By Victor Reklaitis, MarketWatch , Ryan Vlastelica

Mylan also rallies, but Twitter, Dover Corp. among the day's big

decliners

U.S. stocks climbed Monday, lifted by energy shares as hopes

grew that OPEC would reach a deal to cut production, a move seen as

necessary for addressing oversupply in the oil market.

The day's gains were broad, with all but one of the S&P

500's sectors trading in positive territory.

The Dow Jones Industrial Average jumped 102 points, or 0.6% to

18,343. A nearly 2% jump in shares of Apple Inc. (AAPL) led

blue-chip advancers in afternoon trade, while Wal-Mart Stores Inc.,

down 1.3%, weighed on the Dow.

The S&P 500 index climbed about 12 points, or 0.5%, at

2,165. Only consumer-staples shares were trading in the red among

the S&P 500's 11 main sectors.

The S&P energy sector surged 1.5% after Saudi Arabia's

energy minister, Khalid al-Falih, said he was optimistic

(http://www.marketwatch.com/story/not-unthinkable-for-oil-to-hit-60-this-year-says-saudi-energy-minister-2016-10-10)

major oil producers could agree to cut production before year-end.

He also said it wasn't "unthinkable" for crude to rise to $60 a

barrel this year, though others said that oil bulls

(http://www.marketwatch.com/story/what-youve-not-been-seeing-in-this-bull-market-illusion-2016-10-10)

had gotten ahead of themselves.

Oil futures rose 3% to above $51 per barrel. A closely watched

meeting of oil producers in Istanbul this week follows a convention

of members of the Organization of the Petroleum Exporting Countries

and non-OPEC countries in Algiers, where a tentative deal to cap

production was struck.

"Oil is definitely front and center amid what seems to be a

shift in the market," said Wayne Kaufman, chief market analyst at

Phoenix Financial Services in New York. If countries do come

together, "that's a big change, and one that would help our energy

companies, which have been in a bad place, profit-wise. That's good

for the market."

The Nasdaq Composite Index gained 42 points, or 0.8%, at 5,334,

and the Nasdaq-100 index touched a fresh intraday trading record of

4,904.57.

Last week, the S&P 500 lost 0.7%, while the Dow shed 0.4%.

Both snapped a three-week winning streak.

Investors also looked ahead to the coming earnings season

(http://www.marketwatch.com/story/5-things-to-expect-this-earnings-season-2016-10-07),

which will provide clarity into how U.S. companies are faring amid

tepid international growth and ahead of an expected interest-rate

increase by the Federal Reserve. Companies in the S&P 500 are

expected to extend their earnings recession to a sixth-straight

quarter, according to FactSet data, though sales are predicted to

break their six-quarter streak of declines.

While investors and analysts have long expected another quarter

of contracting profits, results that miss a lowered bar of

expectations could hit a market that continues to trade near record

levels. The season unofficially begins Tuesday afternoon, when

Alcoa Inc. (AA) reports. The giant aluminum maker is presenting its

last quarterly earnings report as a single company

(http://www.marketwatch.com/story/alcoa-to-release-last-earnings-before-it-splits-up-2016-10-10),

as it plans to split in two on Nov. 1.

"If earnings don't go up, the market will be relying on multiple

expansion at a time when interest rates are going higher--that's

not going to work," Kaufman said. "If we're going to see stocks go

up, then we need to see the earnings picture improve

dramatically."

Economic news: There are no top-tier U.S. economic releases due

to hit on Monday, as government workers get a holiday for Columbus

Day.

In Federal Reserve news, Chicago Fed President Charles Evans is

scheduled to deliver a speech in Australia at about 9:30 p.m.

Eastern Time.

Corporate movers: In corporate news, Mylan NV(MYL) jumped 8.6%

following news of a settlement

(http://www.marketwatch.com/story/mylan-shares-surge-on-epipen-settlement-news-2016-10-07)

in the company's EpiPen pricing controversy. The stock was the

biggest percentage gainer among S&P 500 components.

On the downside, Twitter Inc.(TWTR) sank 13% after a Bloomberg

report over the weekend suggested the social media company won't

attract any takeover bids

(https://www.bloomberg.com/news/articles/2016-10-08/twitter-sales-process-said-almost-dead-as-suitors-lose-interest).

Dover Corp.(DOV) dropped 6.8% after the maker of gear for the

energy, engineered systems and refrigeration industries cut its

profit and sales outlook for the year

(http://www.marketwatch.com/story/dover-cuts-earnings-and-revenue-outlook-2016-10-10).

U.S.-listed shares of Royal Bank of Scotland PLC(RBS.LN)

(RBS.LN) fell 2% in the wake of reports showing the bank pushed

businesses into default

(http://www.marketwatch.com/story/rbs-shares-fall-on-report-showing-bank-pushed-businesses-into-default-2016-10-10).

In deal news, Noble Group Ltd.(NBL) said it has signed a $1

billion dea

(http://www.marketwatch.com/story/calpine-buys-nobles-us-energy-business-for-1-billion-2016-10-09)l

with Calpine Corp.(CPN) to sell its U.S. energy unit to the power

generation giant. Shares of Noble rose 2.1%.

Other markets: Gold futures rose 0.7%. European stocks closed

higher, while Asian markets mostly gained, though both Japan and

Hong Kong were closed for a holiday. A key dollar index rose

0.2%.

The Mexican peso advanced against the dollar

(http://www.marketwatch.com/story/mexican-peso-gains-after-2nd-presidential-debate-trump-video-fallout-2016-10-10)

on Monday, with analysts saying the move signaled a belief that

Donald Trump's chances of becoming president had fallen after a

tumultuous weekend in which a 2005 video surfaced

(http://www.marketwatch.com/story/trumps-lewd-comments-to-billy-bush-surface-in-recording-2016-10-07).

In the video, Trump boasted of groping women and his sexual

conquests, including pursuing a married woman.

The second presidential debate

(http://www.marketwatch.com/story/donald-trump-hillary-clinton-trade-blows-in-heated-second-debate-2016-10-09)

between Trump and Democratic nominee Hillary Clinton, which

occurred Sunday night, wasn't seen as likely to change the odds of

the election results.

Check out:

(END) Dow Jones Newswires

October 10, 2016 13:10 ET (17:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

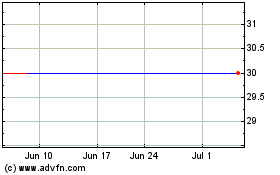

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

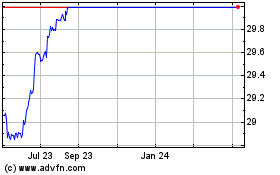

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024