By Ellie Ismailidou and Wallace Witkowski, MarketWatch

Bullard sticks to 1 rate increase until 2018; U.K. political

developments boost optimism

U.S. stocks on Tuesday carved out fresh intraday records and

were still trading above their all-time closing highs as a rise in

oil prices and stronger-than-expected earnings from Alcoa Inc.

bolstered sentiment.

The S&P 500 , which closed at a record for the first time in

nearly 14 months, extended its rally, rising 17 points, or 0.8%, to

2,154. Energy shares were leading the gains, advancing 2.3%,

boosted by a sharp rise in oil prices .

Three of the S&P's 10 sectors were in negative

territory--utilities, consumer-staples and telecom, off 0.9%, 0.3%

and less than 0.1% respectively. All three sectors traditionally

are viewed as safety plays in times of market turmoil.

The Dow Jones Industrial Average added 122 points, or 0.7%, to

18,349, trading above its closing record set in May 2015 and

briefly hitting an intraday record of 18,363.72. Shares of DuPont

(DD) and Goldman Sachs Group Inc. (GS) led the blue-chip gauge,

while Wal-Mart Stores Inc.(WMT) and Boeing Co. (BA) were

laggards.

Meanwhile, the Nasdaq Composite Index advanced 36 points, or

0.6%, to 5,025 and was trading in positive territory for the year,

up 0.4% year to date.

A stronger-than-expected second-quarter report from Alcoa Inc.

(AA)--viewed as the unofficial kickoff of the earnings season--also

engendered optimism on Wall Street, as investors continued to bask

in the glow of Friday's solid nonfarm payrolls report.

Markets in the U.S. and Europe were also encouraged on Monday by

news that U.K. Home Secretary Theresa May will become the new

British prime minister

(http://www.marketwatch.com/story/andrea-leadsom-drops-bid-to-become-uks-next-prime-minister-2016-07-11-7103452),

avoiding months of uncertainty over who would take over after David

Cameron. However, the FTSE 100 ended lower as the pound

strengthened somewhat

Friday's strong jobs number and an orderly transition in the

U.K. in the wake of Brexit are calming markets, said Karyn

Cavanaugh, senior market strategist at Voya Financial

"All the things we were worrying about haven't come to

fruition," Cavanaugh said. Plus, she said, there's still the hope

that this earnings season won't be as dreary as advertised.

Read:BOE set to cut rates for the first time in 7 years on

Brexit backlash

(http://www.marketwatch.com/story/boe-set-to-cut-rates-for-the-first-time-in-7-years-on-brexit-backlash-2016-07-11)

European

(http://www.marketwatch.com/story/european-stocks-extend-post-brexit-gains-2016-07-12)

and Asian

(http://www.marketwatch.com/story/nikkei-keeps-rolling-on-expectations-of-fresh-stimulus-2016-07-11)

markets also traded higher, while oil rallied

(http://www.marketwatch.com/story/oil-hovers-at-2-month-low-on-glut-worries-2016-07-12),

and gold and the yen

(http://www.marketwatch.com/story/stimulus-talk-sinks-japanese-yen-further-2016-07-12)--traditional

havens--retreated.

"In this global record-low-interest-rate environment, where else

will investors go?" said Mark Kepner, managing director of sales

and trading at Themis Trading, adding that the U.S. equity market

is where global investors are currently looking for yield.

"A Federal Reserve on hold combined with a great jobs number,"

according to Kepner, was the right mix of conditions for a stock

rally to emerge. And despite frothy stock valuations

(http://www.marketwatch.com/story/with-greater-highs-for-stocks-come-greater-risks-2016-07-11),

"stocks actually look cheap relative to bonds," he said, as bond

yields have tumbled to record lows and bond prices have spiked.

On Tuesday, St. Louis Fed President James Bullard stuck with his

view of a single interest rate increase until 2018, despite the

strong rebound in U.S. job growth in June.

Still, many strategists remained skeptical in the face of this

strong rally. "An intraday high--just like age--is just a number,"

said Kim Forrest, senior portfolio manager at Fort Pitt

Capital.

To gauge whether the rally is sustainable "there's only one

element that can show whether stocks merit these valuations:

earnings," Forrest said.

Alcoa's strong earnings--which reported adjusted earnings per

share of 15 cents, beating forecasts of 9 cents a share

(http://www.marketwatch.com/story/alcoa-shares-up-5-after-company-earnings-top-expectations-2016-07-11)

(http://www.marketwatch.com/story/alcoa-shares-up-5-after-company-earnings-top-expectations-2016-07-11)--was

an example of such a strong performance, but "we need to see more

companies begin saying they expect to see revenue and earnings

growth," Forrest said.

"There could be a few more [earnings] surprises during the week

given the strength of the U.S. economy. The country's economic data

proved to be a lot stronger for the last quarter as compared with

the previous one," said Naeem Aslam, chief market analyst at

ThinkForex, in a note.

Economic news: Minneapolis Fed President Neel Kashkari hosts a

town hall forum in Marquette, Mich., at 5:30 p.m. Eastern.

Cleveland Fed President Loretta Mester will talk about the

economic outlook and monetary policy in Sydney, Australia, at 10:30

p.m. Eastern.

On the data front, a June reading on small-business optimism

rose for a third straight month

(http://www.marketwatch.com/story/small-business-optimism-rises-for-third-straight-monthly-gain-2016-07-12),

but remained soft compared with its long-term average. And U.S.

wholesale inventories inched higher in May as automobile stocks

tumbled, suggesting inventory investment likely remained a drag on

economic growth in the second quarter.

Movers and shakers: Fastenal Co.(FAST) reported an unexpected

drop in second-quarter profit, sending shares down 3.3%.

Later this week, major banks like J.P. Morgan Chase &

Co.(JPM), Citigroup Inc.(C) and Wells Fargo & Co.(WFC) are

slated to report.

Shares of Sage Therapeutics Inc. soared 39% after announcing

positive phase 2 data for its treatment for patients with severe

postpartum depression.

Seagate Technology PLC(STX) jumped 22% on Tuesday after the data

storage company late Monday said it would cut 6,500 jobs globally,

which is about 14% of its workforce.

U.S.-listed shares of Shire PLC(SHPG) rose 4% after U.S. health

regulators approved its dry-eye treatment

(http://www.marketwatch.com/story/shires-dry-eye-treatment-wins-fda-approval-2016-07-11),

a potential blockbuster drug that is expected to go on sale in the

third quarter.

AMC Entertainment Holding Inc.(AMC) gained 6.7% after the

company said it plans on buying Odeon & UCI Cinemas Group from

private-equity firm Terra Firma, a deal valued at GBP921 million

(http://www.marketwatch.com/story/amc-agrees-to-buy-london-based-odeon-uci-in-deal-valued-at-921-million-pounds-2016-07-12)

($1.21 billion).

Economic news: Minneapolis Fed President Neel Kashkari hosts a

town hall forum in Marquette, Mich., at 5:30 p.m. Eastern.

Cleveland Fed President Loretta Mester will talk about the

economic outlook and monetary policy in Sydney, Australia, at 10:30

p.m. Eastern.

On the data front, a June reading on small-business optimism

rose for a third straight month

(http://www.marketwatch.com/story/small-business-optimism-rises-for-third-straight-monthly-gain-2016-07-12),

but remained soft compared with its long-term average. And U.S.

wholesale inventories inched higher in May as automobile stocks

tumbled, suggesting inventory investment likely remained a drag on

economic growth in the second quarter.

--Sara Sjolin in London contributed to this article.

(END) Dow Jones Newswires

July 12, 2016 13:13 ET (17:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

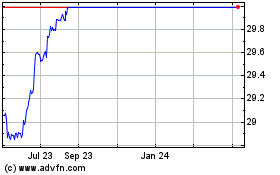

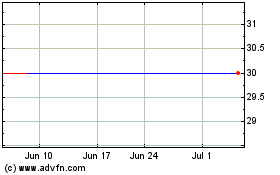

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024