UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant

x

Filed by

a party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

¨

|

|

Definitive Additional Materials

|

|

|

|

|

x

|

|

Soliciting Material Pursuant to §240.14a-12

|

ALCOA INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing party:

|

|

|

|

(4)

|

|

Date Filed:

|

Alcoa Inc. Reverse Stock Split

Questions & Answers

|

1.

|

What is a reverse stock split?

|

In a reverse stock split, a company reduces the number

of its outstanding shares. For example, a shareholder who owns three shares of Alcoa common stock today would own one share after the reverse stock split.

|

2.

|

What is the proposal that Alcoa’s shareholders will be voting on?

|

Alcoa has

announced plans for a 1-for-3 reverse stock split of Alcoa’s common stock and a proportionate, 1-for-3 reduction in the number of authorized shares of its common stock issuable under its Articles of Incorporation.

Alcoa expects to hold a special meeting of shareholders on October 5, 2016 to seek approval for the reverse stock split and for the

proportionate, 1-for-3 reduction in the number of authorized shares of its common stock issuable under its Articles of Incorporation. The affirmative vote of a majority of the votes cast by all shareholders entitled to vote is required to approve

both matters. Alcoa has set August 3, 2016, as the record date for the special meeting. A preliminary proxy statement has been filed with the U.S. Securities and Exchange Commission, and Alcoa plans to file a definitive proxy statement in due

course.

Please read the preliminary proxy statement and the definitive proxy statement, when available, for information regarding how to

vote on the reverse stock split proposal and other important information.

|

3.

|

Why is Alcoa seeking to implement a reverse stock split?

|

Although a stock’s

trading price is affected by multiple factors, a reverse stock split is likely to increase the per share trading price of Alcoa common stock as a result of the reduction in the number of shares outstanding. An increase in the trading price may

improve the marketability and liquidity of Alcoa common stock, which may facilitate trading in Alcoa common stock.

For example,

some investors may prefer to invest in stocks that trade at a per share price range more typical of companies listed on the NYSE, and certain institutional investors are prohibited from purchasing stocks that trade below certain minimum price

levels. Also, brokerage commissions paid by investors, as a percentage of a total transaction, tend to be higher for lower-priced stocks.

|

4.

|

Why is Alcoa seeking to implement an authorized share count reduction?

|

Alcoa’s

Articles of Incorporation authorize the issuance of up to 1,800,000,000 shares of common stock. A proportionate, 1-for-3 reduction in the number of authorized shares of common stock will maintain the relative amount of common shares that

Alcoa is authorized to issue as compared to the total amount currently outstanding. In effect, because the authorized number of shares of common stock would be reduced at the same proportionate,

1-for-3 ratio as the reverse stock split, the reverse stock split and reduction in authorized share count would not have the practical effect of increasing the aggregate value, based on per share trading price, of authorized shares of Alcoa common

stock.

|

5.

|

Will a reverse stock split affect the value of my investment?

|

Although a stock’s

trading price is affected by multiple factors, a reverse stock split should not by itself change the total value of your shares. For example, absent other factors, a shareholder who owns 300 shares today with a value of $10/share would own 100

shares with a value of $30/share after the reverse stock split—in each case, the same total value of $3,000. As always, the trading price of Alcoa common stock is subject to market fluctuations and other factors.

|

6.

|

When would the reverse stock split become effective?

|

If shareholders authorize the

proposed 1-for-3 reverse stock split at the special meeting, the reverse stock split and authorized share count reduction will become effective upon the filing by Alcoa of Articles of Amendment implementing these actions in the Pennsylvania

Department of State. The reverse stock split is expected to occur before Alcoa’s separation into Arconic and Alcoa Corporation.

Even

if shareholders authorize the reverse stock split and authorized share count reduction, and adopt such Articles of Amendment, Alcoa may delay the filing of the Articles of Amendment or abandon the reverse stock split and the authorized share count

reduction if the Board of Directors determines that such action is in the best interests of Alcoa and its shareholders.

|

7.

|

Will the reverse stock split impact the shares of Arconic and Alcoa Corporation?

|

In

connection with Alcoa’s previously announced separation into two independent, publicly-traded companies, Alcoa Inc. will be renamed Arconic Inc., and common shares of Alcoa Inc. will become common shares of Arconic Inc. Accordingly, an increase

in the per-share trading price of Alcoa Inc. common shares resulting from the reverse stock split may, after the separation, improve marketability and liquidity, which may facilitate trading, in Arconic common shares.

Prior to completing the separation, Alcoa’s Board of Directors will determine the number of shares of Alcoa Corporation common stock that

will be distributed for each outstanding share of common stock of Alcoa Inc. In determining this distribution ratio, the Board of Directors is expected to consider the impact that it will have on the per-share trading price of Alcoa Corporation

common shares and the trading, marketability and liquidity of such shares.

|

8.

|

How will Alcoa treat fractional shares?

|

Alcoa does not anticipate issuing fractional

shares as a result of the reverse stock split: shareholders entitled to receive fractional shares as a result of the reverse stock split will receive cash payments in lieu of such shares.

-2-

|

9.

|

Will there be any change to Alcoa’s preferred shares?

|

The number of outstanding

preferred shares of Alcoa, and the number of authorized preferred shares of Alcoa, will not be reduced. The reverse stock split only applies with respect to Alcoa’s common stock. No approval of the holders of Alcoa’s outstanding preferred

shares is required for the reverse stock split.

The conversion ratio applicable for Alcoa’s Class B preferred stock will be

proportionately adjusted so that the number of common shares into which each Class B preferred share is convertible into will be reduced on a proportionate, 1-for-3 basis.

|

10.

|

Will there be any change to Alcoa’s convertible notes?

|

Under the terms of

Alcoa’s outstanding convertible notes due 2019, the conversion rate will be adjusted on the date the common stock first trades on the NYSE reflecting the Reverse Stock Split to result in a reduction in the number of shares of common stock into

which each such convertible note may be convertible that is proportionate to the 1-for-3 split ratio.

|

11.

|

Is the reverse stock split subject to completing Alcoa’s pending separation?

|

No.

Alcoa expects to proceed with the reverse stock split and authorized share count reduction prior to and regardless of whether Alcoa’s previously announced separation into two independent, publicly-traded companies is completed.

* * *

Important Information about the Reverse Stock Split Proposal

This communication may be deemed to be solicitation material in connection with the proposal to be submitted to Alcoa’s shareholders at its special

meeting seeking approval to effect a reverse stock split and a reduction in the number of authorized shares of its common stock (the “Reverse Split Proposal”). In connection with the Reverse Split Proposal, Alcoa has filed a preliminary

proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”). Shareholders are urged to read the preliminary proxy statement and all other relevant documents filed with the SEC when they become available,

including the definitive proxy statement, because they will contain important information about the Reverse Split Proposal.

-3-

Investors and security holders will be able to obtain the documents (when available) free of charge at the

SEC’s website, www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC when available at Alcoa’s website, www.alcoa.com. You also may read and copy any reports, statements and other information

filed by Alcoa with the SEC at the SEC public reference room at 100 F Street, N.E. Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

Participants in the Solicitation

Alcoa and its directors

and executive officers may be deemed to be participants in the solicitation of proxies from Alcoa’s shareholders in respect of the Reverse Split Proposal. Information about the directors and executive officers of Alcoa is set forth in

Alcoa’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on March 24, 2016. Investors may obtain additional information regarding the interests of Alcoa and its directors and executive officers in

the Reverse Split Proposal by reading the preliminary proxy statement and, when it becomes available, the definitive proxy statement relating to the special meeting.

Forward-Looking Statements

This communication contains

statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,”

“projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions or

projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements about the reverse stock split, authorized share count reduction and special meeting. Forward-looking

statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are

based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and

uncertainties. Such risks and uncertainties include, but are not limited to (a) uncertainties as to the timing of the separation and whether it will be completed; (b) the possibility that various closing conditions for the separation may

not be satisfied; (c) the possibility that shareholder approval for the reverse stock split and authorized share count reduction will not be obtained; (d) the possibility that factors unrelated to the reverse stock split may impact the per

share trading price of Alcoa’s common stock; and (e) the other risk factors discussed in Alcoa’s Form 10-K for the year ended December 31, 2015, and other reports filed with the SEC. Alcoa disclaims any obligation to update

publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law.

-4-

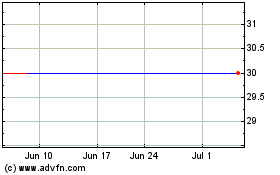

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

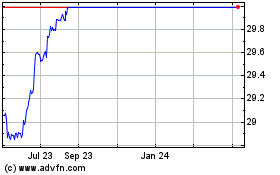

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024