 2015.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Abbott Laboratories

(Exact name of registrant as specified in its charter)

|

Illinois |

|

36-0698440 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

Abbott Laboratories |

|

|

|

100 Abbott Park Road |

|

60064-6400 |

|

Abbott Park, Illinois |

|

(Zip Code) |

|

(Address of Principal Executive Offices) |

|

|

ABBOTT LABORATORIES STOCK RETIREMENT PROGRAM

(Full title of the plan)

Hubert L. Allen

Abbott Laboratories

100 Abbott Park Road

Abbott Park, Illinois 60064-6400

(Name and address of agent for service)

Telephone number, including area code, of agent for service: (224) 667-6100

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

x |

Accelerated filer |

o |

|

Non-accelerated filer |

o |

Smaller reporting company |

o |

|

(Do not check if a smaller reporting company) |

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities to

be registered |

|

Amount to be

registered |

|

Proposed maximum

offering price per

share (a) |

|

Proposed maximum

aggregate offering

price (a) |

|

Amount of

registration fee (a) |

|

|

Common shares (without par value) |

|

35,000,000 |

|

$ |

48.76 |

|

$ |

1,706,600,000 |

|

$ |

198,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

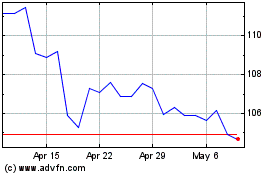

(a) In addition, pursuant to Rule 416(c) under the Securities Act of 1933, this registration statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described herein. The filing fee has been calculated in accordance with Rule 457(c) based on the average of the high and low prices of the registrant’s Common Shares reported on the New York Stock Exchange on June 2, 2015.

Pursuant to General Instruction E, the contents of Abbott Laboratories Stock Retirement Program Registration Statement on Form S-8 (File no. 33-50452) are incorporated herein by reference.

Part II. Information Required in the Registration Statement

Item 8. Exhibits

Reference is made to the Exhibit Index which is incorporated herein by reference. Neither an opinion of counsel concerning the Program’s compliance with the requirements of ERISA nor an Internal Revenue Service (“IRS”) determination letter is furnished because the Registrant undertakes that it will submit, or has submitted, the Abbott Laboratories Stock Retirement Program and any amendments thereto to the IRS in a timely manner and has made or will make all changes required by the IRS in order to qualify the Program.

2

SIGNATURES

THE REGISTRANT. Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in unincorporated Lake County, and State of Illinois, on June 5, 2015.

|

|

ABBOTT LABORATORIES |

|

|

|

|

|

|

|

|

|

By: |

/s/ Miles D. White |

|

|

|

Miles D. White, |

|

|

|

Chairman of the Board and |

|

|

|

Chief Executive Officer |

3

Each person whose signature appears below constitutes and appoints Miles D. White and Hubert L. Allen, and each of them, as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this registration statement, and to file the same with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature |

|

Title |

|

Date |

|

|

|

|

|

|

|

/s/ Miles D. White |

|

Chairman of the Board, |

|

June 5, 2015 |

|

Miles D. White |

|

Chief Executive Officer, and |

|

|

|

|

|

Director |

|

|

|

|

|

|

|

|

|

/s/ Brian B. Yoor |

|

Senior Vice President, Finance and |

|

June 5, 2015 |

|

Brian B. Yoor |

|

Chief Financial Officer (Principal |

|

|

|

|

|

Financial Officer) |

|

|

|

|

|

|

|

|

|

/s/ Robert E. Funck |

|

Vice President, Controller |

|

June 5, 2015 |

|

Robert E. Funck |

|

(Principal Accounting Officer) |

|

|

|

|

|

|

|

|

|

/s/ Robert J. Alpern, M.D. |

|

Director |

|

June 5, 2015 |

|

Robert J. Alpern, M.D. |

|

|

|

|

|

|

|

|

|

|

|

/s/ Roxanne S. Austin |

|

Director |

|

June 5, 2015 |

|

Roxanne S. Austin |

|

|

|

|

|

|

|

|

|

|

|

/s/ Sally E. Blount, Ph.D. |

|

Director |

|

June 5, 2015 |

|

Sally E. Blount, Ph.D. |

|

|

|

|

|

|

|

|

|

|

|

/s/ W. James Farrell |

|

Director |

|

June 5, 2015 |

|

W. James Farrell |

|

|

|

|

|

|

|

|

|

|

|

/s/ Edward M. Liddy |

|

Director |

|

June 5, 2015 |

|

Edward M. Liddy |

|

|

|

|

4

|

/s/ Nancy McKinstry |

|

Director |

|

June 5, 2015 |

|

Nancy McKinstry |

|

|

|

|

|

|

|

|

|

|

|

/s/ Phebe N. Novakovic |

|

Director |

|

June 5, 2015 |

|

Phebe N. Novakovic |

|

|

|

|

|

|

|

|

|

|

|

/s/ William A. Osborn |

|

Director |

|

June 5, 2015 |

|

William A. Osborn |

|

|

|

|

|

|

|

|

|

|

|

/s/ Samuel C. Scott III |

|

Director |

|

June 5, 2015 |

|

Samuel C. Scott III |

|

|

|

|

|

|

|

|

|

|

|

/s/ Glenn F. Tilton |

|

Director |

|

June 5, 2015 |

|

Glenn F. Tilton |

|

|

|

|

5

THE PLAN. Pursuant to the requirements of the Securities Act of 1933, the Abbott Laboratories Stock Retirement Program has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in unincorporated Lake County, and State of Illinois, on the 5th day of June, 2015.

|

|

ABBOTT LABORATORIES STOCK RETIREMENT PROGRAM |

|

|

|

|

|

|

|

|

|

By: |

/s/ Mary K. Moreland |

|

|

|

Mary K. Moreland, Plan Administrator |

6

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

4 |

|

Abbott Laboratories Stock Retirement Program. |

|

|

|

|

|

23.1 |

|

Consent of Ernst & Young LLP. |

|

|

|

|

|

23.2 |

|

Consent of Deloitte & Touche LLP. |

|

|

|

|

|

23.3 |

|

Consent of Grant Thornton LLP. |

|

|

|

|

|

24 |

|

Power of Attorney is included on the signature page. |

7

Exhibit 4

ABBOTT LABORATORIES STOCK RETIREMENT PROGRAM

PREAMBLE

(As Amended and Restated Effective January 1, 1996

and as further amended thru the 6th Amendment

adopted December 16, 2013)

ABBOTT LABORATORIES STOCK RETIREMENT PROGRAM

Preamble

1.1. Purpose. This document amends and restates the provisions of the Abbott Laboratories Stock Retirement Plan (“the Program”), effective as of January 1, 1996. Effective January 1, 1996, the Program shall be known as the Abbott Laboratories Stock Retirement Program. The Program consists of this Preamble and two parts, Part A titled “Abbott Laboratories Stock Retirement Plan” and Part B titled “Abbott Laboratories Stock Retirement Plan (Puerto Rico)”. Part A shall be funded by a trust known as “Abbott Laboratories Stock Retirement Trust” and Part B shall be funded by a separate trust known as “Abbott Laboratories Stock Retirement Trust (Puerto Rico)”. Effective January 1, 2006, Part A and its related trust are intended to constitute a profit sharing plan and trust under Sections 401(a) and 501(a) of the United States Internal Revenue Code of 1986 (the “U.S. Code”), with a cash or deferred arrangement under U.S. Code Section 401(k), and a portion of the plan is intended to constitute an employee stock ownership plan which meets the applicable requirements of U.S. Code Sections 409 and 4975(e)(7), and the provisions of Part A and its related trust shall be construed and applied accordingly. Immediately prior to January 1, 2006, the entire Part A constituted a stock bonus plan that was an employee stock ownership plan. Part B, the cash or deferred arrangement forming a part of Part B, and its related trust are intended to qualify as a profit sharing plan containing a cash or deferred arrangement under sections 1081.01(a) and (d) of the Puerto Rico Internal Revenue Code of 2011, as amended (the “PR Code”), and the provisions of Part B and its related trust shall be construed and applied accordingly.

1.2. History of the Program. The Program was originally established by Abbott Laboratories (the “Corporation”), effective July 9, 1951, to facilitate the retirement of eligible participating employees by providing benefits that reinforce those available to such employees under the Abbott Laboratories Annuity Retirement Plan and other Abbott Laboratories retirement benefits.

The Program provides an arrangement by which employees may invest in stock of the Corporation (“Company Stock”) by contributing to the applicable trust under Part A or Part B and by which the Corporation and its affiliates will encourage such investment by also making contributions to such trusts. Contributions received by the trusts from Participants and Employers have been applied by the trustees thereof to acquire, and hold, shares of Company stock for the benefit of Participants in the Program.

Part A as in effect on January 1, 1996 applies to “Eligible Employees” of the Corporation and of certain of its Subsidiaries and Divisions, as provided for in Part A. Part B as in effect on January 1, 1996 applies to “Eligible Employees” of certain Subsidiaries of the Corporation as provided for in Part B.

Effective January 1, 2013, the Corporation established the Abbott Laboratories Stock Retirement Plan (Puerto Rico) as Part B of the Program The Abbott Laboratories Stock Retirement Plan (Puerto Rico) replaced the former Abbott Laboratories Stock Retirement Plan

2

(Puerto Rico), which was assumed by AbbVie Inc. and renamed the AbbVie Puerto Rico Savings Plan in connection with the separation and distribution described in Supplement A to the Abbott Laboratories Stock Retirement Plan (Puerto Rico).

1.3. Rights Under Prior Plan. Except as otherwise specifically provided, the benefits provided under the Program for any Participant who retired or whose employment with the Employers otherwise terminated prior to January 1, 1996 shall be governed in all respects by the terms of the Program as in effect on the date of his or her retirement or other termination of employment.

1.4. Employer Contributions. For each Plan Year, beginning with the Plan Year ending December 31, 1997, the Employers participating under Part A or Part B shall make Employer Contributions to the trust for Part A or Part B, as applicable, for the benefit of each Participant who is an Eligible Employee under such Part at any time during the Plan Year and on whose behalf Basic Contributions have been made at any time during the Plan Year. Except as provided in the last sentence of this Section 1.4, the aggregate amount of Employer Contributions made by the Employers to the Program for the Plan Year shall be determined from time to time by the Board of Directors of the Corporation. For each Plan Year ending before January 1, 2001, and for the 9-month period beginning on January 1, 2001 and ending on September 30, 2001, the Corporation shall allocate the aggregate Employer Contributions to the Program between Part A and Part B in the proportion and amounts necessary for the Point Value under Part A (as defined in Section 15.37 of Part A) to have the same dollar value as the Point Value under Part B (as defined in Section 14.36 of Part B). For each payroll period ending on or after October 1, 2001, the Corporation shall allocate the aggregate Employer Contributions to the Program between Part A and Part B in the proportion that the Basic Contributions made during such payroll period by Participants who are Eligible Employees under Part A bears to the Basic Contributions made during such payroll period by Participants who are Eligible Employees under Part B. In addition to the foregoing, for the Plan Years ending December 31, 2001, December 31, 2002 and December 31, 2003, the Employers participating under Part B shall make Employer Contributions to the trust for Part B in an amount sufficient to provide that the Employer Contribution allocated for each such Plan Year to each Participant who is an Eligible Employee under Part B (and who was also an Eligible Employee participating under Part B on December 31, 2000) shall not be less than the product of: (i) the Point Value under Part B for the Plan Year ended December 31, 2000, multiplied by (ii) the sum of the Participant’s earnings points and service points for the Plan Year ended December 31, 2000 (annualized if he or she was not a Participant for the entire Plan Year).

1.5. Definitions. Except where otherwise noted, words and phrases used in this Preamble shall have the same meaning as the meanings assigned such words and phrases under Part A and Part B.

1.6. Amendment and Termination. The Corporation reserves the power to amend this Preamble from time to time, to any extent and in any manner that it may deem advisable. All major amendments and all decisions or amendments which are reasonably expected to have the effect of suspending or terminating Employer contributions or suspending or terminating

3

payment of benefits to Participants or Beneficiaries, or terminating the Program shall be made by the Board of Directors of the Corporation. All other amendments shall be made by the Board of review. For purposes of the foregoing, the term “major amendment” shall have the same meaning as the meaning given that phrase in Part A. Part A and Part B may be amended and terminated as provided therein. This Preamble shall terminate upon termination of both Part A and Part B.

Notwithstanding anything contained in this Section 22, any material revision (within the meaning of the New York Stock Exchange rules) to this Preamble shall be subject to the approval of the Company’s compensation committee or a majority of the Company’s independent directors (within the meaning of the New York Stock Exchange rules).

4

ABBOTT LABORATORIES STOCK RETIREMENT PROGRAM

PART A

ABBOTT LABORATORIES STOCK

RETIREMENT PLAN

(As Amended and Restated Effective January 1, 1996

and as further amended thru the 35th Amendment

adopted December 15, 2014)

TABLE OF CONTENTS

|

ARTICLE 1. INTRODUCTION |

1 |

|

1.1 |

Purpose |

1 |

|

1.2 |

History of the Prior Plan |

1 |

|

1.3 |

Rights Under Prior Plan |

1 |

|

ARTICLE 2. PARTICIPATION |

1 |

|

2.1 |

Date of Participation |

1 |

|

2.2 |

Enrollment of Participants |

2 |

|

2.3 |

Re-employment of Participant |

2 |

|

2.4 |

Duration of Participation |

3 |

|

2.5 |

Participant Restricted Due to Conflict of Interest |

3 |

|

2.6 |

Participation by Additional Participating Employers |

4 |

|

2.7 |

Securities Law Restrictions |

5 |

|

ARTICLE 3. CONTRIBUTIONS |

5 |

|

3.1 |

Participant Contributions |

5 |

|

3.2 |

Basic Contributions |

5 |

|

3.3 |

Supplemental Contributions |

6 |

|

3.4 |

Contribution Agreements |

6 |

|

3.5 |

Employer Contributions for Periods Ending on or Before September 30, 2001 |

6 |

|

5A |

Employer Contributions for Periods Ending on and After October 1, 2001 |

7 |

|

3.6 |

Qualified Non-elective Employer Contributions |

7 |

|

3.7 |

Time for Making and Crediting of Contributions |

8 |

|

3.8 |

Certain Limits Apply |

8 |

|

3.9 |

Return of Contributions |

8 |

|

3.10 |

Special Limits for Corporate Officers |

9 |

|

ARTICLE 4. PARTICIPANT ACCOUNTS |

9 |

|

4.1 |

Accounts |

9 |

|

4.2 |

Adjustment of Accounts |

9 |

|

ARTICLE 5. INVESTMNET OF ACCOUNTS |

10 |

|

5.1 |

Company Stock |

10 |

|

5.2 |

Other Investment Funds |

10 |

|

5.3 |

Investment of Employer Contributions and Reinvestment of Company Stock |

11 |

|

5.4 |

Investment Elections |

11 |

|

5.5 |

Default Investment Fund |

11 |

|

5.6 |

Participant Direction of Investments |

11 |

|

5.7 |

Dividends on Company Stock |

12 |

|

5.8 |

Investment Options for Former M & R Employees |

12 |

|

5.9 |

Voting of Company Stock |

12 |

|

ARTICLE 6. WITHDRAWALS PRIOR TO SEPERATION FROM SERVICE |

13 |

|

6.1 |

Inservice Withdrawals of After-Tax Contributions |

13 |

|

6.2 |

Inservice Withdrawals of Certain Rollover Contributions |

17 |

|

6.3 |

Withdrawals at Age 59-1/2 |

21 |

|

6.4 |

Required Distributions After Age 70-1/2 |

21 |

|

6.5 |

Distributions Required by a Qualified Domestic Relations Order |

21 |

|

6.6 |

Participant’s Consent to Distribution of Benefits and Direct Rollover Notice |

22 |

|

6.7 |

In-Service Withdrawals of Certain Employer Contributions |

22 |

|

6.8 |

Distributions While on Military Leave |

22 |

|

ARTICLE 7. LOANS TO PARTICIPANTS |

23 |

|

7.1 |

In General |

23 |

|

7.2 |

Rules and Procedures |

23 |

|

7.3 |

Maximum Amount of Loans |

23 |

|

7.4 |

Minimum Amount of Loan; Number of Loans; Frequency of Loans; Fees for Loans |

24 |

|

7.5 |

Note; Security; Interest |

24 |

|

7.6 |

Repayment |

25 |

|

7.7 |

Repayment upon Distribution |

25 |

|

7.8 |

Default |

25 |

|

7.9 |

Nondiscrimination |

26 |

|

7.10 |

Source of Loan Proceeds |

26 |

|

7.11 |

Reinvestment of Loan Repayments |

26 |

|

ARTICLE 8. BENEFITS UPON RETIREMENT, DEATH OR SEPERATION FROM SERVICE |

26 |

|

8.1 |

Retirement |

26 |

|

8.1A |

Separation from Service for Reasons other than Death of Retirement |

26 |

|

8.2 |

Time of Distribution |

27 |

|

8.3 |

Amount and Manner of Distribution |

28 |

|

8.4 |

Distributions After a Participant’s Death |

29 |

|

8.5 |

Designation of Beneficiary |

30 |

|

8.6 |

Special Distribution Requirement |

31 |

|

8.7 |

Married Participant’s |

31 |

|

ARTICLE 9. ADMINISTRATION |

31 |

|

9.1 |

Board of Review |

31 |

|

9.2 |

Investment Committee |

31 |

|

9.3 |

Administrator |

32 |

|

9.4 |

Powers of Administrator |

32 |

|

9.5 |

Nondiscriminatory Exercise of Authority |

33 |

|

9.6 |

Reliance on Tables, etc. |

33 |

|

9.7 |

Claims and Review Procedures |

33 |

|

9.8 |

Indemnification |

33 |

|

9.9 |

Expenses and Compensation |

33 |

|

9.10 |

Notices; Participant Information |

34 |

|

ARTICLE 10. AMENDMENT AND TERMINATION |

34 |

|

10.1 |

Amendment |

34 |

|

10.2 |

Termination |

35 |

|

10.3 |

Distributions upon Termination of the Plan |

35 |

|

10.4 |

Merger or Consolidation of Plan; Transfer of Plan Assets |

35 |

|

ARTICLE 11. LIMITS ON CONTRIBUTIONS |

36 |

|

11.1 |

Code Section 404 Limits |

36 |

|

11.2 |

Code Section 415 Limits |

36 |

|

11.3 |

Code Section 402(g) Limits |

36 |

|

11.4 |

Code Section 401(k)(3) Limits |

37 |

|

11.5 |

Code Section 401(m) Limits |

40 |

|

11.6 |

Aggregation Rules |

43 |

|

ARTICLE 12. ROLLOVER AND TRANSFER CONTRIBUTIONS |

43 |

|

12.1 |

Contribution of Amount Distributed from Another Qualified Plan |

43 |

|

12.2 |

Transfer of Amount Distributed from a Rollover IRA |

43 |

|

12.3 |

Monitoring of Rollovers |

44 |

|

12.4 |

Transfer Contribution |

44 |

|

12.5 |

Treatment of Transferred Amount under the Plan |

44 |

|

12.6 |

Non-Spouse Rollovers |

45 |

|

ARTICLE 13. SPECIAL TOP-HEAVY PROVISIONS |

45 |

|

13.1 |

Provisions to Apply |

45 |

|

13.2 |

Minimum Contribution |

45 |

|

13.3 |

Special Vesting Schedule |

46 |

|

13.4 |

Adjustment to Limitation on Benefits |

46 |

|

13.5 |

Definitions |

46 |

|

13.6 |

Separate Top Heavy Determinations for Subsidiaries |

48 |

|

ARTICLE 14. MISCELLANEOUS |

48 |

|

14.1 |

Exclusive Benefit Rule |

48 |

|

14.2 |

Limitation of Rights |

48 |

|

14.3 |

Nonalienability of Benefits |

48 |

|

14.4 |

Changes in Vesting Schedule |

48 |

|

14.5 |

Governing Law |

49 |

|

ARTICLE 15. DEFINITIONS |

49 |

|

15.1 |

Accounts |

49 |

|

15.2 |

Administrator |

49 |

|

15.3 |

Affiliated Corporation |

49 |

|

15.4 |

Annuity Starting Date |

49 |

|

15.5 |

After-Tax Contribution Account |

50 |

|

15.6 |

Alternate Payee |

50 |

|

15.7 |

Basic After-Tax Contribution |

50 |

|

15.8 |

Basic After-Tax Contribution Account |

50 |

|

15.9 |

Basic Contribution |

50 |

|

15.10 |

Basic Pre-Tax Contribution |

50 |

|

15.11 |

Basic Pre-Tax Contribution Account |

50 |

|

15.12 |

Beneficiary |

50 |

|

15.13 |

Board of Directors |

50 |

|

15.14 |

Board of Review |

50 |

|

15.15 |

Break Year |

50 |

|

15.16 |

Code |

50 |

|

15.17 |

Company Stock |

50 |

|

15.18 |

Compensation |

51 |

|

15.19 |

Contribution Agreement |

52 |

|

15.20 |

Corporation |

52 |

|

15.21 |

Investment Committee |

52 |

|

15.22 |

Division |

52 |

|

15.23 |

Eligible Employee |

52 |

|

15.24 |

Employee |

53 |

|

15.25 |

Employer |

53 |

|

15.26 |

Employer Contributions |

53 |

|

15.27 |

Employer Contribution Account |

53 |

|

15.28 |

Entry Date |

53 |

|

15.29 |

ERISA |

54 |

|

15.30 |

Highly Compensated Employee |

54 |

|

15.31 |

Hour of Service |

54 |

|

15.32 |

Investment Fund |

54 |

|

15.33 |

Participant |

54 |

|

15.34 |

Period of Credited Service |

54 |

|

15.35 |

Plan |

58 |

|

15.36 |

Plan Year |

58 |

|

15.37 |

Point Value |

58 |

|

15.38 |

Pre-Tax Contribution Account |

58 |

|

15.39 |

Pre-Tax Contributions |

58 |

|

15.40 |

Prior Plan |

58 |

|

15.41 |

Qualified Domestic Relations Order |

58 |

|

15.42 |

Qualified Nonelective Employer Contribution |

58 |

|

15.43 |

Regulation |

58 |

|

15.44 |

Retirement Program |

58 |

|

15.45 |

Rollover Contribution Account |

58 |

|

15.46 |

Rollover Contribution |

59 |

|

15.47 |

Section |

59 |

|

15.48 |

SRP Stable Value Fund |

59 |

|

15.49 |

Subsidiary |

59 |

|

15.50 |

Supplemental After-Tax Contribution |

59 |

|

15.51 |

Supplemental After-Tax Contribution Account |

59 |

|

15.52 |

Supplemental Contribution |

59 |

|

15.53 |

Supplemental Pre-Tax Contribution |

59 |

|

15.54 |

Supplemental Pre-Tax Contribution Account |

59 |

|

15.55 |

Transfer Contribution |

59 |

|

15.56 |

Transfer Contribution Account |

60 |

|

15.57 |

Trust |

60 |

|

15.58 |

Trustee |

60 |

|

15.59 |

Unallocated Account |

60 |

|

15.60 |

Valuation Date |

60 |

|

15.61 |

Year of Credited Service |

60 |

|

Supplement A — EGTRRA Compliance |

A-1 |

|

Supplement B — Special Rules Relating to Transfer of Certain Accounts to Hospira 401(k) Retirement Savings Plan and Trust |

B-1 |

|

Supplement C — Abbott Laboratories Stock Retirement Plan Special Rules Relating to the ESOP Portion of the Plan |

C-1 |

|

Supplement D — Roth 401(k) Contributions |

D-1 |

|

Supplement E — Special Rules Relating To Transfer Of Certain Accounts To And From The Abbvie Savings Plan and Trust |

E-1 |

ARTICLE 1. INTRODUCTION

1.1. Purpose. Effective January 1, 2006, the Plan and its related trust are intended to constitute a profit sharing plan and trust under Sections 401(a) and 501(a) of the United States Internal Revenue Code of 1986 (the “U.S. Code”), with a cash or deferred arrangement under U.S. Code Section 401(k), and the portion of the Plan comprising the Company Stock Fund is intended to constitute an employee stock ownership plan which satisfies the applicable requirements of U.S. Code Sections 409 and 4975(e)(7), and the provisions of the Plan and Trust shall be construed and applied accordingly.

1.2. History of the Prior Plan. The Plan was originally established by Abbott Laboratories (the “Corporation”), effective July 9, 1951, to facilitate the retirement of eligible participating employees by providing benefits which reinforce those available to such employees under the Abbott Laboratories Annuity Retirement Plan and other Abbott Laboratories retirement benefits.

On February 24, 1964, the Corporation was substituted as the employer under the M & R Trust was consolidated with the Plan and Trust. Special provisions relating to employees and other persons covered under the M & R Retirement Investment Trust when it was consolidated with the Plan and the Trust are set forth in Supplement A to the Prior Plan. Supplement A modified the Prior Plan and the Trust to the extent it was inconsistent with the Prior Plan and Trust.

The Plan as in effect on January 1, 1996 applies to Eligible Employees of the Corporation and of all Subsidiaries and Divisions that participated in the Plan as of December 31, 1995. The Plan will also apply to Eligible Employees of any Subsidiary or Division that is designated by the Board of Review to participate in the Plan in accordance with Section 2.6, from and after the effective date of such designation.

1.3. Rights Under Prior Plan. Except as otherwise specifically provided, the benefits provided under the Plan for any Participant who retired or whose employment with the Employers otherwise terminated prior to January 1, 1996 will be governed in all respects by the terms of the Prior Plan as in effect on the date of his or her retirement or other termination of employment.

ARTICLE 2. PARTICIPATION

2.1. Date of Participation. Each individual who was a Participant on September 30, 2001 and is an Eligible Employee on October 1, 2001 shall continue to be a Participant in the Plan. Beginning October 1, 2001, each other Employee shall become a Participant on any Entry Date following his or her date of hire after he or she has completed the applicable forms under Sections 2.2 and 3.4.

1

2.2. Enrollment of Participants. An Eligible Employee shall become a Participant by signing an application form furnished by the Administrator within 30 days after he or she receives the application, or by such other means as the Administrator establishes for enrollment. Such application shall authorize the Participant’s Employer to deduct from his or her Compensation (or reduce his or her Compensation by) the contributions required under Section 3.2 or 3.3, whichever is applicable.

2.3. Re-employment of Participant. If an Employee’s employment with the Corporation, an Affiliated Corporation or a Subsidiary should terminate and such Employee is subsequently re-employed by the Corporation, an Affiliated Corporation or a Subsidiary, the following shall apply:

(a) If the re-employment occurs before the Employee has a Break Year, the Period of Credited Service to which he or she was entitled at the time of termination shall be reinstated, the period of his or her absence (but not to exceed 12 months) shall be included in his or her Period of Credited Service, and he or she will be reinstated as a Participant on his or her date of reemployment, if the Participant is an Eligible Employee on that date.

(b) If an Employee is reemployed after a Break Year, and at the time of termination he or she was not a Participant in the Plan, then:

(i) If the Employee’s Years of Credited Service to which he or she was entitled at the time of termination exceeds his or her number of consecutive Break Years, the Period of Credited Service to which he or she was entitled at the time of termination shall be reinstated.

(ii) If the Employee’s number of consecutive Break Years equals or exceeds the greater of 5 years or the aggregate Period of Credited Service to which he or she was entitled at the time of termination, the Employee shall be considered as a new Employee for all purposes of the Plan and any Period of Credited Service to which he or she was entitled prior to the date of termination shall be disregarded.

(c) If an Employee is reemployed after a Break Year, and at the time of termination he or she was a Participant in the Plan, the Period of Credited Service to which he or she was entitled at the time of termination shall be reinstated.

(d) If a Participant is transferred or is given a leave of absence for a temporary or indefinite period for the purpose of becoming an Employee of a Subsidiary or an Affiliated Corporation which is not an Employer hereunder, and such Participant is not treated as an Eligible Employee under Section 15.23(b), he or she will continue as a Participant until his or her retirement date or earlier termination of service with the Corporation, all Affiliated Corporations and all Subsidiaries, except that during such period the Employee may not make any contributions and

2

will not be credited with any Employer contributions except for a pro rata share of his or her Employer’s contributions for the year in which the transfer is made or the leave began, as the case may be, based upon his or her own contributions and service up to the date of such transfer or the date such leave began, as the case may be. If a Participant’s employment with the Corporation, all Affiliated Corporations and all Subsidiaries is terminated by reason of his or her death, retirement or otherwise while he or she is employed by the Corporation, any Affiliated Corporation or any Subsidiary which is not an Employer hereunder, the Participant will be considered to have terminated his or her employment with the Employers at the same time and for the same reason.

(e) In the case of maternity or paternity absence (as defined below) which commences on or after January 1, 1985, an Employee shall be deemed to be employed by the Corporation, an Affiliated Corporation, or any Subsidiary (solely for purposes of determining whether the Employee has incurred a Break Year) during the calendar year following the calendar year in which his or her employment terminated. A “maternity or paternity absence” means an Employee’s absence from work because of the pregnancy of the Employee or birth of a child of the Employee, the placement of a child with the Employee in connection with the adoption of such child by the Employee, or for purposes of caring for the child immediately following such birth or placement. The Administrator may require the Employee to furnish such information as the Administrator considers necessary to establish that the employee’s absence was for one of the reasons specified above.

2.4. Duration of Participation. An individual who has become a Participant under the Plan will remain a Participant for as long as an Account is maintained under the Plan for his or her benefit, or until his or her death, if earlier. Notwithstanding the preceding sentence and unless otherwise expressly provided for under the Plan, no contributions under the Plan shall be made on behalf of any Participant, unless the Participant is an Eligible Employee at the time for which the contribution or allocation is made.

2.5. Participant Restricted Due to Conflict of Interest. If a conflict of interest as defined in subsection (d) should arise with respect to any Participant:

(a) Such Participant shall continue as a Participant until his or her retirement date or earlier termination of service with the Employer, an Affiliated Corporation or a Subsidiary, except that during the period of such conflict of interest such Participant shall make no Basic After-Tax Contributions, such Participant’s Employer shall make no Basic Pre-Tax Contributions on his or her behalf, and such Participant shall be credited with no Employer Contributions except for a pro rata share of his or her Employer’s Employer Contributions for the year in which such conflict arises, based on his or her Basic Contributions and service to the date such conflict arises.

3

(b) Such Participant must, within 30 days after notice from the Administrator, elect to have 100% of the value of the shares of Company Stock credited to his or her Accounts transferred to the SRP Stable Value Fund or one of the other investment options available under the Plan (other than Company Stock). If the Participant fails to make such election, such shares shall be sold and the sale proceeds shall be transferred to the default Investment Fund selected under Section 5.6. Any Basic After-Tax Contributions, Basic Pre-Tax Contributions and pro-rata Employer Contributions, any Supplemental After-Tax Contributions and Supplemental Pre-Tax Contributions designated by the Participant under Section 5.1 to be invested in shares of Company Stock, and any dividends on shares of Company Stock held in the Participant’s Accounts, made for or paid during the calendar year in which such conflict of interest arises, shall likewise be transferred to the investment option the Participant selects under the first sentence of this subsection (b) or to the default Investment Fund referred to in the second sentence. These transfers shall not be subject to any of the investment restrictions or transition rules described in Section 5.4.

(c) Such Participant may elect to make Supplemental After-Tax Contributions and Supplemental Pre-Tax Contributions during the period of such conflict of interest, notwithstanding the suspension of Basic After-Tax Contributions and Basic Pre-Tax Contributions under subsection (a), provided that no such contributions may be invested in shares of Company Stock.

(d) A “conflict of interest” means a business, professional, family or other relationship involving the Participant, which, as a result of statute, ordinance, regulation or generally recognized professional standard or rule requires divestiture by the Participant of shares of Company Stock. The existence or nonexistence of a conflict of interest for purposes of this Section 2.5 shall be determined by the Administrator, which determination shall be final and binding on all persons. Any determination made under this subsection (d) shall have no effect on the application of any human resources or corporate policies of any Employer regarding conflict of interest.

2.6. Participation by Additional Participating Employers. The Board of Review may extend the Plan to any nonparticipating Division by filing with the Trustee and the Investment Committee a certified copy of an appropriate resolution by the Board of Review to that effect. Any Subsidiary or Affiliated Corporation may adopt the Plan and become a participating Employer hereunder by:

(a) filing with the Board of Review, the Trustee and the Investment Committee a written instrument to that effect, and;

(b) filing with the Trustee and the Investment Committee a certified copy of a resolution of the Board of Review consenting to such action.

4

At the time the Plan is extended to any Division of the Corporation or is adopted by any Subsidiary or Affiliated Corporation or any time thereafter, the Board of Review may modify the Plan or any of its terms as applied to said Division, Subsidiary, or Affiliated Corporation and its employees. The Board of Review may include in the Plan any employee of any prior separate business entity, part or all of which was acquired by or becomes a part of any Employer. To the extent and on the terms so provided by the Board of Review at the time of acquisition, or at any subsequent date or in any Supplement to the Plan, the last continuous period of employment of any employee with such prior separate business entity, part or all of which is or was acquired by, or becomes a part of any Employer, will be considered a Period of Credited Service.

2.7. Securities Law Restrictions.

(a) The Administrator may, from time to time, impose such restrictions on participation in the Plan, as the Administrator deems advisable, to facilitate compliance with federal and state securities laws, to secure exemption under any rule of the Securities and Exchange Commission, or to comply with the Corporation’s corporate policy with respect to “blackout periods” related to Company Stock. Such restrictions shall apply to all Participants or to such individual Participants as the Administrator shall determine in his or her sole discretion and may include but shall not be limited to (i) moratoriums on purchases, sales, withdrawals or distributions of Company Stock; (ii) moratoriums on loans and transfers into and out of Company Stock; and (iii) suspensions of Basic Contributions and Supplemental Contributions allocated to Company Stock.

(b) Any Participant for whom Basic Contributions are suspended under Section 2.7(a) may elect to make or continue making Supplemental Contributions, provided that no such contributions may be invested in shares of Company Stock.

ARTICLE 3. CONTRIBUTIONS

3.1. Participant Contributions. Except as provided in Sections 2.5 and 2.7, each Participant who has satisfied the eligibility requirements of Section 2.1 may have Basic Contributions made to the Plan on his or her behalf as described in Section 3.2 and may elect to have Supplemental Contributions made to the Plan on his or her behalf as described in Section 3.3; provided, however, that a Participant may make Supplemental Contributions only if Basic Contributions are concurrently being made.

3.2. Basic Contributions. Except as provided in Section 2.5, each Participant who is an Eligible Employee may enter into a Contribution Agreement with the Employer under which the Participant’s Compensation for each pay period shall be reduced by 2%, and the Employer will contribute to the Trust an equal amount as a Basic Pre-Tax Contribution, or as a Basic After-Tax Contribution, as the Participant elects. For purposes of this Section 3.2, Compensation shall be limited to that portion of his or her Compensation as is determined from time to time by the Board of Directors or the Board of Review. Each Participant who makes such contributions shall be eligible to share in the Employer Contributions under Section 3.5.

5

3.3. Supplemental Contributions. Only those Participants who make the Basic Contributions required under Section 3.2 may make Supplemental Contributions. All Supplemental Contributions shall be made in multiples of 1% of the Participant’s Compensation, provided that a Participant’s Supplemental Contributions may not exceed 25% of his or her Compensation. The Participant shall elect in the Contribution Agreement described in Section 3.4 to make such contributions as Supplemental Pre-Tax Contributions, as Supplemental After-Tax Contributions, or both, as applicable. No Employer Contributions under Section 3.5 shall be made with respect to Supplemental Contributions.

3.4. Contribution Agreements. Each Contribution Agreement shall be on a form prescribed or approved by the Administrator or in such manner as the Administrator finds acceptable, and may be entered into, changed or revoked by the Participant, with such prior notice as the Administrator may prescribe, as of the first day of any pay period with respect to Compensation payable thereafter. A Contribution Agreement shall be effective with respect to Compensation payable to a Participant after the date determined by the Administrator, but not earlier than the date the Agreement is entered into. The Administrator may reject, amend or revoke the Contribution Agreement of any Participant if the Administrator determines that the rejection, amendment or revocation is necessary to ensure that the limitations referred to in Section 3.8 and Article 11 are not exceeded.

3.5. Employer Contributions for Periods Ending on or Before September 30, 2001. For each Plan Year ending before January 1, 2001, and for the 9-month period beginning on January 1, 2001 and ending on September 30, 2001, the Employers shall make Employer Contributions to the Trust for the benefit of each Participant who is an Eligible Employee at any time during the Plan Year and on whose behalf Basic Contributions have been made at any time during the Plan Year. The amount of Employer Contributions made by the Employers for a Plan Year shall be that amount allocated to the Plan under Section 1.4 of the Preamble to the Abbott Laboratories Stock Retirement Program for such Plan Year. For purposes of this Section 3.5, the 9-month period beginning on January 1, 2001 and ending on September 30, 2001 shall be treated as though it were a Plan Year.

The Employers may contribute from time to time to the Unallocated Account a portion of the estimated Employer Contributions for the Plan Year. The Trustee shall invest such funds in Company Stock periodically in accordance with stock trading procedures established by the Investment Committee and agreed to by the Trustee. All dividends paid during the year on the Company Stock thus purchased and held in the Unallocated Account and other income received on Employer Contributions held in the Unallocated Account pending investment in Company Stock shall be used to purchase additional Company Stock to the extent such funds are not used to pay Plan expenses and/or Under-Payment Expenses (where Under-Payment Expenses mean the correction of the under-payment of contributions to the Accounts of Participants due to system or administrative errors, which correction shall be in accordance with administrative procedures established by the Administrator).

After the amount of Employer Contributions for the Plan Year has been determined, the Employers shall pay the remaining Employer Contributions to the Trust within 90 days after the end of the Plan Year. The Company Stock purchased with such additional Employer Contributions and all shares of Company Stock then held in the Unallocated Account shall be allocated among the accounts of the eligible Participants as of the last day of the Plan Year, based on the value of the Participant’s earnings points and service points determined as follows:

(a) One earnings point will be allocated to each eligible Participant for each $2 of Basic Contributions made on his or her behalf during the Plan Year;

(b) Five service points will be allocated to each eligible Participant for each Full Year of Credited Service he or she has earned as of the end of the Plan Year, not to exceed 175 service points;

(c) A Participant who dies, retires under the Abbott Laboratories Annuity Retirement Plan, or terminates employment with an Employer on account of total disability for which benefits are payable under the Abbott Laboratories Extended Disability Plan, at any time during the Plan Year, will be considered as having continued to be employed until December 31 of that Year and will thus earn a Year of Credited Service for purposes of subsection (b);

(d) A Participant who separates from service with the Corporation, all Affiliated Corporations and all Subsidiaries for any reason other than death, disability or retirement, at any time during the Plan Year, will be allocated a pro rata portion of the service points the Participant would have received had the Participant continued to be employed until December 31 of that Year, prorated based on the months during the Plan Year prior to the Participant’s separation from service, and will thus earn a partial Year of Credited Service for purposes of subsection (b);

(e) A Participant who is transferred or given a leave of absence in circumstances described in Section 2.3(d) above, at any time during the Plan Year, will be allocated a pro rata portion of the service points the Participant would have received had the Participant continued until December 31 of that year, prorated based on the Participant’s service up to the date of such transfer or the date such leave began, as the case may be, and will thus earn a partial Year of Credited Service for purposes of subsection (b);

(f) If (i) a Participant retires under the Abbott Laboratories Annuity Retirement Plan and elects to receive the distribution of his or her Accounts during the same Plan Year, (ii) a Participant dies during the Plan Year and the Beneficiary elects to take a distribution of the Participant’s Accounts during the same Plan Year; or (iii) a Participant separates from service during the Plan Year for reasons other than retirement or death and does not elect to defer his distribution to a later Plan Year, the Employer Contribution due in each case for the Plan Year shall be calculated using the Point Value determined for the prior Plan Year and allocated to the applicable Participant’s Employer Contribution Account. If a Participant or Beneficiary who becomes eligible for a distribution during the Plan Year does not

6

take a distribution during the same Plan Year as described in the prior sentence, the Employer Contribution which would be allocable to his or her Accounts shall be determined and allocated as of the end of the Plan Year under Subsection 3.5(g) below, as if the Participant were actively employed as of the last day of the Plan Year, but shall be calculated as described in (a)-(e) above based on the service recognized therein.

(g) The amount of the Company Stock which will be allocated as of the end of the Plan Year to the Employer Contribution Account of each eligible Participant for such Plan Year shall be determined by multiplying the aggregate cost (after adding earnings and deducting expenses as herein permitted) of the Company Stock held in the Unallocated Account at the end of the Plan Year by a fraction, the numerator of which is the sum of the Participant’s earnings points and service points as of the end of the Plan Year and the denominator of which is the aggregate of all earnings points and all service points for all eligible Participants as of the end of such Plan Year (less the points attributable to Participants to whom or on whose behalf distributions are made during the Plan Year). Once the portion of the aggregate cost which is attributable to each eligible Participant is determined, the applicable number of shares represented by such cost shall be allocated to the Participant’s Employer Contribution Account.

3.5A. Employer Contributions for Periods Ending on and After October 1, 2001. For each payroll period ending on or after October 1, 2001, the Employers shall make Employer Contributions to the Trust for the benefit of each Participant who is an Eligible Employee at any time during the payroll period and on whose behalf Basic Contributions have been made at any time during the payroll period. The amount of Employer Contributions made by the Employers for a payroll period shall be that amount allocated to the Plan under Section 1.4 of the Preamble to the Abbott Laboratories Stock Retirement Program for such payroll period. The Trustee shall invest such Employer Contributions in Company Stock in accordance with stock trading procedures established by the Investment Committee and agreed to by the Trustee. The Company Stock purchased with such Employer Contributions shall be allocated among the Employer Contribution Accounts of the eligible Participants as of the day on which the payroll is paid, pro rata, according to the Basic Contributions made by each such Participant during that payroll period. The number of full and fractional shares of Company stock to be so allocated to the Employer Contribution Account of each eligible Participant for such payroll period shall be based on the average cost per share of the Company Stock purchased with the Employer Contributions made for such payroll period.

3.6. Qualified Non-elective Employer Contributions. At the direction of the Corporation, an Employer may make Qualified Non-elective Employer Contributions to the Trust for a Plan Year either (a) on behalf of all Participants for whom Pre-Tax Contributions are made for the Plan Year, or (b) on behalf of only those Participants for whom Pre-Tax Contributions for the Plan Year are made and who are not Highly Compensated Employees for the Plan Year, as the Board of Review shall determine. Except as otherwise expressly provided for, any Qualified Non-elective Employer Contribution shall be treated as a Pre-Tax Contribution for all purposes

7

under the Plan. Qualified Non-elective Employer Contributions may be made pursuant to this Section 3.6, (i) with respect only to Participants who are employed by any Subsidiary which is not an Affiliated Corporation, (ii) with respect only to Participants who are employed by Employers which are Affiliated Corporations, or (iii) with respect to Participants described in both (i) and (ii). Notwithstanding any provision to the contrary, a Qualified Non-elective Employer Contribution may only be made if it complies with the requirements of the Final Regulations, including Code sections 1.401(k)-2(a)(6) and 1.401(m)-2(a)(6).

3.7. Time for Making and Crediting of Contributions. Basic and Supplemental Pre-Tax and After-Tax Contributions for any calendar month will be withheld from the Participants’ Compensation through payroll deductions and will be paid in cash to the Trust as soon as such contributions can reasonably be segregated from the general assets of the Employers, but in any event no later than the 15th business day of the next following month. Such contributions will be credited to the Participants’ respective Pre-Tax Contribution and After-Tax Contribution Accounts as of the earlier of (a) the date such contributions are received by the Trust and (b) the last day of the Plan Year in which the Compensation is paid. In addition and subject to the limits provided in Section 3.3, a Participant may make Supplemental After-Tax Contributions by delivering to the Trustee, a certified check in the amount of such contribution and the contribution shall be credited to the Participant’s Supplemental After-Tax Contribution Account as of the date it is received by the Trustee. Any Employer Contributions or Qualified Non-elective Employer Contributions for a Plan Year will be contributed to the Trust at such time as the Corporation determines, but no later than the time prescribed by law (including extensions) for filing the Corporation’s federal income tax return for its taxable year in or with which the Plan Year ends. Such contributions will be credited to the Employer Contribution Accounts or Pre-Tax Contribution Accounts, respectively, of Participants on whose behalf they are made at such time as the Corporation determines, but no later than the last day of such Plan Year.

3.8. Certain Limits Apply. All contributions to this Plan are subject to the applicable limits set forth under Code sections 401(k), 401(m), 402(g), 404, and 415, as further described in Article 11.

3.9. Return of Contributions. No property of the Trust or contributions made by the Employers pursuant to the terms of the Plan shall revert to the Employers or be used for any purpose other than providing benefits to Eligible Employees or their Beneficiaries and defraying the expenses of the Plan and the Trust, except as follows:

(a) Upon request of the Corporation, contributions made to the Plan before the issuance of a favorable determination letter by the Internal Revenue Service with respect to the initial qualification of the Plan under Section 401(a) of the Code may be returned to the contributing Employer, with all attributable earnings, within one year after the Internal Revenue Service refuses in writing to issue such a letter.

(b) Any amount contributed under the Plan by an Employer by a mistake of fact as determined by the Employer may be returned to such Employer upon its request,

8

within one year after its payment to the Trust.

(c) Any amount contributed under the Plan by an Employer on the condition of its deductibility under Section 404 of the Code may be returned to such Employer upon its request, within one year after the Internal Revenue Service disallows the deduction in writing.

(d) Earnings attributable to contributions returnable under paragraph (b) or (c) shall not be returned to the Employer, and any losses attributable to those contributions shall reduce the amount returned.

In no event shall the return of a contribution hereunder cause any Participant’s Accounts to be reduced to less than they would have been had the mistaken or nondeductible amount not been contributed. No return of a contribution hereunder shall be made more than one year after the mistaken payment of the contribution, or disallowance of the deduction, as the case may be.

3.10. Special Limits for Corporate Officers. Notwithstanding any other provision of the Plan, the Administrator may, from time to time, impose additional limits on the percentages of Compensation which may be contributed to the Plan by, or on behalf of, Corporate Officers, provided that such additional limits are lower than the limits applicable to other Participants. The amount and terms of such limits shall be determined by the Administrator in its sole discretion, need not be the same for all Corporate Officers and may be changed or repealed by the Administrator at any time. For purposes of this Section 3.10, the term “Corporate Officer” shall mean an individual elected an officer of the Corporation by its Board of Directors but shall not include assistant officers.

ARTICLE 4. PARTICIPANT ACCOUNTS

4.1. Accounts. The Administrator will establish and maintain (or cause the Trustee to establish and maintain) for each Participant a Basic After-Tax Contribution Account, a Basic Pre-Tax Contribution Account, a Supplemental After-Tax Contribution Account, a Supplemental Pre-Tax Contribution Account, an Employer Contribution Account, a Rollover Contribution Account (if applicable), a Transfer Contribution Account (if applicable) and such other accounts or sub-accounts as the Administrator in its discretion deems appropriate. All such Accounts shall be referred to collectively as the “Accounts”.

4.2. Adjustment of Accounts. Except as provided in the following sentence, as of each Valuation Date, the Administrator or Trustee, as the case may be, shall adjust the balances of each Account maintained under the Plan on a uniform and consistent basis to reflect the contributions, distributions, income, expense, and changes in the fair market value of the assets attributable to such Account since the prior Valuation Date, in such reasonable manner as the Administrator or Trustee, as the case may be, shall determine. Employer Contributions made to the Unallocated Account, Company Stock acquired under Section 3.5 with such Employer Contributions, and dividends paid on such Company Stock will not be valued as of each Valuation Date, but will be allocated to the Participants’ Accounts only as of the end of the Plan

9

Year in accordance with Section 3.5 and thereafter such amounts will be valued in accordance with the first sentence of this Section 4.2. Notwithstanding any other provision of the Plan, to the extent that Participants’ Accounts are invested in mutual funds or other assets for which daily pricing is available (“Daily Pricing Media”), all amounts contributed to the Trust will be invested at the time of their actual receipt by the Daily Pricing Media, and the balance of each Account shall reflect the results of such daily pricing from the time of actual receipt until the time of distribution. Investment elections and changes made pursuant to Section 5.5 shall be effective upon receipt by the Daily Pricing Media. References elsewhere in the Plan to the investment of contributions “as of” a date other than that described in this Section 4.2 shall apply only to the extent, if any, that assets of the Trust are not invested in Daily Pricing Media.

ARTICLE 5. INVESTMENT OF ACCOUNTS

5.1. Company Stock. The Plan shall provide a Company Stock Fund as a permanent feature of the Plan. The Company Stock Fund shall be invested exclusively in Company Stock (other than for the purpose of maintaining sufficient liquidity to provide for distributions, withdrawals, and transfers under the Plan) without regard to (1) the diversification of assets of the Plan and Trust, (2) the risk profile of Company Stock, (3) the amount of income provided by Company Stock, or (4) the fluctuation in the fair market value of Company Stock, unless the Investment Committee determines that there is a serious question concerning the short-term viability of the Company as a going concern.

All Employer Contributions made before April 1, 2003, all Basic Contributions made before January 1, 1999, and all dividends and earnings received on those Employer and Basic Contributions shall be invested in shares of Company Stock unless and until they are transferred to another Investment Fund then available under the Plan pursuant to Section 5.4. A Participant may also direct that some or all of his or her Basic Contributions made on or after January 1, 1999, Supplemental Contributions, Rollover Contributions (if applicable) or Transfer Contributions (if applicable) be invested in shares of Company Stock. Company Stock shall be purchased and sold by the Trustee on the open market or from the Corporation in accordance with stock trading procedures established by the Investment Committee and agreed to by the Trustee.

5.2. Other Investment Funds. Other than with respect to the Company Stock Fund and subject to Section 5.1, the Investment Committee may, from time to time, direct the Trustee to establish one or more Investment Funds, which may include registered investment companies (including those for which the Trustee or an affiliate is the investment advisor, principal underwriter or distributor), group trusts for the collective investment of pension and profit sharing plans which are qualified under section 401(a) of the Code, and other pooled Investment Funds. A Participant may direct that some or all of his or her (i) Basic Contributions made on or after January 1, 1999, and (ii) Supplemental Contributions, Rollover Contributions or Transfer Contributions be invested in one or more of the Investment Funds available under the Plan in such increments and in such manner as the Investment Committee and the Trustee establish in investment procedures. To the extent permitted by Sections 5.1 and 5.4, a Participant may instruct the Trustee that amounts held in his or her Accounts that are invested in Company Stock

10

be transferred to and invested in one or more of the Investment Funds established under this Section 5.3. Any amounts held in a Participant’s Accounts that are not otherwise restricted as to investment under Section 5.1 or 5.4 may be invested or reinvested in Company Stock or any of the Investment Funds then available under the Plan in accordance with the procedures established under Section 5.5.

5.3. Investment of Employer Contributions and Reinvestment of Company Stock. Notwithstanding any other provision in the Plan to the contrary, and except as provided in the next sentence, any Employer Contribution made under the Plan to a Participant on or after April 1, 2003 shall be invested on a pro rata basis in accordance with the Participant’s investment election(s) in effect for his or her Pre-Tax Contributions at the time the Employer Contribution is made. If a Participant’s Accounts consist solely of After-Tax Contributions, then any Employer Contribution made under the Plan to such Participant on or after April 1, 2003 shall be invested on a pro rata basis in accordance with the Participant’s investment election(s) in effect for his or her After-Tax Contributions at the time the Employer Contribution is made. A Participant may direct the Trustee to liquidate all or a portion of the Company Stock held in his or her Accounts and reinvest the proceeds in any of the other Investment Funds described in Section 5.3 in accordance with the procedures established under Section 5.5.

5.4. Investment Elections. Subject to Sections 5.1, 5.2, and 5.4, a Participant, Beneficiary or Alternate Payee may make or change investment instructions with respect to the portion of the Accounts over which he or she has investment direction at such times and at such frequency as the Administrator shall permit in accordance with investment procedures established for the Plan. Such investment instructions shall be in writing or in such other form as is acceptable to the Trustee.

5.5. Default Investment Fund. The Administrator shall from time to time identify one or more of the Investment Funds as the default Investment Fund into which all contributions, for which the Participant has the right to direct investment, shall be invested if the Participant fails to provide complete and clear investment instructions for such contributions. Such contributions shall remain in the default Investment Fund until the Trustee receives investment instructions from the Participant in a form acceptable to the Trustee.

5.6. Participant Direction of Investments. To the extent that this Article 5 does not prohibit a Participant, Beneficiary or Alternate Payee from directing the investment of his or her Accounts, the Plan is intended to be a participant-directed plan and to comply with the requirements of ERISA Section 404(c) and the Department of Labor Regulations 2550.404c-1 as a participant-directed plan. To the extent this Section 5.7 applies, the Administrator shall direct the Trustee from time to time with respect to such investments pursuant to the instructions of the Participant (or, if applicable, the Alternate Payee, or the deceased Participant’s Beneficiary), but the Trustee may refuse to honor any investment instruction if such instruction would cause the Plan to engage in a prohibited transaction (as described in Code section 4975(c)) or cause the Trust to be subject to income tax. The Administrator shall prescribe the form upon which, or such other manner in which such instructions shall be made, as well as the frequency with which such instructions may be made or changed and the dates as of which such instructions shall be effective. The Board of Review reserves the right to amend the Plan to remove the right of

11

Participants, Beneficiaries or Alternate Payees to give investment instructions with respect to their Accounts. Nothing contained herein shall provide for the voting of shares of Company Stock by any Participant, Beneficiary or Alternate Payee, except as otherwise provided in the Trust. For any period in which the Plan is an “applicable defined contribution plan” as defined in Code Section 401(a)(35) by virtue of the Plan holding applicable publicly traded employer securities, the Corporation shall permit Participants, Beneficiaries, and Alternate Payees to direct the investment of their accounts under rules and procedures that comply with Code Section 401(a)(35) and applicable Treasury Regulations thereunder.

5.7. Dividends on Company Stock. Except with respect to shares of Company Stock acquired during the Plan Year and held in the Unallocated Account, cash dividends on shares of Company Stock shall be; (a) paid in cash to Participants or Beneficiaries, (b) paid to the Plan and distributed in cash to Participants or Beneficiaries not later than 90 days after the close of the Plan Year in which paid, or (c) paid to the Plan and credited to the applicable Accounts in which the shares are held, as elected by each Participant or Beneficiary in accordance with rules established by the Administrator. Cash dividends on such Stock which are not paid or distributed to Participants and Beneficiaries and cash proceeds from the sale of any rights or warrants received with respect to such Stock shall be invested in shares of Company Stock when such dividends or proceeds are received by the Trust, and thereafter such shares shall be credited to such Accounts based on the average cost of all shares purchased with such dividends or proceeds. Stock dividends or “split-ups” and rights or warrants appertaining to such shares shall be credited to the applicable Accounts when received by the Trust. Cash dividends received with respect to shares of Company Stock held in the Unallocated Account and cash proceeds from the sale of rights or warrants received with respect to such Company Stock shall be reinvested in Company Stock and allocated under Section 3.5, to the extent not used to pay expenses of the Plan and/or Under-Payment Expenses, as defined in Section 3.5. Any stock dividends or “split-ups” (and any rights or warrants unless sooner sold) appertaining to shares of Company Stock held in the Unallocated Account will be held in the Unallocated Account until the end of the Plan Year and allocated under Section 3.5.

5.8. Investment Options for Former M & R Employees. Effective April 3, 1996 (or such subsequent date as the Administrator determines in his or her sole discretion), Participants (and any Beneficiaries of deceased Participants or Alternate Payees with respect to such Participants or deceased Participants) who have Accounts formerly held in the M & R Retirement Trust (“M & R Accounts”) and who had special investment options described in Supplement A of the Prior Plan, shall reinvest their Accounts in one or more of the investment options described in Section 5.1, 5.2 and 5.3. If at the end of the transition period established by the Administrator for such reinvestment, any portion of such M & R Accounts has not been reinvested pursuant to the prior sentence, then the Administrator shall direct the Trustee to liquidate the investments in such Accounts and transfer the proceeds to one or more default investment funds designated by the Administrator.

5.9. Voting of Company Stock. Each Participant or Beneficiary shall be entitled to direct the manner in which shares of Company Stock credited to his or her Account are to be voted, as provided in the Trust.

12

ARTICLE 6. WITHDRAWALS PRIOR TO SEPARATION FROM SERVICE

6.1. Inservice Withdrawals of After-Tax Contributions. For purposes of Code Section 72, all amounts held in a Participant’s After-Tax Contribution Accounts that are attributable to Basic or Supplemental After-Tax Contributions made after 1986 (including earnings) shall be considered a “separate contract”. In addition, for purposes of applying the withdrawal provisions set forth in this Section 6.1(a), (b) and (c), a Participant’s Accounts containing Company Stock shall be separate and distinct from all other Investment Funds in such Accounts, such that a Participant can elect under Sections 6.1(a), (b) and (c) to withdraw all of the Participant’s Company Stock without withdrawing any of the other Investment Funds or all of the Participant’s Investment Funds (in other than Company Stock) without withdrawing any Company Stock, or any combination of Company Stock or other Investment Funds as the Participant may elect. If the Participant’s non-Company Stock funds are in more than one Investment Fund, then such withdrawal shall be made proportionately from all such Investment Funds. Subject to the foregoing, a Participant may elect to take a withdrawal from his or her After-Tax Contribution Accounts in accordance with the following conditions and order of priority:

(a) Pre-1987 Supplemental and Basic After-Tax Contributions. A Participant may withdraw from the Trust (i) in cash, any or all of his or her Supplemental and Basic After-Tax Contributions made prior to 1987 and/or (ii) some or all of the shares of Company Stock purchased with such After-Tax Contributions. If the Participant elects to receive any withdrawal in Company Stock or cash from Company Stock, such amounts will be withdrawn (i) from the Company Stock in the Supplemental After-Tax Contribution Account until exhausted and (ii) then from the Company Stock in the Basic After-Tax Contribution Account until exhausted. If the Participant elects to receive any withdrawal in cash from the Investment Funds (other than Company Stock), such amounts shall be withdrawn (i) from the Investment Funds (other than Company Stock) in the Supplemental After-Tax Contribution Account until exhausted and (ii) then from the Investment Funds (other than Company Stock) in the Basic After-Tax Contribution Account until exhausted.

(b) Post-1986 Supplemental and Basic After-Tax Contributions (Five Years Credited Service Required). A Participant who has completed five or more Years of Credited Service and who has withdrawn all of his or her pre-1987 Supplemental and Basic After-Tax Contributions under subsection (a) may then withdraw from the Trust any or all of his or her Supplemental and Basic After-Tax Contributions made after 1986 and earnings thereon. Withdrawals under this subsection (b) may be in cash or shares of Company Stock but shall not exceed the value of the Supplemental and Basic After-Tax Contribution Accounts that is attributable to the Participant’s After-Tax Contributions made after 1986. If the Participant elects to receive any withdrawal in Company Stock or cash from Company Stock, such amounts will be withdrawn (i) from the Company Stock in the Supplemental After-Tax Contribution Account until exhausted and (ii) then from the Company

13

Stock in the Basic After-Tax Contribution Account until exhausted. If the Participant elects to receive any withdrawal in cash from the Investment Funds (other than Company Stock), such amounts shall be withdrawn (i) from the Investment Funds (other than Company Stock) in the Supplemental After-Tax Contribution Account until exhausted and (ii) then from the Investment Funds (other than Company Stock) in the Basic After-Tax Contribution Account until exhausted.

(c) Post-1986 Supplemental After-Tax Contributions (Less Than Five Years Credited Service Required). A Participant who has not completed five or more Years of Credited Service and who has withdrawn all of his or her pre-1987 After-Tax Contributions (if any) under subsection (a) may then withdraw from the Trust any or all of his or her Supplemental After-Tax Contributions made after 1986 and earnings thereon. Withdrawals under this subsection (c) may be in cash or shares of Company Stock but shall not exceed the value of the Supplemental After-Tax Contribution Account that is attributable to the Participant’s Supplemental After-Tax Contributions made after 1986. If the Participant elects to receive any withdrawal in Company Stock (or cash from Company Stock) such amount will be withdrawn from the Company Stock in the Supplemental After-Tax Contribution Account until exhausted. If the Participant elects to receive any withdrawal in Investment Funds (other than Company Stock), such amount will be withdrawn from the Investment Funds (other than Company Stock) in the Supplemental After-Tax Contribution Account.

(d) Remainder of After-Tax Contribution Accounts. A Participant, who has withdrawn all of his or her After-Tax Contributions available under subsections (a), (b) and (c) in both Company Stock and in Investment Funds (other than Company Stock), may then withdraw from the Trust any or all of the amount remaining in his or her After-Tax Contribution Accounts (other than the Basic After-Tax Contribution Account, in the case of a Participant who has not completed five or more Years of Service).

(e) Source of Withdrawn Amounts. If the Participant elects to receive his or her withdrawal in shares of Company Stock held in his or her After-Tax Contribution Accounts, whole shares shall be distributed and the value of a fractional share necessary to exhaust the Company Stock allocated to such Accounts shall be distributed in cash.

(f) Pre-1987 Shares.

(i) For purposes of Section 6.1(a), shares of Company Stock purchased with a Participant’s Supplemental After-Tax Contribution made prior to 1987 shall be determined as follows:

14

(A) First, the average cost to the Trust of all unwithdrawn shares of Company Stock purchased with Participant’s Supplemental After-Tax Contributions made prior to 1987 and related dividends shall be established.

(B) Next, the total of the Participant’s unwithdrawn Supplemental After-Tax Contributions made prior to 1987 and applied to the purchase of Company Stock (net of any such amounts that have been reinvested in Investment Funds other than Company Stock) shall be divided by the average cost established under subparagraph (A) above and the resulting amount shall be the number of shares of Company Stock purchased with the Participant’s Supplemental After-Tax Contributions prior to 1987.

(ii) For purposes of Section 6.1(a), shares of Company Stock purchased with a Participant’s Basic After-Tax Contributions made prior to 1987 shall be determined as follows: