One lesson: Not always relying on official statistics

By Simon Constable

The chief executive officer of Amsterdam materials company AMG

Advanced Metallurgical Group NV, Heinz Schimmelbusch, once at the

center of a controversial derivatives trade that cost a staggering

$1.3 billion ( see related article), is back and bucking

commodities-market trends.

While other companies have suffered stock drops and cut

dividends, AMG shares have soared (up 33.5% in 2015) and the firm

paid its first dividend last year. Shares of rivals such as Rio

Tinto PLC, Alcoa Inc. and Glencore PLC, meanwhile, were

hammered.

Dr. Schimmelbusch and his team at AMG -- which makes lithium for

car batteries and heat-resistant coatings for jet engines, among

other things -- foresaw the commodities slowdown in 2012 and

started an austerity program to reduce capital expenditure and

working capital, and retire debt. Four years later, the firm is

debt-free and ready to expand.

In an interview, Dr. Schimmelbusch explained how the move has

paid off. Edited excerpts follow:

Spotting a discrepancy

WSJ: What did you see in the metals markets that others

didn't?

DR. SCHIMMELBUSCH: In 2012 we saw a discrepancy between what our

business partners were telling us about conditions in China and

what the official statistics said.

When we asked Chinese-company leaders what was going on they

said that they felt the official statistics didn't necessarily

reflect what was happening on the ground. They were also

pessimistic about the availability of bank loans to private

enterprises.

We then started to compare the import-export statistics, which

didn't seem to match with the gross-domestic-product announcements.

There were so many uncertainties about what was happening and it

didn't fit with the optimism that some of our colleagues in the

industry had.

We knew that Chinese long-term growth was the reason for the

commodity boom. If that was interrupted, the commodity boom would

be interrupted, and therefore we started the austerity drive as a

hedge against that.

The program reduced capital expenditure, shrank working capital

and we paid down our debt. We also reduced our risk positions by

entering into long-term contracts with our customers.

WSJ: Economists -- and you hold a Ph.D. in economics -- have a

terrible reputation for forecasting. How did you make sure that

your anecdotal evidence was correct?

DR. SCHIMMELBUSCH: Here on our board we have economist Steve

Hanke, and he is informed and knowledgeable about the global

currency markets and monetary policy. We compared notes on my

observations about China, and our views reinforced each other's.

[Prof. Hanke saw a credit crunch for China's private sector

developing, which augured a huge slowdown in that country.]

As part of the process, he ran a model on commodity markets and

market participants. We ended up pretty sure of ourselves.

WSJ: The markets for all commodities are volatile, but it's also

true that for your products it's more so. Would you explain why

that is?

DR. SCHIMMELBUSCH: The volatility of the price of critical

materials follows a certain pattern. When you have an increase in

demand, such as the demand for lithium for use in batteries, then

prices explode because the supply of the materials cannot increase

quickly enough to keep up with demand.

Eventually there will be an increase in the supply, and an

effort by the end users to use less of the materials. As that

happens, the price explosion comes to an end.

WSJ: Even if China's consumption of commodities doesn't rebound,

you see a sustained long-term demand for your products. Why?

DR. SCHIMMELBUSCH: Our success will be a function of long-term

technology trends, because we provide materials that enable these

technologies to work.

For instance, we produce graphite and lithium for batteries, and

titanium alloys tailored to the aerospace sector. When you are a

producer of titanium alloys you don't need China. You need the

aerospace industry, which is global. When you produce tantalum, you

are depending on the smartphone industry, which isn't regionally

defined.

Austerity to expansion

WSJ: AMG introduced its first dividend last year. Do you think

commodities markets have hit bottom?

DR. SCHIMMELBUSCH: Our balance sheet has improved enough to have

shareholders participate without disturbing our ability to finance

our growth plans.

The dividend also allows those asset managers who are restricted

to buying dividend-paying stocks to invest in our shares.

The important thing now is that we are changing from austerity

mode to an expansion strategy because we feel the opportunities are

pretty obvious. We are currently deeply involved in an expansion of

our lithium resource in Brazil, partly because the price for the

metal is spiking and growth in demand is stable. The lithium we own

was a byproduct of tantalum production, which is used in

smartphones. The huge benefit here is that much of the extraction

costs for the lithium have been covered by the tantalum mine.

WSJ: The mining and metals industry has a reputation of being

dirty; you see it as green. Please explain.

DR. SCHIMMELBUSCH: Our products enable the aerospace industry to

coat turbine blades with ceramics, which provide a thermal barrier

coating. It means the nickel-alloyed engine blades can be used at

higher temperatures, raising the fuel efficiency and reducing

emission of carbon-dioxide.

Other materials we produce, such as graphite and lithium, allow

for energy storage in batteries.

The same thing is true for titanium alloys, which can replace

nickel alloys in the engines. They are lighter-weight than nickel

alloy and very heat resistant.

Mr. Constable is a writer in New York. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

June 06, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

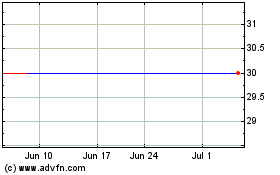

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

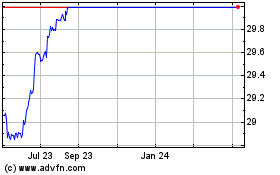

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024