Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America, serving both

professional installer and do-it-yourself customers, today

announced its financial results for the fourth quarter ended

December 31, 2016. Fourth quarter GAAP earnings per diluted

share (Diluted EPS) were $0.84. Fourth quarter Adjusted earnings

per diluted share (Adjusted EPS) were $1.00, which exclude $0.08 of

amortization of acquired intangible assets and integration and

restructuring costs of $0.08 primarily associated with the

acquisition of General Parts International, Inc. (General

Parts).

Fourth Quarter Performance Summary

Twelve Weeks Ended

Fifty-Two Weeks Ended

December 31,2016

January 2,2016

December 31,2016

January 2,2016

Sales (in millions) $ 2,082.9 $ 2,033.5 $ 9,567.7 $

9,737.0

Comp Store Sales % 3.1 % (2.5 %) (1.4 %) 0.0

%

Gross Profit (in millions) $ 907.6 $ 909.2 $

4,255.9 $ 4,422.8

SG&A (in millions) $ 801.4 $

808.5 $ 3,468.3 $ 3,597.0

Adjusted SG&A (in millions)

(1) $ 781.9 $ 751.6 $ 3,354.5 $ 3,427.7

Operating

Income (in millions) $ 106.1 $ 100.7 $ 787.6 $ 825.8

Adjusted Operating Income (in millions) (1) $ 125.6 $ 157.6

$ 901.4 $ 995.1

Diluted EPS $ 0.84 $ 0.74 $ 6.20 $

6.40

Adjusted EPS (1) $ 1.00 $ 1.22 $ 7.15 $ 7.82

Avg Diluted Shares (in thousands) 73,886 73,861 73,856

73,733

(1)

Fiscal 2016 and 2015 include certain non-operational

expenses. The Adjusted SG&A, Adjusted Operating Income and

Adjusted EPS for the twelve weeks ended December 31, 2016 and

January 2, 2016, respectively, have been reported on an adjusted

basis to exclude General Parts integration, store consolidation

costs and support center restructuring costs of $10.1 million and

$47.2 million, respectively, and General Parts amortization of

acquired intangible assets of $9.4 million and $9.7 million,

respectively. The Adjusted SG&A, Adjusted Operating Income and

Adjusted EPS for the fifty-two weeks ended December 31, 2016 and

January 2, 2016, respectively, have been reported on an adjusted

basis to exclude General Parts integration, store consolidation

costs and support center restructuring costs of $72.8 million and

$127.1 million, respectively, and General Parts amortization of

acquired intangible assets of $40.9 million and $42.3 million,

respectively. For a better understanding of the Company's adjusted

results, refer to the reconciliation of the financial results

reported on a GAAP basis to the adjusted basis in the accompanying

financial tables in this press release.

“We are pleased with the sequential improvement in our sales

performance and positive comparable sales for the quarter. Our top

line progress is a direct reflection of sustained investment in the

customer. Our stronger sales execution and improved availability

enabled us to serve our customers better,” said Tom Greco,

President and Chief Executive Officer.

Greco continued, “Our bottom line in the quarter reflects a

planned inventory reduction along with sustained investments in the

customer to accelerate top line growth. Our first priority is to

deliver an outstanding experience for our customers and deliver

consistent top line performance. We fully expect to balance our top

and bottom line performance over time as we offset investments with

a robust productivity agenda.”

Fourth Quarter and Full Year 2016 Highlights

Total sales for the fourth quarter increased 2.4% to $2.08

billion, as compared with total sales during the fourth quarter of

fiscal 2015 of $2.03 billion. The sales increase was driven by the

comparable store sales growth of 3.1%, inclusive of the positive

impact of the year-over-year comparable benefit from holiday timing

and new store and Worldpac branch openings partially offset by the

store closures and Carquest store consolidations. Total sales for

fiscal 2016 were $9.57 billion compared to fiscal 2015 of $9.74

billion.

The Company's Gross Profit rate was 43.6% of sales during the

fourth quarter as compared to 44.7% during the fourth quarter last

year. The 114 basis-point decrease was primarily driven by

previously capitalized supply chain costs flowing through the

income statement and reducing gross profit as a result of the

planned reduction of inventory levels. The Company's Gross Profit

rate was 44.5% of sales for fiscal 2016 as compared to 45.4% for

fiscal 2015.

On a GAAP basis, the Company's SG&A rate was 38.5% of sales

during the fourth quarter as compared to 39.8% during the same

period last year. The 128 basis-point decrease was primarily due to

lower integration and restructuring related costs during the fourth

quarter compared to last year. Excluding this impact, the Company's

Adjusted SG&A rate was 37.5% of sales during the fourth quarter

as compared to 37.0% during the same period last year. The 58

basis-point increase in Adjusted SG&A was primarily driven by

ongoing customer focused investments. On a GAAP basis, the

Company's SG&A rate was 36.3% of sales for fiscal 2016 as

compared to 36.9% during the same period last year. The Company's

Adjusted SG&A rate was 35.1% of sales during fiscal 2016 as

compared to 35.2% during the same period last year.

On a GAAP basis, the Company's Operating Income during the

fourth quarter was $106.1 million, an increase of 5.4% versus the

fourth quarter of fiscal 2015. On a GAAP basis, the Operating

Income rate was 5.1% during the fourth quarter as compared to 5.0%

during the fourth quarter of fiscal 2015. The Company's Adjusted

Operating Income was $125.6 million during the fourth quarter, a

decrease of 20.3% versus the fourth quarter of fiscal 2015. As a

percentage of sales, Adjusted Operating Income in the fourth

quarter was 6.0% versus 7.7% during the fourth quarter of fiscal

2015. For fiscal 2016, the Company's GAAP Operating Income rate was

8.2% versus 8.5% during fiscal 2015. For fiscal 2016, the Company's

Adjusted Operating Income was 9.4% versus 10.2% during fiscal

2015.

Operating cash flow decreased approximately 27.4% to $500.9

million in fiscal 2016 from $689.6 million in fiscal 2015. Free

cash flow was $241.3 million in fiscal 2016 compared to $454.9

million in fiscal 2015. Capital expenditures in fiscal 2016 were

$259.6 million as compared to $234.7 million in fiscal 2015.

Store Information

As of December 31, 2016, the Company operated 5,062 stores

and 127 Worldpac branches and served approximately 1,250

independently owned Carquest stores.

2017 Full Year Assumptions

New Stores

75 to 85 new stores including Worldpac branches Comparable

Store Sales (1)

0% to 2% Adjusted Operating Income Rate (2)

15 to 35 basis points

improvement Income Tax Rate (3)

37.5% to 38.0% Integration Expenses (2)

Approximately $30

million to $35 million Capital Expenditures

Approximately $250 million Free

Cash Flow

Minimum $400 million Diluted Share Count

Approximately 74 million shares

1.

Comparable store sales estimate excludes sales to independently

owned Carquest locations and includes the impact of Carquest store

consolidations. 2. Adjusted Operating Income excludes

non-operational expenses related to the integration of General

Parts ("Integration Expenses") and the recurring non-cash

amortization of General Parts' intangible assets. Adjusted

Operating Income is a non-GAAP measure. Management believes

Adjusted Operating Income is an important measure in assessing the

overall performance of the business and utilizes this metric in its

ongoing reporting. On that basis, Management believes it is useful

to provide Adjusted Operating Income to investors and prospective

investors to evaluate Advance’s operating performance across

periods adjusting for these items. Adjusted Operating Income might

not be calculated in the same manner as, and thus might not be

comparable to, similarly titled measures reported by other

companies. Adjusted Operating Income should not be used by

investors or third parties as the sole basis for formulating

investment decisions, as it excludes a number of important cash and

non-cash recurring items. Please refer to a more detailed

explanation of the Company's use of non-GAAP financial measures in

the accompanying financial tables where the Company provides a

reconciliation of its 2016 and 2015 financial results reported on a

GAAP basis to the adjusted basis. Because of the forward-looking

nature of the 2017 non-GAAP financial measures, specific

quantifications of the amounts that would be required to reconcile

these non-GAAP financial measures to their most directly comparable

GAAP financial measures are not available at this time. 3.

Income tax rate estimate does not factor in any impact from the

adoption of Accounting Standards Update (ASU) 2016-09 related to

changes in the presentation of excess tax benefits (deficits) from

share-based payment awards. The Company will adopt the provisions,

as specified by the ASU, effective fiscal 2017.

Dividend

On February 15, 2017, the Company's Board of Directors

declared a regular quarterly cash dividend of $0.06 per share to be

paid on April 7, 2017 to stockholders of record as of

March 24, 2017.

Investor Conference Call

The Company will host a conference call on Tuesday, February 21,

2017, at 8:00 a.m. Eastern time to discuss its quarterly results.

To listen to the live call, log on to the Company's website,

www.advanceautoparts.com, or dial (866) 908-1AAP. The call will be

archived on the Company's website until February 22, 2018.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket

parts provider that serves both professional installer and

do-it-yourself customers. As of December 31, 2016, Advance

operated 5,062 stores and 127 Worldpac branches and employed 74,000

Team Members in the United States, Canada, Puerto Rico and the U.S.

Virgin Islands. The company also serves approximately 1,250

independently owned Carquest branded stores across these locations

in addition to Mexico and the Bahamas, Turks and Caicos, British

Virgin Islands and Pacific Islands. Additional information about

the Company, employment opportunities, customer services, and

on-line shopping for parts, accessories and other offerings can be

found on the Company's website at www.AdvanceAutoParts.com.

Forward Looking Statements

Certain statements contained in this release are forward-looking

statements, as that term is used in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements address

future events or developments, and typically use words such as

believe, anticipate, expect, intend, plan, forecast, outlook or

estimate. These forward looking statements include, but are not

limited to, key assumptions for 2017 financial performance

including adjusted operating income; statements regarding expected

growth and future performance of Advance Auto Parts, Inc. (AAP),

including store growth, capital expenditures, comparable store

sales, gross profit rate, SG&A, adjusted operating income, free

cash flow, income tax rate, General Parts integration costs and

adjusted operating income rate targets; expectations regarding

leadership changes and their impact on the company’s strategies,

opportunities and results; statements regarding enhancements to

shareholder value; statements regarding strategic plans or

initiatives, growth or profitability; and all other statements that

are not statements of historical facts. These forward-looking

statements are subject to significant risks, uncertainties and

assumptions, and actual future events or results may differ

materially from such forward-looking statements. Such differences

may result from, among other things, AAP’s ability to implement its

business and growth strategy; ability to attract, develop and

retain executives and other employees; changes in regulatory,

social and political conditions, as well as general economic

conditions; competitive pressures; demand for AAP’s products; the

market for auto parts; the economy in general; inflation; consumer

debt levels; the weather; business interruptions; information

technology security; availability of suitable real estate;

dependence on foreign suppliers; and other factors disclosed in

AAP’s 10-K for the fiscal year ended January 2, 2016 and other

filings made by AAP with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on these

forward-looking statements. AAP intends these forward-looking

statements to speak only as of the time of this communication and

does not undertake to update or revise them as more information

becomes available.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (in thousands)

(unaudited)

December 31,2016

January 2,2016

Assets

Current assets: Cash and cash equivalents $ 135,178 $

90,782 Receivables, net 641,252 597,788 Inventories, net 4,325,868

4,174,768 Other current assets 70,466 77,408 Total

current assets 5,172,764 4,940,746

Property and

equipment, net 1,446,340 1,434,577

Goodwill 990,877

989,484

Intangible assets, net 640,903 687,125

Other

assets, net 64,149 75,769 $ 8,315,033 $ 8,127,701

Liabilities and

Stockholders' Equity

Current liabilities: Current portion of long-term

debt $ 306 $ 598 Accounts payable 3,086,177 3,203,922 Accrued

expenses 554,397 553,163 Other current liabilities 35,166

39,794 Total current liabilities 3,676,046 3,797,477

Long-term debt 1,042,949 1,206,297

Deferred income

taxes 454,282 433,925

Other long-term liabilities

225,564 229,354

Total stockholders' equity 2,916,192

2,460,648 $ 8,315,033 $ 8,127,701

NOTE: These preliminary condensed

consolidated balance sheets have been prepared on a basis

consistent with our previously prepared balance sheets filed with

the Securities and Exchange Commission for our prior quarter and

annual report, but do not include the footnotes required by

generally accepted accounting principles, or GAAP, for complete

financial statements. The Company retrospectively adopted ASU

2015-03 in the first quarter of 2016, which resulted in a

reclassification of debt issuance costs from Other assets, net to

Long-term debt.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations Twelve

and Fifty-Two Week Periods Ended December 31, 2016 and

January 2, 2016 (in thousands, except per share data)

(unaudited)

Q4 2016 Q4 2015 YTD 2016 YTD 2015

Net sales $ 2,082,891 $ 2,033,545 $ 9,567,679 $ 9,737,018

Cost of sales 1,175,327 1,124,373

5,311,764 5,314,246 Gross profit

907,564 909,172 4,255,915 4,422,772 Selling, general and

administrative expenses 801,417 808,494

3,468,317 3,596,992 Operating income

106,147 100,678 787,598

825,780 Other, net: Interest expense (13,365 )

(13,809 ) (59,910 ) (65,408 ) Other (expense) income, net

4,129 (3,044 ) 11,147 (7,484 )

Total other, net (9,236 ) (16,853 ) (48,763 )

(72,892 ) Income before provision for income taxes 96,911

83,825 738,835 752,888 Provision for income taxes 34,546

29,006 279,213 279,490

Net income $ 62,365 $ 54,819 $ 459,622

$ 473,398 Basic earnings per common share (a) $ 0.84

$ 0.75 $ 6.22 $ 6.45 Diluted earnings per common share (a) $ 0.84 $

0.74 $ 6.20 $ 6.40 Average common shares outstanding (a)

73,685 73,263 73,562 73,190 Average diluted common shares

outstanding (a) 73,886 73,861 73,856 73,733

(a)

Average common shares outstanding is

calculated based on the weighted average number of shares

outstanding during the quarter or year-to-date period, as

applicable. At December 31, 2016 and January 2, 2016, we had 73,749

and 73,314 shares outstanding, respectively.

NOTE: These preliminary condensed

consolidated statements of operations have been prepared on a basis

consistent with our previously prepared statements of operations

filed with the Securities and Exchange Commission for our prior

quarter and annual report, with the exception of the footnotes

required by GAAP for complete financial statements.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows Forty

Week Periods Ended December 31, 2016 and January 2, 2016

(in thousands) (unaudited)

December 31,2016

January 2,2016

Cash flows from operating activities: Net income $

459,622 $ 473,398 Depreciation and amortization 258,387 269,476

Share-based compensation 20,452 36,929 Provision (benefit) for

deferred income taxes 20,213 (9,219 ) Excess tax benefit from

share-based compensation (22,429 ) (13,002 ) Other non-cash

adjustments to net income 3,960 15,542 (Increase) decrease in:

Receivables, net (41,642 ) (21,476 ) Inventories, net (144,603 )

(244,096 ) Other assets 14,421 7,423 (Decrease) increase in:

Accounts payable (119,325 ) 119,164 Accrued expenses 49,341 35,103

Other liabilities 2,477 20,400 Net cash

provided by operating activities 500,874 689,642

Cash

flows from investing activities: Purchases of property and

equipment (259,559 ) (234,747 ) Business acquisitions, net of cash

acquired (4,697 ) (18,889 ) Proceeds from sales of property and

equipment 2,212 270 Net cash used in

investing activities (262,044 ) (253,366 )

Cash flows

from financing activities: Decrease in bank overdrafts (5,573 )

(2,922 ) Net payments on credit facilities (160,000 ) (423,400 )

Dividends paid (17,738 ) (17,649 ) Proceeds from the issuance of

common stock, primarily for employee stock purchase plan 4,532

5,174 Tax withholdings related to the exercise of stock

appreciation rights (19,558 ) (13,112 ) Excess tax benefit from

share-based compensation 22,429 13,002 Repurchase of common stock

(18,393 ) (6,665 ) Other (390 ) (380 ) Net cash used

in financing activities (194,691 ) (445,952 )

Effect of exchange rate changes on cash 257

(4,213 )

Net increase (decrease) in cash and cash

equivalents 44,396 (13,889 )

Cash and cash equivalents,

beginning of period 90,782 104,671

Cash and cash equivalents, end of period $ 135,178 $

90,782

NOTE: These preliminary condensed

consolidated statements of cash flows have been prepared on a

consistent basis with previously prepared statements of cash flows

filed with the Securities and Exchange Commission for our prior

quarter and annual report, but do not include the footnotes

required by GAAP for complete financial statements.

Reconciliation of Non-GAAP Financial

Measures

The Company's financial results include certain financial

measures not derived in accordance with generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures

should not be used as a substitute for GAAP financial measures, or

considered in isolation, for the purpose of analyzing our operating

performance, financial position or cash flows. However, the Company

has presented these non-GAAP financial measures as management

believes that the presentation of its financial results that

exclude non-cash charges related to the acquired General Parts

intangibles and non-operational expenses associated with i) the

integration of General Parts, ii) store consolidation costs and

iii) support center restructuring costs is useful and indicative of

its base operations because the expenses vary from period to period

in terms of size, nature and significance and relate to the

integration of General Parts and store closure activity in excess

of historical levels. These measures assist in comparing the

Company's current operating results with past periods and with the

operational performance of other companies in the industry. The

disclosure of these measures allow investors to evaluate the

Company’s performance using the same measures management uses in

developing internal budgets and forecasts and in evaluating

management’s compensation. Included below is a description of the

expenses the Company has determined are not normal, recurring cash

operating expenses necessary to operate the Company’s business and

the rationale for why providing these measures are useful to

investors as a supplement to the GAAP measures.

General Parts Integration Expenses

- As disclosed in the Company’s filings with the Securities and

Exchange Commission, the Company acquired General Parts

International, Inc. (“General Parts”) for $2.08 billion on January

2, 2014 and is in the midst of a multi-year integration plan to

integrate the operations of General Parts with Advance Auto Parts.

This includes the integration of product brands and assortments,

supply chain and information technology. The integration is being

completed in phases and the nature and timing of expenses will vary

from quarter to quarter over several years. The integration of

product brands and assortments was primarily completed in 2015 and

the focus has shifted to integrating the supply chain and

information technology systems beginning in 2016. Due to the size

of the acquisition, the Company considers these expenses to be

outside of its base business. Therefore, the Company believes

providing additional information in the form of non-GAAP measures

that exclude these costs is beneficial to the users of its

financial statements in evaluating the operating performance of the

base business and its sustainability once the integration is

completed.

Store Closure and Consolidation

Expenses - Store consolidation expenses consist of expenses

associated with the Company’s announced plans to (i) convert or

consolidate the Carquest stores acquired from General Parts, (ii)

close its Autopart International stores in Florida and (iii) close

approximately 80 underperforming Advance Auto Parts stores in the

fourth quarter of fiscal 2015. The conversion and consolidation of

the Carquest stores is a multi-year process that began in 2014. As

of December 31, 2016, 615 Carquest stores acquired from General

Parts had been consolidated or converted into existing Advance Auto

Parts stores format. As of December 31, 2016, the Company operated

608 stores under the Carquest name. The closure of the 40 Autopart

International stores in Florida, primarily in the first quarter of

2015, and closure of 80 underperforming Advance Auto Parts stores

in the fourth quarter of 2015 significantly exceed the Company’s

average store closure activity. While periodic store closures are

common, these closures represent major programs outside of the

Company’s typical market evaluation process. The Company also

continues to have store closures that occur as part of its normal

market evaluation process and has not excluded the expenses

associated with these store closures in computing the Company’s

non-GAAP measures. The Company believes it is useful to provide

additional non-GAAP measures that exclude these costs to provide

investors greater comparability of our base business and core

operating performance.

Support Center Restructuring

Expenses - The costs excluded for support center

restructuring activities include costs associated with (i) closing

the Company’s Minnesota office and relocating functions to existing

offices, (ii) relocating functions within the Company’s Roanoke, VA

office and Raleigh, NC office (formerly the headquarters for

General Parts) and (iii) eliminating duplicative functions between

these two offices. These actions are a direct consequence of the

acquisition and integration of General Parts and therefore the

Company does not consider these expenses to be normal, recurring,

cash operating expenses necessary to operate its business. These

actions were substantially completed as of the end of fiscal 2015

and the Company has had no material support center restructuring

expenses following the end of fiscal 2015.

The Company has included a reconciliation of this information to

the most comparable GAAP measures in the following tables.

Reconciliation of

Adjusted Net Income and Adjusted EPS:

Twelve Week Periods Ended(in

thousands, except per share data)

Fifty-Two Week Periods Ended(in

thousands, except per share data)

December 31,2016

January 2,2016

December 31,2016

January 2,2016

Net income (GAAP) $ 62,365 $ 54,819 $ 459,622 $ 473,398 SG&A

adjustments (a) 19,477 56,881 113,768 169,340 Provision for income

taxes on adjustments (b) (7,401 ) (21,615 )

(43,232 ) (64,349 ) Adjusted net income $ 74,441 $

90,085 $ 530,158 $ 578,389 Diluted

earnings per common share (GAAP) $ 0.84 $ 0.74 $ 6.20 $ 6.40

SG&A adjustments, net of tax 0.16 0.48

0.95 1.42 Adjusted EPS $ 1.00

$ 1.22 $ 7.15 $ 7.82

Reconciliation of

Adjusted Selling, General and Administrative

Expenses:

Twelve Week Periods Ended(in

thousands)

Fifty-Two Week Periods Ended(in

thousands)

December 31,2016

January 2,2016

December 31,2016

January 2,2016

SG&A (GAAP) $ 801,417 $ 808,494 $ 3,468,317 $ 3,596,992

SG&A adjustments (a) (19,477 ) (56,881 )

(113,768 ) (169,340 ) Adjusted SG&A $ 781,940 $

751,613 $ 3,354,549 $ 3,427,652

Reconciliation of

Adjusted Operating Income:

Twelve Week Periods Ended(in

thousands)

Fifty-Two Week Periods Ended(in

thousands)

December 31,2016

January 2,2016

December 31,2016

January 2,2016

Operating income (GAAP) $ 106,147 $ 100,678 $ 787,598 $ 825,780

SG&A adjustments (a) 19,477 56,881

113,768 169,340 Adjusted operating

income $ 125,624 $ 157,559 $ 901,366 $ 995,120

(a)

The adjustments to SG&A expenses for

the twelve and fifty-two weeks ended December 31, 2016 include

General Parts integration, store consolidation costs and support

center restructuring costs of $10,084 and $72,828 and General Parts

amortization of acquired intangible assets of $9,393 and $40,940,

respectively. The adjustments to SG&A expenses for the twelve

and fifty-two weeks ended January 2, 2016 include General Parts

integration, store consolidation costs and support center

restructuring costs of $47,213 and $127,059 and General Parts

amortization of acquired intangible assets of $9,668 and $42,281,

respectively.

(b)

The income tax impact of non-GAAP

adjustments is calculated using the estimated tax rate in effect

for the respective non-GAAP adjustments.

Reconciliation of

Free Cash Flow:

Fifty-Two Week Periods Ended

December 31,2016

January 2,2016

Cash flows from operating activities $ 500,874 $ 689,642 Purchases

of property and equipment (259,559 ) (234,747 ) Free

cash flow $ 241,315 $ 454,895

NOTE: Management uses free cash flow as a

measure of our liquidity and believes it is a useful indicator to

stockholders of our ability to implement our growth strategies and

service our debt. Free cash flow is a non-GAAP measure and should

be considered in addition to, but not as a substitute for,

information contained in our condensed consolidated statement of

cash flows.

Adjusted Debt to

Adjusted EBITDAR:

(In thousands, except adjusted debt to

adjusted EBITDAR ratio)

Four Quarters Ended

December 31,2016

January 2,2016

Total debt (a) $ 1,043,255 $ 1,206,895 Add: Capitalized lease

obligation (rent expense * 6) 3,221,202 3,190,728

Adjusted debt 4,264,457 4,397,623 Operating income 787,598

825,780 Add: Adjustments (b) 72,828 127,059 Depreciation and

amortization 258,387 269,476 Adjusted EBITDA

1,118,813 1,222,315 Rent expense (less favorable lease amortization

of $3,498 and $4,786, respectively) 536,867 531,788

Adjusted EBITDAR $ 1,655,680 $ 1,754,103

Adjusted Debt to

Adjusted EBITDAR 2.6 2.5

(a)

The Company retrospectively adopted ASU

2015-03 in the first quarter of 2016, which resulted in a

reclassification of debt issuance costs from Other assets, net to

Long-term debt.

(b)

The adjustments to the four quarters ended

December 31, 2016 include General Parts integration, store closure

and consolidation costs and support center restructuring costs of

$72.8 million. The adjustments to Fiscal 2015 include General Parts

integration, store closure and store consolidation costs and

support center restructuring costs of $127.1 million.

NOTE: Management believes its Adjusted

Debt to Adjusted EBITDAR ratio (“leverage ratio”) is a key

financial metric for debt securities, as reviewed by rating

agencies, and believes its debt levels are best analyzed using this

measure. The Company’s goal is to maintain a 2.5 times leverage

ratio and investment grade rating. The Company's credit rating

directly impacts the interest rates on borrowings under its

existing credit facility and could impact the Company's ability to

obtain additional funding. If the Company was unable to maintain

its investment grade rating this could negatively impact future

performance and limit growth opportunities. Similar measures are

utilized in the calculation of the financial covenants and ratios

contained in the Company's financing arrangements. The leverage

ratio calculated by the Company is a non-GAAP measure and should

not be considered a substitute for debt to net earnings, net

earnings or debt as determined in accordance with GAAP. The Company

adjusts the calculation to remove rent expense and capitalize the

Company’s existing operating leases to provide a more meaningful

comparison with the Company’s peers and to account for differences

in debt structures and leasing arrangements. The use of a multiple

of rent expense to calculate the adjustment for capitalized

operating lease obligations is a commonly used method of estimating

the debt the Company would record for its leases that are

classified as operating if they had met the criteria for a capital

lease or the Company had purchased the property. The Company’s

calculation of its leverage ratio might not be calculated in the

same manner as, and thus might not be comparable to, similarly

titled measures by other companies.

Store Information:

As of December 31, 2016, the Company operated 5,062 stores

and 127 Worldpac branches and served approximately 1,250

independently owned Carquest stores. The below table summarizes the

changes in the number of the company-operated stores and branches

during the twelve and fifty-two weeks ended December 31,

2016.

AAP

AI CARQUEST WORLDPAC

Total October 8, 2016 4,237

181 640 127 5,185 New 22 — 3 — 25

Closed (2 ) — (2 ) — (4 ) Consolidated — — (17 ) — (17 ) Converted

16 — (16 ) — —

December 31,

2016 4,273 181

608 127 5,189 January

2, 2016 4,102 184 885 122

5,293 New 64 — 9 5 78 Closed (13 ) (3 ) (7 ) — (23 )

Consolidated (3 ) — (156 ) — (159 ) Converted 123 —

(123 ) — —

December 31, 2016

4,273 181 608

127 5,189

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170221005623/en/

Advance Auto Parts, Inc.Media ContactLaurie Stacy,

540-561-1206laurie.stacy@advanceautoparts.comorInvestor

ContactZaheed Mawani,

919-573-3848zaheed.mawani@advanceautoparts.com

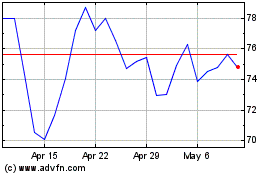

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Apr 2023 to Apr 2024