Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

| Abbott Laboratories |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Table of Contents

Table of Contents

Abbott Laboratories

100 Abbott Park Road

Abbott Park, Illinois 60064-6400 U.S.A.

On the Cover: Glucerna

Juliana Auler, São Paulo, Brazil

Juliana Auler is an English teacher, translator and dedicated mom to a highly active toddler. As a person with diabetes, Juliana understands better than most the importance of proper

nutrition. She relies on Glucerna to help fill in the gaps in her diet, while keeping her blood sugar at optimal levels.

TABLE OF CONTENTS

|

|

|

Abbott Laboratories 1

|

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

YOUR VOTE IS IMPORTANT

Please sign and promptly return your proxy

in the enclosed envelope, or vote your

shares by telephone or using the Internet.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 24, 2015

The Annual Meeting of the Shareholders of Abbott Laboratories will be held at Abbott's headquarters, 100 Abbott Park Road, at the intersection of

Route 137 and Waukegan Road, Lake County, Illinois, on Friday, April 24, 2015, at 9:00 a.m. for the following purposes:

- •

- To elect 11 directors to hold office until the next Annual Meeting or until their successors are elected (Item 1 on the

proxy card),

- •

- To ratify the appointment of Ernst & Young LLP as auditors of Abbott for 2015 (Item 2 on the proxy card),

- •

- To vote on an advisory vote on the approval of executive compensation (Item 3 on proxy card), and

- •

- To transact such other business as may properly come before the meeting, including consideration of two shareholder proposals, if

presented at the meeting (Items 4 and 5).

The Board of Directors recommends that you vote FOR Items 1, 2, and 3 on the proxy card.

The Board of Directors recommends that you vote AGAINST Items 4 and 5 on the proxy card.

The close of business on February 25, 2015, has been fixed as the record date for determining the shareholders entitled to receive notice of and to vote at the Annual

Meeting.

Abbott's 2015 Proxy Statement and 2014 Annual Report to Shareholders are available at www.abbott.com/proxy.

If you are a registered shareholder, you may access your proxy card by either:

- •

- Going to the following website: www.investorvote.com/abt, entering the information

requested on your computer screen and then following the simple instructions, or

- •

- Calling (in United States, U.S. territories, and Canada), toll-free 1-800-652-VOTE (8683) on a touch-tone telephone, and following the

simple instructions provided by the recorded message.

Admission to the meeting will be by admission card only. If you plan to attend, please complete and return the reservation form on the back cover, and an admission card will be

sent to you. Due to space limitations, reservation forms must be received before April 17, 2015. Each admission card, along with photo identification, admits one person. A shareholder may

request two admission cards, but a guest must be accompanied by a shareholder.

By

order of the Board of Directors.

Hubert

L. Allen

Secretary

March 13, 2015

|

2 Abbott Laboratories

|

|

|

Table of Contents

PROXY SUMMARY

This summary contains highlights about our Company and the upcoming 2015 Annual Meeting of Shareholders. This summary does not contain all of the information that you should

consider in advance of the meeting, and we encourage you to read the entire Proxy Statement carefully before voting.

The accompanying proxy is solicited on behalf of the Board of Directors for use at the Annual Meeting of Shareholders. The meeting will be held on April 24, 2015, at

Abbott's headquarters, 100 Abbott Park Road, at the intersection of Route 137 and Waukegan Road, Lake County, Illinois. This proxy statement and the accompanying proxy card are being mailed to

shareholders on or about March 13, 2015.

|

ABBOTT—DURABLE GROWTH AND INCOME

|

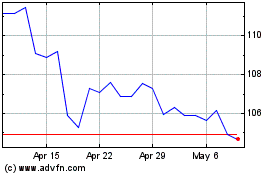

Abbott's

investment identity is one of long-term durable growth and increasing returns to shareholders. In 2014, Abbott achieved another strong year of financial results and

returns. Abbott's 1-year total shareholder return (TSR) of 20.1% significantly outperformed both the Standard & Poor's 500 Index (S&P 500) and the Dow Jones Industrial Average

(DJIA)*. Our 1-year TSR performance ranked in the 89th percentile versus Abbott's peer group. Abbott also returned $3.5 billion to shareholders in the form of

dividends and share repurchases in 2014, an increase of 40% versus the prior year. Over the last 10 years, Abbott has delivered a cumulative TSR of 165%, significantly outperforming both the

S&P 500 and DJIA over that same time horizon. In addition to sustained TSR over-performance during this period, Abbott's diversified model delivered more durable performance during market

correction periods over this cycle, including the global financial crisis in 2008.

- *

- Source:

Thomson Reuters. Thomson Reuters applied an adjustment factor to adjust Abbott historical prices prior to and up through December 31, 2012 to

account for the AbbVie separation, which was effective on January 1, 2013. To accurately reflect the TSR created by Abbott since the AbbVie separation, Abbott uses the daily dividend

reinvestment methodology to calculate TSR. Other financial data providers may use different methodologies to adjust for the AbbVie separation, which may produce different results.

|

|

|

Abbott Laboratories 3

|

Table of Contents

|

ABBOTT OVERVIEW—UNIQUELY DIVERSE AND BALANCED

|

Abbott

is one of the most globalized healthcare companies, with approximately 70% of our revenue coming from international markets, including nearly 50% of revenue coming

from faster-growing emerging geographies. And approximately 50% of our sales are direct to consumers and patients, rather than third-party payers, making Abbott one of the most consumer-facing

healthcare companies in the world.

The

four businesses that compose Abbott are leaders in large, attractive markets and aligned with favorable, long-term healthcare trends. These businesses operate in different sectors of the overall

healthcare market: nutritionals, pharmaceuticals, diagnostics, and innovation-driven medical devices. Our broad presence and expertise allow us to create new solutions-across the spectrum of health,

around the world, for all stages of life-that help people maximize their potential through better health. We leverage our diverse business model and broad exposure across many geographies to deliver

durable and reliable long-term growth while minimizing volatility that may present itself from time to time in any one business or market.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUTRITION

• 34% of Abbott revenue • Leadership in pediatric and adult nutrition • Science-based new product pipeline

• Competes in medical and consumer markets

|

|

|

|

|

|

ESTABLISHED PHARMACEUTICALS

• 16% of Abbott revenue • 100% of sales in emerging geographies following the sale of

the developed markets business • Competes in

branded generic pharmaceutical markets; high patient/consumer interactions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIAGNOSTICS

• 23% of Abbott revenue • Leadership in immunoassay diagnostics and blood screening

• Capital-intensive business • Competes in core laboratory diagnostics, molecular

diagnostics, and point-of-care diagnostics markets

|

|

|

|

|

|

MEDICAL DEVICES

• 27% of Abbott revenue • Leadership in coronary devices, mitral valve repair, and

LASIK • Entered electrophysiology market in 2014

• Competes in innovation-driven medical devices

in vascular, diabetes, and vision care markets

|

|

|

- *

- Continuing

operations exclude the businesses sold in the first quarter of 2015: Abbott's developed markets branded generics business and Animal Health

business. While Abbott managed these businesses until they were sold the first quarter of 2015, Abbott's earnings release and 2014 Annual Report on Securities and Exchange Commission Form 10-K

presented results on a continuing operations basis.

|

4 Abbott Laboratories

|

|

|

Table of Contents

SELECT STRATEGIC GROWTH INITIATIVES EXECUTED IN 2014

2014 was another year of major strategic progress and accomplishment for each of our businesses. During the year, Abbott executed a

number of initiatives that are reflected in the long-term goals of our officers as we continue to build and shape our company. Decisions and actions taken in 2014 provide the basis for sustainable

success over the long term.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Established Pharmaceuticals-Reshaped for accelerated growth |

|

Repositioned our Established Pharmaceuticals business for rapid and sustainable growth, including: Acquired CFR Pharmaceuticals, establishing Abbott among the top 10

pharmaceuticals companies in Latin America. Acquired Veropharm, establishing Abbott as a top 5 branded generic pharmaceuticals company in Russia. In February 2015, completed the sale of the developed markets business of our Established Pharmaceuticals segment. Abbott's Established Pharmaceuticals business now operates entirely in emerging

geographies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nutrition-Strengthened and expanded in key geographies |

|

Continued to build our local R&D presence and capabilities in key emerging geographies, including opening state-of-the-art manufacturing plants in China and India.

Invested in our local supply chain in China by partnering with the world's largest dairy cooperative to support long-term demand. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical Devices-Launched several new products and advanced key clinical programs |

|

Launched several new cataract lens products, which replace the natural lens to improve vision for patients with cataracts. Launched the FreeStyle® Libre flash glucose

monitor in Europe. This unique device reads glucose levels through a small sensor that can be worn discreetly and eliminates finger sticks. Entered the $3 billion,

fast growing, electrophysiology market with a technology that can improve the treatment of atrial fibrillation, one of the most common heart rhythm disorders in the world. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diagnostics-Advanced several next-generation systems in R&D |

|

Continued to advance several next-generation R&D platforms for the core laboratory, molecular, and point-of-care diagnostics markets that will positively impact patient care, improve service to customers, enhance

laboratory productivity, and reduce costs. The first of those platforms launched at the end of 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued to make significant progress in expanding our operating margins |

|

Expanded our adjusted operating margin ratio from continuing operations by nearly 200 basis points over 2013, primarily by improvements in the Diagnostics, Nutritionals, and Vascular businesses. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Abbott Laboratories 5

|

Table of Contents

2014 RESULTS

In 2014, Abbott generated revenue of $22.3 billion, including revenue from discontinued operations associated with the

divestitures of certain businesses that were initiated during 2014.* Operational sales from continuing operations, which excludes the impact of foreign exchange and the divested businesses, increased

5.5% versus 2013. The operational sales growth rate from continuing operations increased sequentially for each quarter of 2014. Adjusted diluted earnings-per-share (EPS), excluding specified items,

was $2.28 in 2014, reflecting growth of 13.4% versus the prior year and exceeding the mid-point of our original 2014 guidance range by $0.07 or 3.2%*. Abbott's adjusted diluted EPS growth ranked in

the top 3 out of 19 peers over each of the past two years since the separation with AbbVie. (See Annex I for a reconciliation of GAAP and non-GAAP financial measures).

The

Board of Directors continuously monitors best practices in governance and adopts measures that it determines are in the best interest of Abbott's shareholders.

Highlights of our governance practices include:

BOARD OF DIRECTORS

- •

- 10 of Abbott's 11 directors are independent

- •

- All directors elected annually

- •

- Independent lead director since 2005

- •

- No former employees serve as directors

- •

- Executive sessions of independent directors at each regularly scheduled meeting

- •

- 97% average attendance of all directors at Board and committee meetings in 2014

- •

- 50% of the independent directors are women or minorities

- •

- Annual succession planning for management

- •

- Annual Board and Board committee self-assessments

SHAREHOLDER INTERESTS

- •

- Annual "Say on Pay" advisory vote to approve executive compensation

- •

- Annual vote to ratify our independent auditor

- •

- Public Policy Committee that oversees corporate political contributions, legal and regulatory compliance, and healthcare compliance

- *

- 2014

revenue and adjusted diluted earnings-per-share figures include the contribution from discontinued operations associated with the previously announced

divestitures of the developed markets segment of our Established Pharmaceuticals business and our Animal Health business. Both of these transactions closed in the first quarter of 2015. Abbott

continued to manage these businesses through the time of closing.

|

6 Abbott Laboratories

|

|

|

Table of Contents

|

EXECUTIVE COMPENSATION PROGRAM

|

Last

year 96% of our shareholders approved the compensation of our named executive officers. Those compensation decisions were made by the Compensation Committee and our

Board of Directors based upon financial metrics, including total shareholder return.

Abbott's

3-year total shareholder return was 80% from 2012-2014. During that same period, our CEO's compensation declined by 29% as a result of aligning our pay practices to the new peer group which

was selected following the separation with AbbVie on January 1, 2013.

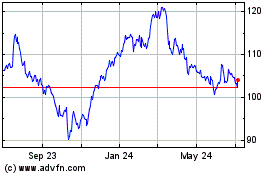

CUMULATIVE TSR* AND ANNUAL ABBOTT CEO PAY

ABBOTT 3-YEAR TSR* VS CHANGE IN CEO PAY

(2012-2014)

- *

- Cumulative

TSR of investment initiated on December 31, 2011.

Source: Thomson Reuters. Thomson Reuters applied an adjustment factor to adjust Abbott historical prices prior to and up through December 31, 2012 to account for the AbbVie separation, which

was effective on January 1, 2013. To accurately reflect the TSR created by Abbott since the AbbVie separation, Abbott uses the daily dividend reinvestment methodology to calculate TSR. Other

financial data providers may use different methodologies to adjust for the AbbVie separation, which may produce different results.

|

|

|

Abbott Laboratories 7

|

Table of Contents

During

2014, we reached out to more than 200 investors and conducted meetings with investors representing more than 35% of our outstanding shares. We continue to evolve our compensation program based

upon feedback we receive during those discussions with investors, as well as continual review of market practices.

|

|

|

|

|

EXECUTIVE COMPENSATION CHANGES FOR 2014

|

|

|

• Increased ROE target for vesting of

performance shares granted in 2015 • Added a

policy prohibiting hedging |

|

• Added an anti-pledging policy • Added a shareholding retention requirement • Strengthened our recoupment policy

|

Over

the past several years, we have made numerous other changes to our program, including:

- •

- Using three performance assessments to determine the amount of equity awards:

- –

- Relative TSR (compared to peer companies)—Determines equity grant guidelines

- –

- Individual performance—Determines individual officer award based on equity grant guidelines

- –

- ROE—Determines that performance has been sustained before awards vest

- •

- Granting equity awards that are double-trigger vesting in the event of a change in control

- •

- Eliminating tax gross-ups in our executive officer pay program

- •

- Engaging a Compensation Committee consultant that performs no other work for Abbott

- •

- Revising executive share ownership guidelines:

- –

- Chief Executive Officer—6 times base salary

- –

- Executive Vice President/Senior Vice President—3 times base salary

- –

- All other officers—2 times base salary

For

additional details on our compensation program, see the Compensation Discussion and Analysis section of this proxy statement, which starts on page 29.

|

8 Abbott Laboratories

|

|

|

Table of Contents

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

The compensation program for our executive officers includes key features that align the interests of our executives with Abbott's business

strategies and goals, as well as the interests of our shareholders. The program does not include features that could misalign these interests.

|

|

|

Abbott Laboratories 9

|

Table of Contents

PEER GROUP

Our investors compare us to other global multinational companies, not necessarily in healthcare, that share similar characteristics aligned with our

investment identity of durable growth and returns to shareholders. Therefore, our peer group was selected to strike the right balance between size, similar return profiles, geographic breadth, and

management and operating structure. The peer group includes companies that are outside the healthcare space and, after the separation with AbbVie, excludes companies that focus primarily on

proprietary pharmaceuticals. It also purposely excludes companies whose revenues are predominately derived from the U.S. and small non-diverse healthcare companies, since our investors tell us that

these companies are not viable peers. In selecting our peer group for performance and compensation benchmarking, we considered:

- •

- Globally diverse manufacturing-driven organizations with significant international operations

- •

- Consumer-facing organizations

- •

- Similar financial and operating measures, including revenue, market capitalization, and number of employees

- •

- Similar return of cash profiles, including dividends and share repurchases

- •

- Similar geographic mix of revenues and profits

|

|

|

|

|

|

|

|

|

|

|

|

3M Company Baxter International Caterpillar, Inc. The Coca-Cola Company Covidien PLC |

|

Danaher Corporation E. I. du Pont Eaton Corporation Emerson Electric Co.

Honeywell International |

|

Illinois Tool Works Johnson & Johnson Kimberly-Clark Corp. McDonald's Corp.

Medtronic |

|

Novartis AG Procter & Gamble Co. Thermo Fisher Scientific United Technologies Corp. |

As

it pertains to healthcare peers, Johnson & Johnson most closely reflects our durable growth and income identity, as well as the lines of business in which we operate. Other healthcare

companies in our peer group reflect specific aspects of our business and/or compete directly with Abbott in specific businesses or product areas while also reflecting our financial and operating

scale.

Although

Abbott has been assigned to the GICS of "Health Care Equipment," this code does not describe Abbott:

- •

- Less than 50% of our sales are generated by healthcare equipment products;

- •

- Approximately 50% of our sales are generated by nutritional and pharmaceutical products; and

- •

- Approximately 50% of our sales are direct to consumers and patients. Therefore, our peer group includes consumer and household product

companies: Procter & Gamble, Kimberly-Clark, Coca-Cola, and McDonald's.

Our

peer group also includes companies that reflect the breadth of our international operations. We currently generate approximately 70% of our revenues internationally and continue to expand our

international presence and operations in order to move closer to the markets we serve.

This

particular set of companies was determined shortly after the separation with AbbVie to reflect the nature of our business going forward. The Compensation Committee, working with its outside

consultant, determined the selection criteria and then chose the companies listed above. In 2014, the Committee reviewed with its consultant and reaffirmed this group of companies.

Given that there had been no significant change in Abbott's revenue size or market capitalization, the positive feedback we had received

from investors, and the Committee's strong opinion that stability in a peer group is important, the Committee and its consultant determined that there is no reason to change this peer group.

See pages 33 and 34 for additional details on our peer group.

|

10 Abbott Laboratories

|

|

|

Table of Contents

OVERVIEW OF TOTAL COMPENSATION MIX

Our compensation program provides an appropriate and competitive mix of elements to incentivize our executives to achieve the Company's business

strategies and goals, while also aligning executive performance and rewards with shareholder interests. Our compensation structure has contributed to a corporate culture that encourages employees to

regard Abbott as a career employer while rewarding employees for both short-and long-term contributions.

The

vast majority of compensation for our officers is performance-based and objectively determined. The remainder of this section provides additional information regarding our compensation programs,

including the mix of total compensation and how incentive awards are determined.

TOTAL COMPENSATION MIX

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation Element |

|

|

Abbott CEO |

|

|

Other Abbott NEOs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Salary |

|

$ |

1,973,077 |

|

$ |

3,142,680 |

|

|

|

|

Annual Cash Incentive Plan |

|

$

|

3,800,000 |

|

$

|

2,923,400 |

|

|

|

|

Long-Term Incentive Awards |

|

|

|

|

|

|

|

|

|

|

Grant made in 2014 based on 2013 results |

|

$

|

9,299,996 |

|

$

|

8,588,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Compensation (See page 43) |

|

$

|

17,732,241 |

|

$

|

20,013,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Abbott Laboratories 11

|

Table of Contents

ANNUAL CASH INCENTIVE PAYOUT CALCULATION FOR EXECUTIVES

Under the annual cash incentive plan, the Compensation Committee sets a target payout (expressed as a percentage of base salary) for each officer

based upon market benchmarks and internal calibration. The final payout is determined based upon achievement of certain annual goals.

The

Compensation Committee may adjust the calculated annual cash incentive plan award amount up or down based on additional factors. Note that the quantitative assessment on its own does not produce

above-target payouts. An above-target payout can only be produced when the Compensation Committee believes performance merits an above-target payout.

Examples of Factors That Could Create Upward Adjustment

- •

- Performance well above plan

- •

- Successful completion of unplanned acquisition

- •

- Acceleration of R&D milestones

Examples of Factors That Could Create Downward Adjustment

- •

- Missing performance targets

- •

- Missing R&D milestones

- •

- Compliance breach

- •

- Violation of our Core Leadership Requirements

For

2014, individual payouts for Abbott's 19 executive officers ranged from 53% to 125% of target. Seven officers received payouts above their target and ten received payouts below their target. The

two remaining officers received payouts at their target. Only officers whose individual and business performance were well above expectations were awarded payouts in excess of their target.

|

12 Abbott Laboratories

|

|

|

Table of Contents

LONG-TERM INCENTIVE GRANTS FOR EXECUTIVES

Unlike many other companies that use performance measures to adjust their long-term incentive (LTI) awards solely during the vesting process, Abbott uses performance measures

three times to determine the amount of equity awards to be granted and vested.

To

align with Company performance, guideline award levels are set using the percentile ranking of Abbott's TSR (1, 3, and 5 years) as compared to our peers. For example, if the combination of

TSR percentile rankings is approximately the 60th percentile, then LTI guideline award levels will be set at the 60th percentile of the peer group market data for LTI.

|

|

|

|

|

|

|

Starting with the guideline award level set in step 1, individual officer awards are adjusted up or down based upon individual performance and the performance of their business. |

|

|

Officer

performance is determined using a 50/50 weighting of individual performance and progress toward long-range plan objectives. This calculation is then raised or lowered depending on the

officer's relative contribution to the overall enterprise.

Awards

granted in 2014, based on individual officer performance in 2013, resulted in individual awards ranging from 80%-130% of guideline award levels. Eight executive officers received a grant of

less than their guideline award level, and six received a grant in excess of their guideline award level. All other executive officers received a grant equal to the guideline award level.

|

|

|

|

|

|

|

In our final step, options and performance shares are again aligned to performance. |

Since our initial guideline award levels are based upon relative TSR, we do not use a relative metric for vesting of our performance-restricted shares. Instead, we vest awards at 100% or 0% depending upon the achievement of our ROE target, meaning

there is no upside and no partial vesting if ROE falls short of the target. |

The

focus on ROE ensures that our growth and investment return objectives are achieved before awards vest. Because ROE measures how much profit the Company generates over the long term with the

capital that shareholders have invested, the Compensation Committee believes it is an appropriate metric for vesting equity granted to the Company's executive officers. The ROE

target for awards granted in 2015 was increased from 10% to 11%.

Options

accrue value only through stock price appreciation. This directly aligns the compensation earned with the value shareholders would have received over the same period of time.

|

|

|

Abbott Laboratories 13

|

Table of Contents

INFORMATION ABOUT THE ANNUAL MEETING

Who Can Vote

Shareholders of record at the close of business on February 25, 2015 will be entitled to notice of and to vote at the Annual Meeting. As of

January 31, 2015, Abbott had 1,508,977,828 outstanding common shares, which are Abbott's only outstanding voting securities. All shareholders have cumulative voting rights in the election of

directors and one vote per share on all other matters.

Notice and Access

In accordance with the Securities and Exchange Commission's "Notice and Access" rules, Abbott mailed a Notice of Internet Availability of Proxy

Materials (the "Notice") to certain shareholders in mid-March of 2015. The Notice describes the matters to be considered at the Annual Meeting and how the shareholders can access the proxy materials

online. It also provides instructions on how those shareholders can vote their shares. If you received the Notice, you will not receive a print version of the proxy materials, unless you request one.

If you would like to receive a print version of the proxy materials, free of charge, please follow the instructions on the Notice.

Cumulative Voting

Cumulative voting allows a shareholder to multiply the number of shares owned by the number of directors to be elected and to cast the total for one

nominee or distribute the votes among the nominees, as the shareholder desires. Nominees who receive the greatest number of votes will be elected. If you wish to cumulate your votes, you must sign and

mail in your proxy card or attend the Annual Meeting.

Voting by Proxy

All of Abbott's shareholders may vote by mail or at the Annual Meeting. Abbott's By-Laws provide that a shareholder may authorize no more than two

persons as proxies to attend and vote at the meeting. Most of Abbott's shareholders may also vote their shares by telephone or the Internet. If you vote by telephone or the Internet, you do not need

to return your proxy card. The instructions for voting can be found with your proxy card or on the Notice.

Revoking a Proxy

You may revoke your proxy by voting in person at the Annual Meeting or, at any time prior to the

meeting:

- •

- by delivering a written notice to the secretary of Abbott,

- •

- by delivering an authorized proxy with a later date, or

- •

- by voting by telephone or the Internet after you have given your proxy.

Discretionary Voting Authority

Unless authority is withheld in accordance with the instructions on the proxy, the persons named in the proxy will vote the shares covered by proxies

they receive to elect the 11 nominees named in Item 1 on the proxy card. Should a nominee become unavailable to serve, the shares will be voted for a substitute designated by the Board of

Directors, or for fewer than 11 nominees if, in the judgment of the proxy holders, such action is necessary or desirable. The persons named in the proxy may also decide to vote shares cumulatively so

that one or more of the nominees may receive fewer votes than the other nominees (or no votes at all), although they have no present intention of doing so.

Where

a shareholder has specified a choice for or against the ratification of the appointment of Ernst & Young LLP as auditors, the advisory vote on the approval of executive

compensation, or the approval of the shareholder proposals, or where the shareholder has abstained on these matters, the shares represented by the proxy will be voted (or not voted) as specified.

Where no choice has been specified, the proxy will be voted FOR the ratification of Ernst & Young LLP as auditors, FOR the approval of executive compensation, and AGAINST the shareholder

proposals.

|

14 Abbott Laboratories

|

|

|

Table of Contents

The

Board of Directors is not aware of any other issue which may properly be brought before the meeting. If other matters are properly brought before the meeting, the accompanying proxy will be voted

in accordance with the judgment of the proxy holders.

Quorum and Vote Required to Approve Each Item on the Proxy

A majority of the outstanding shares entitled to vote on a matter, represented in person or by proxy, constitutes a quorum for consideration of that

matter at the meeting. The affirmative vote of a majority of the shares represented at the meeting and entitled to vote on a matter shall be the act of the shareholders with respect to that matter.

Effect of Broker Non-Votes and Abstentions

A proxy submitted by an institution such as a broker or bank that holds shares for the account of a beneficial owner may indicate that all or a

portion of the shares represented by that proxy are not being voted with respect to a particular matter. This could occur, for example, when the broker or bank is not permitted to vote those shares in

the absence of instructions from the beneficial owner of the stock. These "non-voted shares" will be considered shares not present and, therefore, not entitled to vote on those matters, although these

shares may be considered present and entitled to vote for other purposes. Brokers and banks have discretionary authority to vote shares in absence of instructions on matters the New York Stock

Exchange considers "routine", such as the ratification of the appointment of the auditors. They do not have discretionary authority to vote shares in absence of instructions on "non-routine" matters.

The election of directors, the advisory vote on the approval of executive compensation, and the shareholder proposals are considered "non-routine" matters. Non-voted shares will not affect the

determination of the outcome of the vote on any matter to be decided at the meeting. Shares represented by proxies which are present and entitled to vote on a matter but which have elected to abstain

from voting on that matter will have the effect of votes against that matter.

Inspectors of Election

The inspectors of election and the tabulators of all proxies, ballots, and voting tabulations that identify shareholders are independent and are not

Abbott employees.

Cost of Soliciting Proxies

Abbott will bear the cost of making solicitations from its shareholders and will reimburse banks and brokerage firms for out-of-pocket expenses

incurred in connection with this solicitation. Proxies may be solicited by mail, telephone, Internet, or in person by directors, officers, or employees of Abbott and its subsidiaries.

Abbott

has retained Georgeson Inc. to aid in the solicitation of proxies, at an estimated cost of $19,500 plus reimbursement for reasonable out-of-pocket expenses.

Abbott Laboratories Stock Retirement Plan

Participants in the Abbott Laboratories Stock Retirement Plan will receive voting instructions for their shares held in the Abbott Laboratories Stock

Retirement Trust. The Stock Retirement Trust is administered by both a trustee and an Investment Committee. The trustee of the Trust is Mercer Trust Company. The members of the Investment Committee

are Stephen R. Fussell and Brian P. Wentworth, employees of Abbott. The voting power with respect to the shares is held by and shared between the Investment Committee and the

participants. The Investment Committee must solicit voting instructions from the participants and follow the voting instructions it receives. The Investment Committee may use its own discretion with

respect to those shares for which no voting instructions are received.

|

|

|

Abbott Laboratories 15

|

Table of Contents

Confidential Voting

It is Abbott's policy that all proxies, ballots, and voting tabulations that reveal how a particular shareholder has voted be kept confidential and

not be disclosed, except:

- •

- where disclosure may be required by law or regulation,

- •

- where disclosure may be necessary in order for Abbott to assert or defend claims,

- •

- where a shareholder provides comments with a proxy,

- •

- where a shareholder expressly requests disclosure,

- •

- to allow the inspectors of election to certify the results of a vote, or

- •

- in other limited circumstances, such as a contested election or proxy solicitation not approved and recommended by the Board of

Directors.

Householding of Proxy Materials

Shareholders sharing an address may receive only one copy of the proxy materials or the Notice of Internet Availability of Proxy Materials, unless

their broker, bank or other intermediary has received contrary instructions from any shareholder at that address. This is known as "householding." Shareholders wishing to discontinue householding and

receive separate copies of the proxy materials or the Notice of Internet Availability of Proxy Materials should notify their broker, bank, or other intermediary.

|

16 Abbott Laboratories

|

|

|

Table of Contents

NOMINEES FOR ELECTION AS DIRECTORS

|

|

|

|

|

|

|

ROBERT J. ALPERN, M.D.

Director since 2008 Age 64

Ensign Professor of Medicine, Professor of Internal Medicine, and Dean of

Yale School of Medicine, New Haven, Connecticut |

|

|

Dr. Alpern

has served as the Ensign Professor of Medicine, Professor of Internal Medicine, and Dean of Yale School of Medicine since June 2004. From July 1998 to June 2004, Dr. Alpern

was the Dean of The University of Texas Southwestern Medical Center. Dr. Alpern also serves as a Director of AbbVie Inc. and as a Director on the Board of Yale—New Haven

Hospital.

As

the Ensign Professor of Medicine, Professor of Internal Medicine, and Dean of Yale School of Medicine, Dean of The University of Texas Southwestern Medical Center, and as a Director on the Board of

Yale—New Haven Hospital, Dr. Alpern contributes valuable insights to the Board through his medical and scientific expertise and his knowledge of the health care environment and the

scientific nature of Abbott's key research and development initiatives.

|

|

|

|

|

|

|

ROXANNE S. AUSTIN

Director since 2000 Age 54

President, Austin Investment Advisors, Newport Coast, California (Private

Investment and Consulting Firm) |

|

|

Ms. Austin

is President of Austin Investment Advisors, a private investment and consulting firm, a position she has held since 2004. From July 2009 through July 2010, Ms. Austin also

served as the President and Chief Executive Officer of Move Networks, Inc., a provider of Internet television services. Ms. Austin served as President and Chief Operating Officer of

DIRECTV, Inc. Ms. Austin also previously served as Executive Vice President and Chief Financial Officer of Hughes Electronics Corporation and as a partner of Deloitte & Touche

LLP. Ms. Austin is also a Director of AbbVie Inc., Target Corporation, Teledyne Technologies, Inc., and Telefonaktiebolaget LM Ericsson.

Through

her extensive management and operating roles, including her financial roles, Ms. Austin contributes significant oversight and leadership experience, including financial expertise and

knowledge of financial statements, corporate finance and accounting matters.

|

|

|

Abbott Laboratories 17

|

Table of Contents

|

|

|

|

|

|

|

SALLY E. BLOUNT, PH.D.

Director since 2011 Age 53

Dean of the J.L. Kellogg Graduate School of Management at Northwestern

University, Evanston, Illinois |

|

|

Ms. Blount

has served as Dean of the J.L. Kellogg Graduate School of Management at Northwestern University since July 2010. From 2004 to 2010, she served as the Vice Dean and Dean of the

undergraduate college of New York University's Leonard N. Stern School of Business. Ms. Blount joined the faculty of New York University's Leonard N. Stern School of Business in

2001 and was the Abraham L. Gitlow Professor of Management and Organizations. Prior to joining NYU in 2001, Ms. Blount held academic posts at the University of Chicago's Graduate School

of Business from 1992 to 2001.

As

Dean of the J.L. Kellogg Graduate School of Management at Northwestern University and as the Vice Dean and Dean of the undergraduate college of New York University's Leonard N. Stern

School of Business, Ms. Blount provides Abbott's Board with expertise on business organization, governance and business management matters.

|

|

|

|

|

|

|

W. JAMES FARRELL

Director since 2006 Age 72

Retired Chairman and Chief Executive Officer of Illinois Tool Works Inc.,

Glenview, Illinois (Worldwide Manufacturer of Highly Engineered Products

and Specialty Systems) |

|

|

Mr. Farrell

served as the Chairman of Illinois Tool Works Inc. from 1996 to 2006 and as its Chief Executive Officer from 1995 to 2005. Mr. Farrell also served on the Board of

Directors of 3M Company from 2006 to 2014, Allstate Insurance Company from 1999 to 2013, and UAL Corporation from 2001 to 2012.

As

a result of his tenure as Chairman and Chief Executive Officer of Illinois Tool Works, Mr. Farrell brings valuable business, leadership and management experience to the Board and provides

guidance on key matters relevant to a major international company.

|

18 Abbott Laboratories

|

|

|

Table of Contents

|

|

|

|

|

|

|

EDWARD M. LIDDY

Director since 2010 Age 69

Partner, Clayton, Dubilier & Rice, LLC, New York, New York (Private Equity

Investment Firm) |

|

|

Mr. Liddy

has been a partner in the private equity investment firm Clayton, Dubilier & Rice, LLC since January 2010, having also been a partner at such firm from April to September 2008.

From September 2008 to August 2009, Mr. Liddy was the Interim Chairman and Chief Executive Officer of American International Group, Inc. (AIG), a global insurance and financial services holding

company. He served at AIG at the request of the U.S. Department of the Treasury. From January 1999 to April 2008, Mr. Liddy served as Chairman of the Board of the Allstate Corporation. He

served as Chief Executive Officer of Allstate from January 1999 to December 2006, President from January 1995 to May 2005, and Chief Operating Officer from August 1994 to January 1999.

Mr. Liddy currently serves on the Board of Directors of AbbVie Inc., 3M Company, and The Boeing Company. In addition, Mr. Liddy formerly served on the Board of The Boeing Company

from 2007 to 2008.

As

the Chairman and Chief Executive Officer of Allstate Corporation and American International Group, Inc., Mr. Liddy brings valuable insights from the perspective of the insurance industry

into Abbott's pharmaceutical and medical device businesses. As a partner of Clayton, Dubilier & Rice, LLC, Mr. Liddy gained significant knowledge and understanding of finance and capital

markets matters, as well as global and domestic strategic advisory experience.

|

|

|

|

|

|

|

NANCY MCKINSTRY

Director since 2011 Age 55

Chief Executive Officer and Chairman of the Executive Board of Wolters

Kluwer N.V., Alphen aan den Rijn, the Netherlands (Global Information,

Software, and Services Provider) |

|

|

Ms. McKinstry

has been the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V. since September 2003 and a member of its Executive Board since June 2001.

Ms. McKinstry also serves on the Advisory Board of the University of Rhode Island, the Board of Overseers of Columbia Business School, and the Advisory Board of the Harrington School of

Communication and Media. Ms. McKinstry served on the Board of Directors of Telefonieaktiebolaget LM Ericsson (LM Ericsson Telephone Company) from 2004 to 2012. Ms. McKinstry also served

on the Board of Directors of MortgageIT Holdings, Inc. from 2004 to 2007.

As

the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Ms. McKinstry contributes global perspectives and management experience, including an understanding of

key issues facing a multinational business such as Abbott's.

|

|

|

Abbott Laboratories 19

|

Table of Contents

|

|

|

|

|

|

|

PHEBE N. NOVAKOVIC

Director since 2010 Age 57

Chairman and Chief Executive Officer, General Dynamics Corporation, Falls

Church, Virginia (Worldwide Defense, Aerospace, and Other Technology

Products Manufacturer) |

|

|

Ms. Novakovic

has been Chairman and Chief Executive Officer of General Dynamics Corporation since January 1, 2013. Previously, she served as President and Chief Operating Officer from

May 2012 to December 2012 and as Executive Vice President, Marine Systems of General Dynamics from May 2010 to May 2012. From May 2005 to April 2010, Ms. Novakovic served as its Senior Vice

President—Planning and Development. She was elected Vice President of General Dynamics in October 2002 after joining the company in May 2001. Previously, Ms. Novakovic was Special

Assistant to the Secretary and Deputy Secretary of Defense, and had been a Deputy Associate Director of the Office of Management and Budget.

As

a member of the Board of Directors and Chief Executive Officer of General Dynamics Corporation, Ms. Novakovic has strong management experience with a major public company, including

significant marketing, operational and manufacturing experience, and contributes valuable insights into finance and capital markets. Her tenure with the Office of Management and Budget and as Special

Assistant to the Secretary and Deputy Secretary of Defense enables her to provide government perspective and experience in a highly regulated industry.

|

|

|

|

|

|

|

WILLIAM A. OSBORN

Director since 2008 Age 67

Retired Chairman and Chief Executive Officer of Northern Trust Corporation

(A Multibank Holding Company) and The Northern Trust Company, Chicago,

Illinois (Banking Services Company) |

|

|

Mr. Osborn

was Chairman of Northern Trust Corporation from 1995 through 2009 and served as its Chief Executive Officer from 1995 through 2007. Mr. Osborn currently serves as a Director

of Caterpillar Inc. and General Dynamics Corporation. He is Chairman of the Board of Trustees of Northwestern University. Mr. Osborn served on the Board of Directors of

Nicor, Inc. from 1999 to 2006 and on the Board of Directors of Tribune Company from 2001 to 2012.

As

the Chairman and Chief Executive Officer of Northern Trust Corporation and The Northern Trust Company, Mr. Osborn acquired broad experience in successfully overseeing complex global

businesses operating in highly regulated industries.

|

20 Abbott Laboratories

|

|

|

Table of Contents

|

|

|

|

|

|

|

SAMUEL C. SCOTT III

Director since 2007 Age 70

Retired Chairman, President and Chief Executive Officer of Corn Products

International, Inc., Westchester, Illinois (A Corn Refining Company) |

|

|

Mr. Scott

retired as Chairman, President and Chief Executive Officer of Corn Products International in 2009. He served as Chairman, President, and Chief Executive Officer from February 2001

until he retired in May of 2009. He was President and Chief Operating Officer from January 1998 until February 2001. He was President of the Corn Refining Division of CPC International from 1995

through 1997, when CPC International spun off Corn Products International as a separate corporation. Mr. Scott currently serves on the Board of Directors of Bank of New York Mellon Corporation

and Motorola Solutions, Inc.

As

the Chairman, President and Chief Executive Officer of Corn Products International, Mr. Scott acquired valuable business, leadership and management experience, including critical insights

into matters relevant to a major public company and experience in finance and capital markets matters.

|

|

|

|

|

|

|

GLENN F. TILTON

Director since 2007 Age 66

Retired Chairman of the Midwest, JPMorgan Chase & Co., Chicago, Illinois

(Banking and Financial Services Company) |

|

|

Mr. Tilton

served as Chairman of the Midwest for JPMorgan Chase & Co. and a member of its companywide Executive Committee from June 2011 to June 2014. From October 2010 to December 2012,

Mr. Tilton also served as the Non-Executive Chairman of the Board of United Continental Holdings, Inc. From September 2002 to October 2010, he served as Chairman, President and Chief Executive

Officer of UAL Corporation, a holding company, and Chairman and Chief Executive Officer of United Air Lines, Inc., an air transportation company and wholly owned subsidiary of UAL Corporation.

Mr. Tilton is also a Director of AbbVie Inc. and Phillips 66. Mr. Tilton also served on the Board of Directors of Lincoln National Corporation from 2002 to 2007, of TXU

Corporation from 2005 to 2007, of Corning Incorporated from 2010 to 2012, and of United Continental Holdings, Inc. from 2001 to 2013.

Having

previously served as Chairman of the Midwest for JPMorgan Chase & Co., Non-Executive Chairman of the Board of United Continental Holdings, Inc., Chairman, President, and Chief Executive

Officer of UAL Corporation and United Air Lines, Vice Chairman of Chevron Texaco, and as Interim Chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex

multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters.

|

|

|

Abbott Laboratories 21

|

Table of Contents

|

|

|

|

|

|

|

MILES D. WHITE

Director since 1998 Age 60

Chairman of the Board and Chief Executive Officer, Abbott Laboratories |

|

|

Mr. White

has served as Abbott's Chairman of the Board and Chief Executive Officer since 1999. He served as an Executive Vice President of Abbott from 1998 to 1999. He joined Abbott in 1984. He

currently serves as a Director of Caterpillar Inc. and McDonald's Corporation.

Serving

as Abbott's Chairman of the Board and Chief Executive Officer since 1999 and having joined Abbott in 1984, Mr. White contributes not only his valuable business, management and

leadership experience, but also his extensive knowledge of the Company and its global operations, as well as key insights into strategic, management and operation matters, ensuring the appropriate

level of oversight and responsibility is applied to all Board decisions.

|

22 Abbott Laboratories

|

|

|

Table of Contents

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The

Board of Directors held seven meetings in 2014. The average attendance of all directors at Board and committee meetings in 2014 was ninety-seven percent and each

director attended at least seventy-five percent of the total number of Board meetings and meetings of the committees on which he or she served. Abbott encourages its Board members to attend the annual

shareholders meeting. Last year, all of Abbott's directors attended the annual shareholders meeting.

The

Board has determined that each of the following directors is independent in accordance with the New York Stock Exchange listing standards: R. J. Alpern,

R. S. Austin, S. E. Blount, W. J. Farrell, E. M. Liddy, N. McKinstry, P. N. Novakovic, W. A. Osborn,

S. C. Scott III, and G. F. Tilton. To determine independence, the Board applied the categorical standards attached as Exhibit A to this proxy statement. The Board

also considered whether a director has any other material relationships with Abbott or its subsidiaries and concluded that none of these directors had a relationship that impaired the director's

independence. This included consideration of the fact that some of the directors are officers or serve on boards of companies or entities to which Abbott sold products or made contributions or from

which Abbott purchased products and services during the year. In making its determination, the Board relied on both information provided by the directors and information developed internally by

Abbott.

The

Board has risk oversight responsibility for Abbott and administers this responsibility both directly and with assistance from its committees.

The

Board has determined that the current leadership structure, in which the offices of Chairman and Chief Executive Officer are held by one individual and an independent

director acts as lead director, ensures the appropriate level of oversight, independence, and responsibility is applied to all Board decisions, including risk oversight, and is in the best interests

of Abbott and its shareholders.

Chairman/Chief Executive Officer

- •

- Coherent leadership and direction for the Board and executive management

- •

- Clear accountability and a single focus for the chain of command to execute our strategic initiatives and business plans

- •

- CEO's extensive industry expertise, leadership experience and familiarity with our business

- •

- By leading management and chairing the Board, we benefit from our CEO's strategic and operational insights, enabling a focused vision

encompassing the full range, from long-term strategic direction and day-to-day execution

Lead Independent Director

- •

- Currently, the Chairman of the Nominations and Governance Committee acts as the lead director

- •

- Chosen by and from the independent members of the Board of Directors, and serves as the liaison between the Chairman of the Board and

the independent directors

- •

- Facilitates communication with the Board and presides over regularly conducted executive sessions of the independent directors or

sessions where the Chairman of the Board is not present

- •

- Reviews and approves matters, such as agenda items, schedule sufficiency, and, where appropriate, information provided to other Board

members

- •

- Has the authority to call meetings of the independent directors and, if requested by major shareholders, ensures that he or she is

available for consultation and direct communication

- •

- The lead director, and each of the other directors, communicates regularly with the Chairman and Chief Executive Officer regarding

appropriate agenda topics and other Board related matters

|

|

|

Abbott Laboratories 23

|

Table of Contents

The

process used by the Nominations and Governance Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought.

Board members should have backgrounds that when combined provide a portfolio of experience and knowledge that will serve Abbott's governance and strategic needs. Board candidates will be considered on

the basis of a range of criteria, including broad-based business knowledge and relationships, prominence and excellent reputations in their primary fields of endeavor, as well as a global business

perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the Board of Directors' oversight role with respect to Abbott's

business and affairs. Each director's biography includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board. The directors'

biographies are on pages 17 to 22.

In

the process of identifying nominees to serve as a member of the Board of Directors, the Nominations and Governance Committee considers the Board's diversity of relevant

experience, areas of expertise, ethnicity, gender, and geography and assesses the effectiveness of the process in achieving that diversity. Currently, 50% of the independent directors are composed of

women or individuals who are minorities.

|

COMMITTEES OF THE BOARD OF DIRECTORS

|

The

Board of Directors has five committees established in Abbott's By-Laws: the Executive Committee, Audit Committee, Compensation Committee, Nominations and Governance

Committee, and Public Policy Committee. Each of the members of the Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee is independent.

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee

|

|

Current Members

|

|

|

Number of

2014

Meetings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit |

|

Roxanne S. Austin (Chair, audit committee financial expert); Edward M. Liddy; Nancy McKinstry; Samuel C. Scott III; Glenn F. Tilton. Each of the committee

members is financially literate, as is required of audit committee members by the New York Stock Exchange. The Board of Directors has determined that Roxanne S. Austin, the Committee's Chair, is an "audit committee financial

expert."

|

|

|

8 |

|

|

|

|

Compensation |

|

W. James Farrell (Chair); Roxanne S. Austin; Edward M. Liddy; William A. Osborn; Samuel C. Scott III

|

|

|

4

|

|

|

|

|

Nominations and Governance |

|

William A. Osborn (Chair); Robert J. Alpern, M.D.; Sally E. Blount, Ph.D.; W. James Farrell; Phebe N. Novakovic

|

|

|

4 |

|

|

|

|

Public Policy |

|

Phebe N. Novakovic (Chair); Robert J. Alpern, M.D.; Sally E. Blount, Ph.D.; Nancy McKinstry, Glenn F. Tilton

|

|

|

4

|

|

|

|

|

Executive |

|

Miles D. White (Chair); Roxanne S. Austin; W. James Farrell; Phebe N. Novakovic; William A. Osborn

|

|

|

0 |

|

|

Executive Committee

The Executive Committee may exercise all the authority of the Board in the management of Abbott, except for matters expressly reserved by law for

Board action.

|

24 Abbott Laboratories

|

|

|

Table of Contents

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to Abbott's accounting and financial

reporting practices and the audit process, the quality and integrity of Abbott's financial statements, the independent auditors' qualifications, independence, and performance, the performance of

Abbott's internal audit function and internal auditors, and certain areas of legal and regulatory compliance. The Committee is governed by a written charter. A copy of the report of the Audit

Committee is on page 61.

Compensation Committee

The Compensation Committee assists the Board of Directors in carrying out the Board's responsibilities relating to the compensation of Abbott's

executive officers and directors. The Committee is governed by a written charter. The Compensation Committee annually reviews the compensation paid to the members of the Board and gives its

recommendations to the full Board regarding both the amount of director compensation that should be paid and the allocation of that compensation between equity-based awards and cash. In recommending

director compensation, the Compensation Committee takes comparable director fees into account and reviews any arrangement that could be viewed as indirect director compensation.

This

Committee also reviews, approves, and administers the incentive compensation plans in which any executive officer of Abbott participates and all of Abbott's equity-based plans. It may delegate

the responsibility to administer and make grants under these plans to management, except to the extent that such delegation would be inconsistent with applicable law or regulation or with the listing

rules of the New York Stock Exchange. The processes and procedures used for the consideration and determination of executive compensation are described in the section of the proxy captioned,

"Compensation Discussion and Analysis."

The

Compensation Committee has the sole authority, under its charter, to select, retain and/or terminate independent compensation advisors. The Committee engaged Meridian as its compensation

consultant for 2014. Meridian performs no other work for Abbott. The Committee engages compensation consultants to provide counsel and advice on executive and non-employee director compensation

matters. The consultant, and its principal, report directly to the Chair of the Committee. The principal meets regularly, and as needed, with the Committee in executive sessions, has direct access to

the Chair during and between meetings, and performs no other services for Abbott or its senior executives. The Committee determines what variables it will instruct the consultant to consider, and they

include: peer groups against which performance and pay should be examined, financial metrics to be used to assess Abbott's relative performance, competitive long-term incentive practices in the

marketplace, and compensation levels relative to market practice. The Committee negotiates and approves any fees paid to the consultant for these services. Based on its evaluation of Meridian's

independence in accordance with the New York Stock Exchange listing standards and information provided by Meridian, the Committee determined that the work performed by Meridian does not present any

conflicts of interest. A copy of the Compensation Committee report is on page 41.

Nominations and Governance Committee

The Nominations and Governance Committee assists the Board of Directors in identifying individuals qualified to become Board members and recommends

to the Board the nominees for election as directors at the next annual meeting of shareholders, recommends to the Board the persons to be elected as executive officers of Abbott, develops and

recommends to the Board the corporate governance guidelines applicable to Abbott, and serves in an advisory capacity to the Board and the Chairman of the Board on matters of organization, management

succession plans, major changes in the organizational structure of Abbott, and the conduct of Board activities. The Committee is governed by a written charter. The process used by this Committee to

identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in

identifying individuals qualified to be Board members. The process used by the Committee to identify nominees is described on page 24 in the section captioned, "Director Selection."

Public Policy Committee

The Public Policy Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to Abbott's public policy, certain

areas of legal and regulatory compliance, and governmental affairs and healthcare compliance issues that affect Abbott. The Committee is governed by a written charter.

|

|

|

Abbott Laboratories 25

|

Table of Contents

|

COMMUNICATING WITH THE BOARD OF DIRECTORS

|

Interested

parties may communicate with the Board of Directors by writing a letter to the Chairman of the Board, to the Chairman of the Nominations and Governance Committee,

who acts as the lead director at the meetings of the independent directors, or to the independent directors c/o Abbott Laboratories, 100 Abbott Park Road, D-364, AP6D, Abbott Park, Illinois 60064-6400

Attention: Corporate Secretary. The General Counsel and Corporate Secretary regularly forwards to the addressee all letters other than mass mailings, advertisements, and other materials not relevant

to Abbott's business. In addition, directors regularly receive a log of all correspondence received by the Company that is addressed to a member of the Board and may request any correspondence on that

log.

|

CORPORATE GOVERNANCE MATERIALS

|

Abbott's

corporate governance guidelines, outline of directorship qualifications, director independence standards, code of business conduct and the charters of Abbott's

Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee are all available in the corporate governance section of Abbott's investor relations Web site

(www.abbottinvestor.com).

|

2014 DIRECTOR COMPENSATION

|

Our

CEO is not compensated for serving on the Board or Board committees. Abbott's remaining directors, who are all non-employee directors, are compensated for their service

under the Abbott Laboratories Non-Employee Directors' Fee Plan and the Abbott Laboratories 2009 Incentive Stock Program.

The

following table sets forth a summary of the non-employee directors' 2014 compensation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned

or Paid in Cash

($)(1) |

|

Stock

Awards

($)(2) |

|

Option

Awards

($)(3) |

|

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)(4) |

|

|

All Other

Compensation

($)(5) |

|

Total

($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. J. Alpern |

|

$126,000 |

|

$134,913 |

|

$0 |

|

$12,332 |

|

$ |

5,000 |

|

$278,245 |

|

|

|

|

R. S. Austin |

|

144,000 |

|

134,913 |

|

0 |

|

0 |

|

|

0 |

|

278,913 |

|

|

|

|

S. E. Blount |

|

126,000 |

|

134,913 |

|

0 |

|

679 |

|

|

15,000 |

|

276,592 |

|

|

|

|

W. J. Farrell |

|

138,000 |

|

134,913 |

|

0 |

|

25,191 |

|

|

0 |

|

298,104 |

|

|

|

|

E. M. Liddy |

|

132,000 |

|

134,913 |

|

0 |

|

0 |

|

|

0 |

|

266,913 |

|

|

|

|

N. McKinstry |

|

132,000 |

|

134,913 |

|

0 |

|

0 |

|

|

25,000 |

|

291,913 |

|

|

|

|

P. N. Novakovic |

|

138,000 |

|

134,913 |

|

0 |

|

0 |

|

|

0 |

|

272,913 |

|

|

|

|

W. A. Osborn |

|

138,000 |

|

134,913 |

|

0 |

|

0 |

|

|

0 |

|

272,913 |

|

|

|

|

S. C. Scott III |

|

132,000 |

|

134,913 |

|

0 |

|

0 |

|

|

25,000 |

|

291,913 |

|

|

|

|

G. F. Tilton |

|

132,000 |

|

134,913 |

|

0 |

|

0 |

|

|

25,000 |

|

291,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- Under

the Abbott Laboratories Non-Employee Directors' Fee Plan, non-employee directors earn $10,500 for each month of service as a director

and $1,000 for each month of service as a chairman of a Board committee (other than the Audit Committee). The Chairman of the Audit Committee receives $1,500 for each month of service as a Chairman of

that committee and the other members of the Audit Committee receive $500 for each month of service as a Committee member. Fees earned under the Abbott Laboratories Non-Employee Directors' Fee Plan are

paid in cash to the director, paid in the form of vested non-qualified stock options (based on an independent appraisal of their fair value), deferred (as a non-funded obligation of Abbott), or paid

currently into an individual grantor trust established by the director. The distribution of deferred fees and amounts held in a director's grantor trust generally commences when the director reaches

age 65, or upon retirement from the Board of Directors, if later. The director may elect to have deferred fees and fees deposited in trust credited to either a guaranteed interest account or to a

stock equivalent account that earns the same return as if the fees were invested in Abbott stock. If necessary, Abbott contributes funds to a director's trust so that as of year-end the stock

equivalent account balance (net of taxes) is not less than seventy-five percent of the market value of the related common

|

26 Abbott Laboratories

|

|

|

Table of Contents

stock

at year-end. The conversion of outstanding Abbott equity awards when Abbott and AbbVie Inc. separated is described in the introduction to the 2014 Outstanding Equity Awards table on

page 47.

- (2)

- The

amounts reported in this column represent the aggregate grant date fair value of the awards in accordance with Financial Accounting

Standards Board ASC Topic 718. Abbott determines the grant date fair value of stock unit awards by multiplying the number of restricted stock units granted by the average of the high and low

market prices of an Abbott common share on the date of grant. In addition to the fees described in footnote 1, each non-employee director elected to the Board of Directors at the annual

shareholders meeting receives vested restricted stock units having a value of $135,000 (rounded down) under the Abbott Laboratories 2009 Incentive Stock Program. In 2014, this was 3,535 units.

The non-employee directors receive cash payments equal to the dividends paid on the shares covered by the units at the same rate as other shareholders. Upon termination, retirement from the Board,

death, or a change in control of Abbott, a non-employee director will receive one share of common stock for each restricted stock unit outstanding under the Incentive Stock Program. The following

Abbott restricted stock units were outstanding as of December 31, 2014: R. J. Alpern, 15,191; R. S. Austin, 22,854; S. E. Blount, 8,451;

W. J. Farrell, 20,965; E. M. Liddy, 10,618; N. McKinstry, 8,451; P. N. Novakovic, 10,618; W. A. Osborn, 17,108; S. C. Scott

III, 18,838; and G. F. Tilton, 18,838. The following AbbVie restricted stock units were outstanding as of December 31, 2014: R. J. Alpern, 8,559;

R. S. Austin, 16,222; S. E. Blount, 1,819; W. J. Farrell, 14,333; E. M. Liddy, 3,986; N. McKinstry, 1,819; P. N. Novakovic, 3,986;

W. A. Osborn, 10,476; S. C. Scott III, 12,206; and G. F. Tilton, 12,206.

- (3)

- The

following options and converted (AbbVie) options were outstanding as of December 31, 2014: N. McKinstry, 6,280 (Abbott) and

6,280 (AbbVie); and P. N. Novakovic, 32,877 (Abbott) and 7,072 (AbbVie).

- (4)

- The

totals in this column include reportable interest credited under Abbott Laboratories Non-Employee Directors' Fee Plan during the year.

- (5)

- Charitable

contributions made by Abbott's non-employee directors are eligible for a matching contribution (up to $25,000 annually). The

amounts reported in this column include charitable matching grant contributions, as follows: R. J. Alpern, $5,000; S. E. Blount, $15,000; N. McKinstry, $25,000;

S. C. Scott III, $25,000; and G. F. Tilton, $25,000.

|

|

|

Abbott Laboratories 27

|

Table of Contents

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS AND DIRECTORS

The table below reflects the number of Abbott common shares beneficially owned as of January 31, 2015, by each director, the

Chief Executive Officer, the Chief Financial Officer, and the three other most highly paid executive officers (the "named officers"), and by all directors and executive officers of Abbott as a group.

It

also reflects the number of stock equivalent units and restricted stock units held by non-employee directors under the Abbott Laboratories Non-Employee Directors' Fee Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Shares

Beneficially

Owned(1)(2) |

|