As filed with the Securities and Exchange Commission on May 8, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Aaron’s, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| Georgia |

|

58-0687630 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

309 E. Paces Ferry Road, N.E.

Atlanta, Georgia 30305-2377

(Address of Principal Executive Offices) (Zip Code)

Aaron’s,

Inc. 2015 Equity and Incentive Plan

(Full Title of the Plan)

Robert W. Kamerschen

Executive Vice President, General Counsel and Corporate Secretary

309 E. Paces Ferry Road, N.E.

Atlanta, Georgia 30305-2377

(404) 231-0011

(Name,

Address and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

William Calvin Smith, III

King & Spalding LLP

1180 Peachtree Street

Atlanta, Georgia 30309

(404) 572-4600

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities

to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum Offering

Price Per Share |

|

Proposed

Maximum

Aggregate

Offering Price |

|

Amount of

Registration Fee |

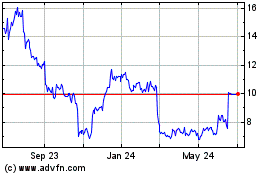

| Common Stock, par value $0.50 per share |

|

5,000,000(1) |

|

$34.01(2) |

|

$170,050,000(2) |

|

$19,759.81(2) |

| |

| |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, this Registration Statement also covers such indeterminate number of additional securities that may become issuable under the Aaron’s, Inc. 2015 Equity and

Incentive Plan as a result of future stock splits, stock dividends or similar adjustments of the Common Stock. |

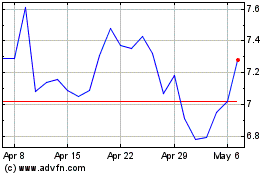

| (2) |

Estimated pursuant to Rule 457(h) based on the average of the high and low reported market prices of shares of the Common Stock on May 6, 2015, as quoted on the New York Stock Exchange, solely for the purpose of

calculating the registration fee payable in connection with this Registration Statement. |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information required by Part I of Form S-8 is omitted from this Registration Statement, and will be delivered to

participants in the Aaron’s, Inc. 2015 Equity and Incentive Plan, in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”).

The documents containing the information required by Part I of Form S-8 will be delivered to participants in the Aaron’s, Inc. 2015

Equity and Incentive Plan pursuant to Rule 428(b) of the Securities Act of 1933, as amended (the “Securities Act”). Consistent with the instructions of Part I of Form S-8, these documents will not be filed with the Securities and

Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference

pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus as required by Section 10(a) of the Securities Act.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The following documents that Aaron’s,

Inc. (the “Company”) has previously filed with the Commission are incorporated herein by reference:

| |

(a) |

Annual Report on Form 10-K for the fiscal year ended December 31, 2014; |

| |

(b) |

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2015; |

| |

(c) |

Current Reports on Form 8-K filed on February 25, 2015 and May 8, 2015; and |

| |

(d) |

The description of the Common Stock contained in the Registration Statement on Form 8-A filed on March 10, 1998, as amended on December 10, 2010, including any other amendment or report filed for the purpose

of updating such description. |

All documents filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Exchange Act subsequent to the date of this Registration Statement (except for any portion of any document which is furnished or otherwise not deemed to be filed with the Commission), and prior to the filing of a post-effective amendment which

indicates that all securities offered hereby have been sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of

filing of such documents.

Any statement contained in any document incorporated or deemed to be incorporated by reference in this

Registration Statement shall be deemed to be modified, superseded or replaced for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or

deemed to be incorporated by reference in this Registration Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to

constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not applicable.

| Item 5. |

Interests of Named Experts and Counsel. |

Not applicable.

| Item 6. |

Indemnification of Directors and Officers. |

The Company’s Amended and Restated

Articles of Incorporation, as amended, provides that none of the Company’s directors will be personally liable to the Company or its shareholders for monetary damages resulting from a breach of the duty of care or any other duty owed to the

Company as a director to the fullest extent permitted by Georgia law.

Article VII of the Company’s Amended and Restated Bylaws requires the Company to indemnify

any person to the fullest extent permitted by law for any liability and expense resulting from any threatened, pending or completed legal action, suit or proceeding resulting from the fact that such person is or was a director or officer of the

Company, including service at the Company’s request as a director, officer partner, trustee, employee, administrator or agent of another entity.

An officer or director may only be indemnified for expenses and, other than in any action, suit or proceeding by or in the right of the

Company, liabilities if he or she acted in good faith and, in the case of conduct in an official capacity, in a manner he or she reasonably believed to be in the best interest of the Company and, in all other cases (other than criminal matters), in

a manner he or she reasonably believed to be not opposed to the best interest of the Company. An officer or director may only be indemnified in a criminal action, suit or proceeding if he or she had no reasonable cause to believe his or her conduct

was unlawful. Notwithstanding this requirement, any officer or director is entitled to indemnification of any expenses in connection with any action, suit or proceeding to the extent such officer or director has been wholly successful on the merits

or otherwise in such action, suit or proceeding.

Article VII of the Company’s Amended and Restated Bylaws also requires the Company

to indemnify any person to the fullest extent permitted by law for any expense imposed upon or incurred in connection with acting as a witness or other participant in any threatened, pending or completed legal action, suit or proceeding resulting

from the fact that such person is or was a director or officer of the Company, including service at the Company’s request as a director, officer partner, trustee, employee, administrator or agent of another entity.

The provisions of the Company’s Amended and Restated Bylaws regarding indemnification are consistent in all material respects with the

laws of the State of Georgia, which authorize indemnification of corporate officers and directors.

The Company’s directors and

officers are also insured against losses arising from any claim against them in connection with their service as directors and officers of the Company for wrongful acts or omissions, subject to certain limitations.

| Item 7. |

Exemption from Registration Claimed. |

Not applicable.

The exhibits to this Registration Statement are listed in the Exhibit Index

immediately following and incorporated by reference in this Registration Statement.

| |

(a) |

The undersigned Company hereby undertakes: |

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| |

(i) |

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

(ii) |

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; |

| |

(iii) |

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

|

provided, however, that paragraphs (a)(l)(i) and (a)(1)(ii) do not apply if the

information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Securities Exchange Act

of 1934 that are incorporated by reference in the Registration Statement.

| |

(2) |

That for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| |

(b) |

The undersigned Company hereby undertakes that, for the purposes of determining any liability under the Securities Act of 1933, each filing of the Company’s annual report pursuant to Section 13(a) or 15(d) of

the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration

Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(c) |

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the

Company has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than

the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in

connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by

it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Atlanta, State of Georgia, on May 8, 2015.

|

|

|

| Aaron’s, Inc. |

|

|

| By: |

|

/s/ John W. Robinson III |

| Name: |

|

John W. Robinson III |

| Title: |

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints John W. Robinson, III, Gilbert L.

Danielson and Robert W. Kamerschen, jointly and severally, his or her true and lawful attorneys-in-fact, each with full power of substitution and resubstitution for him or her in any and all capacities, to do any and all things and to sign any and

all documents, including pre- and post-effective amendments, in connection with this Registration Statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby

ratifying and confirming all that each of such attorneys-in-fact or their substitute or substitutes may lawfully so or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities set forth opposite their names and on the date indicated above.

|

|

|

| Signature |

|

Title |

|

|

| /s/ John W. Robinson III |

|

|

| John W. Robinson III |

|

Chief Executive Officer and Director

(Principal Executive Officer) |

|

|

| /s/ Gilbert L. Danielson |

|

|

| Gilbert L. Danielson |

|

Executive Vice President, Chief Financial Officer

(Principal Financial Officer) |

|

|

| |

|

|

| Ray M. Robinson |

|

Chairman of the Board of Directors |

|

|

| /s/ Matthew E. Avril |

|

|

| Matthew E. Avril |

|

Director |

|

|

| /s/ Leo Benatar |

|

|

| Leo Benatar |

|

Director |

|

|

| /s/ Kathy T. Betty |

|

|

| Kathy T. Betty |

|

Director |

|

|

| |

|

|

| Cynthia N. Day |

|

Director |

|

|

| /s/ Hubert L. Harris, Jr. |

|

|

| Hubert L. Harris, Jr. |

|

Director |

|

|

| /s/ Brian R. Kahn |

|

|

| Brian R. Kahn |

|

Director |

|

|

| /s/ David L. Kolb |

|

|

| David L. Kolb |

|

Director |

|

|

| /s/ H. Eugene Lockhart |

|

|

| H. Eugene Lockhart |

|

Director |

INDEX TO EXHIBITS

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Amended and Restated Articles of Incorporation of the Company, as amended (incorporated by reference to Exhibit 3(i) to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013). |

|

|

| 4.2 |

|

Amended and Restated By-laws of the Company (incorporated by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2014). |

|

|

| 4.3 |

|

Specimen of Form of Stock Certificate Representing Shares of Common Stock of the Company, par value $0.50 per share (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form 8-A/A filed on

December 10, 2010). |

|

|

| 5.1 |

|

Opinion of King & Spalding LLP. |

|

|

| 23.1 |

|

Consent of King & Spalding LLP (including in Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of Ernst & Young LLP. |

|

|

| 24.1 |

|

Power of Attorney (included in signature page). |

|

|

| 99.1 |

|

Aaron’s, Inc. 2015 Equity and Incentive Plan (incorporated by reference to Appendix A to the Company’s Definitive Proxy Statement filed on April 7, 2015) |

|

|

| 99.2 |

|

Form of Employee Stock Option Award Agreement under the Aaron’s, Inc. 2015 Equity and Incentive Plan. |

|

|

| 99.3 |

|

Form of Executive Performance Share Award Agreement under the Aaron’s, Inc. 2015 Equity and Incentive Plan. |

|

|

| 99.4 |

|

Form of Executive Officer Restricted Stock Unit Award Agreement under the Aaron’s, Inc. 2015 Equity and Incentive Plan. |

|

|

| 99.5 |

|

Form of Director Restricted Stock Unit Award Agreement under the Aaron’s, Inc. 2015 Equity and Incentive Plan. |

Exhibit 5.1

|

|

|

|

|

|

|

|

|

King & Spalding LLP 1l80 Peachtree

Street N.E. Atlanta, Georgia 30309-3521 |

May 8, 2015

Aaron’s, Inc.

309 E. Paces Ferry Road, N.E.

Atlanta, Georgia 30305

Re: Aaron’s, Inc. – Form S-8 Registration Statement

Ladies and Gentlemen:

We have acted as counsel

for Aaron’s, Inc., a Georgia corporation (the “Company”), in connection with the preparation of a Registration Statement on Form S-8 (the “Registration Statement”) to be filed with the Securities and Exchange Commission

under the Securities Act of 1933, as amended (the “Act”). The Registration Statement relates to 5,000,000 shares (the “Shares”) of the Company’s common stock, par value $0.50 per share, to be issued pursuant to, or upon the

exercise of options, stock appreciation rights or other stock-based awards granted under, the Aaron’s, Inc. 2015 Equity and Incentive Plan (the “Plan”).

In connection with this opinion, we have examined and relied upon such records, documents, certificates and other instruments as in our

judgment are necessary or appropriate to form the basis for the opinions hereinafter set forth. In all such examinations, we have assumed the genuineness of signatures on original documents and the conformity to such original documents of all copies

submitted to us as certified, conformed or photographic copies, and as to certificates of public officials, we have assumed the same to have been properly given and to be accurate. As to matters of fact material to this opinion, we have relied,

without independent verification, upon statements and representations of representatives of the Company and public officials.

The

opinions expressed herein are limited in all respects to the Georgia Business Corporation Code, and no opinion is expressed with respect to the laws of any other jurisdiction or any effect which such laws may have on the opinions expressed herein.

This opinion is limited to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated herein.

Based upon the foregoing and subject to the limitations, qualifications and assumptions set forth herein, we are of the opinion that the

Shares are duly authorized and, when issued pursuant to, or upon the exercise of options, stock appreciation rights or other stock-based awards granted under, the Plan, the Shares will be validly issued, fully paid and nonassessable.

Aaron’s, Inc.

May 8, 2015

Page

2

This opinion is given as of the date hereof, and we assume no obligation to advise you after

the date hereof of facts or circumstances that come to our attention or changes in law that occur which could affect the opinions contained herein.

We consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we

are in the category of persons whose consent is required under Section 7 of the Act.

|

| Very truly yours, |

|

| /s/ King & Spalding LLP |

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement on Form S-8 pertaining to the Aaron’s, Inc. 2015 Equity and

Incentive Plan filed on or about May 7, 2015 of our reports dated March 2, 2015 with respect to the consolidated financial statements of Aaron’s, Inc. and subsidiaries, and the effectiveness of internal control over financial

reporting of Aaron’s, Inc., included in its Annual Report (Form 10-K) for the year ended December 31, 2014, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Atlanta, Georgia

May 7, 2015

Exhibit 99.2

AARON’S, INC.

2015

EQUITY AND INCENTIVE PLAN

EMPLOYEE STOCK OPTION AWARD AGREEMENT

THIS AGREEMENT (the “Agreement”) is made and entered into as of the day of

, 2015, by and between AARON’S, INC. (“the “Company”) and the individual identified below (the “Grantee”).

W I T N E S S E T H :

WHEREAS, the Company maintains the Aaron’s, Inc. 2015 Equity and Incentive Plan (the “Plan”), and the Grantee has been

selected by the Compensation Committee (the “Committee”) to receive an Option Award under the Plan;

NOW, THEREFORE, IT

IS AGREED, by and between the Company and the Grantee, as follows:

|

|

|

|

|

| Grantee: |

|

|

|

|

|

|

|

| Number of Shares: |

|

Shares |

|

|

|

|

|

| Option Exercise Price: |

|

$ per Share |

|

|

|

|

|

| Grant Date: |

|

, 2015 |

|

|

|

|

|

| Vesting Schedule: |

|

|

|

|

|

|

|

| Percentage of Shares* |

|

Vesting Date |

|

|

|

|

|

|

|

|

|

| * |

If the number of Shares determined based on the stated percentage is not a whole number, the number will be rounded up to the next whole Share on the 1st vesting

date, rounded down on the 2nd vesting date, and on the final vesting date, shall equal the total number of Shares less the number of Shares previously vested. |

1.1 An option to purchase the number of shares of the Company’s

Common Stock, par value $.50 per share (the “Shares”) set forth above, is hereby granted to the Grantee pursuant to the Plan (hereinafter referred to as the “Option”). The Option is subject in all respects to the

terms and conditions of the Plan. For all purposes of the Plan, the date of the Option granted hereunder (the “Grant Date”) shall be the date set forth above as the Grant Date. The Option is a nonqualified stock option and is

not intended to qualify as an incentive stock option within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended.

1.2 This Agreement shall be construed in accordance and consistent with, and subject to, the

provisions of the Plan (the provisions of which are incorporated herein by reference) and, except as otherwise expressly set forth herein, the capitalized terms used in this Agreement shall have the same definitions as set forth in the Plan. For

purposes of this Agreement, employment with any subsidiary of the Company shall be considered employment with the Company.

1.3 This Award

is conditioned on the Grantee’s acceptance of this Agreement, including through an online or electronic acceptance method approved by the Company. If this Agreement is not properly accepted by the Grantee within one month of the Grantee’s

receipt of the Agreement, it may be canceled by the Committee resulting in the immediate forfeiture of all Options.

The per Share price the Grantee must pay to exercise the Option

(the “Option Exercise Price”) is set forth above.

| |

3. |

Duration and Exercise of Option |

3.1 Vesting Schedule. The Option shall vest with

respect to the number of Shares and on the dates set forth in the Vesting Schedule above. Once vested, the Option may be exercised, from time to time, with respect to all or any part of the total number of vested Shares, subject to earlier vesting

or termination of the Option as provided in this Agreement.

3.2 Expiration. The Option may not be exercised with respect to any

Shares subject hereto after the earliest of (i) ten (10) years from the Grant Date, (ii) the date the Grantee’s employment is terminated by the Company or a Subsidiary for Cause, (iii) twelve (12) months following the

date of the Grantee’s death or the date the Grantee is terminated by the Company due to the Grantee’s Disability, or (iv) two (2) months after the Grantee ceases to be an employee of the Company for any other reason including

Retirement (such earliest date is herein called the “Option Expiration Date”) and may be exercised until the Option Expiration Date only in accordance with the terms of this Agreement and the Plan.

3.3 Termination for Cause. If the Grantee’s employment is terminated for Cause, the entire Option (whether vested or unvested)

shall be immediately forfeited as of the Grantee’s date of termination of employment.

3.4 Death or Disability. If the Grantee

dies while employed by the Company or is terminated by the Company due to the Grantee’s Disability, any unvested portion of the Option shall immediately vest and become exercisable, and such portion together with any vested, unexercised portion

of the Option shall remain exercisable until the Option Expiration Date.

2

3.5 Other Termination of Employment. Upon the Grantee’s termination of employment for

any reason other than Cause, death or Disability, any unvested portion of the Option will be forfeited. Any vested portion shall remain exercisable until the Option Expiration Date.

3.6 Change in Control. Notwithstanding Section 3.5 above, in the event of a Change in Control followed within two years by a

termination of the Grantee’s employment by the Company without Cause, any unvested portion of the Option shall become immediately vested and exercisable as of the date of the Grantee’s termination of employment.

3.7 Exercise. This Option may be exercised in whole or in part by delivering to the Company a written notice of exercise specifying the

number of Shares to be purchased together with full payment of the aggregate Option Exercise Price as provided in the Plan.

| |

4. |

Securities Laws Restrictions |

The Option may not be exercised at any time unless, in the

opinion of counsel for the Company, the issuance and sale of the Shares issued upon such exercise is exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”), or any other applicable securities or

“blue sky” laws, or the Shares have been registered under such laws. The Company shall not be required to register the Shares issuable upon the exercise of the Option under any such laws. Unless the Shares have been registered under all

such laws, the Grantee shall represent, warrant and agree, as a condition to the exercise of the Option, that the Shares are being purchased for investment only and without a view to any sale or distribution of such Shares and that such Shares shall

not be transferred or disposed of in any manner without registration under such laws, unless it is the opinion of counsel for the Company that such a disposition is exempt from such registration. The Grantee acknowledges that the certificates

evidencing the shares issued upon the exercise of the Option shall bear an appropriate legend giving notice of the foregoing transfer restrictions, and/or that the Company’s or its transfer agent’s and registrar’s books and records

may contain notations to similar effect.

Unless the Committee specifically determines otherwise, the Option

is personal to the Grantee and the Option may not be sold, assigned, transferred, pledged or otherwise encumbered other than by will or the laws of descent and distribution. Any such purported transfer or assignment shall be null and void.

| |

6. |

No Right to Continued Employment |

Nothing in this Agreement or the Plan shall be

interpreted or construed to confer upon the Grantee any right with respect to continuance of employment by the Company or a subsidiary, nor shall this Agreement or the Plan interfere in any way with the right of the Company or a subsidiary to

terminate at any time the Grantee’s employment, subject to Grantee’s rights under this Agreement.

3

The Grantee shall be responsible for all federal, state and local

income and employment taxes payable with respect to this Award and the delivery of Shares upon exercise of the Award. Prior to the issuance of Shares upon exercise of this Option, Grantee must pay, or make adequate provision for, any applicable

domestic or foreign tax withholding obligation of the Company, whether national, federal, state or local. The Company shall have the right to retain and withhold from any payment or distribution to the Grantee the amount of taxes required by any

government to be withheld or otherwise deducted and paid with respect to such payment. The Company may require Grantee to reimburse the Company for any such taxes required to be withheld and may withhold any payment or distribution in whole or in

part until the Company is so reimbursed.

| |

8. |

Plan Documents; Grantee Bound by the Plan |

The Grantee hereby acknowledges that a copy

of the Plan, the Plan Prospectus and the Company’s latest annual report to shareholders or annual report on Form 10-K are available on the Company’s intranet site or upon request. Grantee agrees to be bound by all the terms and provisions

of the Plan.

9.1 Grantee hereby acknowledges that the Company may disclose

(and/or has already disclosed) to the Grantee and the Grantee may be provided with access to and otherwise make use of, certain valuable, Confidential Information (as defined below) of the Company. Grantee also acknowledges that due to the

Grantee’s relationship with the Company, Grantee will develop (and/or has developed) special contacts and relationships with the Company’s employees, customers, suppliers and vendors and that it would be unfair and harmful to the Company

if the Grantee took advantage of these relationships to the detriment of the Company. For purposes of this Section 9, references to the Company shall be deemed to include references to any subsidiary of the Company.

9.2 Grantee hereby agrees that during employment and for a period of one (1) year following any voluntary or involuntary termination of

employment with the Company (regardless of reason), the Grantee will not directly or indirectly, individually, or on behalf of any Person other than the Company:

(a) solicit, recruit or induce (or otherwise assist any person or entity in soliciting, recruiting or inducing) any employee or

independent contractor of the Company who performed work for the Company within the final year of the Grantee’s employment with the Company to terminate his or her relationship with the Company;

4

(b) knowingly or intentionally damage or destroy the goodwill and esteem of the

Company, the Company’s Business or the Company’s suppliers, employees, patrons, customers, and others who may at any time have or have had relations with the Company;

(c) solicit the Company’s Customers, directly or indirectly, for the purpose of providing products or services identical

to or reasonably substitutable with the products or services of the Company’s Business; or

(d) engage in or otherwise

provide Services, directly or indirectly, within the Territory, to or for any Person or entity engaged in a business that competes directly or indirectly with the Company’s Business. Businesses that compete with the Company specifically

include, but are not limited to, the following entities and each of their subsidiaries, affiliates, franchisees, assigns or successors in interest: AcceptanceNow; American First Finance, Inc.; American Rental; Bi-Rite Co., d/b/a Buddy’s Home

Furnishings; Bestway Rental, Inc.; Better Finance, Inc.; billfloat; Bluestem Brands, Inc.; Conn’s, Inc.; Crest Financial; Curacao Finance; Dent-A-Med, Inc. d/b/a The HELPcard; Discover Rentals; Easyhome, Inc.; Flexi Compras Corp.; FlexShopper

LLC; Fortiva Financial, LLC; Genesis Financial Solutions, Inc.; Lendmark Financial Serivces, Inc.; Mariner Finance, LLC; Merchants Preferred Lease-Purchase Services; New Avenues, LLC; Okinus; Premier Rental-Purchase, Inc.; OneMaine Financial

Holdings, Inc.; Purchasing Power, LLC; Regional Management Corp.; Rent-A-Center, Inc. (including, but not limited to, Colortyme); Santander Consumer USA Inc.; Springleaf Financial; Tidewater Finance Company; and WhyNotLeaseIt.

9.3 The Grantee further agrees that during employment and for a period of one (1) year thereafter (or, with respect to Confidential

Information that constitutes a “trade secret” under applicable law, until such information ceases to be a trade secret), he will not, except as necessary to carry out his duties as an employee of the Company, disclose or use Confidential

Information. The Grantee further agrees that, upon termination or expiration of employment with the Company for any reason whatsoever or at any time, the Grantee will deliver promptly to the Company all materials (including electronically-stored

materials), documents, plans, records, notes, or other papers, and any copies in the Grantee’s possession or control, relating in any way to the Company’s Business or containing any Confidential Information of the Company, which at all

times shall be the property of the Company.

9.4 For purposes of this Section 9, the following terms shall have the meanings

specified below:

(a) “Company’s Business” means the businesses of (i) financing, renting,

leasing and selling new, rental or reconditioned residential furniture, electronic goods, household appliances, and related equipment and accessories; and/or (ii) providing web-based, virtual or remote lease-to-own programs or financing.

5

(b) “Confidential Information” means information, without regard

to form and whether or not in writing, relating to Company’s customers, operation, finances, and business that derives value, actual or potential, from not being generally known to other Persons, including, but not limited to, technical or

non-technical data (including personnel data relating to Company employees), formulas, patterns, compilations (including compilations of customer information), programs, devices, methods, techniques (including rental, leasing, and sales techniques

and methods), processes, financial data (including rate and price information concerning products and services provided by the Company), or lists of actual or potential customers (including identifying information about customers). Such information

and compilations of information shall be contractually subject to protection under this Agreement whether or not such information constitutes a trade secret and is separately protectable at law or in equity as a trade secret. Confidential

Information includes information disclosed to the Company by third parties that the Company is obligated to maintain as confidential.

(c) “Customers” means all customers the Company in the Territory (i) with whom Grantee has had contact on

behalf the Company, (ii) whose dealings with the Company were coordinated or supervised by Grantee, or (iii) about whom Grantee obtained Confidential Information, in each case during the twelve (12) calendar months immediately prior

to termination of Grantee’s Services in the Territory.

(d) “Person” has the meaning ascribed to such

term in the Plan. For the avoidance of doubt, a Person shall include any individual, corporation, bank, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or other entity.

(e) “Services” means the services the Grantee provides or has provided for the Company.

(f) “Territory” means the United States, which is the geographic area in which the Company conducts the

Company’s Business.

9.5 If, during his employment with the Company or at any time during the restrictive periods described above,

the Grantee violates the restrictive covenants set forth in this Section 9, then the Committee may, notwithstanding any other provision in this Agreement to the contrary, cancel any outstanding Options under this Agreement that have not yet

been exercised. The parties further agree and acknowledge that the rights conveyed by this Agreement are of a unique and special nature and that the Company will not have an adequate remedy at law in the event of a failure by the Grantee to abide by

its terms and conditions nor will money damages adequately compensate for such injury. It is, therefore, agreed between the parties that, in the event of a breach by the Grantee of any of his obligations contained in Section 9 of this

Agreement, the Company shall have the right, among other rights, to damages sustained thereby and to obtain an injunction or decree of specific performance from

6

any court of competent jurisdiction to restrain or compel the Grantee to perform as agreed herein. The Grantee agrees that this Section 9 shall survive the termination of his or her

employment. Nothing contained herein shall in any way limit or exclude any other right granted by law or equity to the Company.

| |

10. |

Modification of Agreement |

No provision of this Agreement may be materially amended or

waived unless agreed to in writing and signed by the Committee (or its designee), and no such amendment or waiver shall cause the Agreement to violate Code Section 409A. Any such amendment to this Agreement that is materially adverse to the

Grantee shall not be effective unless and until the Grantee consents, in writing, to such amendment (provided that any amendment that is required to comply with Code Section 409A shall be effective without consent unless the Grantee expressly

denies consent to such amendment in writing). The failure to exercise, or any delay in exercising, any right, power or remedy under this Agreement shall not waive any right, power or remedy which the Company has under this Agreement.

This Option and the Shares received upon exercise of the Option shall be

subject to clawback by the Company to the extent provided in any policy adopted by the Board including any policy adopted to comply with the requirements of Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Should any provision of this Agreement be held by a court of competent

jurisdiction to be unenforceable or invalid for any reason, the remaining provisions of this Agreement shall not be affected by such holding and shall continue in full force in accordance with their terms.

The validity, interpretation, construction and performance of this

Agreement shall be governed by the laws of the State of Georgia without giving effect to the conflicts of laws principles thereof.

| |

14. |

Successors in Interest |

This Agreement shall inure to the benefit of, and be binding

upon, the Company and its successors and assigns, and upon any Person acquiring, whether by merger, consolidation, reorganization, purchase of stock or assets, or otherwise, all or substantially all of the Company’s assets and business. This

Agreement shall inure to the benefit of the Grantee’s legal representatives. All obligations imposed upon the Grantee and all rights granted to the Company under this Agreement shall be final, binding and conclusive upon the Grantee’s

heirs, executors, administrators and successors.

7

| |

15. |

Resolution of Disputes |

Any dispute or disagreement which may arise under, or as a

result of, or in any way relate to the interpretation, construction or application of this Agreement shall be determined by the Committee. Any determination made hereunder shall be final, binding and conclusive on the Grantee and the Company for all

purposes.

This Agreement and this Option Award is intended to be exempt

from or to satisfy the requirements of Code Section 409A and any regulations or guidance that may be adopted thereunder from time to time and shall be interpreted by the Committee as it determines necessary or appropriate in accordance with

Code Section 409A to avoid a plan failure under Code Section 409A(a)(1). This Section does not, however, create any obligation on the part of the Company to modify the terms of this Option or the Plan and does not guarantee that the Option

or the delivery of Shares upon exercise of the Option will not be subject to taxes, interest and penalties or any other adverse tax consequences under Code Section 409A. The Company will have no liability to the Grantee or any other party if

the Option, the delivery of Shares upon exercise of the Option or any other payment hereunder that is intended to be exempt from, or compliant with, Code Section 409A, is not so exempt or compliant or for any action taken by the Committee with

respect thereto.

[Signature Page Follows]

8

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

By signing below or by accepting this Award as evidenced by electronic means acceptable to the

Committee, Grantee hereby (i) acknowledges that a copy of the Plan, the Plan Prospectus and the Company’s latest annual report to shareholders or annual report on Form 10-K are available from the Company’s intranet site or upon

request, (ii) represents that he is familiar with the terms and provisions of this Agreement and the Plan, and (iii) accepts the Option Award subject to all the terms and provisions of this Agreement and the Plan. Grantee agrees to accept

as binding, conclusive and final all decisions or interpretations of the Compensation Committee of the Board of Directors upon any questions arising under the Plan. Grantee authorizes the Company to withhold from any compensation payable to him, in

accordance with applicable law, any taxes required to be withheld by federal, state or local law as a result of the grant, vesting or exercise of the Option.

9

Exhibit 99.3

AARON’S, INC.

2015

EQUITY AND INCENTIVE PLAN

EXECUTIVE PERFORMANCE SHARE AWARD AGREEMENT

THIS AGREEMENT is made and entered into as of the day of March, 2015, by and between AARON’S, INC. (“the

“Company”) and the eligible participant who is identified in a separate grant notice (the “Grantee”).

WITNESSETH:

WHEREAS, the

Company has adopted the Aaron’s, Inc. 2015 Equity and Incentive Plan (the “Plan”), and the Plan will be submitted to the Company’s shareholders for approval; and

WHEREAS, the Grantee has been selected by the Compensation Committee (the “Committee”) to receive a grant of Performance

Shares under the Plan, contingent upon shareholder approval of the Plan;

NOW, THEREFORE, IT IS AGREED, by and between the Company and the

Grantee, as follows:

| |

1. |

Award of Performance Shares |

1.1 The Company hereby grants to the Grantee the right to

earn shares of the Company’s Common Stock, Par Value $0.50 Per Share (“Shares”) based upon satisfaction of certain performance conditions pursuant to the provisions and restrictions contained in the Plan and this Agreement (the

“Performance Shares”). The grant date of this award of Performance Shares is March , 2015 (“Grant Date”). The target number of Performance Shares granted to the Grantee is [NUMBER] (the

“Target Award”. This Award is intended to be a Qualified Performance-Based Award as defined in the Plan.

1.2 This

Agreement shall be construed in accordance and consistent with, and subject to, the provisions of the Plan (the provisions of which are incorporated herein by reference) and, except as otherwise expressly set forth herein, the capitalized terms used

in this Agreement shall have the same definitions as set forth in the Plan. For purposes of this Agreement, employment with any subsidiary of the Company shall be considered employment with the Company.

1.3 This Award is conditioned on the Grantee’s acceptance of this Agreement, including through an online or electronic acceptance method

approved by the Company. If this Agreement is not accepted by the Grantee within one month of the Grantee’s receipt of the Agreement, it may be canceled by the Committee resulting in the immediate forfeiture of all Performance Shares.

1

1.4 This Award is contingent upon shareholder approval of the Plan. Notwithstanding any other

provision of the Plan, the Grantee will have no rights under this Agreement unless and until the Company’s shareholders approve the Plan. If the Company’s shareholders do not approve the Plan on or before December 31, 2015, this Award

will be canceled and the Grantee will have no rights with respect to this Award or pursuant to this Agreement.

2.1 Performance Conditions. Subject to the terms and conditions set

forth herein and in Section 2.2 below, the Grantee will be eligible to earn up to 200% of the Grantee’s Target Award based on attainment of the Performance Measures (as defined and set forth on Exhibit A of this Agreement) for the

period beginning on January 1, 2015 and ending on December 31, 2015 (the “Performance Period”). If the Committee determines that the threshold level of performance for a Performance Measure was not achieved, the Grantee

will immediately forfeit the Performance Shares with respect to such Performance Measure. If the Committee determines that at least the threshold level of performance for a Performance Measure was achieved, the Grantee will be eligible to earn a

portion of the Performance Shares as provided on Exhibit A. The Committee will determine and certify the number of Performance Shares, if any, that the Grantee earns based on satisfaction of the Performance Measures as soon as practicable and

within 75 days following the end of the Performance Period (the “Earned Award”). In all cases, the number of Performance Shares, if any, in the Grantee’s Earned Award will be rounded down to the nearest whole number of

Performance Shares (as necessary). Upon the Committee’s determination of the Earned Award, the Grantee will immediately forfeit all Performance Shares other than the Earned Award. To become vested in the Earned Award, the Grantee must also

satisfy the employment requirements of Section 2.2 below.

2.2 Employment Requirements.

(a) Continuous Employment. Except as provided in subsections 2.2(b) and (c) below, the Grantee will vest in the

Earned Award with respect to the percentage of the Earned Award and on the dates set forth in the following table only if the Grantee remains continuously employed with the Company or any subsidiary during the period beginning on the Grant Date and

ending on the applicable vesting date:

|

|

|

| Percentage

of Earned Award |

|

Vesting Date |

|

|

|

|

|

|

|

|

|

2

If the number of Shares determined based on the stated percentage is not a whole

number, the number will be rounded up to the next whole number on the 1st vesting date, rounded down on the 2nd vesting date, and on the final

vesting date, shall equal the total number of Shares in the Earned Award less the total number of Shares in the Earned Award that could have vested on the 1st and 2nd vesting dates.

(b) Death or Disability. If the Grantee’s

employment with the Company is terminated prior to the end of the Performance Period due to the Grantee’s death or by the Company due to the Grantee’s Disability, the Grantee will vest in a pro rata portion of the Earned Award (if any) on

the date on which the Committee determines the Earned Award and will forfeit the remainder of the Earned Award (if any) on such date. The portion of the Earned Award that will vest under the immediately prior sentence shall be determined by

multiplying the total number of Performance Shares in the Earned Award by a fraction, the numerator of which is the total number of calendar days during which the Grantee was employed by the Company during the Performance Period and the denominator

of which is 365, rounded up to the nearest whole number of Performance Shares (as necessary). If the Grantee’s employment is terminated due to death or by the Company due to Disability after the end of the Performance Period and prior to the

date the Earned Award is fully vested, any unvested portion of Grantee’s Earned Award shall become fully vested and nonforfeitable as of the later of (i) the date the Committee determines the Earned Award, or (ii) the date of

Grantee’s death or termination by the Company for Disability.

(c) Change in Control. In the event of a Change

in Control followed within two years by a termination of the Grantee’s employment by the Company without Cause prior to the end of the Performance Period or prior to the date the Committee determines the Earned Award, the Grantee shall vest in

full in the Target Award as of the date of the Grantee’s termination of employment. In the event of a termination of the Grantee’s employment by the Company without Cause within two years after a Change in Control and after the Committee

has determined the Earned Award, the Grantee shall vest in the unvested portion of the Earned Award as of the date of the Grantee’s termination of employment.

(d) Other Termination of Employment. If the Grantee’s employment with the Company terminates for any reason other

than as provided in (b) or (c) above, the unvested portion of the Earned Award will be forfeited on the Grantee’s termination date.

3.1 On, or as soon as practicable and no later than 60 days after, the date

a portion of the Earned Award vests in accordance with Section 2 above, the Company shall deliver to the Grantee a number of Shares equal to the number of Shares in the vested portion of the Earned Award. In the case of vesting due to the

Grantee’s death,

3

the Shares shall be delivered to Grantee’s personal representative or his estate as soon as practicable and no later than 60 days after Grantee’s date of death (or if later, the date

the Earned Award is determined).

3.2 The Company may deliver the Shares by the delivery of physical stock certificates or by

certificateless book-entry issuance. The Company may, at the request of Grantee or the personal representative of his estate, deliver the Shares to the Grantee’s or the estate’s broker-dealer or similar custodian and/or issue the Shares in

“street name,” either by delivery of physical certificates or electronically.

| |

4. |

Stock; Dividends; Voting |

4.1 Except as provided in Section 4.2, the Grantee shall

not have voting or any other rights as a shareholder of the Company with respect to the Performance Shares. Upon settlement of the Performance Shares with the issuance of Shares, the Grantee will obtain full voting and other rights as a shareholder

of the Company.

4.2 In the event of any adjustments in authorized Shares as provided in Article 4 of the Plan, the number of Performance

Shares and Shares or other securities to which the Grantee shall be entitled pursuant to this Agreement shall be appropriately adjusted or changed to reflect such change, provided that any such additional Performance Shares, Shares or additional or

different shares or securities shall remain subject to the restrictions in this Agreement.

4.3 The Grantee represents and warrants that

he is acquiring the Performance Shares and the Shares under this Agreement for investment purposes only, and not with a view to distribution thereof. The Grantee is aware that the Performance Shares and the Shares may not be registered under the

federal or any state securities laws and that, in addition to the other restrictions on the Shares, the Shares will not be able to be transferred unless an exemption from registration is available. By making this award of Performance Shares, the

Company is not undertaking any obligation to register the Performance Shares or Shares under any federal or state securities laws.

Unless the Committee specifically determines otherwise, the

Performance Shares are personal to the Grantee and the Performance Shares may not be sold, assigned, transferred, pledged or otherwise encumbered other than by will or the laws of descent and distribution. Any such purported transfer or assignment

shall be null and void.

| |

6. |

No Right to Continued Employment |

Nothing in this Agreement or the Plan shall be

interpreted or construed to confer upon the Grantee any right with respect to continuance of employment by the Company or a subsidiary, nor shall this Agreement or the Plan interfere in any way with the right of the Company or a subsidiary to

terminate at any time the Grantee’s employment, subject to Grantee’s rights under this Agreement.

4

The Grantee shall be responsible for all federal, state and local

income and employment taxes payable with respect to this Award of Performance Shares and the delivery of Shares in satisfaction of the Performance Shares. Unless the Grantee otherwise provides for the satisfaction of the withholding requirements in

advance, upon vesting of all or a portion of the Earned Award of Performance Shares, the Company shall withhold and cancel a number of Shares having a market value equal to the minimum amount of taxes required to be withheld. The Company shall have

the right to retain and withhold from any payment or distribution to the Grantee the amount of taxes required by any government to be withheld or otherwise deducted and paid with respect to such payment. The Company may require Grantee to reimburse

the Company for any such taxes required to be withheld and may withhold any payment or distribution in whole or in part until the Company is so reimbursed.

| |

8. |

Plan Documents; Grantee Bound by the Plan |

The Grantee hereby acknowledges availability

of the Plan, the Plan Prospectus and the Company’s latest annual report to shareholders or annual report on Form 10-K on the Company’s intranet. Grantee agrees to be bound by all the terms and provisions of the Plan.

9.1 Grantee hereby acknowledges that the Company may disclose

(and/or has already disclosed) to the Grantee and the Grantee may be provided with access to and otherwise make use of, certain valuable, Confidential Information (as defined below) of the Company. Grantee also acknowledges that due to the

Grantee’s relationship with the Company, Grantee will develop (and/or has developed) special contacts and relationships with the Company’s employees, customers, suppliers and vendors and that it would be unfair and harmful to the Company

if the Grantee took advantage of these relationships to the detriment of the Company. For purposes of this Section 9, references to the Company shall be deemed to include references to any subsidiary of the Company.

9.2 Grantee hereby agrees that during employment and for a period of one (1) year following any voluntary or involuntary termination of

employment with the Company (regardless of reason), the Grantee will not directly or indirectly, individually, or on behalf of any Person other than the Company:

(a) solicit, recruit or induce (or otherwise assist any person or entity in soliciting, recruiting or inducing) any employee or

independent contractor of the Company who performed work for the Company within the final year of the Grantee’s employment with the Company to terminate his or her relationship with the Company;

5

(b) knowingly or intentionally damage or destroy the goodwill and esteem of the

Company, the Company’s Business or the Company’s suppliers, employees, patrons, customers, and others who may at any time have or have had relations with the Company;

(c) solicit the Company’s Customers, directly or indirectly, for the purpose of providing products or services identical

to or reasonably substitutable with the products or services of the Company’s Business; or

(d) engage in or otherwise

provide Services, directly or indirectly, within the Territory, to or for any Person or entity engaged in a business that competes directly or indirectly with the Company’s Business. Businesses that compete with the Company specifically

include, but are not limited to, the following entities and each of their subsidiaries, affiliates, franchisees, assigns or successors in interest: AcceptanceNow; American First Finance, Inc.; American Rental; Bi-Rite Co., d/b/a Buddy’s Home

Furnishings; Bestway Rental, Inc.; Better Finance, Inc.; billfloat; Bluestem Brands, Inc.; Conn’s, Inc.; Crest Financial; Curacao Finance; Dent-A-Med, Inc. d/b/a The HELPcard; Discover Rentals; Easyhome, Inc.; Flexi Compras Corp.; FlexShopper

LLC; Fortiva Financial, LLC; Genesis Financial Solutions, Inc.; Lendmark Financial Serivces, Inc.; Mariner Finance, LLC; Merchants Preferred Lease-Purchase Services; New Avenues, LLC; Okinus; Premier Rental-Purchase, Inc.; OneMaine Financial

Holdings, Inc.; Purchasing Power, LLC; Regional Management Corp.; Rent-A-Center, Inc. (including, but not limited to, Colortyme); Santander Consumer USA Inc.; Springleaf Financial; Tidewater Finance Company; and WhyNotLeaseIt.

9.3 The Grantee further agrees that during employment and for a period of one (1) year thereafter (or, with respect to Confidential

Information that constitutes a “trade secret” under applicable law, until such information ceases to be a trade secret), he will not, except as necessary to carry out his duties as an employee of the Company, disclose or use Confidential

Information. The Grantee further agrees that, upon termination or expiration of employment with the Company for any reason whatsoever or at any time, the Grantee will deliver promptly to the Company all materials (including electronically-stored

materials), documents, plans, records, notes, or other papers, and any copies in the Grantee’s possession or control, relating in any way to the Company’s Business or containing any Confidential Information of the Company, which at all

times shall be the property of the Company.

9.4 For purposes of this Section 9, the following terms shall have the meanings

specified below:

(a) “Company’s Business” means the businesses of (i) financing, renting,

leasing and selling new, rental or reconditioned residential furniture, electronic goods, household appliances, and related equipment and accessories; and/or (ii) providing web-based, virtual or remote lease-to-own programs or financing.

6

(b) “Confidential Information” means information, without regard

to form and whether or not in writing, relating to Company’s customers, operation, finances, and business that derives value, actual or potential, from not being generally known to other Persons, including, but not limited to, technical or

non-technical data (including personnel data relating to Company employees), formulas, patterns, compilations (including compilations of customer information), programs, devices, methods, techniques (including rental, leasing, and sales techniques

and methods), processes, financial data (including rate and price information concerning products and services provided by the Company), or lists of actual or potential customers (including identifying information about customers). Such information

and compilations of information shall be contractually subject to protection under this Agreement whether or not such information constitutes a trade secret and is separately protectable at law or in equity as a trade secret. Confidential

Information includes information disclosed to the Company by third parties that the Company is obligated to maintain as confidential.

(c) “Customers” means all customers of the Company in the Territory (i) with whom Grantee has had contact

on behalf the Company, (ii) whose dealings with the Company were coordinated or supervised by Grantee, or (iii) about whom Grantee obtained Confidential Information, in each case during the twelve (12) calendar months preceding

termination of Grantee’s Services in the Territory.

(d) “Person” has the meaning ascribed to such

term in the Plan. For the avoidance of doubt, a Person shall include any individual, corporation, bank, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or other entity.

(e) “Services” means the services the Grantee provides or has provided for the Company.

(f) “Territory” means the United States. Grantee agrees that the Company conducts the Company’s Business

in the Territory.

9.5 If, during his employment with the Company or at any time during the restrictive periods described above, the

Grantee violates the restrictive covenants set forth in this Section 9, then the Committee may, notwithstanding any other provision in this Agreement to the contrary, cancel any Performance Shares outstanding under this Award that have not yet

vested. The parties further agree and acknowledge that the rights conveyed by this Agreement are of a unique and special nature and that the Company will not have an adequate remedy at law in the event of a failure by the Grantee to abide by its

terms and conditions nor will money damages adequately compensate for such injury. It is, therefore, agreed between the parties that, in the event of a breach by the Grantee of any of his obligations contained in Section 9 of this

7

Agreement, the Company shall have the right, among other rights, to damages sustained thereby and to obtain an injunction or decree of specific performance from any court of competent

jurisdiction to restrain or compel the Grantee to perform as agreed herein. The Grantee agrees that this Section 9 shall survive the termination of his or her employment. Nothing contained herein shall in any way limit or exclude any other

right granted by law or equity to the Company.

| |

10. |

Modification of Agreement |

No provision of this Agreement may be materially amended or

waived unless agreed to in writing and signed by the Committee (or its designee), and no such amendment or waiver shall cause the Agreement to violate Code Section 409A. Any such amendment to this Agreement that is materially adverse to the

Grantee shall not be effective unless and until the Grantee consents, in writing, to such amendment (provided that any amendment that is required to comply with Code Section 409A shall be effective without consent unless the Grantee expressly

denies consent to such amendment in writing). The failure to exercise, or any delay in exercising, any right, power or remedy under this Agreement shall not waive any right, power or remedy which the Company has under this Agreement.

This Award of Performance Shares and the Shares received upon settlement of

the Performance Shares shall be subject to clawback by the Company to the extent provided in any policy adopted by the Board including any policy adopted to comply with the requirements of Section 954 of the Dodd-Frank Wall Street Reform and

Consumer Protection Act.

Should any provision of this Agreement be held by a court of competent

jurisdiction to be unenforceable or invalid for any reason, the remaining provisions of this Agreement shall not be affected by such holding and shall continue in full force in accordance with their terms.

The validity, interpretation, construction and performance of this

Agreement shall be governed by the laws of the State of Georgia without giving effect to the conflicts of laws principles thereof.

| |

14. |

Successors in Interest |

This Agreement shall inure to the benefit of, and be binding

upon, the Company and its successors and assigns, and upon any Person acquiring, whether by merger, consolidation, reorganization, purchase of stock or assets, or otherwise, all or substantially all of the Company’s assets and business. This

Agreement shall inure to the benefit of the Grantee’s legal representatives. All obligations imposed upon the

8

Grantee and all rights granted to the Company under this Agreement shall be final, binding and conclusive upon the Grantee’s heirs, executors, administrators and successors.

| |

15. |

Resolution of Disputes |

Any dispute or disagreement which may arise under, or as a

result of, or in any way relate to the interpretation, construction or application of this Agreement shall be determined by the Committee. Any determination made hereunder shall be final, binding and conclusive on the Grantee and the Company for all

purposes.

This Agreement and this award of Performance Shares is intended

to satisfy the requirements of Code Section 409A and any regulations or guidance that may be adopted thereunder from time to time and shall be interpreted by the Committee as it determines necessary or appropriate in accordance with Code

Section 409A to avoid a plan failure under Code Section 409A(a)(1). To ensure compliance with Section 409A of the Code, (i) under all circumstances, vested Performance Shares that have not otherwise been forfeited shall be

settled by delivery of the Shares no later than March 15th of the year following the year in which the Performance Shares vest, and (ii) this Agreement is subject to the provisions of

Section 17.12 of the Plan (including the six-month delay, if applicable). This Section 16 does not create any obligation on the part of the Company to modify the terms of this Agreement or the Plan and does not guarantee that the

Performance Shares or the delivery of Shares upon settlement of the Performance Shares will not be subject to taxes, interest and penalties or any other adverse tax consequences under Code Section 409A. The Company will have no liability to the

Grantee or any other party if the Performance Shares, the delivery of Shares upon settlement of the Performance Shares or any other payment hereunder that is intended to be exempt from, or compliant with, Code Section 409A, is not so exempt or

compliant or for any action taken by the Committee with respect thereto.

[Signature Page Follows]

9

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

By signing below or by accepting this Award as evidenced by electronic means acceptable to the

Committee, Grantee hereby (i) acknowledges that a copy of the Plan, the Plan Prospectus and the Company’s latest annual report to shareholders or annual report on Form 10-K are available from the Company’s intranet site or upon

request, (ii) represents that he is familiar with the terms and provisions of this Agreement and the Plan, and (iii) accepts the award of Performance Shares subject to all the terms and provisions of this Agreement and the Plan using an

online grant agreement/e-signature. Grantee hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Compensation Committee of the Board of Directors upon any questions arising under the Plan. Grantee

authorizes the Company to withhold from any compensation payable to him including by withholding Shares, in accordance with applicable law, any taxes required to be withheld by federal, state or local law as a result of the grant or vesting of the

Performance Shares.

10

Exhibit 99.4

AARON’S, INC.

2015

EQUITY AND INCENTIVE PLAN

EXECUTIVE OFFICER RESTRICTED STOCK UNIT AWARD AGREEMENT

THIS AGREEMENT is made and entered into as of the 10th day of March, 2015, by and between

AARON’S, INC. (“the “Company”) and [GRANTEE NAME] (the “Grantee”).

WITNESSETH:

WHEREAS, the Company has adopted the Aaron’s, Inc. 2015 Equity and Incentive Plan (the “Plan”), and the Plan will be

submitted to the Company’s shareholders for approval; and

WHEREAS, the Grantee has been selected by the Compensation Committee (the

“Committee”) to receive a grant of Restricted Stock Units (“RSUs”) under the Plan, contingent upon shareholder approval of the Plan;

NOW, THEREFORE, IT IS AGREED, by and between the Company and the Grantee, as follows:

| |

1. |

Award of Restricted Stock Units |

1.1 The Company hereby grants to the Grantee an award

of [NUMBER] RSUs, subject to, and in accordance with, the restrictions, terms and conditions set forth in this Agreement and in the Plan. The grant date of this award of RSUs is March 10th, 2015 (“Grant Date”). This Award is

intended to be a Qualified Performance-Based Award as defined in the Plan.

1.2 This Agreement shall be construed in accordance and

consistent with, and subject to, the provisions of the Plan (the provisions of which are incorporated herein by reference) and, except as otherwise expressly set forth herein, the capitalized terms used in this Agreement shall have the same

definitions as set forth in the Plan. For purposes of this Agreement, employment with any subsidiary of the Company shall be considered employment with the Company.

1.3 This Award is conditioned on the Grantee’s acceptance of this Agreement, including through an online or electronic acceptance method

approved by the Company. If this Agreement is not accepted by the Grantee within one month of the Grantee’s receipt of the Agreement, it may be canceled by the Committee resulting in the immediate forfeiture of all RSUs.

1.4 This Award is contingent upon shareholder approval of the Plan. Notwithstanding any other provision of the Plan, the Grantee will have no

rights under

this Agreement unless and until the Company’s shareholders approve the Plan. If the Company’s shareholders do not approve the Plan on or before December 31, 2015, this Award will

be canceled and the Grantee will have no rights with respect to this Award or pursuant to this Agreement.

2.1 Subject to Sections 2.2, 2.3, and 9 below, if the Grantee

remains employed by the Company and the performance goals reflected on Exhibit A (the “Performance Goals”) are met, the Grantee shall become vested in the RSUs with respect to the number of RSUs and on the dates set forth in

the following table.

|

|

|

| Percentage of RSUs |

|

Vesting Date |

|

|

|

|

|

|

|

|

|

If the number of RSUs determined based on the stated percentage is not a whole number, the number will be rounded up to the

next whole number on the 1st vesting date, rounded down on the 2nd vesting date, and on the final vesting date, shall equal the total number of

RSUs less the total number of RSUs that could have vested on the 1st and 2nd vesting dates. As provided in Exhibit A, (i) no RSUs will

vest on a vesting date unless and until the Committee certifies whether the Performance Goals for the applicable performance period were attained, and (ii) some or all of the RSUs will be forfeited to the extent the Performance Goals are not

attained.

2.2 If, prior to the date all RSUs have vested, the Grantee dies or the Grantee’s employment is terminated due to

Disability, the unvested RSUs (that have not been forfeited for failure to meet the Performance Goals) shall become fully vested and nonforfeitable as of the Grantee’s death or the date of termination for Disability. Except as provided in the

prior sentence or as provided in Section 2.3, if Grantee terminates employment for any other reason including retirement prior to the date all RSUs have vested, the unvested RSUs shall be forfeited and all rights of Grantee to such RSUs shall

be terminated.

2.3 Notwithstanding the other provisions of this Agreement, in the event of a Change in Control followed within two years

by a termination of the Grantee’s employment by the Company without Cause prior to the date all RSUs have vested, the unvested RSUs (that were not forfeited for failure to meet the Performance Goals) shall become fully vested and nonforfeitable

as of the date of the Grantee’s termination of employment.

2

3.1 Vested RSUs shall be settled on, or as soon as practicable and no later

than 60 days after, the date they are vested in accordance with Section 2 above by delivering to the Grantee a number of shares of the Company’s Common Stock, Par Value $0.50 Per Share (the “Shares”) equal to the number of

vested RSUs. In the case of vesting due to the Grantee’s death, the Shares shall be delivered to Grantee’s personal representative or his estate as soon as practicable and no later than 60 days after the Grantee’s date of death.

3.2 The Company may deliver the Shares by the delivery of physical stock certificates or by certificateless book-entry issuance. The Company

may, at the request of Grantee or the personal representative of his estate, deliver the Shares to the Grantee’s or the estate’s broker-dealer or similar custodian and/or issue the Shares in “street name,” either by delivery of

physical certificates or electronically.

| |

4. |

Stock; Dividends; Voting |

4.1 Except as provided in Section 4.2, the Grantee shall

not have voting or any other rights as a shareholder of the Company with respect to the RSUs. Upon settlement of the RSUs with the issuance of Shares, the Grantee will obtain full voting and other rights as a shareholder of the Company.

4.2 In the event of any adjustments in authorized Shares as provided in Article 4 of the Plan, the number of RSUs and Shares or other

securities to which the Grantee shall be entitled pursuant to this Agreement shall be appropriately adjusted or changed to reflect such change, provided that any such additional RSUs, Shares or additional or different shares or securities shall

remain subject to the restrictions in this Agreement.

4.3 The Grantee represents and warrants that he is acquiring the RSUs and the

Shares under this Agreement for investment purposes only, and not with a view to distribution thereof. The Grantee is aware that the RSUs and the Shares may not be registered under the federal or any state securities laws and that, in addition to

the other restrictions on the Shares, the Shares will not be able to be transferred unless an exemption from registration is available. By making this award of RSUs, the Company is not undertaking any obligation to register the RSUs or Shares under

any federal or state securities laws.

Unless the Committee specifically determines otherwise, the RSUs

are personal to the Grantee and the RSUs may not be sold, assigned, transferred, pledged or otherwise encumbered other than by will or the laws of descent and distribution. Any such purported transfer or assignment shall be null and void.

3

| |

6. |

No Right to Continued Employment |

Nothing in this Agreement or the Plan shall be

interpreted or construed to confer upon the Grantee any right with respect to continuance of employment by the Company or a subsidiary, nor shall this Agreement or the Plan interfere in any way with the right of the Company or a subsidiary to

terminate at any time the Grantee’s employment, subject to Grantee’s rights under this Agreement.

The Grantee shall be responsible for all federal, state and local