Amended Current Report Filing (8-k/a)

March 05 2015 - 4:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2015 (February 27, 2015)

Abbott Laboratories

(Exact name of registrant as specified in its charter)

|

Illinois |

|

1-2189 |

|

36-0698440 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification

No.) |

100 Abbott Park Road

Abbott Park, Illinois 60064-6400

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (224) 667-6100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously reported in the Current Report on Form 8-K, dated February 27, 2015, Abbott Laboratories (“Abbott”) completed the sale of its developed markets branded generics pharmaceuticals business (“Business”) to Mylan in exchange for 110 million ordinary shares of Mylan N.V.

Abbott is filing this amendment to the February 27, 2015 Current Report to include the financial information required by Item 9.01.

Item 9.01 Financial Statements and Exhibits.

(b) Unaudited pro forma consolidated financial information of Abbott giving effect to the disposition of the Business, and the related notes thereto, are attached hereto as Exhibit 99.1.

(d) Exhibits

|

Exhibit

No. |

|

Exhibit |

|

2.1 |

|

Amended and Restated Business Transfer Agreement dated as of November 4, 2014 (incorporated by reference to Exhibit 2.1 to the Quarterly Report on Form 10-Q filed by Abbott Laboratories with the Securities and Exchange Commission on November 5, 2014) |

|

|

|

|

|

99.1 |

|

Unaudited pro forma consolidated financial information |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: March 5, 2015 |

ABBOTT LABORATORIES |

|

|

|

|

|

|

|

|

By: |

/s/ Thomas C. Freyman |

|

|

|

Thomas C. Freyman |

|

|

|

Executive Vice President, Finance and |

|

|

|

Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit |

|

|

|

No. |

|

Exhibit |

|

2.1 |

|

Amended and Restated Business Transfer Agreement dated as of November 4, 2014 (incorporated by reference to Exhibit 2.1 to the Quarterly Report on Form 10-Q filed by Abbott Laboratories with the Securities and Exchange Commission on November 5, 2014) |

|

|

|

|

|

99.1 |

|

Unaudited pro forma consolidated financial information |

4

Exhibit 99.1

Abbott Laboratories and Subsidiaries

Unaudited Pro Forma Consolidated Financial Information

On February 27, 2015, Abbott Laboratories (“Abbott”) completed the sale of its developed markets branded generics pharmaceuticals business (“Business”) to Mylan in exchange for 110 million ordinary shares of Mylan N.V.

The following unaudited pro forma consolidated balance sheet of Abbott as of December 31, 2014 assumes that the sale of the Business occurred on December 31, 2014. The statement is presented based on information currently available, is intended for informational purposes only, and does not purport to represent what Abbott’s financial position actually would have been had the sale of the Business occurred on December 31, 2014, or to project Abbott’s financial performance for any future period.

The unaudited pro forma consolidated financial information should be read in conjunction with the audited consolidated financial statements and accompanying notes and “Management’s discussion and Analysis of Financial Condition and Results of Operations” included in Abbott’s Form 10-K for the year ended December 31, 2014. The Historical column in the Unaudited Pro Forma Consolidated Balance Sheet reflects Abbott’s historical balance sheet at December 31, 2014 and does not reflect any adjustments related to the sale of the Business. The information in the Sale of Business column in the Unaudited Pro Forma Consolidated Balance Sheet was derived from the assets and liabilities held for sale and related to the Business at December 31, 2014. The Sale of Business column also reflects the estimated fair value of the proceeds and the gain resulting from the difference between fair value of the proceeds and the carrying value of the Business assets and liabilities held for sale.

Abbott Laboratories and Subsidiaries

Unaudited Pro Forma Consolidated Balance Sheet

As of December 31, 2014

(dollars in millions)

|

|

|

Historical |

|

Sale of

Business |

|

Notes |

|

Pro Forma

Abbott |

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,063 |

|

|

|

|

|

$ |

4,063 |

|

|

Investments |

|

397 |

|

5,774 |

|

(a) |

|

6,171 |

|

|

Trade receivables, less allowances |

|

3,586 |

|

|

|

|

|

3,586 |

|

|

Inventories: |

|

|

|

|

|

|

|

|

|

|

Finished products |

|

1,807 |

|

|

|

|

|

1,807 |

|

|

Work in process |

|

278 |

|

|

|

|

|

278 |

|

|

Materials |

|

558 |

|

|

|

|

|

558 |

|

|

Total inventories |

|

2,643 |

|

|

|

|

|

2,643 |

|

|

Deferred income taxes |

|

1,705 |

|

|

|

|

|

1,705 |

|

|

Other prepaid expenses and receivables |

|

1,975 |

|

|

|

|

|

1,975 |

|

|

Current assets held for disposition |

|

892 |

|

(741 |

) |

|

|

151 |

|

|

Total Current Assets |

|

15,261 |

|

5,033 |

|

|

|

20,294 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments |

|

229 |

|

|

|

|

|

229 |

|

|

Property and Equipment, at Cost: |

|

12,632 |

|

|

|

|

|

12,632 |

|

|

Less: accumulated depreciation and amortization |

|

6,697 |

|

|

|

|

|

6,697 |

|

|

Net Property and Equipment |

|

5,935 |

|

|

|

|

|

5,935 |

|

|

Intangible Assets, net of amortization |

|

6,198 |

|

|

|

|

|

6,198 |

|

|

Goodwill |

|

10,067 |

|

|

|

|

|

10,067 |

|

|

Deferred Income Taxes and Other Assets |

|

1,651 |

|

|

|

|

|

1,651 |

|

|

Non-current Assets Held for Disposition |

|

1,934 |

|

(1,911 |

) |

|

|

23 |

|

|

|

|

$ |

41,275 |

|

$ |

3,122 |

|

|

|

$ |

44,397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

$ |

4,382 |

|

|

|

|

|

$ |

4,382 |

|

|

Trade accounts payable |

|

1,064 |

|

|

|

|

|

1,064 |

|

|

Salaries, wages and commissions |

|

776 |

|

|

|

|

|

776 |

|

|

Other accrued liabilities |

|

2,943 |

|

204 |

|

(b) |

|

3,147 |

|

|

Dividends payable |

|

362 |

|

|

|

|

|

362 |

|

|

Income taxes payable |

|

270 |

|

350 |

|

|

|

620 |

|

|

Current portion of long-term debt |

|

55 |

|

|

|

|

|

55 |

|

|

Current liabilities held for disposition |

|

680 |

|

(403 |

) |

|

|

277 |

|

|

Total Current Liabilities |

|

10,532 |

|

151 |

|

|

|

10,683 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term Debt |

|

3,408 |

|

|

|

|

|

3,408 |

|

|

Post-employment Obligations and other long-term liabilities |

|

5,588 |

|

1,402 |

|

(c) |

|

6,990 |

|

|

Non-current liabilities held for disposition |

|

108 |

|

(108 |

) |

|

|

— |

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

Shareholders’ Investment: |

|

|

|

|

|

|

|

|

|

|

Preferred shares, one dollar par value Authorized — 1,000,000 shares, none issued |

|

— |

|

|

|

|

|

— |

|

|

Common shares, without par value Authorized — 2,400,000,000 shares Issued at stated capital amount — Shares: 1,694,929,949 |

|

12,383 |

|

|

|

|

|

12,383 |

|

|

Common shares held in treasury, at cost — Shares: 186,894,515 |

|

(8,678 |

) |

|

|

|

|

(8,678 |

) |

|

Earnings employed in the business |

|

22,874 |

|

1,621 |

|

(d) |

|

24,495 |

|

|

Accumulated other comprehensive income (loss) |

|

(5,053 |

) |

56 |

|

|

|

(4,997 |

) |

|

Total Abbott Shareholders’ Investment |

|

21,526 |

|

1,677 |

|

|

|

23,203 |

|

|

Noncontrolling Interests in Subsidiaries |

|

113 |

|

|

|

|

|

113 |

|

|

Total Shareholders’ Investment |

|

21,639 |

|

1,677 |

|

|

|

23,316 |

|

|

|

|

$ |

41,275 |

|

$ |

3,122 |

|

|

|

$ |

44,397 |

|

Note 1. Pro Forma Adjustments

(a) Reflects the estimated fair value of the Mylan shares received.

(b) Reflects the estimated deferred revenue related to the transition services and manufacturing supply agreements.

(c) Reflects the estimated non-current deferred revenue related to the transition services and manufacturing supply agreements and noncurrent income tax liabilities.

(d) Reflects the estimated gain on the sale of the Business.

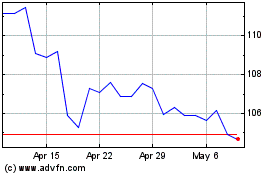

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

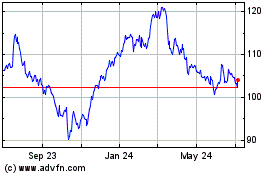

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024