Advance Auto Parts, Inc. (NYSE:AAP), the largest automotive

aftermarket parts provider in North America, serving both

professional installer and do-it-yourself customers, today

announced its financial results for the fourth quarter ended

January 3, 2015. Fourth quarter comparable cash earnings per

diluted share (Comparable Cash EPS) were $1.37, an increase of 46%

versus the fourth quarter last year. These fourth quarter

comparable results exclude $0.08 of amortization of acquired

intangible assets, integration costs of $0.30 associated with the

acquisition of General Parts International, Inc. (General Parts),

$0.01 of integration costs associated with the integration of

B.W.P. Distributors, Inc. (BWP) and $0.17 from an additional week

of business (53rd week). Full year Comparable Cash EPS of $7.59

increased 33.9% from Fiscal 2013 and exclude $0.36 of amortization

of acquired intangible assets, integration costs of $0.61

associated with the acquisition of General Parts, $0.08 of

integration costs associated with the integration of BWP and $0.17

from the 53rd week.

Comparable Fourth Quarter Performance Summary

(1,2) Twelve Weeks Ended

Fifty-Two Weeks Ended

January 3, 2015

December 28, 2013

January 3, 2015

December 28, 2013

Comparable Sales (in millions) $ 2,086.8 $ 1,408.8 $

9,693.5 $ 6,493.8

Comp Store Sales % 1.1 % 0.1 % 2.0

% (1.5 %)

Comparable Gross Profit (in millions) $

936.2 $ 701.8 $ 4,385.8 $ 3,252.1

Comparable SG&A

(in millions) $ 764.5 $ 587.9 $ 3,430.3 $ 2,558.8

Comparable Operating Income (in millions) $ 171.7 $ 113.8 $

955.6 $ 693.3

Comparable Cash EPS $ 1.37 $ 0.94 $

7.59 $ 5.67

Avg Diluted Shares (in thousands) 73,494

73,248 73,414 73,414 (1)

Fiscal 2014 includes certain

non-comparable expenses and an additional week of business (53rd

week). Comparable Sales and Comparable Gross Profit for the twelve

and fifty-two weeks ended January 3, 2015 have been reported on a

comparable basis to exclude the impact of the 53rd week. The

Comparable SG&A, Comparable Operating Income and Comparable

Cash EPS for the twelve and fifty-two weeks ended January 3, 2015

have been reported on a comparable basis to exclude BWP integration

costs of $0.8 million and $9.0 million, respectively, General Parts

integration costs of $36.0 million and $73.2 million, respectively,

General Parts amortization of acquired intangible assets of $9.9

million and $42.7 million, respectively, and the impact of the 53rd

week. The Comparable SG&A, Comparable Operating Income and

Comparable Cash EPS for the twelve and fifty-two weeks ended

December 28, 2013 have been reported on a comparable basis to

exclude transaction expenses related to our General Parts

acquisition of $21.9 million and $27.0 million, respectively, and

BWP integration costs of $3.1 million and $8.0 million,

respectively. Included in the transaction costs in each period

presented is $2.0 million that is classified as interest expense.

For a better understanding of the Company's comparable results,

refer to the presentation of the respective financial measures on a

GAAP basis and reconciliation of the financial results reported on

a comparable basis to the GAAP basis in the accompanying financial

tables in this press release.

(2)

Consistent with its comparable store sales

policy, the Company did not include the sales from General Parts in

its comparable store sales results in 2014.

“I would like to thank all our Team Members for their hard work

during the fourth quarter and the 2014 fiscal year,” said Darren R.

Jackson, Chief Executive Officer. “Our organizational focus

delivered on our base business outcomes with record operating

profits and full year Comparable Cash EPS of $7.59 while

successfully achieving the first full year of integration

deliverables. We look forward to 2015 with optimism as we continue

the integration of General Parts and build on our performance from

2014.”

Fourth Quarter 2014 Highlights

On a comparable basis, total sales for the fourth quarter

increased 48.1% to $2.09 billion, as compared with total sales

during the fourth quarter of fiscal 2013 of $1.41 billion. The

sales increase was driven by the acquisition of General Parts, a

comparable store sales increase of 1.1% and the addition of new

stores over the past 12 months. On a GAAP basis, total sales for

the fourth quarter increased 58.8% to $2.24 billion, as compared

with total sales during the fourth quarter of fiscal 2013 of $1.41

billion. On a comparable basis, total sales increased 49.3% to

$9.69 billion for fiscal 2014, compared with total sales of $6.49

billion over the same period last year. On a GAAP basis, total

sales increased 51.6% to $9.84 billion for fiscal 2014, compared

with total sales of $6.49 billion over the same period last

year.

The Company's Comparable Gross Profit rate was 44.9% of sales

during the fourth quarter as compared to 49.8% during the fourth

quarter last year. The 495 basis-point decrease in gross profit

rate was primarily due to the higher mix of commercial sales which

has a lower gross margin rate resulting from the acquisition of

General Parts partially offset by acquisition synergy savings in

the quarter. On a GAAP basis, the Company's gross profit rate was

44.9% of sales during the fourth quarter as compared to 49.8%

during the fourth quarter last year. For fiscal 2014, the Company's

comparable gross profit rate was 45.2%, a 484 basis-point decrease

over the same period last year. On a GAAP basis, the Company's

comparable gross profit rate was 45.2% for fiscal 2014, a 484

basis-point decrease over the same period last year.

The Company's Comparable SG&A rate was 36.6% of sales during

the fourth quarter as compared to 41.7% during the same period last

year. The 510 basis-point decrease was primarily the result of the

acquired General Parts business having lower SG&A costs

combined with lower incentive compensation expenses. On a GAAP

basis, the Company's SG&A rate was 38.3% of sales during the

fourth quarter as compared to 43.4% during the same period last

year. For fiscal 2014, the Company's Comparable SG&A rate was

35.4% versus 39.4% during fiscal 2013. For fiscal 2014, the

Company's GAAP SG&A rate was 36.6% versus 39.9% during fiscal

2013.

The Company's Comparable Operating Income was $171.7 million

during the fourth quarter, an increase of 50.8% versus the fourth

quarter of fiscal 2013. As a percentage of sales, Comparable

Operating Income in the fourth quarter was 8.2% compared to 8.1%

during the fourth quarter of fiscal 2013. On a GAAP basis, the

Company's operating income during the fourth quarter of $146.1

million increased 60.8% versus the fourth quarter of fiscal 2013.

On a GAAP basis, the Operating Income rate was 6.5% during the

fourth quarter as compared to 6.4% during the fourth quarter of

fiscal 2013. For fiscal 2014, the Company's Comparable Operating

Income rate was 9.9% versus 10.7% during fiscal 2013. For fiscal

2014, the Company's GAAP Operating Income rate was 8.7% versus

10.2% during fiscal 2013.

Operating cash flow increased approximately 30.0% to $709.0

million in fiscal 2014 from $545.3 million in fiscal 2013. Free

cash flow increased to $480.5 million in fiscal 2014 from $349.5

million in fiscal 2013. Capital expenditures in fiscal 2014 were

$228.4 million as compared to $195.8 million for fiscal 2013.

“In our first year as a combined company, we are pleased with

our overall performance delivering positive comparable store sales,

strong growth in free cash flow and approximately 38% growth in

Comparable Operating Income dollars in fiscal 2014,” said Mike

Norona, Executive Vice President and Chief Financial Officer. “The

strength of our commercial business combined with achievement of

our targeted synergies and continued disciplined focus on expense

management throughout the year allowed us to increase our fiscal

2014 comparable earnings per share 33.9% over last year.”

Store Information

As of January 3, 2015, the Company operated 5,261 stores

and 111 Worldpac branches and served approximately 1,325

independently-owned Carquest stores. The below table summarizes the

changes in the number of the company-operated stores and branches

during the fifty-three weeks ended January 3, 2015.

AAP AI

BWP CARQUEST WORLDPAC

Total December 28, 2013 3,741

217 91 — — 4,049 New 126 5 — 12

8 151 Closed (6 ) (1 ) — (12 ) — (19 ) Acquired — — — 1,233 103

1,336 Consolidated (2 ) (11 ) (34 ) (98 ) — (145 ) Converted 29

— (19 ) (10 ) — —

January 3,

2015 3,888 210 38

1,125 111 5,372

2015 Annual Financial Outlook Key Assumptions

Fiscal 2015 financial outlook and certain key assumptions

provided below are on a 52-week basis versus 53 weeks in fiscal

2014.

New Stores 100 to 120 new stores

including Worldpac Comparable Store Sales(1)

Low Single Digits Comparable Cash EPS((2))

• including net synergies of $45 - $55

million related to the acquisition of GPI(3)

• excluding the amortization of intangible

assets associated with the acquisition of GPI

• excluding one-time expenses to achieve

synergies related to the acquisition of GPI

$8.35 - $8.55 Income tax rate(4)

37.5% to 38.0% One-time Expenses to Achieve Synergies(5)

Approximately $75 - $85 million Capital

Expenditures(6) $325 to $340 million Free Cash

Flow Minimum $475 million Diluted Share Count

Approximately 73.5 million shares (1)

Advance calculates comparable store sales

based on the change in store sales starting once a store has been

open for 13 complete accounting periods (approximately one year)

and by including e-commerce sales. We include sales from relocated

stores in comparable store sales from the original date of opening.

Acquired stores are included in our comparable store sales once the

stores have completed 13 complete accounting periods after the

acquisition date (approximately one year). Accordingly, the

previously acquired GPI stores and branches will be included in

2015 comparable store sales beginning with our second fiscal period

of 2015. Sales to independently-owned CarQuest locations will not

be included in comparable store sales. The 2015 comparable store

sales estimates include the impact of store consolidations.

(2)

Comparable Cash EPS is defined as Cash EPS

in addition to the exclusion of other non-comparable items,

including one-time expenses to achieve synergies related to the GPI

acquisition and integration costs associated with the integration

of BWP. Cash EPS is EPS excluding the amortization of GPI's

intangible assets. Both Comparable Cash EPS and Cash EPS are

non-GAAP measures. Because of the forward-looking nature of these

non-GAAP financial measures, specific quantifications of the

amounts that would be required to reconcile these non-GAAP

financial measures to their most directly comparable GAAP financial

measures are not available at this time. Management believes

Comparable Cash EPS is an important measure in assessing the

overall performance of the business and utilizes this metric in its

ongoing reporting. On that basis, Management believes it is useful

to provide Comparable Cash EPS to investors and prospective

investors. Comparable Cash EPS and Cash EPS might not be calculated

in the same manner as, and thus might not be comparable to,

similarly titled measures reported by other companies.

(3)

Total net run rate cost synergies related

to the acquisition of GPI are estimated to be $160 million by

approximately the end of the third year following the close of the

acquisition. These net synergies will be driven primarily through

the areas of procurement as well as corporate, store and supply

chain efficiencies.

(4)

The estimated tax rate for fiscal 2015 is

higher than fiscal 2014 due to specific favorable items in 2014

that we do not expect to reoccur in 2015.

(5)

Total one-time expenses to achieve

synergies related to the acquisition of GPI are estimated to be

approximately $190 million over a five year period following the

close of the acquisition with the majority of the costs being

incurred within the first three years.

(6)

The capital expenditures estimate includes

integration capital for 2015.

“Our 2015 annual comparable cash EPS outlook will be in the

range of $8.35 to $8.55," said Mike Norona, Executive Vice

President and Chief Financial Officer. “We will continue to

build on our 2014 progress and leverage the size and scale of our

company as we focus on continued sales growth, serving our

customers and improving our operating profit in 2015.”

Dividend

On February 11, 2015, the Company's Board of Directors

declared a regular quarterly cash dividend of $0.06 per share to be

paid on April 3, 2015 to stockholders of record as of

March 20, 2015.

Investor Conference Call

The Company will host a conference call on Thursday, February

12, 2015, at 10:30 a.m. Eastern Time to discuss its quarterly

results. To listen to the live call, please log on to the Company's

website, www.AdvanceAutoParts.com, or dial (866) 908-1AAP. The call

will be archived on the Company's website until February 12,

2016.

About Advance Auto Parts

Headquartered in Roanoke, Va., Advance Auto Parts, Inc., the

largest automotive aftermarket parts provider in North America,

serves both the professional installer and do-it-yourself

customers. As of January 3, 2015 Advance operated 5,261 stores

and 111 Worldpac branches and served approximately 1,325

independently-owned Carquest branded stores in the United States,

Puerto Rico, the U.S. Virgin Islands and Canada. Advance employs

approximately 73,000 Team Members. Additional information about the

Company, employment opportunities, customer services, and on-line

shopping for parts, accessories and other offerings can be found on

the Company's website at www.AdvanceAutoParts.com.

Forward Looking Statements

Certain statements contained in this release are forward-looking

statements, as that term is used in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements address

future events or developments, and typically use words such as

believe, anticipate, expect, intend, plan, forecast, outlook or

estimate. These forward looking statements include, but are not

limited to, guidance for 2015 financial performance, statements

regarding the benefits and other effects of the acquisition of

General Parts; the combined company’s plans, objectives and

expectations; expected growth and future performance of AAP,

including store growth, capital expenditures, comparable store

sales, gross profit rate, SG&A, operating income, free cash

flow, income tax rate, integration costs for BWP and General Parts,

synergies, expenses to achieve synergies, comparable cash earnings

per diluted share for fiscal year 2015 and other statements that

are not historical facts. These forward-looking statements are

subject to significant risks, uncertainties and assumptions, and

actual future events or results may differ materially from such

forward-looking statements. Such differences may result from, among

other things, the risk that the benefits of the General Parts

acquisition, including synergies, may not be fully realized or may

take longer to realize than expected; the possibility that the

General Parts acquisition may not advance AAP’s business strategy;

the risk that AAP may experience difficulty integrating General

Part’s employees, business systems and technology; the potential

diversion of AAP’s management’s attention from AAP’s other

businesses resulting from the General Parts acquisition; the impact

of the General Parts acquisition on third-party relationships,

including customers, wholesalers, independently owned and jobber

stores and suppliers; changes in regulatory, social and political

conditions, as well as general economic conditions; competitive

pressures; demand for AAP’s and General Part’s products; the market

for auto parts; the economy in general; inflation; consumer debt

levels; the weather; business interruptions; information technology

security; availability of suitable real estate; dependence on

foreign suppliers; and other factors disclosed in AAP’s 10-K for

the fiscal year ended December 28, 2013 and other filings made by

AAP with the Securities and Exchange Commission. Readers are

cautioned not to place undue reliance on these forward-looking

statements. AAP intends these forward-looking statements to speak

only as of the time of this communication and does not undertake to

update or revise them as more information becomes available.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (in thousands)

(unaudited)

January 3, 2015

December 28, 2013

Assets

Current assets: Cash and cash equivalents $ 104,671 $

1,112,471 Receivables, net 579,825 277,595 Inventories, net

3,936,955 2,556,557 Other current assets 119,589 42,761 Total

current assets 4,741,040 3,989,384

Property and

equipment, net 1,432,030 1,283,970

Assets held for sale

615 2,064

Goodwill 995,426 199,835

Intangible assets,

net 748,125 49,872

Other assets, net 45,122 39,649 $

7,962,358 $ 5,564,774

Liabilities and

Stockholders' Equity

Current liabilities: Current portion of long-term

debt $ 582 $ 916 Accounts payable 3,095,365 2,180,614 Accrued

expenses 520,673 428,625 Other current liabilities 126,446 154,630

Total current liabilities 3,743,066 2,764,785

Long-term

debt 1,636,311 1,052,668

Other long-term liabilities

580,069 231,116

Total stockholders' equity 2,002,912

1,516,205 $ 7,962,358 $ 5,564,774

NOTE: These preliminary condensed consolidated balance sheets

have been prepared on a basis consistent with our previously

prepared balance sheets filed with the Securities and Exchange

Commission for our prior quarter and annual report, but do not

include the footnotes required by generally accepted accounting

principles, or GAAP, for complete financial statements.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations Fiscal

Fourth Quarters Ended January 3, 2015 and December 28,

2013 (in thousands, except per share data) (unaudited)

Q4

2014 Q4 2013 Comparable Adjustments (a)

As Reported 53rd Week

IntegrationCosts

Comparable As Reported

ComparableAdjustments(a)

Comparable (13 weeks) (12 weeks) (12 weeks) (12 weeks) Net

sales $ 2,237,209 $ (150,386 ) $ — $ 2,086,823 $ 1,408,813 $ — $

1,408,813 Cost of sales 1,233,268 (82,606 ) —

1,150,662 707,036 — 707,036 Gross

profit 1,003,941 (67,780 ) — 936,161 701,777 — 701,777 Selling,

general and administrative expenses 857,864 (46,720 )

(46,655 ) 764,489 610,933 (23,002 ) 587,931

Operating income 146,077 (21,060 ) 46,655 171,672

90,844 23,002 113,846 Other, net:

Interest expense (17,002 ) 1,291 — (15,711 ) (9,986 ) 1,987 (7,999

) Other income, net 1,883 (212 ) — 1,671 1,009

— 1,009 Total other, net (15,119 ) 1,079

— (14,040 ) (8,977 ) 1,987 (6,990 ) Income

before provision for income taxes 130,958 (19,981 ) 46,655 157,632

81,867 24,989 106,856 Provision for income taxes 46,524

(7,610 ) 17,729 56,643 32,600 5,509

38,109 Net income $ 84,434 $ (12,371 ) $ 28,926

$ 100,989 $ 49,267 $ 19,480 $ 68,747

Basic earnings per share (b) $ 1.15 $ (0.17 ) $ 0.39

$ 1.37 $ 0.68 $ 0.27 $ 0.94 Diluted earnings per share (b) $ 1.15 $

(0.17 ) $ 0.39 $ 1.37 $ 0.67 $ 0.27 $ 0.94 Average common

shares outstanding (b) 72,997 72,997 72,997 72,997 72,761 72,761

72,761 Average diluted common shares outstanding (b) 73,494 73,494

73,494 73,494 73,248 73,248 73,248

(a)

The comparable adjustments to Q4 2014

include adjustments to remove the impact of the 53rd week of

operations and adjustments to Selling, general and administrative

expenses for BWP integration costs of $0.8 million, General Parts

integration costs of $36.0 million and General Parts amortization

of $9.9 million related to the acquired intangible assets. The

comparable adjustments for Q4 2013 includes transaction expenses

related to our General Parts acquisition of $21.9 million, of which

$2.0 million was interest related, and BWP integration costs of

$3.1 million.

(b)

Average common shares outstanding is

calculated based on the weighted average number of shares

outstanding during the quarter. At January 3, 2015 and December 28,

2013, we had 73,074 and 72,840 shares outstanding,

respectively.

NOTE: These preliminary condensed consolidated statements of

operations have been prepared on a basis consistent with our

previously prepared statements of operations filed with the

Securities and Exchange Commission for our prior quarter and annual

report, with the exception of the footnotes required by GAAP for

complete financial statements and inclusion of certain non-GAAP

adjustments and measures as described in footnote (a) above.

Management believes the reporting of comparable results is

important in assessing the overall performance of the business and

is therefore useful for investors and prospective investors.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations Fiscal

Years Ended January 3, 2015 and December 28, 2013 (in

thousands, except per share data) (unaudited)

2014 2013

Comparable Adjustments (a) As Reported 53rd

Week

IntegrationCosts

Comparable As Reported

ComparableAdjustments

Comparable (53 weeks) (52 weeks) (52 weeks) (52 weeks) Net

sales $ 9,843,861 $ (150,386 ) $ — $ 9,693,475 $ 6,493,814 $ — $

6,493,814 Cost of sales 5,390,248 (82,606 ) —

5,307,642 3,241,668 — 3,241,668 Gross

profit 4,453,613 (67,780 ) — 4,385,833 3,252,146 — 3,252,146

Selling, general and administrative expenses 3,601,903

(46,720 ) (124,930 ) 3,430,253 2,591,828 (32,987 )

2,558,841 Operating income 851,710 (21,060 ) 124,930

955,580 660,318 32,987 693,305

Other, net: Interest expense (73,408 ) 1,291 — (72,117 ) (36,618 )

1,987 (34,631 ) Other income, net 3,092 (212 ) —

2,880 2,698 — 2,698 Total other, net

(70,316 ) 1,079 — (69,237 ) (33,920 ) 1,987

(31,933 ) Income before provision for income taxes 781,394 (19,981

) 124,930 886,343 626,398 34,974 661,372 Provision for income taxes

287,569 (7,610 ) 47,473 327,432 234,640

9,268 243,908 Net income $ 493,825 $ (12,371 )

$ 77,457 $ 558,911 $ 391,758 $ 25,706 $

417,464 Basic earnings per share (b) $ 6.75 $ (0.17 )

$ 1.06 $ 7.64 $ 5.36 $ 0.35 $ 5.71 Diluted earnings per share (b) $

6.71 $ (0.17 ) $ 1.05 $ 7.59 $ 5.32 $ 0.35 $ 5.67 Average

common shares outstanding (b) 72,932 72,932 72,932 72,932 72,930

72,930 72,930 Average diluted common shares outstanding (b) 73,414

73,414 73,414 73,414 73,414 73,414 73,414

(a)

The comparable adjustments to 2014 include

adjustments to remove the impact of the 53rd week of operations and

adjustments to Selling, general and administrative expenses for BWP

integration costs of $9.0 million, General Parts integration costs

of $73.2 million and General Parts amortization of $42.7 million

related to the acquired intangible assets. The comparable

adjustments for 2013 includes transaction expenses related to our

General Parts acquisition of $27.0 million, of which $2.0 million

was interest related, and BWP integration costs of $8.0

million.

(b)

Average common shares outstanding is

calculated based on the weighted average number of shares

outstanding during the year-to-date period. At January 3, 2015 and

December 28, 2013, we had 73,074 and 72,840 shares outstanding,

respectively.

NOTE: These preliminary condensed consolidated statements of

operations have been prepared on a basis consistent with our

previously prepared statements of operations filed with the

Securities and Exchange Commission for our prior quarter and annual

report, with the exception of the footnotes required by GAAP for

complete financial statements and inclusion of certain non-GAAP

adjustments and measures as described in footnote (a) above.

Management believes the reporting of comparable results is

important in assessing the overall performance of the business and

is therefore useful for investors and prospective investors.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows Fiscal

Years Ended January 3, 2015 and December 28, 2013 (in

thousands) (unaudited)

January 3, 2015

December 28, 2013

Cash flows from operating activities: (53 weeks) (52

weeks) Net income $ 493,825 $ 391,758 Depreciation and amortization

284,693 207,795 Share-based compensation 21,705 13,191 Provision

(benefit) for deferred income taxes 48,468 (2,237 ) Excess tax

benefit from share-based compensation (10,487 ) (16,320 ) Other

non-cash adjustments to net income 15,912 3,278 (Increase) decrease

in: Receivables, net (48,209 ) (32,428 ) Inventories, net (227,657

) (203,513 ) Other assets (63,482 ) 11,011 Increase (decrease) in:

Accounts payable 216,412 113,497 Accrued expenses (28,862 ) 63,346

Other liabilities 6,673 (4,128 ) Net cash provided by

operating activities 708,991 545,250

Cash flows from

investing activities: Purchases of property and equipment

(228,446 ) (195,757 ) Business acquisitions, net of cash acquired

(2,060,783 ) (186,137 ) Sale of certain assets of acquired business

— 19,042 Proceeds from sales of property and equipment 992

745 Net cash used in investing activities (2,288,237 )

(362,107 )

Cash flows from financing activities: Increase

(decrease) in bank overdrafts 16,219 (2,926 ) Issuance of senior

unsecured notes — 448,605 Payment of debt related costs — (8,815 )

Net borrowings on credit facilities 583,400 — Dividends paid

(17,580 ) (17,574 ) Proceeds from the issuance of common stock,

primarily exercise of stock options 6,578 3,611 Tax withholdings

related to the exercise of stock appreciation rights (7,102 )

(21,856 ) Excess tax benefit from share-based compensation 10,487

16,320 Repurchase of common stock (5,154 ) (80,795 ) Contingent

consideration related to previous business acquisitions (10,047 )

(4,726 ) Other (890 ) (627 ) Net cash provided by financing

activities 575,911 331,217 Effect of exchange

rate changes on cash (4,465 ) —

Net (decrease)

increase in cash and cash equivalents (1,007,800 ) 514,360

Cash and cash equivalents, beginning of period 1,112,471

598,111

Cash and cash equivalents, end of

period $ 104,671 $ 1,112,471

NOTE: These preliminary condensed consolidated statements of

cash flows have been prepared on a consistent basis with previously

prepared statements of cash flows filed with the Securities and

Exchange Commission for our prior quarter and annual report, but do

not include the footnotes required by GAAP for complete financial

statements.

Advance Auto Parts, Inc. and Subsidiaries

Supplemental Financial Schedules Fiscal Years Ended

January 3, 2015 and December 28, 2013 (in thousands)

(unaudited)

Reconciliation of

Free Cash Flow:

January 3, 2015

December 28, 2013

(53 weeks) (52 weeks) Cash flows from operating activities $

708,991 $ 545,250 Purchases of property and equipment (228,446 )

(195,757 ) Free cash flow $ 480,545 $ 349,493

NOTE: Management uses free cash flow as a measure of our

liquidity and believes it is a useful indicator to stockholders of

our ability to implement our growth strategies and service our

debt. Free cash flow is a non-GAAP measure and should be considered

in addition to, but not as a substitute for, information contained

in our condensed consolidated statement of cash flows.

Adjusted Debt to

EBITDAR:

(In thousands, except adjusted debt to EBITDAR

ratio)

January 3, 2015 December

28, 2013 (53 weeks) (52 weeks) Total debt

$

1,636,893

$

1,053,584

Add: Capitalized lease obligation (rent expense * 6)

3,038,904 2,145,654 Adjusted debt 4,675,797 3,199,238

Operating income 851,710 660,318 Add: Comparable adjustments

(a) 82,234 32,987 Depreciation and amortization 284,693

207,795 EBITDA 1,218,637 901,100 Rent expense (less

favorable lease amortization of $4,972) 506,484

357,609 EBITDAR

$

1,725,121

$

$1,258,709

Adjusted Debt to EBITDAR

2.7 2.5

(a)

The comparable adjustments to 2014 include

BWP integration costs of $9.0 million, and General Parts

integration costs of $73.2 million. The comparable adjustments to

2013 include transaction expenses related to our General Parts

acquisition of $25.0 million and BWP integration costs of $8.0

million.

NOTE: Management believes its Adjusted Debt to EBITDAR ratio

(“leverage ratio”) is a key financial metric and believes its debt

levels are best analyzed using this measure. The Company’s goal is

to quickly pay down debt resulting from the GPI acquisition, get

back to a 2.5 times leverage ratio and to maintain an investment

grade rating. The leverage ratio calculated by the Company is a

non-GAAP measure and should not be considered a substitute for debt

to net earnings, net earnings or debt as determined in accordance

with GAAP. The Company’s calculation of its leverage ratio might

not be calculated in the same manner as, and thus might not be

comparable to, similarly titled measures by other companies.

Fourth Quarter

Performance Summary on a GAAP

Basis(a):

Quarters Ended

Fiscal Years Ended January 3, 2015

December 28, 2013

January 3, 2015 December 28, 2013 (13

weeks) (12 weeks) (53 weeks) (52 weeks)

Sales (in millions)

$ 2,237.2 $ 1,408.8 $ 9,843.9 $ 6,493.8

Comp Store Sales

% 1.1 % 0.1 % 2.0 % (1.5 %)

Gross Profit (in

millions) $ 1,003.9 $ 701.8 $ 4,453.6 $ 3,252.1

SG&A (in millions) $ 857.9 $ 610.9 $ 3,601.9 $ 2,591.8

Operating Income (in millions) $ 146.1 $ 90.8 $ 851.7

$ 660.3

Diluted EPS $ 1.15 $ 0.67 $ 6.71 $ 5.32

Avg Diluted Shares (in thousands) 73,494 73,248

73,414 73,414

(a)

These financial measures for the thirteen

and fifty-three weeks ended January 3, 2015 have been reported on a

GAAP basis which includes the impact of a 53rd week of operations,

BWP integration costs of $0.8 million and $9.0 million,

respectively, General Parts integration costs of $36.0 million and

$73.2 million, respectively, and General Parts amortization of

acquired intangible assets of $9.9 million and $42.7 million,

respectively. These financial measures for the twelve and fifty-two

weeks ended December 28, 2013 have been reported on a GAAP basis

which includes transaction expenses related to our General Parts

acquisition of $21.9 million and $27.0 million, respectively, and

the impact of BWP integration costs of $3.1 million and $8.0

million, respectively. Included in the transaction costs in each

period presented is $2.0 million that is classified as interest

expense. These financial measures should be read in conjunction

with our financial measures presented on a comparable basis earlier

in this press release. Management believes the reporting of

financial results on a non-GAAP basis to remain comparable is

important in assessing the overall performance of the business and

is therefore useful for investors and prospective investors.

Advance Auto Parts, Inc.Media:Shelly Whitaker, APR,

540-561-8452shelly.whitaker@advanceautoparts.comorInvestors:Zaheed

Mawani, 952-715-5097zaheed.mawani@advanceautoparts.com

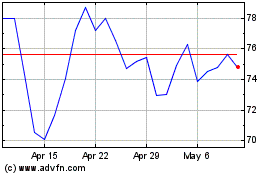

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Apr 2023 to Apr 2024