By Sue Chang and Joseph Adinolfi, MarketWatch

Fed's beige book suggests consumer spending easing

U.S. stocks struggled to push higher on Wednesday as the market

took a breather following a three-day rally that had pushed the

S&P 500 and Dow industrials to record closing levels.

The S&P 500 index edged up less than a point to 2,152, with

its broad advance capped by declines in energy and

consumer-discretionary stocks.

"With the S&P 500 up 7.5% the last 10 trading days for the

first time in four-and-a-half years, there's an obvious reason to

take profits today," said Frank Cappelleri, executive director of

institutional sales at Instinet.

The Dow Jones Industrial Average rose 26 points to 18,373. Gains

by Microsoft Corp.(MSFT) and UnitedHealth Group Inc.(UNH) off set

losses by Home Depot Inc. (HD) and Exxon Mobil Corp.(XOM).

The S&P 500 and Dow both rose 0.7% to close at record highs

(http://www.marketwatch.com/story/sp-500-poised-for-fresh-record-as-alcoa-spurs-earnings-optimism-2016-07-12)

on Tuesday, supported by a rally in energy shares and

stronger-than-expected earnings from Alcoa Inc.(AA)

The Nasdaq Composite Index shed 7 points, or 0.1%, to 5,015.

"The market is consolidating as investors wait until more data

come through," said Bill Stone, chief investment strategist at PNC

Asset Management Group.

The next two days are heavy on economic indicators with weekly

jobless claims due on Thursday and inflation, retail sales and

industrial output numbers scheduled for Friday.

The Bank of England is also expected to cut interest rates for

the first time in more than seven years

(http://www.marketwatch.com/story/boe-set-to-cut-rates-for-the-first-time-in-7-years-on-brexit-backlash-2016-07-11)

when it meets on Thursday.

"The consensus points to a rate cut, but it will be interesting

to see how the market responds if it didn't," said Stone.

The economic uncertainty caused by Brexit, the U.K. vote to

leave the European Union, has been a key driver of the recent push

to record levels, raising an expectation for economic disruption in

Europe and the U.K. that lured investors to U.S. assets, said

Mohannad Aama, managing director at Beam Capital Management.

And while economic and financial fundamentals may not justify

further gains, record-low sovereign bond yields and a cautious

Federal Reserve will likely keep values elevated as investors have

fewer better alternatives, Aama added.

Read:Investor pileup driving government bonds to their most

expensive levels ever

(http://www.marketwatch.com/story/bonds-have-never-been-this-expensive-but-investors-keep-piling-in-2016-07-13)

"All these factors push you into U.S. stocks and it's unclear

what was the hair that broke the camel's back that made us break

through this S&P level," he said. "But for now, it looks like

we have a few more points to go."

However, some strategists raised concerns that the recent rally

has been led by defensive plays like utilities and telecom

shares.

"Usually, market rallies driven by defensive sectors don't tend

to last very long. We need to see leadership by sectors like

financials or technology to really count on this rally having

legs," said Jeffrey Kleintop, chief global investment strategist at

Charles Schwab.

Stocks pared some losses following the Federal Reserve's beige

book report, which indicated that the U.S. economy is holding

steady

(http://www.marketwatch.com/story/feds-beige-book-finds-softening-in-retail-sales-2016-07-13)

and that consumption may be softening.

"It's the same old, same old story with the economy moving ahead

at a moderate pace," said Bob Pavlik, chief market strategist at

Boston Private Wealth LLC.

The report did little to shift interest-rate expectations.

"While a July and September rate rise would seem out of the

question given current global concerns a decent survey won't deter

some Fed members from rattling the prospect of a rise in rates,

even if they know they won't be able to deliver one," said Michael

Hewson, chief market analyst at CMC Markets said in a note.

In other economic news on Wednesday, U.S. import prices climbed

0.2% in June. And, the U.S. ran a $6 billion budget surplus in June

(http://www.marketwatch.com/story/us-runs-6-billion-budget-surplus-in-june-treasury-says-2016-07-13).

Fed speakers: On Wednesday, Dallas Fed President Rob Kaplan was

sanguine about the outlook for the U.S. consumer, speaking at an

event run by the World Affairs Council of Greater Houston.

At 6 p.m. Eastern, Philadelphia Fed President Harker will give a

speech on the economic outlook at the 2016 World Class Summit in

Philadelphia.

Movers and shakers: Shares of Juno Therapeutics Inc.(JUNO)

rallied 15% after the drugmaker late Tuesday said it would resume a

drug trial

(http://www.marketwatch.com/story/juno-shares-jump-after-clinical-trial-of-cancer-treatment-resumed-2016-07-12)

of a potential leukemia treatment. The trial had been placed on

clinical hold last week following two patient deaths.

SemiLEDS Corp.(LEDS) tanked 18% after the LED chips maker late

Tuesday said third-quarter revenue slumped 18% and that is loss

widened to $3.3 million.

Amazon.com Inc.(AMZN) shed 0.5% even after Benchmark lifted the

price target on the stock to $915 from $750.

After the market closes, Yum! Brands Inc.(YUM) is slated to

report earnings

(http://www.marketwatch.com/story/what-to-expect-from-yum-brands-earnings-2016-07-12).

Other markets: Asian stocks closed mostly higher, but were off

intraday highs after the Japanese government denied it would use

"helicopter money"

(http://www.marketwatch.com/story/asian-markets-gain-but-off-highs-after-japan-says-no-helicopter-money-coming-2016-07-13)

to boost the economy.

Europe's main stock benchmark rose for a fifth straight session

(http://www.marketwatch.com/story/european-stocks-aiming-higher-for-a-fifth-consecutive-session-2016-07-13),

getting closer to erasing its entire post-Brexit loss.

Oil prices slumped

(http://www.marketwatch.com/story/crude-prices-back-off-ahead-of-possible-supply-rise-2016-07-13),

while gold rose and the dollar was down against

(http://www.marketwatch.com/story/dollar-slips-after-japan-rules-out-helicopter-money-2016-07-13)

other major currencies.

--Sara Sjolin contributed to this report.

(END) Dow Jones Newswires

July 13, 2016 15:13 ET (19:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

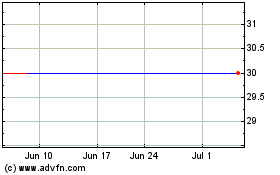

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

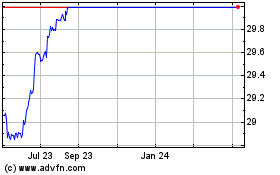

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024