SEC 873 (03/2003) Potential persons who are to respond to the collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control number.

|

|

OMB APPROVAL |

|

OMB Number: 3235-0060 |

Expires: March 31, 2018 |

Estimated average burden |

hours per response..............5.71 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 11, 2016

ADVANCE AUTO PARTS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-16797 | 54-2049910 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

|

| |

5008 Airport Road, Roanoke, Virginia | 24012 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (540) 362-4911

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

oWritten communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

oSoliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

oPre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

oPre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

INFORMATION TO BE INCLUDED IN THE REPORT

Item 2.02 Results of Operations and Financial Condition.

On February 11, 2016, Advance Auto Parts, Inc. (the "Company") issued a press release setting forth its financial results for its fourth quarter and fiscal 2015 year ended January 2, 2016. This release includes forward looking statements including, but are not limited to, statements related to the Company's 2016 fiscal year.

The Company's financial results for the fourth quarter and fiscal year ended January 2, 2016 and January 3, 2015 include General Parts International, Inc. ("GPI") integration costs, store closure and consolidation costs, support center restructuring expenses and amortization of GPI acquired intangible assets. In addition, the fourth quarter and fiscal year ended January 3, 2015 included an additional week of operations (53rd week). As a result of these expenses and the additional week, the Company’s financial results for these periods are not comparable with prior periods. Thus, the Company’s financial results have been presented in this press release on both a generally accepted accounting principles ("GAAP") basis and on a comparable basis to exclude the impact of the 53rd week and the integration costs, store closure and consolidation costs, restructuring expenses and amortization recognized in the respective periods. The Company has provided the required reconciliation of the financial results reported on a comparable basis to the most directly comparable GAAP basis and has provided an explanation as to why the financial results presented on a non-GAAP basis are useful to investors.

The press release is attached as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

| Exhibit Number | |

| | |

| 99.1 | Press Release, dated February 11, 2016, issued by Advance Auto Parts, Inc. |

Note: The information contained in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ADVANCE AUTO PARTS, INC. |

| | (Registrant) |

| | |

Date: February 11, 2016 | | /s/ Michael A. Norona |

| | (Signature)* |

| | Michael A. Norona |

| | Executive Vice President and Chief Financial Officer |

* Print name and title of the signing officer under his signature.

EXHIBIT INDEX

|

| |

Exhibit Number | |

99.1 | Press Release, dated February 11, 2016, issued by Advance Auto Parts, Inc. |

Exhibit 99.1

|

| |

News Release | Advance Auto Parts |

5008 Airport Road |

| Roanoke, VA 24012 |

| |

| Laurie Stacy |

| Media Contact |

| t: 540-561-8452 |

| e: laurie.stacy@advanceautoparts.com |

| |

| Zaheed Mawani |

| Investor Contact |

| t: 919-573-3848 |

| e: zaheed.mawani@advanceautoparts.com |

Advance Auto Parts Reports Fourth Quarter Fiscal 2015 Comparable Cash EPS of $1.22

ROANOKE, Va., February 11, 2016 - Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive aftermarket parts provider in North America, serving both professional installer and do-it-yourself customers, today announced its financial results for the fourth quarter ended January 2, 2016. Fourth quarter comparable cash earnings per diluted share (Comparable Cash EPS) were $1.22. These results exclude $0.08 of amortization of acquired intangible assets and integration and restructuring costs of $0.40, primarily associated with the acquisition of General Parts International, Inc. (General Parts).

|

| | | | | | | | | | | | | | | | |

Comparable Fourth Quarter and Full Year Performance Summary (1) |

| | | | | | | | |

| | Twelve Weeks Ended | | Fifty-Two Weeks Ended |

| | January 2,

2016 | | January 3,

2015 | | January 2,

2016 | | January 3,

2015 |

| | | | | | | | |

Comparable Sales (in millions) | | $ | 2,033.5 |

| | $ | 2,086.8 |

| | $ | 9,737.0 |

| | $ | 9,693.5 |

|

| | | | | | | | |

Comp Store Sales % | | (2.5 | %) | | 1.1 | % | | 0.0 | % | | 2.0 | % |

| | | | | | | | |

Comparable Gross Profit (in millions) | | $ | 909.2 |

| | $ | 936.2 |

| | $ | 4,422.8 |

| | $ | 4,385.8 |

|

| | | | | | | | |

Comparable SG&A (in millions) | | $ | 751.6 |

| | $ | 764.5 |

| | $ | 3,427.7 |

| | $ | 3,430.3 |

|

| | | | | | | | |

Comparable Operating Income (in millions) | | $ | 157.6 |

| | $ | 171.7 |

| | $ | 995.1 |

| | $ | 955.6 |

|

| | | | | | | | |

Comparable Cash EPS | | $ | 1.22 |

| | $ | 1.37 |

| | $ | 7.82 |

| | $ | 7.59 |

|

| | | | | | | | |

Avg Diluted Shares (in thousands) | | 73,861 |

| | 73,494 |

| | 73,733 |

| | 73,414 |

|

| |

(1) | Fiscal 2015 and 2014 include certain non-comparable expenses and Fiscal 2014 includes an additional week of business (53rd week). The Comparable SG&A, Comparable Operating Income and Comparable Cash EPS for the twelve weeks ended January 2, 2016 and January 3, 2015, respectively, have been reported on a comparable basis to exclude General Parts integration, store closure and consolidation costs and support center restructuring costs of $47.2 million and $36.7 million, respectively, and General Parts amortization of acquired intangible assets of $9.7 million and $9.9 million, respectively. The Comparable SG&A, Comparable Operating Income and Comparable Cash EPS for the fiscal years ended January 2, 2016 and January 3, 2015, respectively, have been reported on a comparable basis to exclude General Parts integration, store consolidation costs and support center restructuring costs of $127.1 million and $82.2 million, respectively, and General Parts amortization of acquired intangible assets of $42.3 million and $42.7 million, respectively. Comparable Sales and Comparable Gross Profit for the twelve and fifty-two weeks ended January 3, 2015 have been reported on a comparable basis to exclude the impact of the 53rd week. For a better understanding of the Company's comparable results, refer to the presentation of the respective financial measures on a GAAP basis and reconciliation of the financial results reported on a comparable basis to the GAAP basis in the accompanying financial tables in this press release. |

“Fourth quarter sales results did not meet our expectations, however, we demonstrated additional cost discipline to offset the softer than expected sales and met our earnings expectations," said George Sherman, President and Interim Chief Executive Officer. "We are a company composed of 5,300 hyper-local businesses that serve the needs of our valuable local customers. We recognize that the best way to substantially improve our customers' experience is to empower our terrific team members who touch those customers every day. We are therefore adapting to a more empowered, field-centric organization that aggressively pursues improved profitability while achieving better than market top line growth. We are relentlessly pursuing opportunities to reduce expenses and increase efficiency while providing our customers with an exemplary experience that drives increased frequency. Through these actions, we fully expect to generate greater profitability and value for our shareholders."

Fourth Quarter & Full Year 2015 Highlights

On a Comparable basis, total sales for the fourth quarter decreased 2.6% to $2.03 billion, as compared with total sales during the fourth quarter of fiscal 2014 of $2.09 billion. The sales decline was driven by the comparable store sales decrease of 2.5% and the impact of previously announced store closures executed in the fourth quarter partially offset by new store openings. Our comparable store sales were negatively impacted by approximately 90 basis points related to the year-over-year timing of the New Year's day holiday which fell in the 53rd week last year, 46 basis points due to foreign exchange currency fluctuations from our Canadian business, as well as lower demand for seasonal categories due to warmer winter weather, partially offset by the favorable consolidation impact from Carquest stores. On a GAAP basis, total sales for the fourth quarter were $2.03 billion for fiscal 2015 compared to $2.24 billion for the fourth quarter of fiscal 2014. For fiscal 2015, the Company's Comparable and GAAP total sales were $9.74 billion. On a Comparable and GAAP basis, the Company's total sales for fiscal 2014 were $9.69 billion and $9.84 billion, respectively.

On both a Comparable and GAAP basis, the Company's Gross Profit rate was 44.7% of sales during the fourth quarter as compared to 44.9% during the fourth quarter last year. The 15 basis-point decrease in gross profit rate was primarily the result of supply chain expense deleverage due to the comparable store sales decline, partially offset by lower shrink expenses. On a Comparable and GAAP basis, the Company's gross profit rate was 45.4% for fiscal 2015 versus 45.2% over the same period last year.

The Company's Comparable SG&A rate was 37.0% of sales during the fourth quarter as compared to 36.6% during the same period last year. The 33 basis-point increase was primarily the result of expense deleverage from the comparable store sales decline partially offset by our continued cost reduction initiatives and disciplined efforts to lower administrative and support costs. On a GAAP basis, the Company's SG&A rate was 39.8% of sales during the fourth quarter as compared to 38.3% during the same period last year. For fiscal 2015, the Company's Comparable SG&A rate was 35.2% versus 35.4% over the same period last year. On a GAAP basis, the Company's SG&A rate was 36.9% for fiscal 2015 versus 36.6% over the same period last year.

The Company's Comparable Operating Income was $157.6 million during the fourth quarter, a decrease of 8.2% versus the fourth quarter of fiscal 2014. As a percentage of sales, Comparable Operating Income in the fourth quarter was 7.7% compared to 8.2% during the fourth quarter of fiscal 2014. On a GAAP basis, the Company's operating income during the fourth quarter of $100.7 million decreased 31.1% versus the fourth quarter of fiscal 2014. On a GAAP basis, the Operating Income rate was 5.0% during the fourth quarter as compared to 6.5% during the fourth

quarter of fiscal 2014. For fiscal 2015, the Company's Comparable Operating Income rate was 10.2% versus 9.9% during fiscal 2014. For fiscal 2015, the Company's GAAP Operating Income rate was 8.5% versus 8.7% during fiscal 2014.

Operating cash flow decreased approximately 2.7% to $689.6 million in fiscal 2015 from $709.0 million in fiscal 2014. Free cash flow decreased to $454.9 million in fiscal 2015 from $480.5 million in fiscal 2014. Capital expenditures in fiscal 2015 were $234.7 million as compared to $228.4 million in fiscal 2014.

Store Information

As of January 2, 2016, the Company operated 5,171 stores and 122 Worldpac branches and served approximately 1,300 independently owned Carquest stores. The below table summarizes the changes in the number of the company-operated stores and branches during the fiscal 2015 year ended January 2, 2016.

|

| | | | | | | | | | | | | | | | | | |

| | AAP | | AI | | BWP | | CARQUEST | | WORLDPAC | | Total |

| | | | | | | | | | | | |

January 3, 2015 | | 3,888 |

| | 210 |

| | 38 |

| | 1,125 |

| | 111 |

| | 5,372 |

|

New | | 82 |

| | 5 |

| | — |

| | 23 |

| | 11 |

| | 121 |

|

Closed | | (50 | ) | | (2 | ) | | (2 | ) | | (35 | ) | | — |

| | (89 | ) |

Consolidated | | (2 | ) | | (25 | ) | | (4 | ) | | (80 | ) | | — |

| | (111 | ) |

Converted | | 184 |

| | (4 | ) | | (20 | ) | | (160 | ) | | — |

| | — |

|

January 2, 2016 | | 4,102 |

| | 184 |

| | 12 |

| | 873 |

| | 122 |

| | 5,293 |

|

2016 Key Assumptions

|

| |

New Stores | 65 to 75 new stores including Worldpac branches |

Carquest Store Consolidations, Conversions & Relocations | 325 to 350 |

Comparable Store Sales(1) | Low Single Digits |

Adjusted Operating Income Rate (2) | 12% |

Income tax rate | 37.5% to 38.0% |

One-time Integration & Restructuring Expenses (3) | Approximately $75 million to $90 million |

Capital Expenditures | $260 million to $280 million |

Free Cash Flow | Minimum $500 million |

Diluted Share Count | Approximately 74 million shares |

| |

1. | Comparable store sales estimate excludes sales to independently owned Carquest locations and includes the impact of Carquest store consolidations. |

| |

2. | Adjusted Operating Income excludes one-time expenses related to the integration of General Parts, restructuring expenses and the recurring amortization of General Parts' intangible assets. Adjusted Operating Income is a non-GAAP measure. Because of the forward-looking nature of these non-GAAP financial measures, specific quantifications of the amounts that would be required to reconcile these non-GAAP financial measures to their most directly comparable GAAP financial measures are not available at this time. Management believes Adjusted Operating Income is an important measure in assessing the overall performance of the business and utilizes this metric in its ongoing reporting. On that |

basis, Management believes it is useful to provide Adjusted Operating Income to investors and prospective investors to evaluate Advance’s operating performance across periods adjusting for non-operating items. Adjusted Operating Income might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures reported by other companies. Adjusted Operating Income should not be used by investors or third parties as the sole basis for formulating investment decisions, as it excludes a number of important cash and non-cash recurring items.

| |

3. | The $75 million to $90 million estimate of incremental one-time costs includes $65 million to $75 million related to ongoing integration efforts and an additional $10 million to $15 million related to supply chain optimization work which includes the closure of the Company's Sutton, MA distribution center and additional activities contemplated as part of the first phase of work. The Company will provide additional details of its multi-year supply chain optimization work and potential future one-time costs as it finalizes those plans. One-time integration related costs are expected to exceed the initial $190 million estimate previously shared at the time of the GPI acquisition as we have trued up estimates, expanded the scope and taken additional structural actions to drive improved efficiency and profitability. |

Dividend

On February 9, 2016, the Company's Board of Directors declared a regular quarterly cash dividend of $0.06 per share to be paid on April 1, 2016 to stockholders of record as of March 18, 2016.

Investor Conference Call

The Company will host a conference call on Thursday, February 11, 2016, at 8:30 a.m. Eastern Time to discuss its quarterly results. To listen to the live call, please log on to the Company's website, www.AdvanceAutoParts.com, or dial (866) 908-1AAP. The call will be archived on the Company's website until February 12, 2017.

About Advance Auto Parts

Headquartered in Roanoke, Va., Advance Auto Parts, Inc., a leading automotive aftermarket parts provider in North America, serves both professional installer and do-it-yourself customers. As of January 2, 2016 Advance operated 5,171 stores and 122 Worldpac branches and served approximately 1,300 independently owned Carquest branded stores in the United States, Puerto Rico, the U.S. Virgin Islands and Canada. Advance employs approximately 73,000 Team Members. Additional information about the Company, employment opportunities, customer services, and on-line shopping for parts, accessories and other offerings can be found on the Company's website at www.AdvanceAutoParts.com.

Forward Looking Statements

Certain statements contained in this release are forward-looking statements, as that term is used in the Private Securities Litigation Reform Act of 1995. Forward-looking statements address future events or developments, and typically use words such as believe, anticipate, expect, intend, plan, forecast, outlook or estimate. These forward looking statements include, but are not limited to, key assumptions for 2016 financial performance including adjusted operating income; statements regarding the benefits and other effects of the acquisition of General Parts and the combined company’s plans, objectives and expectations; statements regarding expected growth and future performance of Advance Auto Parts, Inc. (AAP), including store growth, capital expenditures, comparable store sales, gross profit rate, SG&A, adjusted operating income, free cash flow, income tax rate, General Parts integration costs and store consolidation costs, synergies, expenses to achieve synergies and adjusted operating income rate targets; expectations regarding leadership changes and their impact on the company’s strategies, opportunities and results;

statements regarding enhancements to shareholder value; statements regarding strategic plans or initiatives, growth or profitability; and all other statements that are not statements of historical facts. These forward-looking statements are subject to significant risks, uncertainties and assumptions, and actual future events or results may differ materially from such forward-looking statements. Such differences may result from, among other things, the risk that the benefits of the General Parts acquisition, including synergies, may not be fully realized or may take longer to realize than expected; the possibility that the General Parts acquisition may not advance AAP’s business strategy; the risk that AAP may experience difficulty integrating General Parts’ employees, business systems and technology; the potential diversion of AAP’s management’s attention from AAP’s other businesses resulting from the General Parts acquisition; the impact of the General Parts acquisition on third-party relationships, including customers, wholesalers, independently owned and jobber stores and suppliers; AAP’s ability to attract, develop and retain executives and other employees; changes in regulatory, social and political conditions, as well as general economic conditions; competitive pressures; demand for AAP’s and General Parts' products; the market for auto parts; the economy in general; inflation; consumer debt levels; the weather; business interruptions; information technology security; availability of suitable real estate; dependence on foreign suppliers; and other factors disclosed in AAP’s 10-K for the fiscal year ended January 3, 2015 and other filings made by AAP with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements. AAP intends these forward-looking statements to speak only as of the time of this communication and does not undertake to update or revise them as more information becomes available.

|

| | | | | | | | | |

Advance Auto Parts, Inc. and Subsidiaries | |

Condensed Consolidated Balance Sheets | |

(in thousands) | |

(unaudited) | |

| | | | | |

| | January 2,

2016 | | January 3,

2015 | |

| | | | | |

Assets | | | | | |

| | | | | |

Current assets: | | | | | |

Cash and cash equivalents | | $ | 90,782 |

| | $ | 104,671 |

| |

Receivables, net | | 597,788 |

| | 579,825 |

| |

Inventories, net | | 4,174,768 |

| | 3,936,955 |

| |

Other current assets | | 77,408 |

| | 119,589 |

| |

Total current assets | | 4,940,746 |

| | 4,741,040 |

| |

| | | | | |

Property and equipment, net | | 1,434,577 |

| | 1,432,030 |

| |

Goodwill | | 989,484 |

| | 995,426 |

| |

Intangible assets, net | | 687,125 |

| | 748,125 |

| |

Other assets, net | | 82,633 |

| | 45,737 |

| |

| | $ | 8,134,565 |

| | $ | 7,962,358 |

| |

| | | | | |

Liabilities and Stockholders' Equity | | | | | |

| | | | | |

Current liabilities: | | | | | |

Current portion of long-term debt | | $ | 598 |

| | $ | 582 |

| |

Accounts payable | | 3,203,922 |

| | 3,095,365 |

| |

Accrued expenses | | 553,163 |

| | 520,673 |

| |

Other current liabilities | | 39,794 |

| | 37,796 |

| |

Total current liabilities | | 3,797,477 |

| | 3,654,416 |

| |

| | | | | |

Long-term debt | | 1,213,161 |

| | 1,636,311 |

| |

Deferred income taxes | | 433,925 |

| | 446,351 |

| |

Other long-term liabilities | | 229,354 |

| | 222,368 |

| |

Total stockholders' equity | | 2,460,648 |

| | 2,002,912 |

| |

| | $ | 8,134,565 |

| | $ | 7,962,358 |

| |

| | | | | |

NOTE: These preliminary condensed consolidated balance sheets have been prepared on a basis consistent with our previously prepared balance sheets filed with the Securities and Exchange Commission for our prior quarter and annual report, but do not include the footnotes required by generally accepted accounting principles, or GAAP, for complete financial statements. The Company retrospectively adopted ASU 2015-17 in the fourth quarter of 2015, which requires the presentation of all deferred income taxes as long-term.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Advance Auto Parts, Inc. and Subsidiaries |

Condensed Consolidated Statements of Operations |

Fiscal Fourth Quarters Ended |

January 2, 2016 and January 3, 2015 |

(in thousands, except per share data) |

(unaudited) |

| | | | | | | | | | | | | | |

| | Q4 2015 | | Q4 2014 |

| | | | | | | | | | Comparable Adjustments (a) | | |

| | As Reported | | Comparable Adjustments (a) | | Comparable | | As Reported | | 53rd Week | | Integration Costs | | Comparable |

| | (12 weeks) | | | | (12 weeks) | | (13 weeks) | | | | | | (12 weeks) |

Net sales | | $ | 2,033,545 |

| | $ | — |

| | $ | 2,033,545 |

| | $ | 2,237,209 |

| | $ | (150,386 | ) | | $ | — |

| | $ | 2,086,823 |

|

Cost of sales | | 1,124,373 |

| | — |

| | 1,124,373 |

| | 1,233,268 |

| | (82,606 | ) | | — |

| | 1,150,662 |

|

Gross profit | | 909,172 |

| | — |

| | 909,172 |

| | 1,003,941 |

| | (67,780 | ) | | — |

| | 936,161 |

|

Selling, general and administrative expenses | | 808,494 |

| | (56,881 | ) | | 751,613 |

| | 857,864 |

| | (46,720 | ) | | (46,655 | ) | | 764,489 |

|

Operating income | | 100,678 |

| | 56,881 |

| | 157,559 |

| | 146,077 |

| | (21,060 | ) | | 46,655 |

| | 171,672 |

|

Other, net: | | | | | | | | | | | | | | |

Interest expense | | (13,809 | ) | | — |

| | (13,809 | ) | | (17,002 | ) | | 1,291 |

| | — |

| | (15,711 | ) |

Other (expense) income, net | | (3,044 | ) | | — |

| | (3,044 | ) | | 1,883 |

| | (212 | ) | | — |

| | 1,671 |

|

Total other, net | | (16,853 | ) | | — |

| | (16,853 | ) | | (15,119 | ) | | 1,079 |

| | — |

| | (14,040 | ) |

Income before provision for income taxes | | 83,825 |

| | 56,881 |

| | 140,706 |

| | 130,958 |

| | (19,981 | ) | | 46,655 |

| | 157,632 |

|

Provision for income taxes | | 29,006 |

| | 21,615 |

| | 50,621 |

| | 46,524 |

| | (7,610 | ) | | 17,729 |

| | 56,643 |

|

Net income | | $ | 54,819 |

| | $ | 35,266 |

| | $ | 90,085 |

| | $ | 84,434 |

| | $ | (12,371 | ) | | $ | 28,926 |

| | $ | 100,989 |

|

| | | | | | | | | | | | | | |

Basic earnings per share (b) | | $ | 0.75 |

| | $ | 0.48 |

| | $ | 1.23 |

| | $ | 1.15 |

| | $ | (0.17 | ) | | $ | 0.39 |

| | $ | 1.37 |

|

Diluted earnings per share (b) | | $ | 0.74 |

| | $ | 0.48 |

| | $ | 1.22 |

| | $ | 1.15 |

| | $ | (0.17 | ) | | $ | 0.39 |

| | $ | 1.37 |

|

| | | | | | | | | | | | | | |

Average common shares outstanding (b) | | 73,263 |

| | 73,263 |

| | 73,263 |

| | 72,997 |

| | 72,997 |

| | 72,997 |

| | 72,997 |

|

Average diluted common shares outstanding (b) | | 73,861 |

| | 73,861 |

| | 73,861 |

| | 73,494 |

| | 73,494 |

| | 73,494 |

| | 73,494 |

|

| |

(a) | The comparable adjustments to Selling, general and administrative expenses for Q4 2015 include General Parts integration, store closure and consolidation costs and support center restructuring costs of $47.2 million and General Parts amortization of acquired intangible assets of $9.7 million. The comparable adjustments to Q4 2014 include adjustments to remove the impact of the 53rd week of operations and adjustments to Selling, general and administrative expenses for General Parts integration and store consolidation costs of $36.7 million and General Parts amortization of acquired intangible assets of $9.9 million. |

| |

(b) | Average common shares outstanding is calculated based on the weighted average number of shares outstanding during the quarter. At January 2, 2016 and January 3, 2015, we had 73,314 and 73,074 shares outstanding, respectively. |

NOTE: These preliminary condensed consolidated statements of operations have been prepared on a basis consistent with our previously prepared statements of operations filed with the Securities and Exchange Commission for our prior quarter and annual report, with the exception of the footnotes required by GAAP for complete financial statements and inclusion of certain non-GAAP adjustments and measures as described in footnote (a) above. Management believes the reporting of comparable results is important in assessing the overall performance of the business and is therefore useful for investors and prospective investors.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Advance Auto Parts, Inc. and Subsidiaries |

Condensed Consolidated Statements of Operations |

Fiscal Years Ended |

January 2, 2016 and January 3, 2015 |

(in thousands, except per share data) |

(unaudited) |

| | | | | | | | | | | | | | |

| | 2015 | | 2014 |

| | | | | | | | | | Comparable Adjustments (a) | | |

| | As Reported | | Comparable Adjustments (a) | | Comparable | | As Reported | | 53rd Week | | Integration Costs | | Comparable |

| | (52 weeks) | | | | (52 weeks) | | (53 weeks) | | | | | | (52 weeks) |

Net sales | | $ | 9,737,018 |

| | $ | — |

| | $ | 9,737,018 |

| | $ | 9,843,861 |

| | $ | (150,386 | ) | | $ | — |

| | $ | 9,693,475 |

|

Cost of sales | | 5,314,246 |

| | — |

| | 5,314,246 |

| | 5,390,248 |

| | (82,606 | ) | | — |

| | 5,307,642 |

|

Gross profit | | 4,422,772 |

| | — |

| | 4,422,772 |

| | 4,453,613 |

| | (67,780 | ) | | — |

| | 4,385,833 |

|

Selling, general and administrative expenses | | 3,596,992 |

| | (169,340 | ) | | 3,427,652 |

| | 3,601,903 |

| | (46,720 | ) | | (124,930 | ) | | 3,430,253 |

|

Operating income | | 825,780 |

| | 169,340 |

| | 995,120 |

| | 851,710 |

| | (21,060 | ) | | 124,930 |

| | 955,580 |

|

Other, net: | | | | | | | | | | | | | | |

Interest expense | | (65,408 | ) | | — |

| | (65,408 | ) | | (73,408 | ) | | 1,291 |

| | — |

| | (72,117 | ) |

Other (expense) income, net | | (7,484 | ) | | — |

| | (7,484 | ) | | 3,092 |

| | (212 | ) | | — |

| | 2,880 |

|

Total other, net | | (72,892 | ) | | — |

| | (72,892 | ) | | (70,316 | ) | | 1,079 |

| | — |

| | (69,237 | ) |

Income before provision for income taxes | | 752,888 |

| | 169,340 |

| | 922,228 |

| | 781,394 |

| | (19,981 | ) | | 124,930 |

| | 886,343 |

|

Provision for income taxes | | 279,490 |

| | 64,349 |

| | 343,839 |

| | 287,569 |

| | (7,610 | ) | | 47,473 |

| | 327,432 |

|

Net income | | $ | 473,398 |

| | $ | 104,991 |

| | $ | 578,389 |

| | $ | 493,825 |

| | $ | (12,371 | ) | | $ | 77,457 |

| | $ | 558,911 |

|

| | | | | | | | | | | | | | |

Basic earnings per share (b) | | $ | 6.45 |

| | $ | 1.42 |

| | $ | 7.87 |

| | $ | 6.75 |

| | $ | (0.17 | ) | | $ | 1.06 |

| | $ | 7.64 |

|

Diluted earnings per share (b) | | $ | 6.40 |

| | $ | 1.42 |

| | $ | 7.82 |

| | $ | 6.71 |

| | $ | (0.17 | ) | | $ | 1.05 |

| | $ | 7.59 |

|

| | | | | | | | | | | | | | |

Average common shares outstanding (b) | | 73,190 |

| | 73,190 |

| | 73,190 |

| | 72,932 |

| | 72,932 |

| | 72,932 |

| | 72,932 |

|

Average diluted common shares outstanding (b) | | 73,733 |

| | 73,733 |

| | 73,733 |

| | 73,414 |

| | 73,414 |

| | 73,414 |

| | 73,414 |

|

| |

(a) | The comparable adjustments to Selling, general and administrative expenses for 2015 include General Parts integration, store closure and consolidation costs and support center restructuring costs of $127.1 million and General Parts amortization of acquired intangible assets of $42.3 million. The comparable adjustments to 2014 include adjustments to remove the impact of the 53rd week of operations and adjustments to Selling, general and administrative expenses for General Parts integration and store consolidation costs of $82.2 million and General Parts amortization of acquired intangible assets of $42.7 million. |

| |

(b) | Average common shares outstanding is calculated based on the weighted average number of shares outstanding during the year-to-date period. At January 2, 2016 and January 3, 2015, we had 73,314 and 73,074 shares outstanding, respectively. |

NOTE: These preliminary condensed consolidated statements of operations have been prepared on a basis consistent with our previously prepared statements of operations filed with the Securities and Exchange Commission for our prior quarter and annual report, with the exception of the footnotes required by GAAP for complete financial statements and inclusion of certain non-GAAP adjustments and measures as described in footnote (a) above. Management believes the reporting of comparable results is important in assessing the overall performance of the business and is therefore useful for investors and prospective investors.

|

| | | | | | | | |

Advance Auto Parts, Inc. and Subsidiaries |

Condensed Consolidated Statements of Cash Flows |

Fiscal Years Ended |

January 2, 2016 and January 3, 2015 |

(in thousands) |

(unaudited) |

| | | | |

| | January 2,

2016 | | January 3,

2015 |

| | (52 weeks) | | (53 weeks) |

Cash flows from operating activities: | | | | |

Net income | | $ | 473,398 |

| | $ | 493,825 |

|

Depreciation and amortization | | 269,476 |

| | 284,693 |

|

Share-based compensation | | 36,929 |

| | 21,705 |

|

(Benefit) provision for deferred income taxes | | (9,219 | ) | | 48,468 |

|

Excess tax benefit from share-based compensation | | (13,002 | ) | | (10,487 | ) |

Other non-cash adjustments to net income | | 15,542 |

| | 15,912 |

|

(Increase) decrease in: | | | | |

Receivables, net | | (21,476 | ) | | (48,209 | ) |

Inventories, net | | (244,096 | ) | | (227,657 | ) |

Other assets | | 7,423 |

| | (63,482 | ) |

Increase (decrease) in: | | | | |

Accounts payable | | 119,164 |

| | 216,412 |

|

Accrued expenses | | 35,103 |

| | (28,862 | ) |

Other liabilities | | 20,400 |

| | 6,673 |

|

Net cash provided by operating activities | | 689,642 |

| | 708,991 |

|

| | | | |

Cash flows from investing activities: | | | | |

Purchases of property and equipment | | (234,747 | ) | | (228,446 | ) |

Business acquisitions, net of cash acquired | | (18,889 | ) | | (2,060,783 | ) |

Proceeds from sales of property and equipment | | 270 |

| | 992 |

|

Net cash used in investing activities | | (253,366 | ) | | (2,288,237 | ) |

Cash flows from financing activities: | | | | |

(Decrease) increase in bank overdrafts | | (2,922 | ) | | 16,219 |

|

Net (payments) borrowings on credit facilities | | (423,400 | ) | | 583,400 |

|

Dividends paid | | (17,649 | ) | | (17,580 | ) |

Proceeds from the issuance of common stock, primarily for employee stock purchase plan | | 5,174 |

| | 6,578 |

|

Tax withholdings related to the exercise of stock appreciation rights | | (13,112 | ) | | (7,102 | ) |

Excess tax benefit from share-based compensation | | 13,002 |

| | 10,487 |

|

Repurchase of common stock | | (6,665 | ) | | (5,154 | ) |

Contingent consideration related to previous business acquisitions | | — |

| | (10,047 | ) |

Other | | (380 | ) | | (890 | ) |

Net cash (used in) provided by financing activities | | (445,952 | ) | | 575,911 |

|

| | | | |

Effect of exchange rate changes on cash | | (4,213 | ) | | (4,465 | ) |

| | | | |

Net decrease in cash and cash equivalents | | (13,889 | ) | | (1,007,800 | ) |

Cash and cash equivalents, beginning of period | | 104,671 |

| | 1,112,471 |

|

Cash and cash equivalents, end of period | | $ | 90,782 |

| | $ | 104,671 |

|

| | | | |

NOTE: These preliminary condensed consolidated statements of cash flows have been prepared on a consistent basis with previously prepared statements of cash flows filed with the Securities and Exchange Commission for our prior quarter and annual report, but do not include the footnotes required by GAAP for complete financial statements.

|

| | | | | | | | |

Advance Auto Parts, Inc. and Subsidiaries |

Supplemental Financial Schedules |

Fiscal Years Ended |

January 2, 2016 and January 3, 2015 |

(in thousands) |

(unaudited) |

| | | | |

Reconciliation of Free Cash Flow: | | | | |

| | | | |

| | January 2,

2016 | | January 3,

2015 |

| | (52 weeks) | | (53 weeks) |

Cash flows from operating activities | | $ | 689,642 |

| | $ | 708,991 |

|

Purchases of property and equipment | | (234,747 | ) | | (228,446 | ) |

Free cash flow | | $ | 454,895 |

| | $ | 480,545 |

|

NOTE: Management uses free cash flow as a measure of our liquidity and believes it is a useful indicator to stockholders of our ability to implement our growth strategies and service our debt. Free cash flow is a non-GAAP measure and should be considered in addition to, but not as a substitute for, information contained in our condensed consolidated statement of cash flows.

|

| | | | | | | | |

Adjusted Debt to EBITDAR: | | | | |

(In thousands, except adjusted debt to EBITDAR ratio) | | Four Quarters Ended |

| | January 2,

2016 | | January 3,

2015 |

| | (Four Quarters Ended) | | (53 Weeks Ended) |

Total debt | | $ | 1,213,759 |

| | $ | 1,636,893 |

|

Add: Capitalized lease obligation (rent expense * 6) | | 3,190,728 |

| | 3,038,904 |

|

Adjusted debt | | 4,404,487 |

| | 4,675,797 |

|

| | | | |

Operating income | | 825,780 |

| | 851,710 |

|

Add: Comparable adjustments (a) | | 127,059 |

| | 82,234 |

|

Depreciation and amortization | | 269,476 |

| | 284,693 |

|

EBITDA | | 1,222,315 |

| | 1,218,637 |

|

Rent expense (less favorable lease amortization of $4,786 and $4,972, respectively) | | 531,788 |

| | 506,484 |

|

EBITDAR | | $ | 1,754,103 |

| | $ | 1,725,121 |

|

| | | | |

Adjusted Debt to EBITDAR | | 2.5 |

| | 2.7 |

|

| |

(a) | The comparable adjustments to the four quarters ended January 2, 2016 include General Parts integration, store closure and consolidation costs and support center restructuring costs of $127.1 million. The comparable adjustments to Fiscal 2014 include General Parts integration and store consolidation costs of $82.2 million. |

NOTE: Management believes its Adjusted Debt to EBITDAR ratio (“leverage ratio”) is a key financial metric and believes its debt levels are best analyzed using this measure. The Company’s goal was to quickly pay down debt resulting from the GPI acquisition in order to get back to a 2.5 times leverage ratio and maintain an investment grade rating. The leverage ratio calculated by the Company is a non-GAAP measure and should not be considered a substitute for debt to net earnings, net earnings or debt as determined in accordance with GAAP. The Company’s calculation of its leverage ratio might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures by other companies.

|

| | | | | | | | | | | | | | | | |

Fourth Quarter Performance Summary on a GAAP Basis(a): | | | | | | |

| | | | | | | | |

| | Quarters Ended | | Fiscal Years Ended |

| | January 2,

2016 | | January 3,

2015 | | January 2,

2016 | | January 3,

2015 |

| | (12 weeks) | | (13 weeks) | | (52 weeks) | | (53 weeks) |

Sales (in millions) | | $ | 2,033.5 |

| | $ | 2,237.2 |

| | $ | 9,737.0 |

| | $ | 9,843.9 |

|

| | | | | | | | |

Comp Store Sales % | | (2.5 | %) | | 1.1 | % | | 0.0 | % | | 2.0 | % |

| | | | | | | | |

Gross Profit (in millions) | | $ | 909.2 |

| | $ | 1,003.9 |

| | $ | 4,422.8 |

| | $ | 4,453.6 |

|

| | | | | | | | |

SG&A (in millions) | | $ | 808.5 |

| | $ | 857.9 |

| | $ | 3,597.0 |

| | $ | 3,601.9 |

|

| | | | | | | | |

Operating Income (in millions) | | $ | 100.7 |

| | $ | 146.1 |

| | $ | 825.8 |

| | $ | 851.7 |

|

| | | | | | | | |

Diluted EPS | | $ | 0.74 |

| | $ | 1.15 |

| | $ | 6.40 |

| | $ | 6.71 |

|

| | | | | | | | |

Avg Diluted Shares (in thousands) | | 73,861 |

| | 73,494 |

| | 73,733 |

| | 73,414 |

|

(a) These financial measures for the twelve weeks ended January 2, 2016 have been reported on a GAAP basis which includes the impact of General Parts integration, store closure and consolidation and support center restructuring costs of $47.2 million and General Parts amortization of acquired intangible assets of $9.7 million. These financial measures for the thirteen weeks ended January 3, 2015 have been reported on a GAAP basis which includes the impact of a 53rd week of operations, General Parts integration and store consolidation costs of $36.7 million and General Parts amortization of acquired intangible assets of $9.9 million. These financial measures for the fiscal 2015 year ended January 2, 2016 have been reported on a GAAP basis which includes the impact of General Parts integration, store closure and consolidation costs and support center restructuring costs of $127.1 million and General Parts amortization of acquired intangible assets of $42.3 million. These financial measures for the fiscal 2014 year ended January 3, 2015 have been reported on a GAAP basis which includes the impact of a 53rd week of operations, General Parts integration and store consolidation costs of $82.2 million and General Parts amortization of acquired intangible assets of $42.7 million. These financial measures should be read in conjunction with our financial measures presented on a comparable basis earlier in this press release. Management believes the reporting of financial results on a non-GAAP basis to remain comparable is important in assessing the overall performance of our base business and is therefore useful for investors and prospective investors.

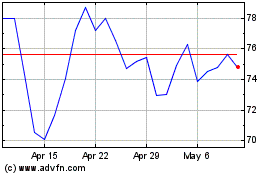

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Apr 2023 to Apr 2024